Octafx copy trading bonus

4.1. The copier only copies the trades that were opened by the master after the subscription for the master within the service. 14.8.

Best forex bonuses

After cancellation, the bonus cannot be applied again or reactivated.

Octafx copy trading bonus

IB monthly reward

The octafx 16 cars trading contest

Three easy steps to start trading

Copytrading app

Our best spreads and conditions

The octafx trading app

IB monthly reward

The octafx 16 cars trading contest

Three easy steps to start trading

Copytrading app

Octafx copytrading terms and conditions

Octafx copytrading (hereinafter—‘service’) is a service that allows traders (hereinafter—‘copiers’) to copy trades from other traders (hereinafter—‘masters’), and can be activated by selecting ‘start copying’.

1. The copier undertakes to do the following to apply for the service:

1.1. Be registered and logged in as a client on the octafx website

1.2. Add money to the wallet

2. The copier is entitled to do the following:

2.1. Stop copying trades at any given time by selecting ‘stop copying’

2.2. Edit the parameters of copying via the edit function both prior to investing with a master and in the course of copying trades

2.3. Copy any number of masters (all current subscriptions can be found under the my tab in the master rating or your copier area)

2.4. Close any copied trade manually at any time in the copier area

2.5. Unsubscribe from the master and stop copying the master’s trades by clicking ‘stop copying’. To unsubscribe, the copier needs to have all the trades closed. Upon unsubscription, all funds invested with the master and the profit return to the copier’s wallet

2.6. Set one of two options how the volume of the copier’s investment will be calculated for participating in every investing operation for every particular master (full-size copying 1-to-1 or in proportion to the copier’s funds). These two options are expressly explained in clause 4, sub-clause 5 of these terms and conditions.

3. The service is available on the metatrader 4 platform.

4. Opening copied trades routine:

4.1. The copier only copies the trades that were opened by the master after the subscription for the master within the service.

4.2. Stop loss/take profit orders will not be visible in the copier area, but if these orders are triggered on the master’s account, the copied trades are also closed.

4.3. The balance keeper option is available from the moment of subscribing to the master’s account and is used to customise the copier’s risks when using the service. The copier can set the balance keeper's value at any percentage from 0% to 50% of the invested funds with the master. The balance keeper suspends copying new orders of the master and closes all the existing orders if the copier's equity in per cent of the initial invested funds goes below the set value. The balance keeper triggers on the set value but does not protect from instantly incurred losses, so it can save fewer investments, especially during a period of high market volatility.

4.4 upon the subscription to a master, the copier specifies the amount of funds to be deducted from the wallet and invested with the selected master. These funds and your profit will return to your wallet when you stop copying the master.

4.5. The volume of the copied trade is selected from two options:

4.5.1. Full size copying 1-to-1 means that the volume of the trade the master opens equals to the volume of the copier trade, opened for the copier

4.5.2. In proportion to the copier’s funds means that the volume depends on the ratio of the leverage and equity for both master’s and copier’s accounts, and is calculated as follows: volume (copied trade) = equity (copier)/equity (master) × leverage (copier)/leverage (master) × volume(master).

4.5.3. Example: the master account equity is $2000 and leverage is 1:200. The copier account equity is $200 and leverage is 1:500. 1 lot trade is opened on the master account. The volume of the copied trade, therefore, is: 200/2000 × 500/200 × 1 = 0.25 lot.

4.6. The copiers’ leverage ratio is set at 1:500. The copiers willing to adjust it need to contact the octafx’s customer support.

4.7. Once the service is activated, the trades will be copied to the copier’s account regardless of whether the owner of the account is signed in or not.

4.8. The copier's order is executed following the master's order (buy or sell) made in his or her account. The signal for opening an order in the copier's account triggers when the master places an order, and such copier's order is executed at the market's price. The same mechanism triggers the order closing. Therefore, the execution prices of these orders may differ. Additionally, the number of the copiers following this master can affect the execution time.

5. Limits applied:

5.1. The minimum volume of the copied trade is 0.01 lot, the maximum volume of a copied trade is 100 lots.

5.2. If the copied trade volume is less than 0.01 lot after the calculation is made, then the trade will not be opened on the copier account.

5.3. If the copied trade volume is bigger than 100 lots after the calculation is made, then the trade will not be opened on the copier account.

6. If the master changes equity (by making a deposit or withdrawal) or leverage, all the copied trades maintain their initial volume on the copier’s account.

7. All trading conditions (leverage, swaps, spreads) of the copiers’ are similar to the ones for the MT4 micro accounts.

8. The master account should be of MT4 micro type.

9. The service is entitled to do the following:

9.1. Restrict the number of master accounts the masters may create at any time without prior notification at its sole discretion

9.2. Unsubscribe the copier from the master without prior notification.

9.3. Reduce the commission set by the master trader and limit its maximum value for all her or his master accounts without prior notification or providing any explanation.

9.4. Amend these terms and conditions at any time without prior notice to the copier or master trader. Such amendments take effect the moment they are published on the service site in these terms and conditions.

9.5. Evaluate the master trader's trading, mark the master trader's account with the ‘high-risk strategy’ warning and exclude such account from the master rating filtered by default (will keep it available for the copiers who change their filter settings accordingly).

10. The master determines the type of commission (of two types—‘fixed per one lot’ and ‘revenue share’) and its amount for copying orders independently. The fixed per one lot commission can range from $0 to $15 per trading lot opened by the copier. The revenue share commission can range from 0% to 50% of the copier’s gain. Commission charges accumulated within one week are paid out to the master’s wallet on saturdays .

11. The commission amount that the copier pays to the master is set at the moment when the copier presses ‘start copying’. If the master changes the commission amount, it does not affect the amount due under this subscription to the master.

12. Commission amounts for the IB

12.1 if the master charges the fixed per one lot commission and is an IB for the copier, the aggregate commission (IB commission + fixed per one lot commission ) should not exceed $15 per trading lot. In this case, the fixed per one lot commission shall prevail. For instance, if the master collects $5 commission per trading lot for IB services and $15 commission per trading lot for master services, such master will get $15 per trading lot in total ($15 per lot— the fixed per one lot commission , $0—IB commission).

12.2. If the master charges the revenue share commission and is an IB for the copier, the aggregate commission (IB commission + revenue share commission ) has no limitation on the amount that can be earned.

13. The commission type is set once upon creation of the master account and is not subject to change afterwards.

14. The copy trading bonus

14.1. The bonus amounts 50% of the funds invested at the beginning of copying the master.

14.2. The bonus can only be applied once for a particular master within the dates of the promotion.

14.3. The bonus cannot be applied to the ongoing investments.

14.4. The bonus cannot be withdrawn or considered as an integral part of the copier’s investment.

14.5. If the equity of your account becomes less than the bonus size, the bonus is cancelled.

14.6. The copier can cancel the bonus manually in the copier area.

14.7. The bonus is cancelled when the copier stops copying the master.

14.8. After cancellation, the bonus cannot be applied again or reactivated.

14.9. The service may reject the copier's bonus application(s) at any time without prior notification or providing reasons for such decision.

14.10. The service may cancel the copier's bonus at any time without prior notification.

14.11. If the amount of the copier's personal funds invested with the master trader upon withdrawal/internal transfer becomes less than or equal to the bonus amount, the bonus will be cancelled.

14.12. Any situation not described in these rules shall be subject to the service's decision.

14.13. The service reserves the right to change, update, or cancel this promotion with notification in the service news.

15.1. The master trader can activate and disable the free trial at any moment.

15.2. The free trial automatically activates when the copier initiates copying the master account if:

15.2.1. The master trader has the free trial available for this master account

15.2.2. The copier has not previously activated the free trial for this master account.

15.3. If the master trader voids the free trial, it continues to work for the copiers who have already activated it.

15.4. If the copier stops copying the master account while the free trial is active, the copier cannot reactivate the free trial for this master account.

15.5. After the free trial expires, the copier's subscription becomes subject to the prior conditions, including the commission amount.

16. The copier’s trading statistics can only be viewed by the copier.

17. The master’s trading statistics are available for the public.

18. The copiers do not have access to the trading terminal. All actions with their subscriptions and trades are made under the copier area.

19. If the service reasonably suspects that the copier violated the deposit and withdrawal rules set out under the customer agreement or the legislation of the country of the copier's residence, the service is entitled to suspend providing the services to such copier.

20. Please mind that the master can make both profitable and losing trades.

Octafx review and tutorial 2021

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

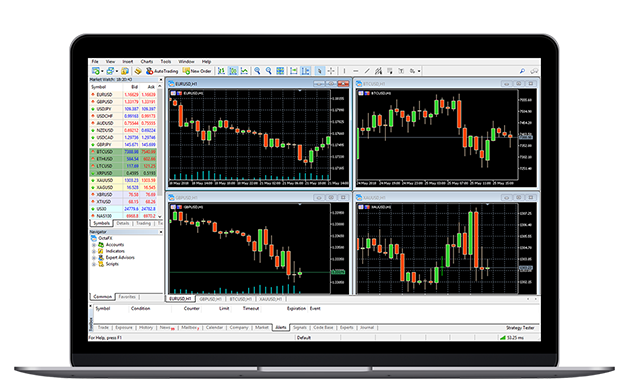

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Octafx metatrader 4

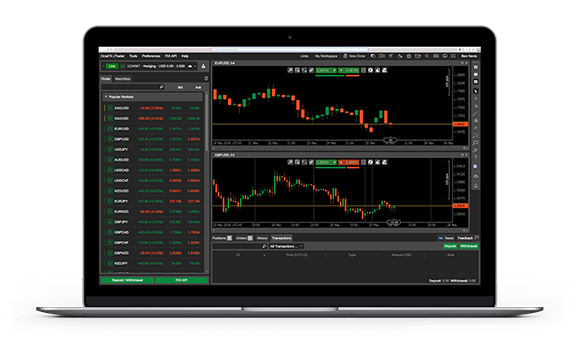

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Octafx metatrader 5

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Octafx ctrader

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

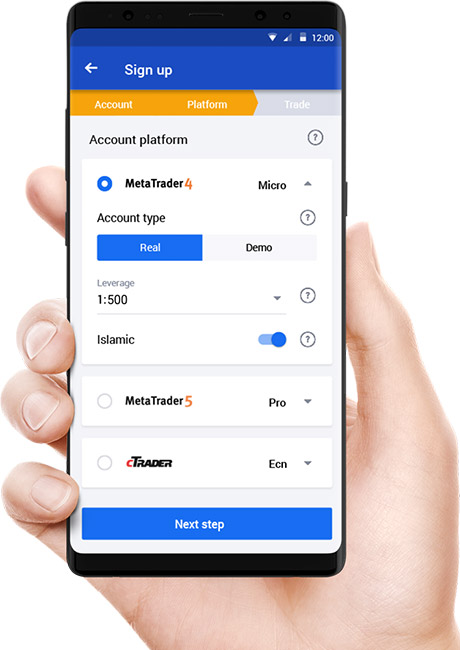

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx MT4 mobile app

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Octafx mobile app

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

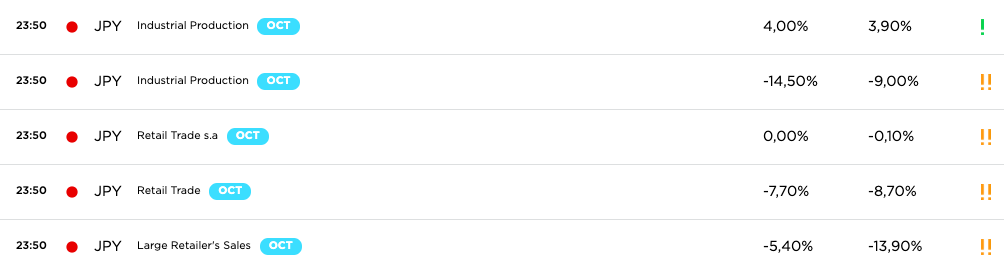

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

Octafx economic calendar

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

Honest octafx review and test for traders

| review: | platforms: | spreads from: | leverage: |

|---|---|---|---|

| (5 / 5) | metatrader 4/5, ctrader | spreads from 0.2 pips | up to 1:500 |

The octafx broker for a long time in european countries has been providing services to traders in more than 100 countries. You might be surprised, the company is currently serving more than 1,500,000 traders. Here, according to the ECN (electronic communication network) model, the platforms can be selected.

In this review, we will show you all the details you need to know about octafx. Is it really worth investing your money there? – find out in our octafx review. Learn about the trading conditions, platforms, and special features for customers. With more than 8 years of experience in the trading industry, we checked octafx in detail.

What is octafx? – the broker presented:

You may know that there is no guarantee of making money in online FX trading. So we think it is very important to move towards the trading platform with your prudence, practical humanity, and knowledge. To be successful in online trading you need to go through many steps like practice, time, patience, and much more. Octafx gives you some of these opportunities so that you can deal with or defeat the market. The broker transmits clear-sighted market knowledge while maintaining the specific skills required to make money online which will give you a much higher balance of profits from losses.

Octafx is one of the best international forex and CFD broker. The main client base of octafx is in europe. This company has been providing opportunities for traders to invest in the market for a long time since 2011. A big advantage of this platform is that traders can easily determine the rate of low wages. Also, octafx helps to guess the speculation about their increasing rate.

More than 2,840,000 of the essential bonus fund was valued in that field. Here octafx is commission-free euro or USD only 0.4 pips! It helps maintain a highly competitive cost structure in emerging markets. The broker supports copy trading to support social businesses. Autochartist pro also supports traders in a wide range of ailments through manual support. Traders come to the octafx offer for the experience of ctrader trading and the metatrader platform.

Facts about the octafx company:

- Founded in 2011

- Based in cyprus and st. Vincent and the grenadines

- Supports copy trading

- Professional trading platforms

- Low trading costs

- Education for new traders

- Supports international clients

(risk warning: your capital is at risk)

Regulations and safety octafx

All online trading activities are regulated by government financial authorities, so trades play a very important role. The license used in trading helps to build a confidential relationship with the customer and build a strong foundation. Every broker has to meet certain rules and criteria to get this government license. If a broker violates the rules or attempts to commit fraud, the license will be permanently revoked.

The octafx broker has several licenses, which bring some great benefits for traders. Octafx holding plc is regulated by cysec (EU) which can give you maximum benefits. The broker has also a dealer license in mauritius (FSC). In this case, traders can make all their own decisions. There is a huge potential for independent limited business without any leverage.

Octafx is regulated by:

- FSC (mauritius)

- Cysec (EU)

Trading conditions for octafx traders – what are the offers?

Forex and CFD trading is very popular nowadays. Private traders like these assets a lot because they can access global financial markets using little capital. Also, you will get the opportunity to increase more profit from octafx. Traders get the opportunity to use maximum leverage 1:500 here. With your small capital, you can easily transfer higher numbers to the market.

Octafx trading conditions

The minimum deposit you can invest is 100$ or 100€ which is guaranteed at a much lower price than other brokers in the market. It is the best of octafx to make a conventional offer that you can apply and accept. You can enter the financial market with very little capital (0.01) lot depending on the position. The octafx broker offers different offers to the clients according to the package, based on the account type.

More than 100 assets are available on the platforms. That includes:

- Forex (currencies)

- Indices

- Metals

- Cryptocurrencies

- Stocks

Investing here means to trade currency, cryptocurrency, any product, stock, and much more. Shares of octafx are excluded from the market subject to the terms of the german stock exchange and the american stock exchange. Many other parties use these shares on favorable terms. Octafx assets are always dependent on the current market.

Although variable spreads are offered in these trade markets, a higher spread may be transmitted depending on the number of customers. You can compare it to the initial or general trading of the stock market. But here the average of the spreads is calculated as 0.4 pip in forex. If you want to get it out of the stock index it will be less than 1 point. Even better if you expect a high rank spread then the black account can help you in this regard. You can use the RAW spread account as an alternative. You will always find many offers here.

See the table for spread comparison at octafx:

In some cases, special offers may be offered in this trade. Such as:

- The first step is a free demo account.

- The minimum deposit is only $ 100 or € 100.

- Leverage will be between 1:30 and 1: 500.

- Spreads from 0.4 points

- Different account types available

- Platforms: metatrader 4/5, ctrader

- Opportunity to execute orders quickly

- Short trading possible

- No hidden fees

- Islamic accounts possible

- Trading without swap fees

- 50% deposit bonus is possible

(risk warning: your capital is at risk)

Test of the octafx trading platforms

Every professional forex broker must have a reliable trusted trading platform for trading. Traders use several tools to gather information on what kind of analysis traders are using in this trade market. See below to know about the various available platforms of octafx.

These are the available platforms of octafx:

- Metatrader 4

- Metatrader 5

- Ctrader

Metatrader 4

Metatrader 4 is a platform that any user can use with ease. Because this trade is a process that is extremely flexible, fast, secure, responsive. Any customer can also use this platform for forex and CFD trading. It analyzes transactions in financial markets and provides secure and fast access. Users of octafx can ensure traders’ advanced access to trading operations in a reliable environment. Octafx trading is an international broker so it supports many languages. It is also very popular as it can automatically supply trades to the market. Also, MT4 has more advanced charging capabilities, it is fully customizable.

Metatrader 5

Metatrader 5 is one of the most popular trades on one of the most popular platforms in the world. MT 5 is the world’s number one multi-asset platform provider of futures, forex, CFD, exchange-traded instrument trading. Investors choose MT 5 as the best investment platform. This market has a large number of customers because this platform is very easy to use. MT5 includes level 2 pricing, robotic system trading, higher chatting, VPS support, education market. There is also the ability to provide free market data and news. The MT5 can also be said to be an automated trading option.

You can use the metatrader supreme edition platform to improve your business because the most advanced tools are applied here. We believe it improves the customer’s business experience. You can try using live and free demo accounts to enjoy this platform. Octafx MT5 and MT4 have powerful global widgets for feedback. This widget improves forex trading performance. Metatrader 4 and metatrader 5 play a major role in rapid order reversal and hedging promotion.

Ctrader

The ctrader is also offered by octafx. It has similar features to the metatrader platform. Here you can get a deeper look into the order flow and liquidity of the markets (level 2 market depth). Robot trading is supported and several chart types. With the ctrader, you will have access to the ECN market (electronic communication network). With ECN trading the conditions are better than with the metatrader accounts. From our reviews, you should use the ctrader for trading. It also supports customized indicators and tools.

Web trader/charting and analysis

Webtrader is a popular and convenient trading platform like MT4 and MT5. This trade allows traders to trade through browsers from anywhere. You can trade securely at any time in web trader. No download is required to get started. Works very fast without any OS choice. User-friendly (easy to use) can be done on the octafx platform. Web trade is much more advanced. Web trader works much faster.

Mobile trading:

MT4/5 and ctrader is one of the top software on the android platform on mobile. It has been designed by octafx markets for traders in a way that is easily accessible on mobile. Octafx clients allow them to access trading on any android device. Being mobile-friendly, it offers many benefits to clients or merchants. Octafx customers may not be able to place orders using mobile devices, where they will be able to perform basic technical analysis on the full chart. Customers will be able to do candlestick, line chart, bar chart, tick chart using excel on mobile.

Octafx allows mobile trading (app)

Octafx helps customers to know the basics by using the mobile trading app in the market. The mobile trading app encourages the customer to increase investment. See below the benefits you will get in the mobile app for metatrader 4/5.

Opportunity to watch live FX quotes, a chart with the display, platform customized, indicator add, broker’s clients can get a massage, market news, read and see broker news, all types of orders use. Time frames change, access trading history, and mobile access for online trading carry friendly and useful features.

The current market situation is quickly available in the metatrader 4/5 mobile application. The application is of course used for FX trading and it can be said to own a few powerful charting of all mobile applications.

(risk warning: your capital is at risk)

How to trade with octafx

Which market you trade your investment in depends on your choice.

Before any broker enters the market, you should know whether the market is moving upwards or downwards. It is up to you to decide whether to buy or sell stock spreads in this market. If you see a drop in the market price then you need to click on ‘sell’. On the other hand, if you see that the price has increased, then click on the ‘buy’ button.

Octafx order mask metatrader 5

You need to add stop-locks here urgently. Because when you move too far away from your location, you can secure your location through a certain process. Brokers can track trade market prices as well as place their trades in the trade market. You can also focus on real-time gains or losses.

How to open an octafx account

You can open a demo account on many topics at octafx. You can open a demo account accordingly by looking at the offers. It is very easy to open a demo account with the octafx and you will get this account quickly. To open an account you need to use your name and an email as well as a strong password. If you do not provide your full name and email address, the account will not be created.

For trading with real money, you will need to verify your account. That means octafx will require some documents to verify your identity. Just answer the questions in the account dashboard and upload the documents. The broker support can help you with that. The process can be over in a few minutes.

Opening account with octafx

Octafx offers different types of account:

The accounts that you can create with octafx are metatrader 4 micro, metatrader 5 pro, and ctrader ECN. We will talk about an account here for your convenience.

Metatrader 4 micro account

You can start with the micro account by depositing only $ 100. The account has floating spreads or fixed spreads. It is the best account for beginners because it offers micro-lots. That means you can open very small positions in the market.

- Minimum deposit $ 100

- Metatrader 4 platform

- Floating spreads from 0.4 pips

- Fixed spreads from 2 pips

- Leverage up to 1:500

- No commission

- Micro-lots

- Best for beginners with small amounts of money

Metatrader 5 pro account

The pro account is for traders who want to trade with more money and higher volume. The conditions are better than the micro account. The minimum deposit is $ 500 and the spreads are starting from 0.2 pips

- Minimum deposit $ 500

- Metatrader 5 platform

- Floating spread from 0.2 pips

- Leverage up to 1:200

- No commissions

- No swaps

- 3 days fees

Ctrader ECN account

ECN trading means investing in the market with raw spreads and deep liquidity. The ctrader is a good platform for professional traders who want to trade high volume with order flow. The minimum deposit is only $ 100. You will get real ECN access. The spreads are starting from 0.4 pips and you have to pay a commission per trade.

- Minimum deposit $ 100

- Ctrader platform

- Spreads from 0.4 pips

- Commissions from $ 3 / 1 lot trade

- No swaps

- Weekend fee

Demo account

You can use a free demo account to evaluate the platform first before depositing. Your virtual credit will be included, in the demo account with 10,000$ automatic funding. It will be deleted from the account after 30 days. Octafx clients submit this demo account so that the customer can be aware of all the tools.

Is there a negative balance protection octafx

Trade market clients think about broker protection before investing. The broker provides customers with maximum protection from investing. Octafx eliminates fears by traders by applying the best tools to ensure additional funding. In some cases, account balances can be negative. Because there is no negative balance system. Octafx can lose its unbalance in extreme market conditions. There is no reason to worry, the broker automatically shuts off your positions as soon as it is detected.

Octafx negative balance protection

Deposits and withdrawals with octafx:

As discussed above, the minimum deposit for opening a real trading account is $/€ 100. You can use for the deposit different payment methods. The available payment methods are:

- Bank wire

- Credit cards

- Cryptocurrencies

- E-wallets (skrill, neteller, perfectmoney, and more)

On most payment methods there are no fees for depositing and withdrawing money. Octafx will not charge additional fees but the payment provider can do it. The fee is depending on the payment methods but most payment methods are for free. The deposits can be instant by electronic methods. With a bank wire, you have to wait 3-5 days to credit the money into your account. Withdrawals with octafx are very fast too. It is depending on the time of the day, sometime the withdrawal is made in a few hours. The maximum time amount is 3 – 5 days for a withdrawal.

(risk warning: your capital is at risk)

Octafx accepted countries and forbidden countries

See below the countries that can access octafx trading:

For a long time in the octafx trading, argentina, australia, austria, bahrain, belarus, brazil have been trading deposits. Also, bulgaria, china, croatia, cyprus, czech republic, denmark are far ahead in terms of business investment. Renowned european countries such as estonia, france, finland, germany, greece, hungary, india, ireland, israel, and italy are directly involved in octafx investment. Octafx includes many more countries, including kuwait, malaysia, malta, mexico, monaco, the netherlands, norway, latvia, and liechtenstein. However, lithuania, luxembourg, oman, poland, portugal, russia, saudi arabia, slovakia, slovenia, south africa, sweden, spain are still trading here. Octafx allows direct deposit transactions to switzerland, thailand, the united arab emirates, the united kingdom, and qatar.

Octafx trading does not give or receive access to US customers in any way.

Each of the countries you see here has the support to join the broker octafx. This company is a very large trading platform so you can safely place your deposits or assets here. Moreover, there is support for a minimum deposit.

Special offers:

There are some special offers from octafx. It supports copy trading and a deposit bonus of up to 50%. In the following section, we will give you more details on it.

Copy trading (social trading)

Octafx offers a copy trading service to its clients. That means you can copy the trades of other traders or get copied. You do not have to be a forex expert to make money with octafx. You can search for a profitable trader and invest in their trader one by one. It is also possible to diversify your portfolio by invest in more than one trader for better risk management.

With octafx you have always control over your portfolio and the copied trades. It is very easy to manage. Just deposit money into your account, pick a successful trader, and start invention.

- Copy professional traders 1 by 1

- Full control over your investment

- Follow the best traders

- Earn money automatically

- Get copied and earn additional money

- Easy to use

Deposit bonus

Octafx offers a 50% deposit bonus. You will get additional money to increase your margin if you activate the bonus. But first of all, you can not pay out the bonus, you can only use it to make more profit. For withdrawal of the bonus, you have to do a certain turnover in trading volume (the bonus amount in lots divided 2).

- 50% deposit bonus

- Increase the free margin

- You can withdraw the bonus after doing the bonus conditions

- The bonus is available for all deposits over $ 50

Conclusion on the octafx review: recommended broker

By now you must have got a great idea about octafx. We would say from our experience that this broker has its license so you can use deposits or assets in this market. Octafx has long been involved in investing and it is directly regulated by the government.

The number of customers of this company is increasing day by day. So octafx proves that it is a reliable trading platform. If you search for it in online brokers, you will first see the name of the octafx. It also controls everything through the provision of powerful software and allows customers to access the account through the mobile app. If you want to gain a transparent trading experience, create an account with octafx broker. You can get something great, from the offers of this company. You will even get the opportunity to get involved in the business with very little profit.

Overall it is a professional provider for forex and CFD trading. The trading conditions are very good and the trading fees are low. In addition, copy trading and a deposit bonus are offered. Deposits and withdrawals are working very fast.

Advantages of octafx:

- Regulated and safe broker

- Free demo account

- Minimum deposit only $ 100

- High leverage up to 1:500

- Different account types

- Metatrader 4/5, ctrader

- Spreads from 0.2 pips

- Low commissions

- Professional support

- Copy trading

- Deposit bonus

Octafx is a good broker for traders who want to trade with tight spreads and low commissions. We can recommend its service and offers. (5 / 5)

Good at trading? Earn from letting others copy you!

Trade as usual and earn additional income from others copying you. Your master profile displays daily and monthly stats on your trading performance—promote it and attract new followers!

How it works

Click on master area and create a master account—start a new one or assign an existing one as your master account.

Get your master account ready for copiers: set your commission amount and describe your strategy.

Use your master area to view detailed statistics on your trading, change your account settings, and view the amount of commission* you’ve earned.

*if you are an IB, the sum of the IB commission and copy trade master commission cannot exceed $15/lot.

Octafx copytrading offers you an additional source of income: open a master trader account, describe your strategy, and set your commission to let others copy your trades.

Сreate multiple master accounts for different strategies

Track detailed statistics for your orders and earned master’s commission in the master area

Enjoy the benefit of no additional commission charged by octafx

Your master area in the octafx trading app for android

- Create master accounts on the go

- View statistics on your copiers and commissions wherever you are

- Manage copying conditions for your new followers on the spot

How can I become a master trader?

Any octafx client with an MT4 account can become a master trader. Just go to your master area and set up your master account.

How do I adjust the amount of the commission I charge my copiers?

Go to your master area, view settings, adjust the commission using the slider, and save changes. The new commission will only be charged from the copiers to subscribe to you after the adjustment. For all other copiers, the commission amount will remain unchanged.

When do I get commission payments from my copiers?

Payouts are made on saturdays at 12 a.M. (EET) every week.

When is the commission charged to my copiers?

The commission is charged the moment you open a trade.

How do I get the commission?

We transfer it to a special wallet. From your wallet, you can add it to any of your trading accounts, or withdraw it.

Octafx copy trading bonus

Pertandingan IB malaysia

Sertai pertandingan dagangan 16 kereta octafx

Tiga langkah mudah untuk mula berdagang

Copytrading app

Spread dan syarat terbaik kami

Aplikasi dagangan octafx

Pertandingan IB malaysia

Sertai pertandingan dagangan 16 kereta octafx

Tiga langkah mudah untuk mula berdagang

Copytrading app

Terma dan syarat octafx copytrading

Octafx copytrading (kemudian daripada ini—’perkhidmatan’) ialah perkhidmatan yang membolehkan pedagang (kemudian daripada ini—’penyalin’) menyalin dagangan daripada pedagang lain (kemudian daripada ini—’pakar’) dan boleh diaktifkan dengan memilih 'mula menyalin'.

1. Penyalin perlu melakukan perkara berikut untuk memohon perkhidmatan ini:

1.1. Berdaftar dan log masuk sebagai pelanggan di laman web octafx

1.2. Menambah wang ke dompet

2. Penyalin berhak melakukan perkara berikut:

2.1. Berhenti menyalin dagangan pada bila-bila masa dengan memilih ‘berhenti menyalin’

2.2. Mengedit parameter menyalin melalui fungsi edit, sebelum melabur dengan pakar dan semasa menyalin dagangan

2.3. Menyalin sebanyak mana pakar (semua langganan semasa boleh ditemui di bawah tab saya dalam penarafan pakar atau ruangan penyalin anda)

2.4. Menutup mana-mana dagangan secara manual pada bila-bila masa dalam ruangan penyalin.

2.5. Membatalkan langganan daripada pakar dan berhenti menyalin dagangan pakar dengan mengklik ‘berhenti menyalin’. Untuk membatalkan langganan, penyalin perlu menutup semua dagangan. Selepas membatalkan langganan, semua dana yang dilaburkan dengan pakar dan keuntungan dikembalikan ke dompet penyalin.

2.6. Tetapkan salah satu daripada dua pilihan untuk cara volum pelaburan penyalin akan dikira untuk penyertaan dalam setiap operasi pelaburan bagi setiap pakar tertentu (penyalinan saiz penuh 1 kepada 1 atau secara berkadaran dengan dana penyalin). Dua pilihan ini diterangkan dengan jelas dalam fasal 4, sub-fasal 5 bagi terma dan syarat ini.

3. Perkhidmatan ini disediakan di platform metatrader 4.

4. Rutin membuka dagangan disalin:

4.1. Penyalin hanya menyalin dagangan yang telah dibuka oleh pakar selepas melanggan pakar dalam perkhidmatan ini.

4.2. Pesanan henti rugi/ambil untung tidak akan dilihat dalam ruangan penyalin, tetapi jika pesanan ini dicetuskan pada akaun pakar, dagangan salinan juga akan ditutup.

4.3. Pilihan penjaga baki disediakan dari waktu bermulanya langganan kepada akaun pakar dan digunakan untuk menyesuaikan risiko penyalin apabila menggunakan perkhidmatan ini. Penyalin boleh menetapkan nilai penjaga baki pada mana-mana peratusan dari 0% hingga 50% daripada dana yang dilaburkan dengan pakar. Penjaga baki menggantung penyalinan pesanan baru daripada pakar dan menutup semua pesanan sedia ada jika ekuiti penyalin dalam peratusan dana yang dilaburkan pada permulaan kurang daripada nilai yang ditetapkan. Penjaga baki mencetuskan nilai yang ditetapkan tetapi tidak melindungi daripada kerugian yang berlaku dengan segera, oleh itu boleh menyelamatkan kurang pelaburan, terutamanya semasa ketaktentuan pasaran yang tinggi.

4.4. Apabila sudah melanggan pakar, penyalin menentukan jumlah dana untuk ditolak daripada dompet dan dilaburkan dengan pakar yang dipilih. Dana ini dan keuntungan anda akan dikembalikan ke dompet anda apabila anda berhenti menyalin pakar.

4.5. Volum bagi dagangan yang disalin dipilih daripada dua pilihan:

4.5.1. Saiz penuh menyalin 1 dengan 1 bermaksud volum dagangan yang dibuka oleh pakar sama dengan volum dagangan penyalin, dibuka untuk penyalin

4.5.2. Secara berkadaran dengan dana penyalin bermakna volum bergantung pada nisbah leveraj dan ekuiti bagi kedua-dua akaun pakar dan penyalin, dan dikira seperti yang berikut: volum (dagangan disalin) = ekuiti (penyalin)/ekuiti (pakar) × leveraj (penyalin)/leveraj (pakar) × volum (pakar).

4.5.3. Contoh: ekuiti akaun pakar ialah $2000 dan leveraj ialah 1:200. Ekuiti akaun penyalin ialah $200 dan leveraj ialah 1:500. 1 lot dagangan dibuka pada akaun pakar. Oleh itu, volum dagangan disalin ialah: 200/2000 × 500/200 × 1 = 0.25 lot.

4.6. Nisbah leveraj penyalin ditetapkan pada 1:500. Penyalin yang ingin melaraskannya perlu menghubungi sokongan pelanggan octafx.

4.7. Apabila perkhidmatan diaktifkan, dagangan akan disalin ke akaun penyalin tanpa mengambil kira sama ada pemilik akaun ini mendaftar masuk atau tidak.

4.8. Pesanan penyalin dilaksanakan mengikut pesanan pakar (beli atau jual) yang dibuat dalam akaun mereka. Isyarat untuk membuka pesanan dalam akaun penyalin tercetus apabila pakar membuat pesanan dan pesanan penyalin tersebut dilaksanakan pada harga pasaran. Mekanisme yang sama mencetuskan pesanan penutupan. Oleh itu, harga pelaksanaan bagi pesanan ini mungkin berbeza. Selain itu, bilangan penyalin yang mengikuti pakar ini boleh menjejaskan masa pelaksanaan.

5. Had dikenakan:

5.1. Olum minimum bagi dagangan disalin ialah 0.01 lot, volum maksimum bagi dagangan disalin ialah 100 lot.

5.2. Jika volum dagangan disalin kurang daripada 0.01 lot selepas pengiraan dibuat, maka dagangan tidak akan dibuka pada akaun penyalin.

5.3. Jika volum dagangan disalin lebih besar daripada 100 lot selepas pengiraan dibuat, maka dagangan tidak akan dibuka pada akaun penyalin.

6. Jika pakar mengubah ekuiti (dengan membuat deposit atau pengeluaran) atau leveraj, semua dagangan disalin mengekalkan volum awal mereka pada akaun penyalin.

7. Semua syarat dagangan (leveraj, swap, spread) penyalin adalah sama dengan syarat untuk akaun MT4 micro.

8. Akaun pakar mestilah jenis MT4 micro.

9. Perkhidmatan ini berhak melakukan perkara yang berikut:

9.1. Mengehadkan bilangan akaun pakar yang boleh dibuat oleh pakar pada bila-bila masa tanpa pemberitahuan awal mengikut budi bicara mutlaknya.

9.2. Membatalkan langganan penyalin daripada pakar tanpa pemberitahuan awal.

9.3. Mengurangkan komisen yang ditetapkan oleh pedagang pakar dan mengehadkan nilai maksimum bagi semua akaun pakar mereka tanpa pemberitahuan awal atau menyediakan sebarang penjelasan.

9.4. Meminda terma dan syarat ini pada bila-bila masa tanpa notis awal kepada penyalin atau pedagang pakar. Pindaan tersebut dikuatkuasakan pada waktu ia diterbitkan di laman web perkhidmatan dalam terma dan syarat ini.

9.5. Menilai dagangan pedagang pakar, menandakan akaun pedagang pakar dengan amaran 'strategi berisiko tinggi' dan mengecualikan akaun tersebut daripada penarafan pakar yang disaring secara lalai (akan tersedia untuk penyalin yang menukar tetapan penapis mereka dengan sewajarnya).

10. Master menentukan jenis komisen (terdiri daripada dua jenis—‘tetap bagi satu lot’ dan ‘syer hasil’) dan jumlahnya untuk menyalin pesanan secara bebas. Komisen tetap bagi satu lot adalah antara $ 0 hingga $ 15 bagi setiap lot perdagangan yang dibuka oleh penyalin. Komisen syer hasil adalah antara 0% hingga 50% daripada keuntungan penyalin. Bayaran komisen yang terkumpul dalam masa satu minggu dibayar ke dompet master pada hari sabtu.

11. Jumlah komisen yang penyalin bayar kepada pakar ditetapkan pada masa penyalin menekan 'mula menyalin'. Sekiranya pakar menukar jumlah komisen, ia tidak akan menjejaskan jumlah yang tertunggak di bawah langganan ini dengn pakar tersebut.

12. Jumlah komisen untuk IB

12.1 sekiranya pakar mengenakan komisen tetap bagi setiap satu lot dan ialah IB bagi penyalin, komisen agregat (komisen IB + komisen tetap bagi setiap satu lot ) tidak boleh melebihi $15 bagi setiap lot dagangan. Dalam keadaan ini, komisen tetap bagi setiap satu lot akan digunakan. Contohnya, jika pakar mengambil komisen $5 bagi setiap lot dagangan untuk perkhidmatan IB dan komisen $15 bagi setiap lot dagangan untuk perkhidmatan pakar, pakar tersebut akan mendapat $15 bagi setiap lot dagangan secara keseluruhannya ($15 setiap lot— komisen tetap bagi setiap satu lot , $0—komisen IB).

12.2. Sekiranya pakar mengenakan komisen bahagian hasil dan ialah IB bagi penyalin, tiada had bagi jumlah komisen agregat (komisen IB + komisen bahagian hasil ) yang boleh diperoleh.

13. Jenis komisen ditetapkan sekali pada masa akaun pakar dibuat dan tidak boleh diubah selepas itu.

14. Bonus salindagang

14.1. Bonus sebanyak 50% daripada dana yang dilaburkan pada permulaan langkah menyalin pakar.

14.2. Bonus ini hanya boleh dimohon sekali untuk pakar tertentu pada tarikh promosi.

14.3. Bonus ini tidak boleh digunakan untuk pelaburan yang sedang berjalan.

14.4. Bonus ini tidak boleh dikeluarkan atau dianggap sebagai sebahagian daripada pelaburan penyalin.

14.5. Jika ekuiti akaun anda menjadi kurang daripada saiz bonus, bonus ini akan dibatalkan.

14.6. Penyalin boleh membatalkan bonus ini secara manual di ruangan penyalin.

14.7. Bonus ini dibatalkan apabila penyalin berhenti menyalin pakar.

14.8. Selepas pembatalan, bonus tidak boleh dimohon sekali lagi atau diaktifkan semula.

14.9. Perkhidmatan ini boleh menolak permohonan bonus penyalin pada bila-bila masa tanpa pemberitahuan awal atau memberikan alasan untuk keputusan tersebut.

14.10. Perkhidmatan ini boleh membatalkan bonus penyalin pada bila-bila masa tanpa pemberitahuan awal.

14.11. Jika jumlah dana peribadi penyalin yang dilaburkan dengan pedagang pakar ketika pengeluaran/pindahan dalaman menjadi kurang daripada atau sama dengan jumlah bonus, bonus akan dibatalkan.

14.12. Mana-mana situasi yang tidak diterangkan dalam peraturan ini akan tertakluk pada keputusan perkhidmatan.

14.13. Perkhidmatan ini berhak mengubah, mengemas kini atau membatalkan promosi ini dengan pemberitahuan pada berita perkhidmatan.

15. Percubaan percuma

15.1. Pedagang master boleh mengaktifkan dan menyahaktifkan percubaan percuma pada bila-bila masa.

15.2. Percubaan percuma akan diaktifkan apabila penyalin mula menyalin akaun master sekiranya:

15.2.1. Pedagang master mempunyai percubaan percuma yang tersedia untuk akaun master ini

15.2.2. Penyalin belum mengaktifkan percubaan percuma untuk akaun master ini.

15.3. Jika pedagang master membatalkan percubaan percuma, ia akan terus berfungsi untuk penyalin yang telah mengaktifkannya.

15.4. Jika penyalin berhenti menyalin akaun master ketika percubaan percuma masih aktif, penyalin tidak akan dapat mengaktifkan percubaan percuma untuk akaun master ini.

15.5. Selepas percubaan percuma tamat, langganan penyalin akan tertakluk kepada syarat terdahulu, termasuk jumlah komisen.

16. Statistik dagangan penyalin hanya boleh dilihat oleh penyalin.

17. Statistik dagangan pakar boleh dilihat oleh orang awam.

18. Penyalin tidak mempunyai akses kepada terminal dagangan. Semua tindakan dengan langganan dan dagangan mereka dibuat di bawah ruangan penyalin.

19. Jika perkhidmatan ini dengan sewajarnya mengesyaki bahawa penyalin melanggar peraturan deposit dan pengeluaran yang diterangkan di bawah perjanjian pelanggan atau peraturan negara kediaman penyalin, perkhidmatan ini berhak untuk menggantung pemberian perkhidmatan kepada penyalin tersebut.

20. Sila ingat bahawa pakar boleh mempunyai dagangan yang menguntungkan mahupun kerugian.

Octafx's bonus promotions of the month - special and lucrative benefits

Check out octafx's bonus promotions of the month. Trade forex and cfds amid coronavirus.

Trade amid coronavirus with octafx

Make a profit and fight against COVID-19 at the same time together with octafx.

Octafx has started a charity drive along with many great offers which will conclude on 22 may .

Now is a great time to participate.

Octafx understands the challenge COVID-19 presents in all aspects of our lives.

That is why they’ve put together a string of offers, which should make your life a little bit easier.

Octafx’s bonus promotions of the month

A range of lucrative benefits are available for two more weeks.

1:1000 leverage even when you deposit a small amount, such as 5 USD you are trading with the power of 5,000 USD. 100% deposit bonus after trading a specific volume, all of the money will be available for withdrawal. Invest just 50 USD and you’ll receive an additional 50 USD plus all the profit you will make after trading 25 lots. 50% copy trading bonus for new subscriptions one of the most worthwhile strategies is using octafx’s copy trading service to mirror the best master traders. When you subscribe to new master traders, you’ll receive a 50% bonus. 3 USD reward payout on XAUUSD per lot trade one lot on any instrument and start receiving rewards for trading gold to your wallet every day. 5 USD reward payout on XAUUSD per 8 lots collect more when you trade eight or more lots of the XAUUSD pair.

Most importantly, octafx will donate two cents (USD) for every lot traded to go towards humanitarian organisations battling COVID-19.

As the charity drive moves forward, you’ll be able to track how much we’ve raised on octafx official website through the events page.

By trading, as you usually would, octafx can make the world a better place, at no expense to you.

With octafx, you can also start trading by using your mobile phones of tablet.

When is the best time to trade?

Octafx made the spreads as low as possible for you.

Make a higher profit from home with lower spreads.

Self-isolation and good care about elderly people can help us overcome the disease, and we all hope better trading conditions will give you a boost.

How to earn from home with lower spreads:

- From 7 a.M. To 8 p.M. (GMT), enter the market via metatrader 4.

- Trade currency pairs with spreads up to 14 points lower than usual.

Octafx wants you to have more opportunities for making money at this difficult time.

Trade wars and coronavirus – the impact on china’s market

Lower customs duties—more gold.

The china-US trade war intensified in 2018 when both countries introduced customs duties targeting each other.

The US was stronger at that point: the USD rate grew while the gold and oil prices remained low.

In 2019, negotiations between the countries did not have much progress. Donald trump was promising a lot of changes.

But all that was achieved was a treaty to reduce customs duties by the united states and promises to protect intellectual property by china.

All this put china in an advantageous position. The US dollar went down, gold went up, and oil volatility increased.

On important news, gold, oil, CNY, and USD were always reacting the same: the gold rate grew, and the oil and USD quotes made spikes of volatility.

The latter could move in different directions depending on the news, but the rates were smoothed out within a day.

Any future escalation now is expected to cause the same market pattern.

The coronavirus attacks the economy

The disease broke out in china at the end of 2019.

Due to quarantine, production capacities do not operate in full; some countries have detained the products from china on the customs.

All these caused tensions on the world’s markets and the decrease of the oil, gas, and rare-earth metals rates.

At that, safe haven instruments, like gold, went up in price.

The effect is expected to last.

Octafx

Post tags

Octafx with low spreads, no swaps, no commissions. The online broker made for serious investors.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

This service has not been reviewed yet.

Please post your thoughts and reviews on this page by all means.

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

So, let's see, what we have: learn how terms and conditions of octafx copytrading for masters and investors. At octafx copy trading bonus

Contents of the article

- Best forex bonuses

- Octafx copy trading bonus

- IB monthly reward

- The octafx 16 cars trading contest

- Three easy steps to start trading

- Copytrading app

- Our best spreads and conditions

- The octafx trading app

- IB monthly reward

- The octafx 16 cars trading contest

- Three easy steps to start trading

- Copytrading app

- Octafx copytrading terms and...

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

- Honest octafx review and test for traders

- What is octafx? – the broker presented:

- Test of the octafx trading platforms

- Metatrader 4

- Metatrader 5

- Ctrader

- Web trader/charting and analysis

- Mobile trading:

- Octafx allows mobile trading (app)

- How to trade with octafx

- How to open an octafx account

- Octafx offers different types of account:

- Demo account

- Is there a negative balance protection octafx

- Deposits and withdrawals with octafx:

- Octafx accepted countries and forbidden countries

- Special offers:

- Copy trading (social trading)

- Deposit bonus

- Conclusion on the octafx review: recommended...

- Good at trading? Earn from letting others copy...

- How it works

- Octafx copytrading offers you an additional...

- Your master area in the octafx trading app for...

- How can I become a master trader?

- How do I adjust the amount of the commission I...

- When do I get commission payments from my copiers?

- When is the commission charged to my copiers?

- How do I get the commission?

- Octafx copy trading bonus

- Pertandingan IB malaysia

- Sertai pertandingan dagangan 16 kereta octafx

- Tiga langkah mudah untuk mula berdagang

- Copytrading app

- Spread dan syarat terbaik kami

- Aplikasi dagangan octafx

- Pertandingan IB malaysia

- Sertai pertandingan dagangan 16 kereta octafx

- Tiga langkah mudah untuk mula berdagang

- Copytrading app

- Terma dan syarat octafx copytrading

- Octafx's bonus promotions of the month - special...

- Check out octafx's bonus promotions of the month....

- Trade amid coronavirus with octafx

- Octafx’s bonus promotions of the month

- When is the best time to trade?

- Trade wars and coronavirus – the impact on...

- The coronavirus attacks the economy

- Octafx

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.