Forex client

Your form is being processed. Welcome, we’ll show you how forex works and why you should trade it.

Best forex bonuses

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader apps" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Forex client

Our services

Invest in forex

Daily turnover of the forex market has exceeded 6.6 trillion U.S. Dollars. Forex trading has been the most lucrative investment options of investors for decades. With forex92’s seasoned forex traders, you can enjoy hassle-free 25% to 35% return on investment every month. If you are a beginner or layman investor, then you can choose our managed forex account that requires at least $10,000 investment with no additional knowledge or skill. Otherwise, you can just copy our trades with even a $100 investment. However, to benefit from our copy trading service, you must know the application of effective money management strategies and usage of our third-party platform zulutrade. In other words, copy trading service is for professional investors only. Under the forex investment plan, our trading team invests your funds in currencies, precious metals, indices and commodity futures.

Invest in crypto

Crypto investments have practically made many people millionaire in mere few months. While cryptocurrencies have enormous profit potential, at the same time, they can cause loss of all or part of your investments due to extreme price volatility. Forex92 presents a crypto investment solution that starts with at least $3000 investment. Under the supervision of forex92’s experienced crypto traders, you can enjoy hassle-free profits every month. All you need is to open a trading account with one of our partner brokers, deposit funds and share your account details with us. Our trading team invests your funds in various cryptocurrencies such as bitcoin, ether, dash, litecoin etc. Although our monthly ROI target is 30%, however, the actual returns can be significantly higher due to the highly volatile nature of cryptocurrencies.

Why choose us?

Successful trading strategy

Our trading model is based on price action and effective money management strategies. Each trade placed by our team is an outcome of extensive technical and fundamental analysis. We monitor financial markets round the clock to find the best out of best trading opportunities and generate steady profits for our valuable clients.

Easy to use services & support

Our fund management services are easy to use. To benefit from our managed forex account, you just need to fund your trading account with one of our partner brokers and share your mt4 credentials with us. We generate around 20% to 30% return on investment (ROI) each month. Similarly, our trade copying service is also very easy to use. All you need is to follow us on zulutrade and enjoy steady profits each month.

Low risk trading

Our trading model is extremely safe. We risk only a small amount of capital on each trade. Further, we do not open multiple trades simultaneously. Instead, we place only a few but quality trades each week. We always operate with the best risk/reward ratio that is around 1:2 or more. Above all, we neither use eas nor any high-risk scalping techniques. We manage all trading accounts manually.

Fully regulated partner brokers

We work with fully regulated forex brokers. We make sure that you invest your hard-earned money with FCA, cysec, and ASIC regulated brokers. Regulated brokers are backed by various insurance schemes, thus you don't lose your investments even if a broker goes bankrupt. Further, regulated brokers hold your funds with AAA rating banks.

Forex client

Trade our company's capital .

Receive 70% of profits,

we cover the losses.

Trade for proprietary trading firm

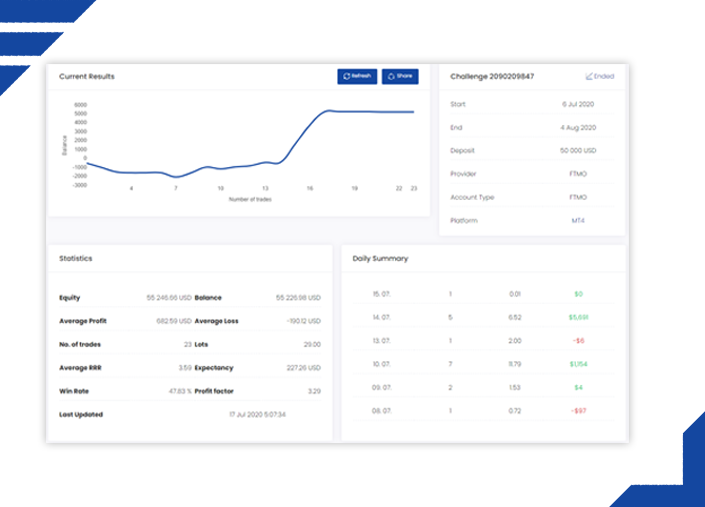

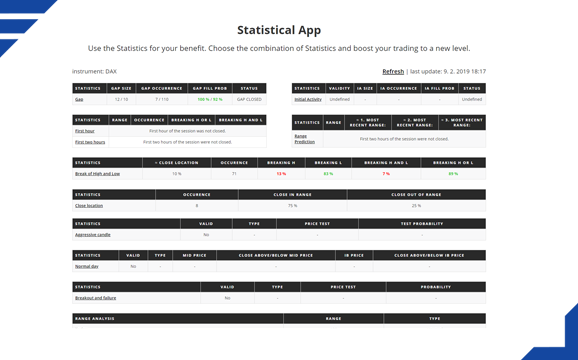

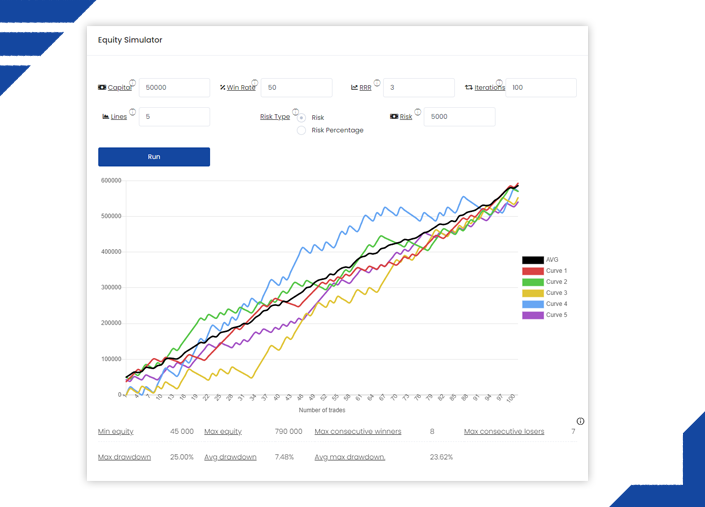

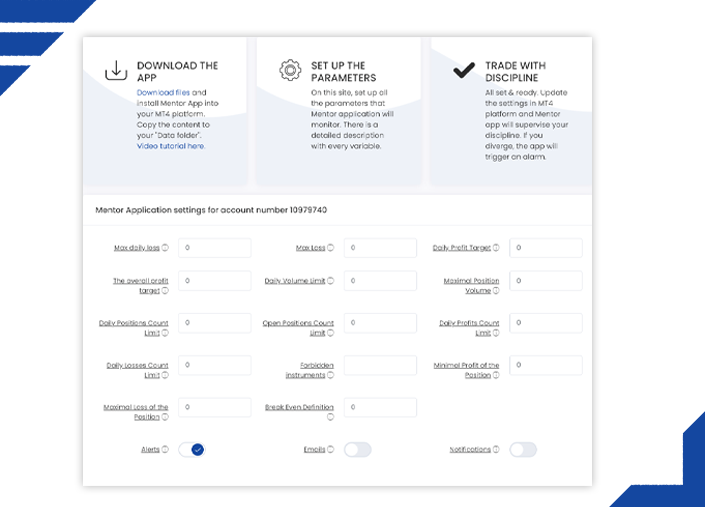

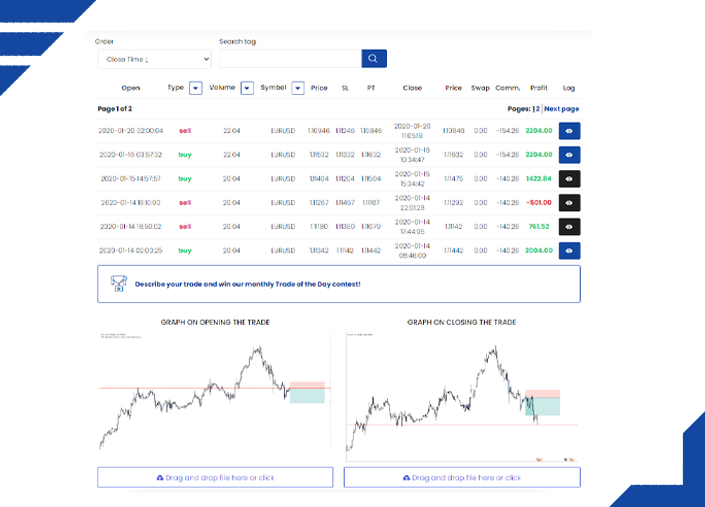

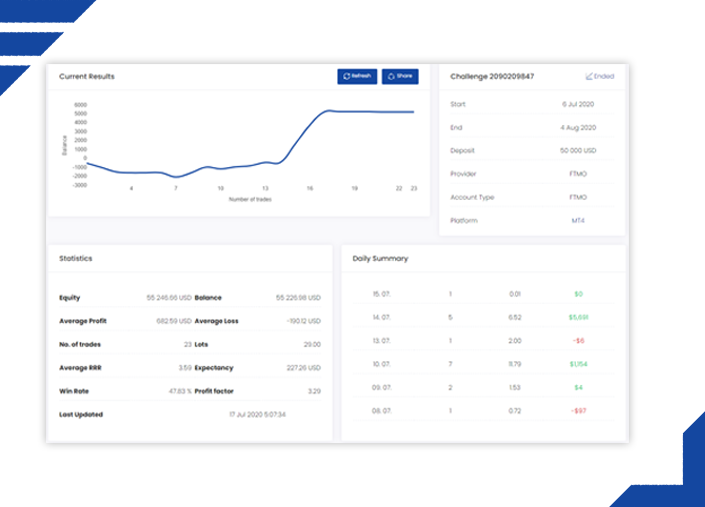

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the evaluation course, you are offered a placement in the FTMO proprietary trading firm where you can remotely manage the FTMO account with a balance of up to 100,000 USD . Your journey to get there might be challenging, but our educational applications, account analysis and performance coach are here to help you on the endeavour to financial independence.

We fund good traders

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the trading course, you are guaranteed a placement in the FTMO proprietary trading firm where you can remotely manage funded account of up to 100,000 USD. Your journey to get there might be challenging, but our educational applications, account analysis and performance psychologist are here to guide you on the endeavour to financial independence.

Evaluation process

FTMO challenge

Verification

FTMO trader

Know your trading objectives

Before we allow you to trade for our proprietary trading firm, we need to be sure that you can manage risk. For this reason, we developed trading objectives. By meeting the trading objectives, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you; we don’t set any limits on instruments or position size you trade.

| Step 1 FTMO challenge | step 2 verification | step 3 FTMO trader | |

|---|---|---|---|

| trading period | 30 days | 60 days | indefinite |

| the FTMO challenge duration is 30 calendar days; the verification duration is 60 calendar days. |

If you manage to pass the trading objectives sooner, you do not need to wait for the remaining duration days.

A trading day is defined as a day when at least one trade is executed.

If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

Current daily loss = results of closed positions of this day + result of open positions.

For example, in a case of the FTMO challenge with the initial account balance of €40000, the max daily loss limit is €2000. If you happen to lose €1000 in your closed trades, your account must not decline more than €1000 this day. It must also not go -€1000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit €2000 in one day, then you can afford to lose €4000, but not more than that. Once again, be reminded that your maximum daily loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of €1000 and then you open a new trade that goes into a floating loss of some -€1200 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -€2200 on the equity, which is more than the permitted loss of €2000.

Be careful as the maximum daily loss resets at midnight CE(S)T! Let’s say that one day you had a profit of €600. On the same day, you have an open position with a currently floating loss of €2500. On this day, the maximum daily loss is not violated. The current daily loss is €1900. ( €600 closed profit – €2500 open position). However, if you hold this position with the open loss of €2500 after midnight, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of €2500 exceeds the max daily permitted loss of €2000.

The size of the maximum daily loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why maximum daily loss limit includes your possible floating losses.

You can get more insight into why this rule is in place in this article.

10% of the initial account balance gives trader enough space to prove that his/her account is suitable for the investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% (80% in case of aggressive version) of its value under any circumstance.

For example: if you trade challenge with $100,000 account balance, your profit target is $10,000 in the FTMO challenge and then $5,000 in the verification.

Note that we will provide you with a new free challenge every time you meet all the trading objectives (regardless of whether that is challenge or verification) except for the profit target. To receive the new FTMO challenge for free, your account profit must be positive at the end of the duration with all positions being closed.

Forex client

We make people rich

Our services

Invest in forex

Daily turnover of the forex market has exceeded 6.6 trillion U.S. Dollars. Forex trading has been the most lucrative investment options of investors for decades. With forex92’s seasoned forex traders, you can enjoy hassle-free 25% to 35% return on investment every month. If you are a beginner or layman investor, then you can choose our managed forex account that requires at least $10,000 investment with no additional knowledge or skill. Otherwise, you can just copy our trades with even a $100 investment. However, to benefit from our copy trading service, you must know the application of effective money management strategies and usage of our third-party platform zulutrade. In other words, copy trading service is for professional investors only. Under the forex investment plan, our trading team invests your funds in currencies, precious metals, indices and commodity futures.

Invest in crypto

Crypto investments have practically made many people millionaire in mere few months. While cryptocurrencies have enormous profit potential, at the same time, they can cause loss of all or part of your investments due to extreme price volatility. Forex92 presents a crypto investment solution that starts with at least $3000 investment. Under the supervision of forex92’s experienced crypto traders, you can enjoy hassle-free profits every month. All you need is to open a trading account with one of our partner brokers, deposit funds and share your account details with us. Our trading team invests your funds in various cryptocurrencies such as bitcoin, ether, dash, litecoin etc. Although our monthly ROI target is 30%, however, the actual returns can be significantly higher due to the highly volatile nature of cryptocurrencies.

Why choose us?

Successful trading strategy

Our trading model is based on price action and effective money management strategies. Each trade placed by our team is an outcome of extensive technical and fundamental analysis. We monitor financial markets round the clock to find the best out of best trading opportunities and generate steady profits for our valuable clients.

Easy to use services & support

Our fund management services are easy to use. To benefit from our managed forex account, you just need to fund your trading account with one of our partner brokers and share your mt4 credentials with us. We generate around 20% to 30% return on investment (ROI) each month. Similarly, our trade copying service is also very easy to use. All you need is to follow us on zulutrade and enjoy steady profits each month.

Low risk trading

Our trading model is extremely safe. We risk only a small amount of capital on each trade. Further, we do not open multiple trades simultaneously. Instead, we place only a few but quality trades each week. We always operate with the best risk/reward ratio that is around 1:2 or more. Above all, we neither use eas nor any high-risk scalping techniques. We manage all trading accounts manually.

Fully regulated partner brokers

We work with fully regulated forex brokers. We make sure that you invest your hard-earned money with FCA, cysec, and ASIC regulated brokers. Regulated brokers are backed by various insurance schemes, thus you don't lose your investments even if a broker goes bankrupt. Further, regulated brokers hold your funds with AAA rating banks.

US regulations for forex brokers

Foreign currency exchanges (forex) run constantly across the globe through over-the-counter markets. The boundaryless space allows seamless access. For example, an australian trader can trade in euros and japanese yen (EURJPY) through a U.S.-based broker despite geographical boundaries.

Speculative trading in the retail forex market continues to grow. As a result, there can be intermediaries (banks or brokers) who engage in financial irregularities, scams, exorbitant charges, hidden fees and high-risk exposure offered through high-leverage levels or other bad practices. Internet and mobile app-based trading allow smooth trading processes, but they also add the risk of unrecognized sites that may close unexpectedly and abscond with investors’ money. Regulations ensure such practices are avoided. Regulations are aimed at protecting individual investors and ensuring fair operations to safeguard clients’ interests.

The most important criteria when selecting a forex broker are the regulatory approval status of the broker and its governing authority.

How U.S. Authorities regulate forex brokerage accounts

The national futures association (NFA) is the “premier independent provider of efficient and innovative regulatory programs that safeguard the integrity of the derivatives markets” (including forex). The scope of NFA activities is as follows:

- After due diligence, provide necessary licenses to eligible forex brokers to conduct forex trading business.

- Enforce required adherence to necessary capital requirements.

- Combat fraud.

- Enforce detailed record-keeping and reporting requirements regarding all transactions and related business activities.

A detailed regulatory guide is available on the official NFA website.

Key provisions of U.S. Regulations:

- The customer is defined as "individuals with assets of less than $10 million and most small businesses," underscoring that these regulations are meant to protect the small investor. High-net-worth individuals may not be covered under standard regulated forex brokerage accounts.

- Available leverage is limited to 50:1 (or a deposit requirement of only 2% on the notional value of a forex transaction) on the major currencies so that uneducated investors do not take unprecedented risks. Major currencies are defined as the british pound, the swiss franc, the canadian dollar, the japanese yen, the euro, the australian dollar, the new zealand dollar, the swedish krona, the norwegian krone, and the danish krone.

- Available leverage is limited to 20:1 (or 5% of the notional transaction value) on minor currencies.

- For short forex options, the notional transaction value amount plus the option premium received should be maintained as a security deposit.

- For long forex options, the entire option premium is required as security.

- The first-in-first-out (FIFO) rule prevents holding simultaneous positions in the same forex asset, that is, any existing trade position (buy/sell) in a particular currency pair will be squared off for the opposite position (sell/buy) in the same currency pair. This also implies no possibility of hedging while trading forex.

- Money owed by the forex broker to the customers should be held only at one or more qualifying institutions in the united states or in money-center countries.

How U.S. Regulations differ

Care should be taken to verify ownership, status, and the location of each forex trading firm, website or app before signing up for a trading account. There are many websites claiming low brokerage charges and high leverage (allowing more trading exposure with less capital); some as high as 1000:1. However, almost all sites are hosted and operated from outside the united states and may not be approved by the concerned authority in the host country. Even those authorized locally may not have regulations that apply to U.S. Residents. Regulations on offered leverage, required deposits, reporting requirements, and investor protections will vary by country.

Here is a list of forex brokerage regulators for a few select countries:

- Australia - australian securities and investments commission (ASIC)

- Cyprus - cyprus securities and exchange commission (cysec)

- Russia - federal financial markets service (FFMS)

- South africa - financial sector conduct authority (FSCA)

- Switzerland - swiss federal banking commission (SFBC)

- United kingdom - financial services authority (FSA)

Verifying a broker’s regulatory status

The NFA provides an online verification system called background affiliation status information center (BASIC) where the status of U.S.-based forex brokerage firms can be verified using their NFA ID, firm name, individual name or pool name. Care should be taken to use the correct name/ID in the correct form as many forex broker firms are known by different names (e.G., a website name may be different from the legal corporate name).

The bottom line:

Financial regulations are complex and often change as markets develop. They also attempt to strike a balance. Too little regulation may lead to ineffective investor protection while too much regulation can result in reduced global competitiveness and dampen economic activity.

Forex market sentiment indicators

According to the april, 2012 foreign exchange committee's semi-annual foreign exchange volume survey, there are on average almost $4.3 billion of forex spot transactions on a daily basis. With so many participants - most of whom are trading for speculative reasons - gaining an edge in the forex market is crucial. Fundamental analysis provides a broad view of a currency pair's movements and technical analysis defines trends and helps to isolate turning points. Sentiment indicators are another tool that can alert traders to extreme conditions and likely price reversals, and can be used in conjunction with technical and fundamental analysis.

Sentiment indicators

sentiment indicators show the percentage, or raw data, of how many trades or traders have taken a particular position in a currency pair. For example, assume there are 100 traders trading a currency pair; if 60 of them are long and 40 are short, then 60% of traders are long on the currency pair.

When the percentage of trades or traders in one position reaches an extreme level, sentiment indicators become very useful. Assume our aforementioned currency pair continues to rise, and eventually 90 of the 100 traders are long (10 are short); there are very few traders left to keep pushing the trend up. Sentiment indicates it is time to begin watching for a price reversal. When the price moves lower and shows a signal it has topped, the sentiment trader enters short, assuming that those who are long will need to sell in order to avoid further losses as the price falls.

Sentiment indicators are not exact buy or sell signals. Wait for the price to confirm the reversal before acting on sentiment signals. Currencies can stay at extreme levels for long periods of time, and a reversal may not materialize immediately.

"extreme levels" will vary from pair to pair. If the price of a currency pair has historically reversed when buying reaches 75%, when the number of longs reaches that level again, it is likely the pair is at an extreme, and you should watch for signs of a price reversal. If another pair has historically reversed when about 85% of traders are short, then you will watch for a reversal at or before this percentage level.

Sentiment indicators come in different forms and from different sources. One is not necessarily better than another, and they can be used in conjunction with one another or specific strategies can be tailored to the information you find easiest to interpret.

Commitment of traders reports

A popular tool used by futures traders is also applicable to spot forex traders. The commitment of traders (COT) is released every friday by the commodity futures trading commission. The data is based on positions held as of the preceding tuesday, which means the data is not real-time, but it's still useful.

Interpreting the actual publications released by the commodity futures trading commission can be confusing, and somewhat of an art. Therefore, charting the data and interpreting the levels shown is an easier way to gauge sentiment via the COT reports.

Barchart.Com provides an easy way to chart COT data along with a particular futures price chart. The chart below shows the daily continuous euro FX (december, 2012) futures contract with a commitment of traders line chart indicator added. The COT data is not displayed as a percentage of the number of traders short or long, but rather as the number of contracts that are short/long.

Figure 1. Daily continuous december euro FX futures

Large speculators (green line) trade for profit and are trend followers. Commercials (red line) use futures markets to hedge, and, therefore, are counter-trend traders. Focus on large speculators; while these traders have deep pockets they can't withstand staying in losing trades for long. When too many speculators are on the same side of the market, there is a high probability of a reversal.

Over the time period shown, when large speculators were short about 200,000 contracts, at least a short-term rally soon followed. This is not a definitive or "time-less" extreme level and may change over time.

Another way to use the COT data is to look for cross-overs. When large speculators move from a net short position to a net long position (or vice versa), it confirms the current trend and indicates there is still more room to move.

Figure 2: weekly continuous december euro FX futures

While the cross-over method is prone to provide some false signals, between 2010 and 2012 several large moves were captured using the method. When speculators move from net short to net long, look for the price of the euro futures, and by extension the EUR/USD, to appreciate. When speculators move from net long to net short, look for the price of the futures and related currency pairs to depreciate.

Futures open interest

the forex market is "over-the-counter" with independent brokers and traders all over the world creating a non-centralized market place. While some brokers publish the volume produced by their client orders, it does not compare to the volume or open interest data available from a centralized exchange, such as a futures exchange.

Statistics are available for all futures contracts traded, and open interest can help gauge sentiment. Open interest, simply defined, is the number of contracts that have not been settled and remain as open positions.

If the AUD/USD currency pair is trending higher, looking to open interest in australian dollars futures provides additional insight into the pair. Increasing open interest as the price moves up indicates the trend is likely to continue. Leveling off or declining open interest signals the uptrend could be nearing an end.

The following table shows how open interest is typically interpreted for a futures contract.

| Futures price | open interest | interpretation |

| rising | rising | strong/strengthening |

| rising | falling | weakening |

| falling | rising | weak/weakening |

| falling | falling | strengthening |

Figure 3: open interest interpretation

The data then must be applied to the forex market. For example, strength in euro futures (US dollar weakness) will likely keep pushing the EUR/USD higher. Weakness in japanese yen futures (US dollar strength) will likely push the USD/JPY higher.

Futures volume and open interest information is available from CME group and is also available through trading platforms such as TD ameritrade's thinkorswim.

Position summaries by broker

to provide transparency to the over-the-counter forex market, many forex brokers publish the aggregate percentage of traders or trades that are currently long or short in a particular currency pair.

The data is only gathered from clients of that broker, and therefore provides a microcosmic view of market sentiment. The sentiment reading published by one broker may or may not be similar to the numbers published by other brokers. Small brokers with few clients are less likely to accurately represent the sentiment of the whole market (composed of all brokers and traders), while larger brokers with more clients compose a larger piece of the whole market, and therefore are likely to give a better indication of overall sentiment.

Many brokers provide a sentiment tool on their website free of charge. Check multiple brokers to see if sentiment readings are similar. When multiple brokers show extreme readings, it is highly likely a reversal is near. If the sentiment figures vary significantly between brokers, then this type of indicator shouldn't be used until the figures align.

Certain online sources have also developed their own sentiment indicators. Dailyfx for example, publishes a free weekly speculative sentiment index (SSI), combined with analysis and ideas on how to trade the data.

The bottom line

forex sentiment indicators come in several forms and from many sources. Using multiple sentiment indicators in conjunction with fundamental and technical analysis provides a broad view of how traders are manoeuvring in the market. Sentiment indicators can alert you when a reversal is likely near - due to an extreme sentiment reading - and can also confirm a current trend. Sentiment indicators are not buy and sell signals on their own; look for the price to confirm what sentiment is indicating before acting on sentiment indicator readings. Losing trades still occur when using sentiment - extreme levels can last a long time, or a price reversal may be much smaller or larger than the sentiment readings indicate.

Forex client

Trade our company's capital .

Receive 70% of profits,

we cover the losses.

Trade for proprietary trading firm

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the evaluation course, you are offered a placement in the FTMO proprietary trading firm where you can remotely manage the FTMO account with a balance of up to 100,000 USD . Your journey to get there might be challenging, but our educational applications, account analysis and performance coach are here to help you on the endeavour to financial independence.

We fund good traders

FTMO developed a unique 2-step evaluation course for traders. This evaluation process consists of the FTMO challenge and the verification and is specifically tailored to discover trading talents.

Upon successful completion of the trading course, you are guaranteed a placement in the FTMO proprietary trading firm where you can remotely manage funded account of up to 100,000 USD. Your journey to get there might be challenging, but our educational applications, account analysis and performance psychologist are here to guide you on the endeavour to financial independence.

Evaluation process

FTMO challenge

Verification

FTMO trader

Know your trading objectives

Before we allow you to trade for our proprietary trading firm, we need to be sure that you can manage risk. For this reason, we developed trading objectives. By meeting the trading objectives, you prove that you are a disciplined and experienced trader. Your trading style is entirely up to you; we don’t set any limits on instruments or position size you trade.

| Step 1 FTMO challenge | step 2 verification | step 3 FTMO trader | |

|---|---|---|---|

| trading period | 30 days | 60 days | indefinite |

| the FTMO challenge duration is 30 calendar days; the verification duration is 60 calendar days. |

If you manage to pass the trading objectives sooner, you do not need to wait for the remaining duration days.

A trading day is defined as a day when at least one trade is executed.

If a trade is held over multiple days, only the day when the trade was executed is considered to be the trading day.

Current daily loss = results of closed positions of this day + result of open positions.

For example, in a case of the FTMO challenge with the initial account balance of €40000, the max daily loss limit is €2000. If you happen to lose €1000 in your closed trades, your account must not decline more than €1000 this day. It must also not go -€1000 in your open floating losses. The limit is inclusive of commissions and swaps.

Vice versa, if you profit €2000 in one day, then you can afford to lose €4000, but not more than that. Once again, be reminded that your maximum daily loss counts your open trades as well. For example, if in one day, you have closed trades with a loss of €1000 and then you open a new trade that goes into a floating loss of some -€1200 but ends up positive in the end, unfortunately, it is already too late. In one moment, your daily loss was -€2200 on the equity, which is more than the permitted loss of €2000.

Be careful as the maximum daily loss resets at midnight CE(S)T! Let’s say that one day you had a profit of €600. On the same day, you have an open position with a currently floating loss of €2500. On this day, the maximum daily loss is not violated. The current daily loss is €1900. ( €600 closed profit – €2500 open position). However, if you hold this position with the open loss of €2500 after midnight, the daily loss limit will be violated. This is because your previous day profit doesn’t count to a new day and the open loss of €2500 exceeds the max daily permitted loss of €2000.

The size of the maximum daily loss gives trader enough space for trading and it guarantees a clearly defined daily risk to the investor. Both the trader and investor benefit from this rule as the account value will not drop below the limit. That’s also why maximum daily loss limit includes your possible floating losses.

You can get more insight into why this rule is in place in this article.

10% of the initial account balance gives trader enough space to prove that his/her account is suitable for the investment. It is a buffer that should keep the trader in the game even if there were some initial losses. The investor has an assurance that the trader’s account cannot decline below 90% (80% in case of aggressive version) of its value under any circumstance.

For example: if you trade challenge with $100,000 account balance, your profit target is $10,000 in the FTMO challenge and then $5,000 in the verification.

Note that we will provide you with a new free challenge every time you meet all the trading objectives (regardless of whether that is challenge or verification) except for the profit target. To receive the new FTMO challenge for free, your account profit must be positive at the end of the duration with all positions being closed.

Advanced platforms

Popular trading platform metatrader 4/5 developed by metaquotes, including a mobile terminal for ios and android operating systems.

MQL4/5 programming language, a wide variety of tools for technical analysis, trading signals, and VPS service.

Trading credits

Deposit funds in your account and get a trading credit up to 50% of the amount deposited.

Trading credits are termless and interest-free, and can be used as guarantees when effecting transactions.

Turnover bonuses

Turnover bonuses are analogues of rebates or cashback. Earn up to $10 for 1 mln. USD of the trading turnover.

Progressive remunirations scale, bonuses are credited automatically and can be withdrawn immediately without any restrictions.

Copy trading

Copy trades of successful traders in the automatic mode or sell your trading signals to subscribers all over the world.

The service was developed by the metaquotes company and was integrated into the metatrader client terminal.

Partnership

CPA (cost-per-action) remuneration up to $300 for each attracted client.

Subsequent «eternal» remuneration for the referrals turnover calculated on a progressive scale - up to

Liquidity provider

Open new opportunities for your brokerage company with forexchief aggregated liquidity.

Effective B2B solution that allows you to offer competitive terms to the most demanding clients on the basis of developed technological infrastructure.

Regulated & licensed

Metatrader 4 and 5

Wide range of contracts

Aggregated liquidity

Bonus programs

Partnership

Bonuses and promotions

- Analog of "bonus for deposit"

- Increase the amount of funds in the account

- Opportunity to receive up to 20,000 USD

- Perpetual and interest-free

- The profit can be withdrawn without restrictions

- No hidden conditions, can be opt out anytime

- Analog of rebates and cashback

- Progressive remuneration scale

- Credited automatically

- Can be withdrawn anytime without restrictions

- Excellent opportunity for additional income

- The bonus is credited automatically upon the first deposit

- The maximum bonus is equal to $500

- The bonus can be withdrawn after performing the required turnover. The profit can be withdrawn without restrictions

- Trading robots and any strategies are allowed, including scalping and arbitrage

- Welcome bonus has unlimited duration

Account types

This is the main account type in the line of forexchief trading accounts designed for experienced traders. The distinctive features of this account are narrow spreads without "markups" and a broker fee, whose amount is calculated as based on the transaction volume at the rate of $15 for USD 1 mln.

This is a classic account type with a "floating" spread that has no transaction fee. Client's orders are executed in "market execution" mode, while the standard speed of trading order execution on the server is in the range of 100-150 msec (under regular market conditions).

This is a "cent" account, whose balance span exceeds that standard hundredfold. Otherwise, this account type is completely identical to the MT4.Directfx. These accounts will be suitable for those clients who want to test MT4.Directfx on its "cent" counterpart.

This is a "cent" account that is different from MT4.Classic+ only by its balance span. Otherwise, those account types are identical. As it’s an intermediary stage between a demo-account and a real standard account, the cent-MT4.Classic+ allows users to make a comfortable transition from "virtual" trading to operation with real money.

The basic option for professionals in the line of forexchief trading accounts. Stable high liquidity, narrow spreads without «markups», the minimum brokerage commission on the transaction volume ($15 for 1 million USD) allows to effectively use all advantages of MT5 trading terminal and «one click trading» technology.

Classic trading account with a "floating" spread without deals fee. Full access to all MT5 functions, «market execution» mode, average speed of ordering does not exceed 100-150 msec (in conditions of a stable market). The optimal solution for professional systems with the modeling of profitability using the floating spread method without taking into account commission costs.

«cent» analog MT5.Directfx, the balance dimension of trading account is 100 times larger. Accounting for trading results in cents is beneficial for beginners, who can not risk large sums, and professionals who perform testing or optimization of trading systems or methods of management

"cent" version of MT5.Classic+ with a low level of risk. Guarantees maximum of practical experience at minimal costs. It is recommended for all systems based on floating spread without deals commission. Provides a comfortable transition from demo trading and small deposits to a full trading account.

Deposit and withdrawal

Wide range of payment systems, 0% commission, negative balance protection, segregation of client funds

Company news

Analytics

Quotes

Risk warning: trading with complex financial instruments such as stocks, futures, currency pairs, contracts for difference (CFD), indexes, options, and other derivative financial instruments involves a high level of risk and is not suitable for all categories of investors. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can't afford to lose. Until you begin to carry out trading transactions, make sure that you fully realize the risks associated with this type of activity.

Forex client

Our services

Invest in forex

Daily turnover of the forex market has exceeded 6.6 trillion U.S. Dollars. Forex trading has been the most lucrative investment options of investors for decades. With forex92’s seasoned forex traders, you can enjoy hassle-free 25% to 35% return on investment every month. If you are a beginner or layman investor, then you can choose our managed forex account that requires at least $10,000 investment with no additional knowledge or skill. Otherwise, you can just copy our trades with even a $100 investment. However, to benefit from our copy trading service, you must know the application of effective money management strategies and usage of our third-party platform zulutrade. In other words, copy trading service is for professional investors only. Under the forex investment plan, our trading team invests your funds in currencies, precious metals, indices and commodity futures.

Invest in crypto

Crypto investments have practically made many people millionaire in mere few months. While cryptocurrencies have enormous profit potential, at the same time, they can cause loss of all or part of your investments due to extreme price volatility. Forex92 presents a crypto investment solution that starts with at least $3000 investment. Under the supervision of forex92’s experienced crypto traders, you can enjoy hassle-free profits every month. All you need is to open a trading account with one of our partner brokers, deposit funds and share your account details with us. Our trading team invests your funds in various cryptocurrencies such as bitcoin, ether, dash, litecoin etc. Although our monthly ROI target is 30%, however, the actual returns can be significantly higher due to the highly volatile nature of cryptocurrencies.

Why choose us?

Successful trading strategy

Our trading model is based on price action and effective money management strategies. Each trade placed by our team is an outcome of extensive technical and fundamental analysis. We monitor financial markets round the clock to find the best out of best trading opportunities and generate steady profits for our valuable clients.

Easy to use services & support

Our fund management services are easy to use. To benefit from our managed forex account, you just need to fund your trading account with one of our partner brokers and share your mt4 credentials with us. We generate around 20% to 30% return on investment (ROI) each month. Similarly, our trade copying service is also very easy to use. All you need is to follow us on zulutrade and enjoy steady profits each month.

Low risk trading

Our trading model is extremely safe. We risk only a small amount of capital on each trade. Further, we do not open multiple trades simultaneously. Instead, we place only a few but quality trades each week. We always operate with the best risk/reward ratio that is around 1:2 or more. Above all, we neither use eas nor any high-risk scalping techniques. We manage all trading accounts manually.

Fully regulated partner brokers

We work with fully regulated forex brokers. We make sure that you invest your hard-earned money with FCA, cysec, and ASIC regulated brokers. Regulated brokers are backed by various insurance schemes, thus you don't lose your investments even if a broker goes bankrupt. Further, regulated brokers hold your funds with AAA rating banks.

So, let's see, what we have: FOREX.Com offers forex and CFD trading with award winning trading platforms, tight spreads, quality executions and 24 hour live support. At forex client

Contents of the article

- Best forex bonuses

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Forex client

- Our services

- Invest in forex

- Invest in crypto

- Why choose us?

- Successful trading strategy

- Easy to use services & support

- Low risk trading

- Fully regulated partner brokers

- Forex client

- Trade for proprietary trading firm

- We fund good traders

- Evaluation process

- FTMO challenge

- Verification

- FTMO trader

- Know your trading objectives

- Forex client

- Our services

- Invest in forex

- Invest in crypto

- Why choose us?

- Successful trading strategy

- Easy to use services & support

- Low risk trading

- Fully regulated partner brokers

- US regulations for forex brokers

- Forex market sentiment indicators

- Forex client

- Trade for proprietary trading firm

- We fund good traders

- Evaluation process

- FTMO challenge

- Verification

- FTMO trader

- Know your trading objectives

- Advanced platforms

- Trading credits

- Turnover bonuses

- Copy trading

- Partnership

- Liquidity provider

- Regulated & licensed

- Metatrader 4 and 5

- Wide range of contracts

- Aggregated liquidity

- Bonus programs

- Partnership

- Bonuses and promotions

- Account types

- Deposit and withdrawal

- Company news

- Analytics

- Quotes

- Forex client

- Our services

- Invest in forex

- Invest in crypto

- Why choose us?

- Successful trading strategy

- Easy to use services & support

- Low risk trading

- Fully regulated partner brokers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.