How to get ewallet

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours.

Best forex bonuses

A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise. South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How to get ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

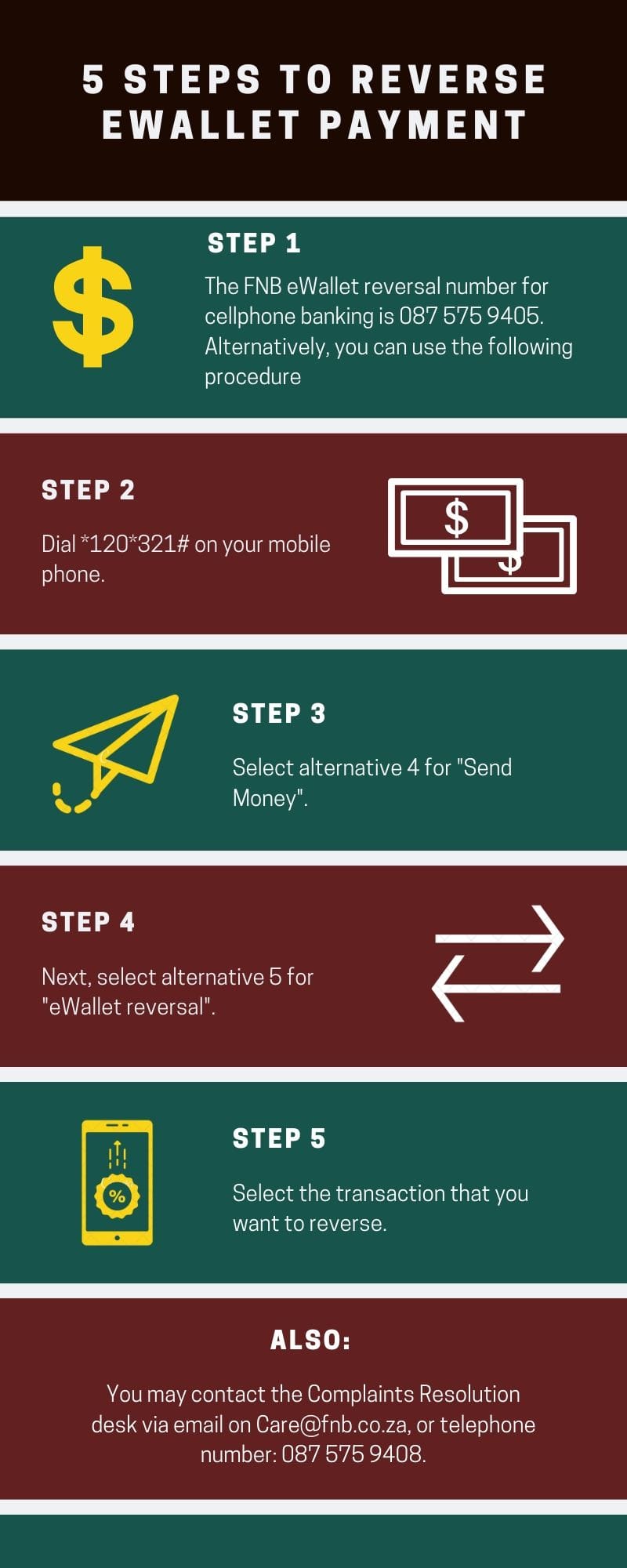

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

Cryptocurrency wallet guide: A step-by-step tutorial

Use this straightforward guide to learn what a cryptocurrency wallet is, how they work and discover which one’s are the best on the market. If you are looking for something a bit more in detail about cryptocurrencies please check out our course on it.

What is a cryptocurrency wallet?

Enjoy a free lesson from the blockgeeks library!

A cryptocurrency wallet is a software program that stores private and public keys and interacts with various blockchain to enable users to send and receive digital currency and monitor their balance. If you want to use bitcoin or any other cryptocurrency, you will need to have a digital wallet.

How do they work?

Millions of people use cryptocurrency wallets, but there is a considerable misunderstanding about how they work. Unlike traditional ‘pocket’ wallets, digital wallets don’t store currency. In fact, currencies don’t get stored in any single location or exist anywhere in any physical form. All that exists are records of transactions stored on the blockchain.

Cryptocurrency wallets are software programs that store your public and private keys and interface with various blockchains so users can monitor their balance, send money and conduct other operations. When a person sends you bitcoins or any other type of digital currency, they are essentially signing off ownership of the coins to your wallet’s address. To be able to spend those coins and unlock the funds, the private key stored in your wallet must match the public address the currency is assigned to. If the public and private keys match, the balance in your digital wallet will increase, and the senders will decrease accordingly. There is no actual exchange of real coins. The transaction is signified merely by a transaction record on the blockchain and a change in balance in your cryptocurrency wallet.

What are the different types of cryptocurrency wallets?

There are several types of wallets that provide different ways to store and access your digital currency. Wallets can be broken down into three distinct categories – software, hardware, and paper. Software wallets can be a desktop, mobile or online.

- Desktop: wallets are downloaded and installed on a PC or laptop. They are only accessible from the single computer in which they are downloaded. Desktop wallets offer one of the highest levels of security however if your computer is hacked or gets a virus there is the possibility that you may lose all your funds.

- Online: wallets run on the cloud and are accessible from any computing device in any location. While they are more convenient to access, online wallets store your private keys online and are controlled by a third party which makes them more vulnerable to hacking attacks and theft.

- Mobile: wallets run on an app on your phone and are useful because they can be used anywhere including retail stores. Mobile wallets are usually much smaller and simpler than desktop wallets because of the limited space available on mobile.

- Hardware:wallets differ from software wallets in that they store a user’s private keys on a hardware device like a USB. Although hardware wallets make transactions online, they are stored offline which delivers increased security. Hardware wallets can be compatible with several web interfaces and can support different currencies; it just depends on which one you decide to use. What’s more, making a transaction is easy. Users simply plug in their device to any internet-enabled computer or device, enter a pin, send currency and confirm. Hardware wallets make it possible to easily transact while also keeping your money offline and away from danger.

- Paper: wallets are easy to use and provide a very high level of security. While the term paper wallet can simply refer to a physical copy or printout of your public and private keys, it can also refer to a piece of software that is used to securely generate a pair of keys which are then printed. Using a paper wallet is relatively straightforward. Transferring bitcoin or any other currency to your paper wallet is accomplished by the transfer of funds from your software wallet to the public address shown on your paper wallet. Alternatively, if you want to withdraw or spend currency, all you need to do is transfer funds from your paper wallet to your software wallet. This process, often referred to as ‘sweeping,’ can either be done manually by entering your private keys or by scanning the QR code on the paper wallet.

Are cryptocurrency wallets secure?

Wallets are secure to varying degrees. The level of security depends on the type of wallet you use (desktop, mobile, online, paper, hardware) and the service provider. A web server is an intrinsically riskier environment to keep your currency compared to offline. Online wallets can expose users to possible vulnerabilities in the wallet platform which can be exploited by hackers to steal your funds. Offline wallets, on the other hand, cannot be hacked because they simply aren’t connected to an online network and don’t rely on a third party for security.

Although online wallets have proven the most vulnerable and prone to hacking attacks, diligent security precautions need to be implemented and followed when using any wallet. Remember that no matter which wallet you use, losing your private keys will lead you to lose your money. Similarly, if your wallet gets hacked, or you send money to a scammer, there is no way to reclaim lost currency or reverse the transaction. You must take precautions and be very careful!

- Backup your wallet. Store only small amounts of currency for everyday use online, on your computer or mobile, keeping the vast majority of your funds in a high-security environment. Cold or offline storage options for backup like ledger nano X or paper or USB will protect you against computer failures and allow you to recover your wallet should it be lost or stolen. It will not, however, protect you against eager hackers. The reality is, if you choose to use an online wallet there are inherent risks that can’t always be protected against.

- Update software. Keep your software up to date so that you have the latest security enhancements available. You should regularly update not only your wallet software but also the software on your computer or mobile.

- Add extra security layers. The more layers of security, the better. Setting long and complex passwords and ensuring any withdrawal of funds requires a password is a start. Use wallets that have a good reputation and provide extra security layers like two-factor authentication and additional pin code requirements every time a wallet application gets opened. You may also want to consider a wallet that offers multisig transactions like armory or copay . A multisig or multi-signature wallet requires the permission of another user or users before a transaction can be made.

Multi-currency or single-use?

Although bitcoin is by far the most well-known and popular digital currency, hundreds of new cryptocurrencies (referred to as altcoins) have emerged, each with distinctive ecosystems and infrastructure. If you’re interested in using a variety of cryptocurrencies, the good news is, you don’t need to set up a separate wallet for each currency. Instead of using a cryptocurrency wallet that supports a single currency, it may be more convenient to set up a multi-currency wallet which enables you to use several currencies from the same wallet.

Are there any transaction fees?

There is no straightforward answer here.

In general, transaction fees are a tiny fraction of traditional bank fees. Sometimes fees need to be paid for certain types of transactions to network miners as a processing fee, while some transactions don’t have any fee at all. It’s also possible to set your own fee. As a guide, the median transaction size of 226 bytes would result in a fee of 18,080 satoshis or $0.12. In some cases, if you choose to set a low fee, your transaction may get low priority, and you might have to wait hours or even days for the transaction to get confirmed. If you need your transaction completed and confirmed promptly, then you might need to increase the amount you’re willing to pay. Whatever wallet you end up using, transaction fees are not something you should worry about. You will either pay minuscule transaction fees, choose your own fees or pay no fees at all. A definite improvement from the past!

Are cryptocurrency wallets anonymous?

Kind of, but not really. Wallets are pseudonymous. While wallets aren’t tied to the actual identity of a user, all transactions are stored publicly and permanently on the blockchain. Your name or personal street address won’t be there, but data like your wallet address could be traced to your identity in a number of ways . While there are efforts underway to make anonymity and privacy easier to achieve, there are obvious downsides to full anonymity. Check out the darkwallet project that is looking to beef up privacy and anonymity through stealth addresses and coin mixing.

Which cryptocurrency wallet is the best?

There is an ever-growing list of options. Before picking a wallet, you should, however, consider how you intend to use it.

- Do you need a wallet for everyday purchases or just buying and holding the digital currency for an investment?

- Do you plan to use several currencies or one single currency?

- Do you require access to your digital wallet from anywhere or only from home?

- Take some time to assess your requirements and then choose the most suitable wallet for you.

Atomic wallet

Atomic wallet is a new multi-asset custody-free solution for secure storage and management of BTC, ETH, XLM, XRP, LTC, and over 300 other coins and tokens. The crypto-assets and features are regularly updated. Private keys are securely encrypted on a user’s device, so one has full control over their funds. The desktop app is available for windows, macos, ubuntu, debian and fedora. Private alpha versions of android and IOS mobile apps will be released in october, 2018. Atomic wallet is a secure all-in-one, non-custodial cryptocurrency storage with a smooth and comprehensive interface. The wallet supports atomic swaps, a cutting-edge feature that helps users significantly save on fees. Atomic wallet also enables users to buy cryptocurrency with USD and EUR and exchange their assets at the best rates via changelly or shapeshift.

- Pros: handy interface, optimum privacy & security, decentralized, multi-currency, custody-free, built-in exchange, bank cards accepted, 24/7 instant support.

- Cons: not all coins support atomic swaps yet

Bread wallet

Bread wallet is a simple mobile bitcoin digital wallet that makes sending bitcoins as easy as sending an email. The wallet can be downloaded from the app store or google play. Bread wallet offers a standalone client, so there is no server to use when sending or receiving bitcoins. That means users can access their money and are in full control of their funds at all times. Overall, bread wallet’s clean interface, lightweight design and commitment to continually improve security, make the application safe, fast and a pleasure to use for both beginners and experienced users alike.

- Pros: good privacy & security, beginner-friendly, simple & clean, open-source software, free.

- Cons: no web or desktop interface, lacks features, hot wallet .

Mycelium

Advanced users searching for a bitcoin mobile digital wallet, should look no further than mycelium. The mycelium mobile wallet allows iphone and android users to send and receive bitcoins and keep complete control over bitcoins. No third party can freeze or lose your funds! With enterprise-level security superior to most other apps and features like cold storage and encrypted PDF backups, an integrated QR-code scanner, a local trading marketplace and secure chat amongst others, you can understand why mycelium has long been regarded as one of the best wallets on the market.

- Pros: good privacy, advanced security, feature-rich, open-source software, free

- Cons: no web or desktop interface, hot wallet, not for beginners

Exodus

Exodus is a relatively new and unknown digital wallet that is currently only available on the desktop. It enables the storage and trading of bitcoin, ether, litecoins, dogecoins, and dash through an incredibly easy to use, intuitive and beautiful interface. Exodus also offers a very simple guide to backup your wallet. One of the great things about exodus is that it has a built-in shapeshift exchange that allows users to trade altcoins for bitcoins and vice versa without leaving the wallet.

- Pros: good privacy & security, beginner-friendly, intuitive, easy to use, in-wallet trading, supports multiple currencies, open-source software, free.

- Cons: hot wallet, no web interface or mobile app

Copay

Created by bitpay, copay is one of the best digital wallets on the market. If you’re looking for convenience, copay is easily accessed through a user-friendly interface on desktop, mobile or online. One of the best things about copay is that it’s a multi-signature wallet so friends or business partners can share funds. Overall, copay has something for everyone. It’s simple enough for entry-level users but has plenty of additional geeky features that will impress more experienced players as well.

- Pros: good privacy & security, multisig transactions, multiple platforms & devices, multiple wallet storage, beginner-friendly, open-source software, free

- Cons: can be slow & unresponsive, limited user support

Jaxx

Jaxx is a multi-currency ether, ether classic, dash, DAO, litecoin, REP, zcash, rootstock, bitcoin wallet and user interface. Jaxx has been designed to deliver a smooth bitcoin and ethereum experience. It is available on a variety of platforms and devices (windows, linux, chrome, firefox, OSX, android mobile & tablet, ios mobile & tablet) and connects with websites through firefox and chrome extensions. Jaxx allows in wallet conversion between bitcoin, ether and DAO tokens via shapeshift and the import of ethereum paper wallets. With an array of features and the continual integration of new currencies, jaxx is an excellent choice for those who require a multi-currency wallet.

- Pros: good privacy & security, multi-currency, wallet linking across multiple platforms, great user support, feature-rich, user-friendly, free.

- Cons: the code is not open source, can be slow to load.

Armory

Armory is an open-source bitcoin desktop wallet perfect for experienced users that place emphasis on security. Some of armory’s features include cold storage, multi-signature transactions, one-time printable backups, multiple wallets interface, GPU-resistant wallet encryption, key importing, key sweeping and more. Although armory takes a little while to understand and use to its full potential, it’s a great option for more tech-savvy bitcoiners looking to keep their funds safe and secure.

- Pros: good privacy, great security features, multi-signature options, solid cold storage options, free.

- Cons: only accessible via the desktop client, not for beginners.

Trezor

Trezor is a hardware bitcoin wallet that is ideal for storing large amounts of bitcoins. Trezor cannot be infected by malware and never exposes your private keys which make it as safe as holding traditional paper money. Trezor is open source and transparent, with all technical decisions benefiting from wider community consultation. It’s easy to use, has an intuitive interface and is windows, OS X, and linux friendly. One of the few downsides of the trezor wallet is that it must be with you to send bitcoins. This, therefore, makes trezor best for inactive savers, investors or people who want to keep large amounts of bitcoin highly secure.

- Pros: good security & privacy, cold storage, easy to use a web interface, in-built screen, open-source software, beginner-friendly.

- Cons: costs $99, a must-have device to send bitcoins

Ledger nano

The ledger wallet nanox is a new hierarchical deterministic multisig hardware wallet for bitcoin users that aims to eliminate a number of attack vectors through the use of a second security layer. This tech-heavy description does not mean much to the average consumer, though, which is why I am going to explain it in plain language, describing what makes the ledger wallet nano tick. In terms of hardware, the ledger wallet nano is a compact USB device based on a smart card. It is roughly the size of a small flash drive, measuring 39 x 13 x 4mm (1.53 x 0.51 x 0.16in) and weighing in at just 5.9g.

- Screen/device protected by metal swivel cover

- Multi-currency support

- 3rd-party apps can run from the device

- U2F support

- When recovering a wallet from seed, the whole process can be done from the device without even connecting it to a computer!

- Fairly inexpensive (

- Not as advanced wallet software (no transaction labeling)

- No ability to create hidden accounts

- No password manager

Green address

Green address is a user-friendly bitcoin wallet that’s an excellent choice for beginners. Green address is accessible via desktop, online or mobile with apps available for chrome, ios, and android. Features include multi-signature addresses & two-factor authentications for enhanced security, paper wallet backup, and instant transaction confirmation. A downside is that green address is required to approve all payments, so you do not have full control over your spending.

- Pros: solid security, multi-platform & device, multi-sig, beginner-friendly, open-source software, free.

- Cons: hot wallet, average privacy, the third party must approve payments.

Blockchain (dot) info

Blockchain is one of the most popular bitcoin wallets. Accessing this wallet can be done from any browser or smartphone. Blockchain.Info provides two different additional layers. For the browser version, users can enable two-factor authentication, while mobile users can activate a pin code requirement every time the wallet application is opened. Although your wallet will be stored online and all transactions will need to go through the company’s servers, blockchain.Info does not have access to your private keys. Overall, this is a well-established company that is trusted throughout the bitcoin community and makes for a solid wallet to keep your currency.

- Pros: good security, easy to use web & mobile interface, well-known & trusted company, beginner friendly, free.

- Cons: hot wallet, weak privacy, the third-party trust required, has experienced outages.

30 best ewallets

There is no doubt that the electronic wallet market in 2019 is as huge as it is elaborate. For the most people using online platforms this is a convenient way to make transactions in a safe, controlled and easy way, without bringing forward the cash or the credit card, all the time. What is ewallet? The e-wallet concept must be able to keep money in a digital ewallet account, to give you the options to transfer money between the e-wallet (digital wallet) and your bank account or the credit card. The payment lanscape has been much improved by these apps and it also benefits from top online technologies.They bring cutting edge procedures regarding money transfer and security, so there are a lot of pros for using these apps. Plus, almost everybody is working with best online wallet these days. So, sooner or later we all have to understand that this is, so far, the best manner for transferring money, besides the old-fashioned cash and the already classic bank or card transfer.

It is good that we have so many options to choose from. This means we can expect ess fee amounts and faster service. There are many types of ewallet.

We have chosen, among so many, 30 top of the top ewallet apps , which have already been consacrated and have proven their worth and utility. These are the apps that are setting the trends on all markets, and here they are, presented for you:

Adyen

This app has spread globally, and allows to connect all types of cards (visa, mastercard etc.). It is considered an innovative payment processor, as cool and as stylish as there can be. It is great for international merchants, but too expensive for low-volume merchants.

Airtel money

It reaches globally but it is somehow restricted to just making recharges and online money transfers, as well as bill payment and online shopping. It doesn’t allow, however, cash withdrawal. If you have more queries then, you can make contact to airtel payment bank customer care number by clicking here !

Alliedwallet

It accepts all major credit and debit cards and almost every international currency. They have been established since 2002 and, are currently working in over 190 countries, thus having one of the best custumer support features.

Apple pay

Apple pay app is the oldest e-wallet app on the market and it accepts a large number of locations and card types. The connection is made simply, via phone with apple pay limit. Do you have questions - how to use apple pay? Or how to set up apple pay? Or how does apple pay work? Or how to pay with apple pay? Click here ! To get apply pay support in order to set up apple pay.

Brinks

It’s a mastercard app that lets you load money on the phone and manage your money on the go. It can perfectly work to send and receive money, as well as make online payments.

Cardfree

This is an integrated commerce system which includes gifts,loyalty, offers, order ahead, databases, complex data analytics. It is also ahead of its many competitiors as it offers the possibility to integrate with other mobile digital wallets on the market.

Chase pay

It is an all-in-one app that combines shopping apps, coupon, food, gas, reward and wallet and payment apps, all in just one that lets you do all that from your phone. They continually develop and add new features that simplify the entire process.

Citi masterpass

This was created to simplify your life to a great extent. It ensures faster checkout with a simple click. It stores all your credit, debit, prepaid, or loyalty cards and all your personal details in one very safe place. You can send, receive money and make online payments with just a click.

Coinbase

This app is dedicated to cryptocurrency transactions. It is one of the most popular in this area. You can sell, purchase, and securely store bitcoin, ethereum and litecoin. They also have a coinbase pro feature that brings an intuitive interface that gives options like real-time order books, charting tools and data exporting. It grants you access to real-time market data.

Due

This is a global app and it offers lots of features for individuals, freelancers or companies, just to mention a few: time tracking, bill payment, invoicing, cost splitting and a unique transaction fee of for all payments.

Ecopayz

It’s easy to create an digital ewallet account here without even having a bank account or credit check. This app is in the top due to its system of bonuses and gold VIP rewards, together with all the other benefits they offer.

Epayments

This is a cost-effective platform, with very low fees. They have also developed a mobile wallet app for all around the world. The platform is divided in two major directions: personal accounts for individuals and business accounts. It works both with visa and mastercard as well as with cryptocurrency.

Famacash

It’s a platform that provides you an online wallet for storing coupons, loyalty cards, sensitive account numbers for all debit and credit cards. It notifies you regarding all promotions and deals from stores and brands.

Gatehub

This is a digital payment platform that allows you to manage your cryptocurrency. You can trade popular coins like bitcoin and ethereum, but not limited to them, and exchange them to other coins or even to US dollars or euros.

Gyft

This e-wallet allows you to manage all the gift cards and coupons and vouchers and to store them on one device, so you can make the most of them, as these things usually get easily lost.

Key ring

This is another e-wallet specialized in managing loyalty and gift cards, coupons and vouchers, which allows customers to centralize them, as well as to share shopping lists, to search promotions and deals with various stores. However this best wallet app does not allow you to manage your debit or credit cards.

Moven

It is an app that operates only on mobile devices. It allows customers to store all their payment information as well as to operate online payments in a very secure manner.

Obopay

A global mobile payment supplier, provides streamline for the entire transaction process. It brings international solutions and specific data for each industry at a time.

Passkit

It is focused towards amplifying customer engagement through its geolocation feature. This is the main objective here, to help companies increase customer engagement, to ease transactions via wide digital payment network.

Paycloud

This platform allows you to store data regarding loyalty and reward cards on your mobile device. It allows local brands and stores within your area to deliver you special promotions and offers.

Papaya

It offers a safe alternative to cash and actual credit cards. It allows customers to shop, send and receive money instantly everywhere in the world.

Paypal

Does this wallet app need any introduction? I guess this is the first name that comes to everybody’s minds when thinking about online payments. They have based their popularity and fame step by step, in the entire world. And these days almost everybody in the online space works with them, at least as one of the options. It updates constantly with latest technologies and it also offers mobile card readers and POS systems.

Payoneer

This is also one of the big ewallet apps, used at a very large scale world wide. This is a great funds transfer solution, especially for freelancers in all the industries around the globe, working with foreign partners.

Paytoo

It acts like an electronic bank account and you can use your mobile feature for bill payment, share funds, money transfer. This app allows you to make direct deposits ans secure the money, manage gift cards etc.

Puut wallet

This platform gives you the opportunity to store all your payment information as well as some personal data of your choice, through its very secure system. It also enables you to make all the usual online money transfers.

Samsungpay

This app lets customers purchase online and make payments just with a tap. This is one of the most used e-wallets on the market. It also offers the option to link several cards to the smartphone, and make payments from all these interconnected cards.

Sequent

It connects all your cards to your mobile allowing you to make payments, securely digitize all the credit or debit cards, also the transit, loyality or even ID cards.

Stocard

It is a free app that allows you to store card information on your mobile device. This app is dedicated to loyalty and reward cards.

Stripe

It is a platform that enables you to make credit card processing and transfer funds. It is mainly focused on business clients, for companies of all sizes.

Tabbedout

This app is dedicated to bars and restaurants. Their clients can view the menu and make payments through their phone. It also helps them solve the issues regarding splitting of the bills, when larger groups are involved.

Zelle

This is a payment app that allows you to make transactions directly from your bank to everybody else. It enables same-day transfers to individual and businesses that have accounts at the participating banks. And this bank network is increasing constantly, by including the most popular players on the market. Up to this point, it allows you to connect only one bank account, so it must be wisely chosen upon registration.

In final words, there are many more famous ewallet apps like paytm, amazon pay, google pay, phonepe, mobikwik, BHIM axis pay and etcetera. Each country has different famous ewallets and each e-wallet provides special offers (discounts) which attracts you to install it in your smartphone and use it for great savings. In all the cases, e-wallet system (payment method) is perfect but, the biggest con of using such app is extreme worth shopping which you must need to control yourself for worth money spend.

HOW TO USE TOUCH N GO E WALLET?

- 1 how to use touch N go E wallet

- 2 where can touch N go be used

- 3 top-up ID touch N go

- 4 how does touch N go ewallet make money? 【touch N go recharge】

- 5 auto-reload

- 6 IC touch N go卡

- 7 where to buy touch n go card?

- 8 can touch n go ewallet be used in mrt

- 9 can IC be touch n go?

- 10 touch n go ewallet what if I forget my password?

Of course, in addition to these relatively familiar ones, there are many smaller ones that we will not say. The main electronic wallet to be discussed today is touch N go E wallet . HOW TO USE TOUCH N GO E WALLET?

Touch N go should have started in malaysia relatively early. I still remember that when I used the highway or went to school, I already started using TNG. But maybe the company leaders want to save money, so they have not made further innovations. Until now, many companies have started to develop their own e-wallet, so we can also see that TNG also has its own e-wallet app. Maybe the company still wants to save money (after all, the concept of saving money is a virtue is correct), so we have paid little attention to the news of their APP (never saw the advertisement).

How to use touch N go E wallet

But it doesn’t matter. Actually, your budget is a little tight, so it doesn’t matter. Maomaochia will help you promote it for free. First, of course, we must first understand how to use this touch N go E wallet. Before you understand, we need a few more steps.

First of all, we need to download the TNG app first. If you do n’t download the app, how do you use it?

Then the second step is that your tng needs to be registered. Touch n go ewallet registration process can be done by following the steps below.

But after you have successfully registered, you can use tng ewallet.So how to download to TNG app?

Basically, you can simply download it from the store to your mobile phone, or you can also directly scan the QR code below.

After the download is complete, it is the registration stage. After entering the APP, click [create account]. At this time, you must enter your phone number, and then you will receive a one-time-password message, enter the password to enter the registration is successful.

After entering the one-time password, you have to create a 6-digit number password, which is used when you want to pay with TNG ewallet. Next, enter your name, country, ID number and email address, and then click next to finish. You can choose to bind your TNG card immediately, or later.

The following is the interface of touch N go app. This is how it looks after entering the software. This app can also transfer funds (that is, transfer money to family and friends), or scan code payment. Then below you can also see the services it supports.

After registration, you can authenticate your ewallet. The advantage is that the upper limit can reach 5000 ringgits, you can transfer money, and finally you can also open fast payment.

Where can touch N go be used

Of course, as with other e-wallets, the most basic thing is to pay for phone bills. The next step is to book movie tickets and air tickets. However, if the airline ticket is airasia, I suggest that you pay through bigpay , because you can get the maximum discount. Of course, the biggest difference of TNG e-wallet is his RFID tag. Now you can pass the toll directly through the APP RFID tag , there is no need to bring a card or the like like before. Although it is not troublesome to bring a card, this is a new feature.

In addition, it is convenient that TNG also has an automatic reload function, which means that you do not need to recharge each time. Now when your e-wallet’s money is lower than a certain amount, it will automatically topup for you, which is very convenient.

- Top up prepare phone charges

- Pay postpaid phone bill

- Pay the bill

- Book movie tickets

- Book an air ticket

- You can buy discount

- RFID

- Paydirect (used by toll)

- Parking (malaysia parking APP)

- Lacing

Top-up ID touch N go

It is very simple to bind your touch N go card to the E-wallet, just click [ADD TNG CARD], then enter the [10 numbers] on your TNG card, and then give you this take a [name] for a TNG card (for example: maomaochia.Com) and click next to add it. But if you want to bind your ID card to use as a TNG card, then you may be more distressed because the ID card number is not displayed on the ID card.

The following will teach you how to do it:

first you go to the gas station, 7-11 is still any place where you can recharge touch N go, use your ID card to recharge, and then remember to take the receipt. At this time, you find [ mfg no ] on the receipt , this is the TNG number on your ID card, and then enter this number in the e wallet to add the TNG card.How does touch N go ewallet make money? 【touch N go recharge】

While using your TNG E-wallet, you can recharge your e-wallet in several ways. So for the demonstration of touch n go recharge, this article will also demonstrate to you once and teach you how to make money with touch N go ewallet.

- First you open the software and click [reload wallet]

- Enter here and you can fill in the amount you want to recharge.

- Now you fill in the number on your debit card or credit card.

- After filling in, click 【reload now】

- It’s that simple.

There are a few points to add to everyone. If you do n’t want to topup your bank card , then you can click this [ FPX online banking ] option, which allows you to recharge via online transfer such as maybank2u, CIMB click , etc. Convenience.

Also, it is actually better to bind this bank card. Because there is also a function here [ quick payment ] that allows you to pay even when the balance in the e-wallet is not enough. The e-wallet will pay through the bank card you bind. So, even if you want to buy something with more money today, you do n’t have to worry about the money in the e-wallet.

Summarize several ways to make money with touch n go ewallet.

- The first is to use the reload PIN for recharge. These reload pins are all available in supermarkets, 7-11, or gas stations. So it’s very convenient.

- The second one is to recharge through credit card and debit card. So it is also very simple. If you want to use the card, then you can fill in your personal information and card number, and then you can easily pay directly through the internet.

- The third is to recharge through FPX. In the case of FPX, online payment is similar to maybank2u.

Auto-reload

Regarding the TNG app, I think that the most eye-catching feature is the auto reload function. Because people like us who often use TNG may recharge it once a week. It has been troublesome to recharge it all the time, but sometimes I do n’t want to recharge too much. Now with this automatic recharge function, it is really good. You can set how much less money is in your wallet (for example: 20-100), and then set how much automatic topup, the app will automatically recharge the TNG amount, so you do n’t need to go to topup all the time.

But the embarrassment is that this auto reload is only to reload your wallet, not to reload your TNG card, so when you want to take MRT or toll, if you use a card, the money in the card will not help you reload .

But do n’t be afraid, we also called TNG to confirm that it is currently an ewallet that can only auto reload TNG , but they will have this feature in the future. It is possible to automatically topup your touch n go card as we think, then it ’s true you do n’t need to worry about not enough money in the TNG card.

IC touch N go卡

Maybe you will worry about using IC to bind to touch N go card is not safe or something. In fact, you don’t have to worry about the impact after binding the card, because it will not affect you if it is tied or not. Instead, after adding your TNG card, you can see the usage history of your card.

Here you can perform edit name [change name], remove card [remove bind card] or email TNG statement [send usage record to your email].

If you are worried about what is wrong with your bound card, or if you have not used it, you can remove the bound card immediately. Just select remove card and confirm the removal.

Where to buy touch n go card?

Touch N go cards are sold in many places, generally you can buy them at gas stations, mynews stores, atms, supermarkets and tocuh 'n go customer service stations, train stations, MRT / LRT stations, 7 eleven, etc.

Can touch n go ewallet be used in mrt

The touch N go card can be used to travel in malaysia. However, touch n go ewallet cannot currently use MRT, LRT, or bus directly, or only use cards.

Can IC be touch n go?

The identity card (IC) identity card can be used as a touch n go card, and can also be used to bind touch n go ewallet.

Touch n go ewallet what if I forget my password?

If your touch n go ewallet has forgotten your password, then you can log in to the software, click the head in the upper right corner, then change the pin password, and then click forgot password.

Cryptocurrency wallet guide: A step-by-step tutorial

Use this straightforward guide to learn what a cryptocurrency wallet is, how they work and discover which one’s are the best on the market. If you are looking for something a bit more in detail about cryptocurrencies please check out our course on it.

What is a cryptocurrency wallet?

Enjoy a free lesson from the blockgeeks library!

A cryptocurrency wallet is a software program that stores private and public keys and interacts with various blockchain to enable users to send and receive digital currency and monitor their balance. If you want to use bitcoin or any other cryptocurrency, you will need to have a digital wallet.

How do they work?

Millions of people use cryptocurrency wallets, but there is a considerable misunderstanding about how they work. Unlike traditional ‘pocket’ wallets, digital wallets don’t store currency. In fact, currencies don’t get stored in any single location or exist anywhere in any physical form. All that exists are records of transactions stored on the blockchain.

Cryptocurrency wallets are software programs that store your public and private keys and interface with various blockchains so users can monitor their balance, send money and conduct other operations. When a person sends you bitcoins or any other type of digital currency, they are essentially signing off ownership of the coins to your wallet’s address. To be able to spend those coins and unlock the funds, the private key stored in your wallet must match the public address the currency is assigned to. If the public and private keys match, the balance in your digital wallet will increase, and the senders will decrease accordingly. There is no actual exchange of real coins. The transaction is signified merely by a transaction record on the blockchain and a change in balance in your cryptocurrency wallet.

What are the different types of cryptocurrency wallets?

There are several types of wallets that provide different ways to store and access your digital currency. Wallets can be broken down into three distinct categories – software, hardware, and paper. Software wallets can be a desktop, mobile or online.

- Desktop: wallets are downloaded and installed on a PC or laptop. They are only accessible from the single computer in which they are downloaded. Desktop wallets offer one of the highest levels of security however if your computer is hacked or gets a virus there is the possibility that you may lose all your funds.

- Online: wallets run on the cloud and are accessible from any computing device in any location. While they are more convenient to access, online wallets store your private keys online and are controlled by a third party which makes them more vulnerable to hacking attacks and theft.

- Mobile: wallets run on an app on your phone and are useful because they can be used anywhere including retail stores. Mobile wallets are usually much smaller and simpler than desktop wallets because of the limited space available on mobile.

- Hardware:wallets differ from software wallets in that they store a user’s private keys on a hardware device like a USB. Although hardware wallets make transactions online, they are stored offline which delivers increased security. Hardware wallets can be compatible with several web interfaces and can support different currencies; it just depends on which one you decide to use. What’s more, making a transaction is easy. Users simply plug in their device to any internet-enabled computer or device, enter a pin, send currency and confirm. Hardware wallets make it possible to easily transact while also keeping your money offline and away from danger.

- Paper: wallets are easy to use and provide a very high level of security. While the term paper wallet can simply refer to a physical copy or printout of your public and private keys, it can also refer to a piece of software that is used to securely generate a pair of keys which are then printed. Using a paper wallet is relatively straightforward. Transferring bitcoin or any other currency to your paper wallet is accomplished by the transfer of funds from your software wallet to the public address shown on your paper wallet. Alternatively, if you want to withdraw or spend currency, all you need to do is transfer funds from your paper wallet to your software wallet. This process, often referred to as ‘sweeping,’ can either be done manually by entering your private keys or by scanning the QR code on the paper wallet.

Are cryptocurrency wallets secure?

Wallets are secure to varying degrees. The level of security depends on the type of wallet you use (desktop, mobile, online, paper, hardware) and the service provider. A web server is an intrinsically riskier environment to keep your currency compared to offline. Online wallets can expose users to possible vulnerabilities in the wallet platform which can be exploited by hackers to steal your funds. Offline wallets, on the other hand, cannot be hacked because they simply aren’t connected to an online network and don’t rely on a third party for security.

Although online wallets have proven the most vulnerable and prone to hacking attacks, diligent security precautions need to be implemented and followed when using any wallet. Remember that no matter which wallet you use, losing your private keys will lead you to lose your money. Similarly, if your wallet gets hacked, or you send money to a scammer, there is no way to reclaim lost currency or reverse the transaction. You must take precautions and be very careful!

- Backup your wallet. Store only small amounts of currency for everyday use online, on your computer or mobile, keeping the vast majority of your funds in a high-security environment. Cold or offline storage options for backup like ledger nano X or paper or USB will protect you against computer failures and allow you to recover your wallet should it be lost or stolen. It will not, however, protect you against eager hackers. The reality is, if you choose to use an online wallet there are inherent risks that can’t always be protected against.

- Update software. Keep your software up to date so that you have the latest security enhancements available. You should regularly update not only your wallet software but also the software on your computer or mobile.

- Add extra security layers. The more layers of security, the better. Setting long and complex passwords and ensuring any withdrawal of funds requires a password is a start. Use wallets that have a good reputation and provide extra security layers like two-factor authentication and additional pin code requirements every time a wallet application gets opened. You may also want to consider a wallet that offers multisig transactions like armory or copay . A multisig or multi-signature wallet requires the permission of another user or users before a transaction can be made.

Multi-currency or single-use?

Although bitcoin is by far the most well-known and popular digital currency, hundreds of new cryptocurrencies (referred to as altcoins) have emerged, each with distinctive ecosystems and infrastructure. If you’re interested in using a variety of cryptocurrencies, the good news is, you don’t need to set up a separate wallet for each currency. Instead of using a cryptocurrency wallet that supports a single currency, it may be more convenient to set up a multi-currency wallet which enables you to use several currencies from the same wallet.

Are there any transaction fees?

There is no straightforward answer here.

In general, transaction fees are a tiny fraction of traditional bank fees. Sometimes fees need to be paid for certain types of transactions to network miners as a processing fee, while some transactions don’t have any fee at all. It’s also possible to set your own fee. As a guide, the median transaction size of 226 bytes would result in a fee of 18,080 satoshis or $0.12. In some cases, if you choose to set a low fee, your transaction may get low priority, and you might have to wait hours or even days for the transaction to get confirmed. If you need your transaction completed and confirmed promptly, then you might need to increase the amount you’re willing to pay. Whatever wallet you end up using, transaction fees are not something you should worry about. You will either pay minuscule transaction fees, choose your own fees or pay no fees at all. A definite improvement from the past!

Are cryptocurrency wallets anonymous?

Kind of, but not really. Wallets are pseudonymous. While wallets aren’t tied to the actual identity of a user, all transactions are stored publicly and permanently on the blockchain. Your name or personal street address won’t be there, but data like your wallet address could be traced to your identity in a number of ways . While there are efforts underway to make anonymity and privacy easier to achieve, there are obvious downsides to full anonymity. Check out the darkwallet project that is looking to beef up privacy and anonymity through stealth addresses and coin mixing.

Which cryptocurrency wallet is the best?

There is an ever-growing list of options. Before picking a wallet, you should, however, consider how you intend to use it.

- Do you need a wallet for everyday purchases or just buying and holding the digital currency for an investment?

- Do you plan to use several currencies or one single currency?

- Do you require access to your digital wallet from anywhere or only from home?

- Take some time to assess your requirements and then choose the most suitable wallet for you.

Atomic wallet

Atomic wallet is a new multi-asset custody-free solution for secure storage and management of BTC, ETH, XLM, XRP, LTC, and over 300 other coins and tokens. The crypto-assets and features are regularly updated. Private keys are securely encrypted on a user’s device, so one has full control over their funds. The desktop app is available for windows, macos, ubuntu, debian and fedora. Private alpha versions of android and IOS mobile apps will be released in october, 2018. Atomic wallet is a secure all-in-one, non-custodial cryptocurrency storage with a smooth and comprehensive interface. The wallet supports atomic swaps, a cutting-edge feature that helps users significantly save on fees. Atomic wallet also enables users to buy cryptocurrency with USD and EUR and exchange their assets at the best rates via changelly or shapeshift.

- Pros: handy interface, optimum privacy & security, decentralized, multi-currency, custody-free, built-in exchange, bank cards accepted, 24/7 instant support.

- Cons: not all coins support atomic swaps yet

Bread wallet

Bread wallet is a simple mobile bitcoin digital wallet that makes sending bitcoins as easy as sending an email. The wallet can be downloaded from the app store or google play. Bread wallet offers a standalone client, so there is no server to use when sending or receiving bitcoins. That means users can access their money and are in full control of their funds at all times. Overall, bread wallet’s clean interface, lightweight design and commitment to continually improve security, make the application safe, fast and a pleasure to use for both beginners and experienced users alike.

- Pros: good privacy & security, beginner-friendly, simple & clean, open-source software, free.

- Cons: no web or desktop interface, lacks features, hot wallet .

Mycelium

Advanced users searching for a bitcoin mobile digital wallet, should look no further than mycelium. The mycelium mobile wallet allows iphone and android users to send and receive bitcoins and keep complete control over bitcoins. No third party can freeze or lose your funds! With enterprise-level security superior to most other apps and features like cold storage and encrypted PDF backups, an integrated QR-code scanner, a local trading marketplace and secure chat amongst others, you can understand why mycelium has long been regarded as one of the best wallets on the market.

- Pros: good privacy, advanced security, feature-rich, open-source software, free

- Cons: no web or desktop interface, hot wallet, not for beginners

Exodus

Exodus is a relatively new and unknown digital wallet that is currently only available on the desktop. It enables the storage and trading of bitcoin, ether, litecoins, dogecoins, and dash through an incredibly easy to use, intuitive and beautiful interface. Exodus also offers a very simple guide to backup your wallet. One of the great things about exodus is that it has a built-in shapeshift exchange that allows users to trade altcoins for bitcoins and vice versa without leaving the wallet.

- Pros: good privacy & security, beginner-friendly, intuitive, easy to use, in-wallet trading, supports multiple currencies, open-source software, free.

- Cons: hot wallet, no web interface or mobile app

Copay

Created by bitpay, copay is one of the best digital wallets on the market. If you’re looking for convenience, copay is easily accessed through a user-friendly interface on desktop, mobile or online. One of the best things about copay is that it’s a multi-signature wallet so friends or business partners can share funds. Overall, copay has something for everyone. It’s simple enough for entry-level users but has plenty of additional geeky features that will impress more experienced players as well.

- Pros: good privacy & security, multisig transactions, multiple platforms & devices, multiple wallet storage, beginner-friendly, open-source software, free

- Cons: can be slow & unresponsive, limited user support

Jaxx

Jaxx is a multi-currency ether, ether classic, dash, DAO, litecoin, REP, zcash, rootstock, bitcoin wallet and user interface. Jaxx has been designed to deliver a smooth bitcoin and ethereum experience. It is available on a variety of platforms and devices (windows, linux, chrome, firefox, OSX, android mobile & tablet, ios mobile & tablet) and connects with websites through firefox and chrome extensions. Jaxx allows in wallet conversion between bitcoin, ether and DAO tokens via shapeshift and the import of ethereum paper wallets. With an array of features and the continual integration of new currencies, jaxx is an excellent choice for those who require a multi-currency wallet.

- Pros: good privacy & security, multi-currency, wallet linking across multiple platforms, great user support, feature-rich, user-friendly, free.

- Cons: the code is not open source, can be slow to load.

Armory

Armory is an open-source bitcoin desktop wallet perfect for experienced users that place emphasis on security. Some of armory’s features include cold storage, multi-signature transactions, one-time printable backups, multiple wallets interface, GPU-resistant wallet encryption, key importing, key sweeping and more. Although armory takes a little while to understand and use to its full potential, it’s a great option for more tech-savvy bitcoiners looking to keep their funds safe and secure.

- Pros: good privacy, great security features, multi-signature options, solid cold storage options, free.

- Cons: only accessible via the desktop client, not for beginners.

Trezor

Trezor is a hardware bitcoin wallet that is ideal for storing large amounts of bitcoins. Trezor cannot be infected by malware and never exposes your private keys which make it as safe as holding traditional paper money. Trezor is open source and transparent, with all technical decisions benefiting from wider community consultation. It’s easy to use, has an intuitive interface and is windows, OS X, and linux friendly. One of the few downsides of the trezor wallet is that it must be with you to send bitcoins. This, therefore, makes trezor best for inactive savers, investors or people who want to keep large amounts of bitcoin highly secure.

- Pros: good security & privacy, cold storage, easy to use a web interface, in-built screen, open-source software, beginner-friendly.

- Cons: costs $99, a must-have device to send bitcoins

Ledger nano

The ledger wallet nanox is a new hierarchical deterministic multisig hardware wallet for bitcoin users that aims to eliminate a number of attack vectors through the use of a second security layer. This tech-heavy description does not mean much to the average consumer, though, which is why I am going to explain it in plain language, describing what makes the ledger wallet nano tick. In terms of hardware, the ledger wallet nano is a compact USB device based on a smart card. It is roughly the size of a small flash drive, measuring 39 x 13 x 4mm (1.53 x 0.51 x 0.16in) and weighing in at just 5.9g.

- Screen/device protected by metal swivel cover

- Multi-currency support

- 3rd-party apps can run from the device

- U2F support

- When recovering a wallet from seed, the whole process can be done from the device without even connecting it to a computer!

- Fairly inexpensive (

- Not as advanced wallet software (no transaction labeling)

- No ability to create hidden accounts

- No password manager

Green address

Green address is a user-friendly bitcoin wallet that’s an excellent choice for beginners. Green address is accessible via desktop, online or mobile with apps available for chrome, ios, and android. Features include multi-signature addresses & two-factor authentications for enhanced security, paper wallet backup, and instant transaction confirmation. A downside is that green address is required to approve all payments, so you do not have full control over your spending.

- Pros: solid security, multi-platform & device, multi-sig, beginner-friendly, open-source software, free.

- Cons: hot wallet, average privacy, the third party must approve payments.

Blockchain (dot) info

Blockchain is one of the most popular bitcoin wallets. Accessing this wallet can be done from any browser or smartphone. Blockchain.Info provides two different additional layers. For the browser version, users can enable two-factor authentication, while mobile users can activate a pin code requirement every time the wallet application is opened. Although your wallet will be stored online and all transactions will need to go through the company’s servers, blockchain.Info does not have access to your private keys. Overall, this is a well-established company that is trusted throughout the bitcoin community and makes for a solid wallet to keep your currency.

- Pros: good security, easy to use web & mobile interface, well-known & trusted company, beginner friendly, free.

- Cons: hot wallet, weak privacy, the third-party trust required, has experienced outages.

So, let's see, what we have: south africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips. what is ewallet? Ewallet is a prepaid account that allows y at how to get ewallet

Contents of the article

- Best forex bonuses

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to get ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- Cryptocurrency wallet guide: A step-by-step...

- What is a cryptocurrency wallet?

- Enjoy a free lesson from the blockgeeks...

- How do they work?

- What are the different types of cryptocurrency...

- Are cryptocurrency wallets secure?

- Multi-currency or single-use?

- Are there any transaction fees?

- Are cryptocurrency wallets anonymous?

- Which cryptocurrency wallet is the best?

- Atomic wallet

- Bread wallet

- Mycelium

- Exodus

- Copay

- Jaxx

- Armory

- Trezor

- Ledger nano

- Green address

- Blockchain (dot) info

- 30 best ewallets

- Adyen

- Airtel money

- Alliedwallet

- Apple pay

- Brinks

- Cardfree

- Chase pay

- Citi masterpass

- Coinbase

- Due

- Ecopayz

- Epayments

- Famacash

- Gatehub

- Gyft

- Key ring

- Moven

- Obopay

- Passkit

- Paycloud

- Papaya

- Paypal

- Payoneer

- Paytoo

- Puut wallet

- Samsungpay

- Sequent

- Stocard

- Stripe

- Tabbedout

- Zelle

- HOW TO USE TOUCH N GO E WALLET?

- How to use touch N go E wallet

- Where can touch N go be used

- Top-up ID touch N go

- How does touch N go ewallet make money? 【touch N...

- Auto-reload

- IC touch N go卡

- Where to buy touch n go card?

- Can touch n go ewallet be used in mrt

- Can IC be touch n go?