Best trading app with bonus

Some investors are happy putting their money into a boring fund and letting it simmer for the long term.

Best forex bonuses

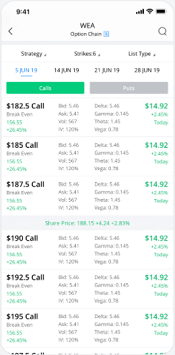

Others are more interested in taking a hands-on approach to managing their money with active stock trading. Whether you buy and sell once in a while or want to enter a trade or more every day, there’s definitely a stock trading app for you. TD ameritrade gets the top spot because it offers something for everyone and excellent pricing. The basic TD ameritrade mobile app is great for beginners and casual stock traders who want to manage their investments on the go. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience.

Best stock trading apps

The best stock trading apps combine low costs and useful features

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/beststocktradingapps-767c084f5ccb44f7a974ff04d9f5264b.jpg)

Some investors are happy putting their money into a boring fund and letting it simmer for the long term. Others are more interested in taking a hands-on approach to managing their money with active stock trading. Whether you buy and sell once in a while or want to enter a trade or more every day, there’s definitely a stock trading app for you.

The best stock app for your unique needs depends on your experience and trading goals. After reviewing fees, tradable assets, and more across several brokerages, we rounded up the best stock trading apps for both beginner and advanced investors to consider.

Best stock trading apps of 2021

| stock trading app | why we picked it | |

|---|---|---|

| TD ameritrade | best overall | open account |

| fidelity | best for beginners | open account |

| webull | best free app | open account |

| sofi | best for learning about trading | open account |

| tastyworks | best for options trading | open account |

| ally | best with banking products | open account |

TD ameritrade mobile: best overall

:max_bytes(150000):strip_icc()/td-ameritrade-logo-89566b8afef04be49fd2a1ffe475b933.png)

TD ameritrade gets the top spot because it offers something for everyone and excellent pricing. The basic TD ameritrade mobile app is great for beginners and casual stock traders who want to manage their investments on the go. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience.

You get access to both apps with a TD ameritrade brokerage account, which has no minimum balance requirements and no fees to trade stocks and etfs. The fully-featured apps combine important account management features and trading features regardless of which one you choose. Thinkorswim also includes a live CNBC feed inside the app.

In november 2019, charles schwab announced that it is acquiring TD ameritrade. The acquisition is expected to close by the end of 2020. Once closed, it’s likely that TD ameritrade trading platforms and charles schwab trading platforms will be combined into one.

Key features

- App names: TD ameritrade mobile and thinkorswim

- Account minimum: no minimum deposit required

- Fees: $0 commission for online stock, ETF, and options trades, but there is a 65 cent flat fee per options contract; $25 for broker-assisted trades; $49.99 for no-load mutual funds; additional fees may apply

- Tradable assets: wide range, including stocks, options, etfs, mutual funds, bonds, and more

- Account types: supports standard, retirement, education, and other types of accounts

Beginner and advanced mobile apps

Support for a wide range of assets and account types

Extensive research resources

Uncertainty of future after schwab acquisition

Money crashers

What do you want to

do with your money?

- Make money

- Careers

- College & education

- Small business

- Extra income

- Manage money

- Banking

- Budgeting

- Taxes

- Giving

- Save money

- Frugality

- Shopping

- Deals

- Borrow money

- Get out of debt

- Credit cards

- Bankruptcy

- Mortgage

- Loans

- Protect money

- Estate planning

- Insurance

- Legal

- Scam alert

- Invest money

- Bonds

- Retirement

- Real estate

About money crashers

- Credit cards

- Cash back

- Low APR interest

- Travel rewards

- Hotel rewards

- Gas rewards

- Student

- Business

- Secured

- Banking

- New bank account promotions

- Best online banks

- Free checking accounts

- High-yield checking accounts

- Rewards checking accounts

- High-yield savings accounts

- Best money market accounts

- Highest-interest CD rates

- Best business checking accounts

- Free business checking accounts

- College student checking accounts

- Bank accounts for kids

- Loans

- Mortgage

- Personal loans

- Family & home

- Kids & parenting

- Home improvement

- Relationships

- Estate planning

- Investing

- New brokerage account promotions

- Best online stock brokers

- IRA accounts

- Stock brokers for beginners

- Free stock trading

- Stock screeners

- Fractional shares of stock

- Stock picking services

- Micro-investing apps

- Robo advisors

- Options trading platforms

- Small business

Recent stories

13 best personal loan companies of 2021

8 best stock brokers that allow you to invest in fractional shares

15 best rewards checking accounts of 2021

Advertiser disclosure: the credit card and banking offers that appear on this site are from credit card companies and banks from which moneycrashers.Com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Moneycrashers.Com does not include all banks, credit card companies or all available credit card offers, although best efforts are made to include a comprehensive list of offers regardless of compensation. Advertiser partners include american express, chase, U.S. Bank, and barclaycard, among others.

Explore

Featured content

14 best cash-back credit cards – reviews & comparison

Featured content

14 best cash-back credit cards – reviews & comparison

Featured content

9 best low APR interest credit cards – reviews & comparison

Featured content

18 best travel rewards credit cards – reviews & comparison

Featured content

15 best hotel rewards credit cards – reviews & comparison

Featured content

11 best gas credit cards – reviews & comparison

Featured content

12 best credit cards for college students – reviews & comparison

Featured content

26 best small business credit cards – reviews & comparison

Featured content

10 best secured credit cards to rebuild credit – reviews & comparison

Share this article

Dig deeper

Follow @moneycrashers

Trending articles

Why gas prices are rising so high – reasons for fluctuations

13 best stock market investment news, analysis & research sites

26 best new bank account promotions & offers – january 2021

13 best paycheck advance apps to help you make it to payday

7 best stock picking services of 2021

Become a money crasher!

Join our community.

12 best new brokerage account promotions & bonus offers – january 2021

Share this article

As a savvy investor, you’re no doubt aware dozens of banks and credit unions entice new business with account-opening promotions. Some reward first-time customers with bonuses worth hundreds of dollars just for opening an account and making qualifying deposits. The best land on our regularly updated roundup of the top new bank account promotions.

You’ve probably seen credit card issuers get in on the action too. Many of the best cash-back credit cards and travel rewards credit cards come with irresistible welcome offers, the best of which rival the most generous new bank account promotions.

If it’s been years since you switched brokerage firms or you’re entirely new to investing, you might be unaware america’s top self-directed and managed investment platforms also offer impressive new-account bonuses. Top-tier new brokerage account promotions dwarf the leading bank and credit card promotions — promising thousands to new customers bringing substantial assets to the table.

Best new brokerage account promotions (january 2021)

These are the best new brokerage account promotions from north america’s top online stock brokers for this month. All are subject to change, so check back often for updates.

Whichever you choose, pair your new brokerage account with a subscription to trade ideas, the most powerful paper trading and market research subscription around.

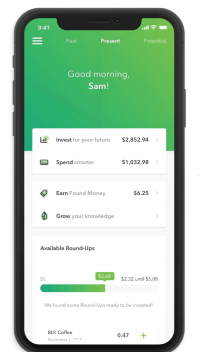

1. Acorns — $10 bonus

Open a new acorns account using the link below to earn a $10 credit. It’s that simple — no minimum deposit or balance required. You’ll receive the credit after completing your account registration.

Moving forward, acorns offers three attractively priced plans that support everyday money management, longer-term saving, and market investing:

- Lite. For just $1 per month, take advantage of a powerful investing platform (invest) that allows you to invest spare change left over from everyday purchases (round-ups) and earn bonus investments from more than 350 found money partners.

- Personal. For just $3 per month, acorns adds a tax-advantaged retirement account that updates regularly to match your goals and a checking account with 55,000+ fee-free atms worldwide and up to 10% bonus investments.

- Family. For just $5 per month, you’ll get everything included in the lower-priced plans, plus early, a kid-friendly investment account featuring automatic recurring investments, exclusive bonus investments, family-centered financial advice, and potential tax savings.

2. Robinhood — up to $200 (or more) in free stock

Open a new robinhood account and to get up to $200 (or more) in free stock. Here’s how it works:

- Apply for a new robinhood brokerage account and get approved.

- Robinhood adds 1 free share of stock worth between $2.50 and $200 (or more) per share, chosen randomly from its inventory of settled shares.

- You can hold the share indefinitely or sell it after 2 trading days.

Bear in mind that you may not receive the same stock as other applicants and your share’s value may fluctuate with market movements. Once open, use your account to trade stocks, etfs, and other market-traded instruments.

3. Webull — free stocks up to $3,700 total value & 3 months free level 2 advance (nasdaq totalview) subscription

Open and fund a new webull account with at least $100 to get up to four free stocks worth up to $3,700 in total. Participating stocks include google, facebook, procter & gamble, starbucks, kraft heinz, and snap.

Plus, sign up to receive a three-month level 2 advance (nasdaq totalview) subscription for free. Here’s how these promotions work:

Account opening bonus (2 free stocks)

Simply sign up and open a qualifying webull account to receive two free stocks valued between $2.50 and $250. You must complete the account opening process by the stated offer end date at the time you apply. This date is subject to change at webull’s discretion.

Deposit bonus (2 free stocks)

Make an initial deposit of $100 or more to your new account by the end of the offer period to claim two free stocks valued between $8 and $1,600 each per share.

Account opening bonus (nasdaq totalview subscription)

Sign up and open your account to receive a three-month level 2 advance (nasdaq totalview) subscription for free. After the promotional period ends, the standard subscription fee applies.

These offers apply only to webull cash and margin accounts.

4. Blockfi — up to $250 BTC bonus

Open and fund a blockfi interest account (BIA) for the first time and make qualifying deposits within the first 30 days of opening. In return, you could earn a special one-time bonus worth up to $250 BTC. The payout tiers work as follows:

- $15 BTC: deposit $25 to $249

- $20 BTC: deposit $250 to $999

- $40 BTC: deposit $1,000 to $4,999

- $75 BTC: deposit $5,000 to $9,999

- $150 BTC: deposit $10,000 to $19,999

- $250 BTC: deposit $20,000 or more

To ensure that you receive the bonus, you must maintain a crypto balance of $25 or greater through the 14th of the month two and a half months from your eligibility month (account opening month). Eligible payouts occur on a rolling basis on or about the 15th of every month.

5. Ally invest — up to $3,500 cash bonus

Open a new self-directed account with ally invest by march 31, 2021, and make a qualifying deposit of new money or assets to earn up to $3,500 bonus cash. The bonus thresholds are:

- $50: deposit $10,000 to $24,999 in new funds or assets.

- $200: deposit $25,000 to $99,999 in new funds or assets.

- $300: deposit $100,000 to $249,999 in new funds or assets.

- $600: deposit $250,000 to $499,999 in new funds or assets.

- $1,200: deposit $500,000 to $999,999 in new funds or assets.

- $2,500: deposit $1,000,000 to $1,999,999 in new funds or assets.

- $3,500: deposit $2,000,000 or more in new funds or assets.

To qualify for the bonus, you must fund the account within 60 days of opening. Once ally invest credits the bonus to the account, the combined bonus and qualifying deposit (less any trading losses) must remain in the account for 300 days. Otherwise, ally invest reserves the right to revoke the bonus.

Deposited funds must come from accounts that aren’t ally or ally subsidiary accounts. You must fund the new account with a minimum qualifying deposit of $10,000 or more to qualify for the minimum cash bonus.

The bonus is available to U.S. Residents, excluding current ally invest account holders, and ally invest account holders who closed their accounts within 90 days of applying.

Account transfer fee credit

Separately, ally invest credits up to $150 in transfer fees charged by other brokerages when you complete a first-time account transfer totaling $2,500 or more. That credit hits your account within 30 days of the transfer.

For more information about ally invest’s taxable brokerage accounts and iras with commission-free trades, read our ally invest review. To learn more about ally bank, ally invest’s parent institution, check out our ally bank review.

6. Citi wealth management — up to $3,500 cash bonus

Open a new eligible citi personal wealth management account by june 30, 2021, and make a qualifying deposit of new money or assets to earn a cash bonus up to $3,500. The bonus thresholds are as follows:

- $500: deposit $50,000 to $199,999 in new funds or securities.

- $1,000: deposit $200,000 to $499,999 in new funds or securities.

- $1,500: deposit $500,000 to $999,999 in new funds or securities.

- $2,500: deposit $1,000,000 to $1,999,999 in new funds or securities.

- $3,500: deposit $2,000,000 or more in new funds or securities.

To earn this bonus, you must do the following:

- Open and enroll your new citi private wealth management account

- Make the qualifying new money deposit within 2 months of account opening

- Enroll the account into e-delivery of statements within 2 months of account opening.

- Maintain the new funding at least through the end of the third month (statement cycle) after account opening.

Eligible funds must be new to citibank and can’t come from or be combined with funds from any other citi accounts. This offer is available to new citi private wealth management clients only.

7. M1 finance — up to $2,500 transfer bonus

Open a new M1 finance account and initiate an account transfer within 60 days of sign-up to earn a transfer bonus of up to $3,500.

Plus, get a free year of M1 plus (a $125 value) when you open a new account by jan. 31, 2021.

The bonus thresholds for the cash bonus are:

- $40 bonus: transfer an account worth $10,000 to $19,999.99.

- $75 bonus: transfer an account worth $20,000 to $49,999.99.

- $150 bonus: transfer an account worth $50,000 to $99,999.99.

- $250 bonus: transfer an account worth $100,000 to $249,999.99.

- $500 bonus: transfer an account worth $250,000 to $499,999.99.

- $1,000 bonus: transfer an account worth $500,000 to $999,999.99.

- $2,500 bonus: transfer an account worth $1,000,000 to $1,999,999.99.

- $3,500 bonus: transfer an account worth $2,000,000 or more.

Your new M1 finance account type must match your old account type. The offer isn’t valid on ACH deposits, wire transfers or direct 401k rollovers. Once the transfer is received, you’ll receive payment within 90 days.

8. E-trade — up to $2,500 cash bonus

Open a new E-trade securities nonretirement brokerage account by jan. 31, 2021, using the promo code ‘BONUS20’, to earn up to $2,500 bonus cash. The bonus thresholds are:

- $25: deposit or transfer $5,000 to $9,999 in new money.

- $50: deposit or transfer $10,000 to $24,999 in new money.

- $200: deposit or transfer $25,000 to $99,999 in new money.

- $300: deposit or transfer $100,000 to $249,999 in new money.

- $600: deposit or transfer $250,000 to $499,999 in new money.

- $1,200: deposit or transfer $500,000 to $999,999 in new money.

- $2,500: deposit or transfer $1,000,000 or more in new money.

You must transfer or deposit new funds or securities within 60 days of enrollment. All deposited or transferred funds must come from accounts outside E-trade and remain in the account (less any trading losses) for at least 12 months.

9. Betterment — up to 1 year managed free

Get up to one year managed free when you open a betterment robo-advisor account and make a qualifying deposit within 45 days. Bonus thresholds are:

- 1 month free: fund your account with $15,000 to $99,999 within the qualification period.

- 6 months free: fund your account with $100,000 to $249,999 within the qualification period.

- 12 months free: fund your account with $250,000 or more within the qualification period.

You can’t combine this offer with any other promotions, and it’s available to U.S. Residents only.

For more about betterment’s benefits, check out our lists of the best high-yield savings accounts and cash management accounts on the market today.

10. Sofi invest — win up to $1,000 in free stock

For a limited time, download the sofi invest app and open a new sofi active invest account for the chance to win up to $1,000 in free stock. Moving forward, enjoy commission-free stock trades and access to fractional shares in select securities with no account minimums.

Terms and conditions apply. See offer for details.

11. Charles schwab — up to $500 cash referral bonus

Open a new qualifying charles schwab account with a qualifying referral from an existing schwab client to earn a cash bonus of up to $500.

To qualify, ask a friend or family member with a schwab account to send you their unique referral code. Then use the code to open a new schwab account with an initial deposit or deposits totaling at least $1,000. Make one or more qualifying deposits within 45 days of your account opening date, and you’ll receive your cash bonus about a week later.

Your bonus amount depends on how much you deposit during the 45-day qualifying period:

- $100: deposit $1,000 to $24,999 in new money or assets.

- $200: deposit $25,000 to $49,999 in new money or assets.

- $300: deposit 50,000 to $99,999 in new money or assets.

- $500: deposit 100,000 and above in new money or assets.

Once your account is open, monthly fees may apply. Multiple members of the same household may qualify for bonuses individually, as long as they open separate schwab accounts.

12. Nvstr — up to $1,000 cash

Open a new nvstr account using this link to earn up to $1,000 in cash. There’s no minimum funding threshold or other hoops to jump through — just open your account, and nvstr rewards you with $10 to $1,000 cash.

There is one catch: nvstr chooses your reward amount at random, and it’s impossible to predict how much you stand to receive. Once the bonus is in your account, you must make at least one trade within three months and keep the bonus funds on deposit for a full year.

The cash offer is available to new nvstr users on live trading accounts only. Simulated trading accounts aren’t eligible.

Final word

If you’re a satisfied investor, you’d be forgiven for feeling no urgency to switch brokerages. Why fix something that’s not broken?

But the prospect of earning hundreds or thousands of dollars in brokerage bonuses is often reason enough.

Most of these brokerages take pains to ensure their new-account bonuses qualify as easy money. In many cases, moving assets to a newly opened account requires little more than completing an account application and authorizing an electronic funds transfer or asset rollover, a process that’s quick and painless enough to complete in a spare 15 minutes.

Even if you’re not ready to take advantage of these brokerage account bonuses, it still pays to add a review of the top brokerage promotions to your due-diligence to-do list for whenever you’re ready to start investing on a new trading platform.

Best trading apps: 2020 list

As you can see, etoro has topped our list as the best trading mobile app overall, grabbing an incredible 4.9/5 rating; this is due to its incredible versatility, social features and worldwide reputation. With regards to the other apps which made it to the top 10, they vary in terms of strengths, weaknesses and features – for example; XM is one of our top forex & CFD apps, and capital.Com is a brilliant mobile app for exchanging cryptos. Overall, the most important thing for us when looking at the best apps is whether or not they are regulated by bodies like the FCA, SEC, FINRA, mifid, cysec.

Best online trading apps 2020

You can download all of the following mobile apps from online brokers for free.

- Etoro: best overall trading app

- Capital.Com: best for global cfds

- Moomoo: best for US stocks

- XM: best for worldwide trust

- Plus500: best for active traders

- City index: best for customer service

- Robinhood: best for free stock trading

- Freetrade: best for stocks/shares UK

- TD ameritrade: best for US stocks and etfs trading

- Forex.Com: best for forex

What is a trading app?

A trading app is a mobile application which you can use to trade different markets. These apps are usually free and serve as an addition to the main platform offered by brokers. In this guide, we’ll be taking a look at the different available types of mobile platforms and answering some of the most commonly asked questions.

Types of trading apps

Not all mobile trading platforms are the same. They vary in terms of what you can trade, where you can use them and regulation. Let’s now take a look at some of the different types of mobile trading platforms out there.

Stock trading apps

Stock apps are mobile trading applications which allow you to buy and sell stocks which are investments in certain companies which sometimes pay out dividends and thus can act as a form of passive income. Stock trading apps are popular as they offer the general public with a way of profiting from the economic growth of companies. If you think a company will do well in the future, you can put your money where your mouth is by buying their stock using stock trading applications and then selling it if/when the price of the stock goes up. If you live in the united states, I would recommend that you use either TD ameritrade, robinhood, charles schwab or the E-trade stock app for stock trading. If you live in the UK, I would recommend freetrade stocks app for free trading. For global stock trading, our favourite mobile trading mobile app is etoro, although etoro is a CFD trading platform, so you don’t actually own the stocks, but you can still profit on them.

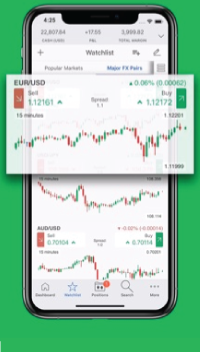

Forex trading apps

Currency (foreign exchange) trading is another popular type of trading globally. One of the main reasons people like trading forex is that unlike stock trading, you can trade forex 24 hours per day, 5 days per week – therefore there are far more opportunities to trade the market. A lot of people who trade stocks turn to forex after the stock market closes for the day. Forex trading platforms aren’t too dissimilar to the other apps listed on this site, the only difference is that most of them connect to a mobile app called MT4 which is basically the standard for forex trading. That being said, there are some forex apps which have native charts – these are my favourite. Forex trading is more global and in some cases, easier to do than stock trading. If you’d like to have a go trading some forex on mobile apps, then I recommend you check out forex.Com or XM – both are 2 of our top favourite forex brokers. You can also check out our full list of the top forex apps.

CFD trading apps

Cfds, also referred to as ‘contracts for difference’ are financial instruments that you can trade through a variety of different broker firms. They allow you to profit from price movements of stocks, commodities (like oil for example), indices, shares, forex and more – all without having to buy or sell the underlying asset. CFD trading platforms are one of the most common types, as they provide an easy way to trade anything all from one app. As you might have noticed from the list above, our best global CFD mobile app is capital.Com, although etoro also provides a huge range of cfds globally too, and has a nice feature which lets you copy other traders.

Bitcoin & crypto trading apps

The meteoric rise of cryptocurrencies in 2017 led to a severely increased interest in the crypto markets. You can trade popular cryptocurrencies like bitcoin, ethereum and XRP on several mobile trading platforms all over the world now. There are two main types of crypto trading, one involves actually buying/selling cryptocurrencies (spot trading), and the other involves exchanging contracts based on the price of cryptocurrencies (similar to cfds) rather than physically owning them – this allows you to use something called leverage which can increase profits, but also losses. We’ve put together a list of our top bitcoin apps, but to summarise, our favourite mobile crypto exchange platforms are currency.Com for contract trading and binance for spot trading.

There are other types of trading, including options, mutual funds and etfs – but there are only so many that we can include in one list, so we kept it to the most popular and beginner-friendly types of trading.

Are trading apps legit?

The majority of trading apps are legit, however, that being said, there are some illegitimate ones floating around. This is one of the main reasons we started this site; to help you find only legit and trusted apps.

Trading app of the month (february, 2021)

Capital.Com

Capital.Com

Capital.Com is trading apps trading app of the month due to its varied asset options, competitive fees and ease-of-use for newer and the most experienced traders.

– 0% commissions

– free sign up

– beginner-friendly

– educational courses

– fast orders

The best day trading apps of 2020

Day trading apps make buying and selling stocks, mutual funds or other securities easier than ever. These apps offer convenience and portability since you can manage your investment portfolio from your mobile device or laptop on the go. But which ones are the best right now? Smartasset has rounded up the best day trading apps of 2020 for tech-savvy investors.

Do you have questions about investing? Speak with a local financial advisor today.

1. Best overall day trading app: TD ameritrade

- Cost per trade: $0 for stocks, etfs and options

- Account minimum: $0

- Designed for: intermediate to advanced investors

One of the nation’s top-rated brokerages, TD ameritrade offers several mobile apps designed for investors, including the thinkorswim app. This app allows users to trade a variety of investments, including stocks, options, foreign currency and futures.

Features are extremely customizable, in that you can generate charts, monitor trends and simulate more complex trading options, based on your risk tolerance, goals and overall investing strategy. TD ameritrade also offers a vast base of educational tools and resources to help you expand and improve your investing know-how.

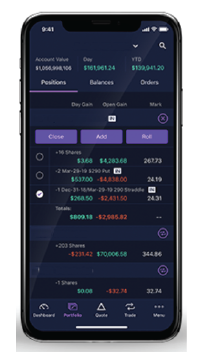

2. Best free day trading app: webull

- Cost per trade: $0 for stocks, etfs and options

- Account minimum: $0

- Designed for: new investors looking to learn

Webull is a commission- and minimum-free brokerage service that features an extremely easy-to-use mobile app. The brokerage’s apps are packed with relevant information about all types of investments and markets, including initial public offerings (ipos), dividends, popular etfs and industries, forex and even more.

You can explore all of the above insights and immediately make investment decisions based on your findings. While you can trade just about any type of security through this app, such as stocks, options and etfs, webull will soon have a cryptocurrency trading feature as well.

3. Best options trading app: E*TRADE

- Cost per trade: $0 for stocks, etfs and options; $0.65 for options contracts; $1.50 for futures contracts; $1 for bonds (online secondary trades)

- Account minimum: $0

- Designed for: beginning to intermediate stock and options traders

E*TRADE is another brokerage powerhouse and the company’s day trading app is streamlined and easy to use. Investors can trade stocks and exchange-traded funds, as well as futures and options. Pricing is very low and the app comes with a built-in risk assessment tool to help you gauge the potential risk factor associated with specific trade strategies. It’s a solid choice for options traders looking for some of the lowest commissions on the market. As an added bonus, support from E*TRADE options specialists is always on tap if you need help executing a trade.

4. Best incremental investing app: acorns

- Cost per trade: $1, $3 or $5 per month, depending on plan choice

- Account minimum: $5

- Designed for: beginners

The acorns investing app is geared toward investors who are just starting to build a portfolio and can only do so with smaller amounts of money. This app, which charges a flat monthly fee ranging from $1 to $6, depending on the account type you choose, invests your spare change for you automatically. You create an acorns account and link it to your bank account. The acorns app then reviews your spending. Once your spare change totals at least $5, the app will invest it in a portfolio of etfs. It’s a very simple way to grow your investments over time with smaller amounts of money. The only drawback, however, is that investment options are limited to etfs. If you’re looking for an app that offers stock trading, you’ll need to consider another day trading app from this list.

5. Best app for experienced investors: tradestation

- Cost per trade: $0 for stocks, etfs, options and futures; an additional $0.50 per option contract; $0.85 per futures contract

- Account minimum: $0 for the TS GO package, or $2,000 for the TS SELECT package

- Designed for: advanced investors

Tradestation is designed with two types of investors in mind: full-time investors who trade for a living and part-time traders who are looking for ways to grow their wealth. The tradestation app allows for trades across stocks, futures, etfs, mutual funds and bonds, as well as cryptocurrency. This app is designed for the more experienced investor who’s looking for in-depth analytical tools and real-time market monitoring. Two brokerage packages are available through tradestation: TS GO and TS SELECT. TS GO is the more basic of the two, as the TS SELECT package exclusively offers surcharge-free trading through the tradestation desktop.

6. Best app for active traders: interactive brokers

- Cost per trade: starting at $0, but varies based on trade volume and package

- Account minimum: $0

- Designed for: consistent traders

Interactive brokers’ mobile app boasts perhaps the most robust set of features of any app on this list. Customers will have access to an extremely wide range of potential investments, with specific market breakdowns for each type of security. More specifically, users will have the chance to invest in stocks, bonds, options, futures, currencies, etfs, mutual funds, hedge funds and efps. In addition to transferring money from your bank accounts, interactive brokers lets user deposit money directly from checks with its mobile check deposit feature. So if you’re looking to trade early and often, there are few options better suited to you than this app.

7. Best FOREX trading app: forex.Com

- Cost per trade: commissions range from $0 to $60 per $1 million and up

- Account minimum: $0, but $25,000 for highest-tier account

- Designed for: FOREX traders

Trading foreign currency is an alternative strategy to trading stocks or etfs. Though it can be a higher risk play, it can also offer higher returns. Forex.Com offers mobile FOREX trading through standard, commissions or high volume trade accounts.

Mobile trading includes access to advanced charts from tradingview and you can easily check margin requirements before executing a trade. You can also build custom watch lists and set alerts so you don’t miss any market movements that could have a critical impact on your FOREX portfolio.

8. Best cryptocurrency trading app: robinhood

- Cost per trade: $0 for basic and crypto accounts; $5 for gold account

- Account minimum: $0

- Designed for: beginning to intermediate investors

The robinhood investing app keeps day trading as simple as possible. There is no account minimum required to start investing and you can trade stocks, etfs, options and even cryptocurrency with no trading or commission fees. The mobile app’s interface is streamlined and easy to use. And it’s designed for the beginning investor in mind. You can easily view your portfolio’s performance at a glance and chart your investment progress over time. A free account could be a great way to ease into stock trading. If you’d like to expand your investment options into margins trading or after-market trades, you can upgrade to a robinhood gold account.

Bottom line

These are by no means the only day trading apps around, but they are the best of the best for 2020. When you’re considering which investing app to use, consider the total picture. Review the trading fees and account minimums, range of investment options, level of support that’s available and the app’s usability and tech features. Keep an eye out for apps that offer demo versions, which let you try out the features before committing your dollars to the platform. And consider using a brokerage comparison tool to keep the process simple. Investing money can really be as easy as downloading an app, and it can make a big difference in your financial future.

5 trading apps with free bonuses

Who doesn’t love a great bonus? We do. We’ve complied the best trading apps with free bonuses so that you can start your trading off with a bang.

Let’s have a look at the best free bonus trading apps.

1. Moomoo

Best for: US stock traders & investors

Bonus: 3 free stocks (up to $1,250)

Moomoo offers a great free bonus offer for new registrations. You can grab 3 free stocks valued up to $1,250.

2. Currency.Com

Best for: crypto traders

Bonus: up to $100

Currency.Com is a free, regulated trading app which gives you a random bonus of up to $100 USD value when you sign up, complete verification and make a deposit.

3. Coinbase

Best for: cryptocurrency enthusiasts

Bonus: $10 free bitcoin

Free bitcoin? Why not! Coinbase offers a $10 free bitcoin bonus offer to new registrations who use an invite link to sign up. The bonus is deposited into your coinbase account.

You have to trade at least $100 of cryptocurrency to get the $10 bonus. After you get the bonus, you can trade it or withdraw it to your bank account or paypal.

4. Webull

Best for: US traders

Bonus: 2 free stocks (up to $1,400)

Webull is a popular alternative commission trading app. When you deposit any amount, you will get 2 free stocks worth up to $1,400 – cool right? The difference between this bonus is the value – it’s up to a huge $1,400. Will you be lucky? Find out by grabbing your free stocks today.

You can sell the free stocks and withdraw them directly to your bank account.

Best for: anyone

Bonus: free VPN

XM is one of the world’s leading CFD trading apps. They’re currently running a neat promotion which gives you a free trading VPN – don’t miss out on it! Sign up for a free XM account today.

Summary

There are a ton of awesome free bonuses on trading apps, it’s hard to choose the best ones, but these are our personal favourites.

There’s no limit to how many bonuses you can redeem you can get, so why not try them all?

Here’s our final roundup of the best free bonus trading apps.

- Currency.Com: best overall

- Moomoo: best for advanced traders

- Coinbase: best for cryptocurrency traders

- Webull: best for US traders

- XM: best for everyone

Have you seen any other awesome free trading bonuses? Let us know in the comments!

About us

Trading apps is your trusted guide to the world of trading on mobile applications. We test and review hundreds of trading apps to bring you the best. Learn more about us on our ‘about‘ page.

4 best no-fee stock trading apps to invest for free

Review these 4 best no-fee stock trading apps to invest in the stock market for free and never pay commission fees when you buy or sell stocks.

These investment apps help you learn about investing in stocks without wasting money on trading fees, and they provide various tools to help beginners invest in the stock market.

These stock trading apps are also perfect for more seasoned investors if you are looking to make on-the-go mobile stock trades from your phone and you are sick of paying fees on every single trade you make.

It’s free to open an account with any of these stock trading apps, and there are no commission fees, no account maintenance fees, no clearing fees, and no stock trading fees of any kind.

Once you open an account (which usually takes just minutes), you can use these apps to trade individual stocks and exchange-traded funds (etfs) with no commission fees, so that you can buy and sell stocks and etfs for free.

If you’re looking for a no-fee stock trading account that allows you to invest in the stock market commission-free, take advantage of these free stock trading services from some of the best investment apps available.

1. Webull app – trade stocks commission-free

Get 2 free stocks ($8-$1,600 each) to deposit $100 in webull

Webull lets investors trade stocks with no commission fees, no clearing fees, and no minimum deposit requirements to get started with a cash account.

You can trade over 5,000 U.S. Stocks and etfs commission-free, plus you also get access to free real-time market data and trading tools to help you navigate your investment strategy.

Opening a webull account is simple and takes just a few minutes, and the webull app is available in the app store and google play.

Read our full webull app review for additional details about their service.

2. Robinhood app – buy and sell stocks with $0 fees

Get a free stock when you join robinhood

Robinhood lets you buy and sell stocks with no commission fees and no minimum account balance requirements for a cash account, so that anyone can invest in your favorite stocks for free.

You’ll get access to all stocks and etfs on the U.S. Exchange, plus you can discover new stocks through collections, track a personalized news feed of your favorite stocks, and access additional stock market tools.

It’s easy to open a robinhood account in a few simple steps, and you can download the robinhood app from the app store and google play (web-based accounts are available as well).

Read our full robinhood app review for additional details about their service.

3. M1 finance app – streamline your stock portfolio

Get a $10 bonus to deposit $100 with M1 finance

M1 finance lets you create a custom portfolio of stocks and etfs simply by adding any individual stock or ETF to your portfolio.

You can then select what percentage of your total funding that you want to invest in each individual stock or ETF.

Whenever you add funds to your portfolio, the money is automatically distributed into your stocks and etfs according to the percentages that you choose to allocate.

There are no commission fees, no markups on any trades, no platform usage fees, and no deposit or withdrawal fees with your connected bank account, which means that all of your money goes into your investments, and not toward fees.

There is a $100 minimum deposit requirement to get started, but once the $100 account minimum has been reached, you can make deposits in any amount that you like going forward, so you can add $10 to your portfolio each week or however else you would like to invest.

It’s free and easy to open an M1 finance account, and the M1 finance app is available for download from the app store and google play (web-based accounts are available as well).

Read our full M1 finance app review for additional details about their service.

4. Public app – invest with friends for free

Get $10 stock bonus with public app

Public offers a social investing experience that allows you to buy and sell stocks commission-free with help from your friends.

Through public, you can connect with your friends, top investors, and the broader public community to discover trending stocks and popular companies.

There are no account minimums, so you can start investing with whatever amount of money you want, and there are no commission fees, no account maintenance fees, no deposit fees, and no withdrawal fees.

You can open an account for free with public in a few simple steps, and the public app is currently available in both the app store and google play store.

Read our full public app review for additional details about their service.

Take advantage of these no-fee stock and ETF trading apps to invest more of your money and stop paying trading fees.

Olymp trade review

Editors summary

Olymp trade is a massive player in the fixed time trading marketplace, and their seamless platform and competitive rates of return are excellent. Their minimum $10 deposit and $1 trades means that the service is accessible to anyone who wants to trade and their education service supports their commitment to new traders as one of the best brokers.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Introduction

Olymp trade is an established broker in the fixed time trades marketplace having launched back in 2014. They are certified by finacom making them a trusted choice for any online trader. Their background is very much as an international broker with a seamless platform and packed education centre available in 12 languages.

With more than 25,000 people trading every day and around $171 million of monthly turnover olymp trade are a massive company in this space. Adding to the brokers' prestige is an award cabinet to be proud of, including "best trading platform" le fonti 2018. They are a grade A broker with a proven track record.

A solid offering of over 70 asset types including currency pairs, commodities, stocks, indices and crypto gives you plenty of opportunities. Another difference between olymp trade is their comfortable level of entry. Traders can start with a small $10 deposit with minimum trades as low as $1 which is excellent news if you're new to the world of online trading.

Account types

Because olymp trade focuses on being user-friendly, they keep things simple, clean and easy to use. Whereas you might see a complicated list of accounts ranging from basic to gold, diamond or platinum offered by others, there are three well-managed choices. You can choose between demo, standard and VIP accounts. All of them are easy to sign up to and offer an excellent trading experience.

Demo account

The olymp trade demo account is excellent for those wanting to get used to the platform, all you need to do is register, and you can start using $10,000 of virtual money straight away. Demo accounts are a tried and tested way for first-time traders to get used to trading or for those switching platforms and looking to familiarise themselves with the software.

Standard account

You only need a $10 deposit to open a real account offering you access to all the available financial instruments, assets, educational materials and analytical tools. You'll also have the opportunity to take advantage of returns of up to 82% which is a competitive offering. Maximum trade amounts are very respectable too at $2000 enabling you to trade freely. We love the standard accounts comprehensive benefits and excellent rate of return.

VIP account

Aimed at the more experienced trader, the VIP account offers many exclusive benefits. Maximum trade amounts rise to a massive $5000 as well as the rate of return being boosted up to an unbeaten 92%. The account also has an extensive list of features including everything from the availability of risk-free trades to a personal consultant and private webinars.

The VIP account is a competitive and well-structured account which is an excellent choice for the seasoned trader.

Trade features and payouts

With payouts ranging from 82% to 92% with the VIP account, they are very well placed within the market when it comes to profitability. The low entry and simplified systems also make it a very clean and seamless trading option.

Some brokers offer lots of different trade types, and these include call/put or high/low trades then there are ladders and pairs, range, one touch and long term. With olymp trade as there are just two types of trades, the classic, tried and tested high/low and 60 second trades.

High/low trades

With a manageable 70 assets to trade with and a minimum of $10 deposit, it is the perfect chance for beginners to cut their online trading teeth. Just choose your asset, currency pairs, gold or silver, and start trading. Correctly predict whether the asset will rise or fall by the expiry time and you could be seeing lucrative returns.

60 second trades

60 second trades are as the name suggests, 60 seconds or one minute expiry times, so you don't have long to spot and seize the moment. Making these trades means things happen very quickly including making a profit if you have the right trading strategies.

Bonuses and promotions

Great news! Olymp trade does generally not offer a standard bonus, but we have secured an exclusive introductory bonus that you must use to your advantage. We have managed to negotiate a new sign-up deal which means they will double your deposit! All you need to do is make a deposit in your live account within an hour after registration and get +100% of your deposit, free.

We know that because of their very affordable deposit level, excellent trading platform, free education centre and competitive rate of returns that they probably don't need to offer bonuses to get people trading successfully with them, but we wanted to secure one for our readers anyway.

Mobile trading

With trading on the move being more critical than ever before, a mobile app, responsive website and accessibility have to be at the forefront of brokers features. It is no longer enough to have a good desktop site and trade off reputation. So many criteria have to be met and being able to keep up with technological developments is one of them.

Launching in 2014, olymp trade understood the importance of mobile technology and have been able to build a modern, seamless platform. From the moment you login, you realise their mobile platform is exceptionally responsive. There is a bespoke olymp trade app for both android and ios available from google play and the apple app store for those who prefer apps to browser trading.

We’ve negotiated a new trader bonus which means they will double your deposit!

Deposits and withdrawals

Like most brokers, the primary payment method of depositing real money funds include the use of a credit card and debit card. Bank wire transfer and other e-payment solutions such as skrill and neteller are also available. Customers can also pay using the latest cryptocurrencies such as bitcoin.

Depositing funds overall is simple although deposits using wire transfer will take longer than other methods. Crypto deposits are much more straight forward and as we found, slightly faster. All deposits are free, and with a deposit amount of only $10 required to open an account, it is a service that is accessible to all.

To withdraw funds request your withdrawal and funds will arrive back in your account or on your card within one day. Payments go to the same source that you used to fund the account in the first instance. Please make sure your trading account is fully verified to avoid any withdrawal problems. This broker told us the most significant cause of refusal is due to a lack of personal identification.

Special features

A distinctive feature of olymp trade comes in the form of its packed education centre. With 56 webinars together with 20 strategy and trend lessons as standard, there is a wealth of information and technical analysis on offer. If you have a VIP account, you can look forward to other perks with the addition of one-on-one training lessons and private webinars.

The demo account is available to anyone that registers on the site, and the $10,000 virtual money is there for traders to use to practise successful trading and get used to the dos and don'ts. The addition of our exclusive bonus if you join these guys makes their offering even more attractive.

In addition to fixed time trades, olymp trade has recently added forex trading to its platform lineup. Forex traders can now benefit from their MT4 (metatrader4) platform and a huge range of currency pairs on offer.

Customer support

Most online brokers offer varying levels of support from a virtual live assistant to a full menu of options to choose from including, emails, telephone numbers, support forums and more. Olymp trade is no different; they have a strong support system in place and support is available by phone, via email or by live chat.

They offer helpful customer support 24/7 in 8 languages, so it's highly likely you'll be able to speak with someone who fully understands you no matter where you are. Throughout our olymp trade review process, we had no problems or difficulties contacting the various support departments.

We want to help our readers in any way we can, but sometimes it's better to talk directly with your investing site to get the answers you need. For example if you have a specific query about your account you'll need to contact them in person due to security.

Alternatively, if you find that contacting your investing partner isn't working, you can contact us and we will be more than happy to try on your behalf. We have excellent working relationships with many of the sites we list and recommend.

Olymp trade

- Email: [email protected]

- Phone: +27 211 003 880

- Address: saledo global, first floor, first st. Vincent bank ltd building, james street, kingstown, st. Vincent and the grenadines

Conclusion

Olymp trade is a massive player in the fixed time trading marketplace, and their seamless platform and competitive rates of return are excellent. Their minimum $10 deposit and $1 trades means that the service is accessible to anyone who wants to trade and their education service supports their commitment to new traders as one of the best brokers.

For the more experienced traders among you, there is the VIP account, which boosts the rate of return further and the maximum trade amount as well as offering lots of special features. Olymp trade pays out over $9 million per month to traders in several countries around the world. They are a category A broker of the international financial commission which gets awarded to those that are proven to be honest and reliable.

Essentially, they tick all of the boxes of a trustworthy broker including offering trader protection, backed by the IFC of up to $20,000. Following our thorough olymp trade review, we found no warnings to imply this broker is a scam and we only found a small number of online complaints. Compared to other broker reviews, olymp trade is highly recommended.

Our review rating system (more info)

To ensure our readers know how our experts get to their conclusions, we feel it's essential to be transparent about the rating system we use. All our ratings focus on seven key factors which are shown below. Some of these factors carry more weight than others due to their importance. The importance of a factor has ultimately been decided by our readers and years of their feedback.

Best day trading platforms for 2021

The stockbrokers.Com best online brokers 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

A day trade is when you buy shares of a stock then sell the same shares before the market closes. Because day traders place far more trades than the average investor, keeping costs low is just as important as buying and selling (or shorting and covering) for a profit.

Having placed over 2,500 trades, I know first hand that having a reliable day trading platform stocked with the trading tools you need is crucial to success.

For our 2021 review, we tested and scored 11 different online brokers. To find the best day trading platform, we focused on both web and desktop platforms and assessed each platform across 55 different features. Alongside tools, we also took into consideration the costs of trading, including margin rates and order execution quality.

What is day trading?

Day trading is a strategy in which a trader buys and sells stocks throughout the trading day. The goal is to end each trading session with a net profit after commissions. Day traders primarily trade during the opening 60 minutes (9:30 - 10:30 AM EST) and closing 30 minutes (3:30 - 4:00 PM EST) of each market session, which is when price volatility is highest.

Best day trading platforms 2021

Here's a breakdown of the best online brokers for day trading.

- Fidelity - best order execution

- Tradestation - best platform technology

- TD ameritrade - best desktop platform

- Interactive brokers - best for professionals

- E*TRADE - best web-based platform

Best order execution

Of the eleven brokers we tested for 2021, hands down, fidelity offers the best order execution quality. Fidelity is the only broker to offer $0 trades and not accept payment for order flow (PFOF), resulting in price improvement above and beyond what other brokers can offer. Pricing aside, fidelity's trading platform, active trader pro (ATP), isn't quite as rich with tools as several competitors, but it gets the job done well. Read full review

Best platform technology

As a trading technology leader, tradestation shines, offering a powerhouse platform across desktop, web, and mobile. Tools in the tradestation arsenal include radar screen (real-time streaming watch lists with 335 customizable columns), charting (290 technical indicators), scanner (custom screening), matrix (ladder trading), and walk-forward optimizer (advanced strategy testing), among others. Read full review

Best desktop platform

TD ameritrade's desktop trading platform, thinkorswim, is our no. 1 desktop platform for 2021 and is home to an impressive array of tools. Highlights include paper trading, earnings analyzer (my personal favorite earnings analysis tool), charts with 489 optional indicators (you can even create your own custom candlestick patterns), backtesting, and even replaying historical markets tick-by-tick. Oh, and thinkorswim for mobile is just as impressive. Read full review

Best for professionals - open account

exclusive offer: new clients that open an account today receive a special margin rate.

The interactive brokers trader workstation (TWS) trading platform offers the largest selection of order types, enabling traders to place every possible trade imaginable, including algorithmic orders. Popular among institutions, including hedge funds, TWS is not beginner-friendly, but for traders who use margin, interactive brokers offers the lowest margin rates in the industry. Focused on professionals, interactive brokers requires a $100,000 minimum deposit for margin accounts. Read full review

Best web-based platform

While E*TRADE lacks a desktop platform, it offers an excellent web-based trading platform, power E*TRADE. Power E*TRADE (also terrific for mobile) cannot go toe-to-toe with the other trading platforms in total tools and customizability. However, power E*TRADE provides ease of use and the core trading tools needed for day traders to succeed. Day trading aside, it is our favorite platform for options trading in 2021. Read full review

Day trading platforms comparison

Popular day trading platform tools include ladder trading, level II quotes, trade hot keys, direct market routing, stock alerts, streaming time & sales, customizable watch lists, and backtesting, among many others.

Below you can find a trading platform comparison table of common tools and features. For a full comparison of 150+ features, use our comparison tool.

| Feature | fidelity | tradestation | TD ameritrade | interactive brokers open account | E*TRADE |

| stock alerts - basic fields | yes | yes | yes | yes | yes |

| stock alerts - advanced fields | yes | yes | yes | no | no |

| streaming time & sales | no | yes | yes | yes | yes |

| streaming TV | yes | no | yes | yes | yes |

| direct market routing - stocks | yes | yes | yes | yes | yes |

| direct market routing - options | yes | yes | yes | yes | yes |

| ladder trading | no | yes | yes | yes | no |

| trade hot keys | yes | yes | yes | yes | yes |

| level 2 quotes - stocks | yes | yes | yes | yes | yes |

| level 2 quotes - options | yes | yes | yes | yes | yes |

| trade ideas - backtesting | yes | yes | yes | yes | no |

| short locator | yes | yes | no | yes | no |

| order liquidity rebates | no | yes | no | yes | no |

Broker pricing comparison

Here's a comparison of pricing across fidelity, tradestation, TD ameritrade, interactive brokers, and E*TRADE. For more comparisons, use the online broker comparison tool.

| Feature | fidelity | tradestation | TD ameritrade | interactive brokers open account | E*TRADE |

| minimum deposit | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| stock trade fee (per trade) | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| ETF trade fee | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| mutual fund trade fee | $49.95 | $14.95 | $49.99 | $14.95 | $19.99 |

| options base fee | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| options per contract fee | $0.65 | $0.50 | $0.65 | $0.65 | $0.65 |

| futures (per contract) | N/A | $1.50 | $2.25 | $0.85 | $1.50 |

| broker assisted trades fee | $32.95 | $50.00 | $44.99 | $30.00 | $25.00 |

Can you day trade on multiple platforms?

Yes. It is not uncommon for day traders to have multiple brokerage accounts and use several trading platforms simultaneously. Common reasons why traders use multiple platforms include having a backup in case of an outage, running dedicating trading strategies, or accessing specific trading tools not available elsewhere.

What are the risks of day trading?

Because day trading involves actively buying and selling stocks throughout the day using margin (borrowed capital), it is inherently risky. Like poker, losing streaks can cause traders to take undisciplined risks, magnifying losses.

Can you start day trading with $500?

If you do not have at least a $25,000 balance, margin approval, and pattern day trader (PDT) status, you can only place four day trades over a period of five business days before your account becomes restricted.

Is day trading illegal?

In the US, day trading is legal. To day trade, you must have at least a $25,000 minimum account balance and be approved as a pattern day trader (PDT). Once classified as a pattern day trader, you gain access to 4:1 margin intraday and 2:1 margin for holding open positions overnight.

Is day trading worth it?

In today's market, hedge funds running sophisticated algorithms make it very difficult to day trade profitably. Most day traders are also severely undercapitalized and get suckered into paying for expensive chat rooms memberships, educational courses, and newsletter subscriptions on social media. Here's a breakdown of what I learned from day trading.

What is the best platform for day trading?

For the lowest pricing, fidelity's active trader pro (ATP) is the best day trading platform thanks to $0 trades with no payment for order flow (PFOF). Fidelity aside, tradestation and TD ameritrade offer the most trading tools and platform customizations. Finally, for the lowest margin rates and most order types, the trader workstation (TWS) trading platform from interactive brokers is best.

What is the fastest trading platform?

The fastest trading platforms are tradestation, TD ameritrade thinkorswim, and interactive brokers traders workstation (TWS) because they are desktop-based.

More details: with a desktop trading platform, the base code runs locally on your computer, maximizing speed. That said, web-based trading platforms built with modern code can match desktop platforms in overall speed. Software aside, like esports, the most common bottleneck for any trading platform is the internet connection.

Summary

To recap, here are the best day trading platforms.

Read next

Explore our other online trading guides:

Methodology

For the stockbrokers.Com 11th annual best trading platforms review published in january 2021, a total of 2,816 data points were collected over three months and used to score brokers. This makes stockbrokers.Com home to the largest independent database on the web covering the online broker industry.

Participation is required to be included. Each broker completed an in-depth data profile and offered executive time (live in person or over the web) for an annual update meeting. Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

1 $0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

TD ameritrade, inc. And stockbrokers.Com are separate, unaffiliated companies and are not responsible for each other’s services and products. View terms.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

So, let's see, what we have: the best stock trading apps allow you to buy and sell anywhere you can get cell reception. Learn about the best stock trading apps here. At best trading app with bonus

Contents of the article

- Best forex bonuses

- Best stock trading apps

- The best stock trading apps combine low costs and...

- Best stock trading apps of 2021

- TD ameritrade mobile: best overall

- Money crashers

- Recent stories

- 13 best personal loan companies of 2021

- 8 best stock brokers that allow you to invest in...

- 15 best rewards checking accounts of 2021

- Explore

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Featured content

- Follow @moneycrashers

- Trending articles

- Why gas prices are rising so high – reasons for...

- 13 best stock market investment news, analysis &...

- 26 best new bank account promotions & offers –...

- 13 best paycheck advance apps to help you make it...

- 7 best stock picking services of 2021

- Become a money crasher! Join our community.

- 12 best new brokerage account promotions & bonus...

- Best new brokerage account promotions (january...

- 1. Acorns — $10 bonus

- 2. Robinhood — up to $200 (or more) in free stock

- 3. Webull — free stocks up to $3,700 total value...

- Account opening bonus (2 free stocks)

- Deposit bonus (2 free stocks)

- Account opening bonus (nasdaq totalview...

- 4. Blockfi — up to $250 BTC bonus

- 5. Ally invest — up to $3,500 cash bonus

- 6. Citi wealth management — up to $3,500 cash...

- 7. M1 finance — up to $2,500 transfer bonus

- 8. E-trade — up to $2,500 cash bonus

- 9. Betterment — up to 1 year managed free

- 10. Sofi invest — win up to $1,000 in free stock

- 11. Charles schwab — up to $500 cash referral...

- 12. Nvstr — up to $1,000 cash

- Final word

- Best trading apps: 2020 list

- Best online trading apps 2020

- What is a trading app?

- Types of trading apps

- Are trading apps legit?

- Trading app of the month (february,...

- The best day trading apps of 2020

- 1. Best overall day trading app: TD...

- 2. Best free day trading app:...

- 3. Best options trading app:...

- 4. Best incremental investing app:...

- 5. Best app for experienced investors:...

- 6. Best app for active traders:...

- 7. Best FOREX trading app:...

- 8. Best cryptocurrency trading app:...

- Bottom line

- 5 trading apps with free bonuses

- 1. Moomoo

- 2. Currency.Com

- 3. Coinbase

- 4. Webull

- Summary

- About us

- 4 best no-fee stock trading apps to invest for...

- 1. Webull app – trade stocks commission-free

- 2. Robinhood app – buy and sell stocks with $0...

- 3. M1 finance app – streamline your stock...

- 4. Public app – invest with friends for free

- Olymp trade review

- Editors summary

- Introduction

- Account types

- Trade features and payouts

- Bonuses and promotions

- Mobile trading

- Deposits and withdrawals

- Special features

- Customer support

- Conclusion

- Our review rating system (more info)

- Best day trading platforms for 2021

- What is day trading?

- Best day trading platforms 2021

- Day trading platforms comparison

- Broker pricing comparison

- Can you day trade on multiple platforms?

- What are the risks of day trading?

- Can you start day trading with $500?

- Is day trading illegal?

- Is day trading worth it?

- What is the best platform for day trading?

- What is the fastest trading platform?

- Summary

- Read next

- Methodology

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.