Is forex trading for real

Currencies rise and fall against each other depending on various economic and geopolitical news.

Best forex bonuses

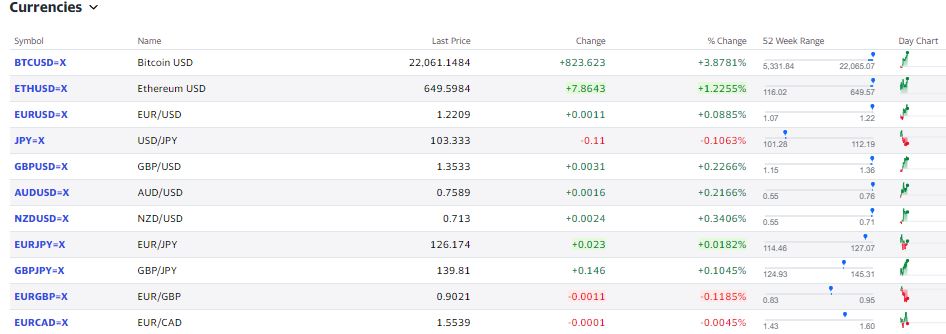

If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment. The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Is forex trading really profitable and can you do it?

One question that comes up a lot is: is forex profitable?

Many times this question comes from retail traders that are not finding any success with their trading approach. When I say “trading approach”, I don’t just mean their trading strategy.

Your trading approach is much more than a trading strategy and we will cover that later.

The short answer is yes, forex trading is profitable.

The slightly longer answer is yes, trading in the forex market is profitable but chances are you won’t make any money.

How do I know trading forex can be profitable? Because I’ve been swing trading forex since 2008 and make money. In fact, you can take a look at my free forex chart setups that I post every week using technical analysis and then update any trades at the end of the week.

Everything in those chart is for one reason: to teach you how to use a simple approach to trading forex to make profits.

It’s one thing to make money trading and an different thing to keep the profits.

Your biggest job as A forex trader

I’ve mentioned it many times in my trading posts but the number one job you have as a trader, is a risk manager. If you do not understand risk…if you do not manage your trades in the proper way, you will lose.

If you are risking too much per trade to withstand a string of losing trades, you will be out of trading faster than you imagined.

If you continue to move your stops around to avoid taking a loss, you will eventually lose your account. Your broker will be happy because you are probably a retail trader and your broker banks your loss, but you won’t be.

Your second job as a trader is simple: enter trading orders.

If you are trading, you’ve done your homework and are trading a strategy that has a verifiable edge in the market. You have made a trading plan complete with which setups to take, how you will exit, where you will take your loss.

You’ve outlined which currencies you will trade and the style of trading you will be doing. Day trading is popular but swing trading currencies is how I trade the retail market. If I day trade, it is not often, is not forex, and is done in the futures markets with the occasional options trading play.

Your job as a trader is to execute the trading plan when your setups take place. You enter your trading orders, manage your trades, and take your profit and loss the way it is set out in your trading plan.

Without a trading plan, you are doomed to fail.

How long can you trade with profits?

Consistency matters when currency trading and if you are applying the trading plan in a consistent manner, you should be able to reap the rewards of the edge your trading plan gives you.

You will take a loss and sometimes many in a row. You will see your trading account fluctuate and it can be painful to see at times. The expectancy of your trading system is what should keep you glued to the trading plan during the times of an equity curve down swing.

The truth is you will have a losing day.

You will have a losing week.

At times, your month may be at break-even or worse, at a loss.

These are the realities of trading and if you are asking about being profitable over the long run, the answer is yes if you are trading a positive expectancy trading strategy.

One week of loss or even a month of not being profitable does not make for trading failure. It must be expected. You must expect to lose and also to imagine that you have yet to take the biggest loss of your trading career.

You read that right. Think that you have yet to experience the most painful loss of all. Expect that a multiple of risk loss is around the corner.

It will remind you that the biggest trading job you have is trading your emotions for a proper mindset and to protect your trading capital.

What is forex money management?

Forex money management is simply about risk. In short, if you take big risks, you can make a lot of money in short period of time but the bad side of that is that a few bad high risk trades and you lose a lot. Wins and losses come in a random distribution.

You never know if that next trading will be a winner.

When you trade a lot, over trader, that’s bad forex money management. When take a lot of risk in a trade, that’s bad forex money management.

Learning forex money management is the easiest thing. But doing it, applying it, sticking to it when everything else doesn’t seem to be working is really hard…and all it comes down to is mindset.

What is A good mindset?

There are many books written about the trading mindset but before I list a few – a great mindset is useless if you are trading a flawed trading strategy.

- You understand that you are not worried about the day to day trading account fluctuations because you are focuses on the long term.

- When a trading loss or trading profit does not bother you, but you see it as part of the whole process to keep growing your account.

- You know that risk management can help you last a very long time in trading forex and failure to follow it is the fastest way to part with your money.

- You understand the negative impacts of greed and fear and learn to control it.

Trading the forex market is a business and like any business, you have to approach it with a professional approach and like most companies, have a “trading resolution”, something you abide by at all times.

The four mindset points above can be a great place to explore.

Break out a pen and paper and jot down those four ideas about mindset. Expand on them and ask what they mean to you.

One word to be A successful currency trader

If I had to use one word to describe the best trader, I would use the word consistency.

By using that one word, I am assuming that everything from your trading plan to the forex broker you will use has been detailed.

The job you have trading currencies is to implement that trading plan. How? With consistency. Traders that do everything in a consistent manner are sticking to a proven edge.

More importantly, by being consistent, when a trader is not seeing their profitability increase or they are seeing their profit drop, they can zero on each step they take to find the issue.

It is difficult to find where a problem is if you are constantly switching gears.

This is why I never think it is a good idea to take trading signals from people you don’t know. Too much trust goes into the word of someone else – someone who is not responsible for your trading account. How can you fix a strategy if you don’t know how the trading signals are generated?

In the end, I believe everyone has the chance to become successful and profitable when trading. The issue is if they will take the steps required to do so.

I also believe that most won’t do what is required and will continue to look for the easy way or the “secret sauce”.

There is no magic. It’s called hard work on the right things. I hope my trading blog and the setups I post every week are helping you gain some ground in your quest to be a profitable trader.

Exploring scams involved with forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/stock-market-convict-184977844-59d6c68d22fa3a0010adb629.jpg)

While foreign exchange (forex) investing is a legitimate endeavor and not a scam, plenty of scams have been associated with trading forex. As with many industries, plenty of predators exist out there, looking to take advantage of newcomers. Regulators have put protections in place over the years and the market has improved significantly, making such scams increasingly rare.

Foreign exchange trading involves the trading of pairs of currencies. for example, someone might exchange euros for U.S. Dollars. In september of 2019, 1 euro ranged in value from about $1.09 to about $1.12. So, a trader who exchanged 100 euros for $112 when the value of the dollar is high could profit by exchanging those $112 for euros when the value of the dollar drops back to $1.09 per euro. Such a transaction would result in a net profit of less than 3%, which likely would be wiped out by the broker's commission.

Forex is a legitimate endeavor. You can engage in forex trading as a real business and make real profits, but you must treat it as such. Don't look at forex trading as a get-rich-overnight business, no matter what you may read in hyped-up forex trading guides.

Exchange rates are volatile and can go up or down unpredictably. When accounting for commissions brokers take from transactions, making money requires significant changes in exchange rates in favor of the trader. High profits are possible, but it's not a market where anyone should expect quick and easy cash.

What makes a scam?

Forex trading first became available to retail traders in the late 1990s. the first handful of years was wrought with overnight brokers that seemed to pop up and then close down shop without notice.

The common denominator was that these brokers were based in nonregulated countries. While some did take place in the united states, the majority seemed to originate overseas where the only requirement to set up a brokerage was a few thousand dollars in fees.

A distinct difference exists between a poorly-run brokerage, which isn't necessarily a scam, and a fraudulent one. Even a poorly run brokerage can run for a long time before something takes it out of the game.

Some common examples of scams investors should look for include churning and brokers who simply underestimate risk. Churning involves brokers who execute unnecessary trades for the sole purpose of generating commissions.

Additionally, some brokers often overestimate the ability of investors to make a lot of money quickly and easily through the forex market. They typically prey on new investors who don't understand that forex trading is what is known as a zero-sum game. When a currency's value against another currency gets stronger, the other currency must get proportionally weaker.

How to avoid being scammed

The first step to take is to check the location of the brokerage's headquarters and research how long it has been in business and where they are regulated. The more the better.

If you feel you are being scammed, contact the U.S. Commodity futures trading commission.

The simple act of finding out who you should call if you feel that you've been scammed, before investing with a brokerage, can save you a lot of potential heartache down the road. If you can't find someone to call because the brokerage is located in a non-regulated jurisdiction, this is usually a red flag and a sign that it's best to find more regulated alternatives.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Is forex a scam?

Chetan shekar

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Wherever you are, getting your hands on the local currency is simple thanks to foreign exchange. And trading foreign exchange, or forex, allows you to swap between different currencies in a matter of minutes and make a profit at the same time.

Online brokers make trading forex market easier than ever. Forex is not a scam. Take a look at our guide to learn more about trading forex.

Table of contents [ hide ]

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Simply put: is forex a scam?

Forex is not a scam. FOREX.Com and other forex trading platforms list currencies in pairs. When you trade forex, you buy 1 currency and sell another simultaneously.

Previously identified scams

How can you be certain that forex isn’t a scam? The foreign exchange market makes the biggest turnover of $6.6 trillion per day. But the opportunity to create these profits in a short time comes with its risks.

Large sums of money on the table mean there are likely brokers that purposely want to mislead you and cheat you out of your money. Here’s a rundown of common forex fraudsters and scams you should avoid.

Broker scams

Forex traders are always on the lookout for the best brokers. Everyone wants the most return on their investment. But it’s important to beware of forex brokers that could take you for a ride.

Be sure to do your research about brokers and their reputations. A good place to start is the footer of the broker’s website. If the footer has no information about regulatory bodies or any other disclaimers, don’t go forward.

The broker should list the securities and exchange commission (SEC) regulations. You can also do a quick check on forexfraud.Com for brokers with a history of negligence and fraud. Remember, your broker must have your best interest at heart and its trading strategies must reflect that.

Signal seller scams

Forex brokers rely on signals or paid information to predict the movement of currencies and their value. This information can be purchased from firms, asset managers or seasoned traders called signal sellers.

You can subscribe to signal sellers on a weekly or monthly basis for a fee. You might hear brokers citing these sources to convince you about a trade.

In such cases, ask your broker to give you a historical performance chart of their signals to assess the authenticity of their claims. Since most signal sellers have a mixed record of good and bad tips, you can have a tough time making a firm decision.

Brokers will leverage such grey areas to give them the benefit of the doubt while swaying you to trade in a particular way. And if the trade doesn’t go as planned, brokers will blame the signal sellers for the losses incurred without taking responsibility.

Point-spread scams

The point-spread scam is 1 of the oldest tricks in the book. Since forex trading started, brokers have been using computer-manipulated bid and ask spreads to deceive the trader.

Typically, forex currency pairs are projected with 4 decimal points. Crooked brokers will manually input a specific bid and ask spread with a large difference in the 4th decimal point for higher commissions. This takes a huge cut from your profits without your knowledge.

In recent years, the point-spread scam has been curbed but it’s not entirely out of practice. Comparing bid and ask spreads from other brokers will give you an immediate insight into point-spread scams.

Robot scams

The latest trend in forex trading is the use of automated algorithms or “expert advisors.” these robotic systems scan the data of various currencies and their past performances to determine and set profitable enter and exit trades in advance for you.

From stellar websites to fake testimonials, these bot-based organizations try to persuade you to think you can create wealth on autopilot without logging into your account regularly.

The tech boom means bots have lured forex beginners who later realize too late their money is all gone. But there are some tried and tested bots in the market that have proved successful in their trades.

Best forex brokers

Forex trading takes place 24 hours a day, 5 days a week. But unlike the stock trading market, which has a multitude of stock options to buy and sell, you only have a limited number of currency pairs in forex to invest in. Since there isn’t an on-ground marketplace for forex, an online platform is essential for active trading.

Signing up with an online forex trading platform gives you access to plenty of research tools and international currency-related news that can make or break your trade. Out of the hundreds of forex trading platforms available online, benzinga has hand-picked the best to get you started.

Is forex trading really profitable and can you do it?

One question that comes up a lot is: is forex profitable?

Many times this question comes from retail traders that are not finding any success with their trading approach. When I say “trading approach”, I don’t just mean their trading strategy.

Your trading approach is much more than a trading strategy and we will cover that later.

The short answer is yes, forex trading is profitable.

The slightly longer answer is yes, trading in the forex market is profitable but chances are you won’t make any money.

How do I know trading forex can be profitable? Because I’ve been swing trading forex since 2008 and make money. In fact, you can take a look at my free forex chart setups that I post every week using technical analysis and then update any trades at the end of the week.

Everything in those chart is for one reason: to teach you how to use a simple approach to trading forex to make profits.

It’s one thing to make money trading and an different thing to keep the profits.

Your biggest job as A forex trader

I’ve mentioned it many times in my trading posts but the number one job you have as a trader, is a risk manager. If you do not understand risk…if you do not manage your trades in the proper way, you will lose.

If you are risking too much per trade to withstand a string of losing trades, you will be out of trading faster than you imagined.

If you continue to move your stops around to avoid taking a loss, you will eventually lose your account. Your broker will be happy because you are probably a retail trader and your broker banks your loss, but you won’t be.

Your second job as a trader is simple: enter trading orders.

If you are trading, you’ve done your homework and are trading a strategy that has a verifiable edge in the market. You have made a trading plan complete with which setups to take, how you will exit, where you will take your loss.

You’ve outlined which currencies you will trade and the style of trading you will be doing. Day trading is popular but swing trading currencies is how I trade the retail market. If I day trade, it is not often, is not forex, and is done in the futures markets with the occasional options trading play.

Your job as a trader is to execute the trading plan when your setups take place. You enter your trading orders, manage your trades, and take your profit and loss the way it is set out in your trading plan.

Without a trading plan, you are doomed to fail.

How long can you trade with profits?

Consistency matters when currency trading and if you are applying the trading plan in a consistent manner, you should be able to reap the rewards of the edge your trading plan gives you.

You will take a loss and sometimes many in a row. You will see your trading account fluctuate and it can be painful to see at times. The expectancy of your trading system is what should keep you glued to the trading plan during the times of an equity curve down swing.

The truth is you will have a losing day.

You will have a losing week.

At times, your month may be at break-even or worse, at a loss.

These are the realities of trading and if you are asking about being profitable over the long run, the answer is yes if you are trading a positive expectancy trading strategy.

One week of loss or even a month of not being profitable does not make for trading failure. It must be expected. You must expect to lose and also to imagine that you have yet to take the biggest loss of your trading career.

You read that right. Think that you have yet to experience the most painful loss of all. Expect that a multiple of risk loss is around the corner.

It will remind you that the biggest trading job you have is trading your emotions for a proper mindset and to protect your trading capital.

What is forex money management?

Forex money management is simply about risk. In short, if you take big risks, you can make a lot of money in short period of time but the bad side of that is that a few bad high risk trades and you lose a lot. Wins and losses come in a random distribution.

You never know if that next trading will be a winner.

When you trade a lot, over trader, that’s bad forex money management. When take a lot of risk in a trade, that’s bad forex money management.

Learning forex money management is the easiest thing. But doing it, applying it, sticking to it when everything else doesn’t seem to be working is really hard…and all it comes down to is mindset.

What is A good mindset?

There are many books written about the trading mindset but before I list a few – a great mindset is useless if you are trading a flawed trading strategy.

- You understand that you are not worried about the day to day trading account fluctuations because you are focuses on the long term.

- When a trading loss or trading profit does not bother you, but you see it as part of the whole process to keep growing your account.

- You know that risk management can help you last a very long time in trading forex and failure to follow it is the fastest way to part with your money.

- You understand the negative impacts of greed and fear and learn to control it.

Trading the forex market is a business and like any business, you have to approach it with a professional approach and like most companies, have a “trading resolution”, something you abide by at all times.

The four mindset points above can be a great place to explore.

Break out a pen and paper and jot down those four ideas about mindset. Expand on them and ask what they mean to you.

One word to be A successful currency trader

If I had to use one word to describe the best trader, I would use the word consistency.

By using that one word, I am assuming that everything from your trading plan to the forex broker you will use has been detailed.

The job you have trading currencies is to implement that trading plan. How? With consistency. Traders that do everything in a consistent manner are sticking to a proven edge.

More importantly, by being consistent, when a trader is not seeing their profitability increase or they are seeing their profit drop, they can zero on each step they take to find the issue.

It is difficult to find where a problem is if you are constantly switching gears.

This is why I never think it is a good idea to take trading signals from people you don’t know. Too much trust goes into the word of someone else – someone who is not responsible for your trading account. How can you fix a strategy if you don’t know how the trading signals are generated?

In the end, I believe everyone has the chance to become successful and profitable when trading. The issue is if they will take the steps required to do so.

I also believe that most won’t do what is required and will continue to look for the easy way or the “secret sauce”.

There is no magic. It’s called hard work on the right things. I hope my trading blog and the setups I post every week are helping you gain some ground in your quest to be a profitable trader.

Online forex trading: A beginner’s guide

What is forex trading and how does it work?

At FXTM, we are committed to ensuring our clients are kept up-to-date on the latest products, state-of-the-art trading tools, platforms and accounts.

For those just getting started, we have created a comprehensive beginner’s guide to introduce you to forex terminology, answer common faqs and, most importantly, keep things simple.

Looking for a breakdown of forex terminology? Head over to our glossary page.

What is the forex market?

What is the forex market?

Foreign exchange (also known as forex or FX) refers to the global, over-the-counter market (OTC) where traders, investors, institutions and banks, exchange, speculate on, buy and sell world currencies.

Trading is conducted over the ‘interbank market’, an online channel through which currencies are traded 24 hours a day, five days a week. Forex is one of the largest financial markets, with an estimated global daily turnover of more than US$5 trillion.

What is forex trading?

Forex trading is the act of buying or selling currencies. Banks, central banks, corporations, institutional investors and individual traders exchange foreign currency for a variety of reasons, including balancing the markets, facilitating international trade and tourism, or making a profit.

Currency is traded in pairs, in both spot and futures markets. The value of a currency pair is driven by economic, political and environmental factors, such as wars, natural disasters, or national elections.

What is a forex broker?

Brokers act as intermediaries, facilitating trades by providing clients access to the 24-hour interbank

in order to conduct trades.

FXTM offers a number of different accounts, each providing services and features tailored to our clients’ individual trading objectives. Discover the account that’s right for you on our account page. New to forex trading? Learn about the markets by opening a demo account page.

Understanding currency pairs

All transactions made on the forex market involve the simultaneous purchasing and selling of two currencies.

These are called ‘currency pairs’, and include a base currency and a quote currency. The diagram below represents the forex pair EUR/USD (euro/US dollar), one of the most common currency pairs traded on the forex market.

Sell 1 euro for 1.0916 US dollars

Buy 1 euro for 1.0918 US dollars

1.0918 - 1.0916 = 0.0002 (2 pips)

1.0918 - 1.0916 = 0.0002 (2 pips)

Base currency

The base currency is the first currency that appears in a forex pair. This currency is bought or sold in exchange for the quote currency.

So, based on the example above, it will cost a trader 1.0916 USD to buy 1 EUR.

Alternatively, a trader could sell 1 EUR for 1.0916 USD.

Quote currencies

The second currency of a currency pair is called the quote currency. In EUR/USD for example, USD is the quote currency.

Ask price

Tthe ask price is the value at which a trader accepts to buy a currency .

Bid price

The bid price is the value at which a trader is prepared to sell a currency.

Spread

A spread is the difference between the ask price and the bid price. In other words, it is the cost of trading.

For example, if the euro to US dollar is trading with an ask price of 1.0918 and a bid price of 1.0916, then the spread will be the ask price minus the bid price. In this case, 0.0002.

A point in price – or pip for short – is a measure of the change in a currency pair in the forex market.

The acronym can also stand for ‘percentage in point’ and ‘price interest point’. A pip is used to measure price movements, and it represents a change in a currency pair. Most currency pairs are quoted to five decimal places.

Note: forex prices are often quoted to four decimal places because their spread differences are typically very small. However, there is no definitive rule when it comes to the number of decimal places used for forex quotes.

On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.E. Several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses.

Always trade carefully and consider the risks involved.

Visualising

currency trades

Trades & key terminology

A ‘position’ is the term used to describe a trade in progress. A long position means a trader has bought a currency expecting its value to increase. Once the trader sells that currency back to the market (ideally for a higher price than he paid for it), his long position is said to be ‘closed’ and the trade is complete.

A short position refers to a trader who sells a currency expecting its value to decrease, and plans to buy it back at a lower price. A short position is ‘closed’ once the trader buys back the asset (ideally for less than he sold it for).

For example, if the currency pair EUR/USD was trading at 1.0916/1.0918, then an investor looking to open a long position on the euro would purchase 1 EUR for 1.0918 USD. The trader will then hold on to the euro in the hopes that it will appreciate, selling it back to the market at a profit once its price has increased.

An investor going short on the EUR would sell 1 EUR for 1.0916 USD. This trader expects the euro to depreciate, and plans to buy it back at a lower rate if it does.

What are the most traded currency pairs on the forex market?

There are seven major currency pairs on the forex market. Other brackets include crosses and exotic currency pairs, which are less commonly traded and all relatively illiquid (i.E., not easily exchanged for cash).

MAJOR CURRENCY PAIRS

Major currency pairs are the most commonly traded, and account for nearly 80% of trade volume on the forex market.

These currency pairs could typically have low volatility and high liquidity.

They are associated with stable, well managed economies, are less susceptible to manipulation and have smaller spreads than other pairs.

CROSSES

Cross currency pairs – crosses – are pairs that do not include the USD.

Historically, crosses were converted first into USD and then into the desired currency, but are now offered for direct exchange.

The most commonly traded are derived from minor currency pairs (e.G. EUR/GBP, EUR/JPY, GBP/JPY); they are typically less liquid and more volatile than major currency pairs.

EXOTIC CURRENCY PAIRS

Exotics are currencies from emerging or smaller economies, paired with a major.

Compared to crosses and majors, exotics are much riskier to trade because they are less liquid, more volatile, and more susceptible to manipulation.

They also contain wider spreads, and are more sensitive to sudden shifts in political and financial developments.

We’ve created a table below which showcases several different currency pairs from each bracket, as well as some nicknames which were coined by traders themselves.

7 MAJOR PAIRS

7 MAJOR PAIRS

6 MINOR PAIRS

6 MINOR PAIRS

6 EXOTIC PAIRS

6 EXOTIC PAIRS

Brackets

MAJOR CURRENCY PAIRS

MINOR CURRENCY PAIRS

EXOTIC CURRENCY PAIRS

Nicknames

Popular currency pairs

Abbreviations

UNDERSTANDING FOREX CHARTS

CANDLESTICK CHART

A candlestick is a chart, also known as a japanese candlestick chart, that is often favoured by traders due to the wide range of information it portrays. The chart displays the high, low, opening and closing prices.

A candlestick has three points: open, close and the wicks.

The wicks show the high to low range and the 'real body' (wide section) shows investors if the closing price was higher or lower than the opening price.

If the candlestick is filled, then the currency pair closed lower than it opened. If the candlestick is hollow, then the closing price is higher than the opening price.

BAR CHART

A bar chart shows the opening, close, high and low of the currency pair’s prices.

The top of the bar represents the highest paid price and the bottom indicates the lowest traded price for that specific time period.

The actual bar represents the currency pair's overall trading range and the horizontal lines on the sides represent the opening (left) and the closing prices (right).

A bar chart is most commonly used to identify the contraction and expansion of price ranges.

LINE CHART

A line chart is easy to understand for forex trading beginners. In a line chart, a line is drawn from one closing price to the next.

When connected, it is easy to identify a general price movement of a currency pair throughout a time period and determine currency patterns.

NEED TO KNOW MORE ABOUT TRADING FOREX?

How to start trading with a forex broker

A broker such as FXTM acts an intermediary between the traders and the liquidity providers. It facilitates in the execution of clients’ orders.

It is recommended to choose a licensed, regulated broker that has at least 5 years of proven experience. If your broker abides by regulatory rules, then you can be sure that they are legitimate.

Once you have an active account, you can trade — but you will be required to make a deposit to cover the costs of your trades. This is called a margin account.

However, it’s really important to remember that becoming a profitable trader isn’t an overnight process. It takes time to become familiar with the markets, and there’s a whole new vocabulary to learn. For this reason, reputable brokers like FXTM offer a demo account. This is a great way to experiment with different trading strategies – but with virtual money and none of the risk!

Once you’re ready to move on to live trading, we’ve got a great range of trading accounts to suit you.

Learn forex trading

As a global broker, we’re firm believers that developing a sound understanding of the markets is imperative to a trader’s potential to succeed. That’s why FXTM offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and experienced traders.

These include free webinars, ebooks, articles and more. Prefer to learn from an expert in person? We also hold insightful seminars and workshops in various regions around the world that a cover a multitude of topics.

There are also many forex tools available to traders such as margin calculators, pip calculators, profit calculators, economic trading calendars, trading signals and foreign exchange currency converters.

Forex widgets can help to enhance your trading experience. Some of the more popular widgets include live rates feed, live commodities quotes, live indices quotes, and market update widgets.

MT4 & MT5 webtrader platforms

A forex trading platform is an online software which enables investors to access the foreign exchange market. It can be used to open, close and manage trades from the device of their choice and contains a variety of tools, indicators and timeframes designed to allow you to monitor and analyse the markets in real-time.

As a leading global broker, FXTM are committed to providing services tailored to the needs of our clients. As such, we’re s proud to offer our traders the choice of two of the industry’s leading forex trading platforms; metatrader 4 (MT4) and metatrader 5 (MT5). They are both available on a PC, mac, mobile (ios and android) or tablet.

Metatrader 4

Metatrader 4, also known as MT4, provides access to a range of markets and hundreds of different financial instruments, including foreign exchange, commodities, cfds and indices.

It provides you with all the tools you need to both manage your trades and analyse the markets, whilst also being completely free to download.

With the metatrader 4 platform, you’ll enjoy easy-to-read, interactive charts that allow you to monitor and analyse the markets in real-time. You’ll also have access to more than 30 technical indicators which can help you to identify market trends and signals for entry and exit points.

Metatrader 5

Metatrader 5, or MT5, is the newest and most advanced online and free trading platform. Trading on MT5 via FXTM gives you even greater access to financial markets including foreign exchange, commodities, cfds, stocks, futures and indices.

Its diverse functionality, fundamental and technical analysis tools, copy trading and automated trading equip you with the best tools and instruments available.

Other great benefits of MT5 include a multi-threaded strategy tester, fund transfer between accounts and a system of alerts to keep up to date with all the latest market events. Traders can also communicate through the embedded MQL5 community chat to network with other traders and share tips and strategies.

These platforms, combined with innovative services such as FXTM’s pivot point tool and FXTM invest, as well an award-winning customer support team, ensures FXTM traders have all the resources they need to trade with confidence.

You can find out more about our trading platforms, or download MT4 and MT5 from our trading platforms page.

Still not trading with a world-leading broker? Sign up today.

More about FXTM

- Myfxtm - client dashboard

- Fxtmpartners affiliate & IB program

- Fxtmpartners

- Partnership widgets

- Careers

- Global networks – nigeria

- Events

- Client services

- Excellent trading terms

FXTM promotions & contest

Media corner

Policies & regulation

FXTM sponsorships

FXTM brand is authorized and regulated in various jurisdictions.

Forextime limited (www.Forextime.Com/eu) is regulated by the cyprus securities and exchange commission with CIF license number 185/12, licensed by the financial sector conduct authority (FSCA) of south africa, with FSP no. 46614. The company is also registered with the financial conduct authority of the UK with number 600475.

Forextime (www.Forextime.Com/uk) is authorised and regulated by the financial conduct authority with license number 777911.

Exinity limited (www.Forextime.Com) is regulated by the financial services commission of the republic of mauritius with an investment dealer license bearing license number C113012295.

Card transactions are processed via FT global services ltd, reg no. HE 335426 and registered address at ioannis stylianou, 6, floor 2, flat 202 2003, nicosia, cyprus. Address for cardholder correspondence: backoffice@fxtm.Com. Business location address: FXTM tower, 35 lamprou konstantara, kato polemidia, 4156, limassol, cyprus.

Exinity limited is a member of financial commission, an international organization engaged in a resolution of disputes within the financial services industry in the forex market.

Risk warning: trading forex and leveraged financial instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Trading non-leveraged products such as stocks also involves risk as the value of a stock can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results. Before trading, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is the responsibility of the client to ascertain whether he/she is permitted to use the services of the FXTM brand based on the legal requirements in his/her country of residence. Please read FXTM’s full risk disclosure.

Regional restrictions: FXTM brand does not provide services to residents of the USA, mauritius, japan, canada, haiti, suriname, the democratic republic of korea, puerto rico, brazil, the occupied area of cyprus and hong kong. Find out more in the regulations section of our faqs.

So, let's see, what we have: december 17, 2020 everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery. At is forex trading for real

Contents of the article

- Best forex bonuses

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Is forex trading really profitable and can you do...

- Your biggest job as A forex trader

- How long can you trade with profits?

- What is forex money management?

- What is A good mindset?

- One word to be A successful currency trader

- Exploring scams involved with forex trading

- What makes a scam?

- How to avoid being scammed

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Is forex a scam?

- Simply put: is forex a scam?

- Previously identified scams

- Best forex brokers

- Is forex trading really profitable and can you do...

- Your biggest job as A forex trader

- How long can you trade with profits?

- What is forex money management?

- What is A good mindset?

- One word to be A successful currency trader

- Online forex trading: A beginner’s guide

- What is the forex market?

- What is forex trading?

- What is a forex broker?

- Understanding currency pairs

- Base currency

- Quote currencies

- Ask price

- Bid price

- Spread

- Visualisingcurrency trades

- What are the most traded currency pairs on the...

- MAJOR CURRENCY PAIRS

- CROSSES

- EXOTIC CURRENCY PAIRS

- 7 MAJOR PAIRS

- 7 MAJOR PAIRS

- 6 MINOR PAIRS

- 6 MINOR PAIRS

- 6 EXOTIC PAIRS

- 6 EXOTIC PAIRS

- Brackets

- Abbreviations

- UNDERSTANDING FOREX CHARTS

- NEED TO KNOW MORE ABOUT TRADING FOREX?

- How to start trading with a forex broker

- Learn forex trading

- MT4 & MT5 webtrader platforms

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.