Open forex account with $10

For traders who are seeking ultra-tight spreads with fixed commissions.

Best forex bonuses

I would like to learn about

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Your form is being processed.

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Fxdailyreport.Com

As a beginner in the forex trading industry, the questions you often hear is regarding the minimum deposit. You see questions such as growing your $10 account into a $100 account or something more. The good news about this is that yes, you can. There are various forex brokers that offer a minimum of at least $10 in your account of better yet, don’t require any minimum deposit at all. When you find a broker that suits your needs, your trading experience runs smoothly than before. In this article, we’ll be talking about forex trading with low investment and whether or not you can trade with $10 in your account.

Can I trade forex with $10?

As mentioned earlier, the key is to find the right forex broker that lets you trade with a low deposit or no minimum deposit required. However, even when you find a broker that lets you trade with just $10, the challenge is in growing that account into a profitable one. A lot of traders get their accounts blown as fast as they started and this is for various factors such as a lack of risk management or a lack of knowledge. Trading with a $10 account will be much more challenging than trading with a $50 account as it will take more discipline, patience, and self-control. This is also where leverage comes into the picture. When your broker gives you high leverage despite having just a $10 account, it’s easy to think you can enter as many trades as you want, as long as it fits the leverage. You’ll be surprised how many traders have this mindset and this is precisely why they don’t profit from forex trading. In the following, we’ll be talking about how to grow your $10.

5 forex brokers with low minimum deposit $1 and $5

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

Do your research

You can’t enter the trading industry with zero knowledge as to how the financial market works, how to set your stop loss and take profit, or even which strategies to implement in your trades. If you’re the type of trader that expects you can rely on others for growing your $10 account, you’ll lose right from the start. Doing your research and studying about forex means that you’ll have a certain knowledge by the time you enter and exit your trades.

Be wary of leverage

There are pros and cons to high leverage so you shouldn’t be too excited when finding a broker that offers you high leverage. A lot of traders make the mistake of over trading because of high leverage, and this is what causes them to lose their profits. To trade effectively with a $10 account, enter trades gradually. Even with high leverage, practice discipline, and proper risk management with all your traders. For instance, it’s not advisable to enter 2 trades with a 0.2 lot size if you’re growing a $10 account. Proper risk management means that you don’t implement greed and emotions in your trades.

Don’t trade when the market is volatile

Advanced trades thrive when the market is volatile just because they already have adequate experience with trading. As a beginner, it’s not advisable to trade during volatile times as you might feel overwhelmed and lose heart immediately when you see your trades losing. Rather, trade during the times when the market is moving gradually and take it from there.

Never trade with emotions

In this entire list, this is something you should never do when trading. In trading with any low investment, don’t apply your emotions, or else, you’ve already lost. Trading with emotions might lead you to close all your trades when you’re losing, even when it’s just a retest, or over-trading a single currency when you have profited. You must remember to always detach your emotions when trading if you want to succeed.

In conclusion, I hope this article was able to shed insight into forex trading with low investment. While a lot of experts say it’s recommendable to deposit a high investment to truly succeed, you can still trade forex with as low as $10. If you have the right discipline, knowledge, and values, you can easily turn your $10 into $100. It may not be overnight, but it’s still very much doable.

Top 10 unlimited forex demo account for 2021

Top rated:

When you decide to begin in the world of forex, demo trading accounts are an important first step that you may decide to take when trying to choose from some of the best forex brokers around.

Starting out with a demo trading account is not just for beginners though, this is something you can use as an experienced trader to get to know more about almost any broker, how they operate, and the trading platforms that they offer.

Throughout this article, we will explain what are the forex brokers where you can get the best demo account with NO time limitation and how you can get the most out of your demo trading account with all of the top forex trading brokers in the industry.

Table of contents

What’s a demo account?

If you are not already aware, demo trading accounts are offered by almost all of the top forex brokers. This is a risk free way in which you can learn more about every broker as a forex trader or if you are involved in CFD trading.

These accounts are offered on a trial basis typically with an amount of virtual money that you can risk. This prevents you from possibly losing your own money while you get to know the trading platform of each broker in more detail. These demo trading account trial periods may be limited in terms of the duration you can use them, or they may also be unlimited. This decision is up to the particular forex broker.

As well as risk free trading in which you cannot lose your money, it is also a chance to find out more about the regulation of online trading under each authority and within the cfd trading or forex broker. This can be helpful in knowing what kind of leverage is available as well as other things such as how account types and funding methods work.

Within this top 10 demo trading account piece, we have collected a range of top brokers who offer demo trading accounts which do not expire, and who also provide access to a large selection of account types for you to choose from as well as trading platforms like the well-known MT4.

This, along with dealing in a range of assets and CFD trading in the likes of cryptocurrency and even copy trading demo accounts, can really help you to better understand the industry as a forex trader and the direction you would like to take.

Top10 unlimited forex demo accounts

The following are 10 of the best brokers offering exceptional unlimited demo trading accounts that we have reviewed and feel would be the best choice in your search for a well authorized and regulated broker.

1. XTB

Looking at XTB, the broker offers both standard and pro accounts for you to choose from as a trader. Both of these account types do come with a demo trading account also available. This demo trading account unlike some others, does not expire. With that said, it may be closed if you have not trading in a 30 day period.

Often, you go to as a trader is currency trading and the ability to trade in one top currency pair or another. In this respect, the XTB broker offers a choice of more than 45 forex pairs across both of these XTB account types.

The XTB spreads are also highly competitive starting from just 0.1pips on some major pairs. If you are more into CFD trading, then you can also sample this within the XTB demo trading account at no risk to your real money whatsoever.

There are more than 100 cfds to choose from in various categories such as indices, commodities, futures, etfs, and a selection of 25 cryptocurrencies to choose from. An XTB broker review will show that they apply a 0.08% fixed commission to every trade and then a possible $3.50 per lot traded commission which depends on the account type you select.

When it comes to trading platforms you can try out and that are available as part of your demo trading account, XTB offers MT4 and xstation. Finally, in terms of fees, the broker does offer some rollover-free accounts although not in every country so you should check with their support team particularly if you are a islamic forex trader.

With XTB you also have the chance to further your development by taking advantage of a strong educational infrastructure through videos, tutorials, webinars, and more to help you grow as a top forex trader.

Open forex trading accounts for any category of traders

Optimal range of trading accounts for forex markets

The liteforex company has developed a large range of trading accounts for any category of traders.Choose the account type that will comply with your trading preferences and open forex account that will meet your needs.

- ECN

- PER ANNUM IN YOUR ACCOUNT 2,5%

- MIN. DEPOSIT $50

- TECHNOLOGIES ECN

- Increased quoting precision

- Market execution of orders with no requotes

- No stop & limit levels

- Scalping and news trading allowed

- Unlimited duration of transactions

- Trades are delivered directly to liquidity providers

- No conflict of interests

- Social trading platform is available

- 2.5% per annum in your account

- Leverage 1:500

- CLASSIC

- LEVERAGE 1:500

- MIN. DEPOSIT $50

- DEPOSIT BONUS 30%

- Increased quoting precision

- Market execution and no requotes

- No stop & limit levels

- Leverage 1:500

- Wide range of trading platforms mt4/m5

- CENT

- Leverage 1:200

- MIN. DEPOSIT $10 DEPOSIT BONUS 30% -->

- The opportunity to trade in micro lots. The size of the contract is only $ 1,000.

- Minimum deposit of $10. CENT accounts do not require huge deposits at this stage of your trading career at liteforex

Accounts specification

| ECN | CLASSIC | |

|---|---|---|

| spread | floating, from 0.0 points | floating, from 1.8 points |

| commission | from 5$ per lot 1 | no 3 |

| execution type | MARKET EXECUTION | MARKET EXECUTION |

| platform | MT4/MT5 | MT4/MT5 |

| leverage | 1:500 - 1:1 | 1:500 - 1:1 |

| account base currency | USD, EUR, MBT | USD, EUR, MBT |

| minimum deposit | $50 | $50 |

| rate, % per year 2 | 2.5% | 0% |

| islamic accounts | yes | yes |

| social trading | available | available |

| contract size, $ | 100000 | 100000 |

| minimum lot | 0.01 | 0.01 |

| maximum number of orders | unlimited | unlimited |

| margin call level | 100 | 100 |

| stop out level | 20 | 20 |

- Forex major - 10$ per lot, forex crosses - 20$ per lot, forex minor - 30$ per lot, metals - 20$ per lot, oil - 0.5$ per lot, CFD on shares - 25 cents per share, stock indices - 0.5$ per contract, crypto - 10$ per lot

- Annual interest rate is the percentage credited on surplus funds (annual interest).

The state of the account is checked daily at the end of the day (at 23:59 GMT +3) to determine the amount of client’s own funds not used in trading. The daily interest amount is calculated in accordance with the following formula:

%, daily = (free_margin - credit) * interest_rate / 100 / 360 , where:

- Free_margin - credit - the amount of client’s own surplus funds at the moment of calculation;

- Interest_rate – interest rate specified;

- 360 – number of days in a year.

The interest calculation algorithm is set by the software developer and can’t be corrected. The calculated amount is accumulated daily and saved automatically. The interests accrued over the whole month are paid on the last calendar days of the month. This accrual is made as one balance operation with a comment "IR".

The accrual is made only on active accounts. If on the last calendar day your account is in the archive or is dormant, the interest for the earlier period of activity (daily interest amount calculated in the current month earlier) will not be paid. If there is no activity on the client's account, the company reserves the right to revise the conditions of annual interest rate’s calculation, up to cancellation. A scarce trading history can be a reason for revision as well.

Open forex trading accounts for any category of traders

Anyone with an aptitude for numbers and an attitude to get maximum can try a hand in forex tradi.

One needs to comprehend the idea of a ‘swap’ to understand the concept of a no swap.

Islamic forex trading accounts

Islamic forex trading accounts also known as no riba accounts it is created to accommodate customer.

Forex or foreign exchange is a popular trading business platform. People trade on foreign currenci.

Are you interested in the forex market? Then, you should join forex trading and earn a considerable.

The recent trend has offered great support to forex trading. If you are willing to make a profit.

A beginner in forex trading needs to open up an account with any reputed forex trading service w.

Risk warning: trading on financial markets carries risks. Contracts for difference (‘cfds’) are complex financial products that are traded on margin. Trading cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and taking into account your investment objectives and level of experience. Click here for our full risk disclosure.

The website is owned by liteforex group of companies.

Liteforex investments limited registered in the marshall islands (registration number 63888) and regulated in accordance with marshall islands business corporation act. The company’s address: ajeltake road, ajeltake island, majuro, marshall islands MH96960. Email:

Liteforex investments limited does not provide service to residents of the EEA countries, USA, israel, and japan.

$10 min deposit forex brokers | cheapest forex brokers 2021

Forex brokers with minimum deposit until $10

Are you looking for forex broker that allows you to trade with $10 or less? Here is the list of forex brokers that allow you to deposit between $1 - $10 and trade!

| Broker | rating | demo | leverage | bonus | platforms | min deposit $ | payments |

| XM | 8 | yes | 1:888 | $30 no deposit | metatrader 4, metatrader 5, XM webtrader | 5 | credit/debit card, neteller, skrill, webmoney, bank wire transfer |

| liteforex | 7 | yes | 1:500 | 30% + 15% | metatrader 4, metatrader 5, webterminal | 10 | credit cards, wire transfer, litecoin, bitcoin, skrill, neteller, perfect money, ok pay, qiwi, wallet one |

| instaforex | 7 | yes | 1:1,000 | $100 no deposit bonus | metatrader 4, metatrader 5, webtrader | 1 | bitcoin, cashu, credit cards, egopay, neteller, skrill, ukash, unionpay, webmoney, wire transfer |

| primexbt | 7 | yes | 1:1000 | primexbt, turbo | 1 | credit cards | |

| oanda | 3 | yes | 1:50 | metatrader 4, fxtrade | 1 | check, credit cards, paypal, wire transfer | |

| tenkofx | 3 | yes | 1:500 | metatrader 4, webtrader | 10 | skrill, neteller, fasapay, webmoney, yandex money, qiwi | |

| Z.Com trade | 3 | yes | 1:200 | Z.Com trader web, Z.Com trader pro (demo account only) | 1 | credit cards, wire transfer, china unionpay, skrill | |

| tradefw | 3 | yes | 1:30 | https://www.Forexexplore.Com/forex-brokers/tradefw-review | 0 | bank wire, credit/debit card. | |

| AGEA | 2 | yes | 1:500 | - | streamster, metatrader 4 | 1 | credit cards, wire, skrill, webmoney, e-dinar, neteller, fasapay, perfect money |

| cmcmarkets | 2 | yes | 500:1 | - | next generation web-based | 1 | credit cards, wire transfer |

| hotforex | 2 | yes | 1:1,000 | 100% bonus | metatrader 4, mobile platform, rapid trader fix/api | 5 | credit cards, skrill, unionpay, neteller, wire transfer, webmoney, fasapay |

| alpari | 2 | yes | 1:500 | 50% welcome | metatrader 4 | 1 | debit or credit card, wire transfer |

| finpro trading | 2 | yes | 1:200 | 100% | metatrader 4, zulutrade, finopro station | 5 | credit cards, paypal, skrill, wire transfer |

| tifia | 1 | yes | 1:1,000 | metatrader 4, webtrader | 10 | wire transfer, credit cards, skrill, neteller, perfect money, fasapay, okpay | |

| fxopen | 1 | yes | 1:500 | $100 | metatrader 4 | 1 | wire, webmoney, alertpay, cashu, c-gold, perfectmoney |

| igofx | 1 | yes | 1:1,000 | metatrader 4 | 1 | wire transfer, credit cards, perfect money | |

| admiralmarkets | 1 | yes | 1:200 | n/a | metatrader 4 | 10 | wire |

| fort financial services | 1 | yes | 1:1,000 | metatrader 4, CQG, ninja trader, binary options | 5 | credit cards, webmoney, skrill, neteller, perfect money, fasapay, wire transfer | |

| FBS | 1 | yes | up to 1:3,000 | $123 welcome bonus | metatrader 4, metatrader 5, webtrading | 1 | credit cards, fasapay, indonesia local banks, neteller, okpay, perfectmoney, skrill, webmoney, wire transfer, thai local banks, exchangers, malaysian banks and bitcoin by skrill |

| simplefx | 1 | yes | 1:100 | metatrader 4 and in-house web-based platform | 1 | wire transfer, credit/debit cards, skrill, neteller, astropay, webmoney, fasapay, qiwi, moneta, ru, yandex, china unionpay, bitcoin and litecoin | |

| JCMFX | 1 | yes | 1:1,000 | metatrader 4 | 10 | credit cards, fasapay, wire transfer, neteller, skrill | |

| LCG | 1 | yes | 1:500 | metatrader 4, LCG trader (web-based, ECN accounts only) | 1 | wire transfer, debit/credit cards, skrill | |

| mahi FX | 1 | yes | 1:100 | metatrader 4, mahifx | 1 | wire transfer, credit cards | |

| paxforex | 1 | yes | 1:500 | no deposit $7 bonus – cannot withdraw | metatrader 4 | 10 | credit cards, fasapay, neteller, OKPAY, perfect money, QIWI, skrill, unionpay, webmoney, wire transfer |

| rekuten securities | 1 | yes | 1:50 | marketspeed FX, trading station (inherited from FXCM) | 1 | wire transfer, checks, ATM (only for local residents) | |

| roboforex | 1 | yes | 1:500 | metatrader 4, ctrader | 1 | credit cards, QIWI wallet, webmoney, yandex.Money, RBK money, skrill, fasapay, cashu, payoneer, china unionpay, neteller, perfect money | |

| tradersway | 1 | yes | 1:1,000 | metatrader 4, ctrader | 0 | skrill, neteller, perfect money, webmoney, QIWI, monetaru, easypay, boletto, cashu | |

| turnkeyforex | 1 | yes | 1:200 | 00% deposit bonus; 30 days of commission-free trading; 30% rescue bonus | metatrader 4, trade station | 5 | credit cards, wire transfer, neteller |

| whaleclub | 1 | yes | 1:100 | in-house whaleclub web platform | 1 | bitcoin | |

| freshforex | 1 | yes | 1:1000 | SIGN-UP BONUS ¢100! | Metatrader 4 | 1 | debit/credit cards, neteller, OKPAY, W1, QIWI, webmoney, skrill, fasapay, contact, wire transfer |

| fxglory | 0 | yes | 1:3,000 | 50% up to $1,000 | metatrader4, mobile | 1 | credit/debit cards, paypal |

| accentforex | 0 | yes | 1:500 | 50% | metatrader 4 | 10 | webmoney, okpay, skrill, wire transfer, credit cards |

| grandcapital | 0 | yes | 500:1 | $500 no deposit | metatrader 4, webtrader | 10 | credit card, neteller, webmoney, cashu, fasapay, scrill, webmoney |

| adamant finance | 0 | yes | 1:500 | metatrader 4 | 1 | bitcoin, cashu, credit cards, fasapay, megatransfer, neteller, OKPAY, QIWI, webmoney, yandex.Money | |

| blitzbrokers (IB for axitrader) | 0 | yes | 1:500 | metatrader 4 | 1 | credit cards, neteller, skrill | |

| forexmart | 0 | yes | 1:1,000 | $150 no deposit needed | metatrader 4 | 1 | credit cards, neteller, skrill, paypal, paxum |

| LH-crypto | 0 | yes | 1:500 | metatrader 4, metatrader 5 | 10 | bitcoin, bitcoin cash, ethereum, litecoin, monero, DASH, ripple, NEO, visa, mastercard, web money, QIWI, wire transfer |

In order to find the best cheapest FX broker, you have to not only look at the minimum deposit requirements but the overall commissions, spreads and extra fees structure. Trading costs can be spotted in the following ways while reviewing a broker:

- Fixed costs: these include the spread or the commission.

- Running costs: the so-called swap fees are recalculated every day and add or subtract credit to the trading account.R

Spread is the difference between buy and sell price and in simple words is the payment the brokerage get for each trade. The tighter the spreads, the better trading conditions your selected broker has.

Commission can be seen with DMA/STP model brokers. With these brokers you get the best spreads possible, but you pay commissions for each trade made. You are looking for a broker with interbank market prices for the best outcome.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

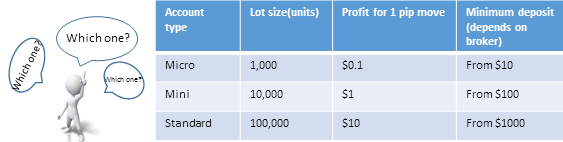

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

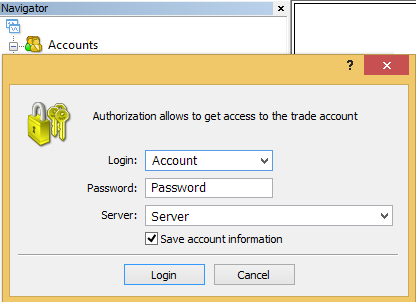

Trading account activation

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

In order to activate trading account open your trading platform and follow further steps.

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

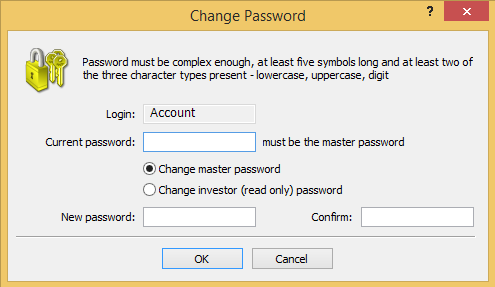

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

Top 10 unlimited forex demo account for 2021

Top rated:

When you decide to begin in the world of forex, demo trading accounts are an important first step that you may decide to take when trying to choose from some of the best forex brokers around.

Starting out with a demo trading account is not just for beginners though, this is something you can use as an experienced trader to get to know more about almost any broker, how they operate, and the trading platforms that they offer.

Throughout this article, we will explain what are the forex brokers where you can get the best demo account with NO time limitation and how you can get the most out of your demo trading account with all of the top forex trading brokers in the industry.

Table of contents

What’s a demo account?

If you are not already aware, demo trading accounts are offered by almost all of the top forex brokers. This is a risk free way in which you can learn more about every broker as a forex trader or if you are involved in CFD trading.

These accounts are offered on a trial basis typically with an amount of virtual money that you can risk. This prevents you from possibly losing your own money while you get to know the trading platform of each broker in more detail. These demo trading account trial periods may be limited in terms of the duration you can use them, or they may also be unlimited. This decision is up to the particular forex broker.

As well as risk free trading in which you cannot lose your money, it is also a chance to find out more about the regulation of online trading under each authority and within the cfd trading or forex broker. This can be helpful in knowing what kind of leverage is available as well as other things such as how account types and funding methods work.

Within this top 10 demo trading account piece, we have collected a range of top brokers who offer demo trading accounts which do not expire, and who also provide access to a large selection of account types for you to choose from as well as trading platforms like the well-known MT4.

This, along with dealing in a range of assets and CFD trading in the likes of cryptocurrency and even copy trading demo accounts, can really help you to better understand the industry as a forex trader and the direction you would like to take.

Top10 unlimited forex demo accounts

The following are 10 of the best brokers offering exceptional unlimited demo trading accounts that we have reviewed and feel would be the best choice in your search for a well authorized and regulated broker.

1. XTB

Looking at XTB, the broker offers both standard and pro accounts for you to choose from as a trader. Both of these account types do come with a demo trading account also available. This demo trading account unlike some others, does not expire. With that said, it may be closed if you have not trading in a 30 day period.

Often, you go to as a trader is currency trading and the ability to trade in one top currency pair or another. In this respect, the XTB broker offers a choice of more than 45 forex pairs across both of these XTB account types.

The XTB spreads are also highly competitive starting from just 0.1pips on some major pairs. If you are more into CFD trading, then you can also sample this within the XTB demo trading account at no risk to your real money whatsoever.

There are more than 100 cfds to choose from in various categories such as indices, commodities, futures, etfs, and a selection of 25 cryptocurrencies to choose from. An XTB broker review will show that they apply a 0.08% fixed commission to every trade and then a possible $3.50 per lot traded commission which depends on the account type you select.

When it comes to trading platforms you can try out and that are available as part of your demo trading account, XTB offers MT4 and xstation. Finally, in terms of fees, the broker does offer some rollover-free accounts although not in every country so you should check with their support team particularly if you are a islamic forex trader.

With XTB you also have the chance to further your development by taking advantage of a strong educational infrastructure through videos, tutorials, webinars, and more to help you grow as a top forex trader.

Open forex trading accounts for any category of traders

Optimal range of trading accounts for forex markets

The liteforex company has developed a large range of trading accounts for any category of traders.Choose the account type that will comply with your trading preferences and open forex account that will meet your needs.

- ECN

- PER ANNUM IN YOUR ACCOUNT 2,5%

- MIN. DEPOSIT $50

- TECHNOLOGIES ECN

- Increased quoting precision

- Market execution of orders with no requotes

- No stop & limit levels

- Scalping and news trading allowed

- Unlimited duration of transactions

- Trades are delivered directly to liquidity providers

- No conflict of interests

- Social trading platform is available

- 2.5% per annum in your account

- Leverage 1:500

- CLASSIC

- LEVERAGE 1:500

- MIN. DEPOSIT $50

- DEPOSIT BONUS 30%

- Increased quoting precision

- Market execution and no requotes

- No stop & limit levels

- Leverage 1:500

- Wide range of trading platforms mt4/m5

- CENT

- Leverage 1:200

- MIN. DEPOSIT $10 DEPOSIT BONUS 30% -->

- The opportunity to trade in micro lots. The size of the contract is only $ 1,000.

- Minimum deposit of $10. CENT accounts do not require huge deposits at this stage of your trading career at liteforex

Accounts specification

| ECN | CLASSIC | |

|---|---|---|

| spread | floating, from 0.0 points | floating, from 1.8 points |

| commission | from 5$ per lot 1 | no 3 |

| execution type | MARKET EXECUTION | MARKET EXECUTION |

| platform | MT4/MT5 | MT4/MT5 |

| leverage | 1:500 - 1:1 | 1:500 - 1:1 |

| account base currency | USD, EUR, MBT | USD, EUR, MBT |

| minimum deposit | $50 | $50 |

| rate, % per year 2 | 2.5% | 0% |

| islamic accounts | yes | yes |

| social trading | available | available |

| contract size, $ | 100000 | 100000 |

| minimum lot | 0.01 | 0.01 |

| maximum number of orders | unlimited | unlimited |

| margin call level | 100 | 100 |

| stop out level | 20 | 20 |

- Forex major - 10$ per lot, forex crosses - 20$ per lot, forex minor - 30$ per lot, metals - 20$ per lot, oil - 0.5$ per lot, CFD on shares - 25 cents per share, stock indices - 0.5$ per contract, crypto - 10$ per lot

- Annual interest rate is the percentage credited on surplus funds (annual interest).

The state of the account is checked daily at the end of the day (at 23:59 GMT +3) to determine the amount of client’s own funds not used in trading. The daily interest amount is calculated in accordance with the following formula:

%, daily = (free_margin - credit) * interest_rate / 100 / 360 , where:

- Free_margin - credit - the amount of client’s own surplus funds at the moment of calculation;

- Interest_rate – interest rate specified;

- 360 – number of days in a year.

The interest calculation algorithm is set by the software developer and can’t be corrected. The calculated amount is accumulated daily and saved automatically. The interests accrued over the whole month are paid on the last calendar days of the month. This accrual is made as one balance operation with a comment "IR".

The accrual is made only on active accounts. If on the last calendar day your account is in the archive or is dormant, the interest for the earlier period of activity (daily interest amount calculated in the current month earlier) will not be paid. If there is no activity on the client's account, the company reserves the right to revise the conditions of annual interest rate’s calculation, up to cancellation. A scarce trading history can be a reason for revision as well.

Open forex trading accounts for any category of traders

Anyone with an aptitude for numbers and an attitude to get maximum can try a hand in forex tradi.

One needs to comprehend the idea of a ‘swap’ to understand the concept of a no swap.

Islamic forex trading accounts

Islamic forex trading accounts also known as no riba accounts it is created to accommodate customer.

Forex or foreign exchange is a popular trading business platform. People trade on foreign currenci.

Are you interested in the forex market? Then, you should join forex trading and earn a considerable.

The recent trend has offered great support to forex trading. If you are willing to make a profit.

A beginner in forex trading needs to open up an account with any reputed forex trading service w.

Risk warning: trading on financial markets carries risks. Contracts for difference (‘cfds’) are complex financial products that are traded on margin. Trading cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and taking into account your investment objectives and level of experience. Click here for our full risk disclosure.

The website is owned by liteforex group of companies.

Liteforex investments limited registered in the marshall islands (registration number 63888) and regulated in accordance with marshall islands business corporation act. The company’s address: ajeltake road, ajeltake island, majuro, marshall islands MH96960. Email:

Liteforex investments limited does not provide service to residents of the EEA countries, USA, israel, and japan.

Forex trading accounts

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Trade the global markets with professional guidance and powerful trading tools

Global markets

/media/forex/images/global/icons/icon-trading-central.Svg" alt="trading central icon" />

Integrated trade ideas

Premium third-party trader resources provided by trading central

/media/forex/images/global/icons/icon-trade-dma.Svg" alt="platform arrows" />

Powerful platforms

/media/forex/images/global/icons/icon-pricing.Svg" alt="pricing icon" />

Active trader

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Key benefits of FOREX.Com

When you open an account with us you'll take advantage of the security, stability and strength that you'd expect from a global leader in forex trading.

/media/forex/images/global/icons/icon-pricing.Svg" alt="pricing icon" />

/media/forex/images/global/icons/icon-chart-autochartist.Svg" alt="autochartist icon" />

/media/forex/images/global/icons/icon-education.Svg" alt="build confidence with educational resources" />

/media/forex/images/stonex-rebranding/icon-snex-nasdaq-trust.Svg" alt="icon SNEX" />

Pricing means nothing without quality trade executions.

Try a demo account

Your form is being processed.

Try a demo account

Your form is being processed.

Account comparison

Standard

Commission

FOREX.Com trading platforms

FOREX.Com advanced desktop platform

Metatrader 5

Metatrader 4

Currency markets

80+ FX pairs plus spot gold & silver

80+ FX pairs plus spot gold & silver

58 FX pairs plus spot gold & silver

Crypto markets

Bitcoin, ethereum, litecoin & ripple

Bitcoin, ethereum, litecoin & ripple

Share markets

4,500+ on FOREX.Com platforms, 400+ on MT5

4,500+ on FOREX.Com platforms

Index markets

Commodity markets

Pricing

Spreads plus commissions

Market-maker model

STP model

Direct market access

Cash rebates

For accounts that qualify

For accounts that qualify

Waived wire fees

For accounts that qualify

For accounts that qualify

Dedicated market strategist

For accounts that qualify

For accounts that qualify

Earn interest

For accounts that qualify

For accounts that qualify

API trading

Recommended balance

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

So, let's see, what we have: open a forex trading account with FOREX.Com. At open forex account with $10

Contents of the article

- Best forex bonuses

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

- Fxdailyreport.Com

- 5 forex brokers with low minimum deposit $1 and $5

- Top 10 unlimited forex demo account for 2021

- What’s a demo account?

- Top10 unlimited forex demo accounts

- Open forex trading accounts for any category of...

- Open forex trading accounts for any category of...

- $10 min deposit forex brokers | cheapest forex...

- Forex brokers with minimum deposit until $10

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- Top 10 unlimited forex demo account for 2021

- What’s a demo account?

- Top10 unlimited forex demo accounts

- Open forex trading accounts for any category of...

- Open forex trading accounts for any category of...

- Forex trading accounts

- Trade the global markets with professional...

- Active trader program

- Key benefits of FOREX.Com

- Pricing means nothing without quality trade...

- Try a demo account

- Try a demo account

- Account comparison

- Standard

- Commission

- FOREX.Com trading platforms

- Metatrader 5

- Metatrader 4

- Currency markets

- Crypto markets

- Share markets

- Index markets

- Commodity markets

- Pricing

- Market-maker model

- STP model

- Direct market access

- Cash rebates

- Waived wire fees

- Dedicated market strategist

- Earn interest

- API trading

- Recommended balance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.