Spread tickmill

Popular comparisons feat. Tickmill the BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

Best forex bonuses

Core spreads vs tickmill

If you're choosing between core spreads and tickmill, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, avatrade, as another alternative to consider.

What would you like to compare?

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

Core spreads is regulated by the financial conduct authority. Core spreads have provided forex trading services since 2014.

Tickmill is regulated by FSA SD008. Tickmill have provided forex trading services since 2014.

Avatrade is regulated by the central bank of ireland, ASIC (australia), FSA (japan), FSB (south africa) and BVI. Avatrade have provided forex trading services since 2006.

TRADING SERVICES OFFERED

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

English, spanish, russian, chinese, indonesian, and vietnamese

English, italian, german, french, greek, hebrew, spanish, arabic, malay, russian, chinese, portuguese and dutch

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by core spreads and tickmill

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

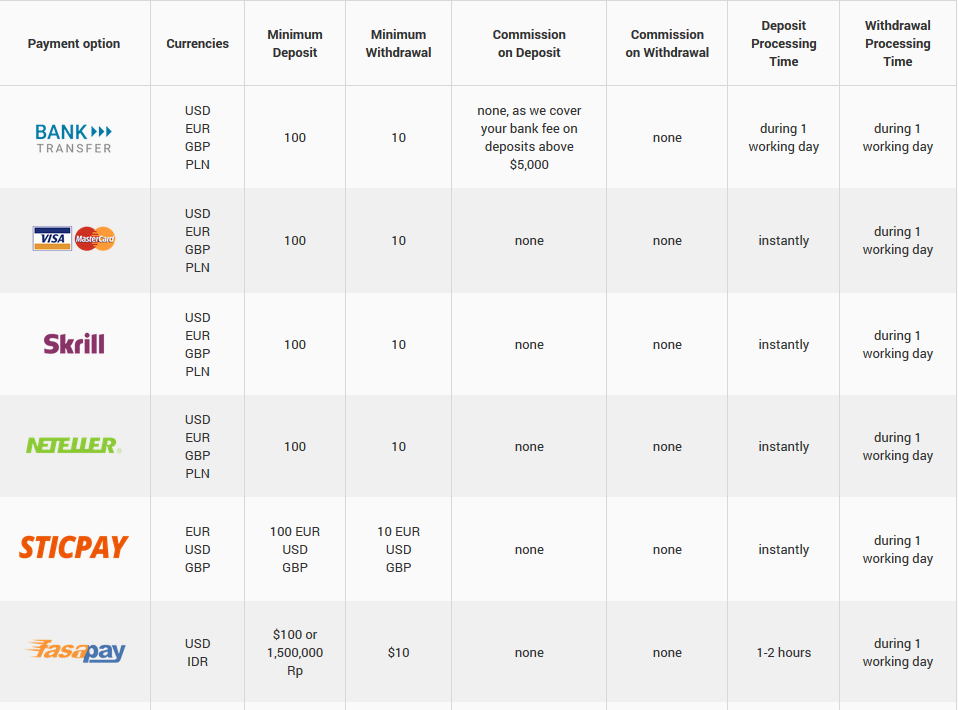

FUNDING METHODS

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

All information collected from https://www.Corespreads.Com/. Last updated on 01/02/2021.

All information collected from http://www.Tickmill.Com/. Last updated on 01/02/2021.

All information collected from http://www.Avatrade.Com/. Last updated on 01/02/2021.

Core spreads is an online trading service provider who are regulated by the financial conduct authority. To open an account with core spreads, minimum deposits start from £/$/10.

With core spreads you can trade currencies, stocks, commodities, indices. If you like to trade on the go, core spreads have iphone, ipad and android apps so you can trade from anywhere on your phone.

Core spreads offer their user friendly coretrader and the popular MT4 platforms to make your trades and also offer customer support in english.

The spreads offered by core spreads for the most popular instruments are:

0.7 EUR/USD 0.8 FTSE 100 0.4 GOLD

0.9 GBP/USD 1.0 DOW/JONES 3.0 crude oil

see all spreads

for more information about trading with core spreads, we have put together an indepth core spreads review with all the pros and cons about this broker.

Tickmill is an online forex trading service provider who are regulated by the financial services authority. To open an account with tickmill, minimum deposits start from $25 or equivalent.

With tickmill you can trade forex, stocks, indices, commodities, cfds and metals. If you like to trade on the go, tickmill have iphone, ipad and android apps so you can trade from anywhere on your phone.

Tickmill offer metatrader 4, metatrader 4 for PC & MAC, metatrader 4 for android & ios, virtual private server (VPS) platforms to make your trades and support 6 different languages.

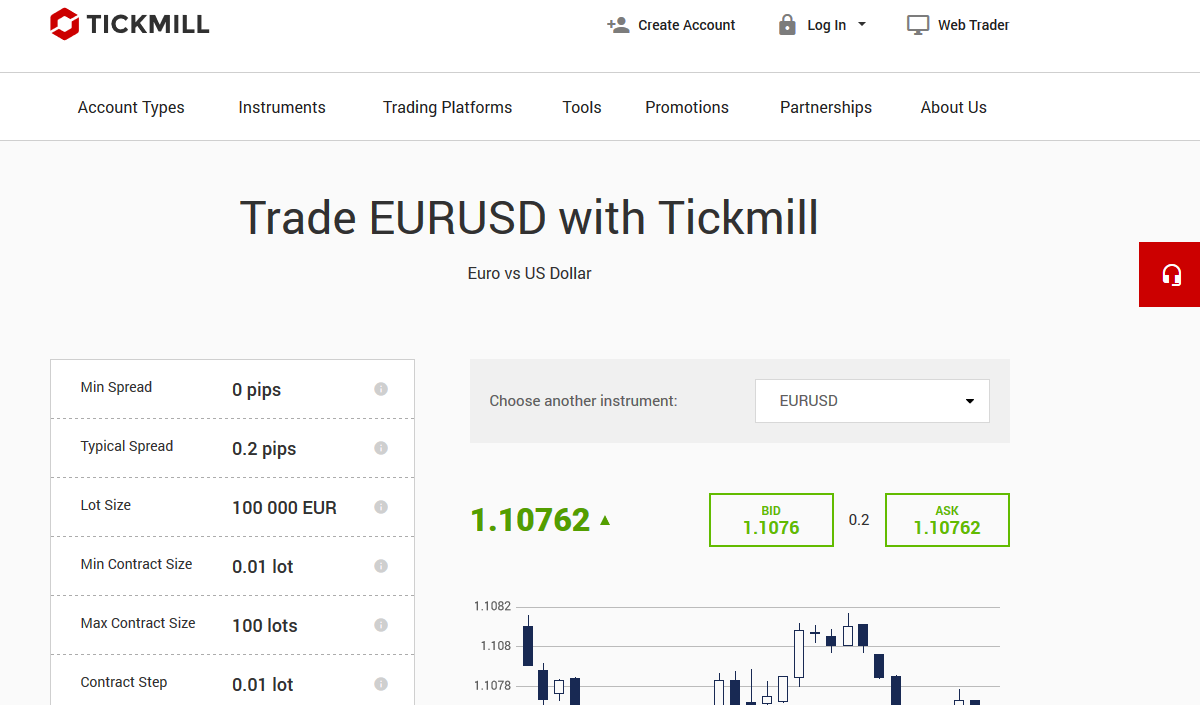

The spreads offered by tickmill for the most popular instruments are:

1 EUR/USD, 3 FTSE 100, 13 GOLD,

1.5 GBP/USD, 4 DOW/JONES, 4 crude oil,

see all the spreads here.

For more information about trading with tickmill, we have put together an indepth tickmill review with all the pros and cons about this broker.

Since 2006, avatrade have attracted over 20,000 traders to their platform. While their spreads are not the most competitive, they do offer traders a range of great features, such as guaranteed stop losses, the ability to hedge / scalp, and low margins.

For more information about trading with avatrade, we have put together an indepth avatrade review with the pros and cons about this broker.

Popular comparisons feat. Core spreads

Popular comparisons feat. Tickmill

Popular comparisons feat. Avatrade

Tickmill (ティックミル)のスプレッド一覧

Tickmill (ティックミル)のスプレッド一覧

Tickmill (ティックミル)スプレッドのメリットとは?

- ティックミル独自のSTP技術は、世界最大の流動性プロバイダーから複数なインターバンクレートをストリーミングして、最も競争力のある価格を自動的に選べ、お客様のMT4のターミナル画面に表示します。

- メージャー通貨ペアにおいて業界最低水準スプレッド(0銭/0ピップ〜)をご提供することが可能です。

- より狭いスプレッドはコストが下がり、利益を得る機会が高くなります。

注意点:

※ 上記のスプレッドは、予告なしにいつでも変更する可能性があります。

* 必要証拠金は口座のレバレッジ設定に基づいて計算されます。いくつかの取引商品のレバレッジは、口座レバレッジに同調して減少しますので、ご了承ください。例: レバレッジを500倍で設定する場合は、USDZARの最大レバレッジは10倍です。ただし、口座のレバレッジは100倍に下げると、USDZARの最大レバレッジは2倍まで減少します。

FX取引時間:

月曜日 – 木曜日: 00:00 – 24:00

金曜日: 00:00 – 23:58

全ての時間は、MT4サーバー時間となります。

株価指数とWTI

注意点:

※ 契約サイズ: 1

※ 必要証拠金: 1% (1:100)

※ 名目価値: マーケット価格のCFDの契約数 1

※ スワップ3倍の日: 金曜

※ 最小ストップ距離: 0 ポイント

※ サーバー時間はグリニッジ標準時+2時間、アメリカとヨーロッパのサマータイム中にはグリニッジ標準時+3時間に設定されています。

※ 株価指数のスワップレートは配当調整 (トータル・リターン インデックスを除く)を含む。スワップレートは定期的に、予告なしに更新されます。

※ 取引時間は予告なしに変更する場合があります。tickmill (ティックミル) の流動性プロバイダーは取引スケジュールを市場の状況に応じて調整することがあります。

貴金属の必要証拠金:

※ 金 (XAUUSD)と銀(XAGUSD)の必要証拠金は、口座のレバレッジ設定に基づいています。

※ 金のレバレッジは、口座レバレッジと同等となりますが、銀のレバレッジは口座レバレッジの4分の1となります。例えば、レバレッジが100倍の場合は、金のレバレッジは100倍、銀のレバレッジは25倍となります。

金取引時間:

月曜日 – 木曜日: 01:01 – 24:00 (休憩時間: 00:01-01:00)

金曜日: 01:01 – 23:58 (休憩時間: 23:59-01:00)

全ての時間は、MT4サーバー時間となります。サマータイムはニューヨーク時間を使用します。

銀取引時間:

月曜日 – 金曜日: 01:00 – 24:00 (休憩時間: 00:01-00:59)

全ての時間は、MT4サーバー時間となります。サマータイムはニューヨーク時間を使用します。

注意点:

※ 契約サイズ: 1

※ 必要証拠金: 1% (1:100)

※ 名目価値: マーケット価格のCFDの契約数 1

※ スワップ3倍の日: 金曜

※ 最小ストップ距離: 0 ポイント

※ サーバー時間はグリニッジ標準時+2時間、アメリカとヨーロッパのサマータイム中にはグリニッジ標準時+3時間に設定されています。

Spread tickmill

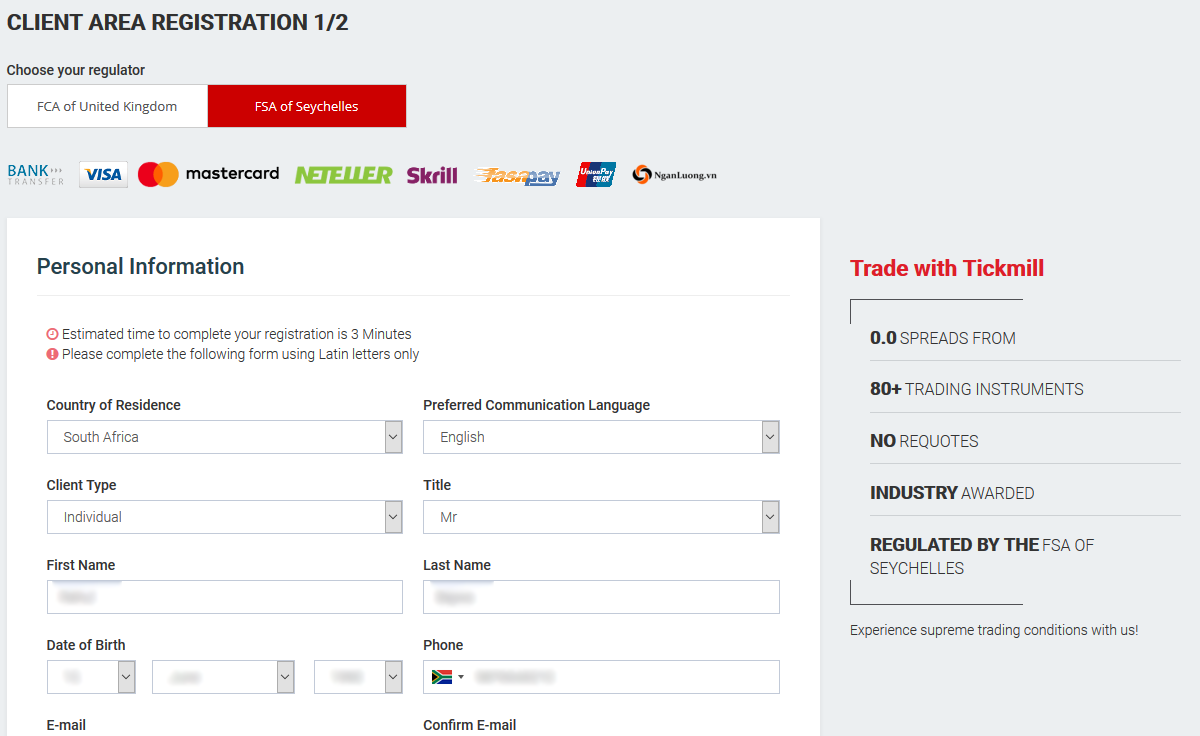

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

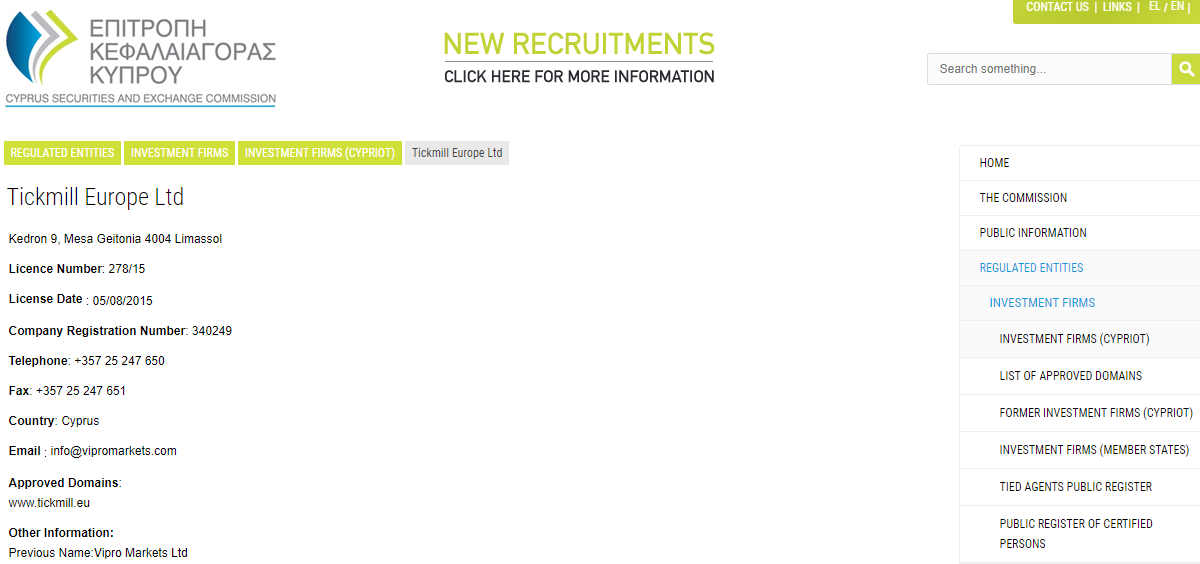

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Spread & swap

Mengetahui biaya yang terkait dengan trading anda

Spread & swap

Lihat spread dan swap tipikal kami di bawah ini.

Apa itu spread forex?

Ketika anda mulai trading, anda akan melihat bahwa anda telah diberi harga ‘bid’ (atau ‘jual’) dan harga ’ask’ (atau‘ beli ’). 'bid' adalah harga di mana anda menjual mata uang dasar, dan 'ask' adalah harga di mana anda membeli mata uang dasar. Perbedaan antara kedua harga ini yang disebut spread.

Ketika order dibuka, selalu ada pihak ketiga yang memfasilitasi pembukaan dan penutupan order tersebut, seperti bank atau penyedia likuiditas. Pihak ketiga ini harus memastikan bahwa ada aliran order beli dan jual yang teratur, yang berarti bahwa mereka harus menemukan pembeli untuk setiap penjual dan sebaliknya.

Pihak ketiga menerima risiko kerugian sementara memfasilitasi order tersebut, sehingga alasan pihak ketiga akan mempertahankan bagian dari setiap order – bagian yang dipertahankan disebut spread!

Bagaimana anda

menghitung spread?

Bagaimana anda menghitung biaya trading?

Untuk mengetahui biaya trading itu sendiri, anda mengambil nilai spread dan pip dan mengalikannya dengan jumlah lot yang anda tradingkan:

biaya trading = spread X ukuran order X nilai pip

Sebagai contoh:

perdagangan yang telah anda buka memiliki spread 1,2 pip. Dalam contoh ini, anda trading dengan mini lot yang sebesar 10.000 unit dasar.

Nilai pip pada $1, sehingga biaya transaksi adalah $1,20

Seperti yang mungkin anda kumpulkan, semakin besar tradingnya, semakin besar biaya transaksi anda!

Apa itu swap?

Penting fakta rate swap/rollover

rate swap berlaku pukul 00:00 waktu platform. Setiap pair mata uang memiliki biaya swap tersendiri dan diukur pada ukuran standar 1 lot (100.000 unit dasar). Swap diterapkan setiap malam ke posisi terbuka anda dan ketika posisi dibiarkan terbuka itu diberikan 'tanggal nilai'. Namun pada rabu malam, tanggal nilai baru untuk order yang diadakan berubah menjadi hari senin. Karena ini, swap dibebankan tiga kali lipat dari rate yang ada. Lihat swap anda di panel MT4 market watch. Anda cukup klik kanan, pilih ‘simbol’, pilih instrumen, lalu pilih ‘properties’

MULAI TRADING dengan tickmill

Mudah dan cepat untuk bergabung!

REGISTER

Selesaikan registrasi, login ke area klien anda dan upload dokumen yang diperlukan.

BUAT AKUN

Setelah dokumen anda disetujui, buat akun live trading.

BUAT DEPOSIT

Pilih metode pembayaran, danai akun trading anda dan mulai trading.

INSTRUMEN TRADING

KONDISI TRADING

AKUN TRADING

PLATFORM

EDUKASI

KEMITRAAN

PROMO

TENTANG KAMI

SUPPORT

Tickmill adalah nama dagang grup perusahaan tickmill.

Tickmill.Com dimiliki dan dioperasikan dalam grup perusahaan tickmill. Tickmill group terdiri dari: tickmill UK ltd, teregulasi oleh financial conduct authority (kantor terdaftar: lantai 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill europe ltd, teregulasi oleh cyprus securities and exchange commission (kantor terdaftar: kedron 9, mesa geitonia, 4004 limassol, siprus), tickmill south africa (PTY) LTD, FSP 49464, teregulasi oleh financial sector conduct authority (FSCA) (kantor terdaftar: the colosseum, lantai 1, century way, office 10, century city, 7441, cape town), tickmill ltd, alamat: 3, F28-F29 eden plaza, eden island, mahe, seychelles teregulasi oleh financial services authority seychelles dan anak perusahaan yang dimiliki 100% procard global ltd, nomor registrasi UK 09369927 (kantor terdaftar: lt 3, 27 - 32 old jewry, london EC2R 8DQ, inggris), tickmill asia ltd - teregulasi oleh financial services authority of labuan malaysia (nomor lisensi: MB/18/0028 dan kantor terdaftar: unit B, lot 49, lantai 1, blok F, gudang lazenda 3, jalan ranca-ranca, 87000 FT labuan, malaysia).

Klien harus minimal 18 tahun untuk menggunakan layanan tickmill.

Peringatan risiko tinggi: trading contracts for difference (CFD) dengan margin memiliki tingkat risiko yang tinggi dan mungkin tidak cocok untuk semua investor. Sebelum memutuskan untuk berdagang contracts for difference (CFD), anda harus mempertimbangkan tujuan perdagangan, tingkat pengalaman, dan selera risiko anda dengan cermat. Adalah mungkin bagi anda untuk mengalami kerugian yang melebihi modal yang anda investasikan dan karena itu anda tidak perlu menyetor uang yang anda tidak mampu kehilangannya. Pastikan anda benar-benar memahami risiko dan berhati-hati untuk mengelola risiko anda.

Situs ini juga berisi link ke website yang dikendalikan atau ditawarkan oleh pihak ketiga. Tickmill belum meninjau dan dengan ini tidak bertanggung jawab untuk setiap informasi atau materi yang diposting di salah satu situs yang terhubung ke situs ini. Dengan membuat link ke situs pihak ketiga, tickmill tidak mendukung atau merekomendasikan produk atau jasa yang ditawarkan di website tersebut. Informasi yang terkandung di situs ini dimaksudkan untuk tujuan informasi saja. Oleh karena itu, tidak boleh dianggap sebagai tawaran atau ajakan untuk setiap orang dalam setiap yurisdiksi yang mana tawaran atau ajakan seperti itu tidak diizinkan atau kepada orang yang dia akan melanggar hukum untuk membuat tawaran atau ajakan seperti itu, atau dianggap sebagai rekomendasi untuk membeli, menjual atau berurusan dengan perdagangan mata uang atau logam mulia tertentu. Jika anda tidak yakin tentang peraturan lokal perdagangan mata uang dan spot logam anda maka anda harus meninggalkan situs ini segera.

Anda sangat disarankan untuk mendapatkan saran finansial, hukum dan pajak independen sebelum melanjutkan dengan perdagangan mata uang atau spot logam. Tidak ada dalam situs ini yang harus dibaca atau ditafsirkan sebagai saran dari pihak tickmill atau afiliasi, direktur, staf atau karyawannya.

Layanan tickmill dan informasi di situs ini tidak ditujukan untuk warga negara/penduduk amerika serikat, dan tidak dimaksudkan untuk distribusi, atau digunakan oleh, siapa pun di negara atau yurisdiksi mana pun jika distribusi atau penggunaan tersebut bertentangan dengan hukum atau peraturan setempat.

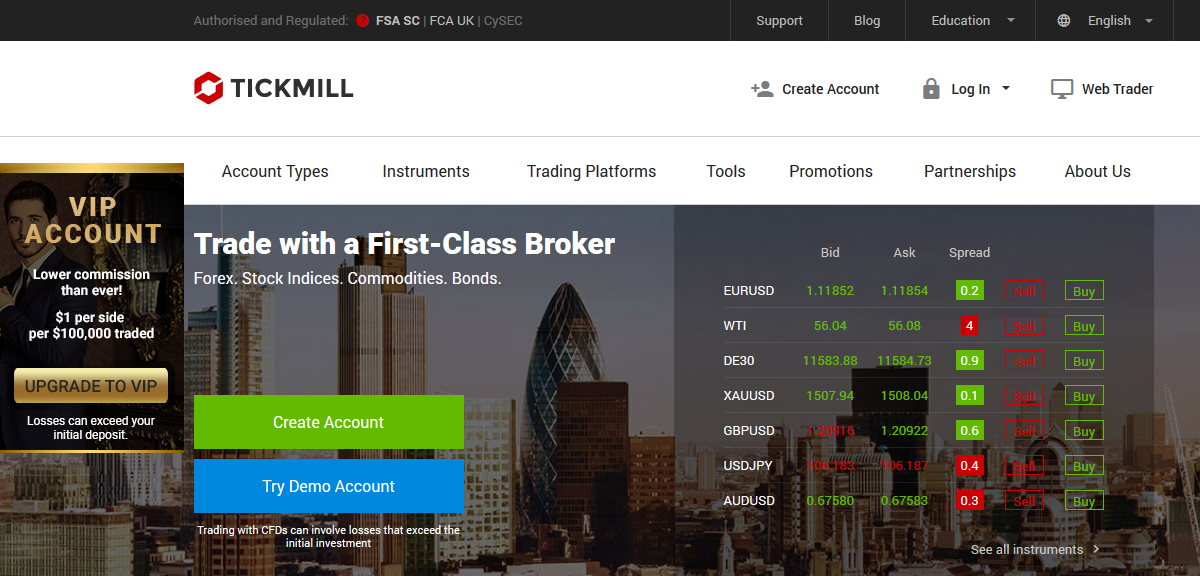

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

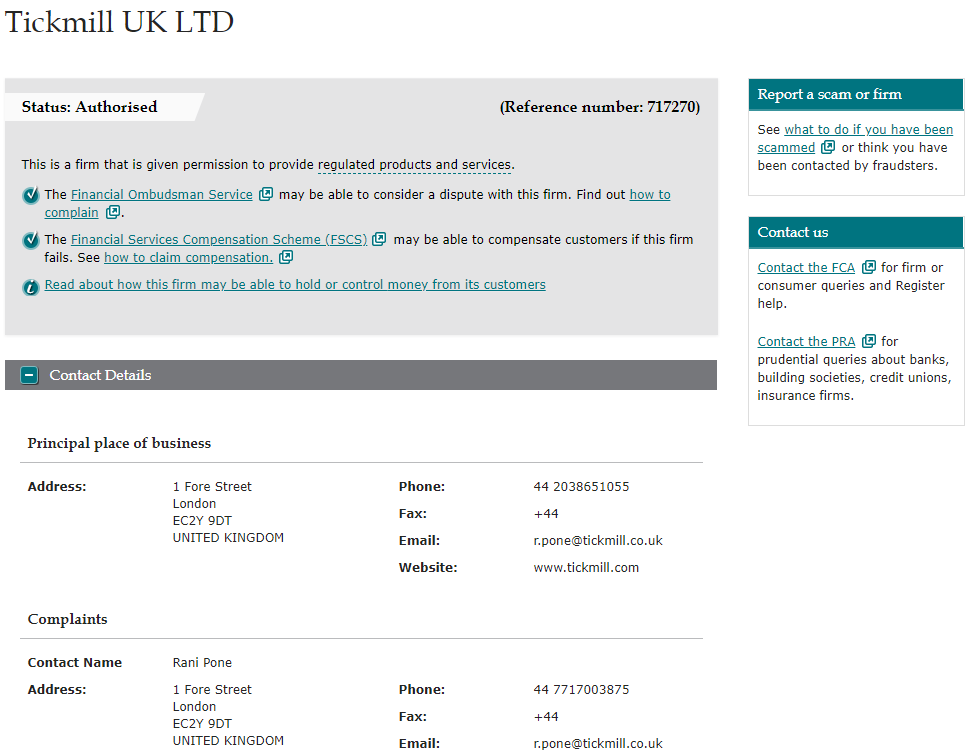

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

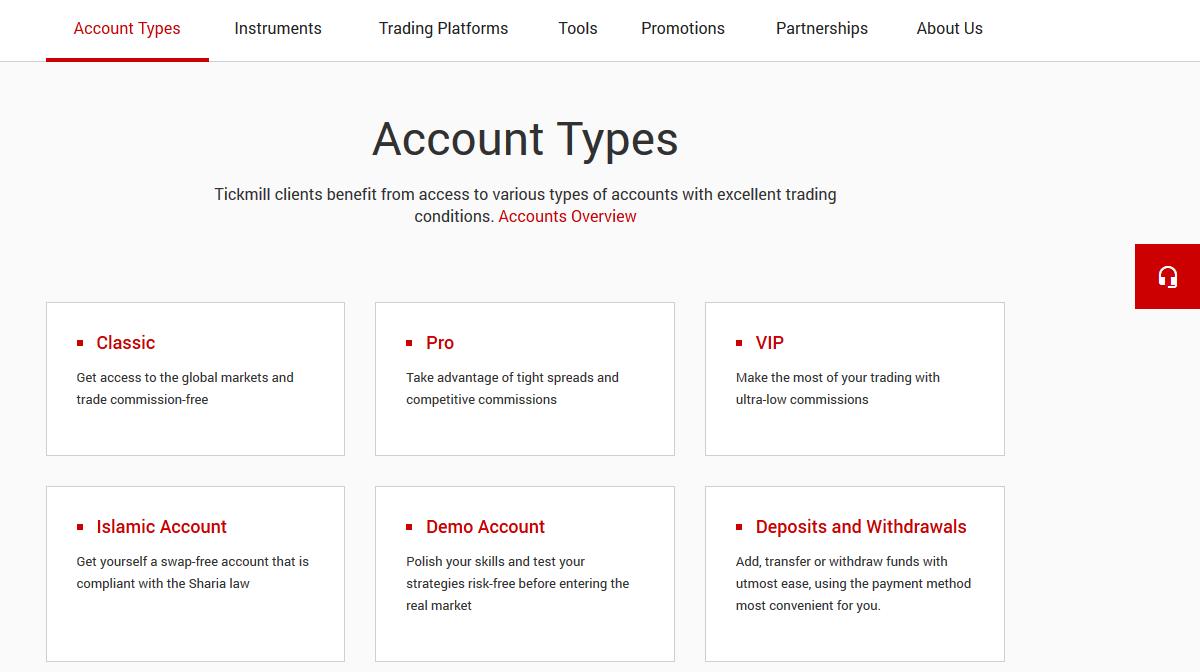

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

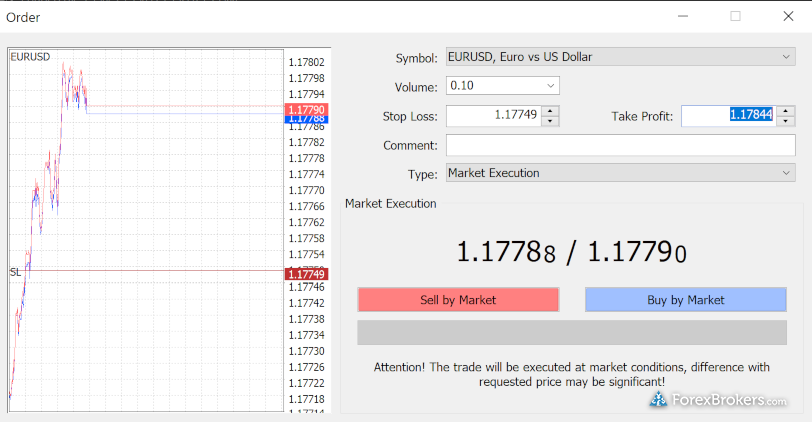

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

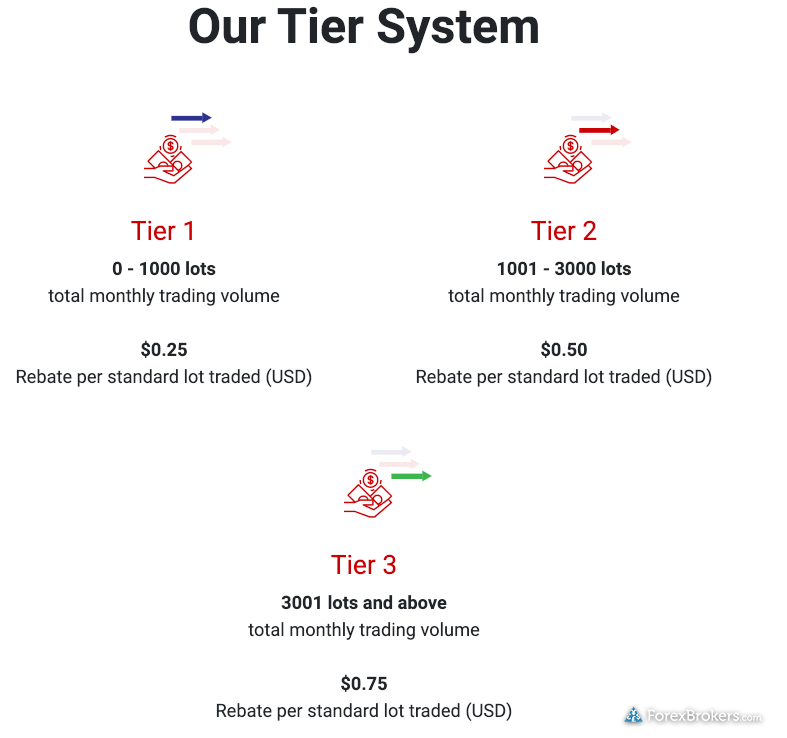

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

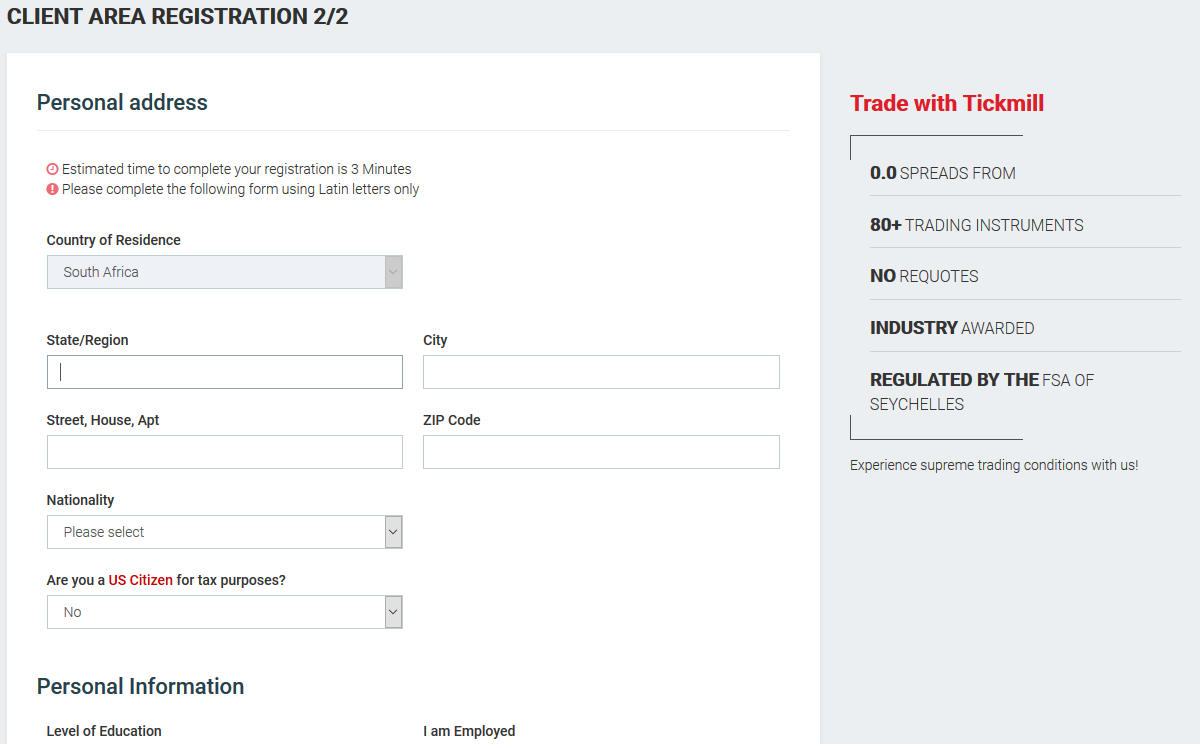

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

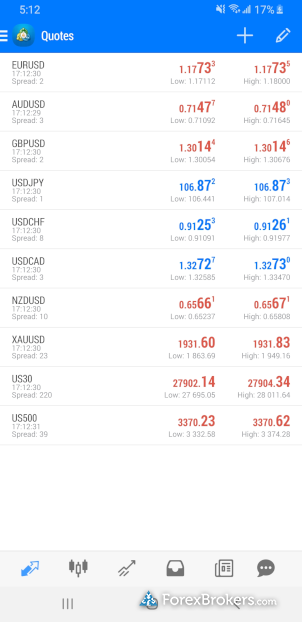

Mobile trading

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

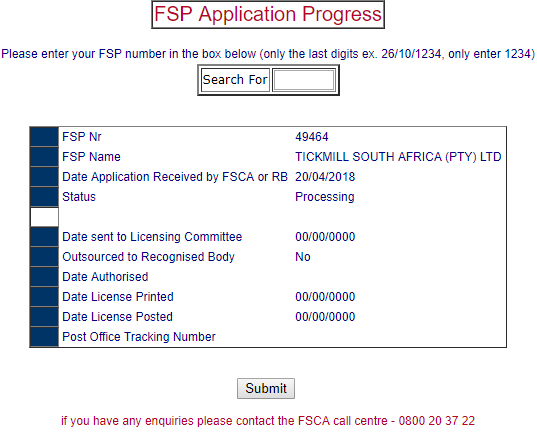

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

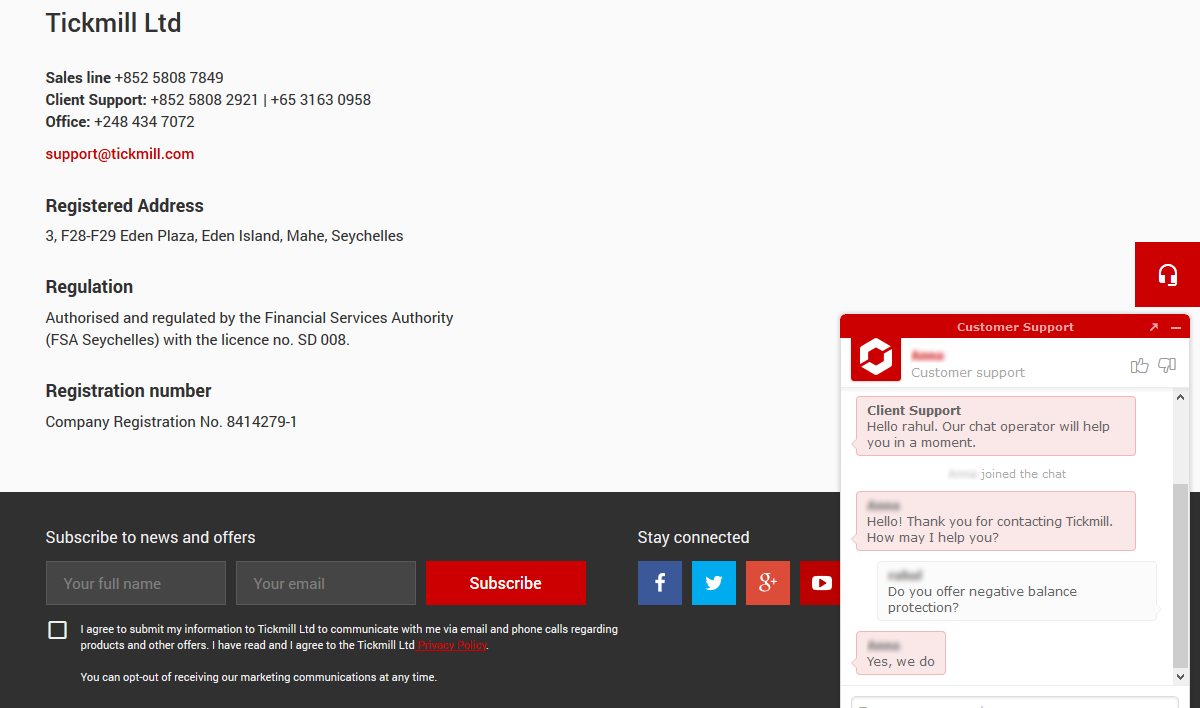

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Tickmill ดีไหม คืออะไร รีวิวโบรกเกอร์ ข้อดี ขัอเสีย [ฉบับเต็ม]

โบรกเกอร์ tickmill

Tickmill คือ โบรกเกอร์ forex ที่มีคุณภาพ โดยชื่อเสียงระดับสากลที่ค่อนข้างดี ประสิทธิภาพในการให้บริการสูงมาก เรทฝากถอนต่ำ spread แคบ และ ค่า commission ถูก ไม่แปลกใจเลยว่า tickmill จะขึ้นมาเป็นโบรกเกอร์ระดับต้นๆในประเทศไทย

เซิฟเวอร์การเทรดไหลลื่น (delay ประมาณ 0.2 วิ) มีความเสถียร และที่สำคัญ มีโปรโมชั่นแจกเงินฟรี 30 USD โดยไม่ต้องฝากเงิน (คล้ายๆกับ XM)

| รายละเอียดสำคัญของโบรกเกอร์ tickmill | |

| โบรกเกอร์ | tickmill |

| website | tickmill.Com |

| ปีก่อตั้ง | 2014 |

| องค์กรกำกับดูแล | FCA, FSA, cysec |

| ฝากขั้นต่ำ | 3,000 บาท |

| ความเร็วฝากถอน | ฝาก : ทันที , ถอน : 5 ชั่วโมง |

| เรทฝากถอน | 0 % |

| leverage | สูงสุด 1:500 |

| spread | EURUSD 7, USDJPY 5, GBPUSD 7 |

| แพลตฟอร์ม | MT4, webtrader |

Tickmill ดีไหม

สำหรับเทรดเดอร์สายเก็งกำไรระยะสั้น ถือว่าเป็นโบรกที่ดีที่สุดเลยก็ว่าได้ เนื่องจาก ค่าบริการต่ำที่สุด (spread + commission) ในบรรดาโบรกเกอร์ที่ทางทีมงานเรารีวิวมาทั้งหมด โดยเฉพาะบัญชี pro

อีกทั้งที่สำคัญ เรทฝากถอน ถูกมาก คือ เทรดเดอร์แทบไม่ต้องเสียค่าส่วนต่างในการฝากถอนเลยทีเดียว (ฝาก 1,000 ถอนได้ 1,000)

ความน่าเชื่อถือ

ทาง tickmail มีการแยกบัญชีเงินทุนของลูกค้าออกจากบัญชีของบริษัท สร้างความมั่นใจในระดับหนึ่งว่าเงินทุนของลูกค้าจะปลอดภัย

ในส่วนของเรื่องชื่อเสียงของทาง tickmill ถือว่าอยู่ในเกณฑ์ที่ดีเลยในระดับสากล

โดย trustpilot ให้คะแนนรีวิว tickmill ถึง 4.1 คะแนน จากผู้รีวิวถึง 262 คน

ทางบริษัทมีการเปิดเผยรายชื่อ CEO ไว้บนหน้าเว็บไซต์อย่างชัดเจน มี link ให้เข้าไปสู่ profile ส่วนตัวของเหล่าผู้บริหารทั้งหมด

ใบอนุญาตที่ทาง tickmill ได้รับ

- FCA | united kingdom : หมาเลขอ้างอิง 717270

- FSA | seychelles : หมายเลขใบอนุญาต SD008

- CYSEC | cyprus : หมายเลขใบอนุญาต 278/15

*เทรดเดอร์ไทยที่สมัครกับทางโบรกเกอร์ tickmill จะตกไปอยู่ภายใต้การดูแลของ FSA

ที่ตั้งสำนักงานใหญ่

ประเทศ seychelles : 3, F28-F29 eden plaza, eden island, mahe, seychelles

3rd floor, 27 – 32 old jewry, london, england, EC2R 8DQ

Kedron 9, mesa geitonia, limassol 4004, cyprus

ประเภทบัญชี

มีให้เลือก 3 ประเภท บัญชีคือ

- Pro : มีค่าคอม spread ต่ำ (*** แนะนำบัญชีนี้ : spread + commission แล้วยังต่ำมากๆ)

- Classic : ไม่มีค่าคอม spread สูง

- VIP : ฝากขั้นต่ำ 50,000 USD

ตารางเปรียบเทียบแต่ละประเภทบัญชี

ค่าคอมแต่ละคู่สกุลเงินของประเภทบัญชี pro

- EURUSD : 4 usd/lot

- USDJPY : 4 usd/lot

- GBPUSD : 5 usd/lot

- USDCHF : 4 usd/lot

- USDCAD : 4 usd/lot

- AUDUSD : 3 usd/lot

- NZDUSD : 2 usd/lot

- XAUUSD : 7 usd/lot

จำนวนการเปิดบัญชีสูงสุด

10 บัญชี MT4 โดยหากเปิดครบแล้ว ถ้าต้องการเปิดเพิ่มให้ทำเรื่องขอได้

Spread และ swap

Tickmill บัญชี pro อยู่ใน อันดับที่ 3 ของ การจัดอันดับโบรกเกอร์ forex : spread commission swap ต่ำสุด (รวมค่าบริการ) จากทั้งหมด 21 โบรกเกอร์ กว่า 55 ประเภทบัญชีเทรด

ถ้าพูดถึงค่า spread + commission อย่างเดียว : tickmill บัญชี pro ต่ำที่สุดเป็นอันดับที่ 1

แต่พอเอาค่า swap มารวม มาแพ้ GMI นิดเดียวตรงที่มี swap ฟรี

ดังนั้น tickmill บัญชี เหมาะกับการเทรดเดอร์ระยะสั้นอย่างมาก (day trade, scalping)

Platform การเทรด

มีเพียง MT4 และ webtrader ให้บริการ

การฝาก การถอน

เรทการฝากถอนดีเยี่ยมเลยสำหรับโบรกนี้ แทบไม่เสียส่วนต่างอะไรเลย มีเรื่องถอนที่นานไปนิดนึง (5 ชั่วโมง)

ความเร็วในการฝากถอนของ tickmill

ถอน : ประมาณ 5 ชั่วโมง

สั่งถอนเมื่อ 7 july 2020 เวลา 10:17

เงินเข้าธนาคารเมื่อ 7 july 2020 เวลา 15:26

เรทในการฝากถอนของ tickmill

ฝาก : 3128 บาท (100 USD)

หลักฐานการฝาก-ถอน

การถอน : ตามหลักใช้เวลาประมาณ 1 วันทำการ

แนะนำให้ทำรายการช่วงเวลากลางวันของไทย เพราะว่าระบบ payment จะทำการเวลาประมาณ 13.30 เป็นต้นไป ดังนั้นรายการถอนที่ทำในช่วงกลางวันจะมีโอกาสได้รับการตรวจโดย payment ในช่วงบ่าย และอาจได้รับเงินเร็วกว่าเวลาอื่น

โปรโมชั่น

บัญชีต้อนรับ (welcom account)

- แจกเงินฟรี 30 USD (ไม่ต้องฝาก)

- สามารถถอนกำไรได้

- เปิดให้เทรดได้ 60 วัน

- สามารถเปิดรับได้ครั้งเดียวเท่านั้น

- สามารถโอนกำไร ไปบัญชีเทรดจริงของ MT4 (classic, pro และ VIP) โดยต้องมีมูลค่าไม่น้อยกว่า 30 USD และ ไม่เกิน 100 USD

- คล้ายๆ กับโบนัส ฟรี 30 USD ของทาง XM แต่เงื่อนไขมากกว่านิดหน่อย

ข้อมูลเพิ่มเติม

- Livechat : มีเจ้าหน้าที่คนไทยให้บริการตั้งแต่ 09.00 – 18.00 วันจันทร์ – ศุกร์ (เข้ามาตอบช้ามาก)

- Line official : tickmill.Th (ตอบช้าหน่อย)

- Email : support@tickmill.Com

- Facebook : https://web.Facebook.Com/tickmill

ข้อเสีย tickmill

- ใช้ระยะเวลาการยืนยันตัวตนถึง 2 วัน

- Live chat บางครั้งรอนานกว่าจะเข้ามาตอบ (กว่า 30 นาที – 1 ชั่วโมง หลายครั้งค้างไปเลย)

- Line official ก็ตอบช้า (ใช้เจ้าหน้าที่คนเดียวกันกับ live chat)

ทีมงาน : thaibrokerforex

Tickmill now offers 0.0 pips forex spread and reduced swap charges

Tickmill has tightened the forex spread and lowered the swap charge for investors.

Tickmill reduces the spread and swap charge

“others think big, we think low”

Tickmill has tightened the forex spread to 0.0 pips and at the same time, reduced the swap charges for traders.

Tickmill constantly supports traders to succeed, and they have improved the trading conditions with the help of their liquidity providers.

Now, you can trade from 0.0 pips spread with minimal swap charges.

Tickmill is going to set the new industry standard with the condition.

Find out more about tickmill’s new trading conditions in the official website.

1. Reduced spreads on tickmill MT4

The main update of this time is the lowered spread.

Tickmill has achieved to lower the spread and now the minimal typical spread is as low as 0.0 pips.

The condition has become possible as tickmill has added more liquidity in the market on MT4 by creating exceptional depth of liquitiy with the help of tickmill’s liquidity providers.

The spread has been lowered not only on major forex currency pairs, but also for gold.

2. Minimal commissions on tickmill MT4

Tickmill’s classic MT4 account type offers low spread with absolutely zero extra commission.

To experience the tight spread as low as 0.0 pips, you need to open tickmill’s pro or VIP account which only charge small commission for trading.

The extra trading commission is only $2 per side per 100,000 traded for pro account type and $1 per side per 100,000 traded for VIP account.

Tickmill has exceptionally low commission fees so you can minimize transaction costs no matter what type of strategy you employ.

3. Slashed swaps on tickmill MT4

For any types of traders, swap charges can be one unnecessary costs while trading forex and cfds.

To minimize the cost even more, tickmill has reduced the swap charges so you can open positions for longer without having to compromise on profit due to unnecessary costs.

Swap charges change often. You can check the current rate in tickmill MT4 as below.

How tickmill’s forex spread has been tightened?

You may be wondering how tickmill has reduced the forex spread and how much are the changes?

We have summarized the changes made by tickmill in the table below.

| Forex currency pairs | previous spread | typical spread now | change |

|---|---|---|---|

| EURUSD | 0.2 pips | 0.0 pips | -100% |

| GBPUSD | 0.7 pips | 0.2 pips | -71% |

| USDJPY | 0.2 pips | 0.1 pips | -50% |

| USDCAD | 0.6 pips | 0.2 pips | -67% |

| AUDUSD | 0.4 pips | 0.1 pips | -75% |

| USDCHF | 0.7 pips | 0.3 pips | -57% |

| NZDUSD | 0.7 pips | 0.3 pips | -57% |

| GBPJPY | 1.1 pips | 0.9 pips | -18% |

| EURJPY | 0.7 pips | 0.2 pips | -71% |

| EURGBP | 0.5 pips | 0.3 pips | -40% |

| XAUUSD | 0.12 pips | 0.07 pips | -42% |

The average forex spread on tickmill MT4 has now become around 0.3 pips, which means the trading cost is only $3 per 100,000 worth of transactions.

By trading with tickmill, you can now save a lot of money.

Take advantage of tickmill’s new conditions and many free trading tools.

Start with tickmill’s $30 no deposit bonus

Are you now interested in start trading with tickmill?

Tickmill’s $30 no deposit bonus is a free welcome bonus, which you can get for free just by opening an account with tickmill.

There is literally no need to make a deposit.

By receiving tickmill’s $30 no deposit bonus, you can start trading forex without risking your own funds.

Tickmill’s $30 no deposit bonus is the great opportunity to try out tickmill’s trading conditions.

Find out more about tickmill’s $30 no deposit bonus in the page below.

Tickmill

Post tags

FSA regulated forex broker with superior trading conditions.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Hello I need your help about to withdraw my money to on my walet is still pending

my cod 6CK6258GAGE

Thank you tickmill team for the great experience. Great support help and fx condition on mt4. Everything is very smooth thanks to my account manager.

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

So, let's see, what we have: is core spreads or tickmill better? Well, it depends on whether you trade forex, crypto, indices or stocks, and what features matter to you. Compare core spreads and tickmill (plus one other) in this up-to-date comparison of their fees, platform, features, pros and cons, and what they allow you to trade in 2021 at spread tickmill

Contents of the article

- Best forex bonuses

- Core spreads vs tickmill

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

- Tickmill (ティックミル)のスプレッド一覧

- Tickmill (ティックミル)のスプレッド一覧

- 株価指数とWTI

- Spread tickmill

- Spread & swap

- Spread & swap

- Apa itu spread forex?

- Bagaimana anda menghitung...

- Bagaimana anda menghitung biaya...

- Apa itu swap?

- Penting fakta rate swap/rollover

- MULAI TRADING dengan tickmill

- Mudah dan cepat untuk bergabung!

- REGISTER

- BUAT AKUN

- BUAT DEPOSIT

- INSTRUMEN TRADING

- KONDISI TRADING

- AKUN TRADING

- PLATFORM

- EDUKASI

- KEMITRAAN

- PROMO

- TENTANG KAMI

- SUPPORT

- Mudah dan cepat untuk bergabung!

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

- Tickmill ดีไหม คืออะไร รีวิวโบรกเกอร์ ข้อดี...

- โบรกเกอร์ tickmill

- Tickmill ดีไหม

- ความน่าเชื่อถือ

- ประเภทบัญชี

- Spread และ swap

- Platform การเทรด

- การฝาก การถอน

- โปรโมชั่น

- ข้อมูลเพิ่มเติม

- ข้อเสีย tickmill

- Tickmill now offers 0.0 pips forex spread and...

- Tickmill has tightened the forex spread and...

- Tickmill reduces the spread and swap charge

- 1. Reduced spreads on tickmill MT4

- 2. Minimal commissions on tickmill MT4

- 3. Slashed swaps on tickmill MT4

- How tickmill’s forex spread has been tightened?

- Start with tickmill’s $30 no deposit bonus

- Tickmill

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.