How do you get your money from forex trading

You need to become a professional trader through learning the best and most accurate technical and fundamental analysis techniques.

Best forex bonuses

This is the only thing that makes you a professional trader who can consistently make profit. Most people think that they can learn to make money through forex trading within a very short time, and become a full-time forex trader who makes thousands or even millions of dollars.

Can you really become a millionaire from forex trading?

There are some questions that are frequently asked by novice traders:

Among all the frequent questions, there is one question which is asked by some novice traders more often:

Can I become a millionaire through forex trading?

I have two clear answers for this question and I explain about each of them in details:

- Yes, you can.

- No, you cannot.

Making lots of money through forex trading is completely dependent on some special conditions.

When someone has the proper conditions, he can make millions through forex trading.

When he doesn’t have the proper conditions, he will do nothing but wasting of time and money.

What are those conditions?

You can increase your wealth and become richer through forex trading and become a millionaire or even a billionaire.

However, if you are among those who want to turn a $500 or even a $5000 account into millions, then I have to tell you that you have to be patient enough.

I am not saying that it is impossible to make millions with forex.

Anything is possible in this world.

However, you have to be patient, because it can’t be done overnight, or even in one year.

You will be faced with some challenges that finding a good broker that doesn’t cheat you is the biggest one.

Many forex brokers (market maker brokers) don’t let you grow your account consistently, because in most cases, your profit is their loss.

Forex is not a get-rich-quick scheme

Forex is not a get-rich-quick scheme

It is not too easy to make a living through currency trading. Someone has to teach you the right techniques, otherwise you can’t get anywhere on your own.

It is the same with the stock trading and all other kinds of tradings and investments.

To make money consistently through forex trading and maybe to become a millionaire finally, you have to pass some important stages.

There are so many jobs that you can follow and become a millionaire.

It is not the job that has to make you a millionaire.

It is “you” who has to follow the job properly to become a millionaire.

For example, there are so many millionaire real estate agents and brokers in big cities like new york.

However, there are a lot more agents who cannot even cover their monthly expenses in the same cities.

All agents are in the same areas, have access to the same markets and customers, ruled under the same jurisdictions, use the same advertising media and… .

But, how can some of them become millionaires, and most of the others fail to have even one sale per month?

Whatever the reason is, it has nothing to do with the real estate business itself, because it is the same for all the agents and brokers.

The reason is in the agents and brokers behavior, life and work style.

Behavior, life and work style

Forex trading is like that too.

It possible to become a millionaire through forex trading, as it is possible to become a millionaire through stock trading, programming, marketing, importing and exporting, constructing, and…

The more important question is “how?”

There are two things that you have to do to become a millionaire forex trader:

2. You have to develop the trading discipline in yourself.

You can’t become rich through forex trading, without having these two at the same time.

It is not even possible to make a living without having the discipline, whether you master the trading techniques or not.

I’ve never seen even one single retail forex trader who has become able to become rich or millionaire without following the proper techniques and having the discipline it takes.

Even I’ve never seen a forex trader who has been able to make a living like this.

There is no consistently profitable and professional currency trader who doesn’t trades forex with the proper technical analysis methods.

When you have a big capital, you can trade currencies through a bank account, instead of retail brokers. But most people still have to be patient to reach this level.

And, as bank accounts are not leveraged, you will trade with more peace of mind. But you should start small at the beginning.

Those who don’t believe in what I explained above can spend some time and money on forex trading at least through having small live accounts with retail forex brokers.

I am 100% sure that they will remember what I’ve explained above, and will be back to this site after wasting lots of time and money. The reason is that most novice traders start trading with real money before they do the above two things: (1) developing proper techniques and (2) discipline.

How can you become a consistently profitable forex trader?

Unlike what most people think, it is not possible to start making money right after learning the forex trading basics and a trading strategy.

There is something very important that most people don’t consider:

To learn how to trade forex, become a consistently profitable trader and hopefully a millionaire, first you have to find a mentor who teaches you the currency trading techniques and help you to develop the discipline in yourself.

Additionally, you’d better to have an income that covers your expenses and leaves you some free time to sit at the computer and learn how to trade with peace of mind.

You can make any money through forex trading and any other kinds of trading when you DON’T HAVE TO make money and you don’t have financial problems. Therefore, having a source of income is a big help.

False forex success stories

Most people think that they can learn to make money through forex trading within a very short time, and become a full-time forex trader who makes thousands or even millions of dollars.

This is is not true at all.

There are so many false forex millionaires stories over the internet.

Be careful not to be deceived by them.

None of the real millionaires or billionaires, like george soros, have made their wealth through forex or stock trading without following strong strategies. However, they are experienced business people who make a lot of money through several sources of income they have.

Then they invest a portion of their wealth in currency, stock, real estate… markets to increase their wealth: A short term investment strategy that makes you a millionaire

This is how they’ve become millionaires or billionaires. Their increase their wealth through forex or stock trading while they have other sources of income.

Therefore, if you like to become a millionaire, first you have to have a good source of income that makes a reasonable amount of money that not only covers your expenses, but also leaves some money for your trading and investments.

Then you can start learning how to trade.

You have to keep on learning and practicing until you become a consistently profitable trader. That’s why we enable our trading students to develop a source of income too.

The hassles of following too many trading strategies

Some traders the hard way of following too many trading strategies, robots and time-frames, and sitting at the computer for several hours per day.

That is the hard way which can hardly take you to your destination.

The simpler and easier way is learning the forex trading basics, and then a simple and strong trading strategy.

Then you have to master your trading strategy through demo trading.

When you succeed to make profit consistently for 12 consecutive months at least, you can open a small live account and start practicing with it.

If you can make profit consistently for 12 consecutive months with your live account too, the way you could make profit with your demo account, then all you have to do is that you keep on trading with your live account to grow it, or adding some more money to it. But don’t make your account too big. You will be faced with lots of negative emotions when you are still new and you want to trade with a too big account.

A source of income is really good

To become a full-time forex traders who makes money consistently, you have to spend some time. I already explained it above.

If you don’t have an income currently, or if your income is not enough to give you time and mind freedom to learn forex, you should develop a source of income that covers your life and enable you to open a live account in the currency market when it is the time.

You can keep making money with your source of income until you are ready to open a trading account. If your income is enough to trade through a bank account later when you are ready to do it, it will be even better.

Trading through a bank account will have a lot more advantages compared to trading through forex brokers.

The only problem of trading through a bank account is that you have to have a lot of money because banks don’t offer any leverage.

Therefore, to become able to trade through a bank account, you have to have a lot of money already.

That is why I emphasized on having a strong source of income earlier in this article.

If you want to become a millionaire forex trader, you must have a good income and backup.

Turning a small $5000 account into a million dollar account is possible theoretically.

You can do it slowly and surely when you become a consistently profitable trader and you have enough patience. However, you have to be a patient and disciplined forex trader to do it. And, you can’t do it alone. You need the mentors technical and emotional support.

Do it the right way:

You need to become a professional trader through learning the best and most accurate technical and fundamental analysis techniques. This is the only thing that makes you a professional trader who can consistently make profit.

When they become consistently profitable forex traders eventually, they have enough money to open live accounts or even professional live forex trading accounts with the banks to trade professionally and increase the money they make.

This is how they can become millionaire forex traders while they also have some other good sources of income to support their forex and stock trading investments.

So, the answer of this question that whether it is possible to become a millionaire through forex trading is in the facts that I explained in detail above.

Be careful not to be deceived by the scam mentors or brokers. They are there to make money from your losses, not to make you a millionaire.

Forex brokers with best money withdrawal options in 2021

The best and most exciting thing about forex trading is, of course, to withdraw your profit from the forex broker. Say you have been trading, made a considerable amount of profit and now you want to spend your profit. In order to be able to do it, first you have to get your money back from the broker. To withdraw money from your forex account is very straightforward in general but does require you to take few steps.

Forex brokers with best money withdrawal options

Forex.Com

Forex.Com is owned and operated by an industry giant; GAIN capital holdings who has been around for more than 20 years. Forex.Com is registered and regulated by CFTC, NFA and CIMA. The broker accepts clients from the US. Investors can deposit and withdraw funds by credit card, bank card and wire transfer. Digital wallets are going to be available soon.

Money withdrawal options: credit card, bank card, wire transfer

XM

XM puts more than ten methods of deposit and withdrawal under disposal of its clients. In addition to international bank transfer and credit card which has become industry standards as deposit and withdrawal methods, XM clients can use various other methods. Those methods include neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort and western union. One important detail which makes XM even more favorable is that the broker covers international wire transfer commission of its own part which considerably reduces the withdrawal cost.

Money withdrawal options: wire transfer, credit card, neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort, western union

Fxpro

Regulated by FCA,cysec and SCB, fxpro is headquarted in london and one of the most prominent forex brokers in the industry. Traders who open an account at fxpro can withdraw and deposit funds through credit card, international bank transfer (SWIFT), paypal, skrill, neteller and china unionpay.

Money withdrawal options: wire transfer, credit card, paypal, skrill, neteller, unionpay

Hotforex

Established in 2010 and headquartered in cyprus, hotforex is an award winning forex broker that offers a wide range of account types and trading instruments. The broker is pursuing a policy of providing the most convenient and advantageous trading conditions for the traders. You can deposit money in hotforex using credit or debit cards and bank wire transfers. Apart from that hotforex also accepts skrill, neteller, fasapay, sofort, mybitwallet, ideal and webmoney.

Money withdrawal options: wire transfer, credit card, skrill, neteller, fasapay, sofort, ideal, webmoney, bitcoin

Exness

Exness was founded in 2008 in russia and has grown into one of the most popular forex brokers in europe since then. The company is regulated by cysec in cyprus and FCA in UK. Having a wide array of payment methods, transacting money on this brokerage platform is pretty easy and quick.

Money withdrawal options: wire transfer, credit card, skrill, neteller, webmoney, perfect money, sticpay, jeton wallet

Choose the withdrawal option

When it comes to withdraw your profit from forex brokers, the methods are not scarce including credit card, wire transfer, paypal, neteller, skrill, western union, bitcoin to name a few.

I usually go with wire transfer when withdrawing my profit. Nevertheless it comes with some caveats. Wire transfer is recommended if only you are going to withdraw an amount over a thousand. Otherwise the bank transfer fees are going to eat up your hard earned profit. Bear in mind that when you choose to get your money back through wire transfer, you are going to get double charged (once by the bank in where your forex broker is located and again by your local bank). The fees could range from $50 to $100 in total. The certain amount completely depends on the bank the broker is working with and your local bank. International wire transfer fees charged by some US banks are explained in this article.

My second favorite option to withdraw funds from forex account is credit card. Again there are some caveats. Some forex brokers don’t allow you to withdraw more than what you deposited with the same credit card. When you deposit $1000 to your forex account using credit card, you can only withdraw an amount up to $1000 by the same card. So you will have to choose another withdrawal method to transfer your profit.

Though I haven’t used so far, other popular methods are digital wallets like neteller, skrill, paypal. Forex brokers don’t charge extra fees to withdraw money by digital wallets however those services apply their own fees when you want to transfer money from the wallet to your bank account.

Submit your withdrawal request

After you decided the best transfer option for you, you have to submit your withdrawal request. Forex brokers used to demand clients to print out a withdrawal form then fill, sign and forward it to the broker by mail or e-mail.

However nowadays you don’t have to go through this cumbersome process. Majority of the forex brokers provide clients with a username and password for the client portal where they can submit their money withdrawal request in just seconds.

Just log in to the client portal, navigate to the money withdrawal section, fill the online form and click the submit button. Congratulations!

An important caveat is that some forex brokers do not require clients to verify their account till to the point they wish to withdraw funds from their account. If this is the case for the broker that you are trading with, you will need to verify your forex trading account by loading proof documents for ID and address. However, you will have always the chance to verify your account upon registration in case you do not want to worry about the last minute rush.

Wait until your fund is transferred to your bank account / credit card / digital wallet

It ranges between one to three business days depending on the forex broker and withdrawal option you used. Wire transfer and credit card transfers could take up to three business days. Though I remember several times that I received the funds same day when I used wire transfer as the transfer option. The commission and fees are not fixed for wire transfer. Since there are three banks involved at a wire transfer transaction, it is hard to know the exact amount that is going to be charged as commission. However, based on my experience, I can say that it should range between $30 and $100.

Digital wallets such as skrill and neteller has a different commission and time schedule. First time you incur any commission is the moment you withdraw funds from your trading account. The rate changes between %3 and %2 of the amount you like to withdraw. It takes fews days between the time that money leaves your trading account and arrives at your digital wallet. Second time you will get charged is the moment you transfer the money from your skrill account to your bank account. That is another %3 – %2 commission.

Wire transfer is my preferred withdrawal and deposit method. I use digital wallets only if wire transfer is not among the methods offered by the forex broker. Credit card is fast and more reasonable than any other withdrawal and deposit method. Nevertheless, I shall kindly point out that in the case you choosed credit card as a withdrawal method, you can only withdraw the amount you deposited by the same credit card. Therefore, you will have to use another method in order to be able to withdraw your profit.

10 ways to avoid losing money in forex

The global forex market is the largest financial market in the world and the potential to reap profits in the arena entices foreign-exchange traders of all levels: from greenhorns just learning about financial markets to well-seasoned professionals with years of trading experience. Because access to the market is easy—with round-the-clock sessions, significant leverage, and relatively low costs—many forex traders quickly enter the market, but then quickly exit after experiencing losses and setbacks. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading.

Do your homework

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Learning about forex is integral to a trader’s success. While the majority of trading knowledge comes from live trading and experience, a trader should learn everything about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies.

Key takeaways

- In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker.

- Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective.

- It's important to use proper money management techniques and to start small when you go live.

- Control the amount of leverage and keep a trading journal.

- Be sure to understand the tax implications and treat your trading as a business.

Homework is an ongoing effort as traders need to be prepared to adapt to changing market conditions, regulations, and world events. Part of this research process involves developing a trading plan—a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives.

How do you make money trading money?

Find a reputable broker

The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker. Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the national futures association (NFA) and is registered with the commodity futures trading commission (CFTC) as a futures commission merchant. each country outside the united states has its own regulatory body with which legitimate forex brokers should be registered.

Traders should also research each broker’s account offerings, including leverage amounts, commissions and spreads, initial deposits, and account funding and withdrawal policies. A helpful customer service representative should have the information and will be able to answer any questions regarding the firm’s services and policies.

Use a practice account

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Few things are as damaging to a trading account (and a trader’s confidence) as pushing the wrong button when opening or exiting a position. It is not uncommon, for example, for a new trader to accidentally add to a losing position instead of closing the trade. Multiple errors in order entry can lead to large, unprotected losing trades. Aside from the devastating financial implications, making trading mistakes is incredibly stressful. Practice makes perfect. Experiment with order entries before placing real money on the line.

$5 trillion

The average daily amount of trading in the global forex market.

Keep charts clean

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. This should be avoided.

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace. The chosen colors, fonts, and types of price bars (line, candle bar, range bar, etc.) should create an easy-to-read-and-interpret chart, allowing the trader to respond more effectively to changing market conditions.

Protect your trading account

While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of the process. Many veteran traders would agree that one can enter a position at any price and still make money—it’s how one gets out of the trade that matters.

Part of this is knowing when to accept your losses and move on. Always using a protective stop loss—a strategy designed to protect existing gains or thwart further losses by means of a stop-loss order or limit order—is an effective way to make sure that losses remain reasonable. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session.

While traders should have plans to limit losses, it is equally essential to protect profits. Money management techniques such as utilizing trailing stops (a stop order that can be set at a defined percentage away from a security’s current market price) can help preserve winnings while still giving a trade room to grow.

Start small when going live

Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. As such, it is vital to start small when going live.

Factors like emotions and slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process.

Use reasonable leverage

Forex trading is unique in the amount of leverage that is afforded to its participants. One reason forex appeals to active traders is the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth. But leverage can just as easily amplify losses.

A trader can control the amount of leverage used by basing position size on the account balance. For example, if a trader has $10,000 in a forex account, a $100,000 position (one standard lot) would utilize 10:1 leverage. While the trader could open a much larger position if they were to maximize leverage, a smaller position will limit risk.

Keep good records

A trading journal is an effective way to learn from both losses and successes in forex trading. Keeping a record of trading activity containing dates, instruments, profits, losses, and, perhaps most important, the trader’s own performance and emotions can be incredibly beneficial to growing as a successful trader. When periodically reviewed, a trading journal provides important feedback that makes learning possible. Einstein once said that “insanity is doing the same thing over and over and expecting different results.” without a trading journal and good record keeping, traders are likely to continue making the same mistakes, minimizing their chances of becoming profitable and successful traders.

Know tax impact and treatment

It is important to understand the tax implications and treatment of forex trading activity in order to be prepared at tax time. Consulting with a qualified accountant or tax specialist can help avoid any surprises and can help individuals take advantage of various tax laws, such as marked-to-market accounting (recording the value of an asset to reflect its current market levels).

Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters.

Treat trading as a business

It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

As with any business, forex trading incurs expenses, losses, taxes, risk and uncertainty. Also, just as small businesses rarely become successful overnight, neither do most forex traders. Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

The bottom line

The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. When approached as a business, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. Traders can improve their odds by taking steps to avoid losses: doing research, not over-leveraging positions, using sound money management techniques, and approaching forex trading as a business.

The best way to learn forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-185920854-56a31baa3df78cf7727bcff9.jpg)

If you've looked into trading forex online and feel it's a potential opportunity to make money, you may be wondering about the best way to get your feet wet and learn how to get started in forex trading.

It's important to have an understanding of the markets and methods for forex trading so that you can more effectively manage your risk, make winning trades, and set yourself up for success in your new venture.

The importance of getting educated

To trade effectively, it's critical to get a forex education. You can find a lot of useful information on forex here at the balance. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters.

As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you open a forex demo account and try out some demo trading. It will give you a good technical foundation on the mechanics of making forex trades and getting used to working with a specific trading platform.

A fundamental thing you may learn through experience, that no amount of books or talking to other traders can teach, is the value of closing your trade and getting out of the market when your reason for getting into a trade is invalidated.

It is very easy for traders to think the market will come back around in their favor. You would be surprised how many traders fall prey to this trap and are amazed and heartbroken when the market only presses further against the direction of their original trade.

The famous and painfully true statement from john maynard keynes states, "the market can stay irrational, longer than you can stay solvent." in other words, it does little good to say the market is acting irrationally and that it will come around (meaning in the direction of your trade) because extreme moves define capital markets in the first place.

Use a micro forex account

The downfall of learning forex trading with a demo account alone is that you don't get to experience what it's like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account or an account with a variable-trade-size broker that will allow you to make small trades.

Trading small will allow you to put some money on the line, but expose yourself to very small losses if you make mistakes or enter into losing trades. This will teach you far more than anything that you can read on a site, book, or forex trading forum and gives an entirely new angle to anything that you'll learn while trading on a demo account.

Learn about the currencies you trade

To get started, you'll need to understand what you're trading. New traders tend to jump in and start trading anything that looks like it moves. They usually will use high leverage and trade randomly in both directions, usually leading to loss of money.

Understanding the currencies that you buy and sell makes a big difference. for example, a currency may be bouncing upward after a large fall and encourage inexperienced traders to "try to catch the bottom." the currency itself may have been falling due to bad employment reports for multiple months. Would you buy something like that? Probably not, and this is an example of why you need to know and understand what you buy and sell.

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade. it doesn't mean, however, that you need to trade them all. It's better to pick a few that have no relation and focus on those. Having only a few will make it easy to keep up with economic news for the countries involved, and you'll be able to get a sense of the rhythm of the currencies involved.

After you've been trading with a small live account for a while and you have a sense of what you're doing, it's ok to deposit more money and increase your amount of trading capital. Knowing what you're doing boils down to getting rid of your bad habits, understanding the market and trading strategies, and gaining some control over your emotions. If you can do that, you can be successful trading forex.

Managing risk

Managing risk and managing your emotions go hand in hand. When people feel emotional, greedy or fearful, that is when they make mistakes with risk, and it's what causes failure. When you look at a trading chart, approach it with a logical, objective mindset that only sees the presence or lack of potential; it shouldn't be a matter of excitement. If pulling the trigger on a trade feels emotional in any way, you should re-evaluate why you're not able to be objective.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

A guide on ‘taking profits’ from your forex trades

If you’ve been around the markets for a while you probably have figured out that it’s one thing to get into a profitable trade and it’s another thing all together to actually take a profit from it. Traders often screw up the process of profit-taking due to emotion, not having a profit-taking plan, or simply not knowing how to read the changing price dynamics of the market.

In today’s lesson, I am going to give you some examples of recent price action trade setups that provided the potential for a nice profit, and then I’ll explain to you how you could have secured that profit. I will also discuss some of the common mistakes that traders make in trying to take profit out of the market. Hopefully, after finishing today’s lesson you will have a better understanding of how to secure open profit when trading the markets and how to avoid some of the most common profit-taking mistakes.

Taking profits on emotion vs. Taking profits on logic

A fact of forex trading is that most traders take their profits as a result of an emotional impulse instead of exiting the market at a pre-determined target or from a pre-planned exit strategy. As a result, traders who exit a trade on emotion typically take much smaller profits than they would like, while traders who exit a trade based on logic and discipline typically are very happy with the profits they take.

There is also an element of being realistic here that I need to touch on before going into the examples below. You see, struggling traders who exit emotionally tend to think they are going to somehow squeeze every last pip out of a move and this causes them to have difficulty closing a trade that has moved into a nice profit. Successful forex traders who know and accept the fact that they cannot take every pip out of a move, are more than happy to settle for taking ‘chunks’ out of moves and exiting their trades when they are significantly in their favor, instead of panicking and exiting at the last minute as the trade comes crashing back to their entry.

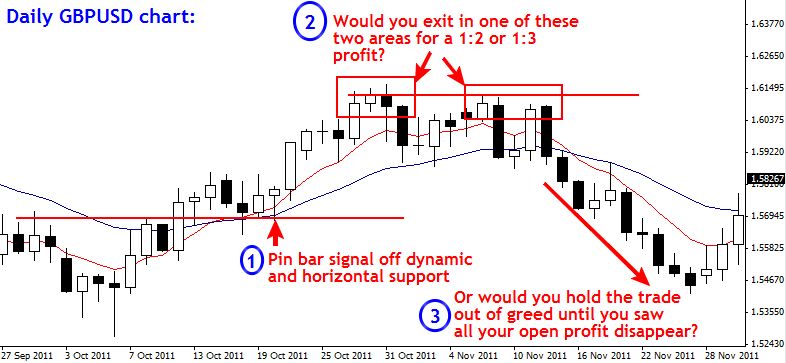

Look at the british pound vs. U.S. Dollar chart below, I have provided an example of exiting based on emotion because you waited too long due to thinking the trade would go just a ‘little bit further’, vs. Exiting based on logic because you don’t care if the trade keeps going since you know and accept that you are extremely unlikely to pick the exact top and bottom of every move:

From the chart example above we can take away a very important point and build it into our forex trading plan:

When we get up 1:2 times our risk in a trade it’s time to either lock in that profit, take it off the table, or at the very least analyze the market structure and ask yourself if you honestly believe the market will continue in your direction before making a significant correction against your position. Remember: markets do not move in straight lines, instead they ebb and flow, as short-term swing traders our aim is to take chunks out of major market moves, not pick the exact top and bottom, so don’t get caught in a cycle of constantly giving up solid 1:2 risk reward gains or more only because you are stuck in a perpetual state of greed and hope.

Let the market take you out

How many times have you manually exited a trade only because it moved against you a little bit and then it rockets on in your favor? Or how many times have you manually exited a trade around breakeven only because you were afraid it would turn into a loss, only to see it turn around and take off in your favor while you were on the sidelines?

Traders often exit the market because they ‘think’ they know what is going to happen. You need to understand that you never know for sure what will happen next, you have to trust your trading edge and then let the market play itself out. Forex trading is a game of risk and reward, and since there is risk involved with every trade you take, you need to accept that risk and look at it as the price of being a trader, and embrace it. The more you fight against the inherent risk of being a trader and try to close your trades out early, before they hit your pre-planned stop, or perhaps not even use a stop loss because you are ‘sure’ the market will turn back in your favor, the greater the chance of you losing a lot or all of your trading money.

If we have a high-probability trading edge like price action forex strategies, we need to let our edge play out over a large series of trades to see it work for us properly. When you manually close a trade just because it moves against you a little bit, you voluntarily interfere with your trading edge. You see, you don’t know if that trade is going to turn around in your favor and hit a 1:3 risk reward winner, or continue moving against you and hit your stop loss. So, you need to give yourself a chance on every trade you take by letting the market play itself out. The best course of action is almost always to set and forget your trades and either take the loss from the risk that you accepted prior to taking the trade, or take a nice profit if the trade moves in your favor. Of course, this largely depends on your ability to find and enter high-probability forex trades, because if you over-trade and enter the market on whims, you aren’t going to last very long in the markets, no matter what your exit strategy is.

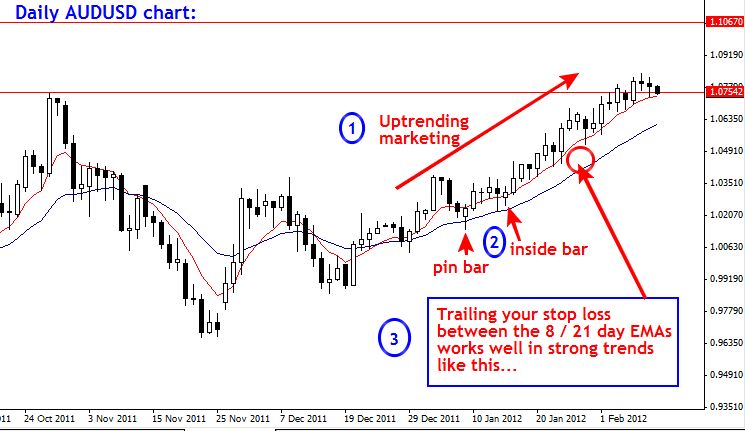

How to take profit in a trending market

A strong trending market provides us with the best opportunity to hit some big winners by letting our trades run via trailing our stops. There is no perfect way to trail your stop loss, and I do get a lot of emails asking me how to trail stops.

There is no way ‘perfect’ way to trail your stop loss, eventually your stop loss will get hit no matter how you decide to trail it, the point of trailing your stop is to give the market room to breathe while at the same time locking in profit as the market moves in your favor. Here is one example of trailing your stop loss by using the 8 and 21 daily EMA support layer in the current uptrend of the AUDUSD.

How to take profit in a range-bound market

Taking profit in a range-bound market is pretty straight forward. Typically, you can watch for price action setups at one boundary of the trading range and then take profit near the other boundary of the range. See this example chart for more:

How to know when to take a 1:2 or 1:3 risk reward profit vs. Trailing your stop

I get a lot of emails about how to know when to take a 1:2 or 1:3 risk reward vs. When to trail your stop. The simple answer is that there is no way to ‘know for sure’, because we can’t ever know anything ‘for sure’ in the markets. But, generally speaking, in strong trending markets we obviously have a better chance of getting a big winner through letting our trade run by trailing our stop. So, knowing when to take the 1:2 or 1:3 profit off the table vs. Trailing your stop, really comes down to your ability to accurately read the market conditions. Also, there is nothing wrong with moving your stop up to lock in a 1:2 or 1:3 risk reward and then trailing your stop up each time the trade moves 1 or 2 times risk in your favor; this way you take the profit and also give yourself a chance at a bigger gain.

How becoming a master price action trader will help you take more profit from your trades

Becoming a master price action trader by learning to trade like a sniper and not a machine gunner, will allow you to identify high-probability price action entries as well as build your market analysis skills. Knowing how to effectively analyze the price action and current market structure prior to entering a trade is paramount to figuring out the best and most logical way to exit the trade. While there are no guarantees in trading, one thing that can be said with certainty is that learning how to correctly read and trade off the raw price dynamics in the market will significantly improve your ability to both enter and exit the market effectively. If you want to learn more about learning to read and trade with price action analysis, check out my price action forex trading course.

2 proven ways to recover scammed bitcoin, money lost to binary options forex

NEW YORK, NY ( TS newswire ) -- 24 oct 2020

IMPORTANT: contactexpressrecoverypro@yahoo.ComORinfo@fundsrecovery247.Comto recover scammed bitcoin, as well as money lost to binary options forex trading / investment scam.

There has been a spike in the number of cryptocurrency scam (bitcoin scam, especially), binary options scam and forex scam in recent years. There are a lot of fraudulent cryptocurrency investment websites, as well as fake binary options and forex brokers. A lot of investors have lost (are still losing) money to these bitcoin cryptocurrency and binary options forex investment scams.

Do you need help to; retrieve stolen bitcoin, recover scammed bitcoin, report a bitcoin scammer to reclaim crypto? There are two ways to go about recovering your lost money. You can either follow a series of funds recovery processes as a way to get money back from bitcoin scammer. Or you can hire a bitcoin recovery expert or funds recovery expert to help recover money lost to binary options forex, and bitcoin cryptocurrency scams.

How to recover scammed bitcoin using DIY

Have you lost bitcoin to scam? Recover scammed or stolen bitcoin cryptocurrency yourself by following these 4 DIY steps below;

A.) contact the fraudulent crypto investment platform: you will have to contact the trading platform that scammed you and stole your bitcoin cryptocurrency. Make them know that if they do not return your money, you will report them to the relevant financial authorities. This doesnt necessarily guarantee that they will give you your money back, but it is definitely a step in the right direction. Because when followed by action, your efforts could pay off.

B.) report to relevant financial authorities: either you suspect you may be, or you know are a victim of trading fraud and you are doing everything you can to get justice. Perhaps you have already opened a case with a scam recovery company like ours but you want to make sure that other traders do not make the same mistake. When you file your complaint, make sure to provide as much information as possible.

C.) get help online: if youre keen on getting your money back, you may ask yourself the following questions; have I exhausted all options in getting my money back? Would I just give up if it were to be a million dollars? Try to publicize your story and seek help online in any way you can. For example, post the name of the broker on reddit, quora or facebook or social media to see if there are others who have information on this company or any clues as to how you could get your money back. This may also help prevent others from digging a whole in their bank account or credit card.

D.) inform your crypto wallet provider: contact your bitcoin wallet or crypto wallet and notify them that the company you paid is a scam and is refusing to give your money back. This will raise awareness and ultimately jeopardize any scams relationship with the crypto wallet which may also help prevent others from being scammed.

Hire bitcoin recovery expert to recover scammed bitcoin

The other option will be to hire a bitcoin recovery expert to recover scammed bitcoin. A bitcoin recovery expert is able to track bitcoin transactions and also investigate and apply all necessary technical processes needed to recover funds lost to bitcoin investment scam and other high level digital currency scams.

Using the service of a bitcoin recovery expert to recover scammed bitcoin, offers you the best and the largest crypto recovery / reclaim solution by providing the potential for billions of dollars in misappropriated cryptocurrency to be effectively and legally recovered.

Before now, there was no end-to-end effective solution in the public market for pursuing the rights of victims of cryptocurrency-related frauds. The early stage, cross-border character, scale, and new technological complexity of blockchain has hindered efforts of victims and law enforcement. A bitcoin recovery expert is able to use the combination of fit for purpose technology, operational processes, experience and capabilities to effectively recover scammed or stolen bitcoin and other misappropriated virtual assets.

Best bitcoin recovery expert to recover scammed bitcoin

Who needs to hire a bitcoin recovery expert? Anyone who has lost cryptocurrency funds in any form of a hack, shut down and/or hacked exchange, ransomware, ransoms, fake icos or who simply has lost funds by sending them to the wrong address. Did you lose lose access to your account by losing your bitcoin private key or, did you lose money to fake bitcoin miners?

You can get all your lost funds back by hiring one of the best bitcoin recovery experts out there. After a lot of thorough examination and scrutiny, we present to you the 2 best bitcoin recovery experts;

Is forex trading really profitable and can you do it?

One question that comes up a lot is: is forex profitable?

Many times this question comes from retail traders that are not finding any success with their trading approach. When I say “trading approach”, I don’t just mean their trading strategy.

Your trading approach is much more than a trading strategy and we will cover that later.

The short answer is yes, forex trading is profitable.

The slightly longer answer is yes, trading in the forex market is profitable but chances are you won’t make any money.

How do I know trading forex can be profitable? Because I’ve been swing trading forex since 2008 and make money. In fact, you can take a look at my free forex chart setups that I post every week using technical analysis and then update any trades at the end of the week.

Everything in those chart is for one reason: to teach you how to use a simple approach to trading forex to make profits.

It’s one thing to make money trading and an different thing to keep the profits.

Your biggest job as A forex trader

I’ve mentioned it many times in my trading posts but the number one job you have as a trader, is a risk manager. If you do not understand risk…if you do not manage your trades in the proper way, you will lose.

If you are risking too much per trade to withstand a string of losing trades, you will be out of trading faster than you imagined.

If you continue to move your stops around to avoid taking a loss, you will eventually lose your account. Your broker will be happy because you are probably a retail trader and your broker banks your loss, but you won’t be.

Your second job as a trader is simple: enter trading orders.

If you are trading, you’ve done your homework and are trading a strategy that has a verifiable edge in the market. You have made a trading plan complete with which setups to take, how you will exit, where you will take your loss.

You’ve outlined which currencies you will trade and the style of trading you will be doing. Day trading is popular but swing trading currencies is how I trade the retail market. If I day trade, it is not often, is not forex, and is done in the futures markets with the occasional options trading play.

Your job as a trader is to execute the trading plan when your setups take place. You enter your trading orders, manage your trades, and take your profit and loss the way it is set out in your trading plan.

Without a trading plan, you are doomed to fail.

How long can you trade with profits?

Consistency matters when currency trading and if you are applying the trading plan in a consistent manner, you should be able to reap the rewards of the edge your trading plan gives you.

You will take a loss and sometimes many in a row. You will see your trading account fluctuate and it can be painful to see at times. The expectancy of your trading system is what should keep you glued to the trading plan during the times of an equity curve down swing.

The truth is you will have a losing day.

You will have a losing week.

At times, your month may be at break-even or worse, at a loss.

These are the realities of trading and if you are asking about being profitable over the long run, the answer is yes if you are trading a positive expectancy trading strategy.

One week of loss or even a month of not being profitable does not make for trading failure. It must be expected. You must expect to lose and also to imagine that you have yet to take the biggest loss of your trading career.

You read that right. Think that you have yet to experience the most painful loss of all. Expect that a multiple of risk loss is around the corner.

It will remind you that the biggest trading job you have is trading your emotions for a proper mindset and to protect your trading capital.

What is forex money management?

Forex money management is simply about risk. In short, if you take big risks, you can make a lot of money in short period of time but the bad side of that is that a few bad high risk trades and you lose a lot. Wins and losses come in a random distribution.

You never know if that next trading will be a winner.

When you trade a lot, over trader, that’s bad forex money management. When take a lot of risk in a trade, that’s bad forex money management.

Learning forex money management is the easiest thing. But doing it, applying it, sticking to it when everything else doesn’t seem to be working is really hard…and all it comes down to is mindset.

What is A good mindset?

There are many books written about the trading mindset but before I list a few – a great mindset is useless if you are trading a flawed trading strategy.

- You understand that you are not worried about the day to day trading account fluctuations because you are focuses on the long term.

- When a trading loss or trading profit does not bother you, but you see it as part of the whole process to keep growing your account.

- You know that risk management can help you last a very long time in trading forex and failure to follow it is the fastest way to part with your money.

- You understand the negative impacts of greed and fear and learn to control it.

Trading the forex market is a business and like any business, you have to approach it with a professional approach and like most companies, have a “trading resolution”, something you abide by at all times.

The four mindset points above can be a great place to explore.

Break out a pen and paper and jot down those four ideas about mindset. Expand on them and ask what they mean to you.

One word to be A successful currency trader

If I had to use one word to describe the best trader, I would use the word consistency.

By using that one word, I am assuming that everything from your trading plan to the forex broker you will use has been detailed.

The job you have trading currencies is to implement that trading plan. How? With consistency. Traders that do everything in a consistent manner are sticking to a proven edge.

More importantly, by being consistent, when a trader is not seeing their profitability increase or they are seeing their profit drop, they can zero on each step they take to find the issue.

It is difficult to find where a problem is if you are constantly switching gears.

This is why I never think it is a good idea to take trading signals from people you don’t know. Too much trust goes into the word of someone else – someone who is not responsible for your trading account. How can you fix a strategy if you don’t know how the trading signals are generated?

In the end, I believe everyone has the chance to become successful and profitable when trading. The issue is if they will take the steps required to do so.

I also believe that most won’t do what is required and will continue to look for the easy way or the “secret sauce”.

There is no magic. It’s called hard work on the right things. I hope my trading blog and the setups I post every week are helping you gain some ground in your quest to be a profitable trader.

How much money can you make from forex trading – 2020 guide

Millions of people across the globe are trading to earn higher profits. If you are a trader, then forex trading is a common term for you. It is the best way to make vast amounts of money by trading in foreign exchange. The most significant advantage of forex is low fees as compared to others. Both beginners and experienced traders can buy or sell currencies with high profits.

No doubt that you can earn an ample amount of money through trading forex. It is important to learn how to make it. If you want to achieve significantly, then you must trade hard. Check out forexstore to start forex trading. In the following write-up, know the amount of money you can earn via trading forex exchange. There are many factors to earn and calculate money won in trading forex. Let’s begin.

1. Trade more

Many individuals are addicted to trading, like gambling. They buy and sell foreign exchange frequently to earn profits. If you think of trading once and get plenty of amounts, then you are wrong. You have to trade more to collect a significant amount. Now, you might be thinking that there are also chances of failure. Is it best to invest money repeatedly? You must invest more to trade more.

Due to higher chances of wins, you can risk your shares again and again in trading forex. When you trade more, the winning probability is quite high. A beginner can risk with time and circumstances, but an experienced trader must not lose the opportunity at all.

2. Managing risk

Risking huge amounts is one of the trading schemes to get high returns. Remember one thing that there are also possibilities of losing massive amounts. You must trade carefully because it eventually affects your account of trading. Before trading forex, you need to create a strategy with positive output.

Suppose if you are getting $10,000 in your account per year by trading $1000, then it will not be the same each year. You can earn more considerably than expected. Try to trade more in some years to get higher profits. It will not affect your account, and in the end, a trader can count on his massive earned money.

3. Money extraction from your trader’s account

You can operate your trading account for buying or selling foreign exchange. The amount will be stored in your account, and you can either trade more, withdraw or keep it there for adding more interest. Every person earns money to enjoy a satisfying life with luxuries and comfort. Make sure that you debit the required money from your account.

It is essential to keep a certain amount as savings for more trading. The added compound will generate more amount, and later, you can get more money out of it. Therefore, it is a good deal of saving amount for the future. Many traders prefer to do such things for better money management.

4. Determine your expectancy

Trading is about risking money. You can determine the expectancy factor by analyzing your performance while trading. Suppose if you are continuously risking your money, and you are getting profits 2 or 3 times, then you are not a good trader. But sometimes, you have an excellent winning rate by getting profits in the initial trading session.

You need to join the winning and losing rate together to know about your future profits and loss. You can easily create different methods for trading if you determine your rate of expectancy. It will help you in earning money via forex trading efficiently.

5. Trading risk is dependent on currency pairs

An experienced trader is aware of different currency pairs. You can lose some amount while trading a currency pair. A trader must know the current currency rate and then buy or sell it. You need to estimate the winning and losing trade to get enough profits. If we calculate the win rate of the trader, then you must find out the difference between the profitable and loser trades.

The win rate is quite less in case of no or fewer commissions. There is a considerable return on the profit without affecting any previous records. The profit from trading on various currency pairs is different. Make sure that you analyze the current rate before investing your money.

6. Calculate profit from forex trading

There is one way to know the amount of earning money by trading forex. You can calculate all the potential earnings. Before that, you must know certain things about your yearly profits, trading amount, earnings, buying, and selling currency assumptions. It is easy to evaluate the profits if you know how exactly you trade and what strategies you must adopt.

Determining all the factors and calculating profits are the best ways to know the amount of money you can make through trading forex. You can also calculate the average rate of profit that you will earn in an entire year.

The bottom line

Trading forex exchange is not a one-day task to earn a considerable amount. You need to invest and experiment a lot to become a good forex trader. There is no doubt that you can make much money from forex trading. But you have to focus on your performance to prevent yourself from massive loss.

Make sure that you come up with highly-effective trading strategies to get profits frequently. Millions of people worldwide are trading, but not everyone is getting the same results. You must calculate everything from your trading performance to future profits from forex. It will ensure that you are on the correct path or not. After analyzing everything, there will be a scope of improvement in your trading performance.

Make sure that you keep the above things in your mind for better results. Try to start trading by investing a small amount to prevent huge losses. It is better to understand your skills before trading enough money on different exchange currencies.

3 things I wish I knew when I started trading forex

Trading forex - what I learned

- Trading forex is not a shortcut to instant wealth.

- Excessive leverage can turn winning strategies into losing ones.

- Retail sentiment can act as a powerful trading filter.

Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. I started out aspiring to be a full-time, self-sufficient forex trader. I had been taught the 'perfect' strategy . I spent months testing it and backtests showed how I could make $25,000-$35,000 a year off of a $10,000 account. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. I was dedicated and I committed myself to the plan 100%.

Sparing you the details, my plan failed. It turns out that trading 300k lots on a $10,000 account is not very forgiving. I lost 20% of my account in three weeks. I didn't know what hit me. Something was wrong. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. It played a huge role in my development to be the trader I am today. Three years of profitable trading later, it's been my pleasure to join the team at dailyfx and help people become successful or more successful traders.

The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why. These are the three things I wish I knew when I started trading forex.

1) forex is not a get rick quick opportunity

Contrary to what you’ve read on many websites across the web, forex trading is not going to take your $10,000 account and turn it into $1 million. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. The old saying “it takes money to make money” is an accurate one, forex trading included.

But that doesn’t mean it is not a worthwhile endeavor; after all, there are many successful forex traders out there that trade for a living. The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income.

I hear about traders all the time targeting 50%, 60% or 100% profit per year, or even per month, but the risk they are taking on is going to be pretty similar to the profit they are targeting. In other words, in order to attempt to make 60% profit in a year, it's not unreasonable to see a loss of around 60% of your account in a given year.

"but rob, I am trading with an edge, so I am not risking as much as I could potentially earn" you might say. That's a true statement if you have a strategy with a trading edge. Your expected return should be positive, but without leverage, it is going to be a relatively tiny amount. And during times of bad luck, we can still have losing streaks. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Which in turn is how traders can produce excessive losses. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

So, let's see, what we have: can you really become a millionaire from forex trading? There are some questions that are frequently asked by novice traders: among all the frequent questions, there is one question which is at how do you get your money from forex trading

Contents of the article

- Best forex bonuses

- Can you really become a millionaire from forex...

- Can I become a millionaire through forex trading?

- How can you become a consistently profitable...

- False forex success stories

- The hassles of following too many trading...

- A source of income is really good

- Do it the right way:

- Forex brokers with best money withdrawal options...

- Forex brokers with best money withdrawal options

- Choose the withdrawal option

- Submit your withdrawal request

- Wait until your fund is transferred to your bank...

- Forex brokers with best money withdrawal options

- 10 ways to avoid losing money in forex

- Do your homework

- Find a reputable broker

- Use a practice account

- Keep charts clean

- Protect your trading account

- Start small when going live

- Use reasonable leverage

- Keep good records

- Know tax impact and treatment

- Treat trading as a business

- The bottom line

- The best way to learn forex trading

- The importance of getting educated

- Use a micro forex account

- Learn about the currencies you trade

- Managing risk

- A guide on ‘taking profits’ from your forex trades

- 2 proven ways to recover scammed bitcoin, money...

- Is forex trading really profitable and can you do...

- Your biggest job as A forex trader

- How long can you trade with profits?

- What is forex money management?

- What is A good mindset?

- One word to be A successful currency trader

- How much money can you make from forex trading –...

- 1. Trade more

- 2. Managing risk

- 3. Money extraction from your trader’s account

- 4. Determine your expectancy

- 5. Trading risk is dependent on currency pairs

- 6. Calculate profit from forex trading

- The bottom line

- 3 things I wish I knew when I started trading...

- Trading forex - what I learned

- 1) forex is not a get rick quick opportunity

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.