Trading forex with $100

You can start the trading journey by investing a hundred dollars in xm market obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

Best forex bonuses

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

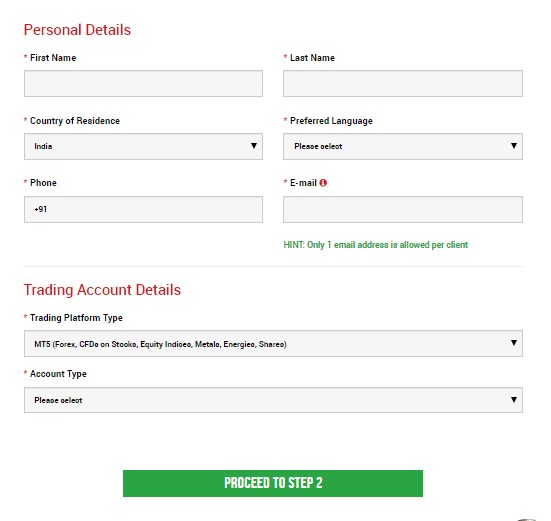

Step 2: filling the personal details

Fill all the box with accurate details

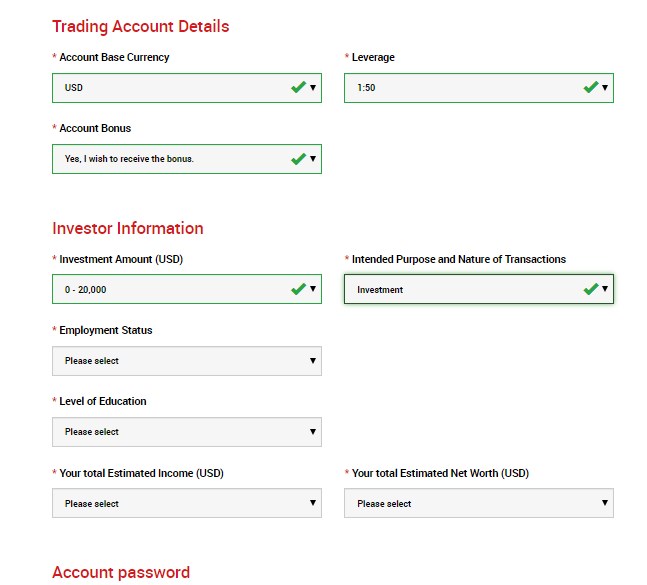

Step 3: investor information & trading account details

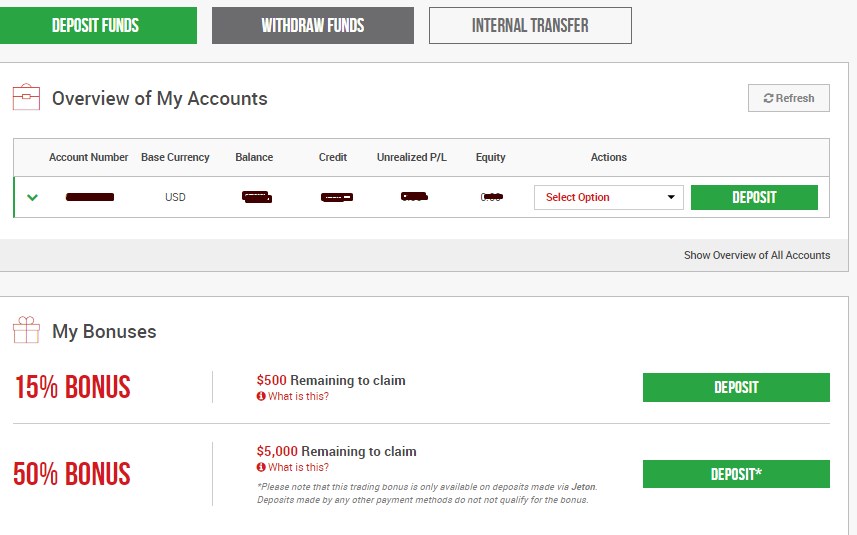

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

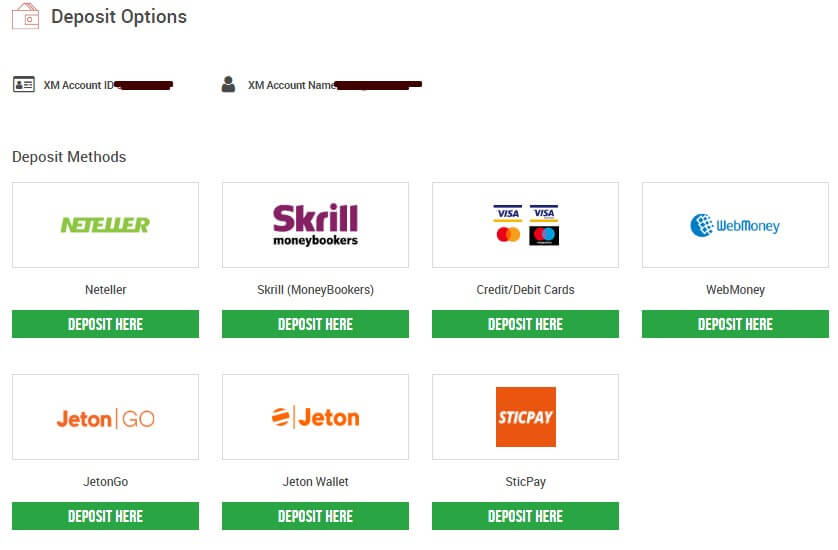

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

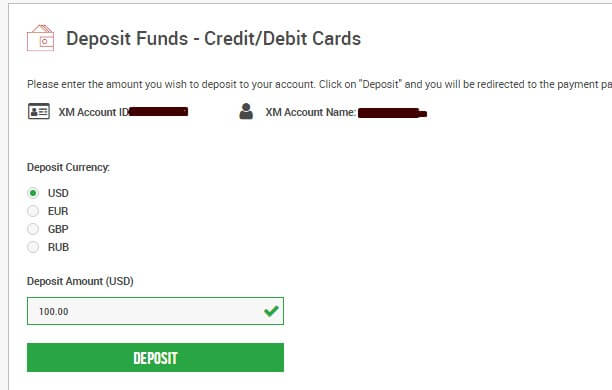

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

How to trade forex with $100

→ click here to start trading forex with $100 .

How to trade forex with just $100 as a starting point?

How to start trading with small initial capital?

How much money do I need to start trading forex?

How long do I have to wait before I start making a decent amount of money from initially trading forex with $100?

Perhaps these are just some of the questions strolling through your mind if you’re to consider trading forex as a newbie. Especially if you want to trade forex with $100!

Can you trade forex with $100?

While there is nothing certain in the world of forex trading, there are many trading possibilities to help you become a pro. One of them is to start trading forex with $100.

Trading forex with a small amount of capital is great if you’re not familiar with the forex market. The truth is that you should trade forex with $100 only when this $100 is not the only money you have to put food on the table. Because to trade forex, you have to be prepared to lose before you win!

That said, there are many other factors to consider before you start trading forex with $100. After all, there’s so much more to forex than earning money!

Invest in forex trading education , practice trading to build up some confidence and develop a consistent forex trading strategy, and always explore your emotions while trading forex.

Should you trade forex with $100?

Too many people believe that trading in the foreign exchange market requires you to start with a considerable initial amount of money at your disposal or to be already pretty wealthy.

Well, to trade forex, you should be financially stable and able to lose. Experts claim that any money you invest in forex trading should be disposable ; in other words, financial losses shouldn’t affect your daily life.

If you are new to the forex market, in particular, you can expect at least a dozen sources to bombard you with recommendations and suggestions on how to get rich trading forex and build considerable forex wealth at a rapid pace and with a low amount of money.

One of the most popular and controversial theories in the field of forex trading suggests that you can initially invest just $100 in entering the forex market, which can quickly grow to as much as $10,000 or even a million in a short period of time. Whether or not forex beginners can stand a chance of a great return is a subject of an endless list of factors. But it’s unlikely.

How to trade forex with $100

Although many people believe that a large amount of money at your disposal is much needed for starting trading forex, there are also many forex beginners coming into the forex market with relatively small trading accounts of just $100, £100 or similar amounts.

Here we should note that there are different forex trading accounts you can consider. Forex brokers often offer four types: standard, mini, micro, and nano accounts. While standard accounts require initial capital, mini accounts allow people to trade forex using mini lots.

However, one of the main fundamentals in the foreign exchange market is that the size of your account is not the most important thing in this initial stage.

Learning is what matters the most in order to benefit from the potential chance to earn money by trading forex. Hands down, you will soon find out that it is easier said than done as it takes a lot of patience and discipline to be able to witness the progress of your account.

If you’re looking for some great options for a forex trading education, make sure you check out trading education’s free forex trading course . With the right educational background and a lot of practice, you will be able to learn the art of forex trading.

On top of that, to trade forex, one should be consistent . Never trade forex out of greed or revenge! Discipline, patience, and emotional control, along with other characteristics and skills valued in the forex realm, are just a few of the fundaments that you should master.

How do you trade forex with $100 and potentially make a profit?

Let’s continue on. As mentioned above, the point of the size of your forex trading account is not that important. Even if you decide to trade forex with $100, you can definitely do so!

The size of your account just provides you with different possibilities, which makes it a function to achieving success… but also experiencing failure. Both success and failure can happen to accounts worth millions of pounds or dollars too.

But let’s assume that we all live in a perfect world and all the flashy forex trading advertisements are without a doubt going to change your life. You want to start your “home business”, you want to trade forex with $100 at first and make a decent monthly profit, you want to be this regular person succeeding on the road to the riches fast and easily.

Speaking hypothetically, all this can eventually happen with the help of forex trading. Thanks to the high leverage in the forex market , you can truly pursue paths that are not available with other sorts of investment endeavours . A quick return is something that in reality does and has happened to some people in forex trading. It is also a truth that some people tend to be treated kindly by the market and have managed to learn from their failures to make more successful forex trades.

How do you really trade forex with $100?

However, this is not the mentality you should enter the forex market with. Simply because all these hypothetical cases are just hypothetical - not something that happens on a day-to-day basis to the regular trader.

At the same time, there is no doubt that compared to other investment opportunities, forex won’t break the bank in order for you to enter the market. You can start trading forex with just $100 . Here are some tips to help you make money with $100.

1. Learn more about forex trading and its complexities

Forex is considered the biggest and most liquid financial market in the world, and some of the advantages of forex trading include:

- You can trade from home and you don’t need to rent an office.

- All you need is a computer and internet connection.

- You don’t need any employees or special inventory.

- You don’t need marketing and advertising.

- Forex operates 24 hours a day, so you can trade forex as a side job.

- You don’t need a university degree. However, a good education is highly recommended. Here’s the link to the free forex course in case you missed it.

It sounds like forex trading offers some really good opportunities, right? Well, you can explore the advantages of forex trading even if you decide to trade forex with $100.

2. Understand leverage in forex

Here we should mention that one of the main factors which attracts traders to forex trading is high leverage. That said, the primary reason why so many people fail and leave the forex market is high leverage, too.

Normally, a minimum of 50:1 leverage ratio is what the majority of all the reliable brokers out there offer . Though leverage in forex can be limited and controlled by government regulations, in some countries forex brokers may offer you a leverage ratio of 500:1 or even 1000:1!

Though all this sounds like a good way to make some quick money, be aware that the higher the leverage, the higher the possibility of losing money. So you may want to keep the risk and the leverage low.

3. Focus on the trading process, not on the money

Do not focus solely on making money. Forex trading is not a get-rich-quick scheme. To trade forex you need to invest a lot of time, resources, and patience.

Of course, we all know that the main motivation in forex trading is making a living. Making money can be a pretty powerful moving force, indeed.

But such motivation can pressure you into making rushed decisions. That’s why do not enter the forex market with the one and only goal of making quick money. Better think of forex trading as constant progress and growth instead of an easy way to monetise everything you do and plan to do.

There is a lot of truth in the saying that making money in forex is simply a result of trading it successfully. When you develop a consistent trading strategy and style , you will soon understand the wise meaning behind these words.

4. Balance life, realistic expectations & forex trading

When it comes to making money, one of the main problems that many newbies face is the way they treat forex trading. Some beginners who want to trade forex with $100 may quit their day jobs in hopes of making forex the main source of income in their lives. Some hope to become millionaires before the age of 40.

When you focus all your mental energy on monetising every step you take, though, you lose your focus of more important things, such as creating a risk management technique , mastering an effective strategy, being consistent, and having a healthy lifestyle.

5. Treat your small account the same you would treat a big one

Even if you trade forex with $100, you need to treat your account as if it is a big one . You better focus on how to be a good trader first.

From then on, it is all a step-by-step learning process, which will help you to trade with a larger account. Once you learn how to trade forex successfully, your money is more likely to follow.

6. Learn to control your emotions when trading forex with $100

No matter if you trade forex with $100 or a large amount, emotional self-control is one of the main keys to success in forex trading. A slow, calculated approach, as well as a lot of patience and discipline, is something that many good forex traders mention when asked about their success.

Interestingly enough, forex traders with smaller accounts tend to be more emotional when trading forex because they want to make their accounts grow fast. Don’t allow this urgent “need” of growing your account to lead you to over-trading, over-leveraging, over-risking, and most probably losing money consistently.

Additionally, do not forget that large accounts are not built overnight; it takes a lot of consistency and a long-term approach rather than taking big risks. Even the “big fish” in forex trading have a trading win rate of between 55% and 70% which is, as you can see, definitely not a perfect and smooth day-to-day trading experience.

In fact, when it comes to forex trading, the path to success is definitely not paved with taking a lot of high risks. Only risk 1% of your trading account . You wouldn’t risk the shirt on your back, right?

7. Build a consistent track record to improve your forex trading performance

Last but not least, having a very small forex trading account means that you need to focus on keeping a consistent track record.

In fact, good track records will help you boost your confidence as a forex trader slowly and surely - even when you trade forex with $100. Once you start making progress - and your track record progresses too - you can then consider proceeding with further developing your forex account and trading larger sums.

This step-by-step approach in forex trading is a very important one. You may have already built your own forex trading strategy and an efficient trading routine . So stick to them and don’t fall into the rabbit hole of over-analysing every piece of data and every headline you have access to.

It is also highly recommended to have a forex trading journal as it will help you stay more disciplined and organised while also providing you with valuable self-reflection insights.

How to manage a small forex trading account?

The basic principles of managing a small and a large forex account are all the same.

However, when you manage a small account you will be obviously trading smaller position sizes per trade, which can lead to dissatisfaction and impatience. In this case, keep greed and emotions out of the equation and avoid over-leveraging and trading too large. This is a common mistake many forex trading beginners tend to make, which can destroy your account faster than you can spell your name.

Focus on trading only the most obvious and confluent price action setups, adopt a more relaxed forex trading style, don’t be aggressive. This will help you manage your money and increase your chances of making a profit.

Also, every time you enter a trade, make sure that you are prepared to lose as you could potentially lose any forex trade. After all, there is a theoretical pattern of loss and gain in life, and forex trading is no exception.

Trading forex with $100: conclusion

With nano and micro forex trading accounts gaining more and more popularity these days, opening an account with $100 is definitely possible. In fact, many brokers work with an initial deposit as low as $10. Some even accept the extreme $5 or $1!

But there is a significant difference between whether you can start to trade forex with $100 and whether you should do it. Just because it is allowed and possible, does not mean that you should start with this amount. Then again, just because someone tells you $100 is too low does not mean that you should not try at all.

The leitmotif in all cases, however, is that you have to be realistic in your expectations and focus on working on a consistent and efficient forex trading strategy . Do not take high risks, do not get emotional, and do not enter obsessed with the idea of earning money overnight; simply try to define the meaning of forex trading “success” beforehand.

Key points

- As there are different forex accounts that traders can consider, trading forex with $100 is possible and potentially profitable.

- The size of your account is not the most important factor in forex trading, so treat your small account the same way you would treat a larger one.

- Education, emotional self-control, consistency, and patience are crucial to success.

- Whether you trade forex with $100,000 or $100, you should be realistic, persistent and ready to lose before you win.

Trade with the largest forex broker

Now you know how to trade forex with just $100

Whether you’re just getting started or ready to take your trading to the next level, forex.Com can help. As the global market leader, forex.Com offers tight spreads on over 90 pairs and access to 300+ markets. Learn more about what it’s like to trade with the largest forex broker and open an account with $100.

Best forex trading platform in the USA

Sign up for forex.Com and start trading forex with $100. There are no management fees or other hidden costs involved.

Forex.Com have proven themselves trustworthy within the industry over many years – we recommend you try them out.

Remember: forex trading involves significant risk of loss and is not suitable for all investors

Fxdailyreport.Com

As a beginner in the forex trading industry, the questions you often hear is regarding the minimum deposit. You see questions such as growing your $10 account into a $100 account or something more. The good news about this is that yes, you can. There are various forex brokers that offer a minimum of at least $10 in your account of better yet, don’t require any minimum deposit at all. When you find a broker that suits your needs, your trading experience runs smoothly than before. In this article, we’ll be talking about forex trading with low investment and whether or not you can trade with $10 in your account.

Can I trade forex with $10?

As mentioned earlier, the key is to find the right forex broker that lets you trade with a low deposit or no minimum deposit required. However, even when you find a broker that lets you trade with just $10, the challenge is in growing that account into a profitable one. A lot of traders get their accounts blown as fast as they started and this is for various factors such as a lack of risk management or a lack of knowledge. Trading with a $10 account will be much more challenging than trading with a $50 account as it will take more discipline, patience, and self-control. This is also where leverage comes into the picture. When your broker gives you high leverage despite having just a $10 account, it’s easy to think you can enter as many trades as you want, as long as it fits the leverage. You’ll be surprised how many traders have this mindset and this is precisely why they don’t profit from forex trading. In the following, we’ll be talking about how to grow your $10.

5 forex brokers with low minimum deposit $1 and $5

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

Do your research

You can’t enter the trading industry with zero knowledge as to how the financial market works, how to set your stop loss and take profit, or even which strategies to implement in your trades. If you’re the type of trader that expects you can rely on others for growing your $10 account, you’ll lose right from the start. Doing your research and studying about forex means that you’ll have a certain knowledge by the time you enter and exit your trades.

Be wary of leverage

There are pros and cons to high leverage so you shouldn’t be too excited when finding a broker that offers you high leverage. A lot of traders make the mistake of over trading because of high leverage, and this is what causes them to lose their profits. To trade effectively with a $10 account, enter trades gradually. Even with high leverage, practice discipline, and proper risk management with all your traders. For instance, it’s not advisable to enter 2 trades with a 0.2 lot size if you’re growing a $10 account. Proper risk management means that you don’t implement greed and emotions in your trades.

Don’t trade when the market is volatile

Advanced trades thrive when the market is volatile just because they already have adequate experience with trading. As a beginner, it’s not advisable to trade during volatile times as you might feel overwhelmed and lose heart immediately when you see your trades losing. Rather, trade during the times when the market is moving gradually and take it from there.

Never trade with emotions

In this entire list, this is something you should never do when trading. In trading with any low investment, don’t apply your emotions, or else, you’ve already lost. Trading with emotions might lead you to close all your trades when you’re losing, even when it’s just a retest, or over-trading a single currency when you have profited. You must remember to always detach your emotions when trading if you want to succeed.

In conclusion, I hope this article was able to shed insight into forex trading with low investment. While a lot of experts say it’s recommendable to deposit a high investment to truly succeed, you can still trade forex with as low as $10. If you have the right discipline, knowledge, and values, you can easily turn your $10 into $100. It may not be overnight, but it’s still very much doable.

How do I trade forex with $100?

Many new traders aspire to make large profits in the forex market. Success stories often motivate others to start trading as well. However, it’s imperative to decide on a few things before you start. At first, you need to decide on the market you will start trading in. This means choosing a market you can easily understand. Many new traders find forex trading to be flexible, easy, and adaptable.

Once you decide on the market, it’s time to select a budget and strategy. You need to ensure that your strategy aligns with the budget, which is the most important element in a market. Many traders suggest that you should start low and gradually. However, some suggest that forex trading is all about investing big. In this article, we will understand the possibility of forex trading at $100.

Can you start forex trading with $100?

Yes, you can start forex trading with a mere $100. But there is a huge difference between what you can do and what you should. If you are unemployed and only have $100 in savings, trading would be unwise. This way, you won’t be able to handle living expenses. You need a backup plan and enough money to start trading at $100.

Is it okay to trade with $100?

Trading forex for $100 is not a bad idea. It is good to trade with a low budget as a beginner because you still have a lot to learn. Forex trading is a challenging profession. It is not about winning the bets but planning and making the right decisions. You need to go slow at the start if you do not want to lose your budget.

In the start, you need to understand how things work in forex trading. Many online brokers offer accounts for beginners with a minimum budget. You can join one of these accounts and practice. Understanding the market and developing effective strategies take time. Use your initial $100 to learn essential trading skills.

How can you trade in forex for $100?

Below, you will find some steps to start trading with $100:

1. Learn about forex trading

Investing little in forex trading is a good way to start when you know nothing or little about the profession. These $100 will help you with the routine and manage your strategies to go big in the future. You need to explore different opportunities in forex trading before making informed decisions.

2. Understand the leverage

Forex trading offers high leverage that attracts a lot of traders. However, many traders quit trading because of these high leverages. Hence, you need to keep the leverage low. Higher leverages increase your chances of losing. For a better understanding, here’s how leverage works.

3. Understanding the process takes time

Initially, you should trade to understand the process rather than make money. Seeking money is where most traders go wrong. Your primary motivation should be to learn the process and make better decisions. Forex trading is about consistent growth and progress that you can achieve when developing an effective trading style and strategy.

4. Consider the small account equal to big ones

When you invest $100 in your forex account, you should consider it equal to the others. People with the bigger picture and huge profits in mind do not find interest in their $100 account. However, they are in their learning stage and need to focus more on strategies than earning big.

5. Control your emotions

With a $100 account, you need to control your emotions. Self-control is essential in forex trading. Whether you are trading a lot or a little, you need to stay patient and keep up with the strategies. Don’t rush to make more profits until you are ready.

6. Keep track of your actions

To enhance your performance, you need to keep track of your progress. A good record will increase your motivation. However, a poor record will help you understand and figure out your mistakes so you can avoid them in the future. This strategy will help improve your performance drastically.

Conclusion

When deciding to trade forex, you need to clear your thoughts and develop a mindset around managing a $100 budget. This way, you build expectations to learn. This $100 experience acts as a building block in your trading career. If you are still confused about trading at $100, you should know that going little will increase your success rate and help you learn more without losing much. However, you should consider your financial status before making any decisions. If you are financially unstable, you should avoid investing in forex trading.

How to start trading forex with $100

No wonder why inexperienced investors’ first question is usually this: can I start trading forex with just $100? Moreover, often, they wonder if it is possible to earn a living by trading forex? Well, the answer to both questions will be explained in this article. Also, we will share with you five examples. So, keep on reading.

Can I start trading forex with $100?

Yes, you can. Typically, margin trading allows traders to open trades with small amounts of money. However, the live trading is different than trading on a demo account. You may lose through the first or even the second $100 in less time than it took to deposit it. Generally, when it comes to trading forex, you should not fear any loss. Each loss can help you learn from your mistakes.

So, if you have lost $100 a couple of times, and you haven’t quit, then you are ready to experiment with other strategies. Moreover, the more you practice your skills in live trading sessions, the sooner you will start earning money. First, you will double the account balance. Then you will increase it again. When it comes to trading forex, time and experience are crucial factors. Also, the key is to learn why you failed. By acknowledging your weakness, you can adjust accordingly.

Further, many experienced investors advise beginners to keep notes on their trades. This way, you can keep track of your weaknesses and strengths over time. For example, have your emotions affected your decision making? What was the feeling you felt when you had trades open? Also, when you write everything down, you will notice if you need to learn how to control your emotions.

Is it possible to earn a living by trading forex?

Well, the answer here is the same. Yes, you can. However, it will take years before you can reach this level. Moreover, when you are not afraid to lose money in order to practice, and you are not a quitter, then you can indeed master your trading skills and eventually start earning a living.

By grasping all the little details, there will come a time when you will double your account balance. Also, it is a good indicator if you manage to double your account twice. Once you achieve this, you might be ready to start working towards earning your living by trading forex.

However, don’t expect to achieve excellent results in a month or two. It might take up to 2 years or even longer to actually see positive results. So, be patient as it takes time. Otherwise, you might experience a spectacular failure.

When should I start trading forex?

Many investors make the same mistake of not practicing enough on a demo account. Before you risk your own money, it’s wiser to master your trading skills. In other words, you should first open a demo account. By doing so, you can try out your strategies with virtual money. Also, you can try the strategy of other experienced traders.

However, the first thing you need to do is to learn the basics of forex trading. Understand how the market works. Practice on a demo account because it allows you to become familiar with trading. Also, it will help you decide on whether you want to put in actual money into your traders or you prefer using virtual funds.

Further, you should invest real money if you have done your homework first. Meaning you:

- Have learned all terms and you understand how they are co-related

- Know how the market works

- Have learned the basics of forex trading

- Know the bid-ask spread you are facing

- Have practiced on a demo account for a while now

- Study the charts

- Have understood the volatility and risk involved

Bottom line

The main reason why people start trading forex is due to the high possibility of being able to make profits. Not only this, but it is possible to earn profits with only a small capital outlay. However, many essential aspects need to be covered first. Otherwise, you will lose everything you have invested in your account balance.

How to start forex trading with $100 and turn it into $10,000

The thing I like most about forex trading is that you can start trading forex with as little as $100 and turn it into $10,000 or even more. In fact, you can open a free demo account and start trading with no money at all. So, how do traders increase their wealth by investing $100?

No forex trading experience: what should I do?

If you are new in the forex industry and you want to become a successful trader, but you unsure how, then you have come to the right place.

Luckily, if you have no previous trading experience, some platforms offer free demo accounts, and you should consider opening one before you begin trading. Moreover, most demo accounts require a $1 deposit or no deposit at all.

Can I gain trading experience without losing money?

By opening a demo account and placing orders there, you will gain trading experience without putting money into an account straight away and risking them. The easiest way for new forex traders to lose their money is,

The most significant advantage of demo accounts is that you still get access to the same markets and trading tools. This way, you will learn how to analyze the market correctly. Also, you will have more time to see how the market works, and there is no risk of losing your money.

Once you have more knowledge, you are more confident, and you understand how to place trades and how to manage risk, then you are ready to open a live trading account.

How do I choose a brokerage for my live trading account?

When it comes to finding the best brokerages, it is essential to do in-depth research. You have to see what each brokerage has to offer, what trading tools the brokerage has to offer, and, most of all, whether a significant oversight body regulates the brokerage.

Your goal is to find the most trusty brokerage before you open an online account.

Can I start trading with $100?

Yes, you can. Opening an online account with $100 is a good start if you want to see your money grow to $10,000. But to ensure your trading success, make sure you follow these steps before you place an order:

- Learn as much as you can about trading

- Understand the basics of FX terminology

- Research, study and analyze the market

- Learn more about the economy of the country

- Learn how to calculate profits properly

- Learn more about the major forex pairs, their nicknames

- Learn how to read forex currency pair quotes

- Create a trading strategy and follow it!

If you do follow the mentioned above steps, you will be one step closer to achieving your goal of turning $100 into $10,000. It won’t happen overnight, so you have to be patient.

Why starting with $100 is A smart choice?

The answer is easy: risk management reasons. Before you place an order, it would be smart to stick to risk management rules. Experienced traders don’t risk more than 1% of their accounts. And that’s how they don’t lose a lot of money.

So, if you begin with $100, then your risk should be $1. Some people might say that $1 won’t help you make money, but you always have to keep your interest!

Imagine what will happen if your risk is $100, and your investment choice was terrible. How will you be able to make $10,000 if you have $0 in your account?

Bottom line

Be patient, invest smart, and over time, your account will grow, and you will reach your goal of making $10,000 with $100.

If you invest more than $100, but you still use everything I shared with you in this article, your chances of achieving your goal sooner, will be higher. When it comes to trading forex, money makes money in this industry.

To learn more about each of the steps I mentioned above, or which are the three best brokerages in 2019, you should read this insightful article.

How you can trade forex with less than $100

Forex is one of the biggest reliable and excellent online trading strategies. Globally, there are a variety of investors who are actively using this platform to obtain substantial gains through a day of abandonment. However, the specific way to focus on gains is to enter the appropriate system approach.

Before entering the legal machine stage, new immigrants will face a complex task. With a strong education, you can make real-time assessments of the fate-changing style and reliable investment amount.

Therefore, all of these will be on the road to victory without delay. In this case, many shoppers worry about the large number of funds used for foreign exchange trading in places where there are few funds. In this case, we will not tell you by investing more than $ 100 now that you will no longer face any risk factors.

Forex trading

If you understand the leverage walk method, then you can become a successful trader without any problems, which is the most important. If you forget the leverage in some buying and selling techniques, then it will lead to disaster. If you are willing to accept the risk of buying and selling with huge amounts of money, it may also result in cross losses. If the industry benefits you, you can also take advantage of it.

Now, your daily currency duties do not need to intervene with foreign exchange trading funds or capital.

You should no longer invest heavily in foreign exchange trading, because if something goes wrong, it may even bring your survival to a halt.

Please don’t forget to no longer bear any risk restrictions to open a trading or make investment beyond the stage.

This is not to adopt the method of getting rich quickly. You want to realize how smooth it is by turning $ 100 into more than a thousand dollars or more in foreign exchange transactions. This is usually risky and maybe a step. Leverage can be comparable and similar to a double-edged sword, making your income more likely.

It can make you fall and take your risks into the abyss. If you change to a terrible route, you can use leverage to amplify your loss of ability.

The leverage of trading at 100: 1 allows you to choose a trading volume of up to 10,000 USD, and may charge every 100 USD to your account. If this is a 100,000 USD purchase and promotional miles, then you can get 1000 USD in your account. With the help of leverage, you can make a considerable profit without problems, which is equivalent to injecting $ 100,000 into your trading account. In addition, even leverage can cause significant losses to your buying and selling accounts.

$ 100 trading account

Please find out the biggest basic factors in the way that the resident conducts foreign exchange transactions and starts shopping and promotional accounts:

Margin calculation area

The most critical battle in purchase and promotion is the calculation between two economic gadgets, the dollar or the euro. You have to remember to invest cash in US dollars. You need to find out how to use the euro to get the marginal value of the final necessities. Please work hard to deal with your marginal costs and 5 micro-quality to get the final cost (about 60 USD).

Current margin cost calculation – you can place the most convenient buying and selling options to generate excellent value as well as margin calculation.

Find out fairness-you want to study your current position and continue in accordance with its principles. The overall value may be equal to your fairness.

Find your unfixed margin – you can get the calculated equity by subtracting the current margin fee from the available margin rate.

Obtaining margin level – the future trading consequences may depend on the percentage of margin level.

You can effortlessly study the above-mentioned reliable steps to provide reliable transactions for your foreign exchange trading account to generate valuable exchanges.

Procrastination of war:

The most important step in foreign exchange trading, everyone knows that successful traders in the market will never delay. Take full advantage of every opportunity you get, you can benefit from the trading goals without any difficulty.

Never postpone any responsibilities or priorities until the next day, until today it needs to be completed. You can redeem by using a demo account, which will help you cope with procrastination effortlessly.

Keep running in the following directions:

The well-known quote “sport makes us perfect”, you can exercise in a comparable way with the help of a demo account to enjoy. This will be very useful for identifying the operation method of foreign exchange trading structure and knowing its talents. Analyzing foreign exchange transactions will take a lot of effort, trial, and time.

Reputation:

Please maintain self-awareness in foreign exchange advertising and marketing. You need to study the dangers you worry about and get the most benefits in a safe area. For this, you can use useful resources to think about evaluating projects and dreams. This is a crucial step, mainly for novices who like to start buying and promoting foreign exchange.

Funds

Super-modern traders should start foreign exchange trading with minimal capital and gradually increase investment from all profits, without any additional deposits. Can’t earn income, or don’t make money.

You can maximize the quantity by fulfilling the transaction without difficulty. With minimal investment, you can reduce the risk of huge losses caused by large amounts of cash.

Unmarried currency pair

Foreign exchange transactions related to foreign exchange transactions are very complicated due to their personal stubbornness, distinctive characteristics, and unpredictability of the market. In the global economy, there is not much difficulty in becoming a superb dealer. You can start with familiar unmarried foreign exchange pairs. Choose the world’s giant or your US is always a better choice for foreign exchange trading.

How to become a day trader with $100

Damyan diamandiev

Contributor, benzinga

Jump straight to webull! Now open to ALL stocks.

Day trading is one of the best ways to invest in the financial markets. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday.

Trades are not held overnight. Day traders profit from short term price fluctuations. Day traders can trade currency, stocks, commodities, cryptocurrency and more.

You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. We’ll show you whether it’s possible to start trading with a very small amount like $100.

How to start day trading with $100:

- Step 1: select a brokerage. Finding an online broker that allows you to trade in the style you want will help you successfully conduct trades.

- Step 2: pick the securities you want to trade. Do your research and decide what you want to start trading.

- Step 3: work out a strategy. Before you begin making your trades, decide what strategy you want to stick to.

- Step 4: begin trading. Once you have your account set up and have taken the necessary prerequisite steps, you can start day trading.

Can you day trade with $100?

The short answer is yes. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use.

Technically, you can trade with a start capital of only $100 if your broker allows. However, it will never be successful if your strategy is not carefully calculated. For this reason, you should support the idea to trade with only $100 through detailed research, a thorough calculation of your strategic outcomes and strict risk management rules.

How to start day trading with $100

We’ll show you what to look for in a broker, how to choose security, how to build your strategy and how to open your first trade.

Step 1: find a brokerage

If you want to trade successfully with only $100, your broker needs to meet some requirements from your side.

Charges: it’ll be better if your broker charges you based on spread rather than based on commission. Commission-based models usually have a minimum charge. Trading small amounts of a commission-based model will trigger that minimum charge for every trade.

The spread fee is the better alternative, as it charges you considering the amount you trade.

Minimum deposit: your broker of choice should have a minimum deposit requirement of $100 or less. Otherwise, you can’t deposit just $100.

Leverage and margin: if you trade with only $100, day trading price ticks are insufficient to give you reasonable earnings. Imagine you invest half of your funds in a trade and the price moves with 0.2% in your favor:

$50 x 0.002 = $0.1 profit

This is why you need to trade on margin with leverage. If you are in the united states, you can trade with a maximum leverage of 50:1. If you are in the european union, then your maximum leverage is 30:1.

This is due to domestic regulations. The maximum leverage is different if your location is different, too. In australia, for example, you can find maximum leverage as high as 1,500:1.

Here are a few of our favorite online brokers for day trading.

Best for

Overall rating

Best for

1 minute review

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best robinhood alternatives.

Best for

- Commission-free trading in over 5,000 different stocks and etfs

- No account maintenance fees or software platform fees

- No charges to open and maintain an account

- Leverage of 4:1 on margin trades made the same day and leverage of 2:1 on trades held overnight

- Intuitive trading platform with technical and fundamental analysis tools

Best for

Overall rating

Best for

1 minute review

Tradestation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Tradestation’s app is also equally effective, offering full platform capabilities.

Best for

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating tradestation’s platform more difficult than it should be

Best for

Overall rating

Best for

1 minute review

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

Best for

Overall rating

Best for

1 minute review

Moomoo is a commission-free mobile trading app available on apple, google and windows devices. A subsidiary of futu holdings ltd., it’s backed by venture capital affiliates of matrix, sequoia, and tencent (NASDAQ: FUTU). Securities offered by futu inc., regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Moomoo is another great alternative for robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, international trading, research and analysis tools, and most popular of all, free level 2 quotes.

Get started right away by downloading moomoo to your phone, tablet or another mobile device.

Best for

- Free level 2 market data for all users who open an account

- Commission-free trading in over 5,000 different stocks and etfs

- Over 8,000 different stocks that can be sold short

- $0 contract fee for trading options, no commission either

- Strong market data and analysis tools with over 50 technical indicators

- Access trading and quotes in pre-market (4 a.M. To 9:30 a.M. ET) and post-market hours (4 p.M. To 8 p.M. ET)

- No minimum deposit to open an account.

- Active trading community with more than 100,000 app users

Step 2: choose securities

Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace.

You can achieve higher gains on securities with higher volatility. Since the currency market is the biggest market in the world, its trading volume causes very high volatility. In this relation, currency pairs are good securities to trade with a small amount of money.

But which forex pairs to trade? Since your account is very small, you need to keep costs and fees as low as possible. You can keep the costs low by trading the well-known forex majors:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- NZD/USD

- USD/CAD

The major currency pairs are the ones that cost less in terms of spread. At the same time, they are the most volatile forex pairs.

Step 3: determine strategy

Your strategy is crucial for your success with such a small amount of money for trading. You need to consider when to trade, the amount you’ll invest in each trade, when you’ll enter a trade, how you will manage your risk and when you’ll exit a trade.

When to trade: A good time to trade is during market session overlaps. For example, the EUR/USD and the GBP/USD are most volatile in the time when the london markets and the U.S. Markets are both open.

The U.K. And europe conduct transactions in GBP and EUR and the U.S. Conducts transactions in USD. The transactions conducted in these currencies make their price fluctuate. Since the GBP, the EUR and the USD fluctuate, the GBP/USD and the EUR/USD forex pairs are very volatile at this time.

This is an image that shows the forex market overlaps. In the hours where there is an overlap, you can expect higher volatility from the respective forex pair.

Amount per trade: the best approach is to invest a large amount of your $100 in each trade but to have no more than a single trade open. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. You can invest 60% of your bankroll in each trade and at the same time to have no more than one trade open.

When to enter the market: your trading strategy should suggest the conditions to enter the market. You can use various technical indicators to do this. Some of these indicators are:

- Candle patterns

- Chart patterns

- Oscillators

- Momentum

- Volume

- Volatility

You can use such indicators to determine specific market conditions and to discover trends. You can aim for high returns if you ride a trend.

Risk management. When you’re trading in normal conditions with a comfortably high amount of money, you shouldn’t risk more than 2% of your capital per trade.

However, since you have only $100, you can take a bit higher risk as your losses are limited to only what you have in our account. A risk of 3% per trade is reasonable for these trading conditions.

Three percent risk per trade means $100 x 0.03 = $3 maximum risk in each deal. You can trade with a maximum leverage of 50:1 in the U.S. This will give you a total buying power of 50 x $100 = $5,000.

If you invest 60% of your bank in each trade, this is $3,000 per trade. Your stop-loss order should be at a percentage distance from your entry price equal to 3/ 3,000 = 0.001 or 0.1%. In other words, if you buy the EUR/USD at 1.1450, your stop-loss order should stay 0.1% below the entry price.

You can calculate it this way:

1.1450 x (1 – 0.001) = 1.1439

1.1439 is the level of your stop-loss order once you take these conditions into consideration.

Conditions to exit a trade: the $100 bankroll trading requires a more aggressive approach, so here are some different exit rules.

Use a trailing stop-loss order instead of a regular one. Still stick to the same risk management rules, but with a trailing stop. Catching a trend will put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit.

In this case, you will only exit the market if the price hits your stop and you will stay in the market as long as it is trending in your favor.

Success rate and profit-loss ratio: if you manage to get 3:1 profit-loss ratio with 30% success rate, you risk $3 per trade aiming for $9 and you succeed in only 30% of the trades, you will generate around 7% profit per 10 trades using the above rules. Here’s how your account will look after 1,000 trades:

If your account grows by 7% per 10 trades, your $100 bankroll will grow to more than $80,000 after 1,000 trades. Of course, this is a very straightforward example and 7% per 10 trades is a big profit, which not many traders achieve.

The suggested strategy involves only one trade at a time due to the low initial bankroll. You can hardly make more than 10-15 trades a week with this strategy. If you conduct 2 trades per day, you’ll need 500 trading days to reach these results with the above success rate. Since every trading year has about 250 trading days, you will need 2 years of strict trading to achieve these results.

Notice that the above trading rules you will need 250 trades (around half a year) to reach $500 and 360 trades (around 9 months) to reach $1,000 in your bank.

On each of these milestones, you can always consider a different strategy where you can trade with less risk (1-2%), invest less in a single trade (25%-30%) and open more than one trade.

Step 4: start trading

Next, create an account. Navigate to the official website of the broker and choose the account type. Remember, you’re looking for an account that lets you trade with only $100 on margin. You’ll need to submit personal details like email, address and phone number and will receive an email message to confirm your email address.

You’ll need to send some identity confirmation, which is a standard procedure and may need to provide some income information, though this is unlikely to happen if you want to fund your account with only $100.

After you confirm your account, you will need to fund it in order to trade. Use a preferred payment method to do so. Download the trading platform of your broker and log in with the details the broker sent to your email address. Make sure you adjust the leverage to the desired level.

Navigate to the market watch and find the forex pair you want to trade. This could be the EUR/USD or the GBP/USD. Open the trading box related to the forex pair and choose the trading amount. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk.

Get started day trading

Day trading could be a stressful job for inexperienced traders. This is why some people decide to try day trading with small amounts first. Trading with a bankroll of only $100 is possible but will require some extra amendments in order to reflect your account on an acceptable pace.

You can always try this trading approach on a demo account to see if you can handle it. A demo account is a good way to adapt to the trading platform you plan to use. You can $100 account trading once you feel comfortable on the demo account.

Turn to webull

0 commissions and no deposit minimums. Everyone gets smart tools for smart investing. Webull supports full extended hours trading, which includes full pre-market (4:00 AM - 9:30 AM ET) and after hours (4:00 PM - 8:00 PM ET) sessions. Webull financial LLC is registered with and regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA). It is also a member of the SIPC, which protects (up to $500,000, which includes a $250,000 limit for cash) against the loss of cash and securities held by a customer at a financially-troubled SIPC-member brokerage firm.

So, let's see, what we have: here is the exact step to start forex with $100 with MT4, MT5 platforms. Features like daily analysis, forex market research, with 24/5 helpline. At trading forex with $100

Contents of the article

- Best forex bonuses

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- How to trade forex with $100

- How to trade forex with $100 to earn more...

- Six steps to start forex with 100...

- 1.Start to invest your money

- 2.The margin calculation takes...

- 3.Now, calculate the margin that you have...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin...

- How to trade forex with $100

- Can you trade forex with $100?

- Should you trade forex with $100?

- How to trade forex with $100

- How do you trade forex with $100 and...

- How do you really trade forex with...

- 1. Learn more about forex trading and its...

- 2. Understand leverage in forex

- 3. Focus on the trading process, not on...

- 4. Balance life, realistic expectations &...

- 5. Treat your small account the same you...

- 6. Learn to control your emotions when...

- 7. Build a consistent track record to...

- How to manage a small forex trading...

- Trading forex with $100:...

- Key points

- Fxdailyreport.Com

- 5 forex brokers with low minimum deposit $1 and $5

- How do I trade forex with $100?

- Can you start forex trading with $100?

- Is it okay to trade with $100?

- How can you trade in forex for $100?

- 1. Learn about forex trading

- 2. Understand the leverage

- 3. Understanding the process takes time

- 4. Consider the small account equal to big ones

- 5. Control your emotions

- 6. Keep track of your actions

- Conclusion

- How to start trading forex with $100

- Can I start trading forex with $100?

- Is it possible to earn a living by trading...

- When should I start trading forex?

- Bottom line

- How to start forex trading with $100 and turn it...

- No forex trading experience: what should I...

- Can I gain trading experience without losing...

- How do I choose a brokerage for my live...

- Can I start trading with $100?

- Why starting with $100 is A smart choice?

- Bottom line

- How you can trade forex with less than $100

- Forex trading

- $ 100 trading account

- Margin calculation area

- Procrastination of war:

- Keep running in the following directions:

- Reputation:

- How to become a day trader with $100

- How to start day trading with $100:

- Can you day trade with $100?

- How to start day trading with $100

- Step 1: find a brokerage

- Step 2: choose securities

- Step 3: determine strategy

- Step 4: start trading

- Step 1: find a brokerage

- Get started day trading

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.