Z com forex

The retail FX broker trading volumes for 2016 have been announced, and it has been confirmed that GMO CLICK securities co., ltd., part of the GMO CLICK group (“GMO CLICK”) has remained no.1 in the world for retail FX trading volume in 2016, for the fifth consecutive year.

Best forex bonuses

Z.Com trade spread does not reflect what they say on their site. On my account their spread 400 to 500 for GBP/JPY and USD/JPY. I have an evidence. I'm not sure if they are true ECN broker. Someone has to answer. I'm not sure new traders know that.

Z.Com trade – forex broker rating and review 2021

| https://trade.Z.Com/ | |

| status | |

| regulation | FCA, SFC, JFSA |

| trading software | metatrader4 |

| headquartered | becket house, 36 old jewry, london, EC2R 8DD, united kingdom |

Z.Com trade is the global brand of the tokyo-headquartered GMO CLICK group – the world’s largest retail forex provider by volume since 2011, as reported by finance magnates.

At the foundation of Z.Com trade’s philosophy is a commitment to providing the best possible trading conditions and technology to traders worldwide. Z.Com trade offers trading on a range of forex, indices and commodities on MT4 – all powered by secure and reliable technology with our deep liquidity pools. Our multilingual support team of experts are also available 24/5 to provide you with assistance whenever you need it.

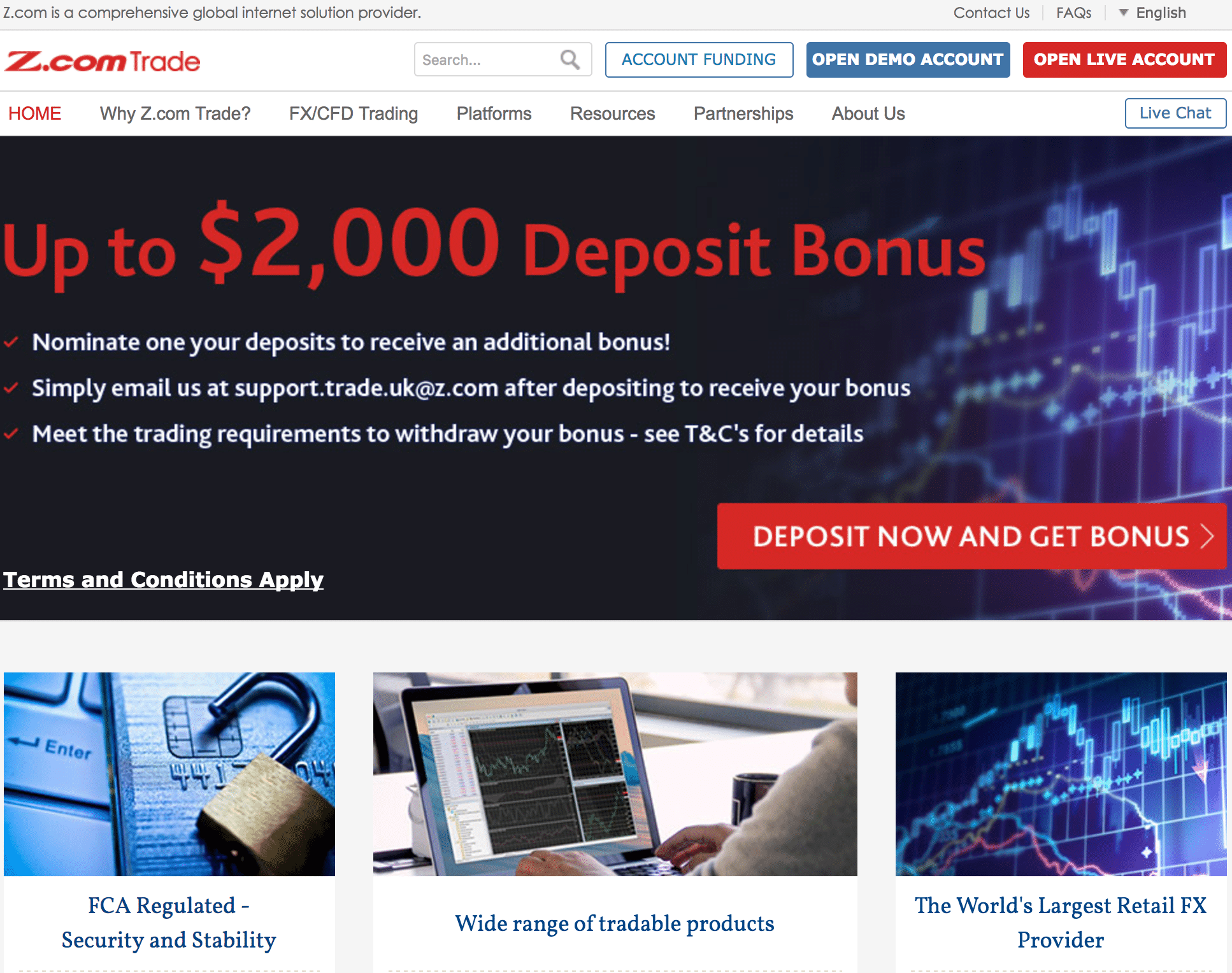

We offer fixed spreads with no commission, and there is no minimum deposit or account balance requirement to trade with us – giving you the flexibility to trade in a way that suits you. There is no charge to deposit funds into your account (we offer visa/mastercard, skrill, bank wire and china unionpay), and client funds are segregated in top tier banks in the UK. New clients can also benefit from a welcome bonus of $30 (€25, £20), and a deposit bonus of up to $2,000!

Z.Com trade is authorised and regulated by the FCA in the UK, and our parent company GMO CLICK holdings inc., is listed on the tokyo stock exchange.

Click here to join over 450,000 traders worldwide in the GMO CLICK group today!

Z.Com trade trading information

Z.Com trade — latest reviews and comments 2021

Z.Com trade spread does not reflect what they say on their site. On my account their spread 400 to 500 for GBP/JPY and USD/JPY. I have an evidence. I'm not sure if they are true ECN broker. Someone has to answer. I'm not sure new traders know that.

Sydney M 30 september, 2019 reply

We tested their trading platform and API for managing investors accounts. Unfortunately, it is complicated process to eliminate impact of transactions cost on overall performance. Broker charges fees and provides execution prices based on its own commercial interest. It means that they have verity of prices from liquidity providers; however, they give you the worst price for execution. Comparing our performance to other brokers like interactive, we can definitely say that it causes losses. I don't think is due to trading platform but because of back office suspicious activity.

Small trader 2 october, 2017 reply

Z.Com trade rating

Z.Com trade reviews rating

Top 10 forex brokers 2021

Latest forex reviews

The retail FX broker trading volumes for 2016 have been announced, and it has been confirmed that GMO CLICK securities co., ltd., part of the GMO CLICK group (“GMO CLICK”) has remained no.1 in the world for retail FX trading volume in 2016, for the fifth consecutive year.

GMO CLICK began offering leveraged foreign exchange trading services in japan in october 2006, under the core values of cost leadership and ease of use, giving way to the industry’s narrowest spreads and a range of trading platform technology.

Z.Com trade reviews and comments 2021

Z.Com trade spread does not reflect what they say on their site. On my account their spread 400 to 500 for GBP/JPY and USD/JPY. I have an evidence. I'm not sure if they are true ECN broker. Someone has to answer. I'm not sure new traders know that.

Sydney M 30 september, 2019 reply

We tested their trading platform and API for managing investors accounts. Unfortunately, it is complicated process to eliminate impact of transactions cost on overall performance. Broker charges fees and provides execution prices based on its own commercial interest. It means that they have verity of prices from liquidity providers; however, they give you the worst price for execution. Comparing our performance to other brokers like interactive, we can definitely say that it causes losses. I don't think is due to trading platform but because of back office suspicious activity.

Small trader 2 october, 2017 reply

Latest forex materials

As many of you know, the foreign currency markets are open for trading 24/5, which makes it very hard for a human to keep track of everything that's going.

The year 2020 is gone, but the problems it has brought upon the world and all of the major forex markets will linger in 2021 as the COVID-10 pandemic is far from.

Choosing the right forex broker, a firm that facilitates the buying and selling of currencies and other financial instruments, is of the utmost importance. Also, it could be.

Gain exclusive market-moving insights and take advantage of news-driven volatility with market buzz. Enjoy real-time coverage of 35,000+ FX pairs, commodities, indices, share cfds and cryptocurrencies. Follow the markets that are moving with market buzz when you trade live with vantage FX.

USD/JPY keeps the positive view and could attempt a move to the 104.75 in the next weeks, suggested FX strategists at UOB group.

Biden's new stimulus plan faces resistance from a bipartisan group. Republicans believe the overall cost of biden's stimulus package could be reduced during.

Oil prices were steady on friday, sticking to ranges seen over the past three weeks, as investors looked for signs of changing supply.

Cedarfx review - is cedarfx.Com a scam or a good forex broker?

RECOMMENDED FOREX BROKERS

| broker name | cedarfx |

| country | st.Vincent and the grenadines |

| regulation | none |

| minimum deposit | $10 |

| leverage | 1:500 |

| trading platforms | MT4, web |

| available assets | crypto, stocks commodities |

| website | cedarfx.Com |

Cedarfx is a forex broker with a noble goal and absolutely no regulation – they work with a british charity and claim to donate to it for every dollar the client pays in commission. The charity then plants trees to combat deforestation in all different parts of the world. What’s interesting about cedarfx as well is that the broker has two account types available – one which is commission free, and one that has a $1 commission on every traded lot. This means that it’s entirely up to the client if they want to help the environment or not.

Other than that policy, we have to say that cedarfx does not stand out from the rest of the offshore brokers. In fact, there are some rather serous issues with them, as noble as the goal they have placed for themselves is. We have outlined them in the following review:

Is cedarfx a legitimate broker?

As you can see from that screenshot, cedarfx is registered in the offshore location of st. Vincent and the grenadines. The problem with that jurisdiction is its complete refusal to regulate the forex markets – this has led to many scammers picking it as a base of operations. Regulation is incredibly important in the forex world and here is why:

The aforementioned scammers are a serious threat, but not the only one – there is also the notorious volatility of the markets, which leads many companies to their premature bankruptcy, taking their investors’ funds with them.

To combat both of these things, there have been regulatory agencies established all over the world, creating different regulations. For example, in the UK scammers are weeded out by the requirement to report back on open and closed positions on a daily basis to the regulator – the FCA. This means that brokers do not have any ability to engage in foul play.

The security of investors’ funds is ensured by both a steep minimal capital requirement, meaning that companies rarely go bankrupt, but also their mandatory participation in guarantee funds. The latter ensure that in the unfortunate event of a broker going under, its clients receive some compensation – up to 85 000 pounds per affected person.

Can I make money with cedarfx?

You cannot – the broker is not licensed and cannot guarantee your funds’ safety. You would be better off sticking to one that can – check out this list of licensed brokers. To cedarfx’s credit, they do not have any sort of shady clause in their tos and this sets them apart from most of their peers in st. Vincent. Still, we would strongly recommend sticking with legitimate brokers.

What leverage does cedarfx provide?

The broker provides a leverage of up to 1:500 – this is common for unlicensed companies. You see, high leverage trading is seen as a double-edged sword – it amplifies both losses and profits to an unimaginable degree. This has led to most regulatory jurisdictions banning the provision of high leverage to retail traders. Of course, as st. Vincent does not regulate its markets, cedarfx can offer as high of an amount as they please to attract clients. If you see a broker with such an audacious leverage, always remember that they are more likely than not to be unlicensed.

What is the minimum deposit with cedarfx?

The broker demands a deposit as little as $10 to start trading. This is about as much as what legitimate brokers demand to open a micro account. These are accounts that can only trade with micro lots, which is perfect for traders that want to test out different strategies. Standard accounts cost between $100 and $200.

What platforms does cedarfx provide?

The broker provides access to two distinct platforms – one is a distribution of metatrader 4 and the other is a web-based platfrom with some of its features. MT4 rightfully has claimed the distinction of the industry standard when it comes to trading platforms with useful and comprehensive features like algorithmic trading. Here is what cedarfx’s desktop platform looks like:

And here is the web-based version of it – it has less features - for example, expert advisers are nowhere to be seen, but it still boasts MT’s wide array of charting tools.

What deposit methods does cedarfx accept?

The broker accepts deposits via bitcoin and credit cards – be wary, as out of them only the latter have any sort of chargeback policy.

Latest news about cedarfx

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

Z.Com trade forex broker broker review

Reviewer : justin freeman

Published: 19th november, 2020.

Broker information

- Company name: GMO-Z.Com trade UK limited

- Founded: 2012

- Country: UK

Platform info

- Platform: Z.Com trader & MT4

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: FCA

- Minimum deposit: none

- Leverage: 1:200

- US clients: no

- Funding methods: wire, credit card, debit card, china unionpay, skrill, cheque

Featured forex broker

Avatrade was established in 2006 and is located in dublin, ireland. Offering trading services in over 150 countries with offices located worldwide. Avatrade is a forex broker that is committed to providing a safe trading environment and is fully regulated and licensed in the EU and BVI, with additional regulation in australia, south africa and japan.

Acknowledged as the retail forex industry volume leader, the GMO CLICK group officially launched its UK subsidiary Z.Com trade, in march 2015. Founded in japan in 2005, the group has offices in the global financial centres of tokyo, hong kong and london, with over 400,000 clients worldwide. GMO-Z.Com trade UK limited is authorised and regulated in the UK by the financial conduct authority (FCA), and its firm reference number is 622897.

Trading in leveraged products carries a high level of risk. Your losses may exceed your initial investment requiring you to make further payments.

Numbers do not lie, and the group’s volume awards and 400,000+ customer base are evidence that they are doing something right. Much of the group’s growth has been in japan, hong kong, and other parts of asia, and by adding london to its global footprint, the group are looking to bring the benefits of their service to more traders worldwide. The firm is proud of its flagship proprietary trading platform, Z.Com trader, and it does also offer MT4 and API connectivity. Aside from flexibility in its technology offerings, Z.Com trade provides some of the tightest spreads in the industry, that range in the fractions of a pip for major currency pairs and crosses.

Z.Com trade is authorised and regulated by the financial conduct authority (FCA) in the UK, and client funds are segregated in top tier financial institutions. Z.Com trade also participates in the UK financial service compensation scheme (FSCS), which can provide compensation of up to £50,000 per person per regulated entity.

With so many options and choices to make, it is also a valuable benefit to have highly capable customer service staff at the ready to assist you in setting up, getting the most out of the technology on offer, and with any other questions that you might have. These professionally trained reps speak several languages and can be reached via live chat, email, or telephone.

Features

Why trade with Z.Com trade? The firm lists these reasons:

・A subsidiary of the GMO CLICK holdings, inc., group of companies, headquartered in tokyo, established in 2005, and listed on the tokyo stock exchange

・growth benchmarks: $1 trillion in monthly volume in 2013 (first in the industry); volume leader in the world today; and over 400,000 global clients

・Z.Com trade is based in london and is authorised and regulated by the financial conduct authority (FCA) in the UK

・client funds are segregated in top-tier financial institutions, and the firm also participates in the UK financial service compensation scheme (which can provide compensation of up to £50,000 per person per regulated entity)

・deposits can be made by major credit or debit card, wire transfer, china unionpay or skrill at no additional charge. There is also no minimum deposit requirement.

・in-house developed online trading platform (Z.Com trader) with advanced charting support available, along with MT4 software and mobile apps

・tight spreads that range from 0.5 to 0.8 pips for major pairs and crosses

・broad array of currency pairs with up to 200:1 leverage available, supplemented by CFD trading in commodities and indices

・STP model, with fixed spread pricing available on Z.Com trader platform, and variable spread pricing on MT4/API

・multilingual customer service representatives, accessible via live chat, email, or telephone

Spreads and leverage

Being a volume leader allows Z.Com trade to offer extremely tight spreads, especially for major currency pairs. Spreads on Z.Com trader are fixed as low as 0.5 pips for USD/JPY and 0.6 pips for EUR/USD, with a maximum available leverage of up to 200:1 on selected currency pairs. For cfds in commodities or indices, leverage and margin requirements vary by asset choice.

Platform

A large enterprise with such resources also has the capability to develop their own software internally, without having to depend on a partner for innovative upgrades. Such is the case with Z.Com trade. Its proprietary flagship platform goes by the name of Z.Com trader and comes with an intuitive interface and advanced charting tool. The software is completely online and does not require any complicated downloads. For metatrader4 enthusiasts, the firm can also support MT4 which is operated on an STP model, offering an ultra-low latency solution with no “last look” execution. For professional traders their API service offers a more flexible and tailored option. Mobile apps are also available for ios and android, allowing users to trade from charts as well as lightning fast “one touch” trading.

Deposits and withdrawals

Z.Com trade accepts deposits via major credit and debit cards, skrill or by bank wire transfer, and does not charge any additional service fees. Withdrawal requests are processed promptly, and a charge is only made for international bank wire transfers. There is also no minimum deposit requirement, allowing you start with an amount you feel comfortable with.

Beginner’s and customer support

Customer service representatives have been professionally trained to assist you with any query that you may have. They can be accessed via live chat, email, or telephone. For beginners and experienced traders alike, support materials include platform guides, information on fundamental and technical analysis, pricing streams, advanced charting tools, news, and an economic calendar of significant events.

Conclusion

The opening of Z.Com trade is one more step by the GMO CLICK group of companies to solidify its dominance in the global forex trading arena. As per the words of its CEO, “we are excited to announce the full launch of Z.Com trade and with the strong foundation of the in-house technology and expertise that we have developed in our home market of japan, we look forward to connecting with even more traders around the world through our forex and CFD trading service.” with respect to this group, “big” is better. The benefits are plentiful – tight spreads, innovative services, and regulatory peace of mind. Z.Com trade is definitely worthy of your consideration.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Forex marketz daily forex news – fully markets update

Euro currency opens the week consolidating

0.0 00 the euro currency spent the past week trading between 1.2360 and 1.2040. Looking at the above EUR/USD MT 4 price action chart, there is near term support in play at 1.2060 and near term …

British pound trades near key congestion zone

0.0 00 the british pound (GBP) is now trading at altitude not seen since the first half of 2018 against the U.S. Dollar. Looking at the above daily MT 4 price chart, the headline GBP/USD currency …

Euro currency fails to break above the falling trend line

0.0 00 looking at the euro currency on the above four (4) hour EUR/USD MT 4 price action chart, this benchmark currency exchange rate is trading around 1.2120 to 1.2125 during the asian trade session on …

New zealand dollar trades around the 21 day SMA

0.0 00 looking at the new zealand dollar on the above daily NZD/USD price action chart, this currency exchange rate is trading just below the 21 day simple moving average and around 0.7160. The new zealand …

Spot gold looks vulnerable below $1,850 per ounce

0.0 00 looking at the popular spot gold futures contract on the above half hour MT 4 price action chart, the precious metal is trading around $1,840 to $1,842 per ounce during thursday’s asian trade session. …

British pound remains above the 10 day SMA

0.0 00 the british pound is trading around 1.37 and 1.3695 during the early trade session on thursday. Looking at the above GBP/USD daily MT 4 price chart this forex market has seen a corrective pullback …

WTI crude oil waits on official EIA inventory data

0.0 00 looking at the widely popular U.S. West texas intermediate (WTI) crude oil futures contract on the above hourly price action chart, this crude oil contract is trading just below a 21 day old rising …

Euro currency defends the 50 day SMA

0.0 00 looking at the benchmark EUR/USD currency exchange rate on the above daily MT 4 price action chart, the euro currency is consolidating after defending the fifty (50) day simple moving average. Forex traders are …

Euro currency trades above the 50 day SMA

0.0 00 looking at the world’s most liquid currency exchange rate, the EUR/USD, and above daily MT 4 price action chart, the euro currency is trading near an intraday low price point of 1.2137 during the …

US dollar consolidates gains around 1.2740

0.0 00 looking at the US dollar on the above daily MT 4 price chart, the benchmark USD/CAD forex market is consolidating gains around 1.2740 and the 21 day simple moving average. This currency exchange rate …

Forex trading A-Z™ - with LIVE examples of forex trading

Чему вы научитесь

Требования

Описание

Learn everything you need to know to start trading on the forex market today!

In this course, I will show you how you can get started in forex trading. We will talk in detail about currencies, charts, bulls & bears, short selling, and much more.

I will thoroughly explain how forex brokers work, so that you are able to easily separate honest brokers from the unreliable ones when you are ready to open a real trading account. I even include a FREE guide to selecting a forex broker, based on my own experience of real trading.

In this course you will also learn how to read the calendar of economic events, which is imperative for fundamental trading on forex as well as other financial marketplaces such as NYSE, london stock exchange, futures exchanges, and more.

I will also supply you with a forex market hours wallpaper for YOUR timezone, allowing you to effortlessly monitor activity of global forex market participants throughout the day.

Nothing is kept secret. I reveal all I know. New lectures will be added to the course constantly - at no extra cost to you! This is a course that will continue to grow and grow.

Take this course now and learn from my 7+ years of experience. Avoid the most common pitfalls that catch 90% of traders!

This course is for complete beginners! All you need is an open mind and a passion to be successful!

As with all my courses:

You have unlimited lifetime access at no extra costs, ever

All future additional lectures, bonuses, etc in this course are always free

There's an unconditional, never any questions asked full 30 day money-back-in-full guarantee

My help is always available to you if you get stuck or have a question - my support is legendary in udemy

Z.Com trade review

Z.Com trade review

Reviewed broker: Z.Com trade

Operated by GMO-Z.Com trade UK limited, and is an affiliated company of GMO CLICK.

Location: tokyo japan, hong kong, london UK

Regulation: financial conduct authority FCA

Trading instruments: global FX, commodities, indies, and cryptocurrencies markets.

Segregated client funds: yes

Why trade with Z.Com forex broker

- Join over 700,000 traders today

FCA regulated and an affiliated company of GMO CLICK

over $1 trillion traded monthly and the world's largest forex provider since 2012 - 80 TRADABLE PRODUCTS

- SPREADS FROM 0.0 PIPS

- 1:200 MAXIMUM LEVERAGE

- STP NDD EXECUTION

- EDUCATION AND ANALYTICAL PORTAL

Trading accounts and features

Classic account

Simplify your trading with our no-commission account

ECN account

For experienced traders who prefer direct market access

| account currencies: | USD, EUR,GBP |

|---|---|

| min deposit: | $€£50 |

| max leverage: | 30:1 |

| min lot size: | 0.01 |

| execution type: | market execution |

| spreads: | floating from 0.0 pips |

| commission: | $4 per 100,000 traded |

| tradable products: | 80 |

| margin closeout: | 50% |

ECN plus account

For professional traders looking to trade larger volumes

| account currencies: | USD, EUR,GBP |

|---|---|

| min account balance: | $€£10k or 100M vol. P/m |

| max leverage: | 30:1 |

| min lot size: | 0.01 |

| execution type: | market execution |

| spreads: | floating from 0.0 pips |

| commission: | $2.5 per 100,000 traded |

| tradable products: | 80 |

| margin closeout: | 50% |

Free educational material: available

Automated trading: available

Swap free islamic accounts: yes

Account base currency: USD, EUR, GBP

Digits after dot in quotes: 5

Minimum position size: 0.1

Standard spread: starting from 1.4 pips on major currency pairs

Trade on the world's most popular trading platform with the world's largest forex provider by volume

- with spreads starting from 1.0 pips on our classic account or 0.0 pips on our ECN accounts.

From MT4, you'll have access to a range of FX, commodities and indices markets from your desktop PC, mac

or ios/android mobile device - all supported with our secure and stable network of technology and infrastructure.

FIX API connectivity

Connect to Z.Com trade directly for flexible access and high-speed trading.

Plug-in to our FIX API at our servers hosted in equinix's LD4 data centre in london, and get all the advantages of Z.Com trade's STP NDD execution model via a front-end solution that suits you.

Access is available in industry-standard FIX 4.4, where you can manage orders and access market data, and create your own strategies to automate your trading experience.

Get the edge with our education and analytical portal

Take your analysis of the markets to the next level with our education and analytical portal, available to all classic, ECN and ECN plus account holders.

All in one trading screen: yes

Market, limit, stop, IFD, OCO, IFDOCO orders: yes

Payment methods review

Minimum deposit requirement: $1

Payment options: credit cards, wire transfer, china unionpay, skrill

Customer support: online chat, email, phone

Using the Z score to determine trade size and boost performance

Suppose that we have a trading method which gives us great confidence, produces satisfactory results over a long time, and which refined through a long period of study and experimentation. We are aware of the risks of high leverage, and do not gamble by entering trades which do not fully meet our requirements. We are pleased with our results, but still unsure about how much we should risk. What can we do to solve this problem?

What does a streak of wins or losses mean?

One of the major issues with any trading method is the length and frequency of streaks of wins or losses. A win streak is a period during which consecutive gains are registered in an account, and a loss streak is the opposite. What kind of bearing do these series of wins and losses have for trade sizes? Obviously, if a style generates wins and losses in streaks, the results are not independent of each other. A profitable trade is suggesting the likelihood that there will be more gains in case the trader increases his position size. Conversely, if a loss warns us that it will be followed by more losses, and we should discard our original approach and seek our wealth at other occasions. In other words, heads in one flip tells us that following coin tosses will bring us more heads, and tails will lead to more tails in subsequent trials. This knowledge may allow us to increase the size of our position with reasonable confidence, or to eliminate it in the case of loss.

The z-score

Z-score is the mathematical tool used for calculating the capability of a trading system for generating wins and losses in streaks. The simple formula allows us to test our performance, and to check if the streaks generated present a random pattern or not. If the pattern is random, or at a non-significant confidence level, our results are independent of each other, and there’s no point in trying to scale in, or build up a position in successive trades. On the other hand, if our strategy is prone to generating streaks in a non-random fashion, we can use this knowledge to maximize our profits.

The formula of the z-score is

N – total number of trades in a series (for example, in a string of (+++—-++—-++) we have 15 trades (++++), and the N is 15 )

R – total number of series of profitable and losing trades (if we have a run for our method, and we have a string of (+++—-++—-++), there are five series S1(+++), S2(—), S3(++), S4(—-), S5(++). So R is 5)

W – total number of profitable trades in the series;

L – total number of losing trades in the series.

A series is simply an unbroken string of wins or losses. For examples, (++++) is a series, as is (—), but (+-+) is not.

So all that we need to do, in order to understand if our strategy allows us to repeat our profits or losses in a non-random way, is to check its z-score, and to compare this to a series of numbers which we will call the confidence level. The confidence level is simply the normal distribution equivalent of the z-score we receive from our tests. If this sounds complicated, all that the trader needs to know is that in order to be considered suitable for profit maximization in money management methods our test must produce results that are greater than 1.96 or less than -1.96 (corresponding to the 95 percentile of normal distribution).

Trade major US tech stocks this earnings season

Why are traders choosing FOREX.Com?

Global market leader

Connecting traders to the currency markets since 2001

Professional accounts

Discover the FOREX.Com

pro service

Innovative & award-winning

Our new mobile app offers one-swipe trading and lightning fast execution

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex trading platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader trading platforms" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Top stories

JD sports buys US outfit DLTR, ASOS buys topshop and.

GBP/USD rises ahead of manufacturing PMI data. Silver surges.

European markets are expected to open higher today following the.

Ready to learn about forex?

/media/forex/images/global/homepage/newtrader.Svg" alt="new trader" />

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

/media/forex/images/global/homepage/createplan-latest.Svg" alt="new trader" />

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

/media/forex/images/global/homepage/strategies-latest.Svg" alt="have some experience" />

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

*based on active metatrader servers per broker, apr 2019. **based on CFD spreads and financing competitor comparison on 28/08/19.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

So, let's see, what we have: Z.Com trade is the global brand of the tokyo-headquartered GMO CLICK group – the world’s largest retail forex provider by volume since 2011, as reported by finance magnates. At the foundation of Z.Com trade’s philosophy is a commitment to providing the best possible trading... At z com forex

Contents of the article

- Best forex bonuses

- Z.Com trade – forex broker rating and review 2021

- Z.Com trade trading information

- Z.Com trade — latest reviews and comments 2021

- Z.Com trade rating

- Z.Com trade reviews rating

- Top 10 forex brokers 2021

- Latest forex reviews

- Z.Com trade reviews and comments 2021

- Latest forex materials

- Cedarfx review - is cedarfx.Com a scam or a good...

- RECOMMENDED FOREX BROKERS

- Is cedarfx a legitimate broker?

- Can I make money with cedarfx?

- What leverage does cedarfx provide?

- What is the minimum deposit with cedarfx?

- What platforms does cedarfx provide?

- What deposit methods does cedarfx accept?

- Latest news about cedarfx

- Z.Com trade forex broker broker review

- Featured forex broker

- Features

- Spreads and leverage

- Platform

- Deposits and withdrawals

- Beginner’s and customer support

- Conclusion

- Forex marketz daily forex news – fully...

- Euro currency opens the week consolidating

- British pound trades near key congestion zone

- Euro currency fails to break above the falling...

- New zealand dollar trades around the 21 day SMA

- Spot gold looks vulnerable below $1,850 per ounce

- British pound remains above the 10 day SMA

- WTI crude oil waits on official EIA inventory data

- Euro currency defends the 50 day SMA

- Euro currency trades above the 50 day SMA

- US dollar consolidates gains around 1.2740

- Forex trading A-Z™ - with LIVE examples of forex...

- Чему вы научитесь

- Требования

- Описание

- Z.Com trade review

- Z.Com trade review

- Reviewed broker: Z.Com trade

- Why trade with Z.Com forex broker

- Trading accounts and features

- Classic account

- ECN account

- ECN plus account

- FIX API connectivity

- Get the edge with our education and analytical...

- Payment methods review

- Using the Z score to determine trade size and...

- What does a streak of wins or losses mean?

- The z-score

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.