Tickmill ecn account

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only you are about to leave tickmill europe ltd client area registration page.

Best forex bonuses

By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

Tickmill ecn account

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill ecn account

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill rebates – 5% commission discount for ECN PRO accounts

We offer the following tickmill rebates and commission discounts:

Your spreads remain exactly the same – there is no spread mark up to provide you this service.

The tickmill account is useful if you are news trading, or scalping, as tickmill has one of the best spreads versus other forex brokers and good execution speeds

Frequently asked questions

- Is this commission discount/rebate service 100% legitimate?

- Yes, abundance trading group is an introducing broker (IB) of all brokers listed on our website, and our role is to introduce new clients to them. We do this by giving back to you part of our referral fee the directly to you in the form of a commission discount.

- Is your service free?

- Absolutely. You do not pay a single cent, and you are not at a disadvantage because we don’t mark up your spreads

- Do you mark up my spreads?

- No! We will never do that. Honesty and integrity is a big part of abundance trading group and we will not do anything to put our clients at a disadvantage. It would also be disadvantageous for us to do that because we would earn a bad reputation for ourselves and future clients would not come to us

- How do I sign up for the rebates or commission discount?

- Click on the link above to sign up

- I am always available at linton@abundancetradinggroup.Com or live chat via instant facebook message to assist. You will be speaking with me, linton

- If I sign up with you, will you have access to my trading account and trade information?

- No. Absolutely not. Only you have access to such information. We only receive compensation for referring you.

- Does it matter if my trades are profitable or not?

- You will receive a commission discount/rebate no matter whether your trades are profitable or not. There is no disadvantage to you.

Questions about tickmill rebates?

Sign up instructions and existing accounts

To open a tickmill ECN pro account with the above commission discount, please click here .

- Please select seychelles as your regulator

- When asked to key in IB number, enter IB number: IB80466563

Existing account holders – login to the tickmill client area, open a new trading account, select new introducing broker in the dropdown and enter IB80466563 into the IB code field.

What to expect: once you click the link above, it will send you to tickmill’s webpage. Go ahead and open your account there. Select seychelles as your regulator. Fill out your personal details, and when asked to enter IB number, enter IB80466563 . Then submit your proof of identity (scanned passport page) and proof of address (scanned utility bill) and wait 12-48 hours for your account to be opened. Once your account is opened, the 5% commission discount will automatically be applied to your account

What to expect (if you have an existing account): login to the tickmill client area, open a new trading account, select new introducing broker in the dropdown and enter IB80466563 into the IB code field. The 5% discount is automatically applied to your account once your account is opened.

- We are always available to assist with the account opening or account transfer through live chat via facebook message or email linton@abundancetradinggroup.Com. You will be speaking with linton

Don’t wait! The faster you sign up, the more you save!

Leave us a review in the comments section below if you have benefited from this rebate!

More information about tickmill

Tickmill spread comparison with other brokers

Stop level, leverage and min trade size

They have zero stop level and offer 500:1 leverage with min 0.01 lot trade size

Trade server location & execution speed from VPS

Tickmill’s MT4 servers are located at LD4/5 (london) and a co-location is possible from a london based VPS from CNS (commercial network services) or beeks . Both are located 2ms* away from tickmill’s trade servers.

*ping latency is 2ms to tickmill’s servers: latency chart

No deposit bonus, withdraw profits – tickmill

Make your perfect risk-free start with $30 forex no-deposit welcome bonus presented by tickmill. Feel the superior execution quality and the perfect trading environment with no-deposit bonus where no investment involves trading live forex. Besides, withdraw all profit earned traded by non-deposit welcome bonus, with a single condition given below. Each client can open only one account for this welcome no-deposit promotion.

€£$ TICKMILL 30 forex no-deposit welcome bonus

Joining link: get-bonus

Ending date: december 31, 2021

Offer is applicable: new traders with a live account

How to apply:

- Register a client account

- Make a live account under client profile

- Bonus is added after complete the registration.`

Cash out: only profits can be withdrawn as below

- Verify the profile by uploading the required documents.

- Trade 5 lots to withdraw all profits.

- At least a 100 deposit must be made to another live trading account.

Terms – tickmill NO deposit bonus

The bonus is not available for the client of algeria, armenia, australia, azerbaijan, belarus, bulgaria, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan and kenya.

Bonus need to claim within 14 business days from the date of registration.

This forex bonus is available to one per client.

Tickmill ecn account

| Website | https://tickmill.Com/ |

| live chat | YES |

| telephone | +852 5808 2921 |

| broker type | non deal desk (NDD) |

| regulations | FCA and FSA |

| min deposit | $100.00 |

| account base currency | USD, EUR, GBP, PNL |

| max leverage | 500:1 |

| trading platforms | metatrader 4, webtrader |

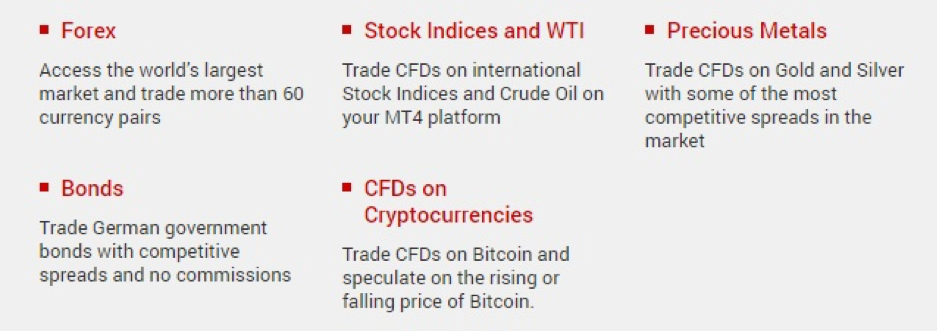

| markets | forex, index CFD trading, precious metals, energy, cryptocurrencies, bonds |

| bonus offered | $30.00 welcome bonus |

| funding options | credit / debit card, china union pay, bank transfer, dotpay, skrill, neteller, fasa pay |

Tickmill review 2021

Overview

This UK-based FCA and FSA-regulated brokerage firm based in the republic of seychelles offers trading to institutions and retail clients globally. Its forex business offers gold and silver as well as 62 currency pairs (including cryptocurrency) for trading. The broker have a lower minimum deposit compared to some of the other brokers on this list. It is a great broker firm for beginners to try their hand.

Accounts

Tickmill offers various types of accounts for various trader profiles. Commission-free classic accounts for beginners, pro accounts, VIP accounts for those who trade a lot and want special service, and islamic accounts. Traders will be thrilled to find the demo account offers metatrader 4 for testing, and includes real-time prices and volatility.

Minimum deposit

$100 in classic and pro accounts, 50,000 minimum balance in VIP accounts.

Maximum leverage

Features

Tickmill offers two platforms to trade on. Metatrader 4 is the main platform. For those who want to trade quickly through their browsers without downloading any software, there is the web trader.

Tickmill also offers a variety of tools including forex margin and currency calculators, autochartist for technical analysis, forex calendar, and myfxbook autotrade. The tickmill VPS keeps the MT4 eas and signals running when the customer is offline. One-click trading option enables quicker real-time trading.

Promotions like the introducing broker service allows traders to earn commissions on reference. A multi account manager is also available.

Educa tion

Webinars and video tutorials are available.

Deposits/withdrawals

Several funding options are available to customers, and withdrawals are processed within one working day.

Customer service

24/7 via online chat or email, and support lines on weekdays.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Cent account forex brokers

What is cent account?

In very simple words, cent accounts are trading accounts that measure balance in cents instead of dollars. This specification is an attractive tool for beginning or those individuals that don’t want to risk large fund amounts while trading.

That means, that forex brokers who offer cent account feature enables engaging into the real trade without large fund requirement, as all calculations and measures will be shown by the cents.

- Cent accounts are handled the same manner as a standard account with the only difference of the nominal amount. As an example, once the trader deposit 10$, the displayed balance on the account will be 1,000 which presents trading funds through cents.

The cent account type is widely used by the beginner traders, as well those traders that would like to practice or test the particular trading strategy on real trading not demo account or to see trading conditions of the real account. Also, usually the minimum deposit is quite small for cent accounts and may require only 100$ as a start, which is a great opportunity to start trading the forex market and currency pairs.

Yet, in a low-risk trading environment, you should always consider the demanding minimum transaction volume and checked carefully at the broker’s offering, as conditions may vary.

Who are best forex cent brokers?

Eventually, forex brokers featuring cent accounts are not too many among the market offering, therefore the listing below can help to choose the best forex company available at your region, which brings cent trading opportunity and start trading trough cents’.

However, the crucial point of the broker’s regulatory status remains the same, as the unscrupulous brokers may easily fake trading conditions and remain you with the loss, even that the balance was an initially small deposit. So always stay alert, make good research and learn more information also available below.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Broker ECN migliori: classifica e guida completa 2021

Stai cercando la lista e la classifica dei migliori broker ECN, noti anche come broker no dealing desk, oppure sei interessato a capire meglio il significato di questo termine? Sei nel posto giusto!

In questa guida vedremo cosa vuol dire broker ECN, quali vantaggi offrono tali piattaforme, e qual è la differenza tra broker ECN e market maker. Inoltre ti fornirò una lista di broker ECN forex che si prestano particolarmente bene a qualunque operatività di trading, incluso lo scalping.

Broker forex ECN di fama mondiale leva massima pari a 1:30 spread estremamente bassi cripto, indici, azioni, commodities deposito minimo: $200 conto demo gratuito

broker forex ECN di fama mondiale leva massima pari a 1:500 spread a partire da 0.0 pips forex, indici, commodities, azioni circa 10 mila prodotti finanziari conto demo gratuito

Broker ECN: significato

Partiamo dal principio e vediamo qual è il significato di broker ECN.

L’acronimo ECN sta per electronic communication network ed associato ai broker si utilizza per indicare tutti quegli intermediari che forniscono ai propri clienti un accesso diretto ai mercati, senza effettuare alcun intervento sui prezzi degli asset.

In poche parole, utilizzando un broker ECN i trader vedono all’interno della piattaforma i prezzi autentici degli asset, ed hanno la possibilità di accedere alle quotazioni bid/ask (offerta/domanda) di mercato.

I broker ECN puri non creano un loro mercato interno e non effettuano riquotazione degli asset. Piuttosto si limitano a svolgere le seguenti operazioni:

- Prendono in carico l’ordine del cliente;

- Cercano un fornitore di liquidità;

- Eseguono l’ordine quando possibile sul mercato di riferimento.

Differenza tra broker ECN e market maker

Per capire a fondo le caratteristiche dei broker ECN è necessario confrontarli con un’altra tipologia molto comune di piattaforme di trading: i cosiddetti broker market maker.

I broker market maker, come ad esempio plus500 o IQ option, non offrono all’interno della loro piattaforma i vari asset al prezzo di mercato, ma creano una sorta di mercato parallelo con prezzi che risultano solitamente appena più elevati rispetto a quello di mercato. Viene infatti aggiunto uno spread, che è il modo in cui tali broker remunerano la propria attività.

Questo non succede nel caso dei broker ECN, dato che essi offrono l’accesso diretto al mercato interbancario. Non starai quindi acquistando l’asset dal broker al prezzo fissato da quest’ultimo, ma lo starai scambiando con una controparte reale, ed il ruolo del broker si limiterà a quello di una mera intermediazione.

Potresti allora pensare che i broker ECN convengano sempre rispetto ai market maker, ma in realtà tutto dipende da quelle che sono le tue esigenze di trading e dalle caratteristiche del broker che decidi di utilizzare. Un broker in qualche modo deve pur guadagnare, quindi se non effettuerà un ricalcolo dei prezzi di mercato aggiungendo uno spread, molto probabilmente addebiterà una commissione fissa per ogni operazione effettuata dal trader.

Vediamo le principali caratteristiche dei broker ECN, i vantaggi e gli svantaggi:

- Offrono l’accesso diretto ai mercati;

- L’ambiente di trading è anonimo, dato che non stai acquistando dal broker;

- I prezzi e le quotazioni bit/ask degli asset sono quelle di mercato;

- Garantiscono una maggiore trasparenza sui prezzi;

- Gli spread sono solitamente assenti o molto bassi;

- Sono perfetti per lo scalping;

- Quasi sempre ci sono delle commissioni fisse su ogni operazione conclusa;

- Gli ordini possono rimanere ineseguiti se manca una controparte sul mercato.

Ecco invece le caratteristiche, vantaggi e svantaggi dei broker market maker:

- Creano un sotto mercato ed effettuano una riquotazione dei prezzi;

- La liquidità della posizione è garantita in ogni momento dal broker;

- Ogni operazione che apri è un contratto che stipuli direttamente col broker;

- Il broker per coprirsi apre in contemporanea una posizione di segno opposto;

- Gli spread sono leggermente più elevati rispetto a quelli dei broker ECN;

- Le commissioni fisse sono solitamente più basse o assenti.

Migliori broker ECN: la classifica

Esistono degli ottimi broker ECN forex a livello internazionale, che consentono qualunque operatività di trading. Alcuni di questi possono essere definiti come broker ECN puri, mentre altri offrono soluzioni miste (in alcuni casi accesso diretto al mercato, in altri riquotazione dei prezzi).

Vediamo di seguito la lista dei migliori broker ECN: quelli regolamentati, che rispettano degli standard elevati di sicurezza e che addebitano spread e commissioni particolarmente basse.

Pepperstone (broker ECN forex)

Pepperstone (qui il sito ufficiale) è probabilmente il miglior broker ECN attualmente disponibile per i trader: opera con spread molto bassi e non effettua alcuna riquotazione degli asset.

Pepperstone è stato fondato in australia nel 2010 ed è diventato velocemente uno dei broker forex più importanti al mondo per volumi scambiati, professionalità e condizioni di trading.

Offre le piattaforme metatrader 4, metatrader 5 e ctrader, 3 delle piattaforme più complete ed utilizzate in assoluto. Si tratta di un broker senza spread per alcuni asset finanziari, mentre per gli altri asset offre comunque delle condizioni di negoziazione molto vantaggiose. Nella sua offerta, a parte il forex, troviamo CFD su indici, azioni, materie prime e criptovalute.

Il broker è altamente regolamentato e sicuro, dato che opera anche sotto la licenza FCA, quindi la leva che offre sui suoi asset non può superare per legge il rapporto 1:30.

Se vuoi aprire un conto reale ed iniziare ad effettuare operazioni di trading, il deposito minimo è di $200. Pepperstone offre tuttavia anche un conto demo gratuito, che puoi utilizzare per iniziare a prendere dimestichezza con la piattaforma e in generale con il trading online. Lo trovi qui.

FP markets (broker ECN no ESMA)

Un altro tra i broker ECN più conosciuti è senz’altro FP markets (qui il sito ufficiale), che gode di ottima reputazione ed è in grado di offrire condizioni di trading molto competitive fra gli intermediari in questa categoria.

FP markets offre la contrattazione su forex, indici, materie prime, azioni e criptovalute, sotto una leva massima pari a 1:500 (si tratta di un broker ECN no ESMA, ovvero non soggetto alle regolamentazioni che limitano l’utilizzo massimo della leva). Il totale dei prodotti finanziari messi a disposizione da questo broker è di circa 10 mila.

Oltre alle classiche piattaforme di trading MT4 e MT5, FP markets offre anche l’utilizzo dell’ottima IRESS trading, che ti consente di utilizzare funzionalità di analisi avanzate e di sovrapporle tra di loro per una visione nettamente migliorata da parte dell’operatore.

Le condizioni relative a spread, commissioni e versamenti minimi dipendono dal conto e dalla piattaforma di trading che sceglierai. A tal riguardo di invito a leggere tutte le condizioni sul sito ufficiale del broker. In ogni caso tieni presente che per alcuni asset lo spread parte da 0.0 pips!

Anche con FP markets hai la possibilità di aprire un conto reale di trading, oppure un conto demo gratuito con cui iniziare a fare pratica senza mettere a rischio soldi reali. Puoi aprirlo qui.

IC markets (broker ECN per scalping)

IC markets è uno fra i migliori broker ECN attualmente in attività ed in generale uno dei più affidabili intermediari su cui scegliere di operare indipendentemente dal proprio livello di esperienza. Viene anche largamente considerato come uno dei migliori broker forex disponibili al mondo.

Tale broker offre la contrattazione di CFD su valute, materie prime, indici, obbligazioni, criptovalute, azioni e future. I CFD forex, in particolare, riguardano più di 60 coppie di valute.

IC markets è un broker ECN, dunque non fa il prezzo degli asset presenti e non effettua riquotazioni. Esso offre i prezzi di mercato così come sono senza modificarli come invece fanno i broker market maker.

Le caratteristiche che rendono questo broker davvero allettante e particolarmente consigliato per trader ambiziosi, sono l’esecuzione degli ordini incredibilmente veloce (mediamente sotto i 40 millisecondi) e gli spread bassissimi (a partire da 0.0 pip).

Le piattaforme disponibili anche in questo caso sono tre: MT4, MT5 e ctrader, con possibilità di ottenere servizi di VPS gestiti per i trader che ne fanno richiesta.

Tra i broker ECN è attualmente uno dei migliori con cui scegliere di operare, nonché una delle scelte maggiormente consigliate per frequent trader, scalper e robot trading che operano su grandi volumi.

Il deposito minimo per iniziare a fare trading su IC markets è pari a 200 dollari, ma il broker offre anche la possibilità di usufruire di un conto demo per prendere dimestichezza con la piattaforma prima di dover utilizzare soldi reali.

Tickmill

Anche tickmill è considerato un buon broker ECN, dato che presenta dei costi di trading tra i più bassi dell’intera industria.

Si tratta di un broker specifico per il forex, che ad esempio offre uno spread di 0.0 pips per la coppia valutaria EUR/USD. Anche per tutte le altre coppie valutarie gli spread sono ridotti.

Tickmill offre un buon set di strumenti per l’analisi e l’approfondimento. Tra le funzioni più rilevanti troviamo ad esempio la funzionalità autochartist, utile per individuare pattnern sui grafici e generare segnali di trading, e la funzionalità autotrade myfxbook per il social e copy trading. Le piattaforme di trading offerte da tickmill sono la MT4, CQG e webtrader.

Questo broker presenta diverse tipologie di conti e condizioni, quindi per maggiori informazioni ti invito ad approfondire sul sito ufficiale, dove puoi aprire anche un conto demo.

So, let's see, what we have: tickmill ecn account estimated time to complete your registration is 3 minutes please complete the following form using latin letters only © 2015-2021 tickmill ™ website terms & conditions at tickmill ecn account

Contents of the article

- Best forex bonuses

- Tickmill ecn account

- Tickmill ecn account

- Tickmill rebates – 5% commission discount for ECN...

- Frequently asked questions

- Questions about tickmill rebates?

- No deposit bonus, withdraw profits – tickmill

- €£$ TICKMILL 30 forex no-deposit welcome bonus

- Tickmill ecn account

- Tickmill review 2021

- Overview

- Accounts

- Minimum deposit

- Maximum leverage

- Features

- Educa tion

- Deposits/withdrawals

- Customer service

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Cent account forex brokers

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Broker ECN migliori: classifica e guida completa...

- Broker ECN: significato

- Differenza tra broker ECN e market maker

- Migliori broker ECN: la classifica

- Pepperstone (broker ECN forex)

- FP markets (broker ECN no ESMA)

- IC markets (broker ECN per scalping)

- Tickmill

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.