Octafx review malaysia

Octa markets cyprus ltd., a brokerage company dedicated to providing investment services, is based in cyprus and under the supervision of the cyprus securities and exchange commission (cysec).

Best forex bonuses

The domain used by the company is вђњdomain octafx.Eu.Вђќ so in essence, the clients will be trading with a broker that is regularly supervised by a european regulatory authority which will further guarantee a safe and smooth trading experience. Octafx, a multi-award-winning forex broker founded in 2011, is licensed by cysec (cyprus) and registered by IBC (SVG).

Octafx malaysia - octafx forex broker review

Octafx, a multi-award-winning forex broker founded in 2011, is licensed by cysec (cyprus) and registered by IBC (SVG).

Octa markets cyprus ltd., a brokerage company dedicated to providing investment services, is based in cyprus and under the supervision of the cyprus securities and exchange commission (cysec). The domain used by the company is вђњdomain octafx.Eu.Вђќ so in essence, the clients will be trading with a broker that is regularly supervised by a european regulatory authority which will further guarantee a safe and smooth trading experience.

The octafx.Com website is registered under octa markets incorporated established in st. Vincent and the grenadines; this enables the clients to enjoy higher leverage possibilities and various bonus programs.

As an experienced STP broker with over 1.5 million trading accounts opened from 100 countries all around the world, octafx serves its clients with tighter spreads (as low as 0 pips) and faster order execution with no slippage, no delays, and no re-quotes. Octafx offers easy and convenient forex trading for all types of traders with the minimum deposit of $5, fixed/floating spreads with no commission, and leverage up to 1:500. Octafx also uses the most popular trading platforms in the currency market namely metatrader 4, metatrader 5, and ctrader.

At octafx malaysia, clients can benefit from various deposit and withdrawal methods (credit cards, VISA, mastercard, debit cards, bank transfer, electronic wallets (ewallets), neteller, skrill, fasapay, unionpay, bitcoin, BCA, mandiri, BNI, BRI, fasapay.) and a wide range of tradable markets (forex, metals, energies, indices, and cryptocurrencies).

Octafx allows its traders to use all types of strategies. Novice traders may enjoy the benefits of octafx MICRO account on metatrader 4 with the help of various educational tools and tutorials, experienced traders may choose the PRO account on metatrader 5, and expert traders are welcome to use the ECN account on the ctrader platform.

Octafx provides optimal customer care through its comprehensive FAQ on the companyвђ™s multilingual website, along with a live customer support available 24 hours from monday to friday via phone call, live chat, social media platforms (facebook, twitter, and instagram), as well as social chatting applications such as whatsapp and telegram in 12 languages, including malaysian, english, hindi, indonesian, urdu, chinese, german, portuguese, spanish, vietnamese, and thai., to make sure its clients will have a satisfactory trading experience. Moreover, as a newcomer or experienced trader, you can participate in octafx monthly trading contests on both demo and real accounts or benefit from welcome bonuses that are offered by the broker.

Octafx malaysia - octafx (capital FX) forex malaysia review

Octafx (capital FX), adalah broker forex, pemenang berbagai anugerah yang ditubuhkan pada 2011, dilesenkan oleh cysec (cyprus) dan didaftarkan oleh IBC (SVG).

Sebagai broker STP (pemprosesan terus tembus) berpengalaman dengan lebih 1.5 juta akaun dagangan dibuka dari 100 negara seluruh dunia, octafx memberikan pelanggannya spread yang sempit (serendah 0 pip) dan pelaksanaan pesanan yang cepat tanpa gelinciran, tanpa kelewatan, dan tanpa sebut harga semula. Octafx menawarkan perdagangan forex yang mudah dan sesuai untuk semua jenis pedagang dengan deposit minima $5, spread tetap/tidak tetap tanpa komisyen, dan leverage sehingga 1:500. Octafx juga menggunakan platform dagangan popular untuk pasaran mata wang seperti metatrader 4, metatrader 5, dan ctrader.

Di octafx malaysia, pelanggan boleh menikmati beberapa kaedah deposit dan pengeluaran (visa, neteller, skrill, bitcoin, dan bank tempatan malaysia) dan keboleh dagangan pasaran meluas (forex, logam, tenaga, indeks, dan mata wang kripto)

Octafx membolehkan pedagangnya untuk menggunakan semua jenis strategi. Pedagang novis boleh menikmati kelebihan akaun MICRO octafx pada metatrader 4 dengan bantuan berbagai alatan dan tutorial pendidikan, pedagang berpengalaman boleh pilih akaun PRO pada metatrader 5, dan pedagang pakar dialukan untuk menggunakan akaun ECN pada platform ctrader.

Octafx membekalkan khidmat pelanggan yang optima melalui soalan lazimnya yang menyeluruh pada laman web berbilang bahasa syarikat, diikuti sokongan pelanggan langsung tersedia 24 jam dari isnin ke jumaat melalui panggilan telefon, chat langsung, platform media social (facebook, twitter, dan instagram), dan juga aplikasi chat social seperti whatsapp dan telegram dalam 12 bahasa, termasuk bahasa inggeris, indonesia, cina, dan belanda, untuk memastikan pengalaman berdagang yang memuaskan kepada pelanggannya. Tambahan pula, sebagai pedagang pemula atau berpengalaman, anda boleh menyertai peraduan berdagang bulanan pada kedua akaun demo dan betul atau mendapat manfaat dari bonus aluan yang ditawarkan oleh broker.

Octafx review 2021

Octafx is a low cost cysec regulated forex broker that is popular in malaysia. Their trading fees is low & support is good too, but have limited number of trading instruments. Read our review to decide if you should choose them or not?

Regulated by: cysec, FSA

Headquarters: st. Vincent and grenadine

Foundation year: 2011

Octafx is a popular STP forex broker that has been operating since 2011 & accepts traders from malaysia. More than 1.5 million trading accounts have been registered with them globally.

Octafx offers three different kinds of trading accounts and the fees that it charges depends on the type of account. Users have the option of using the metatrader 4, metatrader 5, or ctrader trading platforms. Octafx is relatively less regulated than other comparable brokers and holds licenses from tier-2 cysec and offshore regulator st. Vincent & grenadine authorities.

Compared to other brokers, octafx offers limited range of instruments including 28 currency pairs & 10+ cfds on commodities, cryptocurrencies, indices. But they offer copytrading feature.

In this octafx malaysia review, we’ve compared every pros & cons, and everything you need to know about octafx before choosing them.

- Octafx is a STP broker, and they charge low fees overall without any hidden fees.

- Negative balance protection is available at octafx malaysia

- Chat support available in bahasa malay & english.

- Offers choice between MT4, MT5 and ctrader trading platforms for mobile, desktop & web.

- Islamic account is available at octafx.

- Not well-regulated. Only with 1 top tier regulator cysec.

- There is no local phone number for support in malaysia.

- Fewer currency pairs, and very few CFD trading instruments offered compared to other competing brokers.

Octafx malaysia – A quick look

| �� our verdict | #1 forex broker in malaysia |

| �� broker name | octafx malaysia |

| �� typical EURUSD spread | 0.7 pips (with micro MT4 account) |

| �� year founded | 2011 |

| �� website | https://www.Octafxmy.Com/ |

| �� minimum deposit | $100 |

| ⚙️ maximum leverage | 1:500 |

| ⚖️ regulation | cysec, FSA |

| ��️ trading instruments | 28 currency pairs, 10+ cfds on indices. Cryptos, metals |

| �� trading platforms | MT4, MT5, ctrader for desktop, web & mobile |

Is octafx malaysia safe?

Octafx is regulated by one tier-2 financial regulator which is less trusted than other comparable brokers. However, being licensed to operate by fewer financial authorities does not automatically mean that octafx is not a safe broker. They have been operating since 2011 and have a proven track record.

Octafx is regulated and authorized under following regulators:

Octafx is registered with the cysec of cyprus under name ‘octa markets cyprus ltd’ – which is authorized and regulated by cysec with license no. 372/18.

Is octafx a safe forex broker for malaysian traders? Yes, would be our short answer.

It is also worth mentioning that octafx also maintains other security procedures to enhance the safety of traders. These practices include segregation of funds, anti-money laundering policies, and negative balance protection.

Octafx is less well-regulated than other comparable brokers, however, they have been in operation since 2011 and are trusted by thousands of users worldwide.

Octafx malaysia fees

The fees and commission that a trader is charged at octafx depend on a variety of factors – such as which type account is being used, when the trade is being made, and which instrument is being traded.

However, traders can get an idea of how much fees octafx malaysia charges by using a few benchmark examples.

Here is a breakdown of trading fees at octafx malaysia:

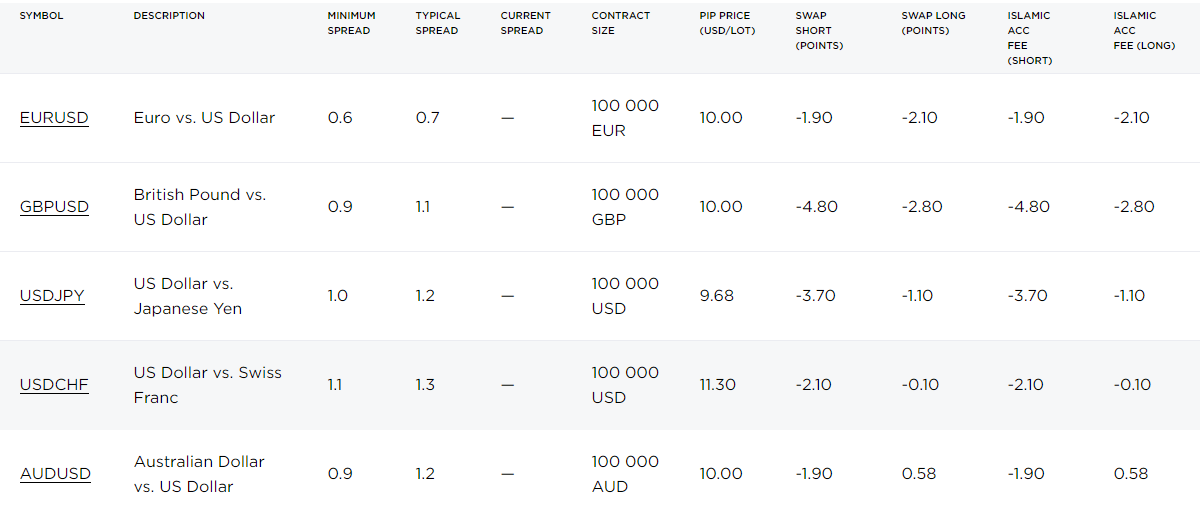

Low typical spread – the minimum spread that is charged at octafx is the lowest for those trading through the ECN ctrader account. However, the average or typical spread that is charged is nearly the same for all three accounts.For a trader using the micro MT4 account, the typical spread charged for trading the benchmark EURUSD currency pair is 0.7 pips.

Below screenshot of table from their website shows the fees with their metatrader 4 account.

The spread that they charge quite competitive when compared to other similar brokers like exness & XM.

In addition to a spread, octafx also charges swap rates. But there is no commission with islamic account, although the overall fees that they charge for islamic accounts is similar to the other types of accounts.

Overall, octafx does not charge a any hidden fees that we noticed. Plus they have an option to open islamic account for swap free trading. We found that octafx are an affordable forex broker.

Octafx bonus

For new account openers, octafx offers a 50% deposit bonus & this offer is available to traders in malaysia.

But to withdraw the bonus funds, you need to trade half the number of standard lots equal to the bonus that you receive.

Octafx deposit and withdrawal

Octafx offers a variety of deposit and withdrawal methods for traders in malaysia.

The following deposit funds options are available at octafx malaysia

- Local bank deposit: traders in malaysia can make a deposit through their local bank in their octafx account. Normally the funds are tracked & added within the same business day.

- Credit/debit card: they also have the option of making deposits through their debit or credit cards.

- Ewallets: additionally, a variety of payment wallets are also accepted for making deposits and withdrawals. Octafx accepts deposits via ewallets like skrill & netteller. The funds added using this method are added within few minutes.

- Bitcoin: octafx also allows you to make your deposit using cryptocurrencies like bitcoin.

Octafx does not charge any deposit or withdrawal fees which makes it highly attractive to open an account with them.

Octafx account types

Octafx offers 3 different types of accounts and each of them are suitable for different kinds of traders. They recommend the micro MT4 account for beginner or novice traders, the pro MT5 for experienced traders, and the ECN ctrader account for progressive traders.

The minimum deposit at octafx malaysia is $100 with their micro metatrader 4 account. The base currency of all types of accounts can be either EUR or USD for all types of accounts for malaysian traders.

In this section, we will be discussing the different account types as applicable to malaysian traders since the terms and conditions may differ from jurisdiction to jurisdiction.

1. Octafx micro account – the trading platform that is available for this type of account is metatrader 4. The floating spread for this type of account starts at 0.4 pips. They do not charge a commission when trading through this type of account.

A trader has the option of choosing between 28 currency pairs, gold and silver, 5 cryptocurrencies, and different indices. For currencies, a trader gets a leverage of 1:500. Swaps are optional.

2. Octafx pro account – pro users can trade through the metatrader 5 trading platform. The floating spread starts from 0.2 pips. They do not charge a commission. The recommended minimum deposit is USD 500.

You can trade between 28 currency pairs, gold and silver, 2 energy, 10 indices, and 5 cryptocurrencies. For currencies, they offer a leverage of 1:200. This account type does not offer swaps.

3. Octafx ECN account – ECN account users can trade through the ctrader trading platform. The floating spread starts at 0.4 pips. They charge a commission when trading through an ECN account. The recommended minimum deposit is USD 100.

Traders have the option of trading between 28 currency pairs and gold and silver. The instruments available is quite limited for an ECN account. Traders can get a leverage of 1:500 for trading currency pairs and 1:200 for trading gold and silver. No swaps are available.

Octafx trading instruments

The availability of instruments depends on the type of account that is being used. The pro MT5 account type offers the wides range of instruments to trade while the ECN ctrader account offers the least number of options.

Through octafx, you have the option of trading 28 currency pairs, gold and silver, 2 energy instruments, 10 different indices, and 5 different cryptocurrencies.

The leverage that is offered depends on the type of account and the type of instrument that is being traded.

Octafx trading platforms

With octafx, you can trade using your mobile, web browser, or desktop regardless of the trading platform. FXTM uses popular third-party software to allow you to conduct your trades.

For micro account users, metatrader 4 is available.

For pro account users, metatrader 5 is available.

For ECN account users, ctrader is available.

Web trading platform – their web trading platform be used if you want to trade through your internet browser. This offers a quick and convenient way for you to access the trading platform. The web trading platform supports all popular web browsers.

Mobile platform – you can enjoy a user-friendly trading experience straight from your mobile phone. If you’re on-the-go or have a long commute then using a mobile platform can be the best choice for you.

Desktop trading platform – this is functionally and design-wise similar to the web trading platform. In the desktop version, you are offered greater functionality than the web version.

Overall, FXTM offers a standard trading experience thanks to its use of the MT4, MT5, and ctader trading platforms. They do not have a proprietary trading platform of their own, which can be an advantage if you are used to using these third-party platforms.

Octafx customer support

Octafx offers support via 3 mediums to traders in malaysia, including chat support, email or via telegram. But the best way to reach customer support for octafx is to use the live chat that is available on their website.

- Good live chat support: live chat is available in bahasa malay and english. Their live chat option was found to be highly responsive and helpful in answering our questions.

Their english chat support is available for 5 days in a week, for 24 hours. But their malay chat support is only available during day time in malaysia. - Email support is okay: in addition to live chat, you can reach out to octafx by filling the contact form on their contact page or emailing [email protected] we received a response from their team within 4 hours, which is great compared to other brokers.

- Telegram: octafx also offers option to contact them via telegram app. We did not test this support channel.

Overall, we found octafx’s malaysian support to be good. We like the fact that they have operators offering support in local language too.

Do we recommend octafx malaysia?

Yes, we do recommend octafx to traders in malaysia.

There are both pros and cons to trading through octafx, but there are more positives than negatives.

The overall fees that octafx charges is lower than most other brokers, which makes than an attractive choice for traders looking for a low-cost broker. They also do not charge any hidden fees.

The customer support offered through live chat is quick and helpful, and also available in local language. Plus, you can request a callback too.

But, many traders will find that the instruments that they offer is quite limited compared to other brokers. Also, octafx is less well-regulated than comparable brokers and is only regulated by a single tier – 1 regulator.

However, octafx has a good track record and is trusted by users across many jurisdictions. They also have separation of funds and anti-money laundering policies in place.

Overall, we believe it is safe to trade forex & cfds with octafx if you are a trader based in malaysia.

Octafx broker review

- Is octafx safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposits and withdrawal fees

- Octafx bonus

- Octafx for beginners

- Educational material

- Analysis material

- Customer support

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Octafx risk statement

- Overview

Summary

Octafx is a client-focused, international broker with a loyal following of malaysian traders. The website is fully translated into bahasa melayu and octafx are always running competitions and promotions for malaysian clients; these include a 50% first deposit bonus, demo trading contests with cash prizes and frequent lottery giveaways (prizes include scooters, laptops and other gadgets).

An islamic option is available for all account types and new traders will like the excellent analytical section and range of useful trading tools such as autochartist, copy trading and an account monitoring service that lets beginners learn anonymously from successful traders. Trader education for beginners is well-presented and platform support is almost unbeatable, with MT4, MT5 and ctrader all offered.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for octafx

Is octafx safe?

Founded in 2011 and regulated by cysec since 2018 (license 372/18), octafx is a well-respected and secure broker. All funds are properly segregated, and the company has received many awards over the years for its quality of service.

The company was briefly regulated by the FCA (the UK’s financial conduct authority) from 2015 to 2017 (ref: 679306) but decided to not renew its licence after the brexit referendum and instead kept its focus on the EU market.

Octafx has received plenty of industry recognition in recent years, winning best forex broker APAC 2019 (global banking & finance review), best mobile trading app 2019 (european CEO magazine) and best FX broker 2019 (fxexplained). Other awards include best forex broker asia 2018 (global banking and finance review), best FX broker 2018 and best trading conditions 2018 (european CEO magazine).

Like all regulated brokers, octafx has segregated accounts (client funds and broker funds are kept in separate accounts in case of broker bankruptcy) and offers negative balance protection for all clients – so you can never lose more money that you have in your account.

Trading conditions

Oxtafx’s trading conditions – including spread, commission, leverage and margin call level – vary depending on which platform/account you decide to go with. All accounts are market execution in under 0.1 seconds and they all allow for hedging, scalping and eas.

Account types

Octafx has three different account types (along with an unlimited demo account) depending on which platform you decide to use. Every account is also available as an islamic account.

Tying your account types to a specific platform is an unusual approach; if you are familiar with a specific platform and wish to continue using it, you are going to be restricted in your account choice.

Demo account: octafx offers an excellent unlimited demo account option, available on MT4, MT5 and ctrader. It offers real market conditions and a chance to win real money in a monthly champion demo contest.

MT4 (micro) account: with the MT4 (micro) account, you can choose either a floating spread, starting at 0.4 pips or a fixed spread, at 2 pips, depending on your preference. This account requires a minimum deposit of 50 USD (though 100 USD is recommended) and no commission is charged on trades. Leverage is fixed at 1:500 for forex trading and the margin call/stop out is 25%/15%. Metals, indices and cryptocurrencies can also be traded (though leverage will be lower and is set at 1:2 for cryptos).

MT5 (pro) account: the MT5 (pro) account only offers a floating spread, starting at 0.2 pips, and requires a minimum deposit of 500 USD. No commission is charged on this account either but leverage for forex trading is fixed at 1:200 and the margin call/stop out is set at 45%/30%. There are no swaps on this account and overnight commissions are charged after 3 days. As with the MT4 account, both CFD and cryptocurrencies can also be traded.

Ctrader (ECN) account: the ctrader (ECN) account also only offers a floating spread, but this starts at 0 pips. A commission is charged on trades and a minimum deposit of 100 USD is required. Leverage is fixed at 1:500 for currencies and 1:200 for metals – cryptocurrencies and cfds are unavailable with this account. Margin call/stop out is set at 25%/15% and overnight commissions are only charged over weekends.

Spreads and commissions

The spreads on the different account types vary by account type. Commission on the ctrader account is charged at 3 USD per lot per side (6 USD round turn).

Deposits and withdrawal fees

Octafx only accepts deposits in EUR or USD. It charges no deposit or withdrawal fees but, unusually, only accepts deposits and withdrawals via the following methods:

- Perfect money: minimum deposit is 5 USD and the minimum withdrawal is 5 USD

- Bitcoin: minimum deposit is 0.00096 BTC and the minimum withdrawal is 5 USD

- Neteller: minimum deposit is 50 USD and the minimum withdrawal is 5 USD

Octafx bonus

Octafx runs seveeral promotional schemes for clients – some which you don’t even have to spend any money to get involved in.

50% deposit bonus

Octafx offers a deposit bonus scheme (up to 50% of your deposit) though withdrawing the bonus is conditional on trading activity, using the following formula.

Fixed-rate deposit promotion

Especially for malaysian traders, octafx offers clients the chance to make an initial deposit at the fixed rate of 300 MYT = 100 USD. This deposit can also be withdrawn at the same fixed rate.

Demo contests

Octafx runs two separate demo account contests, one on the MT4 platform and the other on the ctrader platform. The ctrader demo contest runs for one week and the participant with the largest demo account balance at the end of the week will win 150 USD, with smaller prizes for the rest of the top five. The MT4 demo contest works the same way, except it runs for four weeks and the grand prize is 500 USD.

Octafx weekly scooter reward

Every week octafx gives away a scooter to a customer, chosen by random. To enter the competition, all you must do is trade five lots over the course of a week (monday-friday).

Trade & win: get gadgets for trading

The trade & win promotion gives traders free prizes and gadgets based on their trading volume. For instance, if you have traded 150 lots with octafx you would be eligible for a android smartwatch. Other prizes include phones and even laptops.

Octafx for beginners

The educational material at octafx and its alternative website is good but focused on new traders; for more experienced traders there is little in the way of educational support. Customer support is competitive but where octafx really shines is in the research and market analysis available.

Educational material

Octafx has recently launched tradingtiger.Pro, an online trading academy for new traders that’s also available in bahasa melayu. The site features a range of short tutorials covering everything you need to know to get started – from forex fundamentals to predicting the market. Each tutorial is a mix of video and text and is well-packaged and easy to understand; learners are tested frequently on the material and the entire website is free of charge. Overall, an excellent resource for beginners traders and we hope octafx considers expanding it to include intermediate and advanced courses and brings the course in-house.

Back on octafx’s main website, the in-house education section is anchored by a collection of articles collectively called forex basics. Article topics range from explainers on ECN trading and risk management to technical analysis and trading strategies as well as more advanced concepts such as pair correlations and fibonacci retracements. These articles are detailed and well-written and offer valuable advice for new and intermediate traders – unfortunately, these topics aren’t available in video format.

Also on the main site, there is a short tutorial section covering the metatrader platforms, copytrading, autochartist and cfds and a video tutorial section focused on getting started with metatrader. Finally, there is a FAQ section and a useful glossary of forex trading terms. The education section also has links to the manuals for the different platforms octafx supports (MT4, MT5 and ctrader)

Analysis material

Octafx has an excellent market insights section which is updated frequently but is only available in english. Regular posts include a daily forecast, a daily review and weekly review. These posts frequently offer predictions of future market movements – but be cautious and do your own research before acting on any predictions.

The market insights section also has a daily video series, uploaded to the octafx youtube channel, called market in a minute, which covers all the big news from the forex markets for the preceding trading day. In addition to all these regular updates, there are irregular short pieces published in reaction to trading events with detailed technical insight.

Octafx also hosts a forex news section, also only in english, with short briefings on all the major news stories affecting the forex markets, this is updated over the weekend and the articles are well-written and concise. These briefings are offered without any suggestion of how the events will affect the markets.

Customer support

Octafx customer support is open 24 hours a day, 5 days a week via live chat, phone (with local numbers for the UK, hong kong and indonesia), email, whatsapp and telegram.

Additionally, the finance department is open from 06:00 – 22:00 (EET) and the customer verification department is open from 08:00 – 17:00 (EET) for account setup and troubleshooting queries.

Trading platforms

As mentioned above, octafx offers MT4, MT5 and ctrader, the three best and most used platforms in the world. Remember that with octafx, platform choice is tied to account type and, as such, will greatly affect trading conditions.

Trading tools

Alongside industry standards such as an economic calendar, profit and trading calculators, octafx also offer an account monitoring tool whereby you can monitor any other octafx traders account and sort by balance, gain, trades and account type. This tool also allows you to dig into the history of an account so you can learn how the account holder has managed their success. Accounts are only represented by numbers, so all holders remain anonymous.

Octafx also offers a copy trading function free for all accounts, allowing beginners to copy experienced, successful traders for a small fee per traded lot. This function is also available through the mobile app.

Octafx also supports autochartist, the industry-standard trading signals provider. Autochartist provides traders with automated alerts for opening and closing trades, a volatility analysis tool which allows you to better optimise take-profit and stop-loss levels and integrated market reports. Autochartist is available on MT4/5 (but not on ctrader) and requires a minimum balance of 500 USD in your octafx account.

Mobile trading apps

All the platforms offered by octafx are also available on mobile devices and tablets. In additions, octafx offers its own octafx trading app (only for android) which gives you access to all your octafx accounts (including your demo account) and comes with market insights fully integrated.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the octafx offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Octafx risk statement

Forex margin trading involves substantial risks. Forex margin trading exposes participants to risks including, but not limited to, changes in political conditions, economic factors, acts of nature and other factors, all of which may substantially affect the price or availability of one or more foreign currencies.

Speculative trading is a challenging prospect, even to those with market experience and an understanding of the risks involved. Only funds that a person would allocate to high-risk investments (i.E., funds that if lost would not affect the person’s standard of living or financial well-being) should be used in trading.

In cases where a client has used only conservative forms of investment in the past, forex trading might not be appropriate for the client. A client must understand that a total loss of all funds deposited can occur, should the market go against the client’s position(s).

Overview

Octafx is a very good ECN broker with varied account options, platforms and trading conditions. Because these account options, platforms and trading conditions are all tightly linked, new customers may feel arbitrarily restricted. That said, octafx has an excellent analytical section, well-designed education for beginners, world-class trading tools and a range of exciting bonus options for malaysian traders.

Honest octafx review and test for traders

| review: | platforms: | spreads from: | leverage: |

|---|---|---|---|

| (5 / 5) | metatrader 4/5, ctrader | spreads from 0.2 pips | up to 1:500 |

The octafx broker for a long time in european countries has been providing services to traders in more than 100 countries. You might be surprised, the company is currently serving more than 1,500,000 traders. Here, according to the ECN (electronic communication network) model, the platforms can be selected.

In this review, we will show you all the details you need to know about octafx. Is it really worth investing your money there? – find out in our octafx review. Learn about the trading conditions, platforms, and special features for customers. With more than 8 years of experience in the trading industry, we checked octafx in detail.

What is octafx? – the broker presented:

You may know that there is no guarantee of making money in online FX trading. So we think it is very important to move towards the trading platform with your prudence, practical humanity, and knowledge. To be successful in online trading you need to go through many steps like practice, time, patience, and much more. Octafx gives you some of these opportunities so that you can deal with or defeat the market. The broker transmits clear-sighted market knowledge while maintaining the specific skills required to make money online which will give you a much higher balance of profits from losses.

Octafx is one of the best international forex and CFD broker. The main client base of octafx is in europe. This company has been providing opportunities for traders to invest in the market for a long time since 2011. A big advantage of this platform is that traders can easily determine the rate of low wages. Also, octafx helps to guess the speculation about their increasing rate.

More than 2,840,000 of the essential bonus fund was valued in that field. Here octafx is commission-free euro or USD only 0.4 pips! It helps maintain a highly competitive cost structure in emerging markets. The broker supports copy trading to support social businesses. Autochartist pro also supports traders in a wide range of ailments through manual support. Traders come to the octafx offer for the experience of ctrader trading and the metatrader platform.

Facts about the octafx company:

- Founded in 2011

- Based in cyprus and st. Vincent and the grenadines

- Supports copy trading

- Professional trading platforms

- Low trading costs

- Education for new traders

- Supports international clients

(risk warning: your capital is at risk)

Regulations and safety octafx

All online trading activities are regulated by government financial authorities, so trades play a very important role. The license used in trading helps to build a confidential relationship with the customer and build a strong foundation. Every broker has to meet certain rules and criteria to get this government license. If a broker violates the rules or attempts to commit fraud, the license will be permanently revoked.

The octafx broker has several licenses, which bring some great benefits for traders. Octafx holding plc is regulated by cysec (EU) which can give you maximum benefits. The broker has also a dealer license in mauritius (FSC). In this case, traders can make all their own decisions. There is a huge potential for independent limited business without any leverage.

Octafx is regulated by:

- FSC (mauritius)

- Cysec (EU)

Trading conditions for octafx traders – what are the offers?

Forex and CFD trading is very popular nowadays. Private traders like these assets a lot because they can access global financial markets using little capital. Also, you will get the opportunity to increase more profit from octafx. Traders get the opportunity to use maximum leverage 1:500 here. With your small capital, you can easily transfer higher numbers to the market.

Octafx trading conditions

The minimum deposit you can invest is 100$ or 100€ which is guaranteed at a much lower price than other brokers in the market. It is the best of octafx to make a conventional offer that you can apply and accept. You can enter the financial market with very little capital (0.01) lot depending on the position. The octafx broker offers different offers to the clients according to the package, based on the account type.

More than 100 assets are available on the platforms. That includes:

- Forex (currencies)

- Indices

- Metals

- Cryptocurrencies

- Stocks

Investing here means to trade currency, cryptocurrency, any product, stock, and much more. Shares of octafx are excluded from the market subject to the terms of the german stock exchange and the american stock exchange. Many other parties use these shares on favorable terms. Octafx assets are always dependent on the current market.

Although variable spreads are offered in these trade markets, a higher spread may be transmitted depending on the number of customers. You can compare it to the initial or general trading of the stock market. But here the average of the spreads is calculated as 0.4 pip in forex. If you want to get it out of the stock index it will be less than 1 point. Even better if you expect a high rank spread then the black account can help you in this regard. You can use the RAW spread account as an alternative. You will always find many offers here.

See the table for spread comparison at octafx:

In some cases, special offers may be offered in this trade. Such as:

- The first step is a free demo account.

- The minimum deposit is only $ 100 or € 100.

- Leverage will be between 1:30 and 1: 500.

- Spreads from 0.4 points

- Different account types available

- Platforms: metatrader 4/5, ctrader

- Opportunity to execute orders quickly

- Short trading possible

- No hidden fees

- Islamic accounts possible

- Trading without swap fees

- 50% deposit bonus is possible

(risk warning: your capital is at risk)

Test of the octafx trading platforms

Every professional forex broker must have a reliable trusted trading platform for trading. Traders use several tools to gather information on what kind of analysis traders are using in this trade market. See below to know about the various available platforms of octafx.

These are the available platforms of octafx:

- Metatrader 4

- Metatrader 5

- Ctrader

Metatrader 4

Metatrader 4 is a platform that any user can use with ease. Because this trade is a process that is extremely flexible, fast, secure, responsive. Any customer can also use this platform for forex and CFD trading. It analyzes transactions in financial markets and provides secure and fast access. Users of octafx can ensure traders’ advanced access to trading operations in a reliable environment. Octafx trading is an international broker so it supports many languages. It is also very popular as it can automatically supply trades to the market. Also, MT4 has more advanced charging capabilities, it is fully customizable.

Metatrader 5

Metatrader 5 is one of the most popular trades on one of the most popular platforms in the world. MT 5 is the world’s number one multi-asset platform provider of futures, forex, CFD, exchange-traded instrument trading. Investors choose MT 5 as the best investment platform. This market has a large number of customers because this platform is very easy to use. MT5 includes level 2 pricing, robotic system trading, higher chatting, VPS support, education market. There is also the ability to provide free market data and news. The MT5 can also be said to be an automated trading option.

You can use the metatrader supreme edition platform to improve your business because the most advanced tools are applied here. We believe it improves the customer’s business experience. You can try using live and free demo accounts to enjoy this platform. Octafx MT5 and MT4 have powerful global widgets for feedback. This widget improves forex trading performance. Metatrader 4 and metatrader 5 play a major role in rapid order reversal and hedging promotion.

Ctrader

The ctrader is also offered by octafx. It has similar features to the metatrader platform. Here you can get a deeper look into the order flow and liquidity of the markets (level 2 market depth). Robot trading is supported and several chart types. With the ctrader, you will have access to the ECN market (electronic communication network). With ECN trading the conditions are better than with the metatrader accounts. From our reviews, you should use the ctrader for trading. It also supports customized indicators and tools.

Web trader/charting and analysis

Webtrader is a popular and convenient trading platform like MT4 and MT5. This trade allows traders to trade through browsers from anywhere. You can trade securely at any time in web trader. No download is required to get started. Works very fast without any OS choice. User-friendly (easy to use) can be done on the octafx platform. Web trade is much more advanced. Web trader works much faster.

Mobile trading:

MT4/5 and ctrader is one of the top software on the android platform on mobile. It has been designed by octafx markets for traders in a way that is easily accessible on mobile. Octafx clients allow them to access trading on any android device. Being mobile-friendly, it offers many benefits to clients or merchants. Octafx customers may not be able to place orders using mobile devices, where they will be able to perform basic technical analysis on the full chart. Customers will be able to do candlestick, line chart, bar chart, tick chart using excel on mobile.

Octafx allows mobile trading (app)

Octafx helps customers to know the basics by using the mobile trading app in the market. The mobile trading app encourages the customer to increase investment. See below the benefits you will get in the mobile app for metatrader 4/5.

Opportunity to watch live FX quotes, a chart with the display, platform customized, indicator add, broker’s clients can get a massage, market news, read and see broker news, all types of orders use. Time frames change, access trading history, and mobile access for online trading carry friendly and useful features.

The current market situation is quickly available in the metatrader 4/5 mobile application. The application is of course used for FX trading and it can be said to own a few powerful charting of all mobile applications.

(risk warning: your capital is at risk)

How to trade with octafx

Which market you trade your investment in depends on your choice.

Before any broker enters the market, you should know whether the market is moving upwards or downwards. It is up to you to decide whether to buy or sell stock spreads in this market. If you see a drop in the market price then you need to click on ‘sell’. On the other hand, if you see that the price has increased, then click on the ‘buy’ button.

Octafx order mask metatrader 5

You need to add stop-locks here urgently. Because when you move too far away from your location, you can secure your location through a certain process. Brokers can track trade market prices as well as place their trades in the trade market. You can also focus on real-time gains or losses.

How to open an octafx account

You can open a demo account on many topics at octafx. You can open a demo account accordingly by looking at the offers. It is very easy to open a demo account with the octafx and you will get this account quickly. To open an account you need to use your name and an email as well as a strong password. If you do not provide your full name and email address, the account will not be created.

For trading with real money, you will need to verify your account. That means octafx will require some documents to verify your identity. Just answer the questions in the account dashboard and upload the documents. The broker support can help you with that. The process can be over in a few minutes.

Opening account with octafx

Octafx offers different types of account:

The accounts that you can create with octafx are metatrader 4 micro, metatrader 5 pro, and ctrader ECN. We will talk about an account here for your convenience.

Metatrader 4 micro account

You can start with the micro account by depositing only $ 100. The account has floating spreads or fixed spreads. It is the best account for beginners because it offers micro-lots. That means you can open very small positions in the market.

- Minimum deposit $ 100

- Metatrader 4 platform

- Floating spreads from 0.4 pips

- Fixed spreads from 2 pips

- Leverage up to 1:500

- No commission

- Micro-lots

- Best for beginners with small amounts of money

Metatrader 5 pro account

The pro account is for traders who want to trade with more money and higher volume. The conditions are better than the micro account. The minimum deposit is $ 500 and the spreads are starting from 0.2 pips

- Minimum deposit $ 500

- Metatrader 5 platform

- Floating spread from 0.2 pips

- Leverage up to 1:200

- No commissions

- No swaps

- 3 days fees

Ctrader ECN account

ECN trading means investing in the market with raw spreads and deep liquidity. The ctrader is a good platform for professional traders who want to trade high volume with order flow. The minimum deposit is only $ 100. You will get real ECN access. The spreads are starting from 0.4 pips and you have to pay a commission per trade.

- Minimum deposit $ 100

- Ctrader platform

- Spreads from 0.4 pips

- Commissions from $ 3 / 1 lot trade

- No swaps

- Weekend fee

Demo account

You can use a free demo account to evaluate the platform first before depositing. Your virtual credit will be included, in the demo account with 10,000$ automatic funding. It will be deleted from the account after 30 days. Octafx clients submit this demo account so that the customer can be aware of all the tools.

Is there a negative balance protection octafx

Trade market clients think about broker protection before investing. The broker provides customers with maximum protection from investing. Octafx eliminates fears by traders by applying the best tools to ensure additional funding. In some cases, account balances can be negative. Because there is no negative balance system. Octafx can lose its unbalance in extreme market conditions. There is no reason to worry, the broker automatically shuts off your positions as soon as it is detected.

Octafx negative balance protection

Deposits and withdrawals with octafx:

As discussed above, the minimum deposit for opening a real trading account is $/€ 100. You can use for the deposit different payment methods. The available payment methods are:

- Bank wire

- Credit cards

- Cryptocurrencies

- E-wallets (skrill, neteller, perfectmoney, and more)

On most payment methods there are no fees for depositing and withdrawing money. Octafx will not charge additional fees but the payment provider can do it. The fee is depending on the payment methods but most payment methods are for free. The deposits can be instant by electronic methods. With a bank wire, you have to wait 3-5 days to credit the money into your account. Withdrawals with octafx are very fast too. It is depending on the time of the day, sometime the withdrawal is made in a few hours. The maximum time amount is 3 – 5 days for a withdrawal.

(risk warning: your capital is at risk)

Octafx accepted countries and forbidden countries

See below the countries that can access octafx trading:

For a long time in the octafx trading, argentina, australia, austria, bahrain, belarus, brazil have been trading deposits. Also, bulgaria, china, croatia, cyprus, czech republic, denmark are far ahead in terms of business investment. Renowned european countries such as estonia, france, finland, germany, greece, hungary, india, ireland, israel, and italy are directly involved in octafx investment. Octafx includes many more countries, including kuwait, malaysia, malta, mexico, monaco, the netherlands, norway, latvia, and liechtenstein. However, lithuania, luxembourg, oman, poland, portugal, russia, saudi arabia, slovakia, slovenia, south africa, sweden, spain are still trading here. Octafx allows direct deposit transactions to switzerland, thailand, the united arab emirates, the united kingdom, and qatar.

Octafx trading does not give or receive access to US customers in any way.

Each of the countries you see here has the support to join the broker octafx. This company is a very large trading platform so you can safely place your deposits or assets here. Moreover, there is support for a minimum deposit.

Special offers:

There are some special offers from octafx. It supports copy trading and a deposit bonus of up to 50%. In the following section, we will give you more details on it.

Copy trading (social trading)

Octafx offers a copy trading service to its clients. That means you can copy the trades of other traders or get copied. You do not have to be a forex expert to make money with octafx. You can search for a profitable trader and invest in their trader one by one. It is also possible to diversify your portfolio by invest in more than one trader for better risk management.

With octafx you have always control over your portfolio and the copied trades. It is very easy to manage. Just deposit money into your account, pick a successful trader, and start invention.

- Copy professional traders 1 by 1

- Full control over your investment

- Follow the best traders

- Earn money automatically

- Get copied and earn additional money

- Easy to use

Deposit bonus

Octafx offers a 50% deposit bonus. You will get additional money to increase your margin if you activate the bonus. But first of all, you can not pay out the bonus, you can only use it to make more profit. For withdrawal of the bonus, you have to do a certain turnover in trading volume (the bonus amount in lots divided 2).

- 50% deposit bonus

- Increase the free margin

- You can withdraw the bonus after doing the bonus conditions

- The bonus is available for all deposits over $ 50

Conclusion on the octafx review: recommended broker

By now you must have got a great idea about octafx. We would say from our experience that this broker has its license so you can use deposits or assets in this market. Octafx has long been involved in investing and it is directly regulated by the government.

The number of customers of this company is increasing day by day. So octafx proves that it is a reliable trading platform. If you search for it in online brokers, you will first see the name of the octafx. It also controls everything through the provision of powerful software and allows customers to access the account through the mobile app. If you want to gain a transparent trading experience, create an account with octafx broker. You can get something great, from the offers of this company. You will even get the opportunity to get involved in the business with very little profit.

Overall it is a professional provider for forex and CFD trading. The trading conditions are very good and the trading fees are low. In addition, copy trading and a deposit bonus are offered. Deposits and withdrawals are working very fast.

Advantages of octafx:

- Regulated and safe broker

- Free demo account

- Minimum deposit only $ 100

- High leverage up to 1:500

- Different account types

- Metatrader 4/5, ctrader

- Spreads from 0.2 pips

- Low commissions

- Professional support

- Copy trading

- Deposit bonus

Octafx is a good broker for traders who want to trade with tight spreads and low commissions. We can recommend its service and offers. (5 / 5)

Top 9 best forex brokers in malaysia for 2021

Top rated:

Searching for a trading broker in malaysia?

With this collection of the best forex brokers the country has to offer. Here you are sure to find one that fits your trading needs.

Making your malaysia forex broker search as easy as possible starts with choosing from one of these top choices, any of which can be opened both quickly and easily.

Table of contents

Is forex trading legal in malaysia?

This is a very valid question and concern since not very long ago forex trading in malaysia was not legal.

Now however, the rules are changing.

You will find that officially within malaysia, the only legal regulation is that people can only register with a financial services company that is regulated within malaysia and compliant with the laws of the country.

With that said, given that forex trading is relatively new to malaysia, there are not yet any brokers that are regulated by the SCM (securities commission of malaysia).

With that said, trading as a malaysian forex trader is still not illegal and some of the forex brokers that we have listed provide the very best in terms of regulatory oversight from top-tier bodies such as cysec, the FCA, or ASIC.

How to trade forex in malaysia

If you want to trade forex within malaysia then the process is in fact quite straightforward since the regulations are still quite new and allow for no particular restrictions in terms of what a forex trader can do or what a broker can offer.

The only key steps beyond choosing the correct malaysian forex broker for you is to submit the relevant documents to begin trading. These will typically include your proof of ID and residency.

From there, you are ready to begin trading.

Top 10 best forex brokers in malaysia

Here is our collection of what we feel are the best malaysia broker choices for you as a forex trader:

1. Instaforex

Starting our list of the best forex brokers in malaysia is instaforex. They are a well-known and award winning broker particularly within asia having won more than 19 awards and counting related to being the “best broker in asia”.

Beyond this, they are also very well regulated by multiple regulatory bodies including the FCA, ASIC, and cysec. When it comes to account types you will have a total of 6 to choose from. Instaforex minimum deposits here range from a bargain $1 up to $1,000 depending on account type. The account types available include 2 cent accounts, a standard account, 2 ECN accounts, and a scalping account.

You can deposit MYR through wire transfer within local banks and you can also utilize a fully functioning demo account to try out the broker. This is ideal, in combination with really low-risk cent accounts to help new forex traders get to know the market.

Finally, an islamic account type is available though there is an additional fee that replaces the swap fee. Instaforex also offers 4 bonuses to traders. This includes a 100% first deposit bonus.

XM is renowned as one of the best forex brokers in the world and is available to malaysian forex traders. They are again regulated by some of the foremost authorities in the industry in the form of FCA, cysec, and ASIC. They were also awarded the “best forex broker in australasia” award along with numerous others.

Opening an XM account, you will be faced with a wide choice of 6 account types. Minimum deposits on these account types range from $5-$100 depending on account, or you can also opt for a shares account with a minimum deposit of $10,000. These deposits can be made through wire transfer, credit card, or ewallet although no MYR deposits are facilitated.

If you would like to try out the broker, you can avail of their full demo account. This, together with the XM micro account offers a great path to get into forex trading in malaysia and around the world.

Spreads at XM can start from as little as 0 pips in many cases, and the XM islamic account follows all of the same conditions of the regular accounts with no mark-ups, higher spreads, or additional commissions.

3. Octafx

Next in our collection of the top malaysian forex brokers is octafx. They are also regulated by two highly trusted regulatory bodies in the form of both the FCA in the UK and cysec in europe. They are reputed within the industry as offering some of the best swap-free services around. In fact, in 2015 they were recognized byb forextraders.Com as the “best forex islamic account” providers.

To that end, micro, ECN, and pro accounts are available with minimum deposits starting at $100 and reaching $500 for a pro account. It is also worth noting that every account is available as a swap-free account. The accounts utilize the top trading platforms of MT4, MT5, and ctrader.

MYR deposits are accepted and can be made through local banks, billplz, and help2pay services with an excellent exchange rate of 3 MYR per $1 USD available. Spreads also start from a highly competitive 0 pips across the board and the trading conditions feature no changes at all when it comes to islamic account trading.

In terms of octafx bonus offers, a 50% deposit bonus is made available on each deposit.

4. Hotforex

Hotforex is another globally recognized forex broker and top choice for you as a malaysian trader. They are well regulated by both cysec and ASIC and offer a wide choice of 6 forex account types to choose from.

Again here, this includes a micro trading account with a minimum deposit of only $5 ideal for new traders, a premium account with a $100 minimum, a zero spread account, and an auto trading account you can try for a minimum deposit of $200. If you are interested in copytrading this is available through hfcopy with a minimum of $100 deposit to copy, or $300 if you want others to copy your trades.

When it comes to deposits, MYR is available through local bank transfer. In other cases, you can use your major credit card or ewallet methods. Either way, a fully realistic demo account is accessible as is an islamic account where needed.

Spreads here start from a competitive 0 pips across the board although some additional fees may apply on islamic accounts. You can offset these through cash rebates, 100% bonuses, and the higher leverage that hotforex try to offer along with many real prize winning trading contests.

5. FBS

Next on the list of the best malaysian forex brokers is FBS. As with all of our brokers they are well-trusted and fully regulated by both cysec and the IFSC. This is an excellent broker with 5 account choices including a great cent account offering that may be just perfect for new traders. These account types also include an ECN account.

Minimum deposits with the broker start from just $1 reaching up to $1,000 depending on your account choice and although MYR deposits are unavailable, funding via wire transfer, credit card, and ewallet are all available. Every account can also be made swap-free where needed.

Although FBS do add an additional admin fee if you hold a position for more than 2 days with a swap-free account, this can be somewhat balanced by the fact they have a comprehensive bonus offering that includes a 100% deposit bonus and contests including some particularly aimed at islamic traders during ramadan.

6. Oanda

Oanda is one of the few brokers to be regulated in the USA by the CFTC as well as the NFA, and globally through the FCA, MAS, ASIC, and IIROC. A who’s who of top regulators for a much trusted broker.

They offer just one account type but it is available with no minimum deposit at all. Perfect if you are new to the forex trading market. Another suitable point here is you can open positions for as low as just one currency unit ($1 or equivalent base currency), although no MYR deposits are available.

With that said, deposits can be made through wire transfers, major credit cards, and ewallets. Fully operational oanda demo accounts are available to try as are islamic accounts on request.

Spreads with this broker are low, starting from just 1 pips and trading is through MT4 trading platform. .

You may find that some additional fees are placed on the islamic account in place of the swap fee, and at the moment there is unfortunately no bonus offering in place.

7. Pepperstone

Pepperstone are another of the standard bearing top brokers offering service to malaysian forex traders. They are regulated by the top authorities of FCA and ASIC and are one of the most chosen ECN brokers around.

They have two available account types that can be opened with a minimum deposit of $200. These are the standard and ECN razor account types which are also both available as islamic accounts. For account deposits, wire transfers, credit cards, and ewallets are all accepted methods of funding although no MYR deposits are available.

Spreads with pepperstone start from 0 pips and trading is available through MT4, MT5, or ctrader and you are welcome to try the pepperstone demo account first.

On the islamic accounts, an admin fee will be applied on positions held for more than 10 days and no pepperstone bonus amount is currently available.

8. IC markets

IC market regulated by cysec and ASIC represent another of the best malaysian forex broker choices for any traders. They offer 2 account types in their standard and raw spread accounts, both of which can be opened with no minimum deposit.

These accounts can be easily funded through wire transfers, major credit cards, or ewallet methods although no MYR deposits are accepted. On the minimum deposit, although there is none in place, the broker do recommend depositing at least $200.

Spreads with IC markets start from the bottom at 0 pips and with the option of trying a demo account and opting for an islamic account through MT4, MT5, or ctrader platforms. Within this islamic account most conditions remain the same. The only change is an admin fee added on positions open for more than one day.

At this time IC markets does not provide for any kind of bonus offering.

9. Etoro

Last but not least on our listing of top malaysian broker choices is etoro. Known the world over, they are regulated well by cysec, FCA, and ASIC. They are well known of course as a top broker for social trading and a particularly good fit if you are new to the sector.

One account type is offered that can also be made swap-free though in this case the minimum deposit would increase from $200 to $1,000 with trading available through the brokers own user-friendly trading platform.

Spreads at etoro typically start from 1 pip though they can be higher. Deposits are catered for through wire transfer, credit card, and ewallets, though no MYR deposit option is available.

You will be glad to know that while there are no bonus offerings, trading conditions remain the same on islamic accounts.

Malaysian trader? Here’s what to look for in a forex broker

Although there are currently no particular set of stringent rules in place from the SCM and everything is routinely left at the discretion of the trader and broker in terms of what is offered in bonus, leverage, and account type terms, there are still a few things that you should try and look out for when choosing the best forex broker to deal with.

1. Stick with regulated brokers

Always try to choose a regulated forex broker like any of the top brokers listed above. The SCM have not yet officially regulated any themselves, but you can very much trust the listed brokers regulated by some of the top bodies worldwide like cysec, ASIC, and the FCA.

It is good practice to deal with these and any who are also ESMA compliant for the most trusted experience and to avoid offshore regulated or non-regulated brokers where you can.

2. Look for the best islamic account

The muslim population in malaysia is more than 50%. This, along with the fact that islam is the official religion mean there is always big demand for malaysian islamic forex trading accounts.

Since swap or overnight broker fees are considered haram when it comes to sharia law, you should be looking to open an islamic account that will not feature any of these fees in order to be fully compliant.

If you are unsure or interested to learn more about this topic, you can read our best islamic forex brokers guide for more information.

3. Choose the broker before choosing the bonus

One of the biggest final things to be sure of is that, since forex broker bonuses are legal in malaysia, that you do not get blinded by that fact.

This means choosing a broker that best suits your trading needs above considering what types of bonus they offer.

Being tempted by a big bonus offer can leave you dissatisfied in other areas when it comes it future trading and so. You should really not base your broker decision on that. Also, always make sure you read the terms and conditions first.

Finally, you should take advantage of any no deposit bonus opportunities offered by a broker as a great chance to see what they can offer.

How to verify if a forex broker is regulated in malaysia

Although there are not any forex broker officially regulated by the SCM as yet, this may well be possible in the future. In that case, you should take the opportunity to check this page for any further developments.

Checking registration with the other top regulatory bodies can also be as simple as a couple of clicks and a search of the following links:

Keep in mind if you are wondering about ESMA regulation, this depends on the country, but if they have registered in a european country, they will typically be ESMA compliant.

Is forex trading taxable in malaysia?

The simple answer to this question is yes.

Forex trading in malaysia is taxable. That is because all revenues should be declared through your ITN (income tax number) and these are unique to each person and issues by the IRBM (inland revenue board of malaysia).

More information on the precise filing processes can be found here.

With that said, since forex trading is new to malaysia, there is still a considerable grey area related to revenues and capital gains taxes, particularly is the broker you trade with is located outside of malaysia.

[disclaimer: we are not accountants, we have done internet research. Due to these grey areas, we strongly suggest you contacting malay local authorities before proceeding]

so, let's see, what we have: octafx malaysia - review & rating of octafx forex broker in malaysia! Octafx trading accounts, spreads, platforms, trading conditions, deposit/withdrawals & more! At octafx review malaysia

Contents of the article

- Best forex bonuses

- Octafx malaysia - octafx forex broker review

- Octafx malaysia - octafx (capital FX) forex...

- Octafx review 2021

- Octafx malaysia – A quick look

- Is octafx malaysia safe?

- Octafx malaysia fees

- Octafx bonus

- Octafx deposit and withdrawal

- Octafx account types

- Octafx trading instruments

- Octafx trading platforms

- Octafx customer support

- Do we recommend octafx malaysia?

- Octafx broker review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for octafx

- Is octafx safe?

- Trading conditions

- Octafx for beginners

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Octafx risk statement

- Overview

- Honest octafx review and test for traders

- What is octafx? – the broker presented:

- Test of the octafx trading platforms

- Metatrader 4

- Metatrader 5

- Ctrader

- Web trader/charting and analysis

- Mobile trading:

- Octafx allows mobile trading (app)

- How to trade with octafx

- How to open an octafx account

- Octafx offers different types of account:

- Demo account

- Is there a negative balance protection octafx

- Deposits and withdrawals with octafx:

- Octafx accepted countries and forbidden countries

- Special offers:

- Copy trading (social trading)

- Deposit bonus

- Conclusion on the octafx review: recommended...

- Top 9 best forex brokers in malaysia for 2021

- Is forex trading legal in malaysia?

- How to trade forex in malaysia

- Top 10 best forex brokers in malaysia

- Malaysian trader? Here’s what to look for in a...

- 1. Stick with regulated brokers

- 2. Look for the best islamic account

- 3. Choose the broker before choosing the bonus

- How to verify if a forex broker is regulated in...

- Is forex trading taxable in malaysia?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.