Traders way review

Used them made 30 deposits 0 withdrawals this is not a good broker for swing trading at all.

Best forex bonuses

Would not reccomend. Pretty bad system , they will only refund the money you put in but not the profit you make, not only that but they took the only easy option to deposit or withdraw money the debit/credit option

Traders way reviews and comments 2021

Ridiculously high spread, my account was doing fine, they raised their 42 spread up to 4124 under 1 minute, also as a trader i have different brokers running, all the brokers XAUUSD spread are fine and running, but tradersway spread still at 223 and the pair appears as closed market, other brokers like hot forex and hugosway price are at 1878, and tradersway price is still closed at 1876. I have pictures of moves I've never seen before in any other broker, this broker definitely is a scam, we should let all traders know.

MCFX 28 october, 2020 reply

I had 3 trades open on my live account all executed at the same time same lot size 1.00 (BUY) at 6am PST. My profit was definitely $350 at the time and I was waiting for it to increase. But everything stopped suddenly and my profit was -$350. I refreshed my computer and also opened my tradingview account to see if my pairs have stopped, but to my surprise they were still going upward. My only option was to close out my profits because the platform for tradersway was stuck during my live session. This is the second strange things have happened to my account with tradersway. Therefore, do not add your money into this company because I feel as though these people are scammers. The only thing that works with this company is the demo account.

Ralph jones 1 october, 2020 reply

Tradersway is a ripoff, I took a 300 deposit to 17k and withdraw half, I had 3 winning trades opened at 500 profit and 9800 left in my tradersway account. Someone opened up crazy trades with outrageous lot sizes and wiped it down to 900. They say they don't have access to anyone accounts but its a lie. Im fighting to get my money back but im pretty sure it's not gone happen. Procced with caution.

Terrance 21 may, 2020 reply

They are scammers. I had $33, I grew it to a point where by I maid $700. I made sure that my trades are close when few hours i go back to the market, my account is -$1.34. Please beware of these scammers, guys. Never ever use this broker and please share the bad experience with them!

Saziso shangase 2 april, 2020 reply

Hi guys, I just wanted to share my experience about this broker. Yesterday I took several of winning trades and my balance account was around 5000 $ with my profit secure, so I was satisfy and decided to go to bed and rest. When I woke up this morning I noticed my balance is only around 1300 $ I checked my trading history and I don't know how come but my wining trades from last night are all gone. So I contact the broker by messenger but the agent said they can't access to my trading history and to send an email to the support what I did. I even tried to call them but same answer from the agent over the phone. That just insane I hope it's just a mistake because otherwise it's just crazy. That happened this morning so I am waiting for them to getting back to my email. I will keep you up to date. Cheers

Mouhoub mebrouk 27 march, 2020 reply

Erick 10 april, 2020

They got me for 20K in january 2018.

Made every attempt to try and sign up with these guys, but just ended up wasting time with the horrible deposit options they offer for canadians. Support was pathetic, didn't even try to help. I wouldn't recommend wasting anytime with trader's way, they weren't interested in getting my business.

All was going good with this broker until now, I took a $50 dollar account to $2500 in 2 months with proper risk management and guess what happened? This broker blew up my entire account by making dozens of unauthorized trades not to mention they played with my spreads and would cancel many of my sell and buy orders, tradersway, like many other unregulated brokers hate traders that actually manage to make a decent profit in the market and make no mistake if you start a small account and grow it to quickly you will be shot down like I was, do not use this broker.

Derek 31 january, 2020 reply

Beware this broker if you regularly have open trades over the weekend or holidays. Spreads can go from a few points to 70+ and stop-out your account especially if you're highly leveraged or margined. Also be aware that they will trade for you sometimes and wipe your account out.

Zahed rustami 30 january, 2020 reply

I can attest to this. Was using tradersway when I held a swing trade over the weekend and come 5:00 sunday my entire account balance of $6000 was gone because of the spread manipulation

Pradipta 3 february, 2020

They close my pending orders before they're triggered. Don't take my word for it, see for yourself.

Mike 23 january, 2020 reply

Tradersway is a none regulated forex broker and their swap can wipes off your account if you keep your opened positions for a week or longer.

Jackson 18 july, 2019 reply

Do not use tradersway. They do not pay out even the money you put in let aline what you profited. They jus keep saying customer mismatch and blame vload meanwhile vload sauys the have no request for voucher payout from them. I've sent tradersway thr conversation i had with vload saying all my documents ate goid they are just waiting for tradersway to request payout and ivr gotten no rrsponse. I hope soneone reads this before its to late!!

Donnell woods 27 june, 2019 reply

Tradersway is going fine so far. I hope they don't mess up a good partnership & great expanding opportunities.

Aaron D. 28 may, 2019 reply

Used them made 30 deposits 0 withdrawals this is not a good broker for swing trading at all. Would not reccomend.

Forexxxxx 10 april, 2019 reply

Pls don't use this broker for youre own sake! They manipulate price and take youre money.

Basele 4 april, 2019 reply

Yea agreed also their location raise suspicions

Rashaan 16 august, 2019

Don't take traders way. I had a trade in profit and they deleted from my history and my broker and pretended like nothing happend, i have complain but they dont give me my money back. They are manipilators

Basele 4 april, 2019 reply

Can you turn the data back on? Always getting disconnected at the most continent time. And why did you take the option to rent a virtual server off you're mt4 platform? Obviously so you can hit the on/off botton. Give me one option to withdraw my money! I already tried going through vload but it says 'costumer mismatch'.

Costumer 2 april, 2019 reply

I'm having that issue now. Did u get it resolved? Plz say u did.

Donnell woods 26 june, 2019

Worst broker there could ever be. Manipulated price. Charges outrageous amount on swap charges. Lets you use high leverage so they can steal your money faster. Had a 50 pip stop loss on 2 trades through a weekend and the market opened on sunday at the same place it had closed on friday and they stopped me out with the 50 pip loss. Checked charts from another broker and the price never got within 49 pips of my stop loss. They steal. They are crooks. Do not use them. If you do I asure you, you will lose your money

Once your account is on profit, they try their best to disable your account and it has happened to me and some friends. I guess they are making a disabling here in south africa since forex trading became a buzz word lately. They make pending orders to disappear. Once the account is profitable, you will wonder of manipulation.

Which broker do you use instead?

Dave 17 september, 2018

Thank you for the warning. I nearly got to use them.

Enoch 8 november, 2018

Traders way no.1 price manipulator at its best. So watch out. Along with UK broker FXCM permanently banned in US as well.

Pretty bad system , they will only refund the money you put in but not the profit you make, not only that but they took the only easy option to deposit or withdraw money the debit/credit option

They just offer 10 currency pair to trade for a standard acc. If any of u likes trading without stop loss dont even think about this broker, they will give a stop out even if u still have your own money in your acc. Frequent disconnection thankfully wasnt at any imp stage of my trading experience with them. Havent tested withdrawal so wont comment on that.

Rakesh 26 february, 2018 reply

The most exiting part of my trading here is what I call ”upside down trading”. Let me explain. When you have extremely high market volatility and the same time use 1:500 leverage, you can have 60% up and down deviation of equity on your trading account. In this case, you need to make sure that each trade will be exactly executed by the price you want. Otherwise, you might loos all your money and face the situation when you have no margin to open any position. So, speaking about my broker as a critical partner, I fully trust him. Because I have never experienced any delays, requotes and stuff like that for my trading career with traders way. Thanks god I can trade with such a high risk and completely rely on my broker. Highly recommend to consider it as your FX broker in long term.

C. Welch 10 august, 2017 reply

Got to admit this platform sure has everything that a trader can hope for, great functionality, nice interface, easy to understand apps, instant execution, some of the lowest spreads..And yea, just made a nice bundle of cable crosses thanks to instant execution. Recommended..

Cory hartwig 25 june, 2015 reply

I am in trading in here for last four month. I am learning in lot in here also trading I am learning many thing. I am also having many trader tell me things about trading. Also learning here is easy as many people come forward to helping me. Good platform.

Rashid alwa 21 may, 2015 reply

Did you got your profit back?

I am in new in here but I know lot in trading for I am tradering many month in currency. I like how platform I have no waiting for my entry in executed also I can using ea in here. Good platform.

Chang krueger 13 april, 2015 reply

I have posted here my complete information mobile number - 07666231229 office number - 022-61642100. I have been scammed by the fraud broker tradersway.Com. They deliberately converted my profitable positions to a losing positions and did not gave me any response on the reason. They are real frauds and I demand action against them. Dnt trust the tradersway.Com big fruad company

Thilakkumar 2 april, 2015 reply

The same exact thing happened to me numerous of times.You are not the only one.

My accounts were protected by stop loss where were never activated during the reversal of trend. On both trades. I had of 247 gbps and was in profit of over 320 gbps. So I should not have a negative balance on my trading account. I deposited 80 gbp. Now the account stands at -989. They are a set of registered scams. They don't respond to email, and calling doesn't make any sense either because they are going to tell u to email them which is pointless.

Cannan 23 april, 2020

I trade in currency for some time now so I think I checked this site out and it has in it everything

Thomas algaram 10 march, 2015 reply

I in trade in last month in my demo also learn in here. What I like is how price is keeping precise also spreading is tiny too. I am also seeing copy trade in here so people like me who is learning also trade good. Yes good platform

Hamid margasay 16 january, 2015 reply

This compant is a money making. If you make profit they will not give but if you lose they will be very happy because they are not investing in any market all scam.

Santhosh rai 20 december, 2014 reply

I am small trading i come here because I read they in offer good account also good option for trading, I see good rate also good spreading, they is very fast in opening and closing open trade, also I can use ea in here, good place in trade here.

Malika aggarwal 27 november, 2014 reply

Choosing a broker is not as difficult as it appears at first sight. However, it is important to find the right approach to this matter. First off, this means studying reviews about 3TG brokers. When making their choice, traders take various criteria into consideration, including: years of broker's operation in the forex market, broker's reputation, their trading conditions, and much more. At the same time, clients' practical comments about the company are equally important. It is recommended that before getting registered with traders way, a trader gets acknowledged with comments of the broker's clients who have real experience of trading with this company.

Promotional terms as well as information published on the official company site are not always objective, therefore they don't give a 100% guarantee of faultless broker's performance.

We introduce original reviews and comments on traders way. They have been written by actual or former clients of the company.

Trader’s way, a prime on-line FOREX and CFD broker, was established with the principle mission - to provide traders with the widest opportunities available on financial markets. We’ve collected the best products, technologies and services, so that the needs of every trader are fully.

Tradersway review

Tradersway

Reason to avoid: offshore license

Listed date: january 3, 2020

Top 3 forex brokers

FXTM review

GO markets review

FP markets review

Beware tradersway is a non-regulated broker. It is NOT SAFE to trade.

What is tradersway?

TW corp. Or tradersway is established in the dominica offshore forex broker company that offers various platforms and social trading capabilities while targeting traders worldwide.

- Company name: tradersway

- Registration/ license: dominica

Besides that tradersway operates over 10 years in the markets and presents itself as a reputable broker with great customer service, wide trading offering, a large selection of trading markets and tools, account types with low deposits also provided with low spreads. Mentioning, that the trading performance established through technological execution on market popular trading platforms MT4 ECN and ctrader.

However, and in fact tradersway being an offshore based and only authorized broker under dominica laws, resulting in that tradersway lacks serious regulation and its applied safety measures.

Is tradersway regulated?

No tradersway is not regulated forex broker since it does not hold a license from any worldwide serious forex authority. Meaning the broker was not checked for its compliance before establishment, never monitored in terms of its safety and simply may operate the business in any way it wishes.

This results in a very high risk trading opportunity, despite its alluring proposal.

Indeed, the dominica governmental guidelines and compliance with the laws mandates financial sector regulation, yet do not cover the forex business yet and are rather just a registration of an entity without particular settlement standards that may ensure safe trading environment.

• A quite pleasant trading offering suitable for beginning and professional traders

• good selection of trading platforms including MT4 and ctrader

• is not recommended to trade or open account with traders’ way due to high risks involved

• only offshore registration with zero regulatory obligations

• lacks international rules or forex operation and necessary safety measures

Is tradersway a scam?

Unfortunately, we cant say that tradersway is a safe broker, it is a high-risk brokerage firm that does not prove any of its trustable scores since it is not a regulated firm, but just an offshore registered company.

For your better understanding read more why not trade with offshore brokers.

Therefore, apart from the tradersway customer service satisfactory proposals that seem to be developed with a dedicated approach and cover clients’ needs, the unlicensed environment of the company does not provide any guarantees to their investors.

• both industry leading trading platforms MT4 and ctrader offered

• is not licensed by any reputable forex authority

• operates only with offshore dominica registration

• comply with none of the international rules or forex operation

Tradersway in the USA

No, tradersway is not a US broker and does NOT accept US traders, even though you may find some claims about that!

Tradersway is a company located in dominica , while dominica itself attracted many financial companies or activists to perform and deliver services to international clients, while however, the company may not hold any strict, reputable license or comply with the operational guidelines that ensure client’s safety .

Deposit & withdrawal

The minimum deposit for opening an account with traders way is $10 USD/GBP. Traders way charges deposit fees depending on the payment method which you use to fund the account.

Traders way withdrawal fees vary depending on the selected withdrawal payment method. Withdrawal requests are processed within 48 hours on business days.

Traders way accepts deposits/withdrawals via the following payment systems: credit cards, debit cards via vload, bank wire transfer, bank transfer (abra), bitcoin, ether, litecoin, ripple, USD coin (USDC), tether (USDT), trueusd (TUSD), skrill, neteller, perfect money, fasapay.

The broker provides a big range of trading instruments used on top of the popular and well-known metatrader 4 and metatrader 5 platforms with standard and ECN accounts available. Moreover, its traders can enjoy fast and convenient one-click trading in MT4 and MT5 with their quickdeal tool.

There is also a ctrader platform for ECN trading. Trader’s way ctrader provides full ECN access to the markets for professional and new traders with the help of ctader.

Conclusion

Of course it is always a choice of a trader to open a live or demo account and engage in trading with traders’ way or any other offshore licensed company and involve yourself into a high risk to lose money. Therefore, it is highly recommended to choose the best broker and give the preference to the regulated brokers that comply with the sharp operational requirements, deliver client’s safety of funds and manage the risks.

Besides the competitive trading conditions, the reliability and sufficient safety always come first, therefore, we advise all traders to open an account only with the authorized by the respected regulation companies which you may find through our lists of regulated forex brokers.

So you better trade with well-regulated brokers such as UK brokers or brokers in australia and reliable forex companies such as IG markets and city index .

Tradersway review

Tradersway is an online forex broker. Traders way offers the metatrader 4, metatrader 5, MT mobile, and ctrader trading currency top platforms. Tradersway.Com offers over 40 currency pairs, metals, cryptocurrencies. Indices and energies for your personal investment and trading options.

Broker details

| established: | 2011 |

| address: | 8 copthall, roseau, dominica |

| contact: | helpdesk@tradersway.Com, +1 849 9370815 |

| regional offices: | |

| regulators: | |

| prohibited countries: |

| deposit methods: | bank wire, bitcoin, ether/ethereum, fasapay, litecoin, neteller, perfectmoney, ripple, skrill, tether |

| withdrawal methods: | bank wire, bitcoin, ether/ethereum, fasapay, litecoin, neteller, perfectmoney, ripple, tether |

Live discussion

Join live discussion of tradersway.Com on our forum

Tradersway.Com profile provided by mr.Max.TW, dec 24, 2014

About trader’s way

Trader’s way, a prime online FOREX and CFD broker, was established with the principle mission - to provide traders with the widest opportunities available on financial markets. We’ve collected the best products, technologies and services, so that the needs of every trader are fully satisfied. Under one broker, without losing time, you can find everything to trade the way you like, without boundaries and limits.

We offer you the widest range of possibilities for trading:

· best trading platforms - metatrader 4, binary options, ctrader, mobile apps

· 4 account types - ECN accounts on MT4 and ctrader, standard accounts with fixed and variable spreads

· 6 markets - FOREX, binary options, stock indices, metals, energies, commodities

The best trading conditions possible:

· minimum deposit – no limitations (for ECN account – only $10)

· tight spreads – from 0 pips

· minimum order size – 0.01 lot (1000 units of base currency)

· all expert advisors (eas) and scalping allowed

· free VPS hosting service

· islamic (swap-free) accounts

· deposit/withdrawals- wire transfer, moneybookers, webmoney, credit card, payza, bitcoin

· every client can be a PARTNER. Commission up to 1.5 pips

High price feed accuracy, no trading restrictions (even on accounts with minimum deposits), and a wide array of trading opportunities are the pillars of our business activities. They're the beacon of our pledge to ensure our mission – to bring you maximum trading with maximum opportunities and freedom!

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

Tradersway is clearly the best platform out there.

Local deposits/withdrawals the very same day.

Great response from the team,brokers are highly co-operative.

I really loved the platform and I dont think I need to try another one ever :)

Length of use: 6-12 months

Length of use: over 1 year

I recommend this broker

Length of use: over 1 year

Length of use: 6-12 months

Tradersway ha sido hasta ahora el mejor broker al que he tenido acceso considerando que soy de EEUU. El spread es bastante bueno considerando otros a los que he tenido acceso. Le doy 4 estrellas pues hasta ahora me ha ido muy bien con ellos, puedes hacer tu traiding y sacar tus ganancias sin problema. Le daría 5 estrellas si el proceso de retirar el dinero fuera más sencillo y rápido. La mejor forma que encontré y que se adapta mi fue a través de vload pero se demora unos días el proceso además las comisiones. De todas formas si haces bien tu traiding vas a tener buenas oportunidades con el broker y podrás pagar las comisiones sin problemas pero sería maravilloso si depositar y retirar el dinero fuera más sencillo y más económico. Lo otro es que ya no están aceptando clientes de EEUU, espero que eso cambie pronto. Este broker lo he recomendado y hasta este momento lo continuo recomendando, estoy seguro que no es el mejor del mundo pero es el mejor que yo he encontrado.

Tradersway has so far been the best broker I have had access to considering that I am from the US. The spread is pretty good considering others I've had access to. I give it 4 stars because so far I have done very well with them, you can do your trading and get your profits without problem. I would give it 5 stars if the process of withdrawing the money was easier and faster. The best way I found and that suits me was through vload, but the process takes a few days, plus the commissions. In any case, if you do your trading well, you will have good opportunities with the broker and you will be able to pay the commissions without problems, but it would be wonderful if depositing and withdrawing money were easier and cheaper. The other thing is that they are no longer accepting US clients, I hope that will change soon. I have recommended this broker and until now I continue to recommend it, I am sure it is not the best in the world but it is the best that I have found.

Trader’s way review

Founded in 2011, trader’s way do have flexible account options and solid trading platforms although the lack of regulation is likely to deter some traders. Furthermore, there is limited non-FX trading instruments.

Trader’s way review, pros & cons

- Fixed spread accounts

- Commission free accounts

- Electronic communication network (ECN)

- Free VPS

- Quickdeal tool

- Fxwire pro newsfeed

- Webinars

- No regulation

- No US clients

- No UK clients

- Limited non-FX instruments

In this detailed trader’s way review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

Trader’s way is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including trader’s way.

Trader’s way review: summary

Founded in 2011, trader’s way is an online trading broker that provides clients across the globe access to trade a range of markets including forex, commodities, cryptocurrency, metals, energies & cfds.

Trader’s way offer a range of different trading platforms including the popular MT4 & MT5 platforms. Account types are flexible to suit individual trader needs and levels of skill. The mobile apps and web trading platforms make trading on the go possible. There are a range of tools to assist with market analysis and to increase trading efficiency.

Trader’s way use an electronic communication network (ECN) model which ensures transparent pricing direct from liquidity providers (lps), interbank market access, good execution speeds and the tightest spreads possible. There is no dealing desk to ensure no conflict of interest between broker and clients.

The minimum deposit starts from just $5 with flexible leverage of up to 1:1000 available. Variable spreads start from just 0 pips with competitive commissions or you can opt for a fixed spread account with spreads starting from 2 pips and no commission charged.

There are no restrictions on trading, whatever your initial deposit or account type, scalping, hedging and expert advisors are allowed. There are multiple funding options and swap free islamic accounts that comply with sharia law are available.

The trader’s way philosophy is to offer clients maximum opportunities and freedom through trading. This is achieved by the trading technologies and services provided to all clients. Regardless of experience or account size, each client is treated with the upmost respect.

Trader’s way review: regulation

Trader’s way is an unregulated offshore broker that is legally registered in dominica and registered under the name TW corp.

Trader’s way claim to keep client funds in banks segregated from their own funds. This means that client funds should not be used for any other purpose and must be available for withdrawal at any time. Cash flows are organized in a way that ensures company expenditure cannot be processed from accounts that are holding clients money. Larger ECN account funds are partially kept with liquidity providers so withdrawal time may be longer according to the safety of funds statement on the website.

Trader’s way implement strict internal policies and procedures to ensure they maintain high business standards. Strict AML & KYC policies are in place to combat against money laundering and inappropriate usage of funds. They also comply with the highest standard of security in relation to finance handling and technology. There is a risk management policy in place based on years of market experience and knowledge. By providing maximum transparency and security they aim to build long lasting relationships with clients, despite the lack of regulation from a government authority.

Trader’s way review: countries

Trader’s way accept clients from all over the world, excluding some countries where restrictions apply such as the united kingdom & united states. Some trader’s way broker features and products mentioned within this trader’s way review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

Trader’s way review: trading platforms

Trader’s way have a good selection of trading platforms to suit all levels of trader skills and expertise. They have the hugely popular metatrader, the powerful and advanced ctrader platform as well as mobile and web platforms.

There is also the quickdeal tool which brings market depth level 2 pricing and one-click trading to metatrader. This tool along with the STP/ECN trading engine transforms the standard metatrader into a more advanced STP/ECN trading platform.

Metatrader 4 (MT4)

MT4 is the most widely used trading platform and is offered by trader’s way with direct interbank market access (DMA). It is very user friendly with an intuitive interface and ton of features for a fully customisable trading environment.

There are 50 built in technical indicators for chart analysis, drawing objects, 9 timeframes, multiple order types, alerts, real-time price quotes in the market watch and a metaeditor for creating your own custom indicators or automated strategies in the MQL4 programming language. There is also a strategy tester for back testing expert advisors (eas) over historical data which can be downloaded from the MT4 server from within the platform.

Information exchanged between the MT4 terminal and servers is protected by a 128-bit key for safety of trading transactions.

MT4 is available on desktop (windows / mac), web and mobile (iphone / ipad / android / tablet).

Trader’s way review: metatrader 4 (MT4) platform

Metatrader 5 (MT5)

MT5 is the successor to MT4 and next generation of trading terminal. The interface is very similar to MT4 although there are a few added features such as more order/execution types, 21 timeframes, 80 technical indicators and a strategy tester capable of back testing multiple currencies.

The implemented financial news and economic calendar can be used to keep up to date with the latest market happenings and for fundamental analysis. The depth of market (DOM) displays bids and asks for a particular instrument at the best prices (closest to the market) at the moment. The DOM window also shows the volume of each order.

MT5 is available on desktop (windows / mac), web and mobile (iphone / ipad / android / tablet).

Trader’s way review: metatrader 5 (MT5) platform

Metatrader web terminal

The metatrader web terminal has the same functionality and interface as the desktop platforms without needing to install or run any software. You simply launch the platform within your browser. Any transmitted information is securely encrypted.

Trader’s way review: metatrader web terminal

Metatrader mobile platform

The metatrader mobile apps allow you to access and manage your trading account on the go from any portable device such as a mobile phone or tablet. This is useful if you want to keep up to date with the markets and your positions but do not have access to your desktop computer. You can use the mobile platforms from anywhere in the world with an internet connection. Mobile platforms are available for download on both android and ios.

Ctrader

Ctrader is another user-friendly platform that is full of features and designed for ECN/STP trading. It makes the advantages that the institutional traders have available to retail traders including superior execution speeds (milliseconds) and level 2 pricing.

Trades are routed through ecns direct to liquidity providers such as global banks, thus giving a transparent live trading environment with no broker dealing desk to interfere and a level playing field.

Ctrader supports manual trading with advanced charting capabilities and one click functionality. There are multiple indicators for technical analysis, multiple timeframes, detachable charts, templates and more. Fully automated trading is also possible via the calgo proprietary algorithmic platform.

Ctrader’s depth of market shows the full range of executable prices coming from liquidity providers. Orders are executed against the full order book using volume weighted average price (VWAP).

Trader’s way review: ctrader platform

Ctrader web terminal

Ctrader web terminal has the same features as the desktop platform without the need for installing or running any additional software. You can trade from any computer with an internet connection and gain access to transparent pricing, fast speeds, and all the features of ctrader directly in your browser.

Trader’s way review: ctrader web terminal

Ctrader mobile

The ctrader mobile applications are available on android and ios so that you can trade whilst on the go using any compatible mobile device. The core functionality of ctrader remains. You simply install the ctrader mobile app and log in with your trader’s way account number and password.

Trader’s way review: trading tools

Trader’s way have a variety of trading tools that can be used to improve trading efficiency, market analysis and for trading signals.

Quickdeal tool

The quickdeal tool is an addon for MT4 & MT5 that enables market depth level 2 pricing and one-click trading in the platforms. Market depth gives you a more detailed insight into the market to help with trading decisions whereas one-click trading allows you to quickly and conveniently place, manage and close trades.

Trader’s way review: quickdeal tool

Cmirror

The cmirror application allows you to copy (mirror) the trades of other signal providers or offer your own signals. Providers charge a commission for using their signal service. Signals are opened and closed fully automated whilst you can set your own customised risk management settings and stop the mirroring process at any time. Signal providers trading history and current positions are available to view to see if they are a suitable option. It must be noted that past performance is by no means any guarantee of future performance.

Trader’s way review: cmirror

Metatrader trading signals

The metatrader platforms have a built-in social trading service where you can copy other traders signals directly into your terminal for free or a monthly fee. You can browse the signal providers and review their performance then choose to subscribe to any signals that appeal to you. You may also offer your own signals. Again, historical performance is absolutely no guarantee of future performance.

Trader’s way review: metatrader signals

VPS hosting service

Trader’s way offer eligible clients a high-quality virtual private server (VPS) with a 24/7 connection. To qualify for a free VPS, you will need a minimum deposit of at least $1,000, minimum 5 trades and 10 lots in volume monthly. If you get the VPS but do not meet the minimum requirements you may be charged the monthly cost.

A VPS enables you to always run your trading platform without needing your computer switch on and can be accessed remotely. This is often seen as a solution for those who wish to run expert advisors (EA) around the clock.

The VPS’s are hosted in close proximity to trader’s way’s main server, for maximum uptime whatever your own internet connection. VPS’s come with metatrader preinstalled and are capable of running several trading terminals simultaneously.

Fxwire pro newsfeed

Fxwire pro by ibtimes is a professional grade real-time financial market newsfeed that is integrated into trader’s way metatrader platforms. It provides traders with a comprehensive overview and insight of global markets which can be used for fundamental analysis.

Ibtimes is a global network of journalists from over 13 countries that convey the most important markets news in an easy to digest format, saving time reading through multiple news releases from various sources. 600 items of news are covered every day with alerts for economic releases, round the clock news covering all market trading hours, reviews of daily events and overview of upcoming events.

Economic calendar

Trader’s way have an integrated economic calendar on their website that is provided by metaquotes, the russian developer of metatrader. This calendar displays recent and upcoming news releases, the markets impacted along with the forecasted and actual results. This calendar can be useful to stay in the loop with the latest market news and for fundamental analysis.

Trader’s way review: economic calendar

Trader’s way review: education

Trader’s way have sections scattered sporadically across their website that cover some of the basic trading principles that would be useful to novice traders. Other than that, educational material in terms of video tutorials and trading guides are limited although they do provide weekly market outlooks and webinars that can help improve understanding of the financial markets.

Market outlook

This section of the trader’s way website has weekly market outlooks that cover technical and fundamental analysis in detail. These can be used to inspire trading ideas.

Trader’s way review: market outlook

Webinars

Trader’s way provide clients free live webinars that can help improve trading knowledge and skills. They are conducted by veteran market expert and chief FX strategist for tradersway, wayne mcdonell who has over 10 years of experience and shares his market outlook. Topics include fundamental/technical analysis, market sentiment, support/resistance, trading strategies, Q&A and more. Previous webinars are available to watch on the tradersway youtube channel.

Trader’s way review: webinars

Trader’s way review: trading instruments

Trader’s way offer 3 main markets, forex, precious metals & energies. All markets can be traded on all platforms and accounts.

Forex

The foreign exchange (forex) market is the biggest and the most liquid market in the world with an average daily trading volume of around $4 trillion. Currencies are exchanged for another at a specific rate with fluctuating global demand and supply determining the rates.

Trader’s way offer 45+ major, minor and exotic FX currency pairs for trading on fixed or floating spread accounts. Minimum transaction value is 0.01 lots and leverage up to 1:1000 is available. The ECN accounts give direct access to interbank liquidity with spreads from 0 pips and competitive commission fees. The more volume you trade, the more you can negotiate a lower commission.

Precious metals

Often regarded as safe havens and used for diversifying a portfolio, gold and silver can be traded as cfds (contract for differences) without needing to own the physical underlying asset. Profit or loss is determined by the change in the value of the asset.

Energies

Constantly changing gas and oil prices make these popular instruments to trade. Trader’s way offer CFD trading on crude light oil and natural gas.

Cryptos

Cryptocurrency is a decentralised digital currency based on complex mathematical algorithms. Cryptos based on bitcoin can be traded on the trader’s way MT4 crypto account.

Trader’s way review: trading accounts & fees

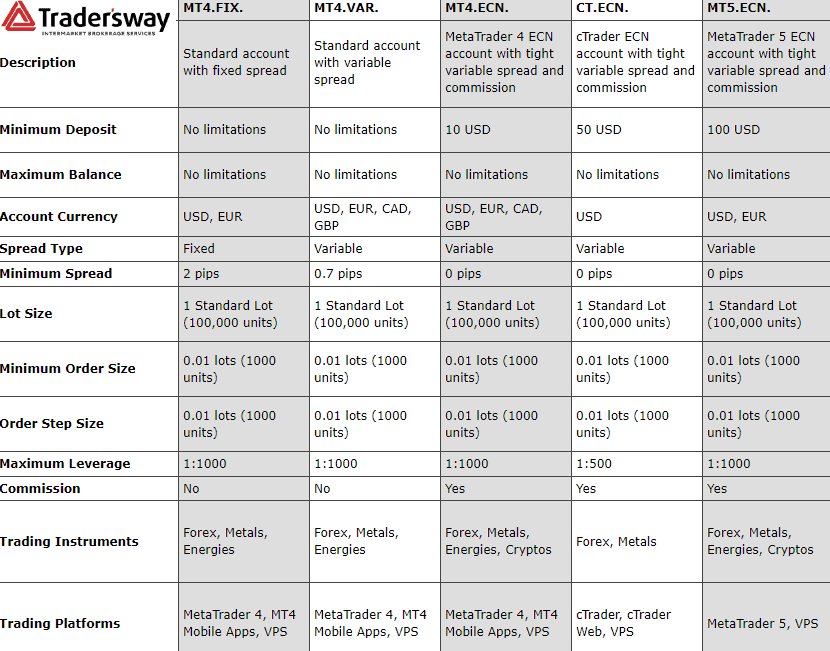

Trader’s way have several account types available with different trading conditions. There are 5 accounts available with variable and fixed spreads, with or without commission, standard and ECN, and different platforms. There are no restrictions on trades for all account types. Islamic swap free accounts are available upon request. Demo accounts are also available if you wish to test the different trading platforms and conditions before opening a real account.

Trader’s way review: trading accounts comparison

MT4.FIX

This is a standard MT4 account with fixed spreads starting from 2 pips and no commission charged. It was designed for traders who prefer to know the spread they will pay on each trading instrument. There is no minimum deposit required, minimum lot size is 0.01 and flexible leverage of up to 1:1000 on currency pairs. Maximum leverage on non-FX instruments is 1/2 of your leverage for metals and 1/8 of your leverage for other instruments.

MT4.VAR

This account type is similar to the standard but has variable spreads starting from 0.7 pips. This is more for traders who prefer real market conditions and want to step into an ECN/STP environment without paying any commission on trades.

MT4.ECN

This account offers true ECN trading with direct access to interbank liquidity on the MT4 platform. Spreads on this account are as tight as possible starting from just 0 pips. There is a very competitive commission charge of $3 with a minimum deposit requirement of $100. Minimum lot size is 0.01 and flexible leverage of up to 1:1000 on currency pairs. Maximum leverage on non-FX instruments is 1/2 of your leverage for metals and 1/8 of your leverage for other instruments.

MT5.ECN

This account provides the same conditions as the MT4 ECN account with the MT5 platform instead.

CT.ECN

This is an ECN account for using the intuitive and convenient ctrader platform designed especially for ECN trading. The minimum deposit is slightly lower at $50 as is the leverage going up to 1:500 rather than 1:1000 as per the other accounts. Leverage is also lower on metals and energies.

MT4.CRYPTO

As the name suggests, this account gives you access to trade cryptocurrencies with leverage and via the MT4 platform. Minimum lot size is 0.01 with 1:2 maximum leverage.

As broker fees can vary and change, there may be additional fees that are not listed in this trader’s way review. It is imperative to ensure that you check and understand all of the latest information before you open a trader’s way broker account for online trading.

Trader’s way review: customer service

Customer support is provided via online chat, telephone and email. There is a US telephone number and they state that they aim to answer support requests within 24 hours on working days.

Trader’s way review: deposit & withdrawal

Trader’s way provide clients with a variety of deposit and withdrawal methods, frequently introducing new payment options to improve the service. They offer bank transfers, credit cards, online payment processors such as skrill & neteller, cryptocurrencies (bitcoin, litecoin & ether) and more.

You can make a transaction by logging into your private client area, choosing your preferred payment option and following the instructions. Support can be reached if you have any questions regarding deposits or withdrawals.

Some fees may be charged when using certain payment methods. Bank transfers may take a few business days to clear whilst some methods such as card payments can be instant.

Accounts can be opened in USD, EUR, CAD, GBP. The different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency.

Trader’s way review: account opening

There is a short online form to complete in order to apply for a trader’s way account. Once done, you will need to verify your email and submit documents for KYC checks. These can be passport and utility bill scans for proof of identification and residential address. Once the accounts department have verified your account, you will be able to fund it and commence trading.

Trader’s way review: account registration

Trader’s way review: conclusion

Whilst trader’s way do have flexible account options and solid trading platforms, the lack of regulation is likely to deter a vast array of traders. Furthermore, there is limited non-FX trading instruments.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Min $5 deposit

Founded in 2011, trader's way do have flexible account options and solid trading platforms although the lack of regulation is likely to deter some traders. Furthermore, there is limited non-FX trading instruments.

Tradersway review

Tradersway is an unregulated offshore forex broker that will appeal to the trader looking for a large choice of cryptocurrency deposit methods such as bitcoin, dash and litecoin. See our trader’s way review of this ECN broker for trading.

Tradersway – strengths and weaknesses

Tradersway review to assess whether this unregulated broker is legit or not and worth using

Tradersway major strengths

- Choice of trading accounts – variable and ECN spreads

- Most popular trading platforms – metatrader 4 and 5, ctrader

- Low minimum deposits – open an account with $10

- Highest level of leverage – trade with 1:1000

- Large and unique range of funding methods

- Regular promotions – 100% deposit bonus

Tradersway weaknesses

- Poor spreads – wide spreads mean higher costs

- Not a tier-1 regulated broker – questions of trust

- High leverage – risk of big losses in A hurry

- Questionable reputation – online feedback is poor

- Limited choice of cfds – range of markets for trade is small

Our rating

The overall rating is based on review by our experts

Strength 1 – choice of trading accounts – variable and ECN spreads

One of the appeals of trader’s way is they have an account to suit all types of traders. Not too many brokers offer the clients a choice of each of the 2 types of trading spreads. Spread-only variable spreads (commission-free) and variable ECN pricing spreads.

This types of account are commonly called the “standard account” by other brokers. With this account, you get variable spreads with no commissions. In place of commission costs, trader’s way widens the spreads slightly so they can make a small profit on your trades. As this account has no commissions, it is popular with beginner traders who are looking for a more simple cost structure, as your costs are already included in the spread.

This type of account uses variable spreads, which means they are constantly changing depending on the liquidity for each currency pair. Spreads for EURUSD avg 1.4 pip, which is more than double the 0.5 pips MT4.ECN account offers.

When trading with this account, you must be using the metatrader 4 trading platform and you will not be able to trade cryptocurrencies.

MT4.ECN, MT5.ECN, CT.ECN:

The ECN trading account types use ECN/STP/DMA trading (the broker appears to use these terms interchangeably) to give connect you directly with liquidity providers so you can achieve the lowest spreads trader’s way offers. To keep spreads tight, the broker charges a commission fee of USD$3.00 to open your position and $3.00 to close your position. However, at times promotions with reduced commissions are offered (see strength 7). The ECN style low spread account is popular with scalping, high volume and robo-traders who will be looking to save on costs trading of large volumes can add up significantly.

With these accounts, you can choose metatrader 4, metatrader 5 or ctrader platforms and you can trade cryptocurrencies with the metatrader accounts.

Trader’s way trading conditions

Tradersway uses a no dealing desk (NDD) trading model with STP, DMA and ECN trading execution. This model gives traders the opportunity to be linked with various liquidity providers to get the best spreads. As trader’s way is not a market maker, they are not your counterparty and do not own any liquidity.

While straight through provider (STP), electronic communication network (ECN) and direct market access (DMA) are similar but different trading execution concepts, trader’s way appear to be using these terms interchangeably so it is not clear exactly which execution is being used. Nevertheless, each method connects traders with liquidity providers with no human intervention.

Conclusion choice of trading accounts:

With tradersway’s choices of trading accounts, forex traders will have the option to pick the best trading account that suits their trading style.

Strength 2 – most popular platforms – metatrader 4 and 5, ctrader

Trader’s way tradersway offer 3 of the most popular trading platforms found in the marketplace, giving forex traders the option to choose which platform they’d like to trade on.

Metatrader 4 and metatrader 5

Trader’s way offers metatrader 4 (MT4) with the MT4.Fix, MT4.Var, MT4.ECN accounts and metatrader 5 (MT5) with MT5.ECN accounts. If choosing MT4.Fix or MT4.Var, you will not be able to trade cryptocurrencies.

Released in 2005, metatrader 4 is the most popular trading platform worldwide. The trading platform is exceptionally popular with beginner traders (but also advanced traders) and those that only wish to trade forex for the following reasons:

- An easy-to-use platform as it offers all the essential tools needed for successful trading with sufficient advanced tools without going overboard

- Offers a clean and uncluttered trading interface so you can see and execute all the trading information you need without information overload

- It is one of the most trusted platforms due to the fact it is one of the oldest and most developed platforms

- It has the largest community of all platforms, which means you can find the support when you need it

- It has one of the largest marketplaces which allows you to choose from a wealth of real-time signals and advisors

- It uses 32-bit processing so is less resource intensive, which suits retail traders who may not have the resources to take advantage of 64-bit systems

- It is specially designed for decentralised trading such as forex, which has no central exchange

- Availability across several devices (desktop, browser and mobile apps (ios and android))

- Free VPS hosting service with pre-installed MT4 software

Metatrader 5 was released in 2010 and is designed to offer a more comprehensive and powerful platform for trading across multiple assets. Despite being a superior platform than MT4, it is not yet as popular however there are good reasons traders should consider MT5 over MT4 platform.

- Metaquotes have announced support and development of MT4 will be reduced going forward so it makes sense to start learning MT5 now rather than in future

- More brokers will begin to offer MT5 in the future, giving you more options when choosing suitable brokers

- Access to a greater choice of cfds such as shares, which require trading through a central exchange

- MT5 offers all the features MT4 platform offers and more.

- 64-bit processing means faster, more reliable processing. Faster processing helps reduce the risk of slippage.

Regardless if you choose MT4 or MT5, you will be getting access to excellent platforms that offer all the features one needs to trade.

Below is a head-to-head comparison of the features of the platform:

Both platforms offer automated trading through expert advisors. While MT4 uses an order system, MT5 uses a positional system which can make automation with MT5 easier.

Looking at the comparisons, the main difference to note is that MT5 offers everything MT4 does and more:

- MT5 offers more technical indicators which allow you to analyse past movements and anticipate future trends using annual reports and economic data. Indicators are useful as they help you identify future trading opportunities. MT5 offers 38 of these tools, increased from 33 on MT4.

- Analytical tools offer a quantitative analysis, which means decisions can be made on pure data without the influence of emotion. MT5 offer 44 of these tools compared to 33 on MT4.

- Timeframes are very useful tools, as currency pairs are constantly changing due to the sheer liquidity in the market. While basic timeframes such as weekly, daily, 4 hour and hourly will suffice for most traders, MT5 really allows traders to dig deep and isolate trends on micro-scale with greater 21 timeframe choices.

Ctrader

Ctrader is one of the most popular trading platforms among traders. The software offers a variety of charting tools with advanced order types, and most importantly, fast entry and execution of orders. It has a very user-friendly interface where it is connected to a back-end technology, with the software available on multiple devices.

What makes ctrader outperform both MT4/5 is that it has a modern design, advanced ordering plus market depth options (not found on MT4). Additionally, it offers calgo, allowing you to develop your trading software (cbots) or create your own indicators.

Additional software tools

Trader’s way offers social trading tools which can help your trading experience. Social trading is especially popular with beginner traders as they allow you to learn from and copy other successful traders, meaning there is no need to learn to forex trade yourself.

This social and auto trading platform offers a wealth of statistical and financial features in order to provide comprehensive analytical tools so users can get a detailed analysis of the trading systems they are using and statements. By providing a deep analysis of the trader’s statements, trading activities can be improvised.

Myfxbook autotrade

Myfxbook’s autotrade copy trading system allows you to copy from a large choice of systems directly into your metatrader trading account. This makes social copying simple and easy, as you can access all the analytical tools myfxbook offers which can be used to find the system that you plan to copy based on your desired criteria.

A strength of myfxbook’s is that it uses algorithms to eliminate poor-performing signals and prioritise only the best performing signals.

MT4 trading signals

MT4 signals is metatrader’s built-in solution for social trading. As this product is part of the trading platform, all you need to do is choose a signal provider and subscribe to their signals. Once subscribed, you can set up your filters so automatically copy the signals provider.

One of the benefits of choosing the metatrader social trading solution is the large community metatrader offers. This means you can choose from an infinite number of signals to follow, thus increasing the chances of finding someone that trades in a style that suits you.

Rating broker by platforms

We like tradersway platform offering. They offer three of 3 most popular generally available platforms on the market and a few social trading tools to further enhance your trading experience. If you’re looking for even more tools, then pepperstone or IC markets are good options. If you’re looking for a specialist platform with risk management features, then easymarkets may appeal.

Conclusion on most popular trading platforms:

Every forex trader prefers a specified trading platform. Tradersway offers the most popular platforms which facilitate trading and analysis. In forex trading, MT4 is still the most used platform among traders since its release in 2005.

Strength 3 – low minimum deposit – open accounts with $10

Most forex brokers require a minimum deposit of $200 to open a live account. Tradersway allows you to start trading with as little as $10.

While you will definitely benefit by investing larger amounts when trading as this presents more opportunities for greater returns, in some circumstances, traders may wish to open an account with minimal amounts. Reasons could include:

- The trader wishes to practice trading with a minimum amount. While a better option to this would be a demo account, some trader may prefer to use a small amount of their own money.

- You want to trade in nano or mini lots. While it can be hard to get big profits trading with very small amounts, leverage of 1:1000 can help you increase your profits.

- You need to open an account before you can transfer funds to use for trading

Although trader’s way has low minimum deposits, it is worth noting the broker does encourage larger initial deposits through their bonus program. The table below compares the minimum deposits with other notable brokers. If you are a serious trader seeking greater earning potential, then you will end up depositing larger amounts of funds inevitably so there are brokers with reasonably larger minimum deposits such as IC markets should not be discounted. Saxo markets have very high minimum deposits, as they are likely targeting semi-professional traders.

| USD | |

|---|---|

| trader's way | $10 MT4.ECN $100 MT5.ECN |

| IC markets | $200 |

| pepperstone | $200 |

| axitrader | $0 |

| CMC markets | $0 |

| IG group | $300 |

| thinkmarkets | $0 |

| FXCM | $50 |

| FXTM | $10 |

| swissquote | $1,000 |

| saxo markets | $10,000 |

By not requiring a minimum deposit, tradersway is giving the chance for small retail traders and beginners to have the chance to be one of the participants in the financial market.

Strength 4 – highest level of leverage – trade with 1:1000

Tradersway allow leverage of up to 1:1000 for each of its metatrader accounts and 1:500 for its ctrader account. Trader’s way uses tiered leverage with the maximum allowable leverage reduced the more you trade.

| Metatrader balance | metatrader leverage | ctrader balance | ctrader leverage |

|---|---|---|---|

| less than 50,000 | 1:1000 | less than 50,000 | 1:500 |

| 50,00- to 50,000 | 1:500 | 10,00- to 50,000 | 1:200 |

| 50,000 to 60,000 | 1:400 | 50,000 and above | 1:100 |

| 60,000 to 70,000 | 1:300 | ||

| 70,000 to 80,000 | 1:200 | ||

| 80,000 to 100,000 | 1:150 | ||

| 100,000 and above | 1:100 |

What high leverage means for traders

Leverage of 1:1000 gives the trader the ability to borrow $1000 for each $1 deposited (in case the account is in US dollars) when trading the forex market.

Using high leverage can assist traders to greatly increase the amounts of profit they can achieve while committing only a small amount of their own money. Should you trade with high leverage, be aware you can also increase your risks of large losses if the currency pairs moved against you.

With up to 1:1000 leverage available to its customers, tradersway offer far more than a regulated broker will offer. ASIC allows brokers operating in australia to offer up to 1:500, while financial authorities in europe such as the FCA, cysec and bafin allow 1:30 for major currency pairs and 20:1 for minor currency pairs.

Trader’s way policy of reducing maximum leverage the more you trade can be seen as a somewhat sensible policy, as losses with large investments using 1:1000 can lead to crippling financial losses.

Strength 5 – large and unique range of deposits

Tradersway gives its clients a wide range of payment types for deposits and withdrawals, including options not commonly found with most other brokers. Traders looking to fund their account anonymously may appreciate vload, abba, and cryptocurrency options.

Credit cards and debit cards deposits and withdrawals

Trader’s way does not accept credit or debit cards for funding, instead, they provide 3rd party platforms to facilitate payment with visa, mastercard and other bank cards. Tradersway does not charge any fees however the 3rd party provider will have fees as the back end.

- Vload is a voucher system where one can transfer funds and then use a pin to place the vouchers funds into a trader’s way account. Withdrawals fees are 5.5%

- Abba is a mobile platform that will accept funds from credit and debit cards, bankwire and even cryptocurrency from where one can transfer their funds to their trader’s way account. Withdrawal fees with cards range from 4-8%

Cryptocurrency deposits and withdrawals

Funding with cryptocurrency is becoming increasingly popular due to the speed one can make deposits and withdrawals and the anonymity that these funding methods allow. With cryptocurrency, traders don’t need to worry about funding red tape that may be associated with traditional methods.

Trader’s way also accepts a large range of funding via cryptocurrency. Cryptocurrencies accepted include bitcoin, litecoin, ripple, ether, USD coin, tether and trueusd. You will need to purchase the coins via a cryptocurrency exchange such as coinbase and then transfer the coins to your trader’s way account.

While trader’s way does not charge any fees, the cryptocurrency network will have their own charges, which usually apply when you make a withdrawal.

Ewallets / digital wallets

If you prefer to fund your accounts via the web, then you have a range of options. These include skrill, perfect money, fasapay and NETELLER. Use of these services will incur charges from the provider.

Below is a summary of the available options provided by tradersway.

| Methods of payments | comments |

|---|---|

| credit/debit cards via vload | 1. Cash voucher system for online payments 2. Only EUR and USD 3. Min/max withdrawal 100/5000 per transaction 5. 5% fee from vload |

| wire transfer | |

| bank transfer (abra) | 1. Deposits can be made with A. Bank transfer (0-0.25% fee) B. Credit/debit cards (4-8% fee) C. BTC, BCH,LTC (cryptocurrency network fees) |

| cryptocurrency options | |

| bitcoin | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| ether | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| litecoin | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| ripple | 1. No min/max transactions 2. 20 XRP fee for deposits lower than 1000 XRP 3. Rippled network fees to withdrawl |

| USD coin (USDC) | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| tether (USDT) | 1. USDT only accepted on ethereum network (ERC20 protocol) not omni version 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| trueusd (TUSD) | 1. No min/max transactions 2. No commissions for deposits 3. Bitcoin network charges fees to withdrawal |

| digital wallets, ewallets | |

| skrill | 1. Minimum $10 for withdrawals 2. 1.9% fee for deposits 3. 1% fee for withdrawals |

| NETELLER | 1. 1% fee for withdrawals |

| perfect money | 1. 1% fee for withdrawals |

| fasapay | 1. 2.9% fee for deposits 2. No withdrawal fees |

Strength 6 – regular promotions – 100% deposit bonus

Tradersway is generous when it comes to bonuses. This forex broker offers a 100% bonus credit on your initial deposit to use for trading. That means you have double the funds available for trading.

Weakness 1 – poor spreads – wide spreads mean higher costs

Our review of tradersway’s spreads by our analysts shows that they are quite wide when compared to similar brokers. Wider spreads mean higher costs. Scalpers especially will want to trade with a broker with tight spreads due to the high volume of trades they will perform.

Tradersway charges an average spread of 0.5 pips for EUR/USD (ECN accounts) which means each time you open and close a trade you will pay USD$5. With a cost of $10 in total to exit your position, this can be expensive when trading with many lots.

Our table below shows how trader’s way spreads compare with other brokers.

No commission spreads

Trader’s way has an average of 0.5 pips EURUSD for commission spreads. This contrasts with some other brokers like pepperstone and IC markets who average around 0.1 pips. To open and close with trader’s way you will pay $10 on average while to open and close pepperstone and IC markets you could pay as little as 0.20 pips on average, equating to $2.00. This means you will save $8.00 for each standard lot you trade. If you are trading with high leverage, regularly this cost difference can be significant.

So, let's see, what we have: read the latest traders way reviews and comments written by real traders. What a forex trader should know before he starts trading with traders way on forex-ratings.Com at traders way review

Contents of the article

- Best forex bonuses

- Traders way reviews and comments 2021

- Tradersway review

- Top 3 forex brokers

- What is tradersway?

- Deposit & withdrawal

- Conclusion

- Tradersway review

- Broker details

- Live discussion

- Tradersway.Com profile provided by mr.Max.TW, dec...

- Video

- Traders reviews

- I recommend this broker

- Trader’s way review

- Trader’s way review: summary

- Trader’s way review: regulation

- Trader’s way review: countries

- Trader’s way review: trading platforms

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Metatrader web terminal

- Metatrader mobile platform

- Ctrader

- Ctrader web terminal

- Ctrader mobile

- Trader’s way review: trading tools

- Quickdeal tool

- Cmirror

- Metatrader trading signals

- VPS hosting service

- Fxwire pro newsfeed

- Economic calendar

- Trader’s way review: education

- Trader’s way review: trading instruments

- Trader’s way review: trading accounts & fees

- Trader’s way review: customer service

- Trader’s way review: deposit & withdrawal

- Trader’s way review: account opening

- Trader’s way review: conclusion

- Tradersway review

- Tradersway – strengths and weaknesses

- Strength 1 – choice of trading accounts –...

- Strength 2 – most popular platforms – metatrader...

- Metatrader 4 and metatrader 5

- Ctrader

- Additional software tools

- Rating broker by platforms

- Conclusion on most popular trading platforms:

- Strength 3 – low minimum deposit – open accounts...

- Strength 4 – highest level of leverage – trade...

- Strength 5 – large and unique range of deposits

- Credit cards and debit cards deposits and...

- Cryptocurrency deposits and withdrawals

- Ewallets / digital wallets

- Strength 6 – regular promotions – 100% deposit...

- Weakness 1 – poor spreads – wide spreads mean...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.