Cfd trading strategy

To truly be successful as a traitor, you will need to find a good strategy.

Best forex bonuses

Naturally, you can also build your own strategy, but leave that to the more experienced players in the game. Right now, you are still just a beginner and you should treat yourself as such. Find a strategy that you believe will help you make a profit. Once you find a strategy, make sure you properly learned and then stick to it no matter what happens. It is very important to stay true to your strategy because there will be moments when you will want to panic sell all your assets. The market is volatile and prices can easily go down and up. Whenever you see a significant price drop, do not panic and stick with your plan.

5 CFD trading tips & strategies every beginner should know – 2020 guide

Stock trading has been around for hundreds of years, but it has always been the market for those that are more financially stronger. However, a lot of things have changed in the 21 st century, making stock buying & much more accessible to a “regular” citizen. In other words, you do not need to have millions of dollars in your bank account to make a transaction in this industry. With easy access to the internet and contracts for difference or CFD, it is not easier than ever to trade.

Nevertheless, just because it is accessible to you, me and everyone else do not make it simple or easy. You can buy and sell with a much smaller amount of money today, but it is still difficult to make a profit out of this as much as it was a hundred years ago.

However, there is no need to lose hope. Today, there is so much information regarding CFD trading, even a beginner could make some real cash out of it. To save you from all those common mistakes you can make as a beginner, I decided to write this guide and tell you about all the trading tips and strategies you need to know about.

Learn more about CFD trading

If all of this is very new to you, the first thing you should probably do is try to understand how this entire industry works. Once you get a good understanding of how it works, you can become a part of it. Otherwise, without any knowledge, you will just end up spending your money aimlessly and you will be left with no capital.

Fortunately, learning about CFD is very easy because there is tons of information regarding the subject on the internet. There are so many different sources you can learn from.

Once you are done doing research, you can start exploring different tips and strategies as a beginner.

Find a good strategy

If you want to be a traitor, you should never rely on luck. This might be the case when you do not have to listen to your gut. Instead, you should use logic to be careful how you invest your capital.

Stock buying or selling can be similar to gambling because there is a risk for you to lose all of your money. That is why it is very important to have a certain strategy and to invest your money as best as you can.

Before you make any kind of move, it is vital that you do some research first on the investment that you want to make.

To truly be successful as a traitor, you will need to find a good strategy. Naturally, you can also build your own strategy, but leave that to the more experienced players in the game. Right now, you are still just a beginner and you should treat yourself as such. Find a strategy that you believe will help you make a profit.

Once you find a strategy, make sure you properly learned and then stick to it no matter what happens. It is very important to stay true to your strategy because there will be moments when you will want to panic sell all your assets. The market is volatile and prices can easily go down and up. Whenever you see a significant price drop, do not panic and stick with your plan.

Pick the right stockbroker

The platform where you will be buying and trading assets is another very important factor that you must consider. Right now, there are probably hundreds of different platforms and applications that allow you to trade cfds.

However, not every platform can be good for you. There are some out there that might try to scam you out of your money or force high fees on you. As a beginner, you should probably look for a platform that has very low fees.

Obviously, it can be a bit difficult to find the perfect trading platform, but if you do a little research and check this or other similar websites, you might be able to find reliable CFD brokers in your area.

Always be ready to take action

As I already mentioned previously, the stock market can be very volatile sometimes and you always need to be ready for those spikes or drops in the prices. You cannot exactly know when they will happen, but you need to be ready.

That is why I believe it is best that you find a CFD trading website that has proper mobile device support or at least has an application for both android and ios.

With direct access to the market through your phone, you can always be ready to take action whenever it is needed. Obviously, I am not telling you to be paranoid and check how your account is doing every 15 minutes, but you should check it at least once a day. You should do that to ensure that everything is stable or whether you need to make some changes with the assets you already have.

Never go all in

There will be situations when you will feel tempted to put all of your money into a single stock or into a single company. No matter how lucrative it seems at that moment, I suggest that you never go all in. The reward that you might get out of that might seem quite good, but it is simply not worth it. With this kind of move, you could lose your entire capital, leaving you with nothing to trade with in the future. That is not how all those experienced players on the market have made their millions.

With patience, focus, and dedication, you can get very far with CFD trading as a beginner. Play it smart, always stick to your strategy, and be very careful with your capital.

There are probably hundreds of other tips or strategies I can share with you regarding this topic, but right now, I think these tips I shared are more than enough. You are still a beginner and you should not overwhelm yourself with too much information. I hope that this guide will be helpful to you.

CFD trading strategies – effective trading

Having reached a stage where you’re comfortable with what cfds are, how they work and the various different options that present themselves to you as a trader, it’s time to start looking further into the nitty-gritty that is trading strategy. Ask any accomplished trader whether or not he employs a consistent, repeatable strategy, and more often than not you’ll find the answer in the affirmative. Devising a strategy is a central component of successful, sustainable investment – anything else is either highly labour and time intensive, or bordering on guesswork.

Why do you need strategies to trade cfds successfully?

A strategy for investing is like a blueprint for building a house – without those instructions in place, it is hard to ensure you’re consistently hitting the mark, and that the pieces of the puzzle will readily fit together when the time comes. While strategies don’t have to be overly complicated, they are procedures best developed through a combination of knowledge and trading theory, and personal (and often bitter) trading experience.

In the forthcoming segment, we’ve attempted to outline the foundations of common CFD trading strategies for you, collating the collective knowledge of experienced traders to reflect a true and accurate position of some of the most widely used trading strategies and techniques in the CFD market. While it’s up to you which (if any) you choose to implement, it is nevertheless important to bear in mind the value of experience, and to take advantage of the mistakes others have made before you to prevent losing your capital unnecessarily.

Learn from experience

Likewise, there is really no substitute for experience when it comes to trading other than the knowledge of those that have gone before you, and there are invaluable lessons to be learned from devoting time and energy to reading up on trading do’s and don’ts. Like most things in life, there are certain fundamental trading lessons that it pays to learn in the theoretical sphere before you launch unsuspectingly into the markets to learn the hard way.

While there are no hard and fast formulae to which you must adhere when trading cfds, there are certain fundamental trains of thought that have served traders well over the years, and it pays dividends to familiarise yourself with these strategies – if not for personal profit, to give you an insight into the possible mindsets of other traders. So without further ado, here are a few of those key trading strategies, tips and techniques that will stand you in good stead in your future trading efforts.

Why is it important?

One might think why it’s so important to have a trading strategy, think again. One has to follow the plan and stick to it. No matter if the markets go south or north, you have to be prepared for it and that’s where the strategy comes into play as you can weather the storm without paying much attention. You know your goal and you stick to it.

Always remember, it’s your money on the line and you have to stay disciplined and dedicated, make sure you’re in control and stick to your own strategy; otherwise, it’s pointless. Discipline and experience are the vital ingredients which will turn your losing trades into the winning ones.

10 golden rules for CFD trading

Cfds have gained popularity in recent years due to the benefits that they offer traders. But CFD trading has certain risks too. We’ve compiled 10 golden rules of CFD trading that can help you to understand the product better.

Publication date : 2018-11-01T13:39:00+0000

1. Develop your knowledge of cfds

Before you start trading it is vital that you understand what cfds are and how they work.

CFD stands for contracts for difference – a derivative product that enables you to speculate on a range of global markets such as forex, commodities, indices and shares, without having to own the underlying asset. This means that you can take a position on rising and falling markets – you would go short (sell) if you predict the price will fall or go long (buy) if you predict the price will rise.

Cfds are a leveraged product, which means that you can gain access to a position by putting down a small deposit, known as a margin. Your profit and loss are calculated on the full size of your position – so it’s important to remember that while leverage can magnify profits, it can also lead to magnified losses, including losses that exceed deposits for individual positions.

2. Build a trading plan

Continuing to develop knowledge is an essential component of successful trading, which includes knowledge about yourself and your trading goals.

A trading plan provides you with a clear path on how, what, when and why you should trade. It will help to shape your behaviour and avoid the pitfall of making decisions based on emotions. These are the most important aspects that should be covered in your trading plan:

- Motivation

- Time commitment

- Trading goals

- Attitude to risk

- Available capital

- Risk management strategies

- Markets to trade

- Trading strategy

- Record keeping

Each trading plan should be unique to the individual. Although your plan can be based on someone else’s, you should always adapt it to your own aims and risk appetite.

3. Stick to your CFD trading strategy

A trading strategy outlines the style of trading you intend to use, including a methodology for entering and exiting trades, as well as the tools and indicators that you might use. Your strategy will depend on how much time you want to spend monitoring the markets. There are a range of different trading styles that you can use depending on which strategy appeals to you – including day trading, swing trading and scalping.

Discover these trading strategies and learn how to become a trader

It is absolutely crucial to stick to your CFD trading strategy, as trading based on the parameters you have set will minimise the impulse to trade out of fear or greed. It is equally important to know when your trading strategy is not working. This can be achieved by keeping a record of your winning and losing trades, and back-testing your trading strategy.

4. Analyse the markets to time your trades

When you are building your CFD trading strategy, you need to decide what type of analysis you will use to identify entry and exit points in the market. There are two types of analysis that traders use: technical and fundamental. Fundamental analysis focuses on external events and influences such as macroeconomic data, company announcements and breaking news. While technical analysis attempts to predict the future direction of a market by analysing historical price charts.

Although you can use each form of analysis individually, it is common to use a combination of the two.

5. Make sure you understand your total position size

Your position size is the total market exposure of your trade. When opening a new position, you should take into consideration your available capital and the amount of risk you are willing to take.

Every CFD trader should outline exactly how much capital they are willing to risk on each trade in their trading plan – and remember this is how much money you can stand to lose.

Remember, CFD trading is leveraged, so your total position size will always be significantly more than your initial deposit, and you could lose more than you commit to a single trade. As a result, a common approach is to only risk a small percentage of your capital on a single trade, and to manage your risk with stops and limits.

6. Manage your risk with stops and limits

A common method of managing risk is attaching stops and limits to a position. These pre-define the exit levels for your trade and can help protect your capital. A stop-loss order is an instruction to your broker to close your trade at a price that is less favourable than the current market price. You need to ask yourself: ‘how much money am I prepared to lose before I close my trade?’ and set your stop-loss accordingly.

You can also place a limit close order, which closes at a level that is more favourable than the current market price. This closes your trade after you have achieved a certain amount of profit, with the intention of protecting your capital from adverse market movements.

Discover the types of orders

7. Start small and diversify your trading over time

As you embark on your CFD trading journey, start small. There are thousands of markets to choose from, so it is important to focus on markets that you are already familiar with or have an interest in. Once you have more confidence in your strategy you can begin to diversify your exposure across a range of asset classes.

Cfds are a great tool for expanding your trading horizons, as they enable you to gain access to declining markets as well as rising ones.

8. Monitor your open positions

Even though you may have stops and limits in place, it is important to frequently review your positions. This will help you to identify any issues or opportunities quickly and prompt you to act when necessary.

It is also important to make sure that you have sufficient capital in your account to cover the total maintenance margin required to keep your position open. If your account falls below the minimum level of funds, you will be placed on margin call – which could result in your position being closed if you do not top up your account.

A great way of monitoring your positions on the go is to download a trading app . With IG, you can access a range of trading apps specifically designed for mobile and tablet devices, and get price alerts sent directly to you whenever there is a significant market movement.

9. Never add to a losing trade

A successful CFD trader will know that no matter how experienced you may be, you will always experience losses. What makes a trader successful is how they respond to these losses. The rule here is to remain focused and in alignment with your trading strategy by not acting on greed. You will learn over time when it is time to cut your losses, and get out of a losing trade.

10. Practise trading with a demo account

If you don’t feel ready to trade on live markets, a great way of testing your trading plan is to open a demo account and practise executing trades with virtual funds. A demo account gives you the opportunity to experience live markets in a risk-free environment, at no cost.

During your time exploring the demo account, make sure that you gain an understanding of the financial terms used and the markets that you have access to. If there is anything you do not understand, you can use trading courses – like those offered through IG academy – to build a stronger foundation of knowledge on cfds.

Using the golden rules of CFD trading

While there are risks associated with trading cfds, committing time to building your knowledge can give you a significant advantage and reduce your risk.

As we have discovered, finding your perfect trading strategy is an ongoing process that should be tailor made to fit your personality and trading goals. There is no end to your development, as even the most experienced traders can learn more. But if you follow these golden rules and stick to your CFD trading strategy, you will be well on you way to becoming a successful CFD trader.

Get more golden insights into CFD trading

Learn more about CFD trading and strategies with unlimited

access to IG academy’s range of online courses, webinars

and seminars.

This information has been prepared by IG, a trading name of IG markets limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Find articles by writer

Markets

Trading platforms

Analysis

About

Contact us

Cfds are a leveraged product and can result in losses that exceed deposits. You do not own or have any interest in the underlying asset. Please consider the margin trading product disclosure statement (PDS) before entering into any CFD transaction with us.

The value of shares and etfs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Please ensure you fully understand the risks and take care to manage your exposure.

IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. IG is not a financial advisor and all services are provided on an execution only basis.

Share trading accounts and new zealand CFD accounts (opened pursuant to IG’s margin trading new zealand customer agreement), are provided by IG markets limited (level 15, 55 collins street, melbourne VIC 3000. ABN: 84 099 019 851, australian financial services licence no. 220440. Derivatives issuer licence in new zealand, FSP no. 18923).

Australian CFD accounts (opened pursuant to IG’s margin trading australian customer agreement) that are opened prior to 15 november 2020 are also provided by IG markets limited. Australian CFD accounts opened from 15 november 2020 are provided by IG australia pty ltd (level 15, 55 collins street, melbourne VIC 3000. ABN 93 096 585 410, australian financial services licence no. 515106).

The information on this site is not directed at residents of the united states or any particular country outside australia or new zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

CFD trading strategies for successful trading

Cfds, or contracts for difference, are derivative off-exchange instruments which allow traders to speculate on longer term price movements. Traded directly with the broker rather than the market, cfds are contracts to buy or sell an underlying instrument at some future point, at a price stipulated today. Like spread betting, cfds allow traders to adopt highly leveraged positions, and can provide traders with an alternative instrument on which to base their market and index projects. There are numerous trading strategies applicable to trading cfds.

The importance of CFD trading strategies is hard to overstate, and without a coherent and defined plan of action it is extremely difficult to get to a stage where your cfds consistently deliver a profit. Trading anything without a strategy is like playing golf blindfolded – while you might hit the ball once or twice, it’s far more feasible to open your eyes and take account of the wider picture with a strategic approach to your CFD trading.

Choosing which CFD trading strategies to employ for best effect is something of a balancing act, and requires you to factor in a number of considerations when making that decision, including your appetite for risk, your trading objectives, the impact of leverage on your positions and your available capital. Nevertheless, finding a trading strategy that works for you is the first step towards more consistent CFD trading, and could set you on your way to building a long-term, profitable trading career.

Two types of strategies

Short term

CFD trading strategies come in a variety of different guises. Some are based on going long, while others are based on selling weak markets short. Others focus on the turning point of markets, while others trade within the boundaries of previous price performance. But aside from the specifics of the nature of an individual strategy will be an underlying concept – it will either focus on long term investment strategy, or a shorter term investment strategy.

While both are equally popular in trading as a whole, cfds tend to fall more often (although not exclusively) into the short-term camp, for the fundamental reason that financing costs can make long-term leverage a problem. But how do short term trading strategies help traders to generate sufficient return to make it worth their efforts, and how do they compare to long term trading strategies on the whole?

Short term trading strategies tend to look at cfds in terms of hours, rather than days, for the simple reasons of financing costs, and the mechanism through which these costs are passed on to traders. Financing costs only become an issue when positions are held overnight, and in allowing a position to roll over the trader is instantly eating into his margin on the day by incurring extra charges. Depending on the nature of the present transaction, this could be sufficient to render a position unprofitable, and you may find yourself in a financially better situation by closing out and taking your profit just before the end of the trading day.

But short term trading strategies also bring other benefits to the table. With a short term position, there’s only so much movement the market can make. While cfds are perhaps best applied in volatile markets, it is a rare occurrence for markets to collapse totally over the course of one day. That’s not to say it doesn’t happen, but you are far less likely to feel the heat of a total market collapse in your CFD positions if they are held over a maximum of one day, rather than, say, a month. By keeping your exposure to different markets brief, short term trading strategies allow you to avoid the dangers of over-exposure.

Similarly, short term trading strategies lend themselves to contracts for difference more naturally because of the high leverage component cfds bring to the table. Cfds are the ideal instrument for a quick in and out, allowing maximum gains to be had in the shortest period of time.

However, trading short term does have its drawbacks, and one of the main concerns many CFD traders express with shorter term trading strategies is that fact that commissions and transaction fees are so significant. It might not seem to be the case when you’re spending a couple of percentage points here and there, but if you were to sit down and accumulate the sheer amount of money short term trading strategies shovel into the pockets of brokers, you would be amazed. With longer term trading strategies, this isn’t so much of a concern, but of course the financing costs start to come into play the longer you hold a position.

Not all trading strategies for cfds have a short-term outlook, despite the vast majority relying on traders opening and trading positions over a short time frame. With cfds, time is most definitely money, and in combating financing costs short-term strategies already have one-up on their longer-term counterparts. However, it’s worth remembering that just because conventional wisdom says short term is the way to go doesn’t necessarily make it any easier or less risky an approach over time than trading on a long-term outlook.

Long term

Conventional wisdom in CFD trading suggests that short term transacting is the best policy, holding open positions for a day or two at the most to counteract the bite of financing costs. Long term trading strategies have long been regarded as the preserve of less highly leveraged trading styles, and tend to go hand in hand with less volatile markets. But is that necessarily a rule to which you must adhere as a CFD trader?

Some CFD trading strategies are in fact designed for those with a longer-term view, and while financing costs are no-doubt an issue that must be borne in mind at all times when dealing with margined investments, they don’t necessarily cancel out the profit potential from a given CFD position.

Take the example of a property developer investing in an office complex. Chances are, the developer will be funded by a bank in order to make the deal happen, and the costs of providing this finance (itself a form of leverage) will accrue over the lifetime of the investment. The developer will of course be required to account for the interest costs and factor in repayments to his financial calculations, but this doesn’t necessarily mean it’s impossible to generate a profit from the transaction. The same is true with holding contracts for difference over the long term.

People don’t tend to invest in cfds, preferring instead to trade them on a quick, short-term basis. But longer-term investment actually have their advantages. One of these core advantages is the ability to ride larger price movements – a door that is abruptly shut to those engaging in shorter term strategies.

Price movements over the course of one day are usually restricted, and it is a rare occurrence the prices will move drastically – even in volatile markets. Contrast that with the potential movements in price that can take place over the course of a couple of months, where serious price rises can make savvy traders serious money – interest costs and all.

Furthermore, the cost of transacting with longer term CFD trading strategies is significantly lower than it is with day trading and other shorter-term outlooks. Because day traders engage in multiple short-lifespan trades, they incur the costs of broker fees and commissions on a much more frequent basis than their longer-term counterparts, and this is a cost that can have a serious impact on your trading bottom line. While it is true to say that longer-term positions generally expose your trading account to greater risk, this can be tempered with lower per-transaction costs, and provided you do your homework, can be an equally, if not more profitable investment approach than going the short term route.

Long term trading strategies are far from the norm in CFD trading, but that’s not to say they are in complete isolation either. Traders who employ long term CFD trading strategies understand that they must bear the brunt of the additional costs, but by striving to stake out for much larger profits, it is hoped that the rising value of open CFD positions will more than cancel out financing costs to deliver a healthy profit over time.

Support and resistance

When trading cfds off the back of technical data, there are few more important terms of which you must be familiar than support and resistance. Support and resistance levels provide traders with clear and defined parameters for trading, and enable decisions to be made over both short and long term outlooks to drive a profit. No matter whether you’re looking at cfds on company shares or cfds on commodities, the interplay of support and resistance makes for a more naturally obvious trading system, and helps define the outer limits of possible CFD transactions.

Support is defined as the bottom end of a market for a particular CFD, that is the point at which downwards momentum halts and buyers re-enter the market in recognition of the under pricing of the CFD. Resistance, in contrast, is the top end of the pricing spectrum, and the point at which traders close out their positions in order to realise their profit – in other words, the point of resistance is the notional ceiling through which the CFD price does not penetrate.

Support and resistance work as trading indicators because markets behave in a relatively cyclical fashion. Take, for example, oil prices. The market for oil is driven by supply and demand, and all things being equal, prices will naturally fluctuate between set levels, revolving around the true value which tends to lie somewhere in the middle. As those that require oil for manufacturing start to buy it, demand increases and forces prices upwards until they reach an unsustainable level, at which point prices fall until they are too cheap, which encourages buyers to re-enter the market, and so the cycle continues.

With investors and price speculators jumping in on the action, and external factors prompting decisions to buy and sell, this serves to make the market a little more volatile and a little less predictable in practice, but nevertheless at a conceptual level, there is both a support and resistance level at which prices become unsustainable at both ends of the spectrum.

Any strategy relying on trading resistance and/or support requires the ability to identify support and resistance levels. One of the key ways in which traders reach conclusions about these thresholds is through graphical analysis, and through closely monitoring the behaviour of prices as the markets move through their cycles.

A one-time low isn’t enough to justify trading that as the market support – a support is a consistent price point, or more accurately prize zone through which the price of the relevant CFD stubbornly does not move, and it is crucial to check and double check these levels as the market moves through its cycle to ensure you’re making a sensible investment decision. Once these levels have been firmly established, its time to sit out and wait the next potential turning point, before riding the wave of the cycle as market trends begin to reverse.

Trading off the back of support and resistance measures allows traders to capitalise on the cyclical nature of the markets, and to take advantage of under and over pricing in specific CFD classes. With the aid of graphical analysis, and a consistent monitoring of CFD prices and external price triggers, trading through support and resistance boundaries can be an effective way to improve your success and consistency when trading contracts for difference.

5 tips for simple CFD trading strategies

If you are interested in CFD trading and wanting to learn how to make money from trades, here are a few tips and tricks to help.

Trading any asset – whether cryptocurrency, stocks or forex – is a fantastic way to raise your capital and padding your income, especially now as things are financially uncertain across the world. Contract for difference (CFD) trading has become a popular way of buying assets through a broker rather than purchasing them directly.

While CFD trading might have a sense of security that direct trading lacks, there is still complexity in how to trade. To make the most money for your time, it’s a good idea to gain a solid foundation of understanding of the strategies of CFD trading. If you have the best methods in place, you are more likely to see a good return on your trading investment.

If you’re just starting out, or are wanting to add to your CFD strategies, here are a few tips and tricks to help:

1. Aim for consistency: find and use a strategy you can maintain

Trades which happen and make a person millions on a “gut feeling” are rare and the exception. If that was the case more often, trading would be based on far more luck and the industry would be a lot more like gambling than anything else. Instead, the rule of thumb is to be a lot more strategic and to figure out what works and stick to it. This goes hand in hand with doing consistent research on your trades. Keep an eye on the market and seek to improve your trades every time you invest.

2. Keep a level head and don’t readjust too often

With your CFD, you want to stick to the plan you set out initially as much as possible and not panic sell or buy based on volatility. But there are times when shifting your strategy is necessary. Trading is all about keeping level-headed and not making emotional decisions based on volatile swings or market sentiment. Rather than sticking to your trades out of stubbornness and buying over-enthusiastically, keep your CFD levels under control and base your decisions on facts not feeling. Always remember: what comes up might also come down, and you don’t want a falling CFD to take your gains and capital with it.

3. Look after your initial capital

As a beginner, your goal shouldn’t be to make more money, not at first. Rather, you should aim to not lose the money you have. Instead of learning how to gain, learn how to avoid losing your money and then when you’re more familiar with the market, you can aim to increase. A good defensive trading strategy is a fantastic way to learn the ropes without risking your capital. When you feel comfortable, you can up the ante and take a more risky approach.

4. Don’t be shy to ask for advice

Everyone started as a beginner and learnt some lessons the hard way. Aim to learn from other’s mistakes and ask for help if you need it. There are platforms available which have a wealth of CFD trading resources. The more you engage with additional resources while making modest trades, the more you can learn both theoretically and practically.

5. Be cautious with your money

The trading industry has countless experienced traders who are able to spot a trade based on another person’s mistake. To mitigate mistakes, learn to be patient with your trades and build your experience in trading before making any bold decisions.

As with all trading, make sure you are aware that any investments you make are not guaranteed, and there is risk involved with CFD trading. Bear the above points in mind and make any mistakes earlier on your trading career rather. That way, the lessons will come at an affordable price with minimal risk.

Posted: nov 19, 2020 author: becky categories: trading guides

Trading strategies

This forex trading technique is powerful as it allows you to profit no matter which way the market is going. By identifying trending markets, your hedge will protect you (and earn profits!) even if the market changes directions. (more. )

Grid trading is a strategy that allows traders to enter the market and make money no matter what the market's trend is. (more. )

The following pivot point trading strategy has been around for a long time. The reason pivot points are so popular is that they are predictive as opposed to lagging. You use the previous day's information to calculate. (more. )

The commitment of traders strategy is based on a weekly report where large institutional traders have to disclose their long and short positions. It is useful as it helps you determine when a market reversal is looming. (more. )

The formation of a pin bar is actually a trend reversal featuring 3 bars. The term "pin bar" is an abbreviation of the term "pinocchio bar". (more. )

False breaks are an indication of what institutional traders are doing: hunting the stop loss levels of small retail taders to get them out of their positions and create a price "vacuum" to reverse the market's trend. (more. )

The inside bar and the NR4/IB trading strategies allow you detect a high probability that a very volatile movement will occur after the breakout of a formation. (more. )

Traders need to understand that trading outcomes follow a random distribution. (more. )

The round number forex trading strategy - when used during periods of low volatility - allows regular non-professional traders to get the upper hand over professionals (banks and market makers). Following a significant. (more. )

This strategy is a basic scalping strategy that aims to make quick gains off of the day's high or low. The rules for entry are very basic and easy to follow. Exit, on the other hand, requires you to make a judgement call and. (more. )

Richard demille wyckoff's method, which compares prices in relation to volume, was later expanded upon by tom williams. VSA is an analytical technique based on the trades of professional traders, it provides information on why and when traders are positioning themselves in the markets. (more. )

At the end of the 1930s, ralph nelson elliott (1871-1948) published the "wave principle", having been inspired by dow's theory and italien mathematician fibonacci's golden number. Elliott believes that the markets don't evolve in a random manner, but instead follow repeated trend cycles (up or down) that are influenced by nature and human behavior. (more. )

For professional traders, the analysis of support and resistance levels is a crucial component of technical analysis. Here are a few cases where you can use a support and resistance forex trading strategy with trendlines. (more. )

Correlations can be used to avoid bad trades, like a false break and to confirm a trade or an analysis. The idea is to see if pairs with a positive correlation are moving in the same direction as the currency pair you are interested in. (more. )

This forex trading strategy is based on price action. It will teach you how to identify the direction of a trend by looking at two different timeframes. Although it is possible to trade trends in a small timeframe, you. (more. )

- inside bars

- pin bars (dojis)

- false signals (more. )

The publication of economic statistics such as the NFP (non-farm payroll) causes great volatility on the forex market. During these announcements, traders must be careful, because professionals (market makers) manipulate the market to hunt down their clients' stops. (more. )

When you trade, setting your take-profit and stop-loss levels is important in order to maximise profits and minimise losses. (more. )

The dollar smile theory - as described by stephen jen, a former currency strategist and economist at morgan stanley - allows traders to predict long term forex trends. (more. )

Charles henry dow is considered to be one of the fathers of technical analysis. Along with edward D. Jones, he co-founded the wall street journal. With the objective of predicting the future evolution of the economy, he created the dow jones index, the world's oldest stock market index. Despite the significant evolution of the financial markets, charles dow's theory is still valid today. Nevertheless, after his death, william. (more. )

Forex tester is professional software that simulates forex trading. It allows you to develop and test your own trading strategies based on technical analysis with the use of several years of historical data. This is an excellent tool to develop your own trading strategy quickly and effectively. For advanced users, there are open interfaces to help you create your own indicators and strategies. (see a video demonstration)

Cfd trading strategy

CFD strategy -trading strategies using contracts for difference (cfds)

The best trading strategy is the one that suits you

There are hundreds of different trading strategies covering all risk profiles. Most people believe that there is a single trading strategy that can make everyone rich, in a matter of months. That is certainly not true. The best trading strategy is the one that suits you. The same trading strategy that can make someone rich, can make another trader poor.

Categories of CFD trading strategies

These are all key categories of long & short CFD trading strategies :

Scalping trading strategies

Intraday trading strategies

Automated cfds trade strategies

News trading cfds trading strategies

Hedging trading strategies

Zone trading cfds trading strategies

Pairs trading cfds trading strategies

Swing trading strategies

Position trading strategies

Carry trading cfds trading strategies

Long-term cfds trading strategies

Dividend stripping trading strategies

The concept of succesful trading -formulating successful strategies

These are some key variables determining the adequacy of a trading strategy for a particular trading profile.

(i) experience in derivatives trading, especially as concerns using high capital leverage

(ii) knowledge and experience in the asset classes involved (forex, indices, metals, etc.)

(ii) available time to be devoted to implementing a trading strategy (very important)

(iv) the risk profile of the trader (how much can he afford to lose)

(v) the character of the trader and the ability to concentrate and make the right decisions during choppy market conditions

Trading strategy and basic steps for succesful trading

These are some basic steps before applying a trading strategy :

(1) define your trading profile according to the above five key variables

(2) start reviewing different trade strategies and focus only on those that may suit your trading profile

(3) find a CFD broker that offers the best trading terms for those particular strategies (check below for more on that subject)

(4) sign a demo account with that particular CFD broker and test the performance of your selected strategies

(5) if you are satisfied with the results, open a real account with the same broker, and start trading on micro-lots (1 lot =$1,000)

(6) if you are satisfied with the results, start trading on standard lots (1 lot =$100,000)

Selecting CFD brokers based on the chosen trading strategy

Whatever strategy you choose to apply you need to be aware of the trading spreads and the overnight financing cost (SWAP rates) you are going to pay.

(i) if you select a scalping or another type of intraday strategy, you need to select a CFD broker offering the tightest spreads for the asset classes involved.

(ii) if you apply a long-term or carry trading strategy, you need to start by choosing the CFD broker offering the most favorable SWAP rates for that particular asset. The overnight financing for holding a certain trade position may be positive or negative.

Selecting between promotions based on the chosen trading strategy

CFD brokers offer good promotions for opening a new trading account with them. You can take advantage of these promotions and make the implementation of your trading strategy easier. The key when choosing trading promotions is to determine the volume activity generated by your trading strategy, as follows:

(a) if your trading strategy will generate high volume activity (scalping, intraday, or similar trading strategy) then you need to join a rebate plan. A rebate plan can reduce 20-30% of your trading cost. Joining a rebate plan is free of charge and it can really make the difference in the long-run.

(b) if your trading strategy is based on positional trading (swing, carry, long-term strategies) then it will not generate high trading volumes. In that case, search for a credit bonus. This bonus will be used as a margin if your capital is lost. Usually, a credit bonus matches 100% of your first deposit. Using a 100% credit bonus means you can deposit 50% lower and have the same size trade position (cutting your risk 50%). The key here is to make sure that the credit bonus you will receive can be used in a negative account balance (ask your broker via email before making the initial deposit).

(i) a rebate plan is, in general, more important in the long-run than a credit bonus,

(ii) almost always, you can combine a rebate plan with a credit bonus (one doesn't cancel the other),

(iii) a credit bonus can be useful as an extra margin (minimizing your deposit requirements),

(iv) make sure your credit bonus can be used in negative account balance (otherwise, it is completely useless).

□ READ MORE

| COMPARE | ► CFD / forex brokers | |||

| CFD TRADING | ► forex cfds | ► gold cfds | ► index cfds | ► shares cfds |

■ CFD strategy -trading strategies using contracts for difference (cfds)

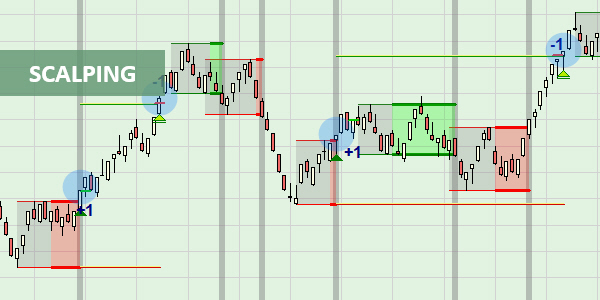

A powerful scalping strategy

The D&D range bar scalping strategy is designed for scalping two of the world’s major market indices. The strategy is based on four very solid principles.

- Range bars are used to find scalping opportunities, even when the market is not volatile.

- Positions are only opened in the direction of the trend.

- Positions are only opened when the market breaks out of a range.

- Positions are managed with multiple profit targets in order to maximize profit.

The D&D range bar scalping strategy

1. DAX, and DOW and range bars

I must confess that I am seduced by the D&D strategy offered by WH selfinvest to the point of having included it on my automated strategies cloud. From my point of view, it is a strategy that offers a solution to the problem of the persistence of low volatility on international indices over the last 2 to 3 years. Indeed, when volatility is low, the earning potential decreases and strategies that have performed well in the past years may simply no longer be profitable.

The name of the D&D strategy refers to the D of the dax and the dow jones. It operates in an unusual environment, that of the range bar charts (also called absolute range charts). The range bar chart has an important part in the success of the D&D strategy. Indeed, it is independent of time and only reacts to price movements. Concretely, if the price remains fixed for several minutes, there are no new candlesticks. On the other hand, if the price accelerates, the chart produces a succession of candlesticks as below during the first trade (entry +1 and exit -1) as well as during the final acceleration which closes the second trade.

The signals are based on the above horizontal ranges that characterize the consolidation phases. When the price moves out of a range, there is usually an opportunity to move into position in the direction of the crossing. Other advantages of the strategy include a trend indicator that automatically filters out signals and colours the background green when it rises or red when it falls.

There's a lot to learn about this strategy that I've been processing in automatic mode on the future dax since the end of last year. The D&D strategy which has unique features is available for free in the nanotrader full platform for WHS customers.

2. A strategy that likes movement

The D&D strategy continues to surprise by its effectiveness. This week, the fear caused by the corona virus has somewhat awakened volatility in the financial markets. The dax index has thus fallen by 3% since it closed last friday. This gave me the opportunity to verify once again that this strategy was effective in exploiting market movements. During this week, it generated €445 for a mini dax future contract which was processed in automatic mode on the 9am-12am interval.

As a reminder, the name of the D&D strategy refers to the D of the dax and the dow jones. It is a strategy that I have been working on the future dax in automatic mode for a few weeks with good results. This week, I tried it on the future mini dax contract to see if it was as efficient as on the future dax. It was the case, as you can see in this extract of the daily net profit. Note that there were no trades on wednesday because the market was not very volatile.

It is always interesting to analyze what is positive or negative in a strategy. As can be seen below, on monday 27/1, we started with two losses, which reminds us that when the market moves sideways, it is difficult to win. The first short trade was excellent . Except that it just missed 2 points to close with a profit. Instead, we lost. The second trade is typical of a lack of momentum that produces losses. The market didn't have the strength to hit the target. We lost. A market without movement leads to losses even with the D&D strategy!

Fortunately, there were enough winning signals to straighten the bar. Notably, when the market started to decline in the late morning. The D&D strategy detects consolidation phases and allows to enter in position when the market resumes its progression as below. Each position is automatically protected by a stop positioned at the top edge of the range and a target positioned at the risk.

Of course, not all signals of the D&D strategy are winners and not every day is a winner. On the other hand, when there are trends, the D&D strategy detects them and allows us to enter and exit the market quickly, often with a profit. This is one of its great strengths and this is due in large part to the quality of the signals. The D&D strategy is available in the nanotrader platform offered by WH selfinvest.

3. The D&D range bar scalper strategy is performing in the midst of a major market downturn

This week has been marked by the return of volatility in the financial markets. The future dax has lost about 12% since its peak last thursday. Against this backdrop, one may wonder how the D&D range bar scalper strategy performed, since it showed good performance when volatility was low. At the end of a very volatile week, this strategy continued to surprise us, producing its best results since last november.

Presented as a solution to thrive in times of low volatility, the D&D range bar scalper strategy has exploited the large declines that have exploded volatility this week. It is designed to trade in the direction of the trend. However, this week, the dax index was mostly trending downward. It is therefore not illogical that the D&D range bar scalper strategy was able to exploit these bearish phases.

If we analyse the equity curve of the future dax during the week below, it shows a profit of €8625, consisting of three winning days, against a losing day and a null day. It can be noted that the total profit on wednesday 26th february reached a record level of €5000, which had never been seen since we started dealing with this strategy last november.

It is interesting to note that the strategy has also performed well on the future mini dax and on the CFD germany 30 as can be seen below.

What this week has shown is that when the dax moves, the D&D range bar scalper strategy can capture a lot of good moves. If volatility is back in a sustainable way, this will be good news for D&D range bar scalper users.

Two other pieces of good news will be of interest to traders who are trading this strategy in automatic mode. The first good news is that the safety net filter, which was only available to futures traders, is now also available to CFD traders. The second good news is that a new feature has been added to the safety net filter: conditional profit protection.

Remember that the safety net filter is only used in automatic mode. It allows you to manage your positions during the day in relation to the evolution of the cumulative result. In concrete terms, for a given instrument, you can define conditions for exiting a position and stopping trading for the day. For example, setting a profit target and/or a loss limit.

It is now also possible to define conditional profit protection. In practice, a profit threshold and a risk are defined. If the profit reaches the threshold, the conditional protection is activated in the form of a trailing stop equal to the risk. As long as the profit rises, trading continues. If the accumulated profit declines by more than the risk, the position is closed and trading stops.

5 simple CFD trading strategies for beginners

5 useful ideas for beginner CFD traders

Have you been thinking of trading but haven’t been sure where to start? CFD trading is trending for a good reason. It is one of the most secure investment methods for traders looking to make a decent return within a relatively short amount of time. There are a number of effective strategies out there for trading cfds, but to keep things simple, here are a few tips for those with little or no experience in this area:

1. Choose a strategy and stick to it

Some people have this romantic notion that traders can “make it big on a hunch.” while it is possible to get lucky and make big returns relying purely on instinct, that would be kind of like gambling, just without the bright lights and complimentary drinks of a casino. It’s important to be deliberate in choosing a trading strategy. Stick to it and don’t panic too much when the prices of your assets change direction—cfds are volatile and you’ll get used to it.

2. Keep your CFD leverage under control

While on the one hand it’s good to stick to your guns and not to get too flustered over a bit of CFD volatility, it is also important not to get too excited and make silly mistakes because of it. Leverage can be a powerful temptation when your trading is going well and it may make you want to increase the size of your position. Don’t forget that what comes up may come crashing down. As a trader, you will soon learn that losses could be lurking around every corner and can creep up on you unexpectedly.

3. Be on a healthy level of alert

It is important to be alert when dealing with the market because there are a lot of veteran traders out there who would be happy to pounce on unsuspecting beginners and take their money. So, it’s important to maintain your discipline about your strategy and not be swayed by all sorts of forces in the environment around you.

4. Preserve capital

One of the main keys to successful trading is to have a successful defense. When you first start trading, don’t worry about actually making money. Instead, focus at that point on not losing anything. As a beginner, your main goal is to keep your losses as limited as possible. As you gain more experience and become a bit more comfortable in the market, you can eventually take on a more offensive strategy that will allow you to start making greater profits.

5. Start with a well-defined trading plan

It is crucial to have a clear and concise trading plan set up in advance to help prevent losses and ensure optimal profit. It will also help keep you calm when things start to get volatile. It is important to understand the difference between a discretionary trading plan or a system trading plan.

Discretionary trading is a protocol through which the trader makes decisions based upon the information available at the time. A discretionary trader may still follow a plan with clearly-defined rules but will involve the element of discretion in each trade. An advantage of this strategy is that it allows the trader to adapt to market conditions. However, this type of strategy lends itself to second-guessing on the part of the trader. Beginners in particular may find it somewhat difficult to work this way.

System trading is a plan based on strict rules that do not allow for any real discretion. You set your criteria and if those criteria are met, the trade is made. The advantage of this strategy is that it prevents traders from being influenced by all sorts of psychological or emotional whims. However, on the other side of the same token, this kind of strategy makes the trader submit to very strict rules with no room for flexibility.

Most importantly, though, beginners need to avoid allowing themselves to feel overwhelmed at the start and should be patient—hey, it takes time to learn. By implementing these ideas and giving yourself time to practice, you may find CFD trading to be exciting and rewarding. Becoming an effective trader doesn’t happen overnight but making sure to have the right strategies can go a long way towards being successful.

So, let's see, what we have: we decided to write this guide and tell you about all the trading tips and strategies you need to know about. At cfd trading strategy

Contents of the article

- Best forex bonuses

- 5 CFD trading tips & strategies every beginner...

- Learn more about CFD trading

- Find a good strategy

- Pick the right stockbroker

- Always be ready to take action

- Never go all in

- CFD trading strategies – effective trading

- Why do you need strategies to trade cfds...

- Learn from experience

- Why is it important?

- 10 golden rules for CFD trading

- 1. Develop your knowledge of cfds

- 2. Build a trading plan

- 3. Stick to your CFD trading strategy

- 4. Analyse the markets to time your trades

- 5. Make sure you understand your total position...

- 6. Manage your risk with stops and limits

- 7. Start small and diversify your trading over...

- 8. Monitor your open positions

- 9. Never add to a losing trade

- 10. Practise trading with a demo account

- Using the golden rules of CFD trading

- Get more golden insights into CFD trading

- Find articles by writer

- CFD trading strategies for successful trading

- Two types of strategies

- Support and resistance

- 5 tips for simple CFD trading strategies

- 1. Aim for consistency: find and use a strategy...

- 2. Keep a level head and don’t readjust too often

- 3. Look after your initial capital

- 4. Don’t be shy to ask for advice

- 5. Be cautious with your money

- Trading strategies

- Cfd trading strategy

- A powerful scalping strategy

- The D&D range bar scalping strategy

- 1. DAX, and DOW and range bars

- 2. A strategy that likes movement

- 3. The D&D range bar scalper strategy is...

- 5 simple CFD trading strategies for beginners

- 5 useful ideas for beginner CFD traders

- 1. Choose a strategy and stick to it

- 2. Keep your CFD leverage under control

- 3. Be on a healthy level of alert

- 4. Preserve capital

- 5. Start with a well-defined trading plan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.