Best broker for trading

Active trader pro is a flexible and powerful trading platform that is a close competitor with interactive brokers’ TWS in terms of functionality.

Best forex bonuses

Fidelity does not offer futures, futures options, or cryptocurrency trading.

Best brokers for day trading

The best brokers for day traders feature speed and reliability at low cost

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market

When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades.

Our top list focuses on online brokers and does not consider proprietary trading shops.

Best online brokers for day trading:

- Interactive brokers: best online broker for day trading, best broker for advanced day traders, and best charting platform for day traders

- Fidelity: best low-cost day trading platform

Interactive brokers: best broker for day trading, best for advanced day traders, and best charting platform for day traders

:max_bytes(150000):strip_icc()/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

- Account minimum: $0

- Fees: maximum $0.005 per share for pro platform or 1% of trade value, $0 for IBKR lite

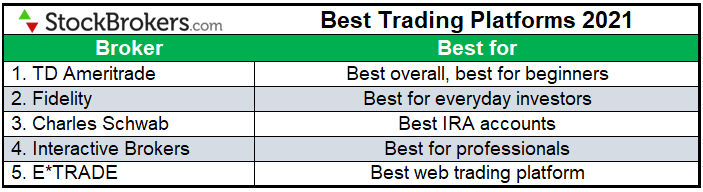

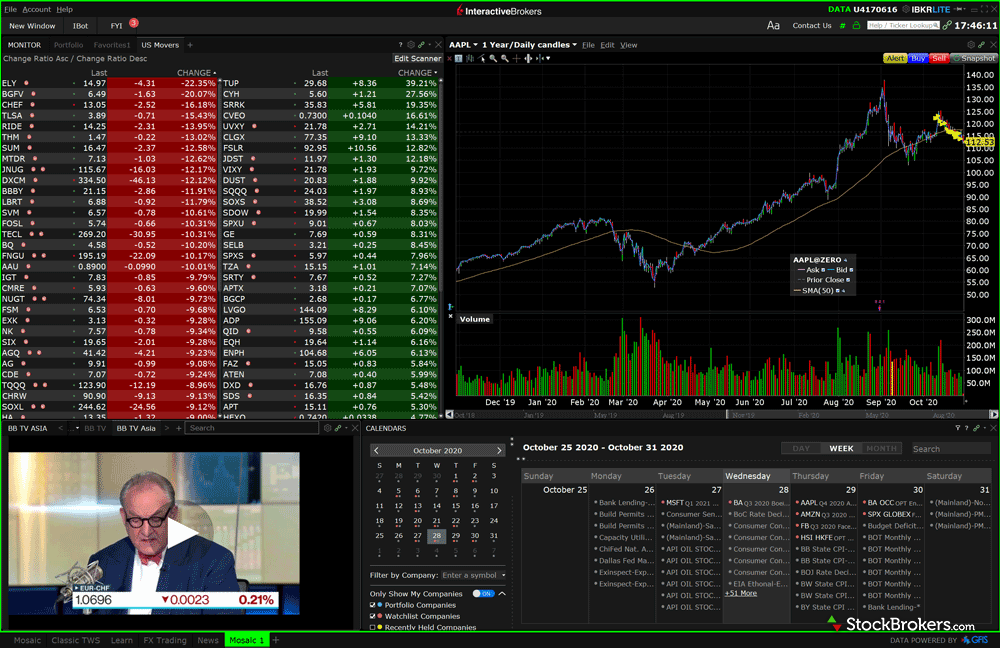

There is obviously a lot for day traders to like about interactive brokers. Interactive brokers allows day traders to invest in a wide array of instruments on a global scale with access to 125 markets in 31 countries. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity.

The only real weakness is the fact that interactive brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees (albeit still very low) while the rest of the industry has moved to zero. This fact has allowed fidelity to prevent interactive brokers from sweeping the day trading portion of our review. Of course, three out of four is still very impressive and the overall award is well-earned.

Interactive brokers’ primary platform for day traders, the traders workstation (TWS) platform, is excellent across the board. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential.

Interactive brokers tied with TD ameritrade in terms of the range and flexibility of the charting tools. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Interactive brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger.

Advanced day traders will find that interactive brokers’ TWS gets better as you need more from it. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. In addition to 60 supported order types, interactive brokers has third-party algorithms that can further fine tune order selection. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order.

On top of the rich features, wide range of assets, and extensive order types, interactive brokers also offers the lowest margin interest rates of all the brokers we reviewed. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by interactive brokers.

No broker can match interactive brokers in terms of the range of assets you can trade and the number of markets you can trade them in.

TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders.

Interactive brokers allows fractional share trading - something that many of its direct competitors are still catching up on.

Interactive brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost.

Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow.

TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential.

Fidelity: best low-cost day trading platform

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)

- Account minimum: $0

- Fees: $0 for stock/ETF trades, $0 plus $0.65/contract for options trade

Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to interactive brokers, coming in just slightly ahead of TD ameritrade. When we are looking at fidelity from the day trading perspective, it is all about active trader pro. Active trader pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. That said, it is fidelity’s pricing that adds the real value for a typical day trader.

Fidelity charges no fees on stocks, etfs, or OTCBB (penny stock) trades. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. There are some brokers that match fidelity in this, but many of them scored lower in terms of trading technology and customizability. Another edge for fidelity, however, is the firm’s order execution. Over 96% of fidelity orders take place as a price that is better than the national best bid or offer. This results in cost savings for day traders on almost every trade. If you are primarily trading equities and you want to keep your costs down as low as possible, then fidelity is the brokerage for you.

Fidelity’s costs are low, its order execution is exceptional, and it sweeps your idle cash to give you a little more return while you are waiting to deploy your money.

Fidelity offers a range of excellent research and screeners.

Active trader pro is a flexible and powerful trading platform that is a close competitor with interactive brokers’ TWS in terms of functionality.

Fidelity does not offer futures, futures options, or cryptocurrency trading.

Day traders looking for more fundamental research may have to use the web platform in addition to active trader pro.

How day traders use their online broker

Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading.

Day traders often prefer brokers who charge per share (rather than per trade). Traders also need real-time margin and buying power updates. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults.

Are you a day trader?

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Most brokers offer speedy trade executions, but slippage remains a concern. Traders should test for themselves how long a platform takes to execute a trade.

Commissions, margin rates, and other expenses are also top concerns for day traders. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders.

It is also important for day traders to consider factors such as customer service and the broker’s financial stability. Customer service is vital during times of crisis. A crisis could be a computer crash or other failure when you need to reach support to place a trade. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard.

The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Take a look at FINRA's brokercheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability.

Methodology

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our reviews are the result of months of evaluating all aspects of an online broker’s platform, including the user experience, the quality of trade executions, the products available on its platforms, costs and fees, security, the mobile experience and customer service. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Traders need real-time margin and buying power updates. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults.

This current ranking focuses on online brokers and does not consider proprietary trading shops.

Our team of industry experts, led by theresa W. Carey, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Click here to read our full methodology.

Fxdailyreport.Com

Till about a decade ago, you had to make use of the telephone if you wanted to invest in the financial markets. You had to call up your broker for placing as well as closing orders. Introduction of online trading has, however, simplified every aspect of the investment process. You can carry out trades from the convenience of your home or on-the-go using the platform provided by brokers. Sounds simple, but the problem is there are umpteen number of forex brokers that offer trading platforms out there in the market. And, you need to work with the best forex broker if you want to achieve your financial goals. So, it all boils down to identifying the right broker to work with and it is definitely not an easy task. Read on to find out as to how you can identify the best forex brokers. In this post, various aspects you need to take into consideration when choosing a forex broker are discussed in detail so that the selection process becomes simpler and easier for you.

Top recommended and the best forex brokers for 2021

| Broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | ||

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: €100 spread: the spread can be as low as 0.01%” (0.01% = spread for EUR/USD) leverage: 1:294 regulation: ASIC, cysec, FCA (UK) | visit broker | ||

| min deposit: $100 spread: starting from 0.9 pips leverage: 400:1 regulation: MIFID, FSB & ASIC | visit broker |

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Main parameters to be checked for identifying the best forex brokers:

#1: regulations and licenses

It is highly recommended that you choose only forex brokers that are regulated or authorized by leading regulatory bodies such as commodity futures trading commission (CFTC), national futures association (NFA) and financial conduct authority (FCA in UK), among many others. This is because regulated brokers are more reliable than their non-regulated counterparts. Further, your hard earned money remains safe with such brokers for two reasons: they will be appropriately capitalized and they maintain segregated accounts for theirs as well as traders’ funds.

#2: forex trading platform

The online trading platforms that recommended forex brokers provide would not only be simple, but also intuitive and easy to operate or navigate. It, therefore, makes sense to try out a few online forex platforms and see for yourself as to which one has a better user interface and is easily navigable.

#3: customer support services

Customer support is a key aspect that you need to evaluate. Best fx brokers would often be aware of the needs of the traders and provide good, efficient and responsive customer support services. During the course of trading forex on an online broker’s platform, there will be times when you need certain time sensitive clarifications. If the customer support service of the broker you are planning to work with is not good enough, you could end up losing money. It is, therefore, recommended that you evaluate the brokers’ customer support service both by speaking to their representatives on telephone and by communicating with them through email.

Leverage offered for forex trading varies from one broker to another. If the leverage is high, the trader can make more profits. However, the risk of accumulating losses is also equally higher. Therefore, you should choose a broker that offers leverage suiting to your needs and based on your style of trading.

Brokers often try to attract you by offering high capital bonuses when you make your first deposit. This is good because you get more money for trading. You can choose the broker that offers the highest first deposit bonus, but you should make sure other aspects discussed above and those that are discussed below suit your needs.

#6: deposits and withdrawals

It is important that you understand the brokers’ policies related to deposits and withdrawals. The features to be evaluated when choosing top forex brokers are minimum amount to be deposited to start trading, deposit methods offered, currency options provided, minimum withdrawal amount specified and waiting time for withdrawals, among others. Further, it makes sense to go through all other written policies in detail.

Brokers make money by charging a fee for each of the trading transactions that you execute on the forex trading platform provided by them. As far as the broker and you are concerned, the significant source of revenue would be the spread, the difference between ask and bid prices. It pays, therefore, to check as to how the brokers you have shortlisted handle spreads:

Do they offer fixed or variable spreads?

What is the average and maximum spread for the currency pairs that you are planning to trade?

What spreads are offered when the volatility is very high?

Do you have to pay any commission for each trade apart from the spread?

Before buying a car, you always go for a test drive. Similarly, look for forex brokers that offer demo accounts. This helps you to open a practice account. You can try out their platform and find out for yourself as to which of the shortlisted brokers is best suited to your requirements. Most brokers offer practice accounts these days. So, it is easy for you to get a feel of the brokers’ platform before committing to depositing money and trading.

#9: other parameters for identifying the best forex brokers

The forex brokerages that offer very low account minimums can be considered for evaluation under the category “best forex brokers”. This is good because you don’t have to deposit large amounts of money in order to trade forex. Minimum account balance can be as low as $5 in the case of some of the reliable forex brokers.

Online forex brokers often try to snatch business through promotions. Do not fall prey to their sales gimmicks. Best forex brokers would never make unbelievable and unachievable promotional offers. It is true that cash and prizes form part of the game, but they should be reasonable.

Another aspect to look for when evaluating online forex brokers is the educational services offered by them. This helps you to master the art of forex trading. Brokers that provide you with a variety of educational tools for assisting you in assessing the forex market are the best forex brokers to work with.

Why expert traders trade with regulated forex brokers

If you’re looking to become a successful forex trader, then working with a skilled and trustworthy broker is very crucial. In the forex market, the two main types of brokers you’ll get include the regulated and the non-regulated brokers. Obviously, the former typically operates under regulations stipulated by a forex regulator. Regulated forex brokers must also be fully licensed and registered in their country of operation, unlike their non-regulated counterparts.

Role of regulation

Of course, the role of regulation in forex market cannot be underestimated. Regulation ensures that all players in this booming industry are strictly supervised. This way, merchants are protected from the many unscrupulous traders out there looking to swindle them off their hard earned money. Another thing, regulation also builds trust between merchants and their brokers, since most merchants don’t have enough time to monitor every investment.

Let’s take a quick look at some of the leading regulatory agencies:

- CFTC and NFA: commodity futures trading commission and national futures association, regulate the financial services sector in united states of america (USA).

- Cysec: the cyprus securities and exchange commission is the regulatory watchdog within the cysec domain. It offers services to the EU member states.

- FCA: the financial conduct authority regulates the operations of over 56,000 financial services and companies in the UK.

- ASIC: the australian securities and investment commission regulate the financial services sector in australia.

- FSB: the financial services board is a south african agency which oversees functioning, regulation, and licensing of south african forex brokers.

- Bafin: bafin is a financial supervisory authority providing its services to forex companies in germany.

Advantages of regulated forex brokers

With regulated brokers, you’ll always have some peace of mind when carrying out your real-money transactions. To expound more, here are the main reasons why expert traders prefer regulated brokers:

1. Credibility

It’s an open secret that most of us like to deal with trusted organizations, especially when money is involved. That being said, the credibility of any forex broker is greatly enhanced if the company is regulated by the relevant agencies. Remember that all regulated forex brokers are mandated to follow some strict rules put in place by their respective regulatory bodies. Furthermore, their regulatory bodies expect them to regularly present a copy of their audit report. Therefore, if a broker is listed on its regulatory body list, then it’s safe to say that the forex broker has fully complied.

2. Compensation

Getting compensated in case of any unfortunate scenario is arguably the best reason why most expert traders opt for regulated brokers. With most regulated brokers, you can rest assured that all your hard earned money will be refunded in case your brokerage firm goes down. For example, brokers operating under cysec are required to remit their contribution to the ICF (investor compensation fund). This pool of funds is to help settle any form of customer claims in case of any eventuality.

3. Effective customer service

Before choosing a forex broker, it’s always recommended that you settle for one who can effectively and immediately resolve all customer issues. In this case, most regulated brokers are always competent enough when dealing with technical support or account issues. In addition, they are very helpful and kind during the whole account opening process.

4. Quick deposits and withdrawals

Any reputable forex broker will allow their merchants to make deposits and withdrawals without any hassle. A regulated broker should have no reason whatsoever to make your earnings process difficult because they don’t have control over your funds. All they have to do is to facilitate the platform to make it convenient enough for you to trade.

5. Updated trading platform

Most regulated brokers are mandated by their respective regulatory authorities to provide their clients with the latest, powerful, and easy-to-use trading platforms. In fact, most of their platforms will readily provide you with all that you need to begin trading immediately. You’ll get a lot of educational materials including webinars, videos, articles, seminars, and e-courses at no extra charge. It goes without saying that regulated brokers also offer their clients free demo accounts to help them sharpen their skills before going live.

6. Legality

All over the world, governments are struggling to deal with issues concerning money laundering. Some of them have even gone ahead to pass very strict anti-money laundering laws. So to be on the safe side, you should always trade with a regulated broker. Most regulated forex brokers will ask you to provide some of your personal identification documents such as proof of address and photo ID. This might sound tedious to you but it’s always safe to be part of a regulated organization that can prove your money is being used in a legal way.

To sum it up, regulated forex brokers are always the best as well as the safest option to trade with. This is because they are always ahead in terms of legality, security, and safety of your funds. All in all, you can manage your risks better if you opt for a regulated forex broker.

Understanding true ECN vs STP broker

The foreign exchange market, also known as currency market, is a universal decentralized market that provides traders an opportunity to trade currencies. It is a market which incorporates all aspects of buying, selling, and exchanging currencies at the present-day or determined rates.

There are different kinds of forex brokers that you can choose to trade forex with. However, though all the brokers in forex are intended to provide a similar basic solution, the way they operate behind the scenes is different. Different types of brokers have varying techniques of operation, and the specific broker you cooperate with can significantly determine your success rate as a forex trader. Here are some crucial factors that will enable you determine which broker between a true ECN and STP broker is the best one to trade forex with:

Understanding true ECN vs STP broker

True ECN i.E. Electronic communications network brokers operate without their individual dealing desk. These brokers provide an electronic trading platform where professional market makers at monetary organizations such as banks, and other online trading participants including traders can enter bids and offers through their particular systems.

STP i.E. Straight through processing brokers are brokers without a dealing desk also. These brokers apply some of the techniques utilized by market makers to provide their particular clients with trading conditions which are more flexible. By STP brokers hiring some of the tactics of market makers, they are able to bypass the limitations connected to trading exclusively within the interbank market.

General overview of true ECN and STP brokers

- Use of scalping techniques

True ECN and STP forex brokers do not care about how much their particular traders make. Therefore, these types of brokers allow traders to utilize scalping techniques to close their respective positions. Note that false ECN and STP brokers cannot allow you to use scalping techniques as a trader since they will be disadvantaged anytime you make small profits.

True ECN and STP brokers are types of forex brokers without a say when it comes to control on spread provided. These brokers have no control on spread offered since it’s the liquidity provider that determines the spread which is to be provided.

Though true ECN and STP brokers can add markups when necessary, they cannot in any way take it further down than the amount provided.

Difference between true ECN and STP brokers

- Commission charged

On true ECN accounts, as a trader you will be required to pay a fixed commission to open and close trades. The spreads offered on true ECN accounts are determined by the rates of liquidity providers.

When using STP accounts as a trader, you will not be required to pay any commissions.

Pros of trading forex with a true STP broker

- Cannot bankrupt themselves

True ECN brokers cannot trade against their specific clients to bankrupts themselves.

- Similar price rates

If you are a forex trader, trading with a true ECN broker means you are guaranteed of price rates that are similar to those of the interbank market.

- Negative balance protection

As a trader utilizing the trading account of a true ECN broker, the broker will be accountable for any dues with liquidity providers should your account read negative as a result of any reason beyond their control.

Cons of choosing a true ECN broker

Dealing with a true ECN broker will require you to pay rollover fees and commission at times.

Pros of trading forex with an STP broker

- Their rates and the interbank prices are same

- They provide their clients low entry capital requirements

Cons of choosing an STP broker

Choosing an STP forex broker means when you enter a trade you’ll not be informed what spread to expect.

Most true ECN and STP brokers are linked to several liquidity providers at the same time period. Despite both true ECN and STP brokers having incredible trading solutions which can meet your needs as a trader, their terms of operation vary. Whether you will choose a true ECN or STP broker, the rule of thumb is always ensuring you minimize losses and maximize profits as much as you can when trading forex. Ensure you compare carefully the terms of service of both a true ECN and STP broker before you choose one to handle your trading needs.

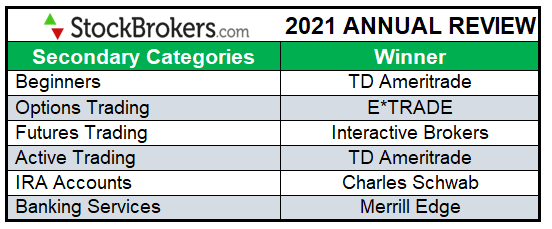

Best trading platforms 2021

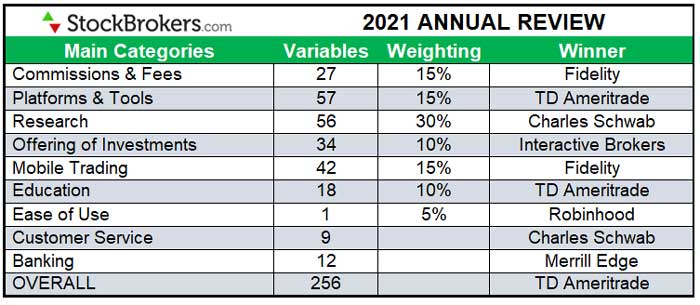

The stockbrokers.Com 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

Do you want to buy shares of stocks like apple (AAPL), facebook (FB), netflix (NFLX), or tesla (TSLA)? If so, you’ll need to set up a trading account with an online broker.

Every stock trading platform is unique. And now – with every broker offering $0 stock and ETF trades – deciding which one to use comes down to differences in the overall trading experience. Investment options, trading tools, market research, beginner education, customer service, and ease of use are all factors investors should consider when choosing a broker.

Having led these annual reviews for the past 11 years, I have seen the industry evolve firsthand. I placed my first stock trade when I was just 14 years old. (it was starbucks.) today, at 34, my lifelong tally of trades is now more than 2,500.

I geek out over every aspect of the trading experience, which is why our review process is so exhaustive. This year we measured more than 250 individual variables. I couldn't have done this alone, though. Big thanks to my teammates steven hatzakis, jessica hoelscher, and joey shadeck, along with the rest of our awesome editorial staff.

Best trading platforms 2021

Here are the best online brokers for 2021, based on 256 variables.

- TD ameritrade - best overall, best for beginners

- Fidelity - best for everyday investors

- Charles schwab - best IRA accounts

- Interactive brokers - best for professionals

- E*TRADE - best web trading platform

Best overall, best for beginners

TD ameritrade delivers $0 trades, fantastic trading platforms, excellent market research, industry-leading education for beginners, and reliable customer service. This outstanding all-around experience makes TD ameritrade our top overall broker in 2021. Read full review

Best for everyday investors

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools, an easy-to-use mobile app, and comprehensive retirement services. Serving over 32 million customers, fidelity is a winner for everyday investors. Read full review

Best IRA accounts

With more than $6 trillion in client assets, charles schwab understands how to consistently deliver value to its customers. Highlights include $0 trades, excellent stock research, a diverse selection of trading tools, and an industry-leading offering of financial planning services. Read full review

Best for professionals| open account

exclusive offer: new clients that open an account today receive a special margin rate.

Once again, in 2021, interactive brokers is our top pick for professionals because of its institutional-grade desktop trading platform and rock bottom margin rates. Professionals aside, interactive brokers also appeals to casual investors with $0 trades and its user-friendly web platform. Read full review

Best web trading platform

Founded in 1982 as one of the first online brokerages in the united states, E*TRADE highlights include $0 trades, two excellent mobile apps, and the power E*TRADE platform, which is great for beginners, active trading, and options trading. Read full review

Other trading platforms

In addition to our top five trading platforms for 2021, we reviewed six others: merrill edge, firstrade, ally invest, tradestation, webull, and robinhood. Here's our high-level takeaways for each. To dive deeper, read our reviews.

6. Merrill edge

Merrill edge offers $0 trades with industry-leading research tools (especially ESG research) and excellent customer service. Better yet, for current bank of america customers, merrill edge's preferred rewards program provides the best rewards of any bank broker we tested in 2021. Read full review

7. Firstrade

While firstrade is easy to use and terrific for chinese-speaking investors, its overall offering struggles to stand out against brokers who also offer $0 stock trades. Read full review

8. Ally invest

for current ally customers looking to invest in stocks, ally's universal-accounts experience and easy-to-use website is a convenient solution. Read full review

9. Tradestation

As a trading technology leader, tradestation supports casual traders through its web-based platform and active traders through its award-winning desktop platform, all with $0 stock and ETF trades. Read full review

10. Webull

webull offers a unique community experience and easy to use trading platforms that will satisfy most young investors. However, for everyday investing, webull lacks the trading tools and features to compete with industry leaders who also offer $0 stock and ETF trades. Read full review

11. Robinhood

robinhood is very easy to use; however, now that all online brokers offer $0 stock and ETF trades, robinhood's lack of trading tools and research leaves it a step behind the competition. Read full review

2021 overall ranking

Here's the overall rankings for the 11 online brokers who participated in our 2021 review, sorted by overall ranking.

Note: due to the pandemic and extensive market volatility, customer service was not scored as a main category.

2021 industry awards

For the stockbrokers.Com 2021 review, all online broker participants were assessed on 256 different variables, with 2,816 data points collected in total. Here are the 2021 main category, secondary category, and industry award winners. Here's how we tested.

What is the best stock broker for beginners?

Based on over 30 variables, the best stock broker for beginners is TD ameritrade. Alongside paper (practice) trading, TD ameritrade offers the largest and most diverse selection of educational content. Highlights include over 200 videos, progress tracking, quizzes, and over 100 monthly webinars, among others.

Which online broker has the lowest fees?

When it comes to buying stocks online, our research found fidelity has the lowest fees overall. Fidelity is the only online brokerage to offer $0 stock trades and not accept payment for order flow (PFOF). Since every broker offers free stock trades, hidden costs matter.

Which online trading platform is best?

Online trading platforms come in one of three forms: desktop (download), web (browser), and mobile (app). After testing 11 brokers and collecting 2,816 data points, we found that TD ameritrade has the best desktop trading platform, E*TRADE has the best web trading platform, and fidelity has the best stock trading app.

Summary

To recap, here are the best trading platforms overall for 2021.

Read next

Explore our other online trading guides:

Methodology

For the stockbrokers.Com 11th annual best trading platforms review published in january 2021, a total of 2,816 data points were collected over three months and used to score brokers. This makes stockbrokers.Com home to the largest independent database on the web covering the online broker industry.

Participation is required to be included. Each broker completed an in-depth data profile and offered executive time (live in person or over the web) for an annual update meeting. Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

More from the editor

Alongside the stockbrokers.Com annual review, our fifth annual forex brokers review, which included 27 forex brokers, was also published on our sister site, forexbrokers.Com. Finally, be sure to check the latest financial advisor ratings, which you can view on investor.Com.

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

TD ameritrade, inc. And stockbrokers.Com are separate, unaffiliated companies and are not responsible for each other’s services and products. View terms.

1 $0.00 commission applies to online U.S. Equity trades, exchange-traded funds (etfs), and options (+ $0.65 per contract fee) in a fidelity retail account only for fidelity brokerage services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an options regulatory fee (from $0.03 to $0.05 per contract), which applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See fidelity.Com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through fidelity clearing & custody solutions® are subject to different commission schedules.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read characteristics and risks of standardized options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Best online brokers

Find and compare the best online trading platforms for every kind of investor

With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. That’s why we put these U.S.-based online brokers through a comprehensive review process that included hands-on research to determine the best in the industry.

Best online brokers and trading platforms:

- Fidelity investments: best overall

- TD ameritrade: best broker for beginners and best broker for mobile

- Tastyworks: best broker for options and best broker for low costs

- Interactive brokers: best broker for advanced traders and best broker for international trading

- Charles schwab: best broker for etfs

Fidelity investments: best overall

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)

- Account minimum: $0

- Fees: $0 for stock/ETF trades, $0 plus $0.65/contract for options trade

Fidelity earned our top spot for the second year running by offering clients a well-rounded package of investing tools and excellent order executions. It has continued to quietly enhance key pieces of its mobile-responsive website while committing itself to lowering the cost of investing for its clients. Fidelity joined in the rush to cut equity and base options commissions to zero in october 2019 but remains devoted to offering top-quality research and education offerings to its clients. the firm also makes it easy for clients to earn interest by sweeping uninvested cash into a money market fund. Fidelity also shares the revenue it generates from its stock loan program, and allows clients to choose which stocks in their portfolios can be loaned out.

Fidelity provides excellent trade executions for investors. On average, over 96% of orders for fidelity customers are executed at a price better than the national best bid or offer.

Fidelity offers a wealth of research and extensive pre-set and customizable asset screeners.

Your uninvested cash is automatically swept into a money market fund to help contribute to overall portfolio returns.

Some traders and sophisticated investors may have to use fidelity’s web platform in addition to active trader pro to access all the tools and research they require.

Non-U.S. Citizens or residents cannot open an account.

Traders and investors must manually refresh the data when using the website.

Fidelity has a wide offering of securities, but no commodities or options on futures.

TD ameritrade: best for beginners and best mobile app

:max_bytes(150000):strip_icc()/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

- Account minimum: $0

- Fees: free stock, ETF, and per-leg options trading commissions in the U.S., as of october 3rd, 2019. $0.65 per options contract.

Best for beginners: TD ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. Work is still being done to further streamline its web and mobile experiences and make them more accessible to new users, but the resources new investors can already access are exceptional. Education is a key component of TD ameritrade’s offerings. You’ll find expanded learning pathways, ranging from beginner to advanced, to help clients understand everything from basic investing concepts to extremely advanced derivatives strategies. You can open an account and poke around without making a deposit, and take advantage of all the learning opportunities until you’re comfortable. TD ameritrade wants new investors to become more confident, and to trade additional asset classes as their skills grow.

Best for mobile: TD ameritrade focused its 2019 development efforts on its most active clients, who are mobile-first – and in many cases, mobile-only. TD ameritrade’s thinkorswim mobile platform has extensive features for active traders and investors alike. The workflow for options, stocks, and futures is intuitive and powerful. You’ll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. The regular mobile platform is almost identical in features to the website, so it’s an easy transition. TD ameritrade clients can trade all asset classes offered by the firm on the mobile apps.

The education offerings are designed to make novice investors more comfortable.

TD ameritrade offers in-person education at more than 280 offices as well as multiple training pathways available on its website and mobile apps.

TD ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details.

Streaming real-time data on thinkorswim’s mobile app is unlimited.

Some investors may have to use multiple platforms to utilize preferred tools.

TD ameritrade offers one of the widest selections of account types, so new investors may be unsure of which account type to choose when opening an account. More support is needed to ensure customers are starting out with the correct account type.

Investors are paid a tiny rate of interest on uninvested cash (0.01-0.05%) unless they take action to move cash into money market funds.

Tastyworks: best broker for options and best broker for low costs

:max_bytes(150000):strip_icc()/tastyworks_productcard-5c61ed6b46e0fb00017dd6f7.png)

- Accountminimum: $0

- Fees: $0.00 stock trades, $1.00 to open options trades $0.00 to close

Best for options: tastyworks officers say that more than 90% of the trades placed by their customers are derivatives, so there are a lot of tools for options and futures traders. Everything is designed to help the trader evaluate volatility and the probability of profit. It’s all about making decisions and taking action. Executions are fast and the costs are low, capping commissions for opening orders for options on equities and futures at $10 per leg. as you build a position from a chart or from a volatility screener, a trade ticket is populated for you. There’s a video viewer embedded so you can keep an eye on the tastytrade network. Though a newcomer to options trading might be initially uncomfortable, those who understand the basic concepts will appreciate the content and features.

Best for low costs: the qualification for this award is simple: the lowest out-of-pocket costs. Tastyworks fits that bill well, as customers pay no commission to trade U.S. Equities online, and there is no per-leg fee for options trades. Tastyworks has a unique fee structure for options trades, charging $1 per contract to open a position, while closing trades are free. In addition, there is a maximum of $10 per leg for options trades, so traders who place large spread orders are happy.

All of the tools you’ll need for analyzing and trading derivatives are built into the tastyworks platform.

The charting capabilities are uniquely tuned for the options trader.

There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows.

Newcomers to trading and investing may be overwhelmed by the platform at first. There’s a learning curve to climb.

There is no fixed income trading (outside of etfs that contain bonds) for those who want to allocate some of their assets to a more conservative asset class.

Besides profit and loss, any additional portfolio analysis requires setting up a login on a separate site.

Interactive brokers: best for advanced traders and best for international trading

:max_bytes(150000):strip_icc()/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

- Account minimum: $0

- Fees: maximum $0.005 per share for pro platform or 1% of trade value, $0 for IBKR lite

Best for advanced traders: interactive brokers (IBKR) earns this award due to its wealth of tools for sophisticated investors and its wide pool of assets and markets. The firm makes a point of connecting to as many electronic exchanges as possible. You can trade equities, options, and futures around the world and around the clock. Interactive brokers’ order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement, and maximize any possible rebate. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows (dark pools) to execute large block orders. The wide array of order types include a variety of algorithms as well as conditional orders such as one-cancels-another and one-triggers-another. You can also set up conditional orders based on price, volume, daily P&L, margin cushion, number of shortable shares available, rebate available from the trading venue, and other factors.

Best for international trading: interactive brokers is the best broker for international trading by a significant margin. Interactive brokers allows investors to access 125 exchanges in 31 countries across the globe. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. Investors can also fund their account in their domestic currency and IBKR will handle the conversion at market rates when you want to buy assets denominated in a non-domestic currency. And, if all that were not enough, the quality of trading tools available through traders workstation (TWS) make it easy to execute multi-layered trades across international borders. Interactive brokers has won this category two years running, and there is no sign of that changing in the near future.

IBKR’s order execution engine has what could be the smartest order router in the business.

Interactive brokers connects clients to 135 markets in 33 countries and enables clients to trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Algorithmic order types include VWAP (volume-weighted average price) and TWAP (time-weighted average price) as well as order types designed to minimize the trader’s impact on the price of a particular stock.

You can only have streaming data on one device at a time. This could be an issue for traders with a multi-device workflow.

The most advanced capabilities are restricted to IBKR pro clients and trades on that plan are not commission free.

Most non-U.S. Exchanges charge additional data fees that increase your trading costs.

Charles schwab: best for etfs

:max_bytes(150000):strip_icc()/charles-schwab-productcard-5c742da0c9e77c00010d6c5b.png)

- Account minimum: $0

- Fees: free stock, ETF trading, $0.65 per options contract

Money is increasingly flowing out of the mutual fund industry and into exchange-traded funds (etfs). Some investors (and most robo-advisors) use etfs exclusively to build a balanced portfolio meant to walk the optimal line between risk and reward. To determine the best online broker for investing in etfs, we looked at research capabilities specific to finding the best etfs for a customer’s specific purpose. Top-notch screeners, analyst reports, fundamental and technical data, and the ability to compare etfs are the main components of this award.

Schwab is a full-service investment firm which offers services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor. It has a wide variety of platforms from which to choose, as well as full banking capabilities. It is, however, schwab’s ETF screener on the streetsmart edge platform that will capture the attention of ETF investors. The streetsmart edge ETF screener has over 150 criteria that can combine fundamental, technical, and third party data. The ETF screener is extremely customizable and your criteria combinations can be saved for future re-use. Schwab’s news and research offerings overall were also among the deepest of all the brokerages we reviewed, sealing up this category for the industry giant.

The streetsmart edge ETF screener is the best among all online brokerages we reviewed.

There are 16 predefined screens for the ETF screener which can be customized according to client needs. Results can be turned into a watchlist, or exported. The ETF screener is available to both prospects (pre-login) and clients using streetsmart edge.

Schwab offers its clients free access to news feeds from bondsource, marketedge, schwab investing insights brief, argus research alerts, briefing.Com, morningstar equity research alerts, business wire, PR newswire, credit suisse, CFRA, and vickers insider activity.

Premium third-party research is offered at a discounted price.

In contrast to the excellent ETF screener in streetsmart edge, the ETF screener on the schwab.Com website is very basic.

If you trade derivatives, most of the tools are on the streetsmart edge platform, but equities traders will wind up referring to technology on the standard website.

Schwab does not automatically sweep uninvested cash into a money market fund, and their base interest rate is extremely low.

What to consider when choosing an online broker

When you are choosing an online stock broker you have to think about your immediate needs as an investor. Are you a beginner? Maybe you need a broker that has great educational material about the stock market. Do you only have a small amount of money you can put aside to invest? Some online brokers allow for small minimum deposits which can be a great option for those with limited funds. Are you always on the go and in need of a robust mobile platform? Some online brokers have incredible mobile apps delivering nearly all the features that their desktop counterparts do.

Another important thing to consider is the distinction between investing and trading. When people talk about investing they generally mean the purchasing of assets to be held for a long period of time. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing interest. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. Trading is generally considered riskier than investing.

All of these factors must be considered before choosing an online broker. Do you want to trade or invest? Do you want a great mobile app to check your portfolio wherever you are? What types of assets are you looking to invest in? Answering these questions is not always easy. You can check out our guide to choosing a stock broker to gain further insight so you can make a sound decision. Once you've made a decision on a broker, you can also check out our guide to opening a brokerage account.

11 best online brokers for stock trading of february 2021

Want to trade stocks? You’re going to need an online broker, and that broker should offer a reasonable investment minimum, high-quality trading tools, robust access to customer service and no hidden account fees. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading.

We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. For example, for active traders, we've noted online brokers with low or no commissions and robust mobile trading platforms. For people venturing into investing for the first time, we've included the best online brokers for educational resources (including webinars, video tutorials and in-person seminars) and on-call chat or phone support.

Read on to see our picks for the best brokers, alongside links to our investing experts' in-depth reviews on each.

Want to trade stocks? You’re going to need an online broker, and that broker should offer a reasonable investment minimum, high-quality trading tools, robust access to customer service and no hidden account fees. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading.

We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. For example, for active traders, we've noted online brokers with low or no commissions and robust mobile trading platforms. For people venturing into investing for the first time, we've included the best online brokers for educational resources (including webinars, video tutorials and in-person seminars) and on-call chat or phone support.

Read on to see our picks for the best brokers, alongside links to our investing experts' in-depth reviews on each.

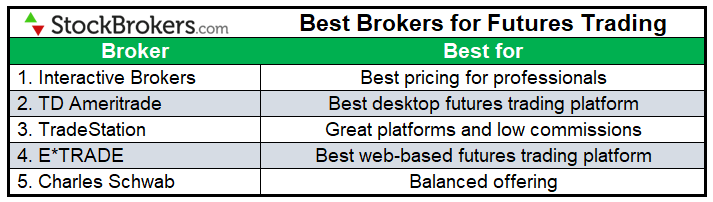

Best brokers for futures trading in 2021

The stockbrokers.Com best online brokers 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

A futures contract is an agreement to buy or sell a particular security or commodity at a future date. Futures markets were originally established to help farmers and other commodity producers hedge (offset or reduce) risk in the future. This is where the “futures” in futures markets comes from.

For our 2021 review, we tested 11 different online brokers, five of which offer futures trading. To find the best futures trading platform, we compared pricing (e.G., contract charges and margin rates) and the platforms themselves, including trading tools, research, usability, and available order types.

Best brokers for futures trading 2021

Here are the five best futures trading platforms for 2021.

- Interactive brokers - best pricing for professionals

- TD ameritrade - best desktop futures trading platform

- Tradestation - great platforms and low commissions

- E*TRADE - best web-based futures trading platform

- Charles schwab - balanced offering

Best pricing for professionals - open account

exclusive offer: new clients that open an account today receive a special margin rate.

As our top pick for professionals in 2021, the interactive brokers trader workstation (TWS) platform offers a slew of trading tools and every order type under the sun (68 in total). Popular among the institutional community, including hedge funds, interactive brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Just beware, interactive brokers requires a $100,000 minimum deposit for margin accounts. Read full review

Best desktop futures trading platform

TD ameritrade thinkorswim is our no. 1 desktop trading platform for 2021 and is home to an impressive array of trading tools. Highlights for futures trading include paper trading with virtual (fake) money, price alerts, plotting economic (FRED) data, charting social sentiment, candlestick pattern recognition, real-time scanning, and ladder trading, among many others. Read full review

Great platforms and low commissions

As a trading technology leader, tradestation shines, supporting traders through its web-based trading platform as well as its desktop platform, which we rated no. 1 for platform technology. Both are excellent. Trading tools aside, tradestation offers two pricing plans for futures trading, providing traders flexibility based on trade frequency and platform access. Read full review

Best web-based futures trading platform

Built as a web-based platform, power E*TRADE innovates and delivers speed, ease of use, and the tools needed for futures traders to succeed. Once again, in our 2021 review, power E*TRADE won our award, best web-based platform. While TD ameritrade offers better education for futures trading, power E*TRADE is an easier platform for beginners to learn. Read full review

Balanced offering

Alongside the charles schwab website, schwab offers customers access to two trading platforms: streetsmart edge (desktop-based; active traders) and streetsmart central (web-based; futures trading). While each trading platform has its highlights and lowlights, all in all, schwab will satisfy most futures traders. Read full review

Best futures trading platforms comparison

| feature | interactive brokers open account | TD ameritrade | tradestation | E*TRADE | charles schwab |

| desktop platform (windows) | yes | yes | yes | no | yes |

| desktop platform (mac) | yes | yes | no | no | yes |

| web platform | yes | yes | yes | yes | yes |

| paper trading | yes | yes | yes | yes | no |

| trade journal | yes | yes | no | no | yes |

| heat mapping | yes | yes | no | no | yes |

| watch lists - total fields | 494 | 514 | 335 | 95 | 130 |

Trading fees

| feature | interactive brokers open account | TD ameritrade | tradestation | E*TRADE | charles schwab |

| minimum deposit | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| stock trade fee (per trade) | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| ETF trade fee | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| mutual fund trade fee | $14.95 | $49.99 | $14.95 | $19.99 | $49.95 |

| options base fee | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| options per contract fee | $0.65 | $0.65 | $0.50 | $0.65 | $0.65 |

| futures (per contract) | $0.85 | $2.25 | $1.50 | $1.50 | $1.50 |

| broker assisted trades fee | $30.00 | $44.99 | $50.00 | $25.00 | $25.00 |

What is futures trading?

Wikipedia defines a futures contract as "a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other."

For an oversimplified example, farmer jake operates a dairy farm. His dairy cows eat a mixture of corn and hay. Farmer jake makes his own hay, but he buys the corn. When corn prices are low, jake makes more money because it costs him less money to feed his cows, which produce the milk that he sells. Contrarily, when corn prices are high, jake’s profit margins on the milk he sells shrinks. By using futures contracts, jake can lock in the price of corn before the season starts to offset (hedge) the risk of a difficult growing season causing corn prices to spike.

Farmers aside, investors trade futures contracts as a way to speculate on the future price of a security or commodity. As one can imagine, futures are traded mostly by institutional investors, but retail investors can also speculate by using a futures trading platform.

With futures trading, investors can trade everything from market indices (e.G., S&P 500 futures) to commodities (crude oil, natural gas, corn, and wheat), metals (e.G., gold and silver), currencies (including bitcoin), treasuries, and more. The regulatory body in the US that oversees futures trading is the national futures association (NFA).

How much does it cost to trade futures?

Futures trading commissions can range from less than one dollar for most commodity futures to as high as $10 per contract when trading bitcoin futures. Commission aside, some brokers also charge monthly platform fees and market data fees, so it is important to consider all costs before selecting a futures trading platform.

Each online broker requires a different minimum deposit to trade futures contracts. For most online brokerages, the minimum deposit is less than $1,000. Before you can trade futures, you must apply for margin trading and futures trading approval.

Which futures trading platform is best?

To find the best futures broker, we compared each platform’s trading tools and pricing. Interactive brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. On the other hand, TD ameritrade provides an excellent downloadable trading platform; however, its pricing is more expensive. For perhaps the best balance of both pricing and tools, tradestation is a winner.

How can I trade futures?

Trading futures requires a funded online broker account with margin and futures trading approval. Once set up, research and determine which contract you want to trade, fill out the order ticket, then place your trade.

More details: remember, each futures contract has different margin requirements. Also, be sure to know whether the contract is cash-settled or physically delivered upon expiration. For contracts with delivery upon expiration, if you hold your position until its contract expiration date, you can become liable for payment of the entire trade value (plus delivery costs).

Do I need a margin account to trade futures?

Yes, a margin account is required to trade futures with an online broker. The margin requirements will vary depending on the instrument being traded. For example, the S&P 500 e-minis are the most popular futures contracts traded (alongside the most liquid) in the united states, so margin requirements are lower, on average.

How is margin calculated for futures trading?

First, you must ensure you have enough capital available to meet any margin requirements (i.E., initial and maintenance margin) before your position is open. The margin requirement is typically a percentage of the value of the underlying asset that each contract controls.

Example: if you wanted to speculate on a price increase of the march 2021 wheat contract (globex ticker code: ZWH1), you would create a buy-to-open order to go long one chicago SRW wheat futures contract. Checking the contract specification shows that one contract controls 5,000 bushels of wheat (136 metric tons), which cost $6.53 per bushel as of january 6th, 2021.

The underlying 5,000 bushels multiplied by the price per bushel ($6.53) equals $32,650 for the total trade value. 5% of the trade value or $1,650 is the margin requirement needed to open this position. A sell-to-close order allows you to exit your existing long position.

More details: if the price of wheat changes drastically, there can be variation margin, where you must post additional collateral or else risk having your trade closed early. Overall, trading as a speculator is different than trading as a hedger or producer of the commodity, as hedgers remove risk by transferring it to you as a speculator.

Is futures trading risky?

Yes, futures trading is risky and not suitable for everyone. Not only does it involve the use of leverage (margin) and potentially volatile assets, there is also the possibility to incur an obligation to make or accept delivery of the underlying asset and be responsible for settling the total trade value.

As long as you close your position before expiration, you avoid the need to physically deliver or cash settle the trade value.

What brokers allow futures trading?

While there are over 334 brokers regulated with the CFTC, the vast majority are not set up for retail investors. For our 2021 review, we found five futures brokers that support everyday investors: interactive brokers, TD ameritrade, tradestation, E*TRADE, and charles schwab.

Can you trade futures with fidelity?

Fidelity does not currently offer futures trading. Investments provided by fidelity include stocks, fractional shares, OTC stocks, options, mutual funds, and bonds. Futures, forex, and crypto trading are not available.

Summary

To recap, here are the best online brokers for futures trading.

Read next

Explore our other online trading guides:

Methodology

For the stockbrokers.Com 11th annual best trading platforms review published in january 2021, a total of 2,816 data points were collected over three months and used to score brokers. This makes stockbrokers.Com home to the largest independent database on the web covering the online broker industry.

Participation is required to be included. Each broker completed an in-depth data profile and offered executive time (live in person or over the web) for an annual update meeting. Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

TD ameritrade, inc. And stockbrokers.Com are separate, unaffiliated companies and are not responsible for each other’s services and products. View terms.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

So, let's see, what we have: investopedia ranks the best online stock brokers for day trading. These trading platforms allow the trader to monitor price, volatility, liquidity, trading volume, and breaking news. At best broker for trading

Contents of the article

- Best forex bonuses

- Best brokers for day trading

- The best brokers for day traders feature speed...

- Best online brokers for day trading:

- Interactive brokers: best broker for day trading,...

- Fidelity: best low-cost day trading platform

- How day traders use their online broker

- Are you a day trader?

- Fxdailyreport.Com

- Top recommended and the best forex brokers for...

- Best trading platforms 2021

- Best trading platforms 2021

- Other trading platforms

- 2021 overall ranking

- 2021 industry awards

- What is the best stock broker for beginners?

- Which online broker has the lowest fees?

- Which online trading platform is best?

- Summary

- Read next

- Methodology

- More from the editor

- Best online brokers

- Find and compare the best online trading...

- Best online brokers and trading platforms:

- Fidelity investments: best overall

- TD ameritrade: best for beginners and best mobile...

- Tastyworks: best broker for options and best...

- Interactive brokers: best for advanced traders...

- Charles schwab: best for etfs

- What to consider when choosing an online broker

- 11 best online brokers for stock trading of...

- Best brokers for futures trading in 2021

- Best brokers for futures trading 2021

- Best futures trading platforms comparison

- Trading fees

- What is futures trading?

- How much does it cost to trade futures?

- Which futures trading platform is best?

- How can I trade futures?

- Do I need a margin account to trade futures?

- How is margin calculated for futures trading?

- Is futures trading risky?

- What brokers allow futures trading?

- Can you trade futures with fidelity?

- Summary

- Read next

- Methodology

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.