Open legit account

The manager will hold on to your CV until a position becomes vacant. Apply during busy periods, such as over the december holidays as there will be a greater need for casual staff during this time.

Best forex bonuses

4. Legit competitions are open to

all residents of south africa aside from employees, directors, members, partners, agents or consultants of retailability (pty) limited (“retailability”), the sponsor of the prize, their respective advertising and promotional agencies, media and PR agencies, or the family members, consultants, directors and associates of such organisations and persons.

Legit account opening online application south africa

Organization : legit

facility : apply for legit account application

country : south africa

website : http://www.Legit.Co.Za/

| you can now ask your question on this facility / status. Ask here (OR) go to the bottom of this page for comments. |

|---|

Legit account opening application

Want to open a legit account- it’s super easy!

Benifits of legit account :

** you get low prices on credit for clothes, shoes and more.

** you can also use your LEGIT card at any jet, jet mart, edgars, CNA, prato or boardmans stores nationwide.

** you can choose funeral plans and other valuable financial services at a low cost.

** you can buy cellphones and mobile accessories, as well as cellphone insurance.

** you qualify for exclusive special offers.

** you are potentially eligible for south africa’s only no-fee credit card.

How to open an account

** to open an account at LEGIT you need to go to store with your ID book, proof of address and your proof of salary for the previous month.

** you can use your LEGIT card at any edgars, jet, jetmart, CNA, or boardmans stores nationwide.

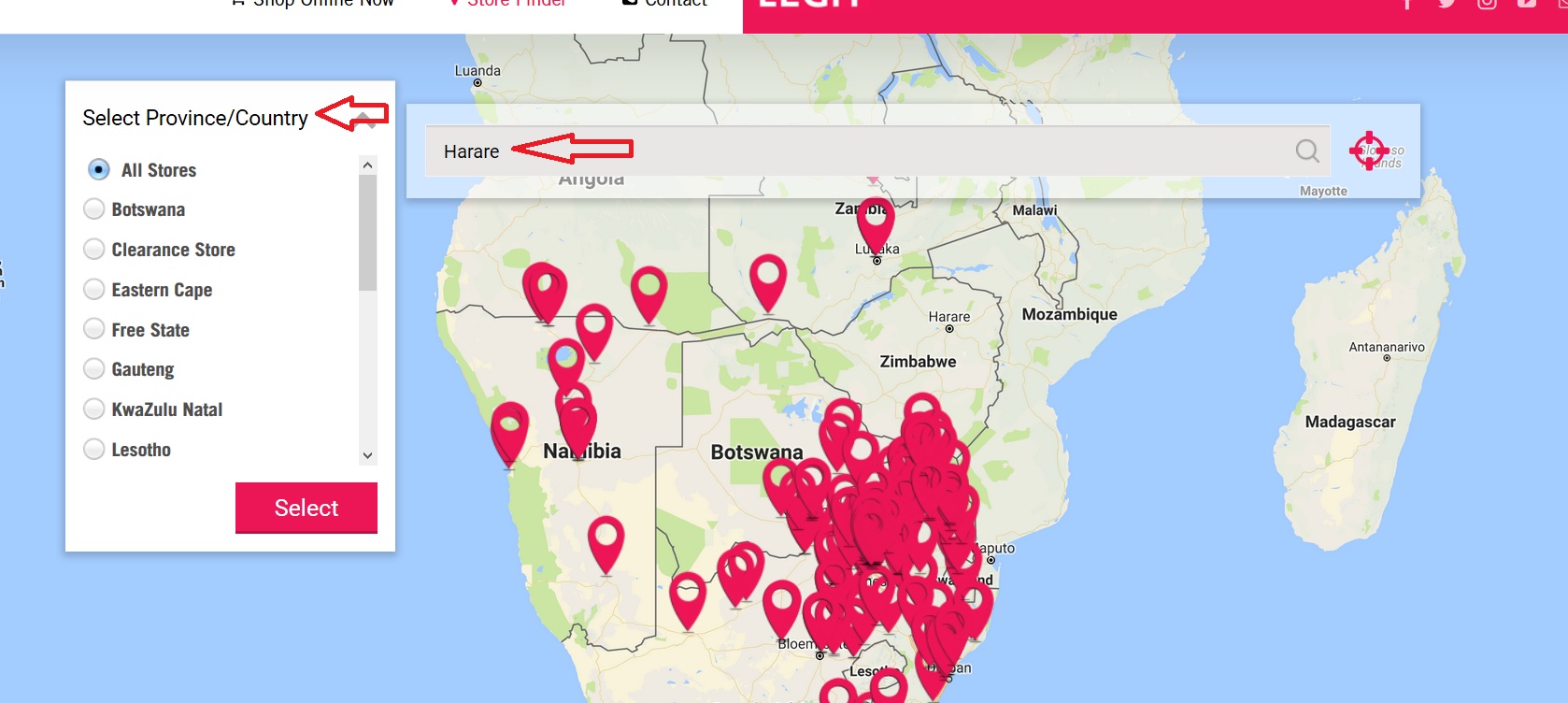

Find nearest store

Click the link find your closest store available in the home page.

Select province/country and enter location to search.

You will get the contact details with directions to the store also.

1. Where is my nearest legit store?

You can search for your nearest legit store online, using our handy store locator. Click here. Should you need further assistance, you can contact us at customercare [AT] legit.Co.Za.

I’ve seen a stunning legit item, but I need to know :

** the price

** what sizes are available

** whether my nearest store stocks it

Please send a picture or description of the item to customercare [AT] legit.Co.Za and we will send you all of the information you need.

2. Why we need your ID number, contact number and address?

Retailability has amended its competition policy based on the the consumer protection act. According the updated policy, all winners must provide the abovementioned details before we dispatch a prize in order to ensure that the prize is handed to the correct person and not an impostor.

3. When entering competitions

read the terms and conditions carefully. This will be explicitly stated underneath the call to entry of the competition page.

4. Legit competitions are open to

all residents of south africa aside from employees, directors, members, partners, agents or consultants of retailability (pty) limited (“retailability”), the sponsor of the prize, their respective advertising and promotional agencies, media and PR agencies, or the family members, consultants, directors and associates of such organisations and persons.

5. I’d like to work at my nearest legit store. How do I apply?

You can apply for a position at your nearest legit store, by introducing yourself to the manager and presenting them with your curriculum vitae and an application letter.

The manager will hold on to your CV until a position becomes vacant. Apply during busy periods, such as over the december holidays as there will be a greater need for casual staff during this time.

Contact us :

for any queries, you can call the legit customer care line here : 086 1192 636

How to open a legit checking account with bad credit

Checking accounts are necessary in today’s world.

Unfortunately, if you have a history of risky financial behavior (which may include bad credit), you can find yourself barred from opening a checking or savings account.

Your credit history (which is tracked by the 3 major credit bureaus) affects your ability to get credit — credit cards, loans, mortgages, etc — but it does not directly affect your ability to open a bank account.

Financial institutions have their own version of a credit check that tracks your banking behavior rather than your credit history. This behavior is recorded by most of the major banks through the following agencies:

- Chexsystems

- Telecheck

- EWS (early warning system)

Chexsystems is the most ubiquitous financial history tracking agency of all three with roughly 80 percent of the banking institutions using it to vet potential clients.

It’s never a good experience when the bank denies you an account simply because you have a few problems with your credit.

The good news for those with bad credit history is that poor credit and obtaining a checking account are not directly related.

But in some cases (depending on the institution) banks may rely on your credit to decide if they will give you a checking account. It is possible that your actual credit score can affect your ability to open a bank account, IF chexsystems or telecheck is not used by a bank. In this situation banks may opt to look at your credit history instead — but this is dependent on banking policy.

And it’s also possible to have good credit while also not being able to open a bank account because you have a chexsystem record.

So, if you have BAD credit and need to open a bank account, here are your options.

Option: try opening a regular bank account

This is the first thing you should try.

If you can open a bank account right away, you are done and problem is solved.

Note, you will likely be unable to open a bank account if you have the following:

- Racked up overdraft fees and not paid the bank for these

- Committed some sort of bank fraud in the past

- Owe the bank money

These will give you a chexsystems record that will stop most banks from giving you an account.

If you have a chexsystems record and can’t fix that record, then you need to find a bank that does not use chexsystems.

Credit unions are a good bet as are smaller, community banks. Some major banks don’t use chexsystems but may use telecheck or EWS.

If EWS is used, your credit history may come into play.

If you have a chexsystems record

The key here is to open an account that does not use chexsystems (or doesn’t flat out reject you based on a chexsystems record). Your best bet here are local banks or credit unions rather than big, national bank branches.

You can apply for BBVA free checking (if you live in alabama, arizona, california, colorado, florida, new mexico, or texas). Don’t live in one of these states, if you don’t live in these states, try the BBVA checking which is offered nationally and has no monthly fees.

Now the good news here is BBVA often ignores chexsystems records (BBVA does use EWS), so you might be good to go. If, however, they reject your application, BBVA will offer you their easy checking account, which is a second chance account. So you stand a very good chance of getting a bank account.

For more recommendations, see our non chexsystems banks list.

If you have bad credit history but good banking history

Even if you have poor credit history, the good news is that as long as you have not mismanaged previous bank accounts and established a poor banking record, you should be able to open a new (regular) checking account with most national and local banks. So try any bank and you should be fine.

Option: open a second chance account

IF the following has not worked so far…

- You can’t open a regular account (and you’ve tried many times with different banks)

- You have done a chexsystems check and you DO have a record

- You are unable or willing to fix your chexsystems record (i.E. You can’t pay a bank money you owe them and request them to remove it or you can’t dispute your record)

- You can’t find a bank that does not use chexsystems (note, you SHOULD be able to if you look around enough)

THEN you need to look at opening a second chance checking account.

What is a second chance checking account

These are basically special bank accounts offered by many banks that are for people who are unable to open regular bank accounts because of credit or chexsystems issues.

They function just like regular bank accounts, but may have additional limitations imposed on them and additional fees.

However, if you prove yourself over a year or two, the banks will upgrade you to a regular bank account.

Many banks, both national and local, do offer these special for people who can’t open a regular bank account. This is more than likely because those people have a chexsystems record, but there may be other reasons as well.

If you can’t open a regular account (and you’ve tried and tried with different banks first), then your best bet is to find a bank that offers a second chance account.

Second chance account features

Some second chance account offer direct deposit. It’s also possible to get a visa debit card (or mastercard debit card). Unfortunately, you won’t be able to write checks from a second chance account. Still, this kind is excellent if you want to improve your credit. After a year, apply for a normal bank account. You should be approved.

Where to find a 2nd chance account

I recommend looking at the BBVA easy checking which BBVA will offer you if you apply but are rejected for another one of their checking accounts first (BBVA does use EWS).

You can also look at banks like wells fargo and TD AMERITRADE which do offer some second chance checking account options.

Option: check chexsystems report (and try to get records removed)

The idea here is to get your credit and chexystems reports, look at them, and see if you can fix anything on the reports.

- Finding an error and reporting that error to get it removed (credit report or chexsystems report)

- Disputing something about that report (credit report or chexsystems report)

- Finding the bank who may have added a record regarded owed payment, then paying the bank what’s owed to get record removed (chexsystems report)

Fixing will mean an improved score (chexsystems or credit score) and may improve your ability to OPEN new bank accounts.

How to dispute your chexsystems report

1) request your chexsystems report

IF you are unable to open a regular bank account, then it’s likely you have a chexsystems record — regardless of your good credit or bad credit.

You need to request your FREE chexsystems report and see what it says. You are allowed one free report each year.

Look at the report and make sure it’s correct. If you spot errors, DISPUTE them and you may be able to clear your chexsystems record enough to be able to open a new bank account.

If your chexsystems record exists and you can’t dispute it, you are going to have to wait 5 years from the time the record is added for the record to be dropped.

2) pay off any owed bank fees and request bank to remove record

IN the event you have a chexsystems record and it relates to owing a bank some money, contact the bank and PAY what you owe off. Banks can get records they’ve added to chexsystems removed and may do so if you pay what you owe.

This may fix your record.

If successful, you may be able to open a new bank account.

So assuming you find you owe a bank money, pay that bank what you owe, then request the bank to remove the chexsystems record, you can then try opening a new bank account once you verify that information has been removed from your chexsystems record.

3) check your credit report

While many banks do not actually do credit checks, some banks may depending on policy. So bad or poor credit can still hinder your ability to open a new bank account even though many banks do use chexsystems and NOT your credit history as the main determinant as to your eligibility.

Request a credit check to see where you stand with your credit history. You might as well know what it is because banks may look at it too.

These days, you don’t need to pay to see your credit scores anymore. Use a completely free service such as credit sesame which gives you access to your credit score without paying a dime (or needing to sign up with a credit card).

Once you obtain your credit report, review it for any errors. Even small errors can affect your score and an increase will improve your chances of opening a checking account online if the bank does a credit check on you prior to opening an account.

Again, your credit report is not essential here, but it’s still a good idea to know what it says — so we recommend you check it first.

Option: open an online-only bank account

If you are not able to open a basic account try using an internet bank (i.E. Online only bank account). You may need to open with a larger deposit but these banks often do not require any credit check (or if they do, they may accept poor credit) and they may not use chexsystems.

Again, it depends on the actual bank, but it’s worth a shot trying.

Some legitimate internet banks are ING direct, HSBC internet account and emigrant direct internet.

Read our best online bank accounts article for some recommendations

Option: open an investment bank account

If you are not successful opening the regular bank accounts, second chance accounts, internet accounts, and can’t find a bank that does not use chexsystems, then you have one more option: try to open an investment account (merrill lynch, fidelity).

TD ameritrade is known to give out accounts. You’ll need to first add TD’s investment account then once you get it, add a TD checking account on as an option. This is a under-the-radar way of getting a full checking account.

These investment accounts need large opening deposits but usually offer an additional checking account. Credit scored are not used to determine if you can get this type of account.

Option: get a prepaid debit card

If all else fails and you absolutely are unable to open any sort of bank account, anywhere, but you need access to BANKING, such as the ability to deposit money to an account online and to withdraw that money from ATM’s or to make purchase on a debit card, consider getting a prepaid debit card.

What can you do with these?

- Receive payments / money to an account

- Send payments online

- Spend the money via a card at stores

- Withdraw cash via ATM’s

But there’s a catch, right?

You’ll pay more money likely in the form of transactional fees. That means you’ll have to pay each time you make a withdrawal via ATM or reload money onto the card.

But it’s a small price to pay for having a bank account like service that you can use.

Some prepaid debit cards may also function like a prepaid credit card these days — you can also use them as prepaid credit cards to make purchases online with the credit card number — as well as allowing normal debit card features. These are sometimes called prepaid visa debit cards.

Prepaid debit cards are not as good as a bank account, BUT if you can’t get a bank account, they WILL work in a pinch as a substitute.

Option: A secured credit card

A secured credit card is basically a credit card with a held deposit you put down on it. That deposit is held and becomes your credit limit. You use the card like a regular credit card.

As this is a credit card, you can add money to it, transfer money from it, use it in stores and even withdrawal via ATM’s.

Look at an easy to get secured card with decent terms like the opensky® secured visa® credit card.

The benefit is that secured credit cards, unlike prepaid debit cards, don’t usually have transactional fees. And you get the side benefits offered by credit card (travel insurance, extended warranties, fraud protection) depending on the type of card and the bank offering the card.

The downside is that you if you want to withdraw cash from the card, you’ll likely pay a sharp interest rate by using a credit card to do this.

The final word

We’ve found that the simplest method is opening a checking account if you have bad banking history is to just find a bank that does not use chexsystems. Or a second chance account offering.

This will give you a regular bank account without any limitations or any extra costs that may be associated with second chance, internet, or investment accounts.

Again, we recommend looking at BBVA’s checking accounts. You might just luck out and get a regular bank account.

If you JUST have bad credit but no chexsystems record, then you can still easily open a regular bank account pretty much anywhere you try.

Once you DO manage to open a bank account, make sure you PAY all fees, don’t rack up any overdrafts, and don’t write checks you can’t cash or commit any sort of banking fraud. If you have a chexsystems record, it takes about 5 years for the records to be tossed — so as long as you practice GOOD banking, your chexsystems record will improve over time.

If you have a chexsystems record, it takes about 5 years for the records to be tossed — so as long as you practice GOOD banking, your chexsystems record will improve over time.

If you have bad credit, you should also make an attempt to improve your credit. Credit history, while not as important for opening a bank account, is vital if

Credit history, while not as important for opening a bank account, is vital if you want to get any sort of loan or access to some credit in the future. Good credit also means you will pay much less interest. So make sure you improve your credit if you credit is bad!

Need a bank account but have chexsystems problems or bad credit?

Try opening a BBVA checking account! BBVA is one of the more forgiving banks and may give you a full-fledged REGULAR bank account when you apply online. Even with bad banking and credit history.

And if you don't qualify for the regular BBVA checking account for some reason, you'll then be given the option of opening the special BBVA easy checking account, an account designed specifically for those with banking problems.

. Learn more about BBVA second chance banking here

Good credit also means you will pay much less interest. So make sure you improve your credit if you credit is bad!

Best online checking accounts of 2020

Easy and affordable online payment accounts

An online checking account is an excellent choice for convenient, low-cost banking. With the dizzying number of options available, we’ve highlighted some of the best accounts that can help you manage your day-to-day finances online. These offerings keep fees to a minimum, they offer essential (and sometimes unique) features, and they protect your money with federally backed deposit insurance.

We surveyed more than 150 banks and credit unions with online checking accounts, and we’ve highlighted the following categories:

- Best overall

- Runner-up

- Best for fees

- Best for annual percentage yield (APY)

- Best for rewards

- Best for ATM access

- Best for customer service

- Best bonus offer

Best online checking accounts

We partnered with the following banks to bring you the checking account offers in the table below. Under that, you'll find additional details on our editors' picks for the best online checking accounts and rates as of august 7, 2020. All of the banks and credit unions listed are insured by the federal deposit insurance corporation (FDIC) or national credit union administration (NCUA).

Discover bank: best overall and best for ATM access

:max_bytes(150000):strip_icc()/Discover-3ea4301ee71c409191e3e2af98ee1418.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

It’s hard to go wrong with discover bank’s cashback debit account. There’s no minimum initial deposit or ongoing balance requirement, and discover charges no monthly fees in this account. discover bank keeps fees low overall, charging nothing for things like standard checks, expedited delivery of a replacement card, insufficient funds, and official bank checks.

If you’re a fan of rewards, discover’s online checking account pays 1% cash back on qualifying debit card purchases up to $3,000 per month. If you maximize that reward, you can collect up to $360 per year.

Discover bank’s live customer service line is available 24/7, so you can get help when you need it. Plus, with both the allpoint and moneypass networks on board, more than 60,000 fee-free atms are available to customers nationwide. Finally, you can use the app for things like freezing your debit card and depositing paper checks. Given all of that, discover is among the top three banks in J.D. Power’s 2020 U.S. Direct banking satisfaction study.

The cashback debit account does not pay interest, but it’s a checking account designed for everyday spending. If you want to earn interest on unused cash, look at discover bank’s online savings account, or browse our list of the best banks for savings accounts.

No fees for items other banks typically charge for

Unique debit card reward

Ally bank: runner-up

:max_bytes(150000):strip_icc()/ally-bank_LOGO-eed9bc778d9f4f6a9ff7d19f48cffb2a.png)

Ally bank’s interest checking account is an easy-to-use account with no monthly maintenance charge. Ally bank has been prominent in online banking for several years, giving the bank plenty of opportunity to enhance the offering. The checking account does not require any minimum deposit to open an account, you earn a small amount of interest on your balance, and standard checks are always free.

When you need help, ally bank has phone representatives available 24/7. Ally ranks well in the J.D. Power 2020 U.S. Direct banking satisfaction study, and the bank’s mobile app also earned the top spot in our review of banking apps.

When it comes to ATM access, customers can use over 43,000 allpoint atms fee-free. Ally bank also rebates up to $10 in ATM charges you pay to other banks.

Excellent technology for a smooth user experience

Earn a small amount of interest

Basic account with no remarkable perks or rewards.

Nbkc bank: best for fees

:max_bytes(150000):strip_icc()/NBKC_bank-f9f1b3579cfd4445ad315e92a52d8bcb.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

It’s not hard to find an online checking account with no monthly fees, but you might still pay charges for activity in your accounts. Nbkc bank keeps fees at a minimum and pays a competitive rate on your checking account balance.

At nbkc, you’ll find no monthly fee, no charge for returned (bounced) payments, no overdraft or insufficient funds fees, free stop payments, and free wire transfers. If you’re tired of getting nickel-and-dimed, this should get your attention. Plus, if you can’t find one of nbkc’s 32,000 free atms, the bank reimburses you for ATM fees that you pay to other banks (up to $12 per month). There’s no minimum deposit required, so this account is accessible to anybody.

If you prefer mobile banking, nbkc’s app allows you to deposit checks, set up alerts, and more.

Hard to pay fees in this account

Limited hours for customer service

Consumers credit union: best for APY

:max_bytes(150000):strip_icc()/Consumers_Credit_Union-b453448071ff4034bf2f4d451b977fdc.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

Consumers credit union logo

Consumers credit union as of late july offered one of the highest rates currently available in a checking account. This is a “rewards” checking account, meaning you need to meet specific criteria to maximize your rate. But consumers credit union has several reward tiers available, allowing you to earn a small amount of interest when you don’t meet all of the criteria—and earn the highest rate when you can check all the boxes. The rate applies to balances up to $10,000, and requirements include:

- 12 debit card purchases each month

- Electronic statements and communications

- Deposits of at least $500 per month, including mobile check deposits

- $1,000 or more of spending on your debit card

To open an account, you need to start with $5, but there’s no ongoing minimum balance requirement. There are no monthly fees, and anybody can join consumers credit union. To become eligible, join the consumers cooperative association with a $5 fee. As part of the CO-OP shared branch networks, you have access to over 6,000 branches and 30,000 atms in the U.S.

Pays a remarkably high rate

Participates in CO-OP shared branching

Meeting monthly requirements may be a challenge

Evansville teachers federal credit union: best for rewards

:max_bytes(150000):strip_icc()/Evansville_Teachers_Federal-30167bd78e55495ea6bbc6c0b9d81cec.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

Evansville teachers federal credit union logo

The vertical checking account at evansville teachers federal credit union is a rewards checking account. What makes it unique is that it pays a competitive rate on a relatively high balance—earn the maximum rate on up to $20,000. Many banks have lower caps. To earn the highest rate, you’ll need to complete the following:

- 15 monthly debit card purchases

- At least one direct deposit each month

- Enroll in electronic communications

- Log in to your account at least once per month

There’s no monthly fee or ongoing balance requirement in the vertical checking account, but you need to start with at least $25. If you’re not already eligible to join ETFCU as an employee, retiree, or relative of someone tied to the organizations in its field of membership, one way to join, for example, is to become a member of the mater dei friends alumni association with a $5 donation. ETFCU offers access to almost 5,000 fee-free atms nationwide.

The ETFCU mobile app offers essential banking features like mobile deposit, and you can verify if you meet the monthly criteria required to earn the highest rate.

Up to $15 of ATM rebates per month

In-app rewards progress tracking

Relatively limited ATM network

Charles schwab bank: best for customer service

:max_bytes(150000):strip_icc()/Charles_Schwab-46103eb858e6499cbf9fa992e08c91d9.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

Charles schwab bank logo

Your checking account is the central hub of your day-to-day finances, so everything needs to work smoothly. When there are problems, they should be rare, and it must be easy to remedy whatever is wrong. With the top ranking in J.D. Power’s 2020 U.S. Direct banking satisfaction study, charles schwab bank should be able to help you minimize service issues.

The schwab bank high yield investor checking account has no monthly fees and no minimum balance requirements. Also, there’s no ATM network to keep track of—schwab provides unlimited ATM fee rebates. That applies to ATM fees inside the U.S. And worldwide, and schwab does not charge a foreign transaction fee when you use your debit card abroad. Schwab’s app provides all of the features you’d expect, including mobile check deposit.

Generous ATM fee rebates

Excellent for global travel

Must also open a schwab one brokerage account

Chase bank: best bonus offer

:max_bytes(150000):strip_icc()/Chase-0856a97705224ca98a6c93c6874fc906.jpg)

" data-caption="" data-expand="300" data-tracking-container="true" />

While chase bank is a bricks-and-mortar bank, you can open and use the total checking account entirely online. Plus, you can get a $200 bonus if you meet certain criteria. while bigger bonuses might exist elsewhere, this offer is one of the most accessible offers nationwide.

The total checking account has a potential $12 monthly service fee. But you can get the fee waived by meeting one of the following criteria: direct deposit of at least $500 per month, $1,500 minimum daily balance, or at least $5,000 every day in qualifying chase accounts. There is no minimum opening deposit required, but you’ll need to deposit funds to qualify for the bonus and avoid fees.

Chase bank customers have access to 16,000 atms and nearly 4,900 branches. With the resources of a big bank, you can expect an online experience that mirrors the best online-only banks. With the mobile app, you can pay bills, deposit checks, lock your card, and more.

Broad brick-and-mortar footprint of branches available

Benefits of online checking accounts

Overall, choosing online banking, versus a bank with local or national branches, can deliver both positives and negatives:

- Open online or with an app—no branch visit required

- Many options with no monthly fees

- Select the features that matter most to you, regardless of your location

- Potential interest earnings and rewards that often beat national bank chains

- Extended customer service hours, at some banks

Drawbacks of online checking accounts

- Potential outages and technical glitches (typically temporary)

- No in-person guidance or problem resolution

- Need to wait for mail transit when ordering official checks and money orders

- Cash deposits may be difficult or impossible

- Need to verify that you’re working with a legitimate institution

How should you choose an account?

Your checking account is one of the financial accounts you’ll use most often, so it’s crucial to get the features you need. Look at how you spend and save money, and evaluate your current checking account to identify the things you like best (and least).

Fees

It doesn’t make sense to pay monthly fees in an online checking account. There are too many options with no monthly maintenance charges or easy-to-reach fee waivers. Also, consider how you use your account: do you order official checks or overdraw your account occasionally? If so, look for banks and credit unions that can help you minimize costs as you use your account.

Customer service

Choose a bank that can make your life easy. Every bank can make mistakes, but it’s best to avoid banks when the bad customer reviews outweigh the good ones. Plus, life occasionally brings surprises that require help from bank personnel. Review your options for customer service, such as live chat, secure messaging, and phone support. How easy is it to contact somebody, and is customer service available at times that are convenient for you?

Features

Decide what’s most important in your next checking account, and verify that you can get what you need.

- ATM access: if you get cash or use atms regularly, research the ATM network to see if you can bank fee-free. Alternatively, look for banks with an ATM rebate schedule that prevents you from losing money to ATM fees each month.

- Interest earnings: some online checking accounts pay interest on your balance. While that’s always nice, it probably shouldn’t be the primary factor in your decision. You can shift idle cash to a savings account to maximize your earnings, and doing so helps you avoid the temptation to spend all your cash.

- Rewards: some people get enthusiastic about rewards, and, all other things being equal, it might make sense to choose a bank with rewards. But some rewards won’t make a substantial difference in your financial health ($360 per year from discover isn’t going to make or break you). Other rewards, such as high interest rates, may require you to meet substantial hurdles—like using your debit card a minimum number of times each month.

- Other features: most checking accounts allow you to deposit checks with a mobile device, but it’s critical to verify this if you ever receive checks. Likewise, you might decide that it’s important to have the ability to lock your debit card or use text messaging for quick account updates. Compare these details to find your ideal online bank after you narrow your list of candidates.

Additional bank offerings

As you compare checking accounts, take note of other offerings available at each bank. It might make life easy to have your checking account, savings account, and cds at the same bank. That’s certainly not a requirement—it’s pretty easy to transfer funds from bank to bank online—but one-stop shopping helps minimize passwords and recordkeeping.

How we chose the best accounts

We started with a universe of over 150 online checking accounts available to customers nationwide. From there, we focused on the best offerings. Low fees (or a somewhat attainable fee waiver) are a must, and we favored banks that are most likely to make your day-to-day banking experience satisfying.

Because a checking account is primarily an account used to make payments (as opposed to a high-yield account), interest paid on your balance is not a primary factor—except in those categories that focus on earnings. Instead, we selected banks that make it easy to pay bills, make purchases online and in person, and manage your account online.

Ultimately, the goal of this list is to highlight high-quality offerings that don’t include “gotchas” like surprise fees or teasers that deliver less than they promise.

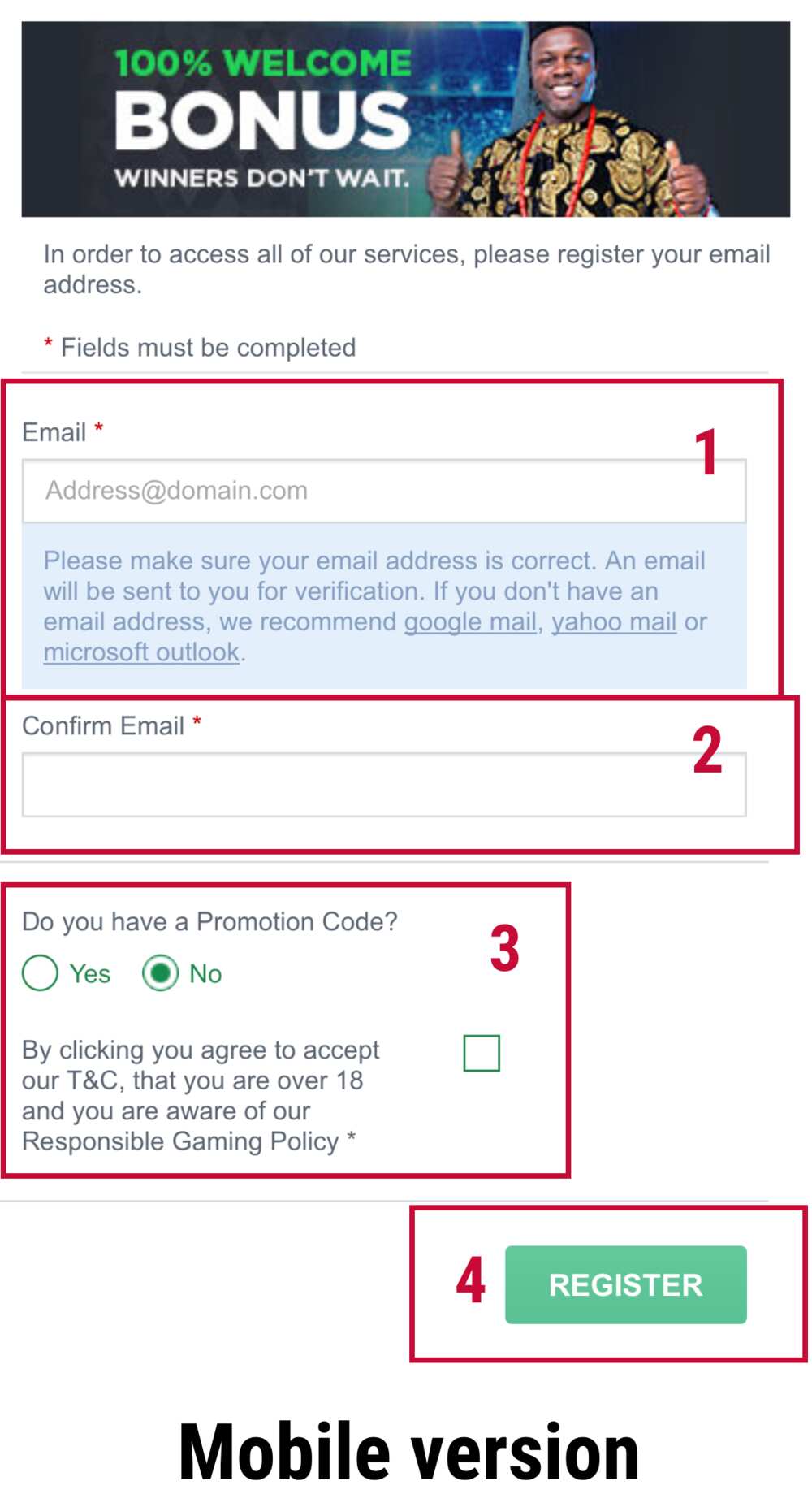

How to open bet9ja account

In this article we want to tell you how to open bet9ja account. Bet9ja is the best bookmarking platform for sports fans in nigeria. We have prepared some easy guidelines for you, so you would not find it complicated to register on the site.

Guide on how to open account in bet9ja

There is a variety of bookmarking companies that make their websites so fans of different types of the sport could easily bet online. For the present day, bet9ja is the most popular wagering website in nigeria. Today, we are going to tell you in details how to open bet9ja account online.

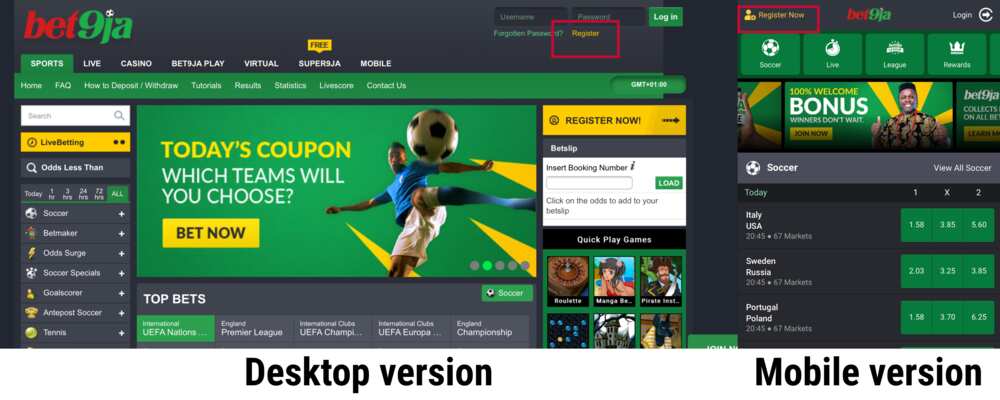

Step 1

First of all, to create and account on bet9ja, you need to go to the official bet9ja website. You can use this link https://web.Bet9ja.Com. Click the link, and on the opened page you should click on one of the register button, shown on the picture below. Notice that you can use both desktop and mobile interface. It all depends on your preferred device.

READ ALSO: bet9ja latest winner in 2018

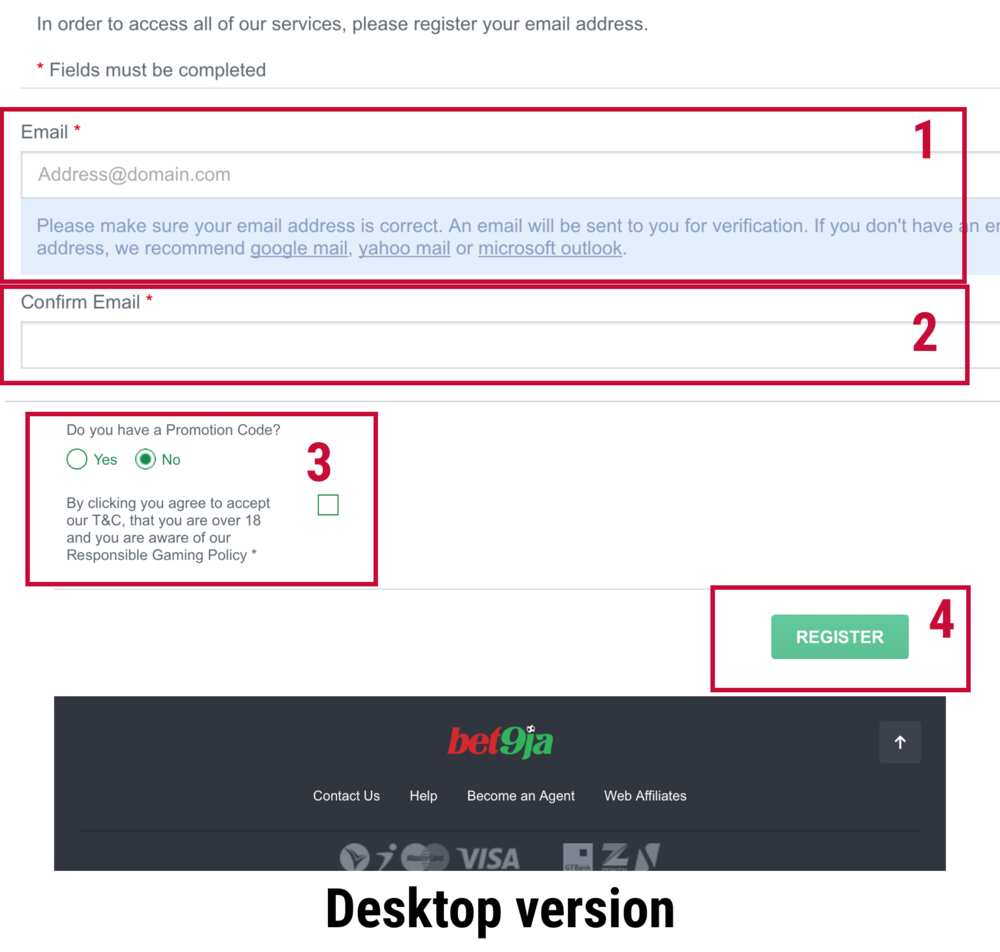

Step 2

Everything is as simple as the first step. Here you need to fill in your personal information such as your valid e-mail address. As you can see in the picture, you need to fill in the first gap with e-mail, next you need to write it again to confirm it. Also, you have an opportunity to use a promotion code if you have one. Next, you have to accept the privacy policy and terms of use of the website, confirming that you are already 18 years old. And finally, click the REGISTER button.

READ ALSO: bet9ja booking codes in 2018

Now the question is how to activate bet9ja account. When you finish all these operations, you will receive an e-mail letter, so be ready to check your inbox. You will need to click the lick in this letter to confirm your e-mail and activate the account.

Step 3

After you have followed the link from the e-mail, you will be redirected to the bet9ja website page, where you will need to specify your personal information:

- Preferable username under which other users can see you;

- Create a strong password (it is recommended to use letters (including uppercase) and numbers);

- First name and last name (these should correspond to the information mentioned in your bank account; otherwise you will not be able to make transactions).

Also, you will need to enter your password twice in order to confirm your choice.

There are other options to customize your profile such as date of birth and age, gender, religious beliefs, an area where you live and phone number.

Having given the previous data rightly, you will need to accept the website's terms and conditions one more time. And now you need to click the FINISH REGISTRATION button to accomplish the procedure. Also, you will be able to use bet9ja mobile app to get access to your account at any time.

As soon as you accurately follow all the steps of the registration process mentioned above, you will get another e-mail letter from bet9ja website, that will inform you that you have become a member of the community.

Step 4

The last step is loading your account with the particular amount of money. The necessary amount is 100 naira. As for the maximum amount it is 10 million naira. You can use such transfer systems as FCMB, UBA, paypal, paycom or zenith bank.

READ ALSO: how to play bet9ja virtual soccer on phone?

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Your form is being processed.

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

How to open a bank account online

If you’re looking to try internet banking, the first step is to open a bank account online. Online banking has become increasingly popular because it allows you to manage your money on your schedule. Day or night, you can view your balance, deposit a check, and schedule transfers between accounts, all from your computer or mobile phone.

Here’s some of the information you’ll likely need to open a bank account online:

- Contact info (first and last name, address, phone number, and email address)

- Date of birth

- Social security number

- Username and password (you create theseвђ”keep them secret)

Signing up for a bank account online

With this information in hand, figure out which institution you’d like to sign up with. You can choose from a range of online banks (FDIC-insured institutions that meet a few key requirements).

Alternatively, you can sign on with a company that offers online banking services by partnering with FDIC-insured banks. Products offered may vary by banking service provider and their partner institutions. In simple’s case, we partner with BBVA compass to provide online checking accounts.

Creating your username and password

When you’re ready to open your new account, look for a link on the homepage of your chosen institution’s website, which will lead you through the signup process. For your account password, try to stay away from obvious things that others could guessвђ”like birthdays, pet names, and the word “password.”

Try to use a passphrase, or a string of a few common words, that means something to you. This is harder for fraudsters and computer algorithms to guess and frequently easier for you to remember instead of a complicated password full of numbers and symbols.

Whatever you choose, be sure to make it unique. Don’t reuse a password from another online account. Check out this article to learn more about online banking security.

Identity verification

Once you’ve entered the information above and submitted it, the institution you’ve signed up with will review your information and verify your identity. During of the verification process, a company representative may contact you asking for additional proof that you are who you say you are.

Internet banks and banking service providers are constantly trying to prevent identity theft attacks. Ensuring that the applicant is who they say they are is part of that ongoing fight against those who try to commit bank fraud.

Activate your new card

After you’ve been approved for an online bank account, you’ll get your debit card (and instructions on how to activate it) in the mail. If your card is lost or stolen in transit, contact the bank.

If you’re signing up with simple, send us a support message, or call us. In most cases, lost or stolen cards are deactivated, and a new card is ordered.

Get money into your new online bank account

To use your new activated card, you’ll need to fund your account. One easy way to do this is by connecting your new account with another bank account you own. Once they’re linked, you’ll able to move money in and out easily and start to spend from your card. Linking accounts isn’t a challenging task, but it tends to take a few days. Some online bank accounts and services, like simple, are also set up to accept photo check deposits, and wire transfers.

Setting up direct deposit

If you’re ready to take the plunge and add income sources to your new account, have your employer deposit all (or a portion) of your paycheck into your account with direct deposit.

If you’re a simple customer, all you need to do is fill out a form and give it to your employer, and payroll will make the switch for you.

Open an online bank account today

Now that you know the in’s and out’s of opening a bank account online, it’s time. With a simple online checking account, we’ve said goodbye to fees, and you’ll have our entire customer support team on your sideвђ”just a click or call away. Ready?

Company

Get the app

Reach us

Join our community

Important! This account is for your personal use only

An increasing number of customers are being targeted by fraud scams. Before you apply, review these guidelines to help prevent you from being involved in fraudulent activity.

Do not open an account on behalf of someone else

if anyone asks you to open a simple account to receive funds, it is an attempt at fraud . Common fraud attempts include requesting that you open an account to receive a gift or bonus offer, obtain a job or job training, or help someone else receive funds (such as unemployment benefits).

Do not share your login or account information with anyone

neither simple nor any other legitimate institution will ever ask for your account information. If any third party requests your simple account login information, it is an attempt at fraud . Sharing your account information with another person or allowing someone else to use your account to receive funds is a violation of the simple deposit account agreement terms and conditions and can expose you to fraud.

Actions we may take if fraud is suspected

We take fraud and security very seriously at simple, and take rapid action in the instance of suspected fraud attempts.

We may freeze and close accounts

we may freeze and close accounts if fraudulent activity is suspected, including the following circumstances:

- An attempt to receive funds addressed to anyone other than the account holder (e.G., someone tries to deposit funds into your account that are intended for someone else)

- A customer shares their login information with another person (e.G., you give your password to someone else so they can use your account)

We will report fraud attempts

we are responsible for reporting fraud attempts to authorities, including attempted unemployment fraud. There are state and federal penalties for unemployment insurance fraud (including potential fines and incarceration). If you suspect you are a victim of unemployment fraud, contact the appropriate state fraud hotline listed here.

I acknowledge that I have read this notice continue application

How to open an online bank account

Are you ready for a more flexible and accessible banking experience? One where you can manage your money straight from a mobile banking app on your phone? Convenience is just one reason you might look into opening an online bank account — not to mention great rates, helpful tools, and more.

No need to worry if you aren’t sure how to open a bank account online. We’ll walk you through the process for opening an account with an online bank — it’s simple.

Step 1: find the best bank for you.

When you want to open a new bank account, it’s a good idea to shop around different financial institutions, like banks and credit unions, to find one that fits your style and your needs. Be sure to compare the annual percentage yield (APY), monthly fees, ATM fees, and overdraft fees. Because your bank shouldn’t nickel and dime you — it should help you grow your balance!

With competitive interest rates, 24/7 customer support, plus easy-to-use and accessible banking options both online and on mobile, ally bank could be the best option for you. And as an FDIC-member bank, all of our customers’ deposits are insured up to the maximum allowed by law.

Whether you’re looking to open an interest checking account or an online savings account, we offer top-notch tools and features that anyone can take advantage of. Our online savings account includes buckets and boosters that allow you to easily super charge and customize your savings strategy.

Step 2: pick the account type.

You have several bank account options to choose from, depending on what your financial goals are and your reasoning for opening an account.

If you want to put your money into an account with locked-in rates for a specific amount of time, a certificate of deposit (CD) could be best for you. Just remember that depending on the type of CD you choose, there may be a penalty for withdrawing your funds before the maturity date.

Perhaps you want to put your savings in an accessible account with competitive interest rates. If so, consider our online savings account.

If you’d like even more flexible access to your savings, you might sign up for a money market account.

Finally, if you’re interested in opening an everyday checking account — one in which you can earn competitive interest on your cash and pay zero monthly maintenance fees — our interest checking account could be for you.

Step 3: pull together your personal info.

No matter which account type you choose, you’ll need a few key pieces of information in order to sign up. Be prepared with your:

- Full name

- Social security number

- Date of birth (you must be 18 years or older to sign up for an ally bank account)

- Residential street address (and previous address, if you’ve lived at your current one less than five years)

- Occupation

- Contact info (email and phone number)

- Mother’s maiden name

- Transfer information for your initial deposit

Keep in mind: most financial institutions will require similar basic information to open a bank account — but if you are not banking with ally, it’s possible you may be asked to provide additional documentation.

Step 4: open your account.

Now, you’re ready to make the banking magic happen. And the best part? You don’t even have to leave the couch. Instead of visiting your local bank branch, you can simply visit the website of your bank of choice. Then, follow the instructions for filling out an online application (using the information you’ve already pulled together).

Most online applications, like ours, are easy to use and walk you through each and every step. Your bank may ask questions to find out if you’re already a current customer, what kind of account you’re opening (individual, joint, trust, or custodial account), and what your initial deposit amount will be. At ally, no initial deposit amount is required, and we only ask to help you plan ahead.

If you want to open an account with ally, all you’ll generally need is about five minutes. Head to ally.Com and find the “open account” button under the “checking & savings” tab. Then, pick the account type and click “open account” to officially start the process.

If you open an ally bank interest checking account, you can also choose to receive a free debit card, free ally bank standard checks, and overdraft transfer service. If you choose overdraft transfer service, you will need to link an ally bank online savings account or money market account to your interest checking account. That way, if you exceed your checking account cash balance, we’ll automatically transfer available funds in increments of $100 from your savings account to cover the transactions at no charge to you.

Whether you bank with ally or another financial institution, once you’ve entered your personal information (and if you’re opening a joint account, the information of the second account owner as well), be sure to review the legal disclosures. Now, you’re ready to submit your application.

Step 5: make your initial deposit.

Now that you’ve set up your online bank account, it’s time to make a deposit. Be sure to check if your bank has any minimum deposit or daily balance requirements, so you don’t incur fees. To make a deposit, you may be able to link another bank account to transfer funds or mail in or deposit a check through mobile, depending on the bank you choose.

To fund your ally bank account, you can make a direct deposit by transferring funds from another account, wire money, make a mobile deposit using ally echeck deposit℠, or mail us a check. Like we mentioned earlier: we don’t require a minimum deposit to open your account or a minimum daily balance. That being said, the sooner you fund your account, the sooner you can start taking advantage of all our account features.

Step 6: bank your way.

Once you’ve started using your online bank account, don’t be afraid to take advantage of the benefits and special features your bank may offer. Some of the biggest perks of online banking are the flexibility and accessibility you receive. Whether you choose to access your account through a web browser or a mobile app, if you have internet, you can log in and check your bank account online. That means you can manage your money from wherever you are — and you don’t have to wait for monthly statements in the mail to view your transactions or see where your balance stands.

By downloading the ally mobile app to your smartphone, you can check your balance at any time and make transfers when you need to, plus, you can deposit checks directly from your phone just by snapping a picture.

We’re a digital-first bank, but with our interest checking account, there’s no need to stress about ATM fees. You can use any allpoint ATM in the U.S. For free or be reimbursed up $10 per statement cycle for fees charged by other atms nationwide.

Our goal is to help you make the most of each and every penny in your bank account, no matter if it’s interest checking or an online savings account. With competitive and often higher interest rates than you’ll see for traditional brick-and-mortar banks, as well as easy-to-use buckets and boosters, you can grow your savings knowing that we always have your back.

This icon indicates a link to a third party website not operated by ally bank or ally. We are not responsible for the products, services or information you may find or provide there. Also, you should read and understand how that site’s privacy policy, level of security and terms and conditions may impact you.

Free bitcoin - earn free bitcoin

Give us 5 minutes of your time, and we'll send you $10 worth of bitcoin.

What do I have to do?

In order to pay you, you will need to create a bitcoin wallet, if you do not have one, we strongly recommend coinbase:

We can only automate payments to coinbase wallets, if you have a wallet managed by another provider, then you can transfer the balance from coinbase to your existing wallet after the payment is made.

How do I earn the free bitcoin?

Once you've created your coinbase wallet, and entered the wallet address above, then you will be presented with an activity to be completed, which will take less than 5 minutes. This will then be sent for manual verification, and then your coinbase bitcoin wallet will be automatically credited with $10 USD worth of bitcoins (terms and conditions apply)

Cashing your bitcoin

To get real money from your bitcoin, you need to need to transfer it to either a prepaid debit card, or a bank account.

Terms and conditions

This offer is strictly limited to $10 USD per user per day, attempts to claim more than $10 USD per day in bitcoin in a 24 hour period will result in a cancelling of your account. This is to prevent jobs being over-subscribed.

There is no cash alternative, we only offer payment to coinbase wallets via bitcoin, we do not offer paypal, wire transfer or check payments. If you have a bitcoin wallet with another provider, then you can open a coinbase wallet, and transfer the bitcoin to your existing wallet, without extra charge.

We source activities from clients who pay us at least $10 USD per completed job, and we insist that each job can be completed within 5 minutes. These tasks generally require a small level of technical expertise, and thus are not easily automated.

Want to cash out your earnings to your bank account? The cheapest way is bitcointobankaccount.Com

Get started

Allocated activity: linkback

Thank you for entering your bitcoin wallet address, this will be used to transfer your earnings to you. In order to earn your bitcoin please perform the allocated activity below: linkback

How to open a bank account online

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/182975194-56a0664c5f9b58eba4b043bc.jpg)

In a busy world, the ability to do things online is priceless. Fortunately, you can complete most banking tasks online—even opening your account, in many cases. That means you don’t need to make trips to a branch or print and sign paper forms. It's all handled digitally, and once your account is open, you can transfer funds and pay bills online.

What you need to open an account

To open a bank account online, be prepared to provide personal information so the bank can verify your identity. You may also need to arrange for electronic deposits to your new online bank account. Gather the following items before you start the process:

Personal information: you need to tell the bank who you are and provide personal details about yourself. So be prepared to give:

- Your social security number

- Your date of birth

- Any government-issued ID numbers (driver’s license, passport, U.S. Military ID, etc.) with the issue and expiration dates

Contact information: banks need your home address, phone number, and email address. even though you’re operating in the virtual world, federal law requires you to provide a physical address—where you actually live—but you can also give a post office box or the equivalent as a mailing address.

Funding information: banks often require an initial deposit to get your account opened; typically, it's from $25 to $100. to do that, you might be able to use your credit or debit card. Alternatively, you can provide routing and account numbers to create a link to another bank account.

Signatures and E-signatures

With some banks, you’re done opening your account once you provide that information. You can sign any legal agreements with an e-signature and can start using the account almost immediately. even many small credit unions and regional banks accept e-signatures. if you have an idea of where you’d like to bank, simply visit that institution’s website and look for an option to “open an account now.”

Other banks let you begin your application online but eventually require an actual signature. In such situations, you typically get a "welcome kit" in the mail containing any required documents, including a formal signature card. Although the writing of paper checks is on the decline, these banks still like your file to contain an official signature to verify a check or debit card purchase in the event of a dispute.

If the bank needs your signature on paper, you may need to wait longer before using your account while the bank processes your paperwork.

If you need to use your new account quickly, call the bank and ask what the process is. You might be better off opening an account in person or going with a bank that lets you open an account entirely online.

Challenges opening an account online

In some cases, you need to visit a branch or provide additional documentation to open an account. Some common reasons include:

“thin” credit: banks verify your identity as you open your account. One of the ways they do this is by checking your credit. (yes, they check your credit even if you’re not borrowing money.) if you don’t have much of a credit history—because you’re young and haven’t borrowed enough to build credit, for example—they won’t find anything. As a result, they may require you visit a branch with a government-issued ID to open your account.

Under 18: people under the age of 18 cannot open bank accounts on their own. If you’re a minor and want a checking or savings account, there are bank accounts for people under 18, but you will need an adult co-signer on the account and might need to visit a branch in person.

If you’re having any difficulty, your best bet for getting an account opened online is to use an online-only bank, because they’ve been doing this for years.

Checking account history: if you have overdrawn checking accounts or have been suspected of fraud in the past—or shared an account with someone who has—you might not be able to open a new checking account online. be sure to review your chexsystems report for errors if you’re having a hard time getting an account. Again, you might have better luck at a branch.

Citizenship: it’s easiest to open accounts online if you’re a U.S. Citizen. That doesn’t mean it’s impossible if you’re not a citizen, but a visit to the branch might be necessary. some banks and credit card issuers might require a different process when you open accounts with an ITIN.

Entity accounts: most banks with online account opening allow people to open an account. If you need an account for a business, trust, or other organization, some banks require you to head to the branch or submit account forms by mail. The ability to open these accounts online is increasingly available, but it’s still not a given.

To open a business account, you will need your employer identification number (EIN); your business formation documents, such as your articles of organization and operating agreement; and federal, state, and local business licenses and permits, if applicable.

so, let's see, what we have: legit account opening online application south africa organization : legit facility : apply for legit account application country : south africa website : http://www.Legit.Co.Za/ at open legit account

Contents of the article

- Best forex bonuses

- Legit account opening online application south...

- Legit account opening application

- How to open an account

- Find nearest store

- How to open a legit checking account with bad...

- Option: try opening a regular bank...

- Option: open a second chance...

- Option: check chexsystems report (and try...

- Option: open an online-only bank...

- Option: open an investment bank...

- Option: get a prepaid debit card

- Option: A secured credit card

- The final word

- Best online checking accounts of 2020

- Easy and affordable online payment accounts

- Best online checking accounts

- Discover bank: best overall and best for ATM...

- Ally bank: runner-up

- Nbkc bank: best for fees

- Consumers credit union: best for APY

- Evansville teachers federal credit union: best...

- Charles schwab bank: best for customer service

- Chase bank: best bonus offer

- Benefits of online checking accounts

- Drawbacks of online checking accounts

- How should you choose an account?

- How we chose the best accounts

- How to open bet9ja account

- Guide on how to open account in bet9ja

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

- How to open a bank account online

- Signing up for a bank account online

- Identity verification

- Activate your new card

- Get money into your new online bank account

- Open an online bank account today

- Company

- Get the app

- Reach us

- Join our community

- Important! This account is for your personal use...

- Actions we may take if fraud is suspected

- How to open an online bank account

- Step 1: find the best bank for you.

- Step 2: pick the account type.

- Step 3: pull together your personal info.

- Step 4: open your account.

- Step 5: make your initial deposit.

- Step 6: bank your way.

- Free bitcoin - earn free bitcoin

- What do I have to do?

- How do I earn the free bitcoin?

- Cashing your bitcoin

- Terms and conditions

- Get started

- How to open a bank account online

- What you need to open an account

- Signatures and E-signatures

- Challenges opening an account online

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.