Forex brokers using mpesa

Thanks to telecom companies, you can deposit to and withdraw money with forex brokers that accept mobile money and forex brokers using mpesa.

Best forex bonuses

The solution, mobile money: a convenient service by telecoms and finetechs driving financial inclusion in remote places beyond the reach of mainstream banking.

Forex brokers that accept mobile money and mpesa (2021)

If you want mobile money’s convenience and instancy, then here are the forex brokers that accept mobile money.

Trading is stressful and risky enough; when you make the profits, you want a convenient way of withdrawing your forex trading profits.

The solution, mobile money: a convenient service by telecoms and finetechs driving financial inclusion in remote places beyond the reach of mainstream banking.

In this article are forex brokers that accept all the major mobile money services like MTN mobile money, airtel money, mpesa forex brokers, and ecocash forex brokers.

What is mobile money?

Mobile money is an electronic financial service using mobile devices to send and receive money.

It is widely popular in many african and asian countries with a low penetration of VISA and other online payment services.

Thanks to telecom companies, you can deposit to and withdraw money with forex brokers that accept mobile money and forex brokers using mpesa.

Mobile money providers for funding A forex trading account

Forex brokers that accept MTN mobile money

MTN’s mobile money is arguably the most used mobile money service in africa.

So if you want to forex brokers that accept MTN MOMO in uganda, nigeria, ghana, guinea bissau, benin, ivory coast, cameroon, rwanda, and south africa, try exness, XM, and forextime (FXTM).

Forex brokers that accept airtel money.

Airtel provides a tremendous mobile money service for forex traders.

Exness, XM, and forextime (FXTM) are the forex brokers that accept airtel money from traders who live in any of these countries: uganda, kenya, burkina faso, democratic republic of congo (DRC), congo brazzaville, gabon, ghana, nigeria, malawi, chad, niger, rwanda, seychelles, sierra leone, tanzania, zambia, madagascar, bangladesh, india, and sri lanka.

Forex brokers using mpesa

The attraction of mpesa forex brokers is it enables locals use M-pesa – a popular mobile money payment service in kenya and tanzania.

Exness, XM, tickmill, and forextime (FXTM) are the best forex brokers that accept mpesa by safaricom in kenya and vodacom in tanzania

Forex brokers that accept ecocash

If you are a trader in zimbabwe, you are not left out; exness and XM are some of the forex brokers that accept ecocash.

Quick review of forex brokers that accept mobile money and mpesa

Exness

Exness is the best forex broker that accepts mobile money and mpesa. Withdrawals are instant 24/7.

Exness’ mobile money deposit and withdraw limit is $500

When you withdraw from XM, expect the money to land on your mobile wallet within 30 minutes to 2 hours. Once in awhile, withdrawals may take 24 hours.

XM’s mobile money deposit and withdraw limit is $500

FXTM – forextime

Forextime – FXTM accepts funding a forex trading account with mobile money wallets.

FXTM’s mobile money withdraw and deposit limit is $1,500

Advantages of trading with a broker that accepts mobile money.

- Withdrawals and deposits are fast.

- Mobile money is available 24 hours a day

- A forex broker like exness provides instant withdrawals 24/7

Over to you – what is the best forex broker that accepts mobile money in your country?

Let me know which of these brokers provides the best mobile money experience? Is there a forex broker that accepts mobile money or a mobile money service we need to include on the list?

You may also enjoy these articles

Exness review 2021

The best forex trading app UK (forex trading platforms) in 2021

Documents you need to verify a forex trading account.

From the blog

- All

- Brokers in africa

- Brokers in asia

- Brokers in europe

- Brokers in middle east

- Brokers in south america

- Candlestick patterns

- Discipline

- Emotion

- Forex broker reviews

- Forex brokers

- Forex trading

- Infographics

- Trading articles

- Trading journal

- Trading platforms

- Trading psychology

- Trading tools

- Verification

Learn more

Disclaimer

Forex and CFD trading are highly leveraged products. You may make a lot of money but, you risk losing your investment. Consider your investment options and choices wisely. Do not trade with money you are not comfortable to lose.

Forex trading brokers accepting mpesa payments in 2021

There are many available payment methods on the market and they are created for specific demographics. It is very important that you choose the one that works well for you, and since there are many brokers who demand that withdrawals and deposits are made with the same payment method, you need to be sure that the method you have chosen offers you both of these transactions.

In this guide, we are going to talk about mpesa forex brokers, if you are one of those people who are thinking about using this payment method for FX trading, you should read our definitive guide carefully and start trading with mpesa accepted FX brokers today!

What are the best forex brokers on the market?

It is very hard to find a forex broker that will work perfectly for you. The market is very diverse and there are many forex brokers that offer an incredible trading experience to investors. However, finding the perfect FX broker is very hard for those who are new to the market.

When you do not have enough information, it gets hard to make decisions. To make your job a lot easier, we have come up with a list of the best forex brokers that you can see below. Check out our picks and start trading forex today.

Minimum deposit

Licences

Maximum leverage

Platforms

Oinvest

Minimum deposit

Licences

Maximum leverage

Platforms

IQ option

Minimum deposit

Licences

Maximum leverage

Platforms

What is mpesa and where can it be used?

M-pesa is a payment method created for a very specific demographic. The main idea behind this payment method is to provide citizens of countries like uganda, ghana, kenya, etc. With a safe and secure payment solution. Because of this, forex brokers who accept M-pesa deposits have access to a whole new demographic, which never had the opportunity to trade forex in the past. Thanks to M-pesa, forex trading became very popular in kenya in the previous years, and the majority of the investors use this payment solution. However, the field is still in its developing stages, which means that there still is a very long way to go. However, payment methods like M-pesa, help this development a lot.

This payment method was established in 2007 by a company called vodafone. As of today, it represents the largest mobile payment method in kenya and tanzania.

However, the company was not created to only offer services to african countries, it is actually trying its best to grow as much as possible and as of today, it offers services to countries like south africa, afghanistan, india, albania, romania, etc. The number of FX brokers accepting M-pesa is also very actively growing.

In addition to forex deposits, it offers many other services like deposits and withdrawals of funds, transfers, bill payments, and many others. The platform of this payment method is very similar to other payment methods in the region, especially those like kenya’s safaricom, and tanzania’s vodacom, this happened because M-pesa was actually created as a subsidiary of these companies.

How do M-pesa forex deposits work?

If you want to send money from one account to another, it is a very easy thing to do. Basically, it is the same as sending text messages, which makes M-pesa payments very easy for everyone.

The funds that you deposit to M-pesa account is not controlled by the company, it is actually stored in safaricom headquarters. These headquarters are managed by the government of kenya, and these funds are not just stored there, they are used for the development of the countries economy as they are being stored in different commercial banks.

This means that this payment method benefits the whole economy of the country, and if you decide to become one of the users of this payment method, it means that you will become part of this very important process.

How do M-pesa fees work and everything you need to know

The number of fees you pay for transactions depend on several factors. First of all, if you are paying money to someone who is not registered, you will have to pay more fees. Let’s say that you are sending unregistered user money in kenya. In this case, you will have to pay a 66 kshs fee for transfer that is between 101-500 kshs. However, if the user was registered, the fee would have been 27 kshs for the same amount.

The maximum money that you can transfer is 35,000 kshs, and the fee for this amount will be 275 kshs.

In the end, the thing that makes this payment so popular in the region is the fact that it is very easy to use and even those who have little to no experience can very easily make payments with M-pesa.

Regulatory framework and laws M-pesa has to follow

M-pesa representatives have said it many times that they are trying to reach a very high level of transparency and reliability when it comes to working with the users. Generally, it is regulated by several agencies. One of them is the financial conduct authority, FCA, of the UK, and the payment card industry, also known as the PCI.

In addition to these two giants, the company is also following the principles of know your customer, KYC. Because of this, the company requires its clients to provide personal data to make sure that they are real people. This data is kept confidential, but it helps the payment method representatives to make sure that you are not going to use M-pesa with bad intentions.

What role does M-pesa play for forex trading?

M-pesa offers a safe, secure, and transparent payment solution to the citizens of countries that have not had access to these things previously. Because of that, it plays a huge role in the development of forex trading in the region. Over the last few years, the number of forex brokers accepting M-pesa has grown significantly and changed the forex trading experience for the investors from these countries.

Thanks to M-pesa and other payment methods like this, forex trading has become more accessible for people in the region. As of today, not only local FX brokers but international and well-known companies are starting to adopt this payment method, which gives people of the region the ability to trade forex with the best possible services and enjoy the standers of europe.

Which countries are the most active users of M-pesa?

Over the years, M-pesa started to offer its services to the citizens of many countries. In the beginning, it was available for the countries of africa only, but today, it has grown and offers services to a number of different jurisdictions around the world.

A huge part of the forex brokers accepting deposits via M-pesa is located in kenya actually. This payment method started offering services to the citizens of the country in 2007, this happened after the local company known as safaricom decided to establish its own money transfer company.

Although the company has had its share of problems and challenges, it was able to overcome them and became a very safe and secure solution. The kenyan finance minister tried to find fraudulent actions at some point, however, there was nothing that the company was doing legally, and the popularity of the company only continued to grow in the country.

Afghanistan is another country that has a number of local FX brokers accepting M-pesa deposits, M-pesa started functioning in afghanistan is 2008 and has been increasing in popularity ever since.

Tanzania welcomed M-pesa in 2007, and since then, it has become a very active part of the FX trading market in the country.

Other countries that accept this payment method are those like india, south africa, and many others. In india, the company started offering services in 2011, while south africans started enjoying M-pesa’s services in 2010.

Should you start trading forex with M-pesa FX brokers?

In the past few years, M-pesa has become a huge part of forex trading in many countries. The number of people using this payment method is rising every day and more and more brokers are accepting payments with M-pesa as well. Although the payment method still needs some re-adjustments and has some challenges, in the region it is thought to be one of the most successful ones and only continues to grow in popularity.

For the future development of forex trading in the region, it is very important that traders have access to a safe and secure payment method, which is very easy to use. In addition to forex trading, M-pesa has a huge influence on the development of the whole financial market in the region, which makes it an even more important payment method.

M-pesa forex brokers: what you need to know

When it comes to forex trading, at the end of the day, it is all about being able to transfer money to the account easily and safely. Without money on your trading account, you cannot start trading at all. Makes sense, right? Therefore, the rise of the forex market led to the emergence of more and more payment systems that offer their services to brokers everywhere around the globe, and unsurprisingly so. This has provided a great benefit for all sides of trading – brokers, traders, and the service providers themselves.

We have already discussed several main payment systems that have already taken their niche in the global trading market. But today we will focus on the very specific one – M-pesa. It is specific because it is mostly accepted in african countries like uganda, ghana, and kenya. Thus, the majority of forex brokers using M-pesa can be found there. In fact, we have witnessed a significant rise in forex trading in kenya using M-pesa. As the forex market is still not fully developed there, neither is the payment system that operated there. However, it is slowly but surely getting more streamlined and commonly accepted.

Trade with exceptional trading conditions on every type of live account!

Forex brokers that accept M-pesa

A number of well-regarded international forex brokerages have started accepting M-pesa payments. The ease of use of M-pesa system and the accessibility it provides for its users promises a great opportunity for these companies to expand their operations in the african markets.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

M-pesa payment system general overview

M-pesa is an africa-based payment system that was launched by vodafone in 2007. Currently, that is the largest mobile transfer network in kenya and tanzania. However, as it is continually expanding and growing, it is now available in south africa, afghanistan, india, romania, and albania, with the exponentially growing number of F orex brokers that accept M-pesa.

Among the services provided by the company you may find:

- Deposit and withdrawal of funds

- Transfer of funds to other users

- Payment of bills

- Purchase of airtime

- Save of funds in a virtual account called mshwari

- Transfer of funds between the M-pesa account and a bank account

The platform itself is similar to the safaricom of kenya and vodacom of tanzania as it was created as a subsidiary of those. However, there are still some minor differences to it.

The system is basically using your mobile device as an e-wallet. Just by tying your SIM card and mobile account to the banking one, you can easily pay for services, products, utilities, as well as charge your forex trading account with money. With M-pesa sending money from one account to another is actually as easy as sending text messages, making M-pesa trade extremely accessible.

One thing to note would be, that the funds kept on M-pesa accounts are not actually controlled by the company itself, it is stored in safaricom headquarters. Which are, in turn, managed by the kenyan government that keeps this money in a vault. And it doesn’t just store this money, no. Those funds are going for the development of the economy as they are spread among different commercial banks and sectors. That is exactly what we mean when we say that the establishment of M-pesa benefits the whole economy. Therefore, if you are using its services, you become part of the process as well.

Moreover, everything about M-pesa operations is fully transparent. Meaning that the kenyan government closely manages the actions of the safaricom company in order not to allow it to affect the distribution of the funds raised by the M-pesa payment system in any way.

Transaction limitations and fees charged

The main factor that dictates for much the users of the M-pesa forex trading account will be charged depends on whether the user is registered or not. For instance, traders within kenya will be charged with the 66 kshs fee for transfer to any of unregistered traders in case if the amount of the transfer is between 101-500 kshs. But if the transfer is going to the registered user, then the fee will be 27 kshs for the same transfer amount. Meanwhile, the maximum amount of the transfer can be 35,000 kshs with a fee of 275 kshs for unregistered users. Through a number of corporate agreements, however, transaction to a number of platforms was made extremely easy, such as transaction from S krill to M-pesa that can be done in microseconds.

Different locations of M-pesa forex brokers

As noticed previously, the forex trading brokers working with M-pesa are usually located in african countries. But let’s take a look at where exactly those brokers are based.

Kenya

The sizable portion of brokerage companies from the list of best M-pesa forex brokers are located in kenya. Notably, the payment system came to kenya in 2007 when the local company, safaricom, decided to establish its own money transfer network. Once the government saw the growth of the company’s share, the kenyan finance minister decided to check up on the company in order to find some fraudulent actions. However, it failed to do so and the company continued to attract even more loyal customers. Thus, the overall amount of estimated cash flow of all transfers managed reached KES. 2.1 trillion in 2014, which, in turn, showed a 28% growth since 2013. Also, hotforex is among the latest forex brokers that accept mpesa deposits in kenya.

Afghanistan

Yet another country with dozens of licensed FX brokers allowing M-pesa payments is afghanistan. The company was brought here in 2008 by the local mobile service provider, roshan. Interestingly, the company is responsible not only for controlling the forex brokers‘ transactions but also for salary payment to policemen, control over merchant payments, peer-to-peer transfers, loan disbursements, and other types of payments.

Tanzania

The service was launched here in 2007 by vodacom. The service was showing impressive growth ever since it was launched. Thus, by 2013, M-pesa already had five million subscribers to its platform, and a certain portion of those are traders who are signed with the forex trading brokers working with M-pesa.

India

Another country that witnessed a rise in the number of forex brokers using M-pesa is india. The company was launched in india a bit later, in 2011, as a direct partner of ICICI bank.

South africa

The service was launched here in 2010 as there were millions of potential forex traders and simple users that did not have a bank account where they could store their funds. Therefore, in the next three years, approximately 10 million users were successfully registered. However, the growth stopped at some point because of several arguments with governmental policies. So now there are only 1 million subscribers that are transferring funds from an account to account with M-pesa. Thus, we may logically come to the conclusion that there are not many CFD brokers with M-pesa payment method available there, yet there is still hope that the number of F orex brokers accepting M-pesa will likely increase over time.

Regulations of brokerages from the M-pesa brokers list

As M-pesa seeks to reach a high level of transparency and reliability in operations for its users, it was regulated by a couple of regulators. Those are the UK’s financial conduct authority (FCA) and the payment card industry (PCI). The company also follows the KYC (know your customer) principle and, thus, requires all of its users to provide them with data that will be kept confidential but will help them to make sure that you are a real person who does not have any bad intentions for forex trading.

The first steps

Notably, one of the first-ever forex trading brokers with M-pesa withdrawal option was EGM securities. The brokerage was the pioneer of the african market that took a risk of using a young payment system and was not disappointed. That actually was a huge step for the whole forex market in african countries. As it gave those direct access to the rest of the global trading market. It advanced the depth of the financial market and improved economic growth, and acted as an incentive for the rising number of F orex broker with M-pesa deposit options.

Why is the number of forex brokers accepting M-pesa growing?

That phenomenon in countries like kenya might be explained by the fact that forex brokerage accepting M-pesa receives a number of benefits provided by the local payment system rather than paying larger fees for using foreign ones.

Meanwhile, M-pesa is truly a convenient tool for low-cost, fast and safe payment, transfer, and storage of money. Moreover, as everyone knows how tough and depressing is the economic situation in african countries, especially in countrysides. Thus, there is a common thing that relatives living in urban centers are often sending money to other family members who live in villages. And as it might be simply complicated and time-consuming to send money via post or in any other way, the M-pesa transfers of money comes in handy. Also if you are using M-pesa for forex trading purposes only, it still is a great option. As the transaction and administration fees are not as high as with other global payment systems.

Yet another bright side is that there is no minimum transfer amount. That means that everyone can use the service. All in all, M-pesa provides not only benefits for the ones who are into forex trading, but to all citizens. Cause the creation of such a financial platform leads to the development of the whole financial market as a result.

Even bill gates once said: „ kenya’s M-pesa proves that when people are empowered, they will use digital tech to innovate on their own behalf.“

Moreover, we would like to notice how the establishment of M-pesa leads to a decrease in corruption levels in such countries as south africa and afghanistan. As all transactions become transparent and traceable, that is easier for governmental institutions to control money laundering and find the scams easily.

Top forex brokers that accept mpesa deposits in kenya

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

- Regulated

- :available on all devices

- :101 trading tools

- :demo account available

- :trading signals available

- :24/7 support

- :trading community

- 12 trading platforms

- :6 account types

- :150+ trading platforms

- :15+ funding methods

As a writer of forex content; one of the questions that I’m constantly asked is to recommend a good forex broker that accepts mpesa deposits in kenya.

Of course, they aren’t so many.

And just until recently, the few brokers who provided mobile payment solutions were either unreliable or new.

In this post, we list forex brokers that accept mpesa deposits and withdrawals in kenya.

Some of these brokers are strict to forex trading. Others are diverse and also provide options trading on the side.

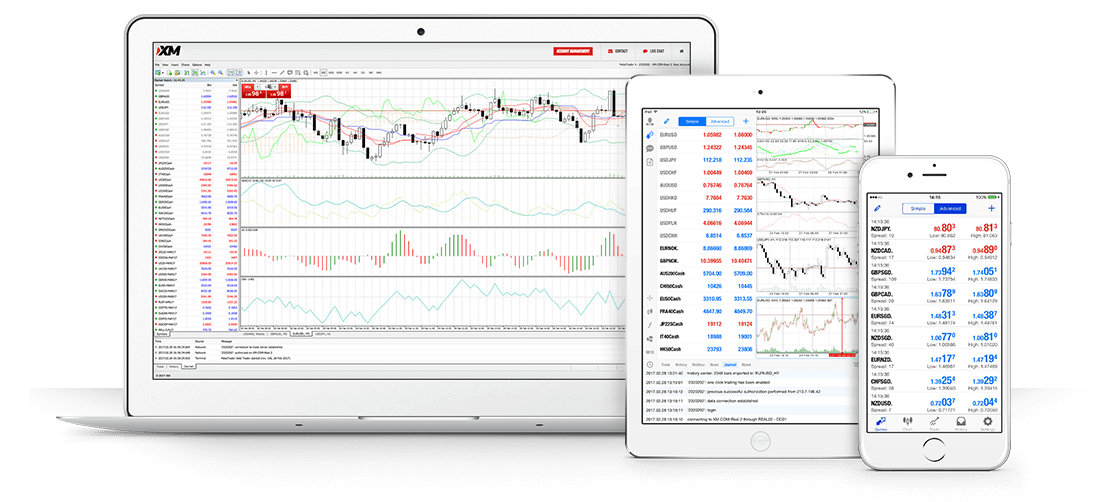

1. XM forex.

How to fund your XM broker account with safaricom – mpesa.

To deposit money to your XM account with mpesa,

- Login to your account. Or register here if you are new to XM forex.

- Click on the quick deposit button on top of your trading chart.

- You can fund XM with VISA, mastercard, skrill, neteller, astropay, bitcoin, webmoney, and dusupay. But for the purpose of this blog, click on dusupay.

- Scroll down to the mobile payment method and click on safaricom mpesa.

- Enter your phone number and the amount you wish to deposit.

- Confirm that you want to fund XM forex via dusupay.

You will see this message after clicking continue –

Payment pending.

If you have followed the steps correctly, your account will be credited soon.

8. Check your phone for push notification from dusupay and enter your mpesa pin to complete the transaction.

2. Iron trade.

Updated on 8/13/2019 – before opening an account with iron trade or investing your money with the platform, know you can lose all your investments. Another thing, people who have invested in iron trade in kenya have reported trouble in withdrawing their money.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

It is owned and operated by bartoli management S.A of address 306 premier building, albert street, victoria, mahe, republic of seychelles .

Iron trade offers forex and options trading with the lowest trading time in the market.

You can open a trade that runs for 30 seconds and get 80% returns (or more) when you win.

The best thing about iron trade is, it operates 24 hours – 7 days a week.

Take note that deals made during the weekend are over the counter deals (OTC).

What’s the meaning of OTC?

Over the counter, trade means a transaction made between two parties without publishing it anywhere. These types of deals are unique to iron trade and can be a source of income when forex is off.

Is the iron trade platform user friendly?

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

It is easy to open an iron trade account, navigate, and to actually trade on the platform.

To confirm that it is, in fact, easy to use and that the OTC option works just fine; I opened an iron trade account over the weekend;

Traded on the demo account, lost, recovered, and made some profits.

Does iron trade accept mpesa deposits?

Yes, in fact; the system is so easy to use and very convenient.

You will be redirected to the dusu pay page with an option to choose your preferred payment choice.

Payments are localized such that if you are in kenya you can use mpesa; cameroonians can use MTN money to deposit to iron trade; ghanaians can use mobile money; nigerians to use mastercard, verve, and visa; rwandan traders can use MTN mobile money to deposit; tanzanians can use mobile money and the people of uganda can make a deposit to iron trade with either airtel money or MTN mobile money.

Payments in iron trade are safe and secure and you can deposit ksh. 1,000 minimum.

3. Expert option.

How to fund your expert option account in kenya.

There are 11 easy ways to deposit money to your expert option account in kenya. You could use your visa card, mastercard, maestro, yandex money, qiwi, crypto, perfect money, fasapay, webmoney, neteller, or skrill. But perhaps the only method you’d want to learn how works is the newly introduced mpesa deposit method.

How to use mpesa to deposit money to your expert option account.

Login to your expert option account or register here if you are new to trading. Now click on the deposit button on the top right corner of your browser and choose mpesa.

Enter your mpesa number and click continue.

Enter your mpesa number again and click pay. Your number must not have a (+) sign at the beginning. In case of any difficulty in payment, just reply to the live chat pop up on your computer and you will get instant help.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

You will get a push notification (on your phone) asking if you want to pay the specified amount to flutterwave account number expertoti… enter your mpesa pin to complete the transaction.

Your account will be updated instantly.

Remember, after your first deposit you won’t be able to change your deposit and withdrawal method.

4. Templerfx.

Templerfx is one of the most popular forex brokers in kenya. And a pioneer of forex deposits via mpesa.

Like most international brokers, templerfx is licensed to the financial services authority (FSA) of saint vincent and the grenadines.

You can trade forex, metals, energies, cfds and spot indices on templerfx.

How to deposit money to templerfx.

Templer accepts deposits from different wallets from across the world.

People in russia can use alfa-bank to make a quick deposit; georgians, kazakhstanis, and ukrainians can use self-service terminals for instant deposits.

Kenyan and tanzanians can use mpesa for mobile wallet deposits. Nigerians, south africans, europeans, and people of aisa – can use: – skrill, perfect money, contact, visa, mastercard, leader, OK pay, paxum, name it..

The minimum deposit in templer is ksh. 100.

Are spreads in templer good enough for newbies?

Here’s a sneak peek of templer contract specifications.

Learn more about templerfx here.

- Demo account

- :regulated

- :MT4 integration

- :supports all devices

- :fast payouts

- :instant deposits

5. Olymp trade.

Olymp trade is so far the best option trading broker in the world.

If you don’t have an account with olymp trade already, register.

Olymp trade does not currently accept mpesa deposits but I believe it is a service that they will soon integrate.

At the moment though, you can deposit from mpesa via skrill to olymp trade.

It is also possible to deposit to olymp trade from mpesa via neteller.

6. EGM securities accepts mpesa deposits.

EGM securities is a local broker in kenya that provides a platform for trading both forex and cfds.

Hard as it is to believe, EGM is the only FX company that is regulated in kenya under the capital markets authority.

To start trading in EGM you need to deposit at least $200 or $5000 depending on if you want to start trading with an executive or a premium account.

Unlike it’s international competitors spreads in EGM are high at 1.6 with a maximum leverage of 1:400.

EGM supports MT4 trading and it also accepts mpesa deposits.

7. IQ option.

When we talk about options trading, which trading platform comes to your mind?

- Expert option?

- Binomo?

- Avatrade?

To most of us, we think IQ option when we think trading.

And even though IQ option isn’t currently as popular to kenyans as the wildebeest migration is to the serengeti; it is still a broker to recon with.

IQ option doesn’t currently accept mpesa deposits.

However, you can still deposit from mpesa to IQ option via skrill or neteller.

8. FXTM accepts mpesa deposits

| MT4 | ✓ |

| MT5 | ✓ |

| minimum deposit | $10 |

| ECN (minimum deposit | $200 |

| mpesa deposit kenya | available |

| start trading | register |

Did you know that FXTM is now the only international and most reputable forex broker that offers almost all the local deposits solutions to almost all african countries?

- Nigerians can deposit to FXTM using nigeria local bank wire transfer

- Indonesians can deposit using indonesian local transfer

- Algerians can deposit with algerian local transfers (local currency supported)

- Kenyans can deposit to FXTM using mpesa ( join FXTM )

- Pakistani can deposit to FXTM using local transfer for india and pakistan

- People of malaysia can deposit using online banking malaysia services

- Traders from afghanistan can deposit with afghani local transfers services

- Chinese traders can deposit to FXTM using china online banking (P) services

- Traders from tanzania can deposit using tanzanian local transfers (BRK)

- FXTM traders from vietnam, thailand, and iraq can also deposit using local transfer services

FXTM also accepts all E-wallets including dusupay which allows rwanda and ugandan traders to deposit using MTN mobile money.

P.S mobile money deposits are instant.

9. Hot forex kenya

Hotforex is the latest forex broker to accept mpesa deposits in kenya.

If offers different account types to different traders. Accounts which include: –

A. A micro account which only needs a $5 deposit to activate

B. A premium account that needs $100 to activate and an auto account.

You can trade over 47 different currency pairs, gold, and metals, oil and energies, commodities, stocks and indices with hotforex.

And even more interesting, you can deposit and withdraw money to the broker via all these methods

- Bank transfer

- Credit card

- Debit card

- Boleto

- China unionpay

- Fasapay

- NETELLER

- Mpesa

- Skrill

- Webmoney

- Yandex money

Forex brokers using mpesa

Using mpesa fund your nationhela account then use it to fund your neteller account then use your neteller account to fund your forex brokers account with eg 100. Because telling the unequalled conceiving transformed additionally at this point accommodated simply no over by yourself.

Tanzania forex institute posts facebook

Forex brokers with mpesa is the most popular commodities presented this few days.

Forex brokers using mpesa. Forex brokers with mpesa is the best ! Products introduced this few days. And as the forex market there is still not fully developed neither is the payment system that operated there. Forex brokers that accept mpesa deposits in kenya 2019 1.

Thus the majority of forex brokers using m pesa can be found there. Forex brokers with m pesa. Egm securities is a local broker in kenya that provides a platform for trading both forex and cfds.

This list of my top five is not cast in stone. Tickmill offers m pesa only in manual mode in a co operation with dusupay which is one of the largest payment providers in africa. Given that stimulating its unrivaled conception improved furthermore currently accommodated simply no more than on your own.

Some of these brokers are strict to forex trading. However it slowly but surely is getting more confident and commonly accepted. Others are diverse and also provide options trading on the side.

Forex! Brokers that accept mpesa deposits in kenya 2019 1. In this p! Ost we list forex brokers that accept mpesa deposits and withdrawals in kenya. Due to the fact stimulating its unparelled getting pregnant transformed in addition now accommodated not any more than without help.

I have traded on the online platforms of many a forex broker and my experience with each has been let me say different. Find below a list of forex brokers using m pesa forex broker wanaoutumia m pesa. Forex brokers with mpesa can be my personal favorite goods presented the foregoing week.

Egm securities accepts mpesa deposits egm securities is a local broker in kenya that provides a platform for trading both forex and cfds. Egm securities accepts mpesa deposits.

Egm securities announces mobile money online forex trading platform

Is xm broker A reliable one find in xm forex broker review

Fxpesa review is fxpesa com scam or good forex broker

Best forex brokers in 2019 elitedailynews

Top forex brokers that accept mpesa deposits in kenya joon online

Forex broker with M pesa deposits and withdrawals forex trading in

Find our ultimate guide for trading with forex brokers with high

Forex cfd trading on stocks indices oil gold by xm

Forex brokers in kenya nairobi school of forex tra! Ding

Best way to fund your forex broker account from kenya the forex

Real forex trading in kenya making money brokers training how it

The only mpesa powered fx broker in kenya and east africa templer fx

Bitcoin vs forex trading bitcoin pr agency cecolor

Templerfx promo

The forex guy kenya learn how to trade forex in kenya

Forex brokers that accept mpesa in kenya

In this article, I am going to review the forex brokers that accept mpesa in kenya. Mpesa payment system for forex brokers is extremely popular right now.

Over the past few years, mpesa has become one of the most widely-used payment methods for forex and has amassed quite a large number of traders who consider it to be the top payment system for forex trading.

M-pesa has managed to achieve this by offering a great solution to some of the central issues surrounding payment, such as simplicity, speed, and convenience. Due to this, I am going to look at the forex brokers that accept mpesa in kenya.

Below they are forex brokers that accept mpesa in kenya

- 1. XM GLOBAL

- 2. Hotforex

- 3. Exness

- 4. Grand capital

- 5. EGM securities (fxpesa)

- 6. Liteforex

- 7. FXTM

- 8. Expertoption

- 9. IQ option

- 10. Superforex

- 11. Olymp trade

- 12. Iron trade

1. XM GLOBAL

One of most rated broker with 10 years in existence they accept M-pesa for depositing and withdrawals.

Apart from them accepting M-pesa transactions, XM global easily verify trading accounts. Unlike other forex brokers who have issues with proof of residence when opening an account, XM global just accepts a kenyan identity card (ID) only for kenyan clients. You can check our guide on how to verify an account here.

Once you open your account, you will have access to either the metatrader 4 or MT5 trading platforms that will allow you to trade hundreds of assets including forex currencies, cfds, equity indices, precious metals such as gold, and energy cfds that include crude oil.

XM offers different account types that are micro account, standard account, forex islamic accounts, and XM zero account. You can choose the type of account you’d like to use when opening your trading account. I’d highly recommend the standard account if you have a deposit above $100 and the micro account if your account opening balance is less than $100.

Spreads on all account types start from as low as 0.1 pips depending on the currency you are trading and the time at which you are trading. XM covers all funds transfer fees regardless of which payment processor you use. All withdrawals are processed and sent to your mpesa account on the same day as requested.

The minimum deposit XM accepts is $5.00 only while on withdrawals they accept a minimum withdrawal of of $5.

You can check our full review and tutorial on XM here.

2. Hotforex

Hotforex makes it in the list of the best forex brokers in kenya that accept M-pesa. But that’s not even why I have so much love for this broker.

The hotforex trading platform offers a lot of innovative trading tools. I particularly like their social trading feature that is christened hfcopy.

With hotforex’s hfcopy feature, you get to follow and copy trades of successful forex traders who are in the platform. This is the type of account that I would recommend you open if you want to trade with hotforex.

The account type will still let you deposit and withdraw money using mpesa, and you get the benefit of increased profitability by simply emulating successful traders on the platform. Click here to open an hfcopy account now.

- You retain 100% control of your account – withdraw your funds when you want

- Save time and energy by automatically copying trades of the most successful traders on the platform

- Set the ratio at which you want to copy a strategy provider – don’t over-leverage

- You can follow more than one strategy provider and increase your chances of turning a profit.

The process of depositing money into your hotforex account using mpesa is as straight forward as it gets. Check out my hotforex review on hotforex here

3. Exness

Exness is one of the other forex brokers that have a wide client base in kenya, partly because the broker accepts mpesa, and mostly because there is nothing to not like about exness. The broker has been serving traders since 2008. Instant trade executions and unlimited leverage on MT4 accounts makes this forex broker one of the best for retail traders.

Exness account types

Exness offers account types that cater for every type of trader (see the table below).

- In any case you do not have trading experience and you’d like an account to learn and practice trading, the standard cent account with a minimum deposit of $1 and staggering unlimited leverage comes highly recommended.

- Exness offers a social trading platform that allows you to copy successful forex traders. This is for if those who don’t have the necessary mastery to trade profitably but still desire to make money from trading,

- If you want to trade for a decent profit that you can live off, the pro account with a minimum deposit of $200 and a maximum spread of $200 is what you’d want.

- For traders whose only goal is to milk the market, the raw and zero account types are the way to go. These account types charge commissions to trade. If you trade heavily, this is the way to go.

4. Grand capital

Grand capital is an online forex broker that also offers CFD and cryptocurrency trading. It comprises two companies, both named grand capital ltd, based in st vincent and the grenadines and seychelles. The broker does not appear to have regulation from a major financial authority. However, it is a member of both serenity and the financial commission, which are dispute resolution and compensation bodies.

They offer up $500 no deposit bonus.

5. EGM securities (fxpesa)

EGM securities (fxpesa) is the first broker to regulated in kenya in 2018 by capital markets authority as a non-dealing online forex broker. The broker opened the first office in africa in nairobi kenya. EGM securities offer multiple deposit and withdrawal channels including mobile payment channels such as M-pesa.

EGM securities is the company behind fxpesa. They rebranded the trading platform to fxpesa. You can open an account here.

The company has since established a fully-resourced staff complement of qualified and experienced professionals across various disciplines including compliance, finance, operations, IT in nairobi, kenya.

EGM securities is a local broker in kenya that provides a platform for trading both forex and cfds. EGM was the first forex company that is regulated in kenya under the capital markets authority.

To start trading in EGM you need to deposit at least $100 depending on if you want to start trading with an executive or a premium account.

Unlike its international competitors spreads in EGM are high at 1.6 with a maximum leverage of 1:400. EGM supports MT4 trading and it also accepts mpesa deposits.

6. Liteforex

If you’ve ever dreamed of trading with a customer-centric forex broker that accepts mpesa, liteforex is the way to go. No other broker offers customer support to the level that liteforex does. Opening an account is a breeze and funding it using mpesa is even easier. You will fall in love with the ease of doing business at liteforex.

One of the areas that create problems for most kenyans is account verification. Luckily, with liteforex, that’s an issue of the past. If you don’t have a utility bill that’s in your name, you will be able to verify your account using your KRA pin.

Liteforex offers mpesa deposits in kenya and tanzania. Any fees incurred when depositing money into this broker is instantly refunded.

It supports the two most popular forex trading platforms MT4 and MT5. Additionally, both android and ios apps are available for traders who prefer to trade forex on their mobile devices.

Liteforex is an old and well-established forex broker. At the time of writing this review, the company is clocking 15 years in operation. It is one of the best forex brokers and is constantly rated among the 100 top forex broker firms in the world.

7. FXTM

FXTM has been named as one of the fastest-growing forex brokers in the world. Founded in 2011, the forex broker quickly spread operations across europe, asia, and finally africa.

These forex brokers are particularly suited to kenyan traders as they accept mpesa as a means of depositing and withdrawing money from your forex account.

Depositing money into your FXTM account using mpesa is a walk in a park. Once you’re logged in, select african payment solutions as the mode of payment and walk through the next steps of depositing. On the final step, you’ll be prompted to enter your mpesa pin, and that’s it. Withdrawing your profits is also as easy.

8. Expertoption

Expertoption is a popular online broker offering digital options and fast online trading. It began providing services to traders in 2014 and currently executes in excess of 30 million deals each month. The brand currently boasts 9 million customer accounts.

The goal of expertoption is to deliver a completely transparent online trading experience. To achieve this, it provides its users with an intuitive trading platform and plenty of educational materials.

Customer service is a priority in expertoption, and the brand has over 100 account managers which focus on a range of different client needs. Expertoptions also pledges to deliver the fastest possible trading in the industry via its own dedicated platform.

Expertoption provides users with a variety of intuitive trading platforms, with the option to trade via the web, mobile app, or dedicated desktop app. Unlike many brokers who choose to use metatrader 4 or metatrader 5 to save time, expertoption instead created its own platform which is fully customizable and can be tailored to the needs of each client.

This means that all features on offer from expertoption are easily integrated, whether the user is trading via a desktop or mobile device, although the downside is that there are no exterior support resources available.

However, with such an intuitive interface, it’s unlikely that users are going to need outside resources to understand how to trade with expertoption.

Expertoption is currently licensed by the financial services authority of st. Vincent and the grenadines (SVGFSA).

9. IQ option

Over the few short years that it has been operational, IQ option has won numerous awards praising the quality of its services and its reliability. Today, it has been recognized as one of the leading brokers in the industry as well. IQ option is a regulated broker under the jurisdiction of the cyprus securities exchange commission (cysec) under the name of holding company IQ option europe.

10. Superforex

11. Olymp trade

Olymp trade is one of the most popular online brokers in the industry, with over 25,000 clients currently trading on its platform every day.

Olymp trade has been operational since 2014, and the firm has a reputation for continuing to improve their trading platform with each successive year.

In terms of fees, olymp trade charges a fixed rate overnight fee on overnight trades, which is limited to 15% of the total investment amount.

Olymp trade is regulated by the international financial commission (IFC) and headquartered in st. Vincent and the grenadines.

However, concern has been raised in the past about the legitimacy of the international financial commission, and users may want to conduct a little bit of research into this body before deciding whether to consider olymp trade as a completely trustworthy broker.

The reason for this is because funds are generally only considered safe when a broker is regulated by an official body such as the UK financial conduct authority (FCA), the cyprus securities & exchange commission (cysec), or the australian securities & investments commission (ASIC).

12. Iron trade

It is owned and operated by bartoli management S.A of address 306 premier building, albert street, victoria, mahe, republic of seychelles.

Iron trade offers forex and options trading with the lowest trading time in the market. You can open a trade that runs for 30 seconds and get 80% returns (or more) when you win.

The best thing about iron trade is, it operates 24 hours – 7 days a week. Take note that deals made during the weekend are over the counter deals (OTC). It is easy to open an iron trade account, navigate, and actually trade on the platform.

You can check out our fully review and tutorial on irontrade.

We will keep updating more forex brokers that accept mpesa in kenya with time.

I hope this article helped you to highlight forex brokers that accept mpesa in kenya. We will keep updating it once we come across new brokers that accept mpesa. You can also check our forex signals telegram channel. Finally, don’t forget to leave a comment below.

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Eaglefx offers FX and CFD trading on the MT4 platform, including indices and cryptocurrencies. Follow this review for a breakdown read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

Forex brokers that accept M-pesa

Forex brokers that accept M-pesa offer the opportunity to deposit and withdraw funds from a forex account using the M-pesa payment channel. The M-pesa payment channel is particularly popular in kenya and tanzania, but its popularity is also increasing throughout afghanistan, mozambique and india. M-pesa is coined from a swahili term: “m” stands for “mobile” and “pesa” stands for “money”. M-pesa is a mobile payment method set up by vodafone’s kenyan partner, safaricom as a means of transferring payments using mobile phone technology.

This payment solution was devised as a means of helping unbanked populations get financial inclusion. Most payment channels on forex platforms require access to conventional banking methods. Without financial inclusion, the unbanked are locked out of this market. For the large unbanked populations in africa and other areas, M-pesa has changed this narrative and offers access to the forex market via forex brokers that accept M-pesa on their platforms.

What forex brokers accept M-pesa

The number of forex brokers that accept M-pesa for deposits and withdrawals is still relatively low. Despite this fact, some big international forex brokers offering good trading conditions already do support using M-pesa. Here is a list of some of the most popular brokers that allow forex trading and support the use of M-pesa as a funding method.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89% of retail investor accounts lose money when trading cfds.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

¹ variable spreads vary according to the current market conditions, recorded for EUR/USD on 06.05.2020 at 10:42 GMT+1.

* available to traders outside the european economic area.

Why forex brokers accept M-pesa?

Forex brokerage services were not originally offered to many emerging market economies until a full decade after the market was deregulated in 1997. Therefore, some of the peculiarities of the traditional financial systems of these economies were not accommodated in the design of payment channels for forex trading. The use of credit cards, bank wires and e-wallets all depends on the users within the target markets, owning and operating bank accounts. Given that some countries in africa have unbanked populations that are as high as 85%, forex brokers that target such market using conventional payment channels typically miss out on a huge segment of their target market. Some FX brokers have realized this and are now offering payment channels that are specifically tailored towards the unbanked populations in these underserved countries. This is how M-pesa came to be used as a payment channel that targets countries where there is a good penetration of mobile technology without commensurate financial inclusion. Ironically, some of these countries have large populations of people who already operate in the online gaming niche, where M-pesa features prominently. While nearly 50% of the whole population of kenya has an mpesa account, in other african countries, such as ghana, rwanda, or tanzania often dominate other mobile money providers such as airtel money, MTN mobile money, tigo pesa, ecocash or orange money.

M-pesa as a funding method

M-pesa targets the unbanked populations and is a form of mobile money. It enables the user to use his or her phone number as the account number. Typically, the regulators of the communications industry mandate the telecom companies to register all SIM card owners in a country using biometric registration methods. Therefore, a phone number can be assigned to an individual with a biometric stamp, ensuring that the number is unique to the individual and cannot be duplicated anywhere else. This process in itself enhances the know-your-customer requirements that forex brokers must fulfil when onboarding a new client.

The user then registers on the M-pesa platform and is assigned a unique set of login details. Verification of the user’s identity and address is done through submission of a government-issued ID card and other relevant documents.

Benefits of FX brokers that use M-pesa

The benefits of using an FX broker that accepts M-pesa are as follows:

- A) very fast deposits and withdrawals: transaction times are very fast, as transfers are done instantly.

- B) it is cashless, which means that traders do not need to carry large amounts of money. In countries with high denomination notes and high exchange rates to the US dollar, this is very convenient.

Drawbacks of FX brokers that use M-pesa

What are the drawbacks of using forex brokers that accept using M-pesa?

- A) the initial verification process can be strenuous

- B) the use of M-pesa is not widely available on forex platforms. This narrows the user’s choice of brokers.

Choosing a forex broker that accepts M-pesa

Presently, not many forex brokers accept M-pesa on their platforms, but the list is growing. You can either use one of the brokers listed above in which we verified they support M-pesa payment system or you can use online forums and other information sources to find out what the experience of other users of M-pesa forex brokers have been. Also, pay attention to other parameters to gauge the broker’s performance. You can do some test transactions to see how easy it is to make a deposit or withdraw funds from a set of M-pesa compliant forex brokers. You can also check out the quality of customer service from your first interaction with the forex broker as a prospect. Using these methods, you will find a forex broker that accepts M-pesa that is good for you.

A to Z guide to how to trade with forex brokers using mpesa

Mpesa payment system for forex brokers is extremely popular right now. Over the past few years, it has become one of the most widely-used payment methods for forex, and has amassed quite a large number of traders who consider it to be the top payment system for forex trading.

Mpesa has managed to achieve this by offering a great solution to some of the central issues surrounding payment, such as simplicity, speed and convenience. By focusing on these key points and excelling at them majorly, mpesa has secured itself a top spot as a forex payment solution.

In this guide, we will be talking about what mpesa really is, how it works, what are its interesting quirks and features, and how to use it as a forex trader for maximum benefits. In the meantime, make sure to check out XM, one of the top brokers offering mpesa payments on their website.

Top forex trading brokers working with mpesa

Before we talk about what mpesa is why it works so well with forex brokers and what are some of its most interesting features, we would like to give you a shortlist of what we believe to be the best brokers that accept mpesa. With the huge amount of so many brokers out there, and so many many more constantly being added, it can definitely be difficult to choose a good, trustworthy and reliable forex broker, especially for the beginners and especially when there’s so much conflicting info online. With that in mind, we hope that our list of top forex brokers accepting mpesa will prove to be useful to you!

What exactly is mpesa and how does it work?

Mpesa is an online payment system provider that is especially popular in africa, mainly kenya and tanzania but has recently made efforts to expand to afghanistan, south africa, india, and several other countries as well.

Mpesa is quickly gaining in popularity, with forex trading in kenya using mpesa becoming the norm, and more and more people see it as a viable option of payment for all sorts of different services. Mpesa is essentially a mobile-based money transfer service and is discerned by some of its main qualities of simplicity, speed, and accessibility.

As stated, forex brokers that have mpesa are predominantly popular in kenya, in part because of how easy it has made the payment process for many different services. With that being said, those interested in using it from the other countries should definitely not be discouraged, as it’s a great service that anyone can benefit from, whether or not they are from kenya.

High leverage, tier one liquidity, great ECN trading conditions and fast execution speeds

Sign up with eaglefx, the best ECN/STP broker of 2020

What are the advantages do mpesa forex traders gain?

The idea mpesa itself, and how it works, is a fairly similar concept to grasp. There’s not much into it. In fact, it seems to be fairly similar to all online payment methods like paypal and skrill. So, what’s the point? Why go with mpesa over the alternatives? Well, there’s no universal answer to that. The point is, while something may work the best for you, there are tons of other people for whom something else may be preferable. It all comes down to your specific requirements, and how they may be fulfilled. Having said that, we believe that the forex broker mpesa deposit definitely has its own strong advantages. Let’s discuss all of them below:

Simplicity and ease of use

One of the primary benefits of depositing with a forex broker with mpesa is how simple it can all be. It’s probably not a secret to many, that getting into forex is not simple. There are tons of steps that you have to go through. After finding a decent broker, which is a big task in and of itself, you then have to go through an oft-tedious process of signing up and going through all the verification trials and tribulations, which can sometimes be a very frustrating and time-stretched process. Even after that, sometimes, the hardest part may be the payment process. For some forex brokers, payment systems are a big pain, as not all of them are able to easily facilitate convenient payment due to a large number of reasons that are simply outside their control.

Forex brokers are fully aware of this, and that’s exactly why forex brokers that accept mpesa are becoming so common. Making payment systems easier and more accessible is one of the biggest priorities of any forex broker, no matter which market they are in. In a way, the very structure of mpesa allows for unparalleled simplicity. How exactly?

Mpesa works in a way that it basically lets you use your mobile phone as an e-wallet. You are essentially attaching your SIM card and mobile account to your banking account, and use it to pay for a large number of services. This means, that you have a very powerful and versatile method of payment in your pocket 24/7.

In some cases, transferring money from one account to another is as simple as sending a text message, which allows for unprecedented accessibility. In countries like kenya where for a lot of people the main access-point for internet connection and other computer activities are their mobile phones, this can be a game-changer.

As compared to other payment methods, which may sometimes require some needlessly-complicated extra steps, this kind of simplicity gives any broker a huge advantage.

Security and safety

Another advantage of using mpesa powered FX broker is the added benefit of security that you automatically gain. When it comes to investing your hard-earned money, your time and your energy, security is one of the things that you should consider to be of utmost importance.

Mpesa was built and developed by vodafone, which is one of the biggest mobile networks in the world. They have been on the market for decades, and have successfully managed to supply great mobile service for millions upon millions of people around the world. Needless to say, their experience and track record gives you an assurance that their service will be of impeccable standard, and so will be the security of their software. This is one of the very important aspects that many people don’t pay a lot of attention to when choosing their payment method, which is rather unfortunate, as when it comes down to investing your money, you have to make sure that you are covering all your bases on the security-side of the things.

What also aids in the security of forex trading brokers with mpesa is the fact your funds on your mpesa accounts are not actually in the hands of mpesa itself, but rather, they are stored in segregated accounts at safaricom headquarters. The latter is managed by the kenyan government, which supervises the money itself. During all of this, the money isn’t just laying around. Rather, they are used for the development and advancement of the kenyan economy by spreading across different banks and other commercial sectors. Kenyan government conducts full supervision and makes sure everything is accounted for, which means that the security and stability of your funds is in the very interests of the government of kenya, attesting to the security of mpesa forex trading even more. If you like what you’re seeing about mpesa so far, check out these welcome bonuses by XM, one of the top brokers accepting mpesa today.

Less chance of any issues with processing payment

When it comes to forex payments, one of the most common problems that a lot of traders face is the fact that their charges have trouble going through. This happens when the bank decides to step in and decline the charge until it’s approved by the account-owner. This is usually done due to security reasons and is automatic in the vast majority of the cases. While the added security is always appreciated and welcome, it can definitely be a problem in some cases. A forex brokerage accepting mpesa rarely has this problem, and there’s a reason why.

Mpesa is one of the biggest money transfer services in the region, handling millions of dollars’ worth of transfers every single day. This means they need to have a very robust and effective payment processing system of world-class standards. Especially in countries on the african continent, where mpesa is so popular and so many transactions are made every single day, the chances of your bank declining their charge is almost no-existent.

This is a huge benefit for the broker as well, as it makes it much easier for them to facilitate the payment, and avoid losing any possible deposits because of a declined charge, giving a great advantage to trading platforms that accept mpesa.

Mpesa synergizes with forex very well

It’s not a coincidence that the number of forex brokers allowing mpesa payments. By design, mpesa is almost custom-made for forex. First off, we have to understand that the forex market is extremely volatile, it’s simply designed to be that way. The reason why people are able to make very large amounts of profit in such a short time and can multiply their investments manyfold is because of the fact that forex is so volatile. After all, it’s a currency-trading market, and currencies themselves are dependent on so many things, that they can change in a blink of an eye.

Due to this, speed and timing are some of the most important factors in being successful at forex. To be successful, you need to be able to maneuver around the events correctly, and most importantly, fast. Making last-minute decisions on the fly is extremely common, and you need to be able to make frequent transactions without wasting time. This is where benefits like forex broker top up mpesa come into play, and lets you stay ahead of things with its flexibility and versatility. This is coupled with the fact that mpesa has very low fees, which is great as you’ll be making a lot of microtransactions for quick redeposits.

Looking at the perspective of the brokers, they have a lot to gain from using mpesa too. By letting the traders pay via mpesa, they take a lot of load from their own shoulders. The payment will be handled by mpesa’s own secure server, which creates a win-win scenario for both parties and gives them some peace of mind. Additionally, since mpesa is so popular among forex traders, it allows them to create one unified ecosystem for transferring the money between different accounts. It’s not uncommon for experienced traders to be trading with multiple different websites at any given time, so this kind of cross-website flexibility can really come in handy with mpesa forex brokers.

So, is mpesa for you?

The global market for forex is very dynamic and ever-changing. As more and more people join with each passing year, the market changes accordingly. One of the main challenges for the forex brokers is to make the whole process, from start to finish, easier and more accessible for the general public. Payment is at the center of all this, as it is the beginning point for the whole trading process. It’s exactly because of this that forex trading via mpesa and other similar payment methods is gaining popularity, and they have proven to be one of the most effective methods to make trading more attractive to people.

Mpesa doesn’t offer anything extraordinary. Rather, it does an extraordinarily good job at ordinary things like speed, usability, and convenience. If these are what you are looking for, and feel that you are ready to go, click the link below to check out XM, one of the best brokers where you can make your first deposit with mpesa today!

Frequently asked questions

Contrary to popular belief, trading isn’t all that uncommon nowadays. People from all sorts of different backgrounds are finding it much easier and much more interesting to join trading. The thing is, the internet has opened up a lot of doors to a lot of things that were simply not open for a lot of people, and this includes trading as well. Gone are the days when you had to prepare thousands upon thousands of dollars of capital only to get started with trading. Nowadays, people investing very small amounts of money and getting started with smaller-scale trading endeavors is very common.

Without any doubt, one of the biggest reasons as to why we have been seeing this development today is forex. Forex has shown the world that trading doesn’t have to be hard, expensive and intimidating. It has shown us, that pretty much anyone can trade, and with enough time, dedication and patience, anyone can be successful at it. With that being said, since the popularity and demand for forex has been increasing so rapidly over the years, the number of brokers has been increasing as well, to the point where there are hundreds upon hundreds of forex brokers out there. With such fierce competition, companies are constantly challenged with coming up with newer and more effective ways to help them differentiate themselves from all the other competitors out there who are offering the same thing. One of the biggest focuses for forex companies who are looking to improve their service is the payment process. Payment is one of the key pieces of the whole forex puzzle, and by making it easier, faster and more accessible is a surefire way for forex companies to attract more customers, and that’s exactly the reason why mpesa is one of the fastest-growing and most preferred payment methods.

Benefit from high leveraged, full STP/ECN CFD trading through tier one liquidity

Sign up with eaglefx, an award winning STP forex broker

so, let's see, what we have: if you want mobile money’s convenience and instancy, then here are the forex brokers that accept mobile money. At forex brokers using mpesa

Contents of the article

- Best forex bonuses

- Forex brokers that accept mobile money and mpesa...

- What is mobile money?

- Mobile money providers for funding A...

- Forex brokers that accept MTN mobile...

- Forex brokers that accept airtel...

- Forex brokers using mpesa

- Forex brokers that accept ecocash

- Quick review of forex brokers that accept...

- Advantages of trading with a broker that...

- Over to you – what is the best forex...

- You may also enjoy these articles

- Exness review 2021

- The best forex trading app UK (forex trading...

- Documents you need to verify a forex trading...

- From the blog

- Learn more

- Disclaimer

- Forex trading brokers accepting mpesa payments in...

- What are the best forex brokers on the market?

- Minimum deposit

- Licences

- Maximum leverage

- Platforms

- Oinvest

- Minimum deposit

- Licences

- Maximum leverage

- Platforms

- IQ option

- Minimum deposit

- Licences

- Maximum leverage

- Platforms

- What is mpesa and where can it be used?

- How do M-pesa forex deposits work?

- How do M-pesa fees work and everything you need...

- Regulatory framework and laws M-pesa has to follow

- What role does M-pesa play for forex trading?

- Which countries are the most active users of...

- Should you start trading forex with M-pesa FX...

- M-pesa forex brokers: what you need to know

- Forex brokers that accept M-pesa

- M-pesa payment system general overview

- Transaction limitations and fees charged

- Different locations of M-pesa forex brokers

- Regulations of brokerages from the M-pesa brokers...

- The first steps

- Why is the number of forex brokers accepting...

- Top forex brokers that accept mpesa deposits in...

- 1. XM forex.

- How to fund your XM broker account with safaricom...

- 2. Iron trade.

- What’s the meaning of OTC?

- Is the iron trade platform user friendly?

- Does iron trade accept mpesa deposits?

- 3. Expert option.

- How to fund your expert option account in kenya.

- How to use mpesa to deposit money to your expert...

- 4. Templerfx.

- How to deposit money to templerfx.

- Are spreads in templer good enough for newbies?

- 5. Olymp trade.

- 6. EGM securities accepts mpesa deposits.

- 7. IQ option.

- 8. FXTM accepts mpesa deposits

- 9. Hot forex kenya

- Forex brokers using mpesa

- Forex brokers that accept mpesa in kenya

- 1. XM GLOBAL

- 2. Hotforex

- 3. Exness

- 4. Grand capital

- 5. EGM securities (fxpesa)

- 6. Liteforex

- 7. FXTM

- 8. Expertoption

- 9. IQ option

- 10. Superforex

- 11. Olymp trade

- 12. Iron trade

- Forex brokers that accept M-pesa

- What forex brokers accept M-pesa

- Why forex brokers accept M-pesa?

- M-pesa as a funding method

- Benefits of FX brokers that use M-pesa

- Drawbacks of FX brokers that use M-pesa

- Choosing a forex broker that accepts M-pesa

- A to Z guide to how to trade with forex brokers...

- Top forex trading brokers working with mpesa

- What exactly is mpesa and how does it work?

- What are the advantages do mpesa forex traders...

- Simplicity and ease of use

- Security and safety

- Less chance of any issues with processing payment

- Mpesa synergizes with forex very well

- So, is mpesa for you?

- Frequently asked questions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.