Tickmill payment methods

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors.

Best forex bonuses

Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk. – you have sufficient funds on your card.

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

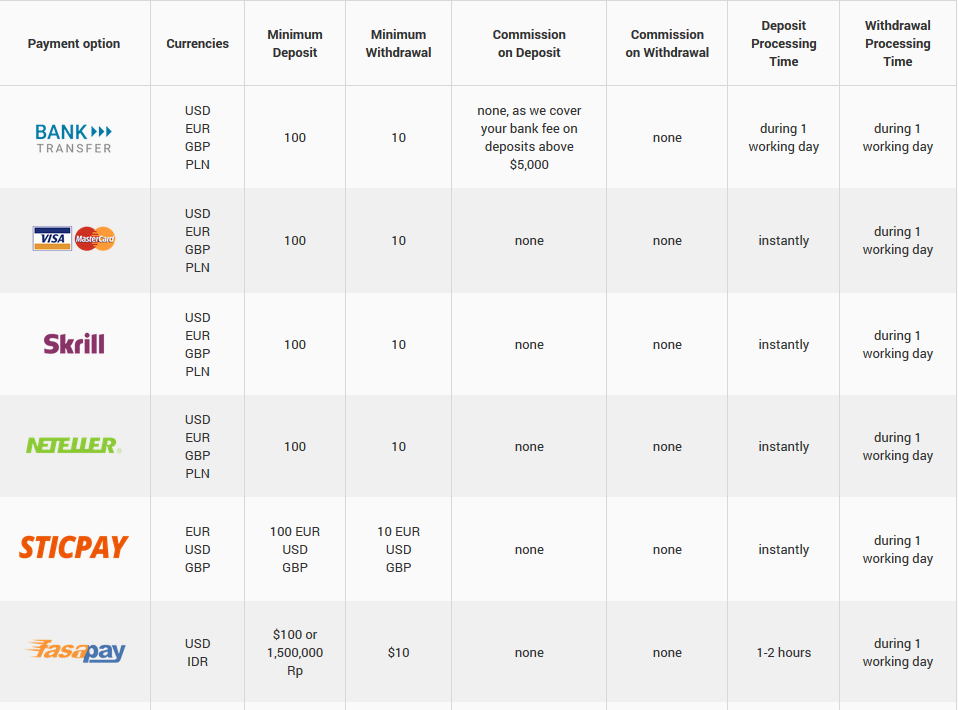

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

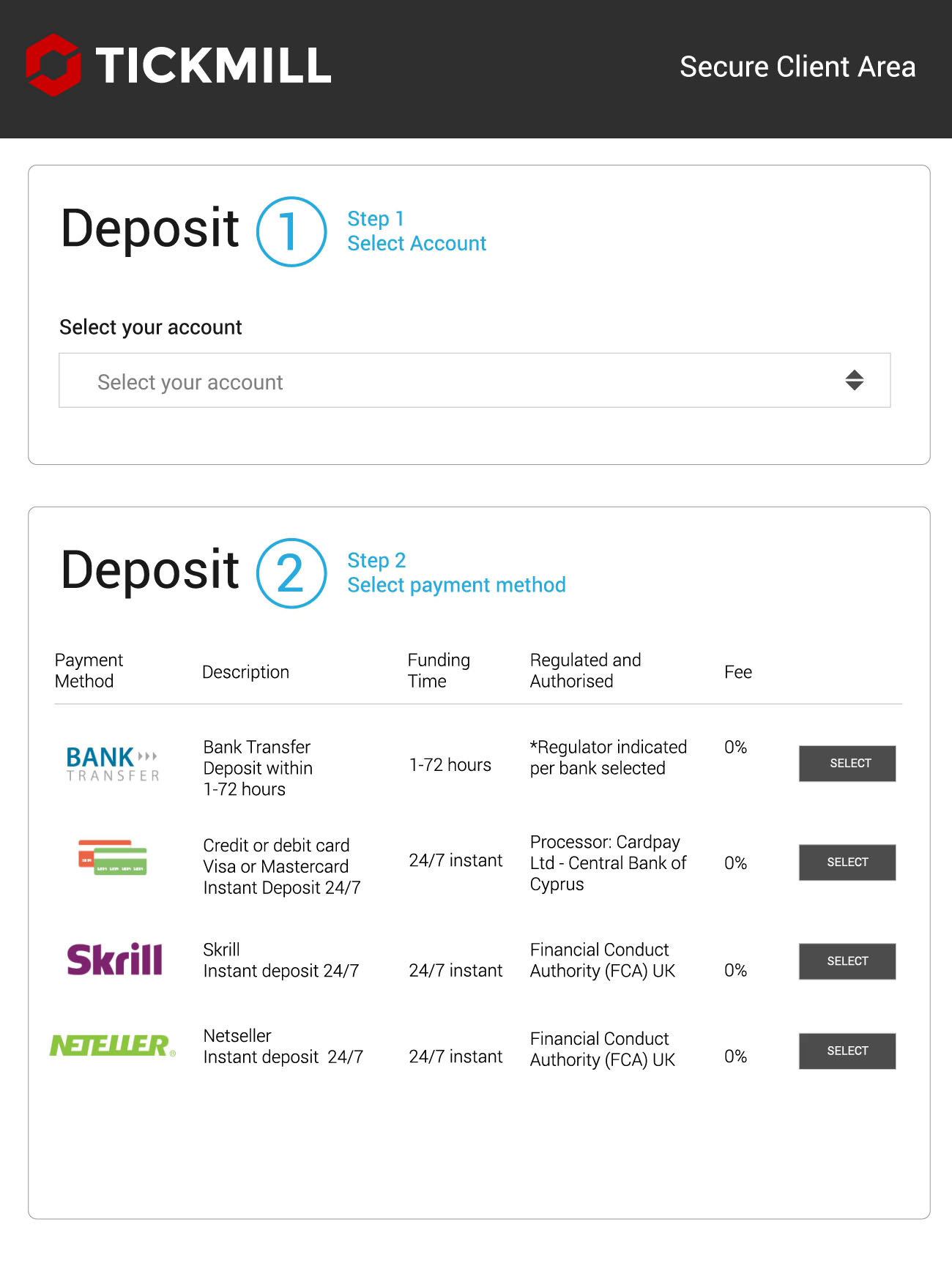

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill withdrawal proof & tutorial

Many traders are worried about withdrawals with forex brokers because on the internet you will find a lot of claims about bad brokers. But with tickmill you will trade with a serious and trusted forex broker. How to do a withdrawal with tickmill? – on this page, we will show you an exact tutorial on how to do it and our personal withdrawal proof with tickmill. Inform you about the methods and processes.

Tickmill withdrawal proof with neteller

As you see in the picture above the withdrawal with tickmill is done in less than 3 days (1 day on our example). The following steps will show you exactly how to do a withdrawal and in the next section, we will go in detail.

How to do the withdrawal:

- Be sure your trading account is fully verified

- Select your trading account

- Select the payment method

- Choose the amount and submit the withdrawal

- You will get an email when the withdrawal is processed

There are no withdrawal fees

(note: get 5% commission rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Step 1: an verified trading account is important

Tickmill is a regulated forex broker who is acting under strict laws and rules. The company has to verify your identity and trading account in order to confirm your payments. Also, trading with real money is not possible with a non verified account under the FCA or cysec regulation. The broker will always ask you for the real documents.

The documents will be verified in a few hours. Just upload a picture or scan of the required identity check. After you did it you can use all the functions of the tickmill trading account and very fast withdrawal.

Step 2: select your tickmill trading account

To do the withdrawal you have to select your trading account. You directly see your account balance that you can withdrawal.

Select your tickmill trading account for the withdrawal

Step 3: select the payment method

Tickmill offers more than 10 different payment methods for money transactions. You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day.

The payment methods are depending on your country of residence and the regulation.

Select your payment method

Payment methods:

- Bank transfer

- Credit cards

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Nganluong.Vn

- Qiwi

- Webmoney

Step 4: choose the withdrawal amount

Now you have to insert your payment details (see the picture below) and the withdrawal amount. Then you can submit the payment. Make sure that the data is correct. If the data is not correct the broker will inform you.

Insert your tickmill withdrawal methods

Step 5: wait till the withdrawal is processed

As mentioned before tickmill will inform you with an email when the withdrawal is processed. The normal withdrawal duration is 1 working day. The support team is working monday till friday. On the weekends the withdrawals are not processed.

Problems with the withdrawal

Sometimes there can be a problem with your withdrawal. That is why we repeat it: you should verify your account correctly in order to trade real money and do correct withdrawals. In addition, tickmill can require additional documents from you. It is very important to follow the advice.

Moreover, the withdrawal details should match exactly your personal data. You can not a withdrawal to a foreign bank account or credit card. Tickmill only processes withdrawals to payment accounts which are belonging to your identity. This is a very important safety feature. Even hackers can not steal your money.

To do a successfull withdrawal you should:

- Verify your account

- Insert the right personal data and payment details

- Follow the brokers instructions

Conclusion: tickmill withdrawals are working without a problem

In conclusion, tickmill is a trusted forex broker who threats the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with tickmill. It is very easy to do the withdrawal of profits.

The advantages:

- More than 10 different payment methods

- Payments are processed within one working day

- No fees for your payments.

- Minimum withdrawal amount only $10

As we showed on this website the withdrawals with tickmill are working very fast and without any fees. (5 / 5)

Tickmill minimum deposit & withdrawal methods

The british broker tickmill is a company originally established in estonia, which is now regulated by the FCA thanks to its branches in great britain and the seychelles. At tickmill, more than 60 forex pairs and cfds can be traded via the popular metatrader 4 or the in-house webtrader, with three different account models at favorable conditions. The STP broker offers access to the markets with a minimum deposit of 100 euro or US-dollars at tickmill. Since the provider is still little known in germany, we will show you how tickmill deposits and withdrawals are handled and what fees traders have to expect for transactions.

Facts about the payment methods and conditions of tickmill:

- A minimum deposit of 100 euro / US dollar

- Payment execution by visa or mastercard, bank transfer, IMMEDIATELY, skrill, neteller, paysafecard, dotpay

- Account management in EUR, USD, GBP and PLN

- No deposit and withdrawal fees

Why payment methods are so important

Traders who are just taking their first steps in forex and CFD trading, possibly having found their way in through a demo account, usually focus on the educational offerings and later on the conditions of a broker. Once they are satisfied with the demo, the transition to a real money account with the same provider is easy. But experienced users know that all too often less attention is paid to payment methods.

Accordingly, dissatisfaction with payment methods, in particular, is one of the most frequent reasons for switching brokers. Some online brokers charge double-digit fees, which significantly reduces the trader’s return, and delay payouts due to unnecessarily long processing times. However, high minimum deposits of four-digit amounts are also a shortcoming, as they make it difficult, especially for beginners, to gain access to trading at all.

- The payment methods offered depend on the broker

- Ewallets are becoming increasingly common

- Deposit and withdrawal methods are usually the same

- Payments via third parties are not accepted

Fortunately, an insight into customer wishes and the competitive pressure among the numerous online brokers on the market ensures that the range of payment methods is also becoming increasingly comprehensive and customer-friendly. Thanks to above all too common ewallets, payments can be made faster and more cost-effectively. However, all providers have certain restrictions in common, such as those relating to payments via third parties. An overview presents the common payment methods, their advantages, and limitations.

Credit cards remain one of the most popular options

If you use a credit or debit card to capitalize on your trading account, most brokers will allow you to deposit and withdraw larger amounts free of charge – usually up to 10,000 euros. Another advantage is the immediate crediting so that trading can begin immediately. And traders do not have to worry about the security of their own data. A glance at the data protection information shows that brokers know and apply the importance of secure data transmission and modern encryption technologies.

In addition, credit cards, formerly a rather exclusive means of payment with their own, quite high annual fees, are now offered very cheaply or even free of charge, especially by direct banks, and are thus accessible to the average customer. Additional costs for the card alone are a thing of the past. What traders should consider is that it is not unusual for brokers to insist on a scan of the credit card for card payments.

The customer does not always have the option of blackening some digits of the card number! In addition, with card payments, the maximum amount deposited is often the payout limit for this option. And not all providers offer free card payments, whether for deposits or withdrawals. Therefore, there are sometimes good reasons against capitalizing the merchant account by credit card.

Bank transfers are secure and much faster

A very secure and mostly free alternative to payment by credit card is the conventional bank transfer, especially in the single euro payment area. SEPA bank transfers are executed within one working day. As long as they are done from your own home banking, there are no costs involved, and most brokers also offer free of charge payment by bank transfer. Furthermore, bank transfer can be tracked very well. However, the secure and inexpensive payment method is anything but fast, because the processing time by the bank is joined by the processing by the broker.

It can take at least two and up to seven working days for the trader to receive the credit on his trading account. Nothing for the hurried! And for international transfers to a broker outside the EU it can take even longer. There may also be costs associated with bank transfers, for example, if the transaction is ordered on paper or by telephone. International bank transfers are subject to interbank commissions, and if the currency of the transaction is not the same as the currency of the trading account, exchange rate costs are added.

Online payment methods

Electronic payment options are becoming increasingly popular – the pioneer is paypal, once the in-house payment solution of the ebay platform, now an independent financial service provider with a banking license. Imitators with almost as large a customer base are skrill and neteller, providers who enable the international transfer of even large amounts at good conditions. Links to the current account are the basis for fast payment options such as trustly or sofort. And international ewallets are joined by regional solutions such as the german giropay.

The value date of the instructed amounts is immediately or within one day at the latest with the electronic payment service providers, and the fees charged by brokers on such payments are, if any, rather low. The security measures for online payments are also convincing, and they can even be made by mobile phone. It is therefore not surprising that the list of e-payment providers is also getting longer and longer among the payment methods used by forex and CFD brokers. This is a real alternative for customers, especially since the chosen payment method is then usually also binding for payouts.

With the deposit you commit yourself for the payout

If a trader has decided on a particular payment method at or shortly after opening the trading account, this method usually remains binding. For example, when depositing by credit card, subsequent withdrawals from the trading account must also be made through the credit card account. A combination of different methods is usually not possible – much to the disadvantage of traders, as it is not uncommon for there to be no fees when depositing via a certain method, but there are fees when withdrawing, and vice versa.

Customers would be better served with a flexible combination of different options, but unfortunately, the majority of brokers do not allow this. If you later want to change a payment method once it has been selected, it is necessary to contact customer support and in any case to go through a re-verification process. In addition, the amount of the largest deposited amount usually automatically represents the limit for later withdrawals.

Everything you need to know about the deposits at tickmill can be found in the following table:

| Method: | minimum amount: | processing time: |

| visa/mastercard | 100 USD | within 24 hours |

| bank transfer | 100 USD | within 24 hours |

| IMMEDIATELY | 100 USD | within 24 hours |

| paysafecard | 100 USD | within 24 hours |

| neteller | 100 USD | within 24 hours |

| skrill | 100 USD | within 24 hours |

| rapid | 100 USD | within 24 hours |

| dotpay | 100 PLN | within 24 hours |

Transactions on own account only

The capitalization of the trading account, no matter by what means, can only ever be done in your own name. Payments by and to third parties, via the partner’s mastercard or as a transfer from friends, are not accepted under any circumstances unless explicit escrow accounts can be kept. This applies not only to brokers within the european union but internationally.

This is due to binding regulations that are intended to help curb money laundering and capital flight. Furthermore, business accounts cannot be used for payments – at least not by private traders. Under certain circumstances, brokers may offer this option for their business customers. The reference account through which all payments are made must be in the same name as the trading account with the broker.

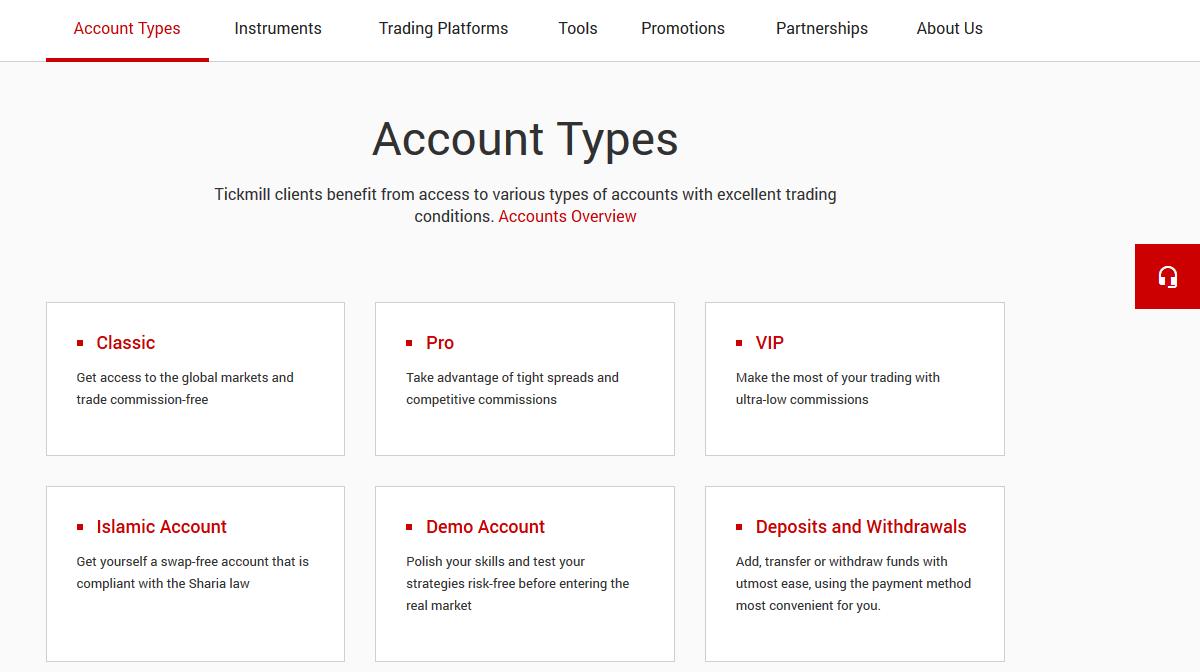

Three accounts, small minimum deposit at tickmill

The british STP broker offers its customers a demo account and three different real money accounts, the “classic” and ECN-pro account with a tickmill minimum deposit of only 100 euro. However, accounts can also be managed in USD, GBP, and PLN. This way, especially beginners do not have to invest too much money to get started in trading. Experienced traders receive particularly favorable conditions for trading with the VIP account, but must make an initial deposit of 50,000 USD.

- Two accounts with 100 USD minimum deposit

- Free demo is offered

- VIP account for experienced traders

- Swap-free islamic account

The different account models allow users to choose the offer that best suits their needs. Trading fees are charged in different ways, with the classic account through spreads, with the ECN account through commissions. For both accounts, the minimum transaction size is only 0.01 lot, which means that even small investments can be traded.

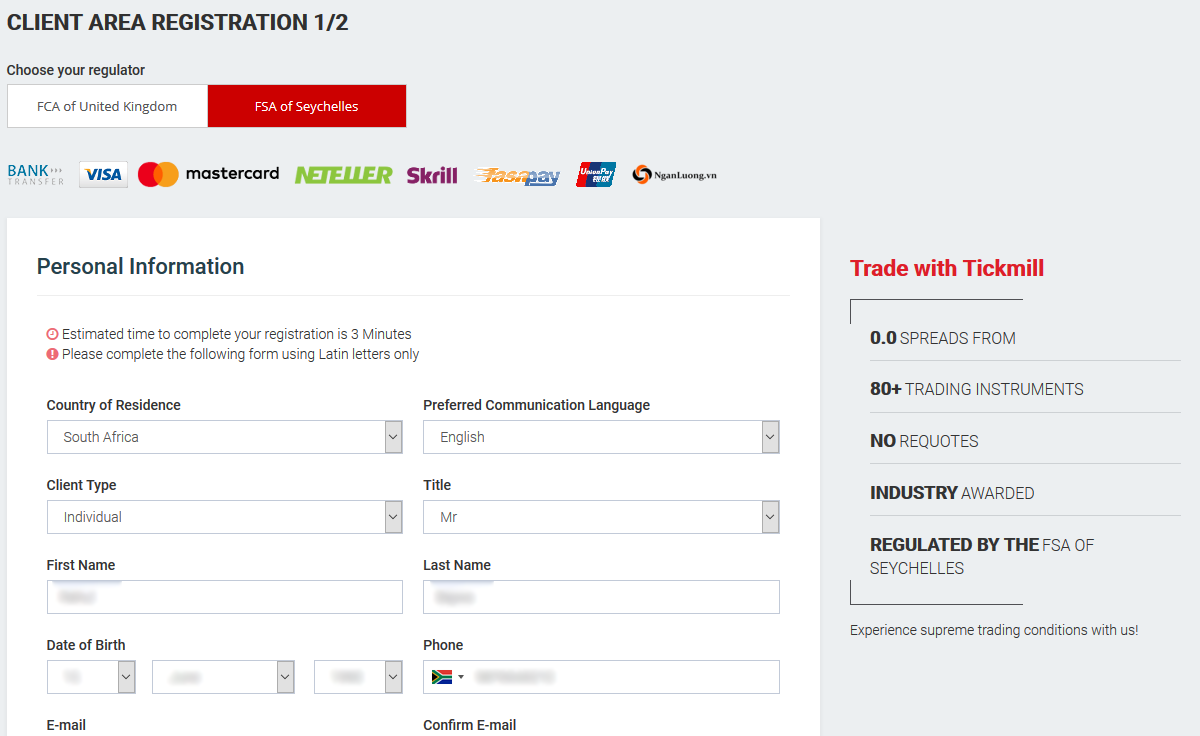

How tickmill deposits and withdrawals are possible

The trading account with tickmill is set up by clicking on the “open account” button in the website header. Traders have the choice of trading with the FCA-regulated UK provider or having their account managed by the seychelles branch, which allows them to use higher levels of leverage. The form, which must now be filled out, asks for first and last name, country of residence, e-mail and telephone number, but also for the preferred language of communication. In addition, the trader can decide whether a private or business account should be managed.

With the sending of these first details, the user receives an e-mail with a confirmation link. Afterward a verification is necessary. For this purpose, a copy of an identification document and a proof of address must be uploaded. Verification is necessary because without it no payouts can be made later. The broker usually verifies the documents within 24 hours, often even faster, so that traders can deposit money immediately at tickmill.

First transactions via the trading account

After verification by the broker, the trading account is activated and the client can make deposits and withdrawals at tickmill. Both are done from the personal customer area, after login. Among the offered payment methods you will search in vain at tickmill paypal. Most options can be used for all offered account currencies, i.E. Euro, US dollar, british pound, and polish zloty. An exception is the IMMEDIATE bank transfer by the swedish provider klarna, where only euro or GBP can be transferred. The polish payment solution dotpay can also only be used for zloty.

No fees for payments at tickmill

Fortunately, there are no fees for depositing money at tickmill and no fees for withdrawals. Traders who wish to capitalize their account by bank transfer can take advantage of tickmill’s zero fees policy. This means that the broker will cover the costs of the transaction from a deposit value of 5,000 USD or the equivalent in one of the other possible currencies, up to a maximum of 100 euros / USD.

In order to receive the refund, traders only need to send a copy of their account statement to tickmill support within one calendar month after making a deposit. The amount will then be refunded within a few days. Nevertheless, tickmill also reserves the right to charge fees for deposits or withdrawals – namely when the user is inactive.

Tickmill payout: fast and free

It is similarly uncomplicated and fast when traders want to withdraw money from their trading account at tickmill. The tickmill payout is requested from the personal customer area, the processing by the broker usually takes place within one working day. However, traders should take into account that depending on the payment method chosen, further processing times may be required by the payment service provider, so that, for example, if withdrawals are made by bank transfer according to tickmill, withdrawals are only credited after up to seven working days.

Withdrawals are generally made via the same channel as deposits, except for paysafe – where an alternative withdrawal method must be selected. Of course, the account holder must be verified in order for the payout to take place at all, and the transferred amounts must not result in a coverage gap for open positions.

Everything you need to know about withdrawals with this broker can be found in the following table:

| Method: | minimum amount: | time-span: |

| visa/mastercard | 25 USD | within 24 hours |

| bank transfer | 25 USD | within 24 hours |

| IMMEDIATELY | 25 USD | within 24 hours |

| paysafecard | 25 USD | within 24 hours |

| neteller | 25 USD | within 24 hours |

| skrill | 25 USD | within 24 hours |

| rapid | 25 USD | within 24 hours |

| dotpay | 25 PLN | within 24 hours |

Buy-in bonus and competitions at tickmill

Bonus payments are prohibited for forex and CFD brokers within the EU, but anyone trading through tickmill’s seychelles office can look forward to the $30 US no deposit bonus. Clients who open a “welcome account” with the broker will receive a credit for this amount, which can be used for trading, without the need to make their first deposit. Winnings made with the welcome account can be transferred to a real money account up to 100 US dollars later.

Another additional offer is the “trader of the month” contest. For this, tickmill customers do not have to register; instead, the broker selects a particularly successful trader, who wins prize money of 1,000 US dollars. Other competitions include, for example, forecasts on the performance of financial instruments, and attractive cash prizes can also be won here.

Occasionally raffles are added, such as recently especially for german traders the possibility to win a trip for two to london and to meet the managing director of tickmill at dinner. Further additional offers include the demo account, the comprehensive, free educational offer, and also the broker’s trading tools, which are also available to traders at the british branch.

Conclusion: good conditions, free payment methods at tickmill

The british broker tickmill, which is not yet very well known in germany, recently launched a website in german to present its services to german traders. Three account models allow trading with forex and cfds with the FCA-regulated provider with STP/ECN market model. The minimum deposit, initially set at 25 USD, has now been raised to 100 USD, but is still low enough for private investors.

The conditions for forex and CFD trading can be described as good, even if the trading offer for cfds is still quite narrow. All relevant information is presented very transparently on the website. Tickmill offers its customers a sufficient choice of payment methods. In addition, all options can be used without fees from the broker, both for deposits and withdrawals.

For bank transfers of amounts over 5,000 euros or US dollars at deposit, the provider even reimburses possible costs on the part of the bank, provided that the customer documents the payment within one calendar month by submitting a bank statement. Alternatively, the trading account can be capitalized by credit card, but also by using skrill, neteller, paysafe or IMMEDIATELY. Processing is carried out immediately; a value date can be expected within one working day at the latest; payout orders are also processed promptly and free of charge.

Traders must find out for themselves whether fees are incurred by the payment service provider, and how long the processing of payouts takes until they are credited to the reference account. By waiving its own fees, the broker offers extensive freedom of choice when selecting a payment method. Interested users also have the opportunity to test tickmill’s offer through the free demo account, which is unlimited in time, and thus get an idea of the broker’s services for themselves.

Read our other articles about tickmill:

Tickmill review 2020

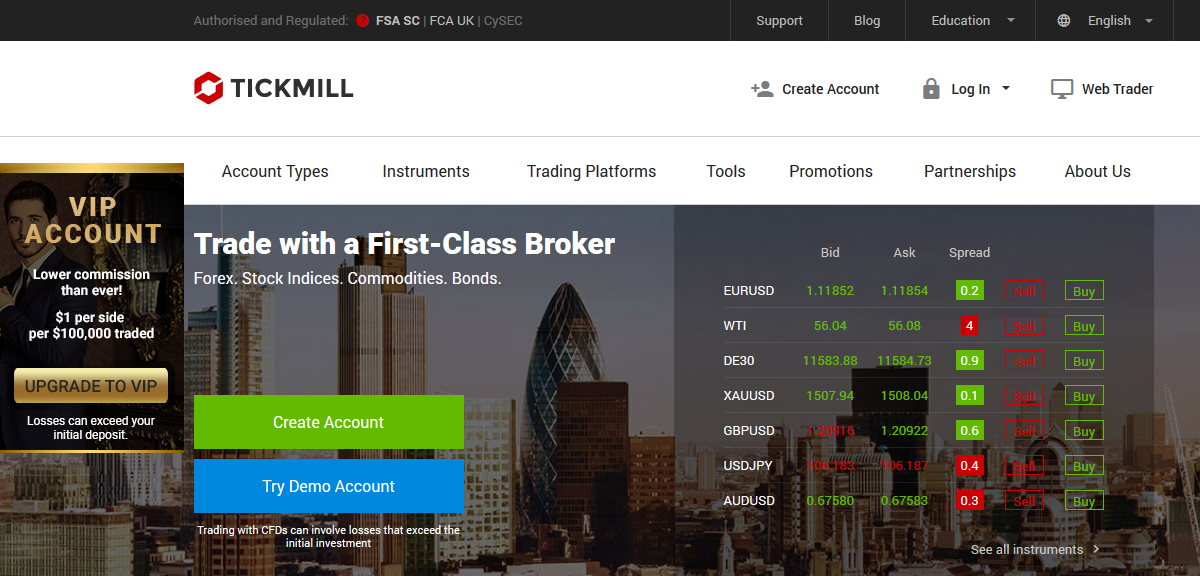

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

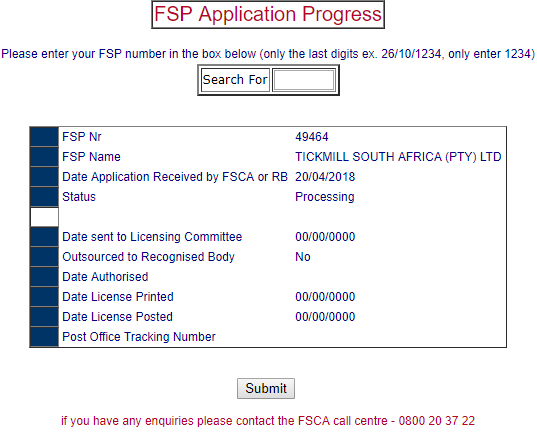

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

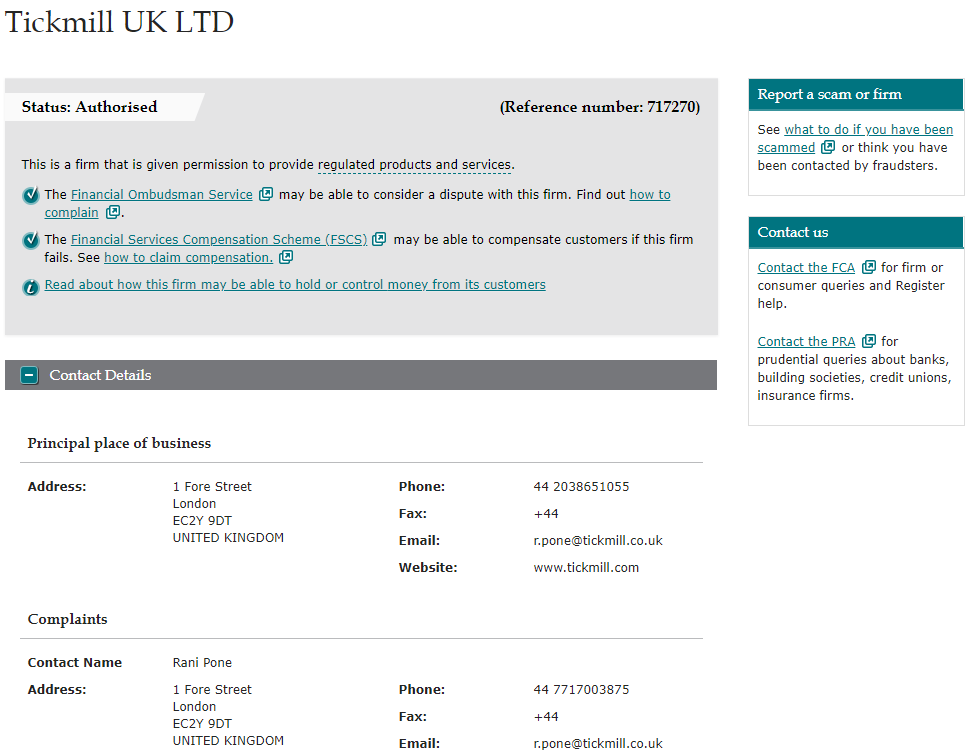

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

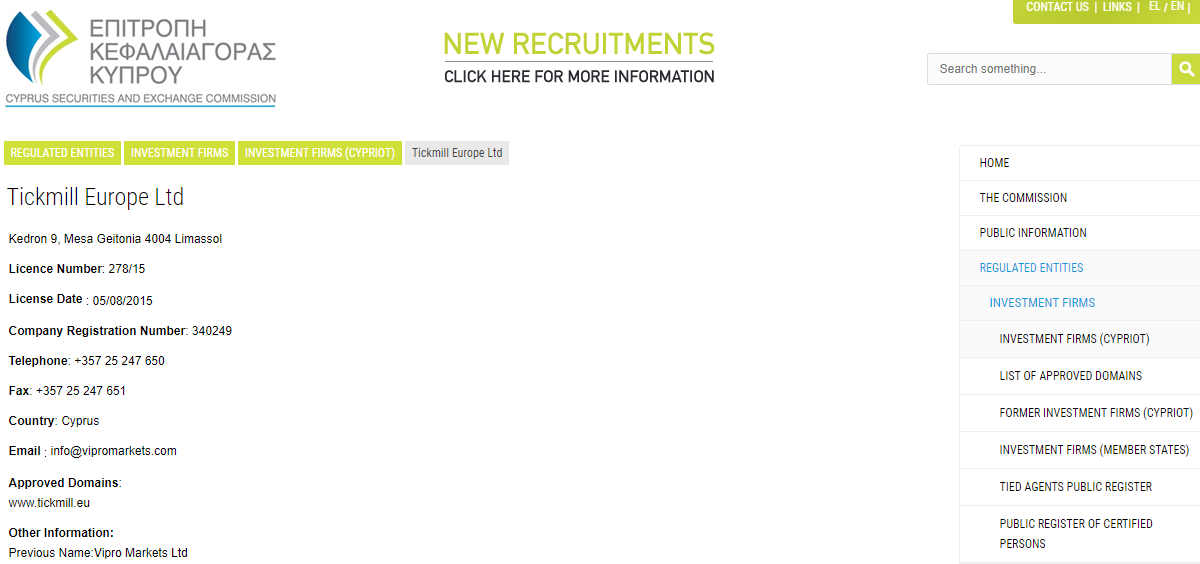

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

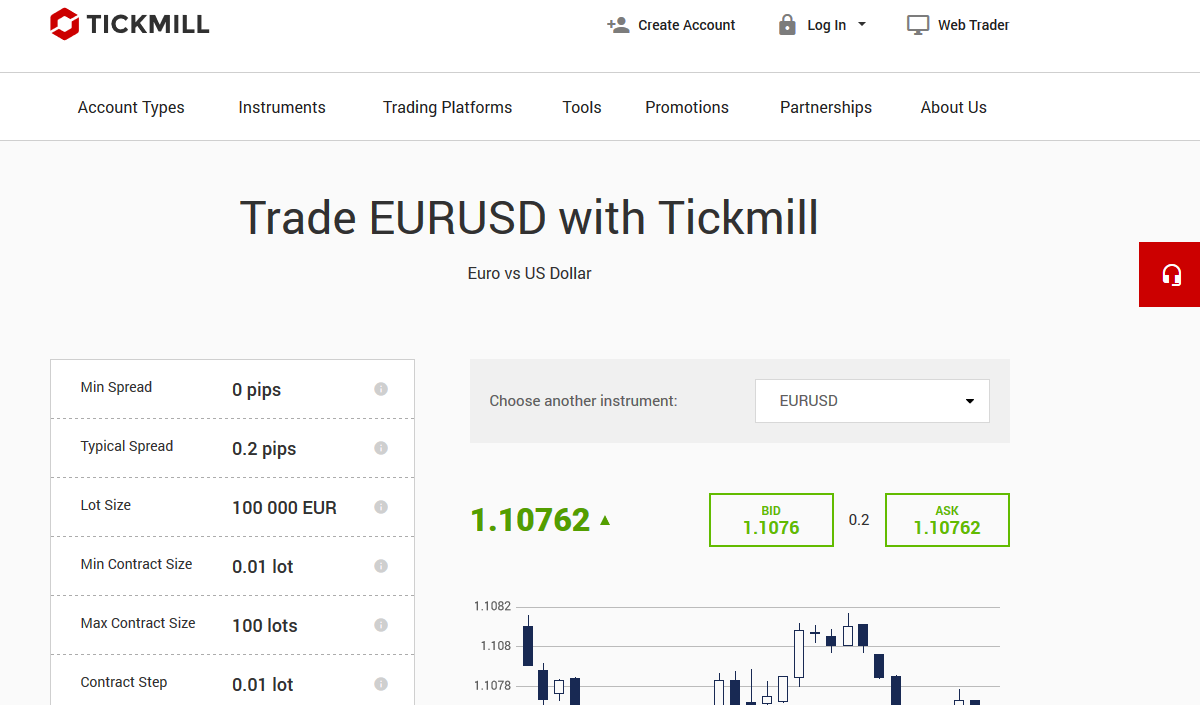

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

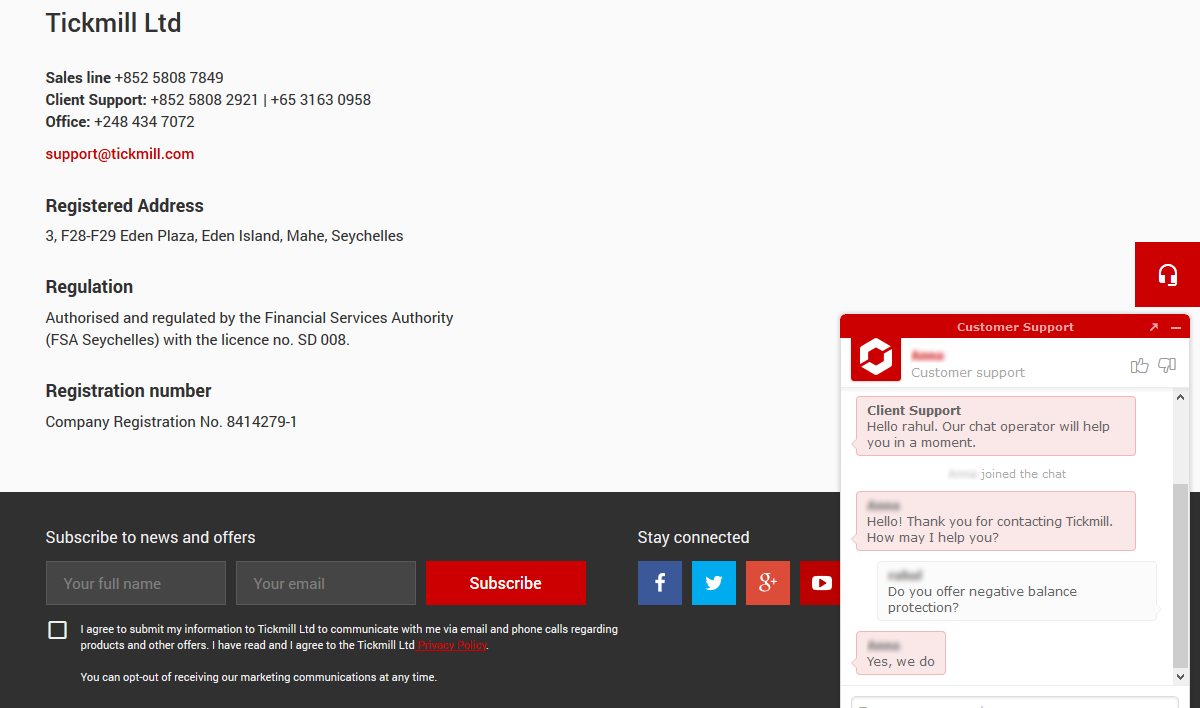

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Tickmill review

In a FAST-MOVING market, choose a STABLE BROKER

Table of contents

Introduction

Tickmill is one of the most credible and reliable forex brokers in the market. Founded in 2014 with its headquarters in london – UK, this company has been providing quality brokerage services to users across the world from the past six years. Users of this broker get to access various financial markets like forex, soft/hard commodities, indices, bonds, etc.

Compared to other brokers with the level of tickmill’s market experience, this broker proved to be heavily regulated with some of the top tier financial regulators. Tickmill offers four types of well curated accounts and users get to pick the ones that is most appropriate to them. Demo trading facility is also available for users which could help novice traders to get the hang of the platform they are going to use.

This broker offers their services on the MT4 trading platform which is highly accepted by traders across the world. Using this platform, users get to trade on both desktops (windows/mac), and smartphones (android/ios). Apart from these, there are various other services this broker provides for their users like trading bot services called autochartist, VPS and many more.

The unique selling proposition of this broker is the lowest fees they offer. When compared to other regulated brokers, tickmill charges very less commissions and trading fees. Options to deposit and withdrawal are also many and are typically not charged. On the flip side, users get to access limited number of asset classes when compared to other brokers of this range.

Tickmill is now in position to claim that it possesses way above 100,000 traders which have jointly opened more than 250,000 active accounts.

Tickmill.Com is owned and operated within the tickmill group of companies.

– tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 – 32 old jewry, london EC2R 8DQ, england),

– tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),

– tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA)

– tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927

– tickmill asia ltd – regulated by the financial services authority of labuan malaysia (license number: MB/18/0028).

Addresses and phones

Addresses:

tickmill UK ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill europe ltd, registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus

tickmill south africa (pty) ltd, registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town

tickmill ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill asia ltd, registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia

Phones:

+852 5808 2921

+6087-504 565

+44 203 608 6100

+357 25041710

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

7 binary options

Tickmill

Tickmill LTD is a company located in the seychelles and is an FCA regulated broker. Tickmill is a retail forex broker with connections to the armada markets which as of january 2015 has switched its focus on providing substantial liquidity and their services to banks, hedge funds, and forex brokers. The company offers at present 62 currency pairs in addition to silver and gold trading.

Account types and platforms

Tickmill provides three types of accounts:

- The classic account requires a minimum deposit of $100, and the spreads vary on average by 1.2 pips.

- The exchange account requires a minimum $300 deposit. This is an ECN account, and so there are no spreads.

- The company also offers a corporate account for businesses.

Tickmill traders can use the excellent metatrader4 platform for all their real-time market information and prices. The platform works on both macs and pcs though macs will need to run a windows emulator. The mobile version of the platform is available for smartphones and tablet computers mainly running ios and android operating systems.

Features

We consider tickmill to be a comparatively high-tech broker. You get this impression the first time by visiting the company’s official website. It’s littered with various technological methods, and the design is very attractive.

The usps (ultimate selling features) are clearly listed on the website as being leverage, micro lots, spreads, and low initial deposit.

Scroll further down the main page, and you’ll find a list of features offered by tickmill. The features are listed as:

- Direct access to the forex markets if you are an ECN broker

- Zero membership fees

- Very low spreads, which means the broker earns money via the commission paid by the trader.

The company also boasts of offering a number of trading strategies some of which are not found with other brokers. Take for instance the one click trader which can easily be downloaded and it has a hedging option. The instructions regarding installation of the spread indicator is clearly detailed in the ’tools’ section of the website.

In addition to the regular MT4 platform tickmill also has a myfxbook autotrade copy platform. The platform allows traders to easily copy the trades from any system directly to their metatrader4 account. The system has been designed so that there is no additional software to be installed and only a list of historically portable types of systems are listed from a handful of real accounts.

You can see some of the features offered by tickmill above

The system can be added and removed whenever needed. Plus, traders get to choose from many metatrader4 systems and the devices it is used on.

The company also has monthly trade competitions. A panel comprising of three judges will choose the best trader based on their overall monthly profit when the month ends. In addition, the maximum drawdown ratio, overall profit to loss, and risk management are also considered.

The company offers customer service mainly via chat, telephone, skype and email from 7:00 – 20:00 GMT. The official website is available in a number of languages such as:

- Russian

- Indonesian

- English

- Spanish

- Chinese

Trading platforms

Trading platforms

Similar to many other forex brokers tickmill supports metatrader4. The software is available for pcs and macs, as well as ios and android devices, plus it can be accessed via a web browser.

It goes without saying that metatrader4 is the most popular forex trading platform or terminal for over a decade. It continues to be the platform of choice for many brokers and investors.

The interface is easy to use and offers all the features a trader would need to execute profitable trades. Plus, there is an advanced charts package, extensive testing environment, technical indicators and an array of expert advisors that are woven into the platform.

Tickmill has also managed to partner with myfxbook, and so it can now offer clients automated trading via its new autotrade platform. A VPS service can also be used with tickmill, making it possible for traders to use the EA applications of choice which can be run 24/7 without having to leave their computers on. The beeks VPS starts at £20 a month.

Methods of payment

Traders who choose to use tickmill can choose from an array of payment methods which include the regular debit/credit cards and wire transfer. In addition, neteller, skrill, dotpay, union pay and fasapay can also be used to fund or withdraw money from the account.

Conclusion

It goes without saying that tickmill is, in fact, a well reputed forex broker and a CFD broker of choice for many traders because of its solid reputation. The fact that it offers a diversified portfolio and great trading conditions make it a broker worth considering. We like the ECN option the most.

Is this your final decision?

We suggest you visit one of the popular forex brokers instead!

- Regulated by the FCA

- Offers ECN with competitive prices

- Supports the MT4 trading platform

- Offers low initial deposit accounts and very high leverage

7 binary options review: tickmill: 4,5 stars

so, let's see, what we have: start CFD forex trading with tickmill and enjoy low minimum deposits and low spreads accessed through easy to use deposit and withdrawal options at tickmill payment methods

Contents of the article

- Best forex bonuses

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill withdrawal proof & tutorial

- How to do the withdrawal:

- Step 1: an verified trading account is important

- Step 2: select your tickmill trading account

- Step 3: select the payment method

- Step 4: choose the withdrawal amount

- Step 5: wait till the withdrawal is processed

- Problems with the withdrawal

- Conclusion: tickmill withdrawals are working...

- Tickmill minimum deposit & withdrawal methods

- Why payment methods are so important

- Credit cards remain one of the most popular...

- Bank transfers are secure and much faster

- Online payment methods

- With the deposit you commit yourself for the...

- Transactions on own account only

- Three accounts, small minimum deposit at tickmill

- How tickmill deposits and withdrawals are possible

- Tickmill payout: fast and free

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

- Tickmill review

- Introduction

- 7 binary options

- Tickmill

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.