Fxopem

外汇入金选项

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| 中国银联 | CNY | 50000 CNY | 100 CNY | 立刻到账 | 入金 |

| 信用卡/借记卡 | EUR, RUB, USD | 7500 EUR, 10000 USD, 300000 RUB | 2 EUR, 2 USD, 60 RUB | 立刻到账 | 入金 |

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| webmoney | USD, EUR | 没有限制 | USD - 1 WMZ; EUR - 1 WME; | 立刻到账 | 入金 |

| epay | EUR, USD, GBP, HKD | 1000000 EUR (或等值其他货币) | 1 EUR (或等值其他货币 ) | 立刻到账 | 入金 |

| advcash | EUR, USD | 没有限制 | 3 EUR (或等值其他货币 ) | 立刻到账 | 入金 |

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| fxopen pre-paid codes | CNY, EUR, USD, GBP | 无限 | 1 USD (或等值货币) | 立刻到账 | 入金 |

| astropay | CNY, USD | 5000 CNY, 1000 USD | 200 CNY, 10 USD | 立刻到账 | 入金 |

如何入金到您的fxopen 帐户

登陆到 my fxopen 个人区,并在入金菜单中选择一种支付方式

填写入金金额,货币,交易帐户,等表格.点击入金.

您将被转到所选择的支付系统的端口以完成转帐.

根据支付系统不同,处理时间或许不同.通过大部分电子支付系统入金是自动到帐的,电汇转帐将需要1-3个工作日

如果入金没有及时加到您的帐户,请,在my fxopen个人区填写入金通知.我们的后台工作人员将核实并人工给您加到帐户.

为什么选择在fxopen交易

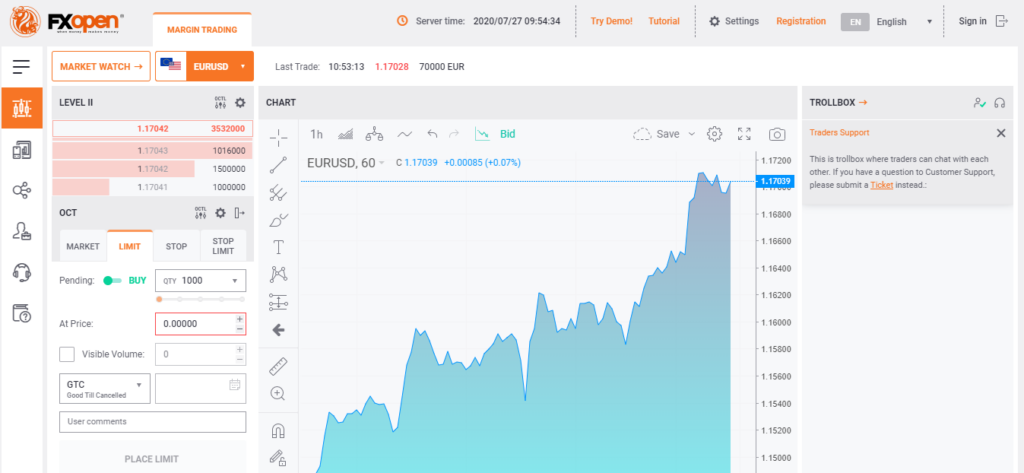

为客户提供通过MT4平台进行ECN交易. 此外,通过我们的一键交易及 level 2 MT4插件, 交易者可以只点击一下鼠标就下单交易.

最低的 入金 – 自 $1起; 先进的价格撮合ECN技术; 最高的杠杆比例 高达 1:500; 广泛快速及可靠的支付选项;

Best forex bonuses

2005-2020 © fxopen 保留所有权利. 由各自的持有者保留不同的商标.

风险警示: 在外汇市场交易包含潜在的风险, 包括完全的资金亏损及其它亏损,并不适合所有的人.客户应根据他们自己的财务状况,投资经验,风险承受能力及其它因素判断其是否适合交易.

Fxopen markets limited, 注册于尼维斯的公司,注册号为 no. C 42235. Fxopen是 财务委员会 的成员.

Deposits and withdrawals

Fxopen AU provides clients with numerous funding options for instant deposits and fast withdrawals.

Important information

- Withdrawal forms received before 12:00 (GMT) will be processed the same business day. If these are received after 12:00 (GMT) or during the weekend, they will be processed the next business day.

- Withdrawals made by bank wire transfer usually take 1-3 business days to reach your account.

- Withdrawals made by card usually take 2-5 business days to reach your account depending on your bank.

- Fxopen AU does not accept payments from third parties. Please ensure that all deposits into your trading account come from a bank account in your name. Payments from joint bank accounts / bank cards are accepted if the trading account holder is one of the parties on the bank account / bank card.

- Any international telegraphic transfer (TT) fees charged by our banking institution are passed onto the client.

- In unforeseen circumstances, withdrawal times may be longer.

- Allow up to 1 hour for the transfer of funds. Fxopen AUS shall not be held liable for any delay of processing if that delay is out of our control.

Trading on the forex market involves substantial risks including total loss of your trading capital and may not suitable for all investors. Investors should make an independent judgement as to whether trading is appropriate for him/her in light of his/her financial condition, investment experience, risk tolerance and other factors. Information and market analysis on this site is considered to be general advice and may not be suitable for your personal financial position.

Before performing any transaction with fxopen, please read the financial services guide and product disclosure statement which may be downloaded from this site or obtained in hard copy by contacting our office.

Fxopen AU pty ltd is authorised and regulated by the australian securities & investments commission (ASIC). AFSL 412871 – ABN 61 143 678 719

fxopen au pty ltd does not provide services to the residents of the united states and canada. The information on this website is not intended to be addressed to the public of belgium and japan.

The information on this website is directed at residents of australia and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

外汇入金选项

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| 中国银联 | CNY | 50000 CNY | 100 CNY | 立刻到账 | 入金 |

| 信用卡/借记卡 | EUR, RUB, USD | 7500 EUR, 10000 USD, 300000 RUB | 2 EUR, 2 USD, 60 RUB | 立刻到账 | 入金 |

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| webmoney | USD, EUR | 没有限制 | USD - 1 WMZ; EUR - 1 WME; | 立刻到账 | 入金 |

| epay | EUR, USD, GBP, HKD | 1000000 EUR (或等值其他货币) | 1 EUR (或等值其他货币 ) | 立刻到账 | 入金 |

| advcash | EUR, USD | 没有限制 | 3 EUR (或等值其他货币 ) | 立刻到账 | 入金 |

| 选项 | 货币 | 最高入金 | 最低入金 | 处理时间 | 入金 |

|---|---|---|---|---|---|

| fxopen pre-paid codes | CNY, EUR, USD, GBP | 无限 | 1 USD (或等值货币) | 立刻到账 | 入金 |

| astropay | CNY, USD | 5000 CNY, 1000 USD | 200 CNY, 10 USD | 立刻到账 | 入金 |

如何入金到您的fxopen 帐户

登陆到 my fxopen 个人区,并在入金菜单中选择一种支付方式

填写入金金额,货币,交易帐户,等表格.点击入金.

您将被转到所选择的支付系统的端口以完成转帐.

根据支付系统不同,处理时间或许不同.通过大部分电子支付系统入金是自动到帐的,电汇转帐将需要1-3个工作日

如果入金没有及时加到您的帐户,请,在my fxopen个人区填写入金通知.我们的后台工作人员将核实并人工给您加到帐户.

为什么选择在fxopen交易

为客户提供通过MT4平台进行ECN交易. 此外,通过我们的一键交易及 level 2 MT4插件, 交易者可以只点击一下鼠标就下单交易.

最低的 入金 – 自 $1起; 先进的价格撮合ECN技术; 最高的杠杆比例 高达 1:500; 广泛快速及可靠的支付选项;

2005-2020 © fxopen 保留所有权利. 由各自的持有者保留不同的商标.

风险警示: 在外汇市场交易包含潜在的风险, 包括完全的资金亏损及其它亏损,并不适合所有的人.客户应根据他们自己的财务状况,投资经验,风险承受能力及其它因素判断其是否适合交易.

Fxopen markets limited, 注册于尼维斯的公司,注册号为 no. C 42235. Fxopen是 财务委员会 的成员.

What is position trading?

Position trading refers to a trader holding a position open for a long period of time. In a way, position trading is similar to investing and has a larger time horizon than swing trading.

A simpler way of explaining what is positional trading is to think of trading on bigger timeframes, like the weekly, monthly, or even the yearly charts. Traders adopting such strategies take very few trades a year on the same market.

Position trading is similar to investing and has a larger time horizon

For those wondering what is positioning strategy useful for if it results in a limited number of trades, the answer comes from the markets traded. If the trader monitors multiple markets, the number of trades pile up, and the trader has plenty of opportunities to take advantage of.

Why using a position trading strategy?

One of the main reasons for using such strategies comes from the limited time available to trade. Most retail traders work a day job and trade as a hobby, in their spare time. And I’m no exception.

One of the main reason for using position trading is this can be done as a hobby without spending a lot of time.

Position trading requires minimum time to interpret a market, and an analysis, technical or fundamental, can be done even over the weekend. Moreover, because of the bigger timeframes involved, different positioning strategies may work on multiple timeframes. Furthermore, positioning trading works as well when using pending orders, so the trader does not have to monitor the markets constantly.

I think that the main reasons for using positional trading are:

1. You have free time to do other things.

2. Avoids the daily noise in the financial markets

3. But it require patience and locked up resources at the time of the investment.

How to calculate the proper position size for a trade

It all starts with the size of the trading account. Also, all traders know that any trade, regardless of the strategy, needs a stop-loss and a take-profit order. Equally, a position trading strategy requires a comprehensive money management plan. Therefore, position trading meaning that the trader must transform the number of pips in the desired risk per trade.

Position trading forex example on the EURUSD pair

Here is a positioning strategy example on the EURUSD pair. It aims at showing how to calculate a position size on a big timeframe, without overtrading and negatively affecting the trading account. Basically, it shows how to position trade effectively.

The EURUSD pair bounced lately from around the same area. Because this is the monthly timeframe, “lately” means in the last years the pair found a bottom. On its way up, it formed a reversal pattern – a double bottom.

Such a pattern has a measured move that completes the letter W. To trade it, the trader must determine:

- How much to risk

- The stop loss

- The take profit

- Volume to trade

Different positioning strategies require the same elements for setting up the right money management. Additionally, the trader needs:

- Free margin

- Equity in the trading account

| position trading forex example (EURUSD) | |

| equity | $10,000 |

| risk/trade | 2% |

| number of pips until stop loss | 1,100 |

| $ risked | $200 |

| $/pip | $0.18 |

| volume to trade (lots) | 0.02 |

| potential profit | $400 or 4% |

| risk-reward ratio | 1:2 |

Types of position trading

The currency market is the perfect market to understand what is open position in trading. In this market, a trader can use any type of directional trading – long, short, or both at the same time. I prefer the last one.

Long positioning strategy in trading

My example showed earlier on the EURUSD chart is a long positioning strategy. A trader goes long a currency pair when it is believed that the pair will move to the upside.

In this case, the EURUSD pair bounced from the double bottom and the expectation is that it will reach the measured move. Therefore, the trader expects the EUR to appreciate against the USD, so the EURUSD pair should rise.

Short positioning strategy in trading

Another way to use positional trading is to go short a market when it is expected to decline. Going short means selling the currency believed to decline and buying the currency believed to appreciate.

The AUDUSD shows an example of how to go short using positional trading indicators. However, this is the 4h timeframe, so the trade does not take that long as to be interpreted as positional trading.

But, when trading the currency market, the broker often let us the trade to take both short and long positions. Hence, a long positional trade on the monthly chart may be hedged temporarily with a short positional trade on the lower timeframes, so to take advantage of all market moves. This can be done using the same or other positional trading indicators. Also, this is in my experience the best way to explain what is long and short position in trading.

One of the way to use positional trading is to go short a market when it is expected to decline. It means selling the currency believed to decline and buying the currency believed to appreciate.

Pros of a forex position trading strategy

- Works well with pending orders

- Requires less time than swing trading or scalping

- The trader has free time to follow its other passions or do something else during the trading week

- Avoids the daily noise in the financial markets

- Works with fundamental analysis

Cons of a position trade

- It takes time for a trade to reach the take profit

- Patience is the most important attribute

- Resources remained blocked in trades that take several months or more until producing results

- Higher costs due to negative swaps when the interest rate differential is not in the trader’s favor

Positional trading tips and tricks

Positional trading works on all markets. No matter what you trade (e.G. Currencies, indices, cfds, commodities), the principles of positional trading remain the same.

To make the most of it, I would couple technical with fundamental analysis. For example, the EURUSD bounced from the same level, putting a possible double bottom in place. That is the technical analysis.

If there is a fundamental reason why the euro might appreciate against the USD, that is another plus for the long trade. For example, the european union just announced in july that the european commission will issue for the first time common debt – joint bonds. This is viewed as a major step towards european integration, and a plus for any technical setup to go long the euro.

Another thing I’d like to consider is the stop-loss and take-profit levels. Ideally, the trader should let the market reaching one or the other. To calculate the entry and exit, some use the position size calculator presented here, or some form of gann calculator for positional trading. From the entry level, gann levels for positional trading are derived.

How to benefit the most from positioning strategy

The best way to make the most of positional trading is to use pending orders. Ideally, traders use the time over the weekend, when the markets are closed, to look for trading setups on the bigger timeframes.

These are easy to spot and interpret because they do not change overnight. For example, look for classic reversal patterns (e.G., head and shoulders, wedges, double and triple tops and bottoms) or japanese reversal patterns (e.G., morning and evening stars, bullish and bearish engulfings, doji candlesticks, piercing patterns, hammers or shooting stars, etc.). Next, place pending orders to entry the market from the most advantageous place. Finally, use proper risk-reward ratios.

A risk-reward ratio suitable for trading any market should exceed 1:2. Effectively, it means that for every $ risked, the trader stands to gain two.

Traders use the time over the weekend, when the markets are closed, to look for trading setups on the bigger timeframes.

My conclusion

Traders involved in the cryptocurrency market are the perfect example of position trading. Called hodlers, traders involved in position trading cryptocurrency hold on to their trades as an investment. As such, crypto position trading merely means buying and holding – hence the name hodler.

However, this is an extreme version of what are positions in trading. To learn the best positional trading tips, one needs to dive into the market, focus on the money management, go long and short, and respect strict risk-reward ratios. Also, use pending orders as much as possible, so to get the best possible entries for a trade.

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

FXOPEN EU

Why choose fxopen EU pro?

Higher leverage

Trade with up to 1:500 leverage

Lower commission

From $15 a million ($1.50 per lot)

Instant and secure

Choose from credit/debit card or wire transfer

Free VPS

The fastest execution with the lowest latency

Segregated funds

Elective professional client funds will still be fully segregated in EU tier 1 bank

Cysec regulated

Fxopen EU is authorised and regulated by the the cyprus securities and exchange commission (cysec)

What protection do professional clients lose?

Professional clients do not get the same protections afforded to retail clients

Professional clients have an obligation to make additional payments should your account fall into a negative balance

As a professional client we will not be obliged to restrict leverage on your account.

As a professional client we may assume your level of experience when assessing product suitability

As a professional client we may prioritise other factors in giving best execution apart from price

As a professional client we can use more sophisticated language when talking about risks and benefits of leveraged trading

Am I eligible for an fxopen EU pro account?

To be eligible for a fxopen EU pro account, you need to meet two of these three professional client eligibility criteria:

Have you placed 10 relevant trades of a significant size per quarter in the last year?

Does your cash and financial instrument portfolio exceed €500,000?

Do you, or have you, worked in the financial sector for at least 1 year?

FXOPEN EU PRO

account trading conditions

STP PRO

Floating market spreads

from 0.5 pips

ECN PRO

Raw market spreads

from 0.0 pips

How do I open a pro trading account?

- Open an account with fxopen EU below

- Request a professional client application form from [email protected]

- Complete your application and return it to fxopen EU

- Once approved, start trading with all the advantages of a fxopen EU pro account

Fxopen EU ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) under license number 194/13.

RISK WARNING: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.The vast majority of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Before performing any transaction with fxopen EU, please read the terms and conditions and 'disclaimers and risk warning' which may be downloaded from this site or obtained in hard copy by contacting our office.

Zarabiaj

handlujд…c na rynku forex za poе›rednictwem brokera ECN

fxopen

posiadajд…cego ponad 15-letnie

doе›wiadczenie

WД…skie spready

i niskie prowizje!

Nasze atuty

Niskie prowizje

Prowizje od 1,5 USD za lot (poе‚owiczne) na kontach ECN

Szybka realizacja zleceе„

Zlecenia sд… realizowane w zaledwie 0,001 sekundy: serwery znajdujд… siд™ w equinix, NY4 i sд… bezpoе›rednio poе‚Д…czone z animatorami rynku

90-dniowy program zwrotu gotówki

Kwota zwrotu gotówki jest ustalana zgodnie z caе‚kowitд… marејд… stosowanд… na wszystkich rachunkach handlowych klienta dla dowolnego rodzaju transakcji

Szeroka gama instrumentów

Ponad 80 instrumentów handlowych, w tym pary walutowe, metale, kontrakty CFD, ropa naftowa, indeksy, kryptowaluty

Bezpieczeе„stwo

Ељrodki klientów sд… przechowywane na oddzielnych kontach, zapewniamy teеј szyfrowanie danych oraz logowanie z uwierzytelnianiem dwuskе‚adnikowym

Doе›wiadczenie

Dziaе‚amy od ponad 15 lat jako broker forex i cieszymy siд™ zaufaniem ponad 1 000 000 inwestorów na caе‚ym Е›wiecie

Technologia ECN

Fxopen ECN umoејliwia dopasowanie zleceе„ klientów do zleceе„ innych uczestników rynku fxopen, np. Innych klientów fxopen, zarówno indywidualnych, jak i instytucjonalnych oraz animatorów rynku - banków, gieе‚d fx, innych brokerów. Dziд™ki temu nie wystд™puje konflikt interesów miд™dzy klientami a brokerem, poniewaеј broker dziaе‚a wyе‚Д…cznie jako poе›rednik.

Zalety fxopen ECN:

- Вђў poprzez agregowanie pе‚ynnoе›ci wielu animatorów rynku i podawanie agregowanej ceny rynkowej klientom, fxopen jest w stanie zaoferowaд‡ wд™ејsze spready i lepszд… realizacjд™ zleceе„, które w przeciwnym razie nie byе‚yby dostд™pne dla klientów detalicznych.

- Вђў spread jest zmienny i zaleејy od warunków rynkowych.

- Вђў realizacja rynkowa bez ostatecznej weryfikacji jest dostд™pna dla wszystkich uczestników ECN fxopen.

- Вђў zapewnione sд… przejrzyste i równe warunki handlowe dla wszystkich klientów.

FXOPEN EU

Why choose fxopen EU pro?

Higher leverage

Trade with up to 1:500 leverage

Lower commission

From $15 a million ($1.50 per lot)

Instant and secure

Choose from credit/debit card or wire transfer

Free VPS

The fastest execution with the lowest latency

Segregated funds

Elective professional client funds will still be fully segregated in EU tier 1 bank

Cysec regulated

Fxopen EU is authorised and regulated by the the cyprus securities and exchange commission (cysec)

What protection do professional clients lose?

Professional clients do not get the same protections afforded to retail clients

Professional clients have an obligation to make additional payments should your account fall into a negative balance

As a professional client we will not be obliged to restrict leverage on your account.

As a professional client we may assume your level of experience when assessing product suitability

As a professional client we may prioritise other factors in giving best execution apart from price

As a professional client we can use more sophisticated language when talking about risks and benefits of leveraged trading

Am I eligible for an fxopen EU pro account?

To be eligible for a fxopen EU pro account, you need to meet two of these three professional client eligibility criteria:

Have you placed 10 relevant trades of a significant size per quarter in the last year?

Does your cash and financial instrument portfolio exceed €500,000?

Do you, or have you, worked in the financial sector for at least 1 year?

FXOPEN EU PRO

account trading conditions

STP PRO

Floating market spreads

from 0.5 pips

ECN PRO

Raw market spreads

from 0.0 pips

How do I open a pro trading account?

- Open an account with fxopen EU below

- Request a professional client application form from [email protected]

- Complete your application and return it to fxopen EU

- Once approved, start trading with all the advantages of a fxopen EU pro account

Fxopen EU ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) under license number 194/13.

RISK WARNING: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.The vast majority of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Before performing any transaction with fxopen EU, please read the terms and conditions and 'disclaimers and risk warning' which may be downloaded from this site or obtained in hard copy by contacting our office.

Zarabiaj

handlujд…c na rynku forex za poе›rednictwem brokera ECN

fxopen

posiadajд…cego ponad 15-letnie

doе›wiadczenie

WД…skie spready

i niskie prowizje!

Nasze atuty

Niskie prowizje

Prowizje od 1,5 USD za lot (poе‚owiczne) na kontach ECN

Szybka realizacja zleceе„

Zlecenia sд… realizowane w zaledwie 0,001 sekundy: serwery znajdujд… siд™ w equinix, NY4 i sд… bezpoе›rednio poе‚Д…czone z animatorami rynku

90-dniowy program zwrotu gotówki

Kwota zwrotu gotówki jest ustalana zgodnie z caе‚kowitд… marејд… stosowanд… na wszystkich rachunkach handlowych klienta dla dowolnego rodzaju transakcji

Szeroka gama instrumentów

Ponad 80 instrumentów handlowych, w tym pary walutowe, metale, kontrakty CFD, ropa naftowa, indeksy, kryptowaluty

Bezpieczeе„stwo

Ељrodki klientów sд… przechowywane na oddzielnych kontach, zapewniamy teеј szyfrowanie danych oraz logowanie z uwierzytelnianiem dwuskе‚adnikowym

Doе›wiadczenie

Dziaе‚amy od ponad 15 lat jako broker forex i cieszymy siд™ zaufaniem ponad 1 000 000 inwestorów na caе‚ym Е›wiecie

Technologia ECN

Fxopen ECN umoејliwia dopasowanie zleceе„ klientów do zleceе„ innych uczestników rynku fxopen, np. Innych klientów fxopen, zarówno indywidualnych, jak i instytucjonalnych oraz animatorów rynku - banków, gieе‚d fx, innych brokerów. Dziд™ki temu nie wystд™puje konflikt interesów miд™dzy klientami a brokerem, poniewaеј broker dziaе‚a wyе‚Д…cznie jako poе›rednik.

Zalety fxopen ECN:

- Вђў poprzez agregowanie pе‚ynnoе›ci wielu animatorów rynku i podawanie agregowanej ceny rynkowej klientom, fxopen jest w stanie zaoferowaд‡ wд™ејsze spready i lepszд… realizacjд™ zleceе„, które w przeciwnym razie nie byе‚yby dostд™pne dla klientów detalicznych.

- Вђў spread jest zmienny i zaleејy od warunków rynkowych.

- Вђў realizacja rynkowa bez ostatecznej weryfikacji jest dostд™pna dla wszystkich uczestników ECN fxopen.

- Вђў zapewnione sд… przejrzyste i równe warunki handlowe dla wszystkich klientów.

Fxopen review and tutorial 2021

Fxopen is a highly regulated FX & CFD broker offering multiple trading platforms.

Trade major, minor & emerging forex pairs with 1:30 leverage.

Trade on dozens of cryptocurrency coins with 1:2 leverage.

Fxopen is an ECN forex broker offering a range of CFD instruments using the metatrader 4 (MT4) and metatrader 5 (MT5) trading platforms. This review will cover account types, fees, minimum deposits, and more. Find out if you should sign up with fxopen.

Fxopen details

Fxopen started as an educational centre offering courses within financial markets. Then in 2005, a group of traders turned the company into a global brokerage with offices in the UK, russia, new zealand, and australia. Today, the broker’s thousands of traders can be found everywhere from canada and germany to vietnam and nigeria.

The fxopen group operates under FX markets limited, a company registered in charlestown, nevis. Fxopen UK is authorised and regulated by the financial conduct authority (FCA). Fxopen australia is regulated by the australian securities and investments commission (ASIC).

Trading platforms

Metatrader 4

Fxopen was the first broker to offer ECN and STP trading via metatrader 4 (MT4), an award-winning platform that boasts instant trade execution at competitive prices.

MT4 is ideal for both beginners and experts and offers a range of customisable features, including:

- 50+ built-in indicators & graphical objects for technical analysis

- Three types of orders (market, limit, and stop)

- Intuitive charting package

- Automated trading (eas)

- Rich historical data

- One-click trading

- Trading signals

MT4 is available for download on windows pcs and can be accessed from the platforms page on the broker’s website.

Fxopen also offers the web-based version of MT4 – a great option for those with apple mac pcs, where a direct download is not available. The webtrader terminal has all the same features of the desktop version and is compatible with all major desktop browsers.

Metatrader 5

Fxopen also offers the metatrader 5 (MT5) platform, offering all the features of MT4 with several additional benefits:

- 80+ built-in indicators & graphical objects for technical analysis

- 21 timeframes to track price movements

- Multi-currency strategy tester

- Netting & hedging allowed

- Economic calendar

Note, cryptocurrency trading is not available on MT5.

MT5 is available for download on windows pcs and can be accessed from the broker’s website.

Ticktrader

For non-UK customers, fxopen also offers ticktrader, a brand new trading platform offering much of the same features as metatrader and more. Using one trading account – ticktrader ECN, the platform is suitable for both beginners and experts.

- Advanced technical analysis tools (30+ indicators)

- Customisable user-friendly interface

- One/double click trading mode

- Detailed charting system

- Trading alert system

- Strategy back tester

- Level 2 pricing

A web-based version of ticktrader is also available. Supporting all the major browsers and operating systems, the ticktrader web terminal offers easy and quick access to trading without the need for a download and without compromising on any features. Users can access the web terminal from the fxopen website.

Markets

Fxopen offers four key markets:

- Currencies – trade over 50 major, minor, and exotic currency pairs.

- Indices – trade nine global indices including the FTSE 100 and S&P 500.

- Commodities – trade on energy and metals such as gold, silver, and crude oil.

- Cryptocurrencies – trade over 40 crypto cfds including bitcoin, ethereum, and ripple.

Spreads & commissions

For major forex pairs including EUR/USD and GBP/USD, spreads average around 0.2 pips, whilst for EUR/GBP, spreads are around 0.5 pips. Spreads for the FTSE 100 start from 0.8 pips while for gold and silver, spreads start from 0.27 and 1.2 respectively. Crude oil spreads average around 4 points.

With ECN accounts, forex commissions are charged based on the account balance and start from $3.50 for accounts lower than $1,000 and reduce to $1.50 for account balances over $250,000. Discounted rates for high volume traders are available. Similarly, for cfds indices and commodities, commissions start from $5 for lower account balances and reduce to $3.50 for higher balances. Crude oil and natural gas are charged at either 0.005%, 0.0025%, or 0.0018% per side, depending on the account balance. For cryptocurrency CFD accounts the commission is 0.5% per side.

With STP accounts, the commission is included in the spread.

Other fees to be aware of include swap charges on positions held overnight. Fxopen provides instructions on how to look up a swap fee on their website.

Leverage

Leverage is available from 1:2 for cryptocurrency trading and 1:30 for forex investing. Leverage for indices is set at 1:20 and for commodities, maximum leverage is 1:10, apart from gold which is available at 1:20. Professional clients can access leverage up to 1:500. Speak to the support team to change leverage levels.

Useful margin and pip value calculators are available on the broker’s website.

Mobile apps

Fxopen offers all of its trading platforms (MT4, MT5, and ticktrader) as mobile apps, compatible with ios and android smartphone and tablet devices. The mobile apps provide the same features as the desktop versions as well as added features including push notifications. The apps can be downloaded from the user’s app store or play store.

Payment methods

Deposit

Fxopen offers several deposit options in USD, EUR, or GBP. Whilst some options are free, there are some fees to be aware of:

- Bank wire transfer – free

- Credit/debit cards – free

- Webmoney – 3.5%

- Trustly – free

- Neteller – 1%

- Skrill – 2%

Minimum deposits range from 10 GBP, USD, or EUR for cards and go up to 300 for wire transfer. For webmoney, trustly, neteller, and skrill, minimum deposits in the chosen currency are 50.

There is no maximum deposit limit for wire transfer. For cards, the limit is 15,000 (GBP, USD, or EUR) and for e-wallets, maximum deposits are either 10,000 or 20,000.

Note that fxopen also permits virtual prepaid cards for new clients. Local deposits are also available for malaysia and indonesia. Details of these can be found in the help centre.

Withdrawal

Withdrawal methods and fees are as follows:

- Bank wire transfer – free for GBP, 30 USD, or 15 EUR

- Credit/debit cards – free

- Webmoney – 3.5%

- Neteller – 1%

- Skrill – 2%

Withdrawal times for bank wire transfer usually take 1 – 3 business days, whilst cards take 2 – 5 business days. The minimum withdrawal for bank wire transfer is 50 GBP, USD, or EUR, and for all other methods, the minimum is 10. There is no maximum withdrawal limit for bank transfers, but for card withdrawals, the limit is set at 15,000 GBP, USD, or EUR. All other methods are either 10,000 or 20,000.

Demo account

Fxopen offers a demo account in any of the three account options and with MT4, MT5, and ticktrader platforms. The demo account can be opened from the main page and gives users up to $1,000,000 in virtual funds. The demo server will remain accessible as long as you log in each month. You can then upgrade to a live real-money account when you’re ready.

Bonuses & promotions

For non-UK customers, fxopen offers a $10 no deposit bonus (NDB) for the ECN ticktrader account and the STP PAMM accounts. There is also a $1 welcome bonus for micro accounts and a forexcup trading contest bonus, subject to demo contest terms and conditions. See the broker’s website for the latest promotional codes.

There are currently no bonuses or promotions for traders located in the UK.

Regulation & reputation

Fxopen UK ltd is authorised and regulated by the financial conduct authority (FCA) in the united kingdom. Fxopen australia is regulated by the australian securities and investments commission (ASIC). The broker receives a decent trust rating in customer reviews.

Fxopen also offers negative balance protection for its retail customers.

Additional features

Fxopen offers several additional features, suited to both beginner and expert traders:

- Market news

- FIX API trading

- Customer forum

- Economic calendar

- VPS (virtual private server) available

- Help centre with support options and knowledge base

- Myfxbook and zulutrade social and copy trading (non-UK only)

Account types

There are three account types available for UK customers: STP, ECN, and crypto. Tradeable instruments with the STP account are forex, gold, and silver. With the ECN account, you can trade forex, gold, silver, indices, and energy. With the crypto account, you can trade cryptocurrencies.

The minimum deposit across all three accounts is 300 GBP, USD, or EUR, which is fairly high compared to the likes of XM trading and IC markets. There are no commissions with the STP account, however, a commission is charged from $1.50 per lot in the ECN account and 0.5% half-turn in the crypto account. Leverage goes up to 1:30 in the STP and ECN accounts and remains at 1:2 for the crypto account. The minimum transaction size across all three is 0.01 lots.

Fxopen also offers PRO versions of the STP, ECN, and crypto accounts, with higher leverage of 1:500 and lower commission rates. Details of this can be found in the pro tab at the top of the broker’s website.

Note that the fxopen UK entity is unable to provide PAMM accounts.

Benefits

If you look at fxopen vs the likes of FXTM and fxpro, traders benefit from:

- MT4, MT5, & ticktrader platforms

- Positive customer reviews in 2021

- Regulated in the UK & australia

- Decent cryptocurrency offering

- True ECN model

Drawbacks

Disadvantages of choosing fxopen include:

- High minimum deposit for UK customers

- More suited to experienced traders

- Limited educational tools

- Limited range of cfds

Trading hours

Trading hours for forex, indices, and commodities run from 22:00 on sunday to 22:00 on friday (UK time). All crypto instruments are tradable 24 hours a day, 7 days a week.

Check the timezone in your area.

Customer support

There are several ways traders can contact fxopen customer support:

- Email – support@fxopen.Co.Uk

- Help centre – submit a ticket after registration

- Customer support telephone – +44 (0) 203 519 1224 (8am – 6pm GMT)

- Trading desk telephone – +44 (0) 203 519 1224 (10pm sunday – 10pm friday GMT)

- Live chat including whatsapp & facebook messenger – located in the bottom right-hand corner of the website

The support team can help with ewallet and bitcoin deposits, withdrawal problems, and proof of address queries.

User security

Both the MT4 and MT5 platforms follow industry-standard security requirements, including 128-bit secure sockets layer (SSL) encryption and two-step verification upon login. All client funds are fully segregated at barclays bank plc or lloyds bank plc in london.

Fxopen verdict

Fxopen is a good ECN broker providing a competitive trading environment with multiple platforms for active traders. Although education resources are fairly limited, the low spreads and commissions, as well as a strong track record make it an attractive option, particularly for high volume traders.

Accepted countries

Fxopen accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use fxopen from belgium, japan, united states.

Is fxopen regulated?

Yes, the brokerage holds licenses with the FCA in the UK and the ASIC in australia. These are two of the most respected agencies and a strong indicator that fxopen is trustworthy.

Is fxopen a good broker for beginners?

Although fxopen is aimed at both beginners and expert traders, there are limited resources available for beginners to learn how to trade. Fxopen also requires a minimum starting capital of £300 which is relatively high.

What leverage is available at fxopen?

Leverage is available up to 1:30 for forex, indices, and commodities, while leverage rates up to 1:2 are available for cryptocurrencies.

What markets are available on fxopen?

You can trade on 50+ FX markets, nine global indices, five commodities, and 40+ cryptocurrencies at fxopen.

How do I open an account with fxopen?

From the broker’s website, you can choose to either open a live account or a demo account from the top right-hand corner. You will need to select which account type you wish to trade and verify your identity and proof of address.

So, let's see, what we have: fxopen的外汇入金方式 允许您用任何喜欢的付款方式为您的fxopen 外汇交易账户进行资金存入 通过大多数电子支付系统,外汇存款立刻到账。 at fxopem

Contents of the article

- 外汇入金选项

- 如何入金到您的fxopen 帐户

- 登陆到 my fxopen 个人区,并在入金菜单中选择一种支付方式

- 填写入金金额,货币,交易帐户,等表格.点击入金.

- 您将被转到所选择的支付系统的端口以完成转帐.

- ...

- 如果入金没有及时加到您的帐户,请,在my...

- 为什么选择在fxopen交易

- Best forex bonuses

- Deposits and withdrawals

- 外汇入金选项

- 如何入金到您的fxopen 帐户

- 登陆到 my fxopen 个人区,并在入金菜单中选择一种支付方式

- 填写入金金额,货币,交易帐户,等表格.点击入金.

- 您将被转到所选择的支付系统的端口以完成转帐.

- ...

- 如果入金没有及时加到您的帐户,请,在my...

- 为什么选择在fxopen交易

- What is position trading?

- Why using a position trading strategy?

- How to calculate the proper position size for a...

- Types of position trading

- Pros of a forex position trading strategy

- Cons of a position trade

- Positional trading tips and tricks

- How to benefit the most from positioning strategy

- My conclusion

- FXOPEN EU

- Why choose fxopen EU pro?

- What protection do professional clients lose?

- Professional clients do not get the same...

- Professional clients have an obligation to make...

- As a professional client we will not be obliged...

- As a professional client we may assume your level...

- As a professional client we may prioritise other...

- As a professional client we can use more...

- Am I eligible for an fxopen EU pro account?

- Have you placed 10 relevant trades of a...

- Does your cash and financial instrument portfolio...

- Do you, or have you, worked in the financial...

- FXOPEN EU PROaccount trading conditions

- How do I open a pro trading account?

- Zarabiaj handlujд…c na rynku forex...

- Nasze atuty

- Niskie prowizje

- Szybka realizacja zleceе„

- 90-dniowy program zwrotu gotówki

- Szeroka gama instrumentów

- Bezpieczeе„stwo

- Doе›wiadczenie

- Technologia ECN

- FXOPEN EU

- Why choose fxopen EU pro?

- What protection do professional clients lose?

- Professional clients do not get the same...

- Professional clients have an obligation to make...

- As a professional client we will not be obliged...

- As a professional client we may assume your level...

- As a professional client we may prioritise other...

- As a professional client we can use more...

- Am I eligible for an fxopen EU pro account?

- Have you placed 10 relevant trades of a...

- Does your cash and financial instrument portfolio...

- Do you, or have you, worked in the financial...

- FXOPEN EU PROaccount trading conditions

- How do I open a pro trading account?

- Zarabiaj handlujд…c na rynku forex...

- Nasze atuty

- Niskie prowizje

- Szybka realizacja zleceе„

- 90-dniowy program zwrotu gotówki

- Szeroka gama instrumentów

- Bezpieczeе„stwo

- Doе›wiadczenie

- Technologia ECN

- Fxopen review and tutorial 2021

- Fxopen details

- Trading platforms

- Markets

- Spreads & commissions

- Leverage

- Mobile apps

- Payment methods

- Demo account

- Bonuses & promotions

- Regulation & reputation

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- User security

- Fxopen verdict

- Accepted countries

- Is fxopen regulated?

- Is fxopen a good broker for beginners?

- What leverage is available at fxopen?

- What markets are available on fxopen?

- How do I open an account with fxopen?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.