How to get money from forex

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though) net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Best forex bonuses

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

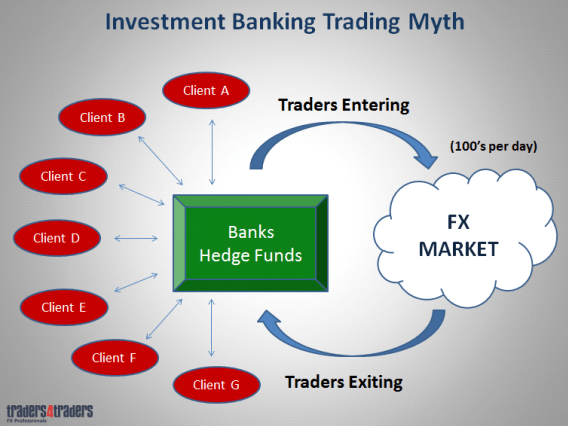

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

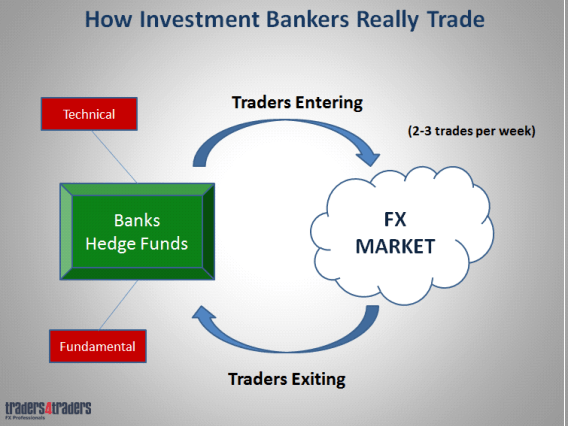

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

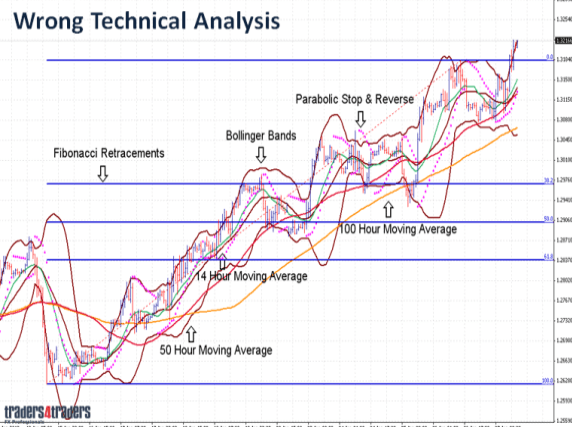

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

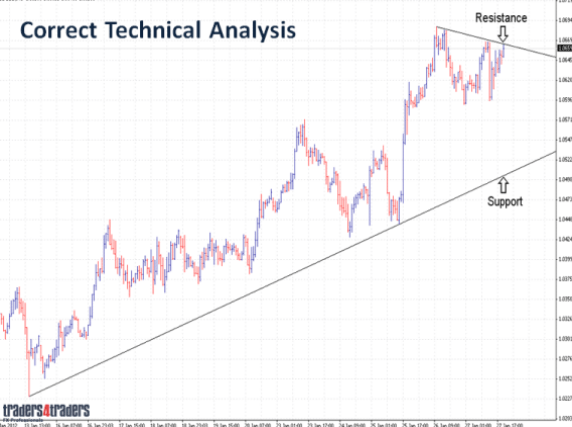

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

How to get money back from forex scam – can you even get it back?

How to get money back from forex

Forex trading is one of the most famous forms of trading on the internet. There was a time in the past when you had to go to money exchanges to get a different currency for the currency you had. However, you can now trade fiat currencies from the comfort of your home, thanks to the online trading industry. When you trade online, you sign up with an online broker first. This broker gives you access to the forex market where you can see all the available currency pairs that you can trade. You can pick any currency pair and trade it with real money. You deposit this money into your online account through bank wire transfer, credit card, or some other method.

If you feel that you have been scammed by a forex broker trading scheme then you are welcome to visit our investment and trading scams page, for more information or visit our contact page to get help.

However, the fame of online trading has attracted many black sheep in the industry. You now have many online forex brokers that are not brokers at all. They are scammers in disguise you want to snatch away your money. Millions of people lose their money in the hands of these fake online brokers. And if you are one of them, you are also wondering how to get money back from forex scam. Can you get it back?

How to get money back from forex scam – getting it back is possible

If you are lucky enough, you can get your money back. Saying that you can’t get your money back at all would be wrong. As you continue to read, you will find out some methods that you can use to get the money back that you have lost in the hands of an online scammer. It won’t be wrong to say here that you have to be very lucky to get the money back. Even if you involve the police or some other intelligence agency, the chances of you getting the money back are very thin. You have to keep in mind that many of these online scammers have created their system after proper research.

They know how to deceive you and escape the system. They scam you, take your money, and disappear to never show up again. Not to mention, you never really know their real identities, and that’s why catching them becomes nearly impossible. However, things have changed in recent years. Today, the chances of you getting the money back have increased tremendously. Let’s discuss three methods that can help you get your money back from an online scam broker.

Methods to get your money back from forex scam

· calling your local police – very little chance

The first on the list of how to get money back from forex scam is the police. Yes, whenever you are scammed or you find yourself involved in a scenario where you have been deceived, you should get in touch with your police. That’s actually the best course of action you can take. However, your local police have some limitations. It cannot catch the thieves that are outside its domain of operation. So, if the broker is located in your country, there is still some chance that the police will get it. However, if the broker is located in some other country, you have nearly no chance of getting the money back from the scam.

· getting in touch with a regulatory authority – 50/50 chance

Now, you will be lucky if you sign up with a broker and get scammed, and then find out that the broker was regulated. If the broker that scammed you is regulated, you have some chance that you can get your money back. You just have to go on the website of the broker and find out which regulatory authority regulates it. After that, you just need to get in touch with the regulatory authority. You might find a contact form on their website or a phone number that you can call. You should immediately inform them about the mishap. You should tell them the name of the broker clearly.

If they have already gotten some complaints against the same broker, the chances are very high that they might even seal the website of that broker. However, such a perfect scenario does not happen every day. Why? Well, why will a scammer get regulated? Yes, in most cases, you are scammed by forex scams that are not regulated in the first place.

· getting help from money-back – very high chance

When you get in touch with money-back to file a complaint against an online forex scam, your chances of getting the money are very high. In fact, when you search how to get money back from forex scam after some years, money-back might be the only name you will find in your search results. Money-back has started only four years ago with its services. It has already served clients from many countries of the world with their issues with online brokers. The company has already dealt with more than a thousand cases successfully, which means the people who filed the complaint against the broker with money-back got their money back.

Why is the success rate of money-back so high in getting the money back from online scam brokers? Well, the company has been formed by a team that consists of professionals lawyers, psychologists, and industry experts. They have come together to form a team that not only knows how the laws that govern the online trading industry but also the tactics that make these online scammers give money back to the traders immediately.

Final thoughts

Just a few years ago, you could not have gotten your money back from the online scammers. If you searched for how to get money back from forex scam, you would have landed on the website of your local police after all. However, local police are usually not able to do anything when the scammer is located on the other side of the world. That’s where you need only digital police like money-back. These scammers are ready to give traders their money back instantly when they hear a lawyer on the phone, and when they know they will lose millions when the case goes inside the court. So, choose your online broker wisely, and your well-wishers even more wisely.

If you feel that you have been scammed by a forex broker trading scheme then you are welcome to visit our investment and trading scams page, for more information or visit our contact page to get help.

2 proven ways to recover scammed bitcoin, money lost to binary options forex

NEW YORK, NY ( TS newswire ) -- 24 oct 2020

IMPORTANT: contactexpressrecoverypro@yahoo.ComORinfo@fundsrecovery247.Comto recover scammed bitcoin, as well as money lost to binary options forex trading / investment scam.

There has been a spike in the number of cryptocurrency scam (bitcoin scam, especially), binary options scam and forex scam in recent years. There are a lot of fraudulent cryptocurrency investment websites, as well as fake binary options and forex brokers. A lot of investors have lost (are still losing) money to these bitcoin cryptocurrency and binary options forex investment scams.

Do you need help to; retrieve stolen bitcoin, recover scammed bitcoin, report a bitcoin scammer to reclaim crypto? There are two ways to go about recovering your lost money. You can either follow a series of funds recovery processes as a way to get money back from bitcoin scammer. Or you can hire a bitcoin recovery expert or funds recovery expert to help recover money lost to binary options forex, and bitcoin cryptocurrency scams.

How to recover scammed bitcoin using DIY

Have you lost bitcoin to scam? Recover scammed or stolen bitcoin cryptocurrency yourself by following these 4 DIY steps below;

A.) contact the fraudulent crypto investment platform: you will have to contact the trading platform that scammed you and stole your bitcoin cryptocurrency. Make them know that if they do not return your money, you will report them to the relevant financial authorities. This doesnt necessarily guarantee that they will give you your money back, but it is definitely a step in the right direction. Because when followed by action, your efforts could pay off.

B.) report to relevant financial authorities: either you suspect you may be, or you know are a victim of trading fraud and you are doing everything you can to get justice. Perhaps you have already opened a case with a scam recovery company like ours but you want to make sure that other traders do not make the same mistake. When you file your complaint, make sure to provide as much information as possible.

C.) get help online: if youre keen on getting your money back, you may ask yourself the following questions; have I exhausted all options in getting my money back? Would I just give up if it were to be a million dollars? Try to publicize your story and seek help online in any way you can. For example, post the name of the broker on reddit, quora or facebook or social media to see if there are others who have information on this company or any clues as to how you could get your money back. This may also help prevent others from digging a whole in their bank account or credit card.

D.) inform your crypto wallet provider: contact your bitcoin wallet or crypto wallet and notify them that the company you paid is a scam and is refusing to give your money back. This will raise awareness and ultimately jeopardize any scams relationship with the crypto wallet which may also help prevent others from being scammed.

Hire bitcoin recovery expert to recover scammed bitcoin

The other option will be to hire a bitcoin recovery expert to recover scammed bitcoin. A bitcoin recovery expert is able to track bitcoin transactions and also investigate and apply all necessary technical processes needed to recover funds lost to bitcoin investment scam and other high level digital currency scams.

Using the service of a bitcoin recovery expert to recover scammed bitcoin, offers you the best and the largest crypto recovery / reclaim solution by providing the potential for billions of dollars in misappropriated cryptocurrency to be effectively and legally recovered.

Before now, there was no end-to-end effective solution in the public market for pursuing the rights of victims of cryptocurrency-related frauds. The early stage, cross-border character, scale, and new technological complexity of blockchain has hindered efforts of victims and law enforcement. A bitcoin recovery expert is able to use the combination of fit for purpose technology, operational processes, experience and capabilities to effectively recover scammed or stolen bitcoin and other misappropriated virtual assets.

Best bitcoin recovery expert to recover scammed bitcoin

Who needs to hire a bitcoin recovery expert? Anyone who has lost cryptocurrency funds in any form of a hack, shut down and/or hacked exchange, ransomware, ransoms, fake icos or who simply has lost funds by sending them to the wrong address. Did you lose lose access to your account by losing your bitcoin private key or, did you lose money to fake bitcoin miners?

You can get all your lost funds back by hiring one of the best bitcoin recovery experts out there. After a lot of thorough examination and scrutiny, we present to you the 2 best bitcoin recovery experts;

How much money can I make forex day trading?

Julie bang @ the balance 2021

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. forex trading can be extremely volatile and an inexperienced trader can lose substantial sums.

The following scenario shows the potential, using a risk-controlled forex day trading strategy.

Forex day trading risk management

Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability.

To start, you must keep your risk on each trade very small, and 1% or less is typical. this means if you have a $3,000 account, you shouldn't lose more than $30 on a single trade. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order, which will be discussed in the scenario sections below.

Forex day trading strategy

While a strategy can potentially have many components and can be analyzed for profitability in various ways, a strategy is often ranked based on its win-rate and risk/reward ratio.

Win rate

Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of 100 trades, your win rate is 55 percent. While it isn't required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

Risk/reward

Risk/reward signifies how much capital is being risked to attain a certain profit. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you'd still be profitable.

Hypothetical scenario

Assume a trader has $5,000 in capital funds, and they have a decent win rate of 55% on their trades. They risk only 1% of their capital or $50 per trade. This is accomplished by using a stop-loss order. For this scenario, a stop-loss order is placed 5 pips away from the trade entry price, and a target is placed 8 pips away.

This means that the potential reward for each trade is 1.6 times greater than the risk (8 pips divided by 5 pips). Remember, you want winners to be bigger than losers.

While trading a forex pair for two hours during an active time of day it's usually possible to make about five round turn trades (round turn includes entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

Trading leverage

In the U.S., forex brokers provide leverage up to 50:1 on major currency pairs. for this example, assume the trader is using 30:1 leverage, as usually that is more than enough leverage for forex day traders. Since the trader has $5,000, and leverage is 30:1, the trader is able to take positions worth up to $150,000. Risk is still based on the original $5,000; this keeps the risk limited to a small portion of the deposited capital.

Forex brokers often don't charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably. ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn).

Trading currency pairs

If you're day trading a currency pair like the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

This estimate can show how much a forex day trader could make in a month by executing 100 trades:

Gross profit is $4,400 - $2,250 = $2,150 if no commissions (win rate would likely be lower though)

Net profit is $2,150 - $500 = $1, 650 if using a commission broker (win rate would be like be higher though)

Assuming a net profit of $1,650, the return on the account for the month is 33 percent ($1,650 divided by $5,000). This may seem very high, and it is a very good return. See refinements below to see how this return may be affected.

Slippage larger than expected loss

It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

Slippage is an inevitable part of trading. It results in a larger loss than expected, even when using a stop-loss order. It's common in very fast-moving markets.

To account for slippage in the calculation of your potential profit, reduce the net profit by 10% (this is a high estimate for slippage, assuming you avoid holding through major economic data releases). This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month.

You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters.

The final word

This simple risk-controlled strategy indicates that with a 55% win rate, and making more on winners than you lose on losing trades, it's possible to attain returns north of 20% per month with forex day trading. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How to get money back from forex scam?

10 famous actors who started out as athletes

How to use a log splitter safely?

5 inspiring interior design ideas for your granny flat

Pros of playing at an online casino

Forex comes from foreign-exchange where you trade different currencies depending on the ups and downs of the currency rates.

For example, if you notice that one currency rate will increase as compared to the other one, you trade in those currencies and earn profits.

It’s not that simple as it looks. In a research, it was found that we usually overestimate our abilities to do something when we see experts doing something and that’s what we do in forex trading as well.

From where the story of the forex scam begins.

How beginners are trapped in forex scam?

Most people see someone else trading in forex. Definitely, someone may be making a lot of money because of his expertise, people get excited and want to go for it.

That’s where they get disappointed.

Money is never an easy thing. If you’re not scamming or hacking someone’s account then it’s really a tough job to make money.

You need a lot of effort to make money.

And that’s what people need to understand in forex trading. Forex trading also requires a lot of learning and expertise to work on and when you don’t do it. You don’t get anything.

Scam traders:

In the meanwhile, scammers reach you or sometimes, you reach them. They show you the glaring results of their trading.

They may or may not be doing great, it’s possible that they purchased those screenshots or accounts to trap people.

Either they do it well or not, they make your mind invest with them and get profits on monthly or quarterly and or annually.

Once you invest some money, you’re trapped to be a victim of continuous scams.

Fraud brokers:

There are some fraud brokers who have created their websites and apps. They invite you for investments and offer you huge profits.

So it’s always a great idea to check the company’s reputation before investing something.

Perfect ways to recover your money from forex scam

I discussed the details of being scammed so that you could avoid it for the future. But, now let’s discuss the perfect ways to recover your money from forex scams.

Definitely, you won’t stop trading for a scam, but you will try to avoid scams next time. That’s why it is better to keep an eye on the tricky ways of the scammers.

Well, the following are some working ways to recover your money back from scammers.

Report cysec:

Cysec (cyprus securities and exchange commission) works against frauds and scams. Whenever you feel something fishy with your broker, for example, your withdrawals are limited or you’re continuously inquired to raise investments to keep working. All such signs of scamming should timely be noted and reported so that cysec could help you.

If the broker had provided you all the true details then it’s possible that you could recover your scammed money back.

But usually, they don’t provide you with the actual details.

Report to police:

It’s also one of the most important things while getting your scammed investments back. You should consult with the police and ask them to deal with the scammer.

If the scammer had provided you the actual details, like phone number, address, or anything else then they might hesitate to scam your money.

Although, every time people have signed such agreements that they can’t get their investments back.

Contact a recovery service

No matter how much trapped you have been or how much heavy amount you lost, recovery services fight for you.

Here the problem is that we aren’t sure if the recovery service is real or not. There are hundreds of guys and companies who work in recoveries. But do they really recover scammed money back?

You should ask them and only trust a true forex scam recovery service.

To judge a recovery service, you should ask them a few questions.

- How long did you work in this field?

- How can you assure me to recover my investments?

- From where do you live?

- How many times did you recover the money back and what percentage couldn’t you?

Once you will read the answers to the questions, you will easily make sure if the recovery service is really good for you or not.

Can you actually get your money back from A fraudulent broker?

There is a lot of advice on the internet about how a trader can identify a good broker and avoid a racket, but very little of it to teach someone how to recover their money if they all for such a racket. Indeed, the reason there are so many FX broker reviews websites and contributors is that there are so many people that have been scammed. Fraud goes on in all financial markets, and not just in FX, so it is important to know how one can get their money back if they feel fleeced. Today, we’re going to consider some strategies you may use to get your money back when your broker doesn’t allow it.

How do you know you’ve been defrauded?

This may seem like a stupid question, but it is worth considering. I myself have been in a situation where I thought my money had been stolen, only to realize later that I had just jumped to that conclusion. In my case, I just lacked patience because the broker (I shall not mention who) had still not replied to any of my correspondence. Fortunately, they did so after a few days and I got my money. Let me just explain my situation so you understand how one may assume fraud where there is none. I had participated in a FX contest and was among the winners, so naturally I immediately began asking for my withdrawal. After sending several emails to customer support, I got no reply for several days, and just thought the whole thing was a racket. Upon further reading of the terms and conditions, I realized that the funds are processed two weeks following the conclusion of the contest, and I had just jumped the gun. (lessons on self-defence: FX scams)

So, how do you really know you’re not going to get your money back and start taking appropriate steps? The first sign is a lack of response from the broker even after repeated requests for a reply. Do not be too quick to judge as I was, but give the company some time to sort out the issue. Many top FX brokers have thousands and probably even hundreds of thousands of clients, which makes it difficult to respond to all messages. There is no standard time to wait here, but if your messages go unanswered after two weeks, you can safely assume there will be none coming. At this point, you can go forward with your complaint and attempt recovering your money. (these are the: top 10 most outrageous FX market scammers)

Another sign, and usually the most obvious is a disappearance of the company. Some FX brokerages are just clean scams that are only meant to collect a certain amount of money from their victims before closing up shop and disappearing. If you are in the unlucky position to have fallen for such a clean racket, immediately begin following up on your complaint before time runs out. (you should: learn how cryptocurrency scams operate and avoid them)

Besides these direct scams, there are also some ‘sophisticated’ scammers who know it’s better to string you along than to declare their intention outright. These scammers will respond to your messages, often in due time, but they will always have an excuse. Perhaps they will keep telling you that they are still following up on the issue, or come up with some fake reasons on why you can’t get your money. Such scams often happen after you make a deposit when lured by some attractive bonus offers. They will then ask you to make a deposit to enjoy the bonus, only for you to be taken around in circles. To be completely sure that this is indeed what is happening to you, make sure you check the company’s terms and conditions page to know the rules of withdrawal. (revealing FX bonuses of brokers: how to identify A real bonus)

What to do first

Now that you are pretty sure the broker is not going to process your withdrawal, you just have to contact the appropriate FX regulators. There is always a financial regulator in every country responsible for overseeing FX brokers, which is why brokers are supposed to get a license before starting operations. If a broker has a license, it becomes much easier to recover your money because they can pursue legal measures against the company. In fact, the top regulators even provide insurance for a broker’s clients, which is why a license is usually expensive from one of these regulators. For example, the FCA provides insurance of up to £50,000 while cysec could compensate you for up to €20,000. To do this, you only need to submit a record of your transaction history and correspondence and let them take care of the rest. (these are: the 3 most trusted exchange authorities in the world)

Therefore, it is very easy to get your money back if you contact the broker’s regulator; but only if the broker is regulated. For a racket broker, they also know this and are not willing to get an expensive license from the top FX regulators. Instead, they could either get a license from an oversees regulator or operate completely without a license. In the first case, it becomes more difficult to get those regulators to prosecute the brokers from oversees, although you could still keep your fingers crossed. If you have lost a significant amount of money and electronic means are not helping, you can always hire a lawyer in the broker’s jurisdiction to go after them in court. However, this is obviously quite expensive unless you feel really bad about the entire encounter. (looking at the: growth of the FX market in africa and other developing countries)

When the broker is completely unregulated, now things become very difficult to get help from the authorities. Sure, you can still report your complaint to your local regulator, but they cannot do anything directly by law. Perhaps the company can be pursued if they have a physical presence in the company. As an example, some FX brokers operate in the UK with just a registration number from the companies house, and the authorities could probably get to the broker somehow. In some previous scams, police have even stormed offices of brokers and arrested the culprits. Consider the november, 2012, raid by FBI in the US that caught 47 fraudsters. These raids are common, and sometimes authorities have managed to recover some of the money. (you should know: how not to be added to the 95% of losing traders)

The chargeback procedure

All the above suggestions require the involvement of institutions in the FX industry, but there is yet another way of going about it – use the help of payment processors. There are numerous ways to fund a trading account with a broker, and these very same means of funding can also be used to get a refund. Let’s look at how you could get a refund from each funding method. (know: how to trade on the NYSE)

Credit card chargeback

Credit/debit cards make transactions a lot easier to perform because you don’t have to carry a lot of cash around. When used to fund a trading account, doing so using a credit card is a lot faster than using, say, wire transfers. Traders and brokers recognize this, which is why there are so many FX brokers accepting credit cards nowadays. With the ease of transactions, there also comes easier fraud, and the credit companies also know this. To protect the money of their clients, top credit card services like visa and mastercard implemented a chargeback procedure to recover money when fraud occurs. The good news is that, if you made a deposit using a credit/debit card, this facility is also available to you. (here are the: basics of stock trading)

Since credit card use has become so common around the world, the authorities even stepped in to protect consumers. In the US, the truth in lending act allows users to reverse transactions through credit cards, while the electronic fund transfer act covers debit card transactions. Laws are different in different countries, but there is usually some form of law that ensures chargebacks. Even the credit companies themselves have this provision to allow the same. These laws were implemented to allow customers to dispute a transaction, but it is also very important if you have been a victim of fraud, such as that committed by a racket broker. One could also take advantage of chargebacks as a way of protesting substandard services or products. (do you wonder: should you invest in cfds or stocks to make more money?)

To initiate a chargeback, you will need to contact the issuer of your credit/debit card. Since it is they who perform the transfer of funds, they are responsible for doing the opposite. These companies use an electronic data interchange (EDI) system to share your personal and financial information, which is then used to validate the transfer. Start with a phone call to the number at the back of the credit card to contact the issuer, and this is usually enough. Some issuers, though, may need the complaint to be submitted in the form of a physical letter, but either way, the point is to notify your credit card issuer. (all about: trading stock indices)

Next you have to provide proof of why you’re requesting the chargeback. If the chargeback request is due to a dispute between you and a seller, copies of emails and other correspondence should suffice. Thereafter, the credit card issuer will contact them to get their side of the story while acting as an intermediary. In the case of a straightforward case of fraud, such as that involving a racket broker, disputes are dealt with quickly because this is the primary function of chargebacks. If your credit card issuer finds in your favour, you should normally get your money back after they have deducted the amount from the recipient’s account. The same way a credit card company gets information about you through EDI, so can they get for the recipient and get a refund. You will not be charged for the refund either, so you get back all your money. (every scalper should know the: 10 rules of how to earn money with scalping)

Chargebacks are successful more often than not as experts have showed. The study was done by consumers’ checkbook, a non-profit organization that does surveys about vendors and service providers. In 2016, they asked several vendors about whether chargebacks work, and they said it does in 90% of cases. In fact, credit card issuers will typically side with the client over the merchant to make the process often successful. Another study by the federal reserve of kansas the same year also found the same results, proving that chargebacks were indeed a very powerful tool for consumers. This is good news for you, if you made your deposit using a credit card because that means you can be assured of a refund when a scam broker gets your money. (even forex brokers go out of business: bankruptcy of forex brokers)

However, the process may not go as smoothly as you may expect, especially when dealing with a fraudulent broker. Many legitimate companies will just accept the chargeback and any additional costs to preserve their business’ reputation. If they have too many chargebacks, credit card companies may refuse to work with them. A scammer does not have the same restrictions, and they will try to fight you. Of course, they would not want to lose the money they worked so hard for and they will give the credit card issuer a reason for the dispute. This is where you will need to have all the necessary evidence to prove that you really deserve that chargeback. It will depend on your resilience because the first person to blink loses and you need to push hard not only for yourself but for the whole industry. The money a scammer gets from you will be used to scam others, so really take it as a service to other traders. (before even asking, just look at some of the: most common questions forex traders ask)

Also keep in mind that this process becomes difficult if you go beyond 120 days from the date of the transaction as this is the given time limit. Beyond this, you may have to bring in the authorities to help. It is also recommended to use the chargeback service as a way of last resort and to try to resolve the issue with the merchant. The studies mentioned above show that chargeback give you a lot of power, but you should not misuse this power to perform cyber theft. (new rules have rolled out causing: changes in forex regulation through mifid II)

Wire transfer reversal

A similar process is also available for deposits made by wire transfer, where the money sent is simply reversed. If your deposit was made by wire transfer, you will contact the broker’s bank for a reversal as it is they who hold the money. Again, you can do this by sending an email or making a phone call to their customer support centre. From there the process is the same as sending a chargeback request for credit card transaction. Provide the evidence to prove that you deserve the reversal and let the bank do the investigations for you. If your case is believable, the bank will perform the reversal, but you may be in for a fight if the broker disputes your claim. Some good evidence you could provide includes any messages sent between you and the broker, whether they are emails or even screenshots of live chat conversations. (to protect your future self, know: how to complain against a broker)

You should feel confident in asking for a chargeback because you’re usually not the only one. If a broker is scamming traders, then they have probably received numerous disputes to their bank account. This will work in your favour as the bank will spot the pattern and perhaps even take further measures against them. (think twice when making A deposit in A forex company)

Things may not always work out well for you, and you need to be prepared for some undesirable outcomes. Certain cases, perhaps the broker had already transferred the money elsewhere, withdrawn it or the company was declared bankrupt. In all these cases, the money is out of the reach of the bank, and they cannot conduct the reversal. The broker’s bank can only reverse your money if it is still in their reach and not withdrawn or sent elsewhere. Even if the broker simply withdrew the money, that is enough to make your reversal impossible. The problem is that banks do not insure client funds but they only facilitate the transfer of money. Making the reversal, therefore, would be like asking the bank to pay from its own pocket. If they did that, they might as well go out of business. (some: 5 tips to identify the perfect ICO to invest in)

Alright, we didn’t mention that to discourage you from pursuing a reversal, but to remind you of the need to act fast as soon as you suspect fraud. You may be lucky and find that the scam broker is yet to wrap up their operation and get your reversal early. Especially when you notice there has been a fraudulent transaction, such cases are taken very seriously. (do you know: what is the financial commission and can it be trusted?)

Another situation that may not end up well for your reversal is if you did the transaction through a third-party ewallet. People tend to trust ewallets because then you don’t have to keep repeating your personal details which is tiring and also less secure as information could be stolen. If you used such a service to make the wire transfer, then you’re out of lack as that transaction would involve another party.

Third party ewallets and payment service providers

As we just mentioned, people like to use ewallets for various reasons. Security is the main one, because if the ewallet provider can be trusted, then you wouldn’t have to enter your account details at the broker’s page. If the broker is a terrible scammer, they could use those details to perform even further fraud from your account. Instead, by using an ewallet, the company does the money transfer for you without giving up your personal information. Another reason people like these ewallets is because they have specialized offers for individuals depending on their needs. As an example, some of them will issue debit cards that make withdrawals faster and instant compared to waiting for a wire transfer for days. (GDPR is finally here! All you need to know and how it affects you)

A few examples of such ewallet providers include payza, skrill, neteller, etc. Then there are some payment service providers like paypal, western union, moneygram, etc. All these are chosen depending on the client’s personal preference, and forex brokers are partnering with these companies to enable fund deposits. If you made a deposit with any of these companies, they could provide you with some reprieve in cases of fraud. Of course, it would depend mostly on the company itself and its policies. After reading several of these companies’ terms of use, you would only get a refund if there was an unauthorized transaction. In other situations, you’re on your own. (do you know: who are the best forex social trading brokers to work with?)

In short, using these ewallets can be secure and what not, but one thing they don’t do is refund money unless it was their fault. And it does make sense, since their job is only to facilitate transactions, not to oversee the transactions.

Going through intermediaries

Because financial fraud is so rampant, not only in forex but also in other industries, some companies have come up to help people regain their money when lost. Say, you lost money to a broker located in saint vincent and the grenadines and yet you live in the UK, instead of travelling there yourself and knocking on the broker’s door, you can hire a company to do it for you at a charge. There are many such companies around the world, and you can use them to help you get a refund or pursue the broker. (concepts every trader should understand: leverage, margin and hedging)

Since this is their job, expect to pay for their services, which means you need to have lost a significant amount of money to go down this path. All the same, now you know all your options when you mistakenly fall for a scammer. And by the way, just because you use an intermediary does not mean you won’t need to provide proof of fraud to justify your claim. The only difference is that these intermediaries are more skilful at getting refunds. As they have been in the industry longer and dealt with plenty of companies, they know the various excuses scammers use and they can cut through it and achieve their purpose. Furthermore, they have time and resources to do the job, unlike you who may be tied up with other business.

What are some ways a broker can fight back?

It’s not enough to know how you can get a refund, but to also prepare for what the broker will hit you back with. Many of the scammers won’t allow you to go after them without a fight, and you need to know what to expect. At the same time, chargebacks have often been abused by some people, and even the authorities sometimes become sceptical in light of all this, you should be prepared for such counter-attacks as:

It’s in the fine print

This is the most common and damning piece of evidence a broker can provide to counter your request for a refund. The truth is that none of us actually goes through the entire terms and conditions page but only scroll quickly to the bottom and click on agree. The brokers who intend to take advantage of this therefore hide many loopholes in the fine print that allow them some wiggle room out of a contract. The reason why this reason is so powerful is that you would have often already crossed one of the trip wires in hidden in the terms and conditions. But since you had already entered and agreed to the contract set before you, you are not even covered legally. (is it time to upgrade to metatrader 5: features of MT5)

To protect yourself from such traps, try to reach as much as you can about a broker’s particular product before you agree to the contract. It is a torturous process, I know, but it will protect you from a lot of pain otherwise. Think of it this way - reading about one product will take you a few minutes, but following up on a case of fraud will take you days or even weeks. Worse still, you may even end up not getting your money back. So you actually save money by taking the time to read the fine print. (can A forex broker avoid sending trades directly to the interbank market?)

You have already spent the money

By spending money, you inadvertently agree to the conditions set forth by the broker. Let’s say you make a deposit of $1,000 with a broker and make a trade on the forex charts that either makes or loses you money. Regardless of the profitability of the trade, you may have already agreed to all of the broker’s conditions because you have already began trading. (forex rigging and manipulation: how the major investors pull it off)

To avoid this trap, go back to the terms and conditions to check if there is a stated lock-in period for funds. In hedge funds, an investor’s money is kept locked in for a year without allowing for withdrawals. A broker may also have included this condition hidden in the fine print so that they can keep money to themselves and rack up the money. Whenever you see such a situation, run! This is one of the signs of a ponzi scheme, needing to attract new customers just to pay off the old ones.

Fake evidence

The very worst scam brokers will go even a step further and produce fake records of transactions that they will claim you made. This is a very sneaky move because it now becomes a case of he said, she said. You’re on one side with a record of all your transactions and they on the other with their own fabricated records. In such a situation, it becomes really difficult for the intermediary to tell who is right. Thankfully, a scam broker will often have a lot of complaints against them, and the intermediary, say, the credit card company, will side with you. If they notice that the broker has received a lot of complaints, then it will be more likely that you are right. To fight against this, you just have to be very serious about your case and push back as hard as you can. (find out: how not to be added to the 95% of losing traders)

Back to the topic question

As you can now see from all the above, it is indeed possible to recover money that you thought was lost to a scam broker, but it takes work. Most of all, it requires that you have evidence to back up your claim in case the broker decides to fight against you. In many cases, people have recovered their money, especially if it wasn’t a huge amount. But bigger deposits are harder to get back because the scammer will quickly transfer the money elsewhere. Still, it doesn’t hurt to try.

In case you want to know more about chargebacks, here is a simple explanation:

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

How to get money from forex

The painful beginning is over and you have finished reading all the basics of forex trading. You are sick and tired of the demo account, the nightmares where you speak only with forex terminology become more frequent and you are ready for the big jump – trading for real money. So how to trade with real money and how to make sure your funding is safe? More importantly, how do you receive the profit money you make?

Many forex beginners may be slightly confused about forex brokers withdrawal methods and brokerage deposit options. So let's review the process of withdrawal once and for all.

Most forex brokers generally accept deposits by credit card, wire transfer and, in some cases, checks. However many forex traders don’t feel safe using their credit card online and giving in to the possibility of endangering their saving account! What has become rather popular now is depositing and withdrawing money from your forex broker with alternative online payment methods such as neteller, skrill, paypal, e-bullion and others.

Most forex traders trust these online payment systems and prefer using them instead of credit card. That’s because money can be sent immediately and securely to and from your forex broker. All of these payment options used by forex brokers may actually protect your money better than it would protect during any other similar online financial transaction.

Each forex broker has different policies, terms and conditions. Many brokers allow you to withdraw your profits via the same payment method you used to deposit, but sometimes you won’t be able to withdraw until a certain amount of money is reached and/or the bonus requirements are met. Also, while most forex brokers do not charge any extra fees, it is common for some brokers to charge transaction fees when it comes to withdrawal.

Here is an example taken from forex.Com broker withdrawal requirements:

If you funded your account with US dollars: there is no fee for withdrawal requests via check. Withdrawal requests via wire transfer will incur a $25 fee for wires within the united states, and $40 fee for international wires (including canada).

If you funded your account with a non-USD deposit: FOREX.Com will convert your US dollar account balance back to the currency you initially deposited and wire your funds back to the originating bank account. A fee of US$40 will be assessed.

Most withdrawal processes are easy and fast, which requires filling in the online form. Some forex brokers, however, request filling the withdrawal form, printing it out, sign and sending it by fax or email. The waiting period varies from 24 hours to several weeks, depending on forex broker policies, which must be reviewed and fully comprehended.

I strongly suggest reading terms and conditions of your selected broker before you make a deposit. If you can’t find the details about withdrawal in terms and conditions, try reading frequently asked questions on the broker’s website. And if that doesn’t help, contact your forex broker via email, online chat or phone and make sure to find the answers to these questions:

1. What are the available payment methods?

2. Are there transaction fees? If so, what are they?

3. What is the withdrawal process?

4. How long does it take to receive the money?

5. What is the minimum amount required to make a withdrawal?

6. How does bonus affect the withdrawal policy?

And always remember that troubles arise from misunderstanding. Make sure that you have a clear vision of what lies ahead before you make a plunge!

So, let's see, what we have: here is a scenario for how much money a simple and risk-controlled forex day trading strategy can make, and guidance on how to achieve that level of success. At how to get money from forex

Contents of the article

- Best forex bonuses

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- Making money in forex is easy if you know how the...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- How to get money back from forex scam – can you...

- How to get money back from forex

- How to get money back from forex scam –...

- Methods to get your money back from forex...

- · calling your local police – very little...

- · getting in touch with a regulatory...

- · getting help from money-back – very...

- 2 proven ways to recover scammed bitcoin, money...

- How much money can I make forex day trading?

- Forex day trading risk management

- Forex day trading strategy

- Hypothetical scenario

- Trading leverage

- Trading currency pairs

- Slippage larger than expected loss

- The final word

- How to get money back from forex scam?

- 10 famous actors who started out as athletes

- How to use a log splitter safely?

- 5 inspiring interior design ideas for your granny...

- Pros of playing at an online casino

- How beginners are trapped in forex scam?

- Perfect ways to recover your money from forex scam

- Can you actually get your money back from A...

- How to make money in forex trading: A complete...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- How to get money from forex

- Here is an example taken from forex.Com...

- 1. What are the...

- 2. Are there transaction fees? If so,...

- 3. What is the withdrawal...

- 4. How long does it take to receive the...

- 5. What is the minimum amount required to...

- 6. How does bonus affect the withdrawal...

- Here is an example taken from forex.Com...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.